What Is an ERC20 Token? what is erc20 token - A Simple Guide for Businesses

Ever heard of an ERC-20 token? At its core, it's a digital asset that lives on the Ethereum blockchain and is built according to a specific set of rules. Think of this technical standard, known as ERC-20, as a universal blueprint. It guarantees that any token made with it will "just work" with any other Ethereum-based application, like wallets, exchanges, and payment systems.

Your Business Guide to ERC-20 Tokens

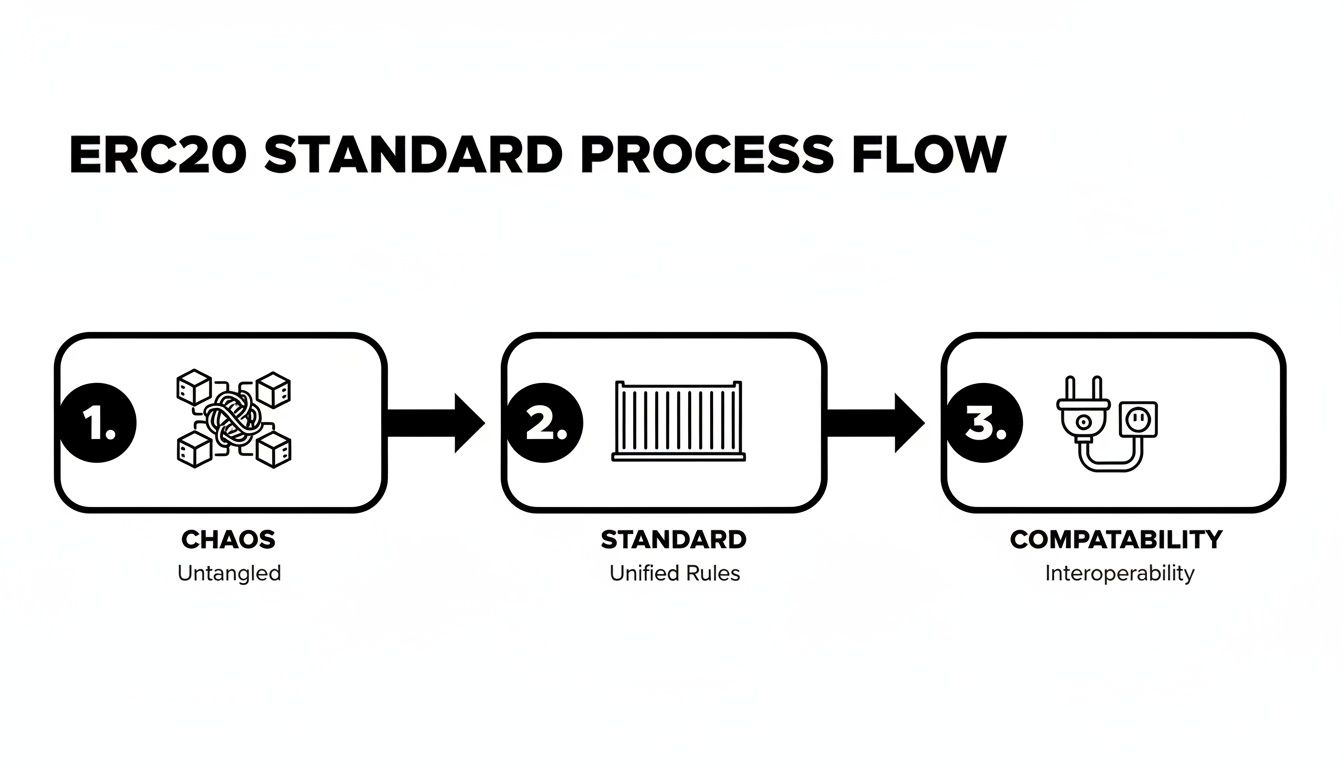

Let's use an analogy. Imagine the chaos of international shipping before the standardized container was invented. Every port had its own system, making loading and unloading cargo a slow, inefficient nightmare. The standardized container changed everything, allowing any crane at any port to handle any container, anywhere in the world.

The ERC-20 standard is the 'universal shipping container' for the Ethereum blockchain. It’s not a currency itself, but rather a technical rulebook. This rulebook ensures that any token following its guidelines is instantly recognizable and usable by any Ethereum wallet, decentralized application (dApp), or exchange. It’s this universal compatibility that allows a payment gateway like BlockBee to seamlessly support thousands of different tokens, giving your business incredible payment flexibility.

The Foundation of a Digital Economy

This standard was first proposed way back in late 2015 and was officially adopted in 2017. Its impact was massive. By early 2026, there were a staggering 1,442,777 ERC-20 token contracts deployed on the Ethereum blockchain. As of mid-March 2025, these tokens held a collective value of around $255 billion, accounting for 51% of the total value locked on the entire Ethereum network.

This framework created a stable, predictable environment where developers and businesses could thrive. Before ERC-20, launching a new digital asset was a huge undertaking, requiring custom code for every little function. Now, developers can simply follow a clear set of rules, which has dramatically lowered the barrier to entry for creating new digital assets.

For a business, this standardization is all about efficiency and interoperability. It means you can accept a huge variety of digital assets through a single, unified system without needing to build custom integrations for each and every one.

This shared language is precisely why the Ethereum ecosystem has blossomed. It powers everything from stablecoins pegged to the US dollar to utility tokens that grant access to specific services. If you want to dive deeper into how these assets work from the ground up, check out our detailed guide on what a crypto token is. Ultimately, this interoperability is the key to unlocking a world of new payment options for your customers.

How the ERC-20 Smart Contract Blueprint Actually Works

Let's move past analogies and get into the nuts and bolts of the ERC-20 standard. At its core, every ERC-20 token is a smart contract—basically, a small program that runs on the Ethereum blockchain. This contract isn't just any old code; it has to follow a strict blueprint, a checklist of functions and events that must be included to be called "ERC-20."

This rulebook is what makes everything work together so smoothly. It ensures every token behaves in a predictable way, no matter where you use it. Think of it like a universal API for tokens; it guarantees that any wallet, exchange, or payment gateway knows exactly how to interact with it. Before this standard, it was a chaotic free-for-all.

This journey from a messy, incompatible landscape to a unified ecosystem is the real magic of ERC-20. To understand these technical rules without getting lost in code, let's group them by what they actually do for a business.

Inventory and Balance Checks

Every business needs to keep track of its inventory. A big part of the ERC-20 standard is dedicated to exactly that: tracking who owns what and how much of it exists. These are "read-only" functions, meaning they just report information without making any changes.

totalSupply(): This is your master inventory count. It tells you the total number of tokens that were ever created. Simple.balanceOf(address): Think of this as looking up a customer's account balance. You provide a wallet address, and it returns how many tokens that address holds.

These two functions are the bedrock of transparency on the network. Anyone can independently verify the total supply of a token or check the holdings of any public address, which builds a massive amount of trust.

Value Exchange and Transfers

Next up are the functions that actually move tokens around. This is the heart of commerce and payments, where value changes hands.

The main function here is transfer(address recipient, uint256 amount). When you send tokens from your wallet to pay for something, you're calling this function. It instantly subtracts the amount from your balance and adds it to the recipient's, all recorded securely on the blockchain.

Key Takeaway: The ERC-20 standard doesn't just suggest these functions; it requires them. This mandatory implementation is the secret sauce that guarantees any ERC-20 token will work perfectly with any platform built to the standard, from a simple wallet app to a sophisticated payment processor.

Delegated Spending Authority

This is where things get really interesting for automated business logic. Two functions, approve() and transferFrom(), work in tandem to let one address spend tokens on behalf of another.

It’s like giving a trusted employee a company credit card with a set spending limit. Here’s how it works:

- The

approve()Function: You, the token owner, "approve" another address (like a monthly subscription service) to withdraw a specific amount of your tokens. - The

allowance()Function: Anyone can check how much spending power you've granted that other address. It's a public record of the "credit limit." - The

transferFrom()Function: The approved address can then use this function to pull the funds from your account as needed, right up to the limit you set.

This approval mechanism is the engine behind countless decentralized applications, powering everything from automated payments to recurring subscriptions. You can dive deeper into these powerful use cases by reading our guide on the applications of smart contracts.

Popular ERC-20 Tokens and What They Actually Do for Businesses

The technical rules of ERC-20 are the blueprint, but the real magic happens when people build things with it. These tokens aren't just lines of code; they're practical tools that businesses are using right now to solve real problems.

Think of the ERC-20 standard as a common language. Because so many tokens "speak" it, they can all interact within the same ecosystem, creating a huge range of tools for finance, operations, and customer engagement.

This screenshot from a token tracker like Etherscan gives you a sense of the scale. The sheer number of different tokens buzzing around on Ethereum shows just how widely adopted the standard has become and the vibrant economy it underpins.

Stablecoins: The Bedrock of Crypto Commerce

If you're a business, the most important type of ERC-20 token to understand is the stablecoin. The whole point of these tokens is to hold a steady value, usually by being pegged to a real-world currency like the U.S. dollar.

- Tether (USDT) and USD Coin (USDC): These are the two heavyweights, essentially functioning as digital dollars. An e-commerce store can take a payment in USDC from a customer in Japan just as easily as from one down the street. It cuts out the headache of currency conversion fees and, more importantly, the price volatility you see with other cryptocurrencies. It just makes cross-border business predictable.

By accepting stablecoins, you give customers a crypto payment option without having to gamble on whether the value of your payment will drop overnight.

Utility Tokens: Your Key to a Service

Next up are utility tokens. The best way to think of these is as a digital key or a prepaid token for a specific service. You need the token to access the product.

A classic example is Chainlink (LINK). Businesses that need reliable, real-world data for their smart contracts use LINK tokens to pay for it. Imagine an insurance company creating a policy that automatically pays out after a hurricane. They’d use LINK to pay the Chainlink network to provide secure, verified weather data to trigger the smart contract. It’s the bridge between the blockchain and the real world.

Governance Tokens: Giving You a Say

Finally, we have governance tokens. These are a bit like owning shares in a company that come with voting rights. Holding these tokens lets you participate in decisions about a project's future.

Uniswap (UNI) is a great case study. If you hold UNI tokens, you can vote on proposals that affect how the Uniswap platform works—things like changing the fee structure or deciding how to spend funds in the project's treasury. For a business that relies on a protocol like Uniswap, holding UNI gives them a voice in its direction, ensuring it evolves in a way that aligns with their own goals.

The sheer variety here—from stable digital cash to utility keys and voting shares—really highlights how flexible the ERC-20 standard is. It’s the foundation for everything from simple payments to the complex machinery of decentralized finance.

By early 2026, the market presence of these tokens underscores their real-world utility. For example, Aave, a leading decentralized lending platform, maintains a market capitalization of $2.59 billion. This thriving ecosystem of established, high-value tokens represents a significant and reliable payment flow opportunity for merchants and businesses. You can explore more data on the top-performing ERC-20 tokens to see the scale of this market.

How Different Token Standards Impact Your Business

To really get a handle on why ERC-20 is the go-to standard for payments, it helps to put it side-by-side with other popular blueprints in the crypto space. While ERC-20 reigns supreme for interchangeable assets, other standards were built for completely different, but equally vital, jobs.

For any business, deciding which digital assets to accept starts with understanding these core differences.

The single most important idea here is fungibility. In simple terms, an asset is fungible if every unit is exactly the same and can be swapped for any other unit without any loss of value.

Think about the cash in your wallet. One $10 bill is worth the same as any other $10 bill. You can trade them back and forth, and they always represent the same purchasing power. That's precisely what makes ERC-20 tokens so effective for payments—they function like digital cash.

Fungible vs. Non-Fungible Tokens: What's the Difference?

On the flip side, you have non-fungible assets. Each one of these is unique and can't be replaced by another. A perfect real-world example is the deed to your house; you can't just swap it for your neighbor's deed and call it even. They represent two completely different, one-of-a-kind properties.

This is the main dividing line between the two most famous standards on the Ethereum network:

ERC-20 (Fungible): This is the blueprint for creating identical, interchangeable tokens. It's the standard behind cryptocurrencies, loyalty points, and any other asset where one unit is just like the next.

ERC-721 (Non-Fungible): This is the standard for creating unique, one-of-a-kind tokens, which you probably know as NFTs. They're used for everything from digital art and collectibles to proving ownership of a specific real-world item.

For a business owner, this distinction is everything. You'd accept an ERC-20 token like USDC for everyday payments, but you might issue an ERC-721 token as a unique digital receipt for a high-value purchase or a special loyalty award for a VIP customer.

Key Takeaway: Fungibility is what makes ERC-20 tokens perfect for commerce. It guarantees that when a customer pays you 100 USDC, you receive exactly 100 USDC in value. Every token is equal, which makes accounting and settlement completely straightforward.

A Quick Look at Popular Token Standards

Of course, Ethereum isn't the only game in town. Other blockchains have their own token standards. For instance, the BNB Chain has a blueprint called BEP-20, which was deliberately designed to be very similar to ERC-20 to make it easy for projects and users to move between the two ecosystems.

To help you sort it all out, here's a quick comparison of the big three and what they mean for your business.

ERC-20 vs ERC-721 vs BEP-20: What Businesses Need to Know

This table breaks down the major token standards, highlighting their core differences and how they typically fit into a business strategy.

| Feature | ERC-20 (Ethereum) | ERC-721 (Ethereum) | BEP-20 (BNB Chain) |

|---|---|---|---|

| Type | Fungible | Non-Fungible | Fungible |

| Primary Use Case | Payments, Stablecoins, DeFi | Digital Collectibles, Art, Gaming Items | Payments, dApps on BNB Chain |

| Analogy | A dollar bill in a wallet | A unique concert ticket with a specific seat number | A different currency, like a Euro, that works similarly to a dollar |

| Business Focus | Accepting uniform payments | Issuing unique digital assets | Accessing a different customer base on another blockchain |

At the end of the day, understanding ERC-20 tokens means recognizing their role as a simple, interchangeable digital asset. It's this powerful yet straightforward characteristic that has made them the default choice for digital currency and the engine driving the vast majority of crypto payments today.

How to Securely Accept ERC-20 Token Payments

So, you understand what an ERC-20 token is and you're ready to start accepting them. Great. But how do you do it safely and without creating a logistical nightmare for your business? Just plastering a static wallet address on your checkout page isn't going to cut it—that approach is clunky, insecure, and simply doesn't scale.

Your first move is to set up a secure crypto wallet that you, and only you, control. We're talking about a non-custodial wallet. This is non-negotiable. It means you hold the private keys to your funds. Think of it like having the only key to your company's digital vault. No key, no access.

A solid wallet is the foundation, but trying to manage crypto payments manually is a fast track to chaos. Imagine trying to figure out which customer sent which payment to a single address. It's a mess. This is exactly where a crypto payment gateway becomes indispensable for any serious business.

Why a Payment Gateway Is a Must-Have

A crypto payment gateway takes the entire messy payment process and automates it from start to finish. It handles all the technical blockchain stuff behind the scenes, bridging the gap between your online store and your customers, so you can focus on what you do best.

Here’s a quick rundown of what a good gateway brings to the table:

- Automated Payment Detection: Instead of one static address, it generates a unique address for every single order. This completely eliminates the guesswork of matching payments to customers.

- Real-Time Confirmations: The system keeps an eye on the blockchain for you. The second a payment is confirmed, you get notified, and you can ship the product or provide the service. No more manual checking.

- A Smoother Checkout: For your customers, the experience is clean and simple. They get a user-friendly interface that makes paying with crypto just as easy as using a credit card.

Think of a payment gateway like BlockBee as the ultimate crypto bookkeeper and cashier rolled into one. It turns a complex, error-prone manual task into a smooth, automated system. It generates the invoices, watches for the payments, and confirms the transactions, letting you accept ERC-20 tokens as effortlessly as you accept Visa.

This kind of automation isn't just a convenience; it's essential for scaling your business and giving your customers the professional experience they expect. You get all the upsides of crypto without the operational headaches.

Streamlining Integration and Management

The best payment platforms are built to be simple. For example, BlockBee provides plugins for all the major e-commerce platforms like WooCommerce, Magento, and OpenCart. This means you can get ERC-20 payments up and running on your store in a matter of minutes, usually without touching a single line of code.

This plug-and-play functionality makes accepting crypto a realistic option for any business, regardless of technical know-how. A good platform will also help you navigate the complexities of transaction fees—known as gas on Ethereum—ensuring that payments go through smoothly without any surprise costs.

Of course, it all starts with choosing the right wallet. For a deeper dive into the best options available, check out our complete guide to the top ERC-20 wallets. By pairing a secure, non-custodial wallet with a robust payment gateway, your business can confidently welcome the world of digital assets, opening up a new global customer base and preparing your revenue streams for the future.

Staying Safe: How to Handle Common ERC-20 Token Risks

While accepting ERC-20 tokens opens up new possibilities, it’s not without its pitfalls. You have to know what you're getting into to do it right. The biggest thing to watch out for on Ethereum is the notoriously unpredictable gas fees. These are the costs to process a transaction, and they can swing wildly. When the network is busy, those fees can spike, eating directly into your profit margins, especially on smaller sales.

Then there's the Wild West nature of token creation. Because the ERC-20 standard is open for anyone to use, the ecosystem is flooded with tokens. Unfortunately, many of these are fraudulent or completely worthless. Accepting a payment in a fake token is no different than a customer handing you a counterfeit bill.

Verifying Your Assets and Keeping Funds Secure

So, how do you protect your business? The number one rule is to always verify the token's smart contract address. Think of this as the token's unique serial number. You can easily look it up on a block explorer like Etherscan to confirm you’re dealing with the real deal, not a cleverly named knock-off.

For an even deeper layer of security, especially for projects creating their own tokens, engaging in professional smart contract auditing is a must. Auditors comb through the code to find vulnerabilities before bad actors can, protecting the integrity of the token and everyone who holds it.

When it comes to storage, a secure hardware wallet is the gold standard for your long-term holdings—it’s non-negotiable for serious funds. But for day-to-day business, a dedicated payment processor like BlockBee is the practical choice. It handles the technical headaches, manages transaction complexities, and ensures you’re only dealing with legitimate, vetted tokens.

The good news is that the space is maturing. By 2026, the most successful projects have started treating their token distribution with incredible discipline, almost like a carefully regulated valve. This leads to more stable and predictable tokenomics, which is great news for merchants who need reliability.

Common Questions About ERC-20 Tokens

Let's tackle some of the most common questions that pop up when businesses first start looking into ERC-20 tokens.

Can My Business Create Its Own ERC-20 Token?

Technically, yes. The ERC-20 standard makes the coding part surprisingly accessible, and anyone with a bit of know-how can deploy a token on the Ethereum network. But that's the easy part.

The real challenge is creating actual value. A successful token needs a convincing business model, sound tokenomics (the economics of the token), and, most importantly, the trust of a community. For the vast majority of businesses, the smarter move is to accept established ERC-20 tokens for payments rather than venturing into creating a new one from scratch.

Are All ERC-20 Tokens Safe to Accept?

Definitely not. The ease of creation is a double-edged sword. It means thousands of tokens exist with little to no real-world use, value, or legitimacy.

It's critical for any business to stick to tokens with a proven track record, deep liquidity, and a clear purpose. Think of major stablecoins like USDC and USDT—these are the kinds of tokens you can accept with confidence.

What's the Difference Between ETH and an ERC-20 Token?

A great way to think about this is to picture Ethereum as a massive, bustling highway system.

ETH is the fuel. It's the gasoline that powers every single action on that highway. You can't do anything—send a token, interact with an app—without a little bit of ETH to pay for the transaction fee, or "gas."

ERC-20 tokens are all the different vehicles driving on that highway. They are the assets, like cars, trucks, and buses, each carrying its own value and purpose. To move any of these vehicles from one place to another, you have to pay the toll using ETH.

You might be thinking, "Why not just manage these payments myself?" While the ERC-20 standard ensures all these tokens can work together, handling crypto payments manually is a huge operational headache. A good payment gateway takes care of the tricky parts—like detecting incoming payments, waiting for transaction confirmations, and integrating a smooth checkout process—which saves you time and cuts down on costly human error.

Ready to make crypto payments simple? BlockBee offers a secure, non-custodial gateway that easily integrates with major e-commerce platforms. Start accepting ERC-20 tokens today.