What Is a Crypto Token A Simple Explainer

Ever feel like you need a secret decoder ring to understand crypto? Let's break it down with a simple analogy. Think of a crypto token like a ticket you win at an arcade. That ticket has real value inside the arcade—you can trade it for prizes or play more games. But it's not the main currency of the entire town; it's designed for that specific ecosystem.

Tokens work in a similar way. They represent something of value on an existing platform, but they aren't their own independent currency system.

So, What Exactly Is a Crypto Token?

To really get a handle on what a crypto token is, picture it as a digital asset that piggybacks on another cryptocurrency's blockchain. A great example is the Ethereum blockchain. Think of it as a massive, public operating system, like a global version of Windows or iOS. Developers can then build their own applications (or "dapps") right on top of it.

Instead of going through the massive effort of building a brand-new blockchain from the ground up for every new idea, developers can simply issue tokens that run on a battle-tested network like Ethereum. This makes creating and distributing new digital assets way more efficient and secure. For a deeper dive, check out this in-depth cryptocurrency market report.

To make this crystal clear, here’s a quick summary of the core concepts.

Crypto Token Core Concepts at a Glance

| Characteristic | Description |

|---|---|

| Foundation | Built on an existing blockchain (e.g., Ethereum, Solana, Binance Smart Chain). |

| Function | Represents a specific asset, utility, or right within a particular project or ecosystem. |

| Creation | Relatively simple to create using smart contracts on the host blockchain. |

| Purpose | Can be used for governance, access to services, representing ownership, and much more. |

This table shows how tokens are essentially versatile digital building blocks, enabling innovation without the need to reinvent the wheel every time.

What Can a Token Represent?

The real magic of a token is its flexibility. It's not just a stand-in for money; it's a programmable asset that can stand for almost anything you can imagine. This opens the door to a whole universe of applications.

Here are just a few examples of what a token can represent:

- Utility: Think of this as a key. It might grant you access to a specific service or premium feature within an application, much like a software license.

- Ownership: A token can represent a digital share of a real-world asset. This could be anything from a piece of fine art or a plot of land to equity in a startup.

- Voting Rights: Many projects use tokens to give holders a direct say in how the project evolves. Your tokens become your votes on important decisions.

- Loyalty Points: Imagine a supercharged rewards program. Tokens can be used to reward customers for their loyalty to a brand or service.

By building on existing blockchains, tokens inherit the security and decentralization of the host network without the immense cost and complexity of launching a new one. This model has been a major catalyst for rapid development in the crypto space.

At the end of the day, a token's purpose is defined by the imagination of its creators. It's a fundamental tool for building new digital economies and interactive platforms. As we'll see, this simple concept unlocks some incredibly powerful possibilities for businesses and their customers.

What's the Real Difference Between a Crypto Token and a Coin?

To really get a handle on what a crypto token is, we need to clear up one of the most common mix-ups in the crypto space: the difference between a token and a coin. People often use the terms interchangeably, but they're fundamentally different things. Getting this distinction right is key to understanding how the whole ecosystem works.

Here’s a simple way to think about it. If a cryptocurrency like Bitcoin is the native currency of its own digital country (its blockchain), then a token is more like a concert ticket, a gift card, or a company's loyalty points. These things have real value and a specific purpose within that country’s economy, but they aren't the official currency.

It All Comes Down to the Blockchain

The biggest difference is their relationship with the blockchain. A crypto coin—like Bitcoin (BTC), Ethereum (ETH), or Solana (SOL)—has its own independent, native blockchain. These coins are the lifeblood of their networks. They’re used for everything from paying transaction fees (often called "gas") to rewarding the people who secure the network (miners or validators).

A crypto token, on the other hand, is a freeloader. It doesn't have its own blockchain. Instead, it’s built on top of an existing one. A developer can use a platform like Ethereum to create a new token using a smart contract, essentially piggybacking on the host blockchain's security and infrastructure without having to build a new one from the ground up.

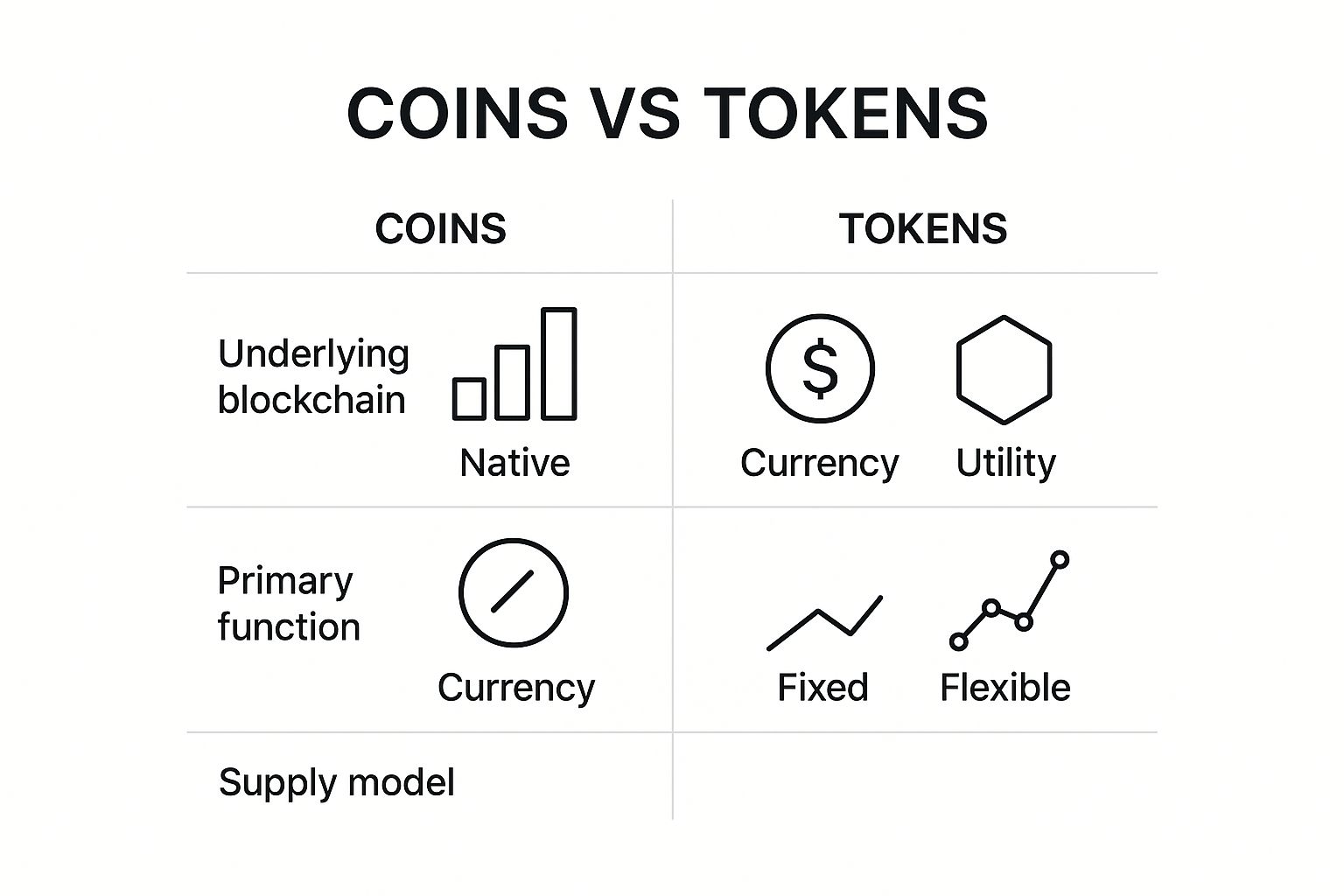

This visual gives you a quick rundown of the main differences.

As you can see, it boils down to whether the asset is native to its own blockchain or built on top of another one. This one difference shapes everything else.

To make this crystal clear, let's break it down in a table.

Comparison Crypto Coin vs Crypto Token

This side-by-side comparison highlights the core distinctions between a crypto coin and a crypto token.

| Feature | Crypto Coin (e.g., Bitcoin) | Crypto Token (e.g., SHIB) |

|---|---|---|

| Blockchain | Operates on its own native blockchain. | Built on top of an existing blockchain (like Ethereum). |

| Creation | Created through the mining or validation process of its blockchain. | Issued via smart contracts on a host platform. |

| Primary Use | Functions as digital money: a store of value and medium of exchange. | Represents a specific utility, asset, or right within a project. |

| Independence | Fully independent and self-sustaining. | Dependent on the host blockchain for security and transactions. |

| Examples | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) | Shiba Inu (SHIB), Chainlink (LINK), Uniswap (UNI) |

Essentially, coins are the fundamental building blocks, while tokens are the versatile applications built upon them.

Different Structures, Different Jobs

This core structural difference means coins and tokens are designed for very different jobs. Coins are almost always intended to act like money—a way to send value, a unit to price things in, and a place to store wealth. Their purpose is broad and foundational to their entire network.

Tokens, however, are specialists. Their purpose is defined entirely by the project that creates them, leading to a massive variety of use cases:

- Utility Tokens: These are like digital keys, granting you access to a specific product or service.

- Governance Tokens: Give holders a say in a project's future, essentially acting like voting shares.

- Security Tokens: These are digital representations of real-world assets, like a share in a company or a piece of real estate.

In short, coins are the fuel that powers a blockchain. Tokens are all the different apps and assets you can build with that fuel. One provides the raw infrastructure; the other drives the innovation.

This relationship is a two-way street. Blockchains like Ethereum offer a secure, decentralized foundation for developers to build on. In return, the thousands of tokens built on top create a bustling economy that drives demand for the native coin (ETH) needed to pay for every transaction. Understanding this dynamic is crucial to seeing the bigger picture of the crypto world.

How Crypto Token Standards Work

Ever wondered how thousands of different tokens, all built by different developers across the globe, can just work together on wallets and exchanges? The magic behind this is something called a crypto token standard.

Think of it as a universal blueprint. It’s like a shared recipe that everyone agrees to follow when creating a new token on a particular blockchain. Because everyone uses the same fundamental recipe, the end products—the tokens—are all compatible with the existing ecosystem of wallets, exchanges, and apps.

This whole concept really exploded with Ethereum’s launch back in 2015. Ethereum introduced the first major token standard, giving developers a clear, simple framework for creating their own assets. This innovation paved the way for the 2017 ICO boom and is the foundation of today’s sprawling DeFi landscape.

The Most Influential Token Standards

While countless blockchains have their own rules, a few key standards have become the industry benchmarks. They are the giants on whose shoulders most new projects stand. These standards are brought to life using various smart contract programming languages that define what a token can and can’t do.

Here are the heavyweights you’ll see most often:

ERC-20 (Ethereum): This is the undisputed king of fungible tokens. "Fungible" is just a fancy way of saying each token is identical and interchangeable with another, like how one dollar bill is the same as any other. This is the standard behind most of the utility tokens and stablecoins you know.

ERC-721 (Ethereum): The polar opposite of ERC-20, this standard is for creating non-fungible tokens (NFTs). Each ERC-721 token is a one-of-a-kind digital item with a unique identity. This makes it perfect for digital art, collectibles, and proving ownership of unique assets.

BEP-20 (BNB Smart Chain): Think of this as the BNB Chain's version of ERC-20. It's the go-to standard for fungible tokens on that network and was cleverly designed to be compatible with Ethereum, making it easier to move assets between the two chains.

SPL (Solana): The Solana Program Library (SPL) is the token standard for the high-speed Solana blockchain. Projects flock to Solana for its lightning-fast transactions and super-low fees. You can find out more by checking out our post about https://blockbee.io/blog/post/blockbee-adds-support-for-solana-and-solana-based-tokens.

Why Standards Are the Bedrock of the Crypto World

Without these shared rulebooks, the crypto space would be a chaotic mess. Imagine if every new token required a custom wallet integration or a unique setup for every exchange. It would be like needing a different electrical adapter for every single device you own. It just wouldn't work.

Token standards create a common language that every application on a blockchain can speak. They guarantee that a new token will play nicely with the existing infrastructure, which is the secret sauce behind the explosive growth of decentralized apps.

This interoperability is what holds the entire token economy together. It ensures predictable interactions, removes huge barriers for developers, and gives users the confidence and security they need to trust the system.

Exploring Real-World Use Cases for Crypto Tokens

It's easy to get lost in trading charts and price speculation, but crypto tokens are much more than just numbers on a screen. Think of them as versatile building blocks, the raw materials developers use to create entirely new digital economies and interactive systems. To really get a handle on what a crypto token is, we have to look at the real-world problems they're actually solving.

Tokens aren't a one-size-fits-all solution. They're specialized tools, and we can group them by what they do within their digital ecosystem. This specialization is what makes them so powerful across so many different fields, from finance and gaming to art and community management.

Utility Tokens: The Keys to Digital Services

A utility token is best thought of as a digital key or an access pass. Its main job isn't to be an investment; it's to give the holder access to a specific product or service on a platform. It’s like a token for an arcade game—its value comes from what you can do with it inside that specific arcade.

These are by far the most common type of token, and they perform all sorts of functions to keep a platform running smoothly.

- Platform Access: Some projects require you to hold or spend their native token to unlock certain features. A decentralized cloud storage network, for example, might make you pay for storage with its own utility token.

- Transaction Fees: Many decentralized apps (dApps) use their own tokens to cover internal transaction costs, which helps create a small, self-sustaining economy.

- Rewards and Incentives: Platforms frequently give out utility tokens to reward people for helpful actions, like creating content, participating in the community, or lending resources to the network.

This setup creates a really interesting dynamic: the token's demand is directly tied to the platform's success. The more people who want to use the service, the more demand there is for the token needed to access it.

Governance Tokens: Giving Power to the People

Next up are governance tokens. These are basically voting shares for a decentralized project. If you hold these tokens, you get a direct say in how the platform or protocol develops over time. It’s a huge departure from the classic, top-down corporate model, pushing decision-making power out to the community itself.

By distributing governance tokens, projects become truly decentralized. Holders can propose and vote on crucial changes, such as adjusting platform fees, allocating funds from the treasury, or deciding on new feature integrations.

This democratic model helps ensure that a platform evolves in a way that actually benefits its most dedicated users, instead of just following the whims of a central authority. It builds a powerful sense of ownership and keeps everyone aligned.

Security Tokens: Bridging Digital and Physical Assets

Finally, we have security tokens, which represent a massive step forward for finance. These are digital contracts that represent ownership in a real-world, tradable asset. Because they're tied to actual assets, they fall under federal security regulations and essentially work like digital versions of stocks, bonds, or even real estate deeds.

This process is called tokenization, and you can apply it to just about any asset you can think of.

- Real Estate: A whole apartment building can be "tokenized," letting investors buy and sell fractional shares of the property. This dramatically lowers the barrier to entry for real estate investing. You can learn more about how blockchain is transforming property ownership in our guide on crypto for real estate.

- Company Equity: Instead of issuing traditional shares, startups can issue security tokens, giving people a more liquid and accessible way to invest in private companies.

- Fine Art: A multi-million-dollar painting can be split into thousands of tokens, allowing a whole group of investors to co-own a masterpiece that would otherwise be out of reach.

By bringing real-world assets onto the blockchain, security tokens unlock greater liquidity, create transparent ownership records, and make transactions faster and cheaper. They're a perfect example of how tokens are building a bridge between the traditional financial world and the power of blockchain technology.

How Businesses Can Start Accepting Token Payments

The idea of accepting crypto tokens might sound intimidating, but for a modern business, it’s becoming just as simple as swiping a credit card. How? The magic lies in crypto payment gateways, which act as the middleman between the complex world of blockchain and your familiar checkout page. These services handle all the technical details, so you can open your doors to a global customer base without needing a degree in computer science.

For any business dipping its toes into crypto, two big worries usually pop up: price volatility and the technical setup. A good payment gateway takes care of both. It gives your customers a smooth, easy way to pay with their preferred tokens and confirms the transaction on the backend, all without a hitch.

What Does a Crypto Payment Gateway Actually Do?

Think of a payment gateway like BlockBee as an automated cashier for your crypto transactions. When a customer decides to pay with a token, the gateway instantly generates a unique payment address and a QR code for them. It then watches the blockchain, waits for the payment to be confirmed, and gives your store the green light to fulfill the order.

All of this happens behind the scenes, leaving you with a simple dashboard to manage all your crypto income.

As you can see, a platform like BlockBee provides a clean interface that lets you track every transaction and manage your funds without needing any specialized tools.

Perhaps the biggest perk is how these gateways handle crypto's infamous price swings. Many offer instant conversion, meaning the moment you receive a token payment, it's automatically swapped for a stablecoin or a fiat currency like the US Dollar. This shields your business from market volatility, guaranteeing you get the exact amount you charged for your goods or services.

A payment gateway lets you grab all the upsides of crypto—like lower fees, borderless payments, and zero chargebacks—without ever having to worry about the price crashing. It’s really the best of both worlds.

Getting Started Is Easier Than You'd Expect

Gone are the days when adding crypto payments meant a huge, expensive development project. Today, the best gateways offer ready-made plugins and simple APIs that plug right into major e-commerce platforms. For most merchants, this means you can be up and running in minutes, not weeks.

Here’s what the process usually looks like:

- Sign Up: Create an account with a payment gateway like BlockBee.

- Set Up Your Wallet: Link the wallet addresses where you want your funds sent. Because platforms like BlockBee are non-custodial, the crypto goes directly to you.

- Install the Plugin: Find and install the plugin for your e-commerce site, whether it's WooCommerce, Magento, or another popular platform.

- Connect Your Store: Just copy your API keys from the gateway dashboard and paste them into the plugin’s settings.

Once that's done, you're ready to accept token payments from anyone, anywhere on the globe. For a more in-depth look, check out our complete guide on https://blockbee.io/blog/post/accepting-cryptocurrency-payments. It’s a simple move that can connect you with a whole new segment of tech-forward customers and place your business on the leading edge of commerce.

What's Next for Crypto Tokens?

Looking down the road, it’s clear that tokens are on a path to become a fundamental part of our digital lives. Think of them as the basic building blocks for a more open and efficient economy.

The next massive shift we’re seeing is the tokenization of real-world assets (RWAs). This is just a fancy way of saying we can now convert ownership of things like real estate, rare art, or even a stake in a private company into a digital token on a blockchain. Suddenly, assets that were once incredibly difficult to buy or sell are becoming liquid and accessible to a much broader audience.

But it’s not just about high finance. Tokens are completely changing the game in digital entertainment and social platforms.

GameFi and SocialFi

In the gaming world, a space now called GameFi, tokens are used to represent everything from a rare sword to in-game currency. This gives players actual, verifiable ownership of their digital loot for the first time. It's a huge departure from the old model where the company owned everything.

We’re seeing a similar trend with SocialFi, where tokens are being used to build and reward online communities. Creators and their followers can finally share in the value they create together, rather than letting a central platform capture all of it.

Market Maturity

The financial markets built around these tokens are also growing up fast. In 2025, the monthly trading volume for crypto derivatives—financial instruments mostly based on tokens—reached a staggering $8.94 trillion. That’s not a small number. In fact, derivatives trading now accounts for about 76% of the entire crypto trading market. If you want to dive deeper into these numbers, you can find more insights on the crypto options market at Coinlaw.io.

Ultimately, tokens are more than just a piece of technology; they represent a whole new way of thinking about ownership. They're rewriting the rules for how we define, control, and trade value, pushing us toward a future that’s more decentralized and puts power back in the hands of the user.

Frequently Asked Questions About Crypto Tokens

As you dive deeper into the world of crypto tokens, you're bound to have some questions. It's a complex space, so let's walk through a few common queries to help bring everything into focus.

Can I Create My Own Crypto Token?

Surprisingly, yes. Blockchains like Ethereum and Solana have established token standards (like ERC-20) that make the technical side of creating a token more straightforward than you might think.

But here’s the thing: coding the token is the easy part. The real work is building something meaningful around it—a legitimate project with a real use case, a dedicated team, and a community that believes in its vision.

Are All Crypto Tokens a Good Investment?

Definitely not. The crypto market is famous for its wild price swings and is filled with risk. A huge number of tokens have no real purpose, and unfortunately, many are just vehicles for scams.

This is why you'll constantly hear the phrase "do your own research" (DYOR). Before you even think about investing, you have to dig into the project's whitepaper, understand its goals, vet the team behind it, and assess its long-term potential.

A token's price on an exchange can be misleading. Focus on understanding the project's actual value and mission, not just the daily price charts.

How Are Tokens Stored Securely?

You store tokens in a digital wallet that’s compatible with their native blockchain. For example, you’d use an Ethereum-compatible wallet to hold ERC-20 tokens.

For the best possible security, a hardware wallet is the gold standard. It’s a physical device that keeps your private keys completely offline, making it virtually impossible for hackers to get to your assets. Once you start accumulating different assets, finding the best crypto portfolio tracker can also be a huge help in keeping everything organized and secure.

Ready to see what token payments can do for your business? With BlockBee, you can easily accept over 70 different cryptocurrencies, all with low fees and instant payouts. Get started for free and discover just how simple crypto can be.