A Business Guide to ERC 20 Wallets

At its core, an ERC-20 wallet is your digital hub for any token built on the Ethereum blockchain. Think of it less like a traditional wallet holding just one type of currency and more like a master key. A single wallet address can securely hold, send, and receive thousands of different digital assets, from popular stablecoins to niche utility tokens, as long as they all follow the same technical playbook.

What Are ERC 20 Wallets and Why Your Business Needs One

Before the ERC-20 standard came along, the world of digital tokens was a bit of a mess. Imagine every new token as a uniquely shaped peg. To use it, you needed a custom-built, perfectly matched hole—a specialized wallet and a separate integration. This created a huge headache for developers, exchanges, and everyday users. It was clunky and inefficient.

The ERC-20 standard fixed all of that by creating a universal blueprint. It was like everyone finally agreed to make all their pegs the same round shape. Suddenly, any token following this standard could fit perfectly into any wallet or app built for it.

This interoperability is the real magic of the ERC-20 standard. It established a common language for tokens on the Ethereum network, making them incredibly easy to create, trade, and use across countless platforms without worrying about compatibility.

For any business, this means an ERC-20 wallet is more than just a place to store crypto. It’s your operational gateway into a massive, thriving ecosystem of digital finance and commerce.

Your Business Onboarding Pass

Simply put, an ERC-20 wallet is any digital wallet that understands this standard. It securely holds your private keys—the secret passcodes that prove you own your assets—and lets you manage any token built on this framework. With just one public address (the one that usually starts with "0x"), you can receive an endless variety of ERC-20 tokens.

This single tool unlocks some powerful capabilities for a modern business:

- Expand Payment Options: Start accepting a wide range of popular stablecoins like USDT and USDC, instantly opening your doors to a global customer base.

- Streamline Global Transactions: Move money across borders in minutes, not days, with far more transparency than the old-school banking system offers.

- Engage with DeFi: Tap into the world of decentralized finance to lend, borrow, or earn a return on your company's digital assets.

The growth here is impossible to ignore. The crypto wallet market, which is essential for managing these tokens, was valued at USD 12.20 billion in 2023. Projections show it rocketing to USD 100.77 billion by 2033, fueled by the explosion of tokens these wallets support. For any business that takes payments online, this is a clear signal that the underlying infrastructure is robust and ready.

To help you get a clearer picture, here are the essential features that make an ERC-20 wallet truly ready for business operations.

Key Features of a Business-Ready ERC 20 Wallet

| Feature | Description | Business Benefit |

|---|---|---|

| Multi-Token Support | The ability to hold, send, and receive thousands of different ERC-20 tokens with a single address. | Simplifies operations by allowing you to manage diverse digital assets from one centralized point. |

| Robust Security | Strong encryption, secure key management (custodial or non-custodial), and optional multi-sig support. | Protects company funds from theft, unauthorized access, and operational errors. |

| Platform Integration | APIs and tools that allow the wallet to connect with payment gateways, e-commerce sites, and accounting software. | Automates payment processing, invoicing, and reconciliation, saving time and reducing manual work. |

| Scalability | The capacity to handle a high volume of transactions without performance degradation. | Ensures your payment system remains reliable and efficient as your business grows and transaction volume increases. |

These features transform a basic wallet into a powerful financial tool for your business.

Unlocking Operational Efficiency

Going beyond just accepting payments, a business-ready ERC-20 wallet becomes your financial command center, especially when integrated with a platform like BlockBee. It’s the place where you manage incoming funds, automate payouts to suppliers or employees, and maintain complete control over your assets without ever needing to trust a third party.

To fully grasp how these wallets function, it helps to understand the blockchain development that powers them. This foundational technology is what provides their security, transparency, and incredible versatility.

Custodial vs. Non-Custodial: The Critical Choice for Asset Control

When it comes to your company’s ERC-20 tokens, choosing between a custodial and a non-custodial wallet is one of the most important decisions you'll make. This isn't just a technical detail; it’s a fundamental choice about security, autonomy, and who ultimately controls your assets.

Think of it this way. A custodial wallet is like a bank vault. You hand your assets over to a third party, like a crypto exchange, and they hold everything for you. They manage the security, the private keys, and all the back-end complexity. You just get a username and password to log in.

A non-custodial wallet, on the other hand, is like a personal safe you keep in your own office. You—and only you—hold the key. This gives you absolute, direct control over every token you own. It's the core idea behind the famous crypto mantra: "Not your keys, not your crypto."

The Convenience of Custodial Wallets

There's no denying that custodial wallets are convenient, especially for newcomers. If you forget your password, there’s usually a "forgot password" link. The experience feels familiar, a lot like online banking.

But that convenience comes with a huge trade-off: trust. You are trusting the custodian to keep your assets safe, to stay in business, and to let you withdraw your funds whenever you want. For any business, that’s a massive single point of failure that’s completely out of your hands.

A custodial setup means you're not just giving a third party access to your funds—you're giving them ownership of the private keys. While it simplifies things, it exposes your business to enormous risks like exchange hacks, frozen accounts, or platform downtime.

Imagine needing to make payroll or pay a supplier, only to find your funds are inaccessible. That dependency can quickly turn into a serious business liability.

The Power of Non-Custodial Control

A non-custodial wallet puts all the security responsibility on you, but in return, it gives you total sovereignty over your funds. Your business holds the private keys, which means you have direct, on-chain control of your assets. This is the gold standard for security and autonomy in the crypto world.

For business operations, the advantages are crystal clear:

- Total Asset Control: No one can freeze, seize, or block access to your funds. This is non-negotiable for business continuity.

- Enhanced Security: You sidestep the catastrophic risk of a centralized exchange getting hacked. Your own security protocols are the only ones that matter.

- Operational Freedom: You can execute mass payouts, manage your treasury, and build payment systems without asking a third party for permission.

This kind of control is vital for any company serious about managing its digital assets. Part of that management is being able to verify what you own. Tools like a template to verify ERC-20 token holdings are invaluable for proving ownership directly on the blockchain.

Why Businesses Prefer Non-Custodial Solutions

For merchants, developers, and established enterprises, the choice becomes obvious. While custodial services might seem easier at first glance, the long-term strategic benefits of a non-custodial approach are simply better for business. It’s the only way to ensure your company’s digital assets truly belong to you.

This is exactly why platforms like BlockBee are built on the non-custodial principle. When a customer pays you, the funds land directly in your wallet—not some intermediary account. This direct-to-wallet model is the cornerstone of secure and reliable payment processing.

Ultimately, going non-custodial is a strategic move to prioritize security and control over outsourced convenience. For a deeper dive on this, check out our guide on choosing a crypto custody solution.

Choosing the Right ERC 20 Wallet Type for Your Operations

Picking the right ERC 20 wallet isn't just a technical choice—it's a core business decision that shapes your security, efficiency, and how easily you can move money. Not all wallets are created equal. Think of them as different tools for different financial jobs. The biggest fork in the road is choosing between "hot" storage for daily business and "cold" storage for locking down your assets.

To make the right call, you first have to get a feel for the main options. Each comes with its own set of pros and cons, making it a better fit for some tasks than others.

Software Wallets: The Everyday Workhorse

Software wallets, which you'll often hear called "hot wallets," are just apps you install on your computer or phone. They live online, which makes them incredibly handy for the constant back-and-forth of daily transactions. If your business takes crypto payments, your software wallet is basically your digital cash register—always on and ready for action.

Their biggest wins are speed and simplicity. You can send and receive ERC-20 tokens in a snap, which is perfect for e-commerce checkouts, paying suppliers, or handling a bunch of small payouts.

But that always-on internet connection is also their Achilles' heel. While they are built to be secure, they're naturally more exposed to online threats like malware and phishing scams than their offline cousins.

Key Takeaway: Software wallets are all about access and speed, making them the perfect tool for managing your daily cash flow. They're the engine of your crypto operations, not the vault where you should be stashing your company's treasury.

This convenience has led to some staggering numbers. In 2025, the Ethereum world is home to over 820 million active wallets, and you'll find that hot wallets make up a whopping 78% of the market. This boom is fueled by the explosion of ERC-20 tokens, pushing software wallet downloads past 520 million globally as people increasingly turn to mobile for easy transfers. If you want to see the trends for yourself, check out these crypto wallet adoption statistics.

Hardware Wallets: The Secure Vault

Hardware wallets are small physical devices, kind of like a specialized USB stick, built for one purpose: keeping your private keys completely offline. This is what we call "cold storage." Since the keys that control your funds never touch an internet-connected device, they're safe from virtually every type of online attack. This makes them the undisputed gold standard for securing large amounts of crypto.

Think of a hardware wallet as your company's Fort Knox. It’s where you put the money you don't need to touch day-to-day, like company profits, long-term investments, or your main treasury reserves.

The trade-off, of course, is convenience. To make a transaction, you have to physically plug in the device and manually approve everything. It’s a deliberate, slower process compared to the click-and-go nature of a software wallet.

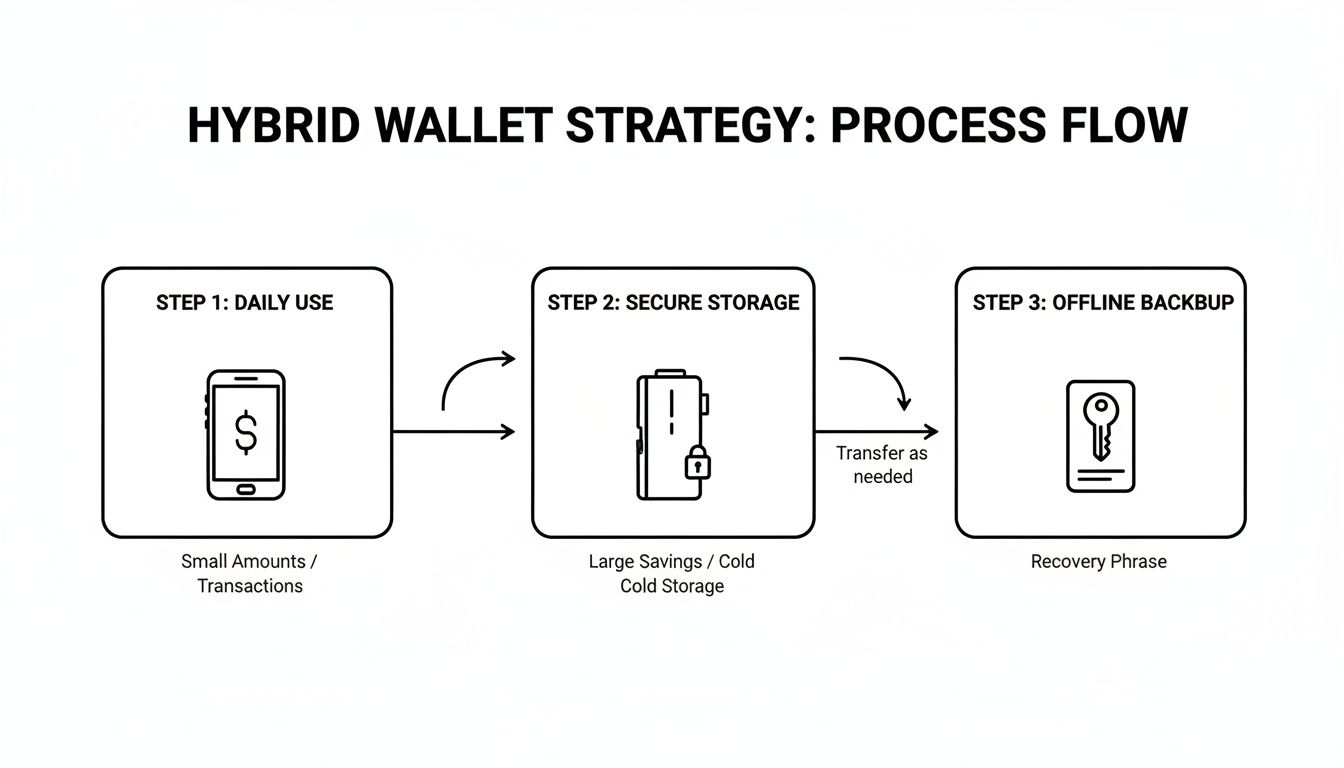

A Hybrid Strategy for Optimal Operations

For most businesses, the smartest move isn't picking one wallet over the other. It’s about creating a hybrid strategy that gives you the best of both worlds: the flexibility of a hot wallet and the security of a cold one.

Here’s what that looks like in practice:

- Daily Transactions: Use a trusted, non-custodial software wallet (like MetaMask or Trust Wallet) to handle all your incoming customer payments and regular business expenses. This keeps things running smoothly without any hiccups.

- Secure Sweeping: Set up a routine—maybe daily or weekly—to "sweep" the funds you've collected from your hot wallet into your hardware wallet. For example, you might decide that any balance over a certain amount gets moved to cold storage for safekeeping.

- Long-Term Holdings: All your significant company assets and profits stay locked down in the hardware wallet, completely offline and untouched until you have a specific reason to move them.

This two-wallet system is a powerful setup. It lets you manage daily payments with ease while knowing the bulk of your company's digital assets are protected by the best security out there.

Comparing ERC 20 Wallet Types for Business Use

To lay it all out clearly, let's put these wallet types side-by-side and see how they stack up against the criteria that really matter for a business.

| Wallet Type | Security Level | Accessibility | Best For |

|---|---|---|---|

| Software Wallet | Good (Hot) | High (Online) | Frequent transactions, e-commerce payments, and daily operations. |

| Hardware Wallet | Excellent (Cold) | Low (Offline) | Securing large balances, long-term holdings, and company treasury. |

| Paper Wallet | High (Cold) | Very Low (Offline) | Deep, long-term archival storage; less practical for business use. |

You'll also hear about paper wallets, which is just printing your private keys on a piece of paper. While technically secure, they are a nightmare from a practical standpoint—they can be lost, damaged, or stolen easily. For almost any real-world business, the hybrid software-hardware model is the most sensible and robust solution you can implement.

2. Integrating ERC-20 Wallets into Your Payment System

So, you've got your wallet. Now what? The next step is bridging the gap between your wallet and your actual business operations. For a lot of merchants, the thought of handling blockchain transactions feels like a technical nightmare. But here's the good news: you don't need to be a blockchain guru to start accepting crypto payments securely.

This is where a non-custodial crypto payment gateway comes in. It’s the missing piece that connects your e-commerce store or business software directly to your wallet, automating the whole payment process from the customer’s click to the funds landing in your account.

The Role of a Payment Gateway

Think of a payment gateway like BlockBee as a universal translator for your business. It takes all the complicated blockchain stuff—like watching for transactions and creating addresses—and turns it into simple, useful information for you. It does all the heavy lifting behind the curtain.

This setup lets you offer a slick, professional checkout for your customers, while you rest easy knowing every payment goes directly into the wallet you control. The integration itself is usually painless, often just a few clicks to install a plugin or a simple API call for custom-built systems.

A non-custodial payment gateway lets you tap into the full power of your ERC-20 wallet without ever giving up control. It automates the messy mechanics of crypto payments so you can focus on your business, not on managing the blockchain.

Once you have this bridge in place, you unlock some powerful features that can seriously clean up your business's crypto operations. These tools are built to solve common headaches in both accounting and the customer experience.

Accepting Incoming Payments with Ease

The most obvious win from integrating ERC-20 wallets is the ability to accept a huge range of tokens from customers anywhere in the world. When a customer decides to pay with an ERC-20 token like USDT or USDC at checkout, the gateway instantly creates a unique payment request for them.

From there, the system keeps an eye on the blockchain for the payment. As soon as it’s confirmed, the gateway pings your e-commerce store to mark the order as paid and ready for fulfillment. The money arrives directly in your non-custodial wallet, with no middleman taking a cut or holding your funds.

This whole process isn't just secure—it's incredibly efficient. It often provides a faster and more transparent checkout than you’d get with credit cards. Better yet, it's all automated, which cuts out manual verification and the risk of someone making a costly mistake.

The infographic below shows a smart way to manage these incoming funds with a hybrid wallet strategy, using a "hot" wallet for daily business and a "cold" one for secure, long-term savings.

As you can see, daily payments can flow into a software wallet for easy access, while you periodically sweep larger amounts into a hardware wallet for maximum security. It’s a balanced approach that gives you both flexibility and peace of mind.

Streamlining Operations with Advanced Features

Beyond just taking payments, a proper integration gives you tools to fine-tune your financial workflow. Two of the most valuable features you’ll find are reusable addresses and mass payouts.

Reusable Deposit Addresses: The old-school security advice was to generate a new address for every single transaction. While safe, this can be a total nightmare for accounting. Modern gateways solve this with static, reusable addresses that are securely monitored. You can give a specific address to a regular client or an internal department, which makes reconciling payments a breeze without sacrificing security. If you need a hand getting started, our tutorial on how to create a wallet address is a great place to begin.

Mass Payouts: This is a lifesaver for any business that needs to pay suppliers, affiliates, or employees in crypto. Instead of creating and sending hundreds of individual transactions—each with its own gas fee—you just upload one file with all the addresses and amounts. The system then bundles and sends all the payments at once, directly from your wallet. This saves a massive amount of time and can seriously cut down on network fees.

These features transform your ERC-20 wallet from a simple digital piggy bank into a core part of your company's financial engine. With plug-and-play support for platforms like WooCommerce, Magento (Adobe Commerce), and PrestaShop, getting started is easier than ever, opening up new ways to make money and run your business more efficiently.

Essential Security Practices for Your Business Wallet

When you're handling company funds, wallet security stops being a personal preference and becomes a critical corporate responsibility. A single weak link can put your customers, your stakeholders, and your entire business at risk. Protecting your company's ERC-20 wallets isn't about just one trick; it's about building a multi-layered defense system where there's no room for error.

This goes far beyond just setting a strong password. It’s about creating institutional-grade protocols, and the entire structure rests on one thing: how you manage your private keys and seed phrases.

Mastering Private Key and Seed Phrase Security

Your private key is what proves you own the funds in your wallet. It's the one thing that lets you spend them. The seed phrase is simply a more user-friendly backup of that key. If you lose either, your funds are gone forever. If a thief gets them, your funds are their funds now.

The first and most important rule is non-negotiable: never store your private key or seed phrase digitally. No text files on a server, no notes app on a phone, and definitely no drafts in your email. These are the low-hanging fruit for hackers.

Instead, your business needs a concrete, physical backup plan:

- Write It Down: The simplest method is still one of the best. Write the seed phrase down on paper.

- Create Redundancy: Don't just make one copy. Create several and store them in completely separate, secure locations, like a fireproof safe in the office and a bank's safe deposit box.

- Use Durable Materials: For serious longevity, think about etching your seed phrase into steel plates. These can survive fires, floods, and other physical disasters that would destroy paper.

This physical-first approach is your ultimate defense against online attacks. A hacker can't get into a safe from halfway around the world. To really nail this down, check out our deep dive on private key security.

Implementing Corporate Governance with Multisig Wallets

For any business, giving one person sole control over transactions is a massive liability. That single point of failure is exactly what multisig (multi-signature) wallets are designed to eliminate. A multisig wallet is set up to require more than one private key to sign off on a transaction before it's sent.

It’s the digital equivalent of a bank vault needing two keys held by two different managers. You can configure a wallet to require 2-of-3 signatures, 3-of-5, or whatever combination makes sense for your operational structure. This introduces real corporate governance into your crypto treasury, making it impossible for one person to move funds on their own.

A multisig setup doesn't just protect you from hackers; it also minimizes internal risks, whether they're from a bad actor or just a simple human mistake.

Layering Your Digital Defenses

Key management is the core, but you still need strong digital security practices for every device and account that touches your crypto. Think of these as additional layers of armor.

Make sure this checklist is standard operating procedure for your team:

- Strong, Unique Passwords: Every single service needs its own complex password. A password manager is the only practical way to handle this securely.

- Two-Factor Authentication (2FA): Enable 2FA everywhere you can. Crucially, use an authenticator app (like Google Authenticator) instead of SMS, which is vulnerable to SIM-swap attacks.

- Phishing Awareness: Your team is your first line of defense. Train them to spot and report suspicious emails. Scammers are experts at impersonating exchanges and partners to trick employees into giving up credentials.

By combining ironclad physical security for your keys, layered digital defenses, and smart governance with multisig wallets, you can build a security framework that truly protects your assets and earns trust.

Gas Fees and Confirmations: The Nuts and Bolts of Ethereum Transactions

When you're running a business that accepts ERC-20 tokens, you’re dealing with more than just the tokens themselves. You're operating on the Ethereum network, and every single action—from a customer payment to an internal transfer—has a cost. This is where gas fees come into play.

Think of gas like the fuel for a car. To get from point A to point B, you need to pay for gas. Similarly, to get a transaction processed on the Ethereum network, you have to pay a fee to the validators who do the computational work.

This fee isn't a flat rate. It works a lot like surge pricing on a ride-sharing app. When the network is busy with tons of people trying to make transactions, the price of gas goes up. For any business, getting a handle on these fluctuating costs is key to protecting your bottom line.

How Ethereum Gas Fees Actually Work

The calculation for gas is pretty straightforward: Gas Limit x (Base Fee + Priority Fee).

Let's break that down:

- Gas Limit: This is the maximum amount of "fuel" you're willing to let your transaction use. A simple token transfer has a standard limit, usually 21,000 units, but more complex actions will need a higher limit.

- Base Fee: Think of this as the minimum price-per-gallon. The network sets this price automatically based on how congested it is.

- Priority Fee (or Tip): This is an optional extra you can add to jump the queue. During busy times, adding a small tip encourages validators to pick up your transaction first.

Learning to balance these components means your transactions get processed smoothly without you having to overpay.

The Waiting Game: Transaction Confirmations

Once you hit "send" on a transaction, it isn't final right away. It has to be picked up, included in a "block" of transactions, and then officially added to the blockchain. This is called a confirmation.

The more blocks that are added on top of the one containing your transaction, the more secure and permanent it becomes. But this process takes time—sometimes minutes—which can be a real headache for customer experience. Nobody wants to be stuck on a checkout page waiting for their crypto payment to go through.

This is exactly where a payment gateway like BlockBee makes a world of difference. It can send an instant notification to your store the moment a payment is detected on the network—long before it's fully confirmed. You can fulfill the order right away, giving your customer a seamless experience while the blockchain does its thing in the background.

This approach keeps your checkout process fast and smooth, which is absolutely vital for keeping e-commerce conversion rates high.

The sheer volume of transactions moving through ERC-20 wallets is staggering. The ecosystem is on track to support 861 million crypto users by 2025, with stablecoins like USDT and USDC leading the charge. This massive scale makes it more important than ever for businesses to have a solid strategy for managing fees and confirmations. You can find more stats on the rapid growth of crypto usage on awisee.com.

Got Questions About ERC-20 Wallets? We've Got Answers.

Even with the best game plan, you're bound to run into some specific questions when you start working with ERC-20 wallets. Let's tackle some of the most common ones we hear from businesses, so you can move forward with confidence.

Can I Keep Different ERC-20 Tokens in the Same Wallet?

Yes, you absolutely can. In fact, this is one of the biggest advantages of the ERC-20 standard.

Think of your wallet less like a single-currency piggy bank and more like a keychain that can hold keys to all your different Ethereum-based assets. A single wallet address can manage hundreds, even thousands, of different ERC-20 tokens all at once. This covers everything from stablecoins like USDT and USDC to the native tokens of countless projects. For a business, this is a huge operational win—no need to juggle a separate wallet for every single token you want to hold or accept.

What Happens If I Accidentally Send an ERC-20 Token to a Bitcoin Wallet?

This is a scenario you want to avoid at all costs. Sending an ERC-20 token to a wallet that doesn't support the Ethereum network, like a standard Bitcoin wallet, almost always means those funds are gone for good. Those other wallets simply don't speak the same language and can't recognize the smart contracts that govern ERC-20 tokens.

Heads Up: There's usually no "undo" button for this kind of mistake. It's absolutely crucial to double- and triple-check that the receiving address is from an Ethereum-compatible wallet before you hit "send." If you're ever unsure, send a tiny test amount first to confirm everything works as expected.

How Do I Find My Public Wallet Address to Receive Funds?

Your public ERC-20 wallet address is what you share with others to get paid. It's a long string of characters that almost always starts with "0x".

Finding it is easy. Just follow these steps:

- Open up your wallet app on your computer or phone.

- Look for a button that says "Receive" or "Deposit". It's usually front and center.

- Clicking it will show you your full wallet address along with a handy QR code for easy scanning.

You can copy that address and share it freely. Just remember: this public address is completely different from your private key or seed phrase. Keep those secret, always.

Ready to bring secure, non-custodial crypto payments to your business? BlockBee gives you the tools to accept ERC-20 tokens and other cryptocurrencies, complete with easy e-commerce plugins and powerful mass payout features. Get started for free at BlockBee.