Mastering Your Private Key Security

When we talk about private key security, we're really talking about the set of rules you live by to protect the one thing that gives you control over your digital assets. This isn't just another password; it's the only thing that proves you own your crypto or other blockchain assets. Keeping it secret isn't just important—it's everything.

The Foundation of Digital Ownership

The best way to think about your private key is as the one-and-only key to your digital safe. It’s a long, complex string of letters and numbers that gives you the power to manage your funds. You can give out your public key (or wallet address) to anyone—that’s like your bank account number for receiving money. But your private key? That's your signature and PIN all rolled into one.

If you lose it, it’s like misplacing the deed to your house. There’s no "forgot password" button to click or a support line to call for a reset. Once that key is gone, so are your assets. For good.

The Real-World Stakes of Private Key Security

The fallout from a compromised private key is swift and brutal. The moment someone else gets their hands on it, they can empty your accounts. This isn't some far-off, theoretical danger; it happens every single day. In fact, stolen credentials are the number one cause of major data breaches.

Look at the data: in just one year, over 2,500 cyberattacks were reported, impacting a staggering 939 million people. The primary culprit? Stolen credentials that gave attackers the keys to the kingdom. You can dig into more eye-opening cybersecurity statistics on huntress.com to see just how common these threats are.

The rule of thumb in this space is simple: If you don't control your keys, you don't control your assets. This is why getting private key security right isn’t just a “best practice.” It's the most critical skill you can learn.

The danger isn't just about losing money, either. A stolen key can unravel your digital life in other ways:

- Identity Theft: An attacker can use your assets and identity to carry out scams or other malicious acts in your name.

- Irreversible Loss: Unlike with a bank, there’s no central authority to step in and reverse a fraudulent crypto transaction. Once it's sent, it's gone.

- Reputational Damage: For any business operating in this space, a key compromise can instantly destroy customer trust and lead to a cascade of legal and financial problems.

Generating Keys The Right Way

The security of your private key all starts with how it’s made. If you create a weak key, it's like building a bank vault with a screen door—every other security measure you take becomes pointless. The real goal here is to generate a key with the highest possible randomness, or entropy, which makes it practically impossible for anyone to guess.

Think of it like this. Using a simple, predictable online tool to make your key is the equivalent of setting your password to "password123". What you really want is something more like a 20-character password with a jumble of random symbols and numbers. That level of randomness is the absolute foundation of a secure private key.

Choosing Your Generation Method

The tool you use to create a private key has a massive impact on its security. Each option presents a different balance of convenience versus protection, so it's important to understand what you're getting into.

- Software Wallets: These are apps that live on your computer or phone. They strike a decent balance between usability and security for everyday use, but they're only as safe as the device they're on. A bit of malware on your laptop could mean your key is compromised.

- Browser Extensions: While they are incredibly handy, extensions are generally your least secure option. They're always connected to the internet and are prime targets for phishing scams and malicious code.

- Hardware Wallets: These are physical devices built for one job: keeping private keys safe and offline. By generating and storing the key in a completely isolated environment, they provide the best security you can get for personal use.

For the highest level of private key security, the gold standard is generating it on an offline, air-gapped computer. An air-gapped machine has never been connected to the internet and never will be, which completely removes the risk of a remote attack. This is exactly how security professionals protect high-value digital assets.

Your key generation environment is everything. Never, ever create a private key on a device that's hooked up to public Wi-Fi. It’s the digital version of shouting your bank PIN across a crowded room.

Critical Mistakes To Avoid From Day One

Getting the key creation right is only half the job. You also have to avoid the common blunders that can compromise your key right from the start. It’s surprising how many people accidentally create vulnerabilities during the generation process itself.

Here are a few disastrous—yet surprisingly common—mistakes to steer clear of:

- Using Online Generators: Stay away from any website that offers to generate a private key for you. There's no way to verify they aren't secretly logging your key, waiting for the right moment to drain your funds.

- Screenshotting Your Seed Phrase: Your seed phrase is the master key to all your assets. Taking a screenshot of it saves a digital file to your device, making it an easy target for hackers who can scan your files or cloud backups.

- Typing Your Seed Phrase into a Digital Document: Similar to taking a screenshot, saving your seed phrase in a text file, an email draft, or even a password manager creates a digital copy that can be stolen. Always write it down on paper or, for even better durability, stamp it into metal.

By understanding these risks and picking a secure method, you're building a strong foundation from the get-go. This first step sets the tone for the entire security lifecycle of your key, so it's absolutely vital to get it right.

Secure Storage Strategies For Your Keys

Generating a strong private key is only half the battle. How you store that key is what really matters for your long-term private key security. A perfectly random key stored on a sticky note or in a simple text file is just asking for trouble. Think of it this way: your storage method is the vault, and it has to be stronger than the people trying to break in.

There's no single "best" way to store a key for everyone. A casual crypto user with a small amount of funds has very different security needs than a business handling millions in digital assets. It all comes down to finding the right balance of security and convenience for your specific situation.

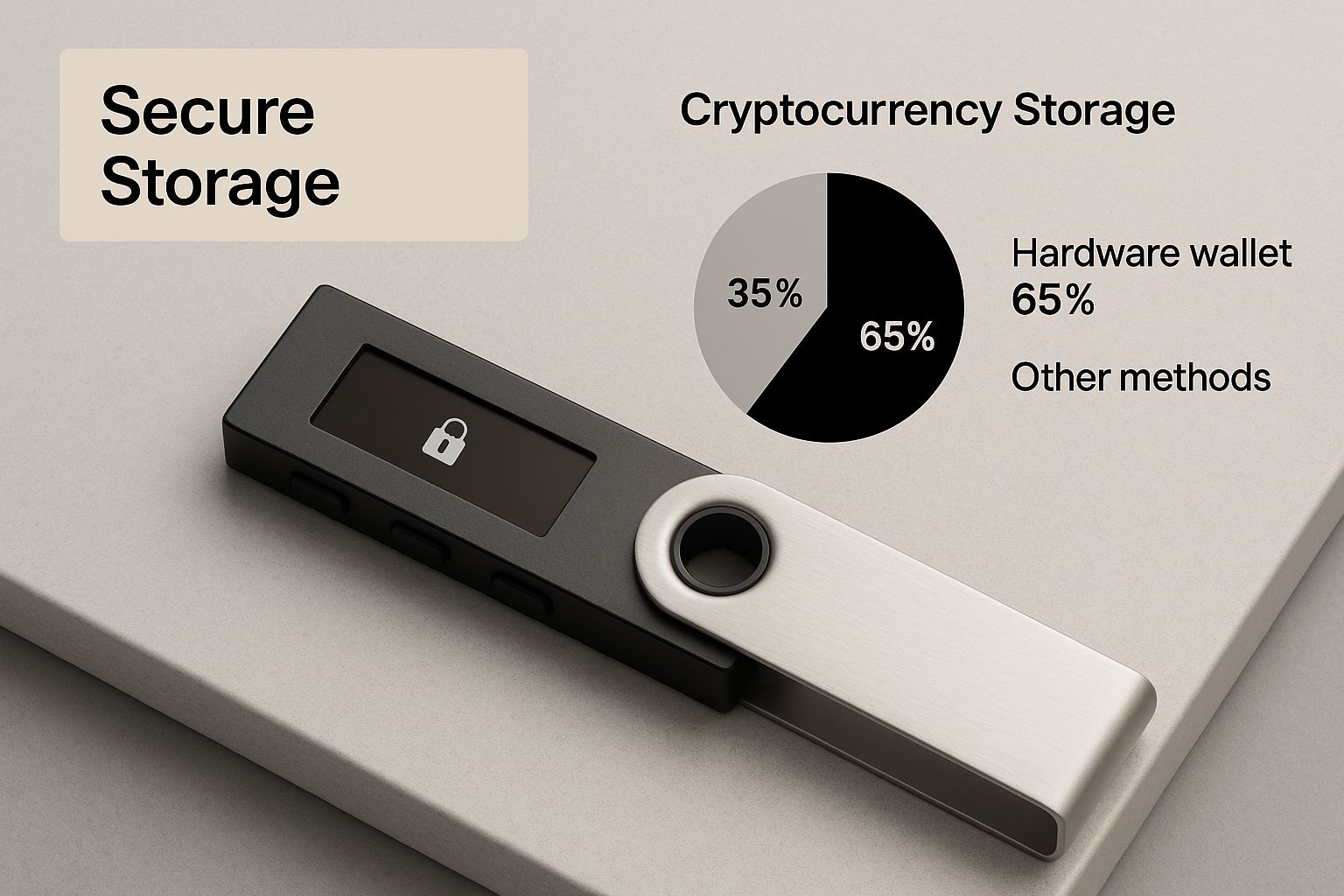

The image above gets to the heart of modern key security: physical separation. By keeping your keys on a dedicated piece of hardware, you create a tangible barrier between your assets and the countless threats lurking online. Software alone just can't compete with that level of isolation.

Understanding Your Storage Options

Let's walk through the most common ways people store their private keys, from the most basic to the most sophisticated. Each has its pros and cons, and their security levels are worlds apart.

- Paper Wallets: This is the original "cold storage" method. You simply print your private and public keys (usually as QR codes) on a piece of paper. It's completely offline, which is great, but it's also incredibly fragile. It's vulnerable to fire, water, or even just the ink fading over time.

- Software Wallets: Often called "hot wallets," these are apps that run on your computer or phone. They're incredibly convenient for making frequent transactions, but that convenience comes at a price. Because they're always connected to the internet, they are a prime target for malware, viruses, and phishing scams. They’re best for holding small amounts you plan to spend, like cash in your pocket.

- Hardware Wallets: These are small, specialized electronic devices built for one purpose: to store private keys offline. When you need to approve a transaction, you connect the device to your computer, and the signing happens inside the secure chip on the wallet itself. The private key never, ever touches the internet. For individuals, this is widely considered the gold standard for security.

The most important concept to grasp here is the difference between "hot" (online) and "cold" (offline) storage. Any key stored on a device that connects to the internet is fundamentally at risk. Real security starts with getting that key offline.

Why Your Password Manager Or Cloud Drive Is A Bad Idea

It's tempting to think you can just drop your private key into your password manager or a folder on Google Drive. After all, those services are encrypted, right?

Don't do it. This is a massive security blunder.

Cloud services and password managers are high-value targets for hackers. A single breach of that one account could give an attacker the literal key to your entire crypto portfolio. Even with strong passwords and 2FA, you’re still placing your trust in a third-party company, which completely undermines the point of self-custody.

Comparison of Private Key Storage Methods

Choosing the right storage solution can feel overwhelming, so I've put together this table to help you compare the most popular options at a glance. It breaks down each method by its security, convenience, and who it's really built for.

| Storage Method | Security Level | Convenience | Typical Cost | Best For |

|---|---|---|---|---|

| Paper Wallet | High (Offline) | Low | Free | Long-term, deep cold storage for users who understand the physical risks. |

| Software Wallet | Medium | High | Free | Small, daily transaction amounts and ease of access. |

| Hardware Wallet | Very High | Medium | $60 - $200 | Serious investors and anyone holding a significant value of digital assets. |

| HSM | Enterprise-Grade | Low | $10,000+ | Businesses, exchanges, and institutions managing large-scale operations. |

As you can see, for the vast majority of people who are serious about protecting their assets, a hardware wallet hits the sweet spot between top-tier security and usability.

Setting one up is straightforward: you initialize the device, it generates a new private key securely offline, and you write down the recovery seed phrase it gives you. That seed phrase is your ultimate backup. If you're new to all this, it's worth taking a moment to learn how to make a cryptocurrency wallet to get a handle on the fundamentals before you dive into hardware.

Smart Key Management And Threat Mitigation

You've done the hard work of generating and storing your private keys, which is a fantastic start. But here’s the thing: true private key security isn’t a one-and-done task. It's an active, ongoing process. How you manage your keys day-to-day and stay aware of new threats is just as important as the tech you use to create them.

Think of it this way: security is a practice, not a product.

One of the most powerful concepts I've learned over the years is the principle of least privilege. It's simple, really. You wouldn't carry your life savings in your pocket to go buy milk, right? The same logic applies here. You should never, ever use the key to your main crypto "vault"—the one holding the bulk of your assets—for routine transactions. It's an unnecessary risk.

A much smarter approach is to have separate wallets for different jobs. Keep a "hot wallet" on your phone or browser with a small amount of crypto for daily spending. Meanwhile, your real wealth stays locked down, secured by a key that almost never sees the light of day, let alone an internet connection.

Adopting Advanced Security Measures

When you're ready to level up your protection, it’s time to look at a multi-signature (multisig) wallet. Imagine a bank's safe deposit box that needs two different people with two different keys to open it. That’s the core idea behind multisig.

A multisig setup demands more than one private key to approve a transaction. For instance, a common setup is a 2-of-3 multisig wallet. This means you have three keys, but you only need two of them to move any funds. This creates some serious advantages:

- Theft Protection: A thief would have to find and compromise multiple keys, which you’ve hopefully stored in completely different places. It makes their job exponentially harder.

- Loss Prevention: Misplace one of your keys? No sweat. You can still access your funds with the other two. It builds in redundancy and peace of mind.

This strategy is a game-changer for businesses or anyone serious about protecting significant assets. Getting comfortable with multisig also helps you understand more complex blockchain functions, which you can dive into in our guide on unlocking blockchain's potential with splitting.

Navigating An Evolving Threat Landscape

Here's a hard truth: even the most bulletproof storage setup can be cracked if you get tricked by clever social engineering or a software bug. Attackers are always dreaming up new ways to fool you into giving up your key or signing a transaction you shouldn't.

Phishing scams are still one of the biggest threats out there. You get an official-looking email from your "wallet provider" creating a sense of urgency—"verify your account now!"—and it directs you to a website that's a perfect clone of the real one. Their goal is to get you to type in your seed phrase.

I can't stress this enough: Never, ever type your seed phrase into a website or any digital app after you’ve set up your wallet. That phrase is for one thing only: recovery. Keep it offline.

It's also absolutely critical to keep your software up to date. The number of cybersecurity vulnerabilities discovered is staggering. A few years ago, we saw an average of 113 new vulnerabilities reported daily, a figure that jumped to 131 the next year. As these alarming cybersecurity statistics on indusface.com show, the digital world is a minefield.

Simply keeping your wallet software, browser, and operating system updated is one of the most effective things you can do. It patches those security holes before a hacker can wiggle through them.

The Future of Digital Authentication

The way we secure our digital lives is finally evolving past the fragile, frustrating methods we've used for decades. For too long, the security of our most important assets—our private keys—has been tied to the weakest link in the chain: the password. But a major shift is happening, driven by the need for something stronger, smarter, and way easier to use.

The future is passwordless, and it’s being built on technologies like passkeys and biometrics.

Instead of you trying to remember a ridiculously complex password to access a private key, your device does the heavy lifting. A passkey is like a unique digital signature that lives securely on your phone or laptop. It never leaves your device.

When you go to log in somewhere, your device uses your face, fingerprint, or a simple PIN to verify it's really you. It then performs a cryptographic "handshake" with the server to confirm your identity without ever sending a secret over the internet. This one change makes traditional phishing attacks—where someone tries to trick you into giving up your password—almost completely obsolete.

The Push Towards A Passwordless World

This isn't some niche idea. Tech giants like Apple, Google, and Microsoft are all-in, building passkey support right into their operating systems because they know the old model is broken. The rest of the industry is catching on fast.

A recent report from RSA Security revealed that 61% of organizations were planning to adopt passwordless solutions within a year. This isn't just a trend; it’s a direct response to the hard fact that stolen credentials are the root cause of roughly 25% of all data breaches. You can dive deeper into the data in their Top Trends in Identity report.

The core concept is both simple and incredibly powerful: prove who you are with something you are (biometrics) or something you have (your device), not just something you know (a password). This removes the single biggest vulnerability in the whole system—our flawed human memory.

For managing your own private keys, this is a game-changer. As these technologies become standard, they won't just simplify your life; they will dramatically boost your security. Your private keys can stay locked down, accessible only with a quick, foolproof biometric scan.

Getting comfortable with passkeys now means you're not just protecting your assets today—you're getting ahead of the curve and future-proofing your entire digital identity.

Common Questions About Private Key Security

Even when you've done everything right, those "what if" scenarios can still keep you up at night. Let's walk through some of the most common questions I hear about private key security and give you some clear, practical answers for navigating those tricky situations.

One of the biggest fears is, "What if I lose my hardware wallet?" If you drop it, break it, or just plain can't find it, is everything gone for good?

Thankfully, no. The real magic isn't the device itself; it's your recovery seed phrase. Think of the hardware wallet as just a very secure container. Your seed phrase is the master key that unlocks it all. You can simply buy a new hardware wallet—it doesn't even have to be the same brand—and use that seed phrase to restore complete access to your funds.

This is exactly why protecting that slip of paper (or steel plate) with your seed phrase on it is far more important than protecting the physical device. The wallet is replaceable; the seed phrase isn't.

Digital Storage and Family Planning

I get this one all the time: "Is it ever okay to store my seed phrase digitally?" The simple, direct answer is a hard no.

Saving it in a password manager, a note-taking app, or a cloud drive creates a digital footprint. That file can be found by malware, sniffed out by hackers, or exposed in a data breach. The risk is just astronomically high. You have to stick with physical, offline methods.

Another critical point that’s easy to overlook is planning for your family. What happens to your crypto if you're not around to manage it? It's a tough thing to think about, but without a plan, your keys—and all the value they protect—could be permanently lost.

Creating a clear, non-digital inheritance plan is a vital part of responsible key management. This doesn't mean just handing over your seed phrase. It means leaving sealed, secure instructions on how your loved ones can access it only when necessary.

A common strategy is to place your seed phrase in a bank's safe deposit box and then include instructions for accessing that box in your will. This approach neatly separates the knowledge of its existence from the physical access, adding a robust layer of security.

Finally, what about exchanges? When you leave your crypto on a platform like Binance or Coinbase, you're using a custodial service. This just means they hold the private keys on your behalf. While it can be convenient, it also means you're trusting a third party with your money.

To truly own your assets, you need to hold the keys yourself in what’s called a non-custodial wallet. To really get a handle on this, check out our guide on the key differences between non-custodial and custodial services.

At BlockBee, we empower businesses to embrace self-custody with secure, non-custodial payment solutions. Take control of your digital assets and streamline your crypto transactions by visiting BlockBee.