How to Make a Cryptocurrency Wallet From Scratch

So, you're ready to get into crypto. The very first thing you need is a wallet, but let's clear up a common misconception right away. When you "make" a crypto wallet, you're not actually creating a container to hold your coins like you would with a physical wallet. Instead, you're generating a special set of digital keys that prove you own your assets on the blockchain.

It’s a subtle but critical difference. This process gives you—and only you—the power to access and manage your crypto.

What It Really Means to Make a Crypto Wallet

Think of it less like a leather bifold in your back pocket and more like a combination of a super-secure password and a personal bank account number, all rolled into one. You're essentially creating a cryptographic key pair that acts as your unique, unforgeable signature in the digital world.

This is the whole point of self-custody. When you keep your funds on a centralized exchange, you're trusting them to hold your assets for you. With your own wallet, you're in complete control. It's a foundational principle in the crypto space, often summed up by the saying, "not your keys, not your crypto." This is what financial freedom in the digital age is all about.

Quick Comparison of Cryptocurrency Wallet Types

The first real decision you'll make is what kind of wallet to use. To help you get a quick lay of the land, here’s a simple table comparing the main options. Each one strikes a different balance between security, convenience, and how you plan to use your crypto.

| Wallet Type | Primary Use Case | Security Level | Convenience |

|---|---|---|---|

| Software Wallet | Daily spending, frequent trading | Good | Very High |

| Hardware Wallet | Long-term holding (HODLing) | Excellent | Medium |

| Paper Wallet | Deep cold storage, gifting | High (if managed well) | Low |

This table should give you a good starting point. Now, let's dig into what each of these categories actually means for you.

Understanding the Main Wallet Categories

Your choice of wallet really comes down to your personal needs. Are you an active trader, or are you planning to buy and hold for the long haul?

- Software Wallets: These are apps you install on your computer or phone. Because they're connected to the internet (making them "hot wallets"), they're perfect for everyday use and making frequent, smaller transactions. They're incredibly convenient but come with some online risks.

- Hardware Wallets: These are small, physical devices—like a specialized USB drive—that keep your keys completely offline in "cold storage." This is the gold standard for security, making them ideal if you're holding a significant amount of crypto and want peace of mind.

- Paper Wallets: This is literally just a piece of paper with your public and private keys printed on it. It’s an old-school method of offline storage. While it protects you from online hacks, it’s also easy to lose, damage, or have stolen physically.

The core idea is to create a secure vault for your digital keys. Your choice depends entirely on your goals—whether you're an active trader needing quick access or a long-term investor prioritizing maximum security.

This drive for personal control is why the crypto wallet market is booming. It was recently valued at USD 14.39 billion and is projected to climb to USD 19.03 billion within a year. That’s a massive jump, and it shows just how many people are realizing the importance of self-custody.

For businesses and developers, a wallet isn't just for storage; it's the engine for accepting payments and managing company funds. Learning more about what we do at https://blockbee.io/about can show you how our non-custodial payment solutions turn a simple wallet into a powerful business asset. But it all starts with this first step: understanding what you're creating.

Choosing the Right Wallet for Your Needs

When it comes to picking a crypto wallet, there’s no single “best” option. The real goal is finding the right fit for what you actually do with your crypto. The wallet that makes sense for a long-term investor is often a terrible choice for an active trader or a business owner. Getting this right from the start saves you from some serious headaches down the road.

So, what's your main objective? Are you planning to buy a large chunk of Bitcoin and just sit on it for years? Or do you see yourself using crypto for daily buys and frequent trading? How you answer that one question will point you in the right direction.

For Long-Term Investors and Large Holdings

If you're dealing with a significant amount of crypto—a sum you absolutely cannot afford to lose—a hardware wallet is essential. I can't stress this enough. These are physical devices, like those from Ledger or Trezor, that keep your private keys completely offline in "cold storage." This simple fact makes them virtually immune to online hacks, malware, and phishing schemes that constantly plague software wallets.

Think about it this way: if your entire portfolio lives on a mobile app and your phone gets compromised, your funds could vanish in a heartbeat. A hardware wallet acts as a physical gatekeeper. It forces you to physically press a button on the device to approve any transaction, adding a powerful, real-world security layer.

For someone planning to hold $10,000 in Ethereum for the next five years, buying a hardware wallet is a no-brainer. The small one-time cost is nothing compared to the peace of mind it buys you.

For Daily Use and Active Trading

On the flip side, if you're all about convenience for smaller, more frequent transactions, then a software wallet is what you're looking for. These generally come in two main flavors:

- Mobile Wallets: Apps like Trust Wallet or Phantom are fantastic for spending on the go. Treat it like the cash in your physical wallet—perfect for scanning a QR code to grab a coffee or send a few bucks to a friend. You wouldn’t carry your life savings in your pocket, and the same principle applies here.

- Desktop Wallets: For anyone actively trading, a desktop wallet like Exodus provides a much more powerful interface. You can manage multiple assets, track performance, and connect to exchanges all from one place. The bigger screen and richer features just make it easier to analyze your portfolio and make quick moves.

A major advantage of many software wallets is how easily they connect to decentralized applications (dApps). If you’re exploring DeFi, NFTs, or blockchain gaming, a browser extension wallet like MetaMask is pretty much required to interact with these platforms.

Key Takeaway: The fundamental trade-off is always security versus convenience. Hardware wallets give you top-tier security but are less convenient for quick access. Software wallets offer incredible convenience but come with a slightly higher risk because they're connected to the internet.

Matching Wallet to Lifestyle

To make things even clearer, let's look at a few common profiles and see what makes the most sense.

| Your Profile | Recommended Wallet Type | Why It Works |

|---|---|---|

| The "HODLer" | Hardware Wallet (e.g., Trezor, Ledger) | Your number one priority is bulletproof security for long-term storage of high-value assets. |

| The Active Trader | Desktop Wallet (e.g., Exodus) | You need a feature-packed hub for frequent trading and in-depth portfolio management. |

| The DeFi User | Web/Browser Wallet (e.g., MetaMask) | You need a seamless bridge to connect with dApps and DeFi protocols across the web. |

| The Everyday Spender | Mobile Wallet (e.g., Trust Wallet) | You need fast and easy access for small, daily crypto payments and transfers. |

At the end of the day, understanding how to make a cryptocurrency wallet begins with this crucial decision. By aligning your wallet choice with how much you're investing, your technical comfort level, and how often you transact, you're setting yourself up for a much safer and smoother journey from day one.

Getting to Grips with Your Private Keys and Seed Phrase

This is where you truly take control of your crypto. When you set up a new cryptocurrency wallet, what you’re really doing is generating a private key—the secret cryptographic code that proves you own your funds on the blockchain. From this key, the wallet creates your seed phrase, which is also called a recovery phrase.

Think of it like this: the private key is the direct, raw password for a single crypto address. The seed phrase, on the other hand, is the master key. It can restore all your private keys and access your funds if your device is ever lost, stolen, or broken. Guarding this phrase is, without a doubt, the most critical part of managing your own crypto.

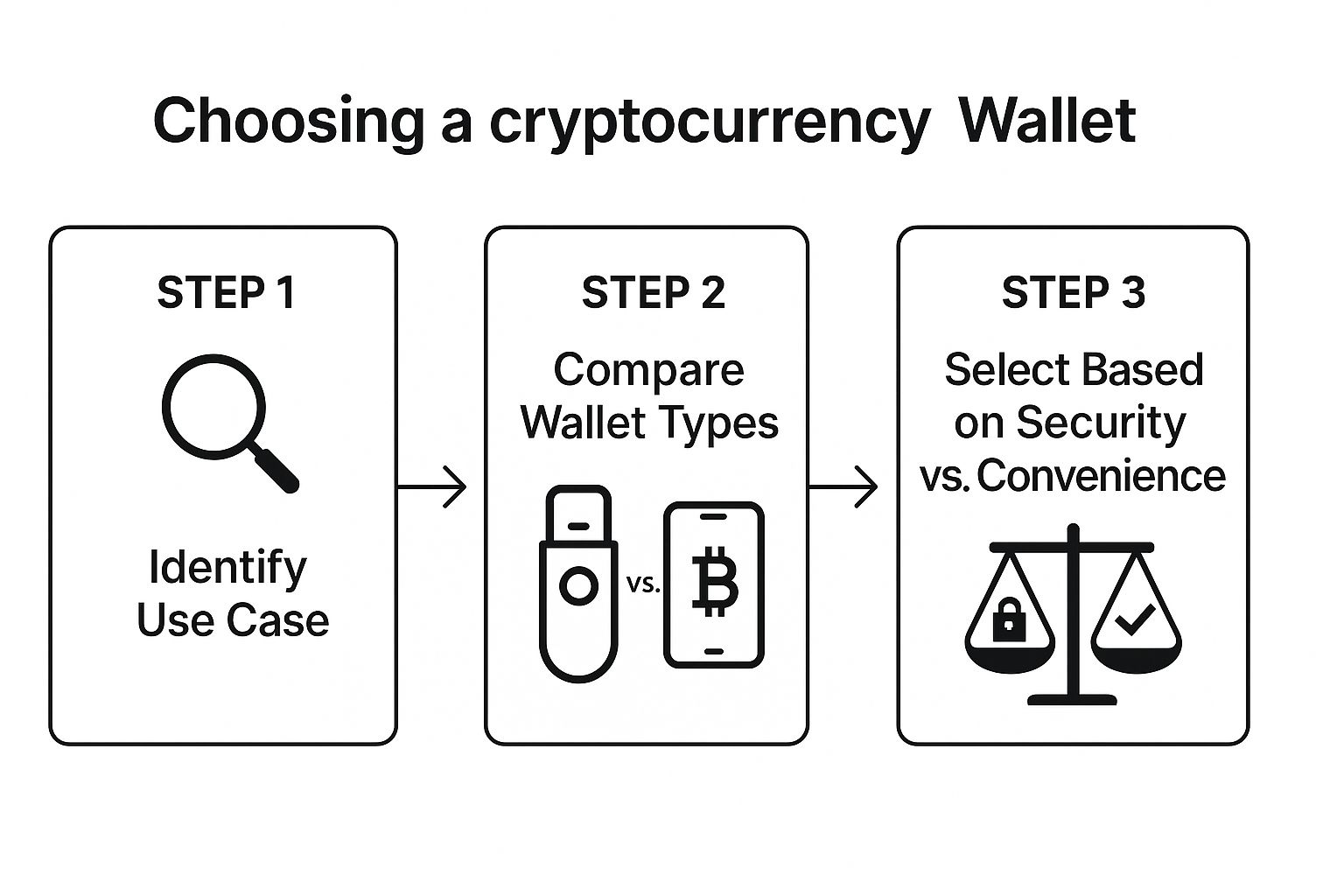

The process starts with figuring out what you need from a wallet, which then leads you to the right type of wallet, and finally to generating these crucial keys.

As the visual shows, your personal needs—whether you prioritize iron-clad security or everyday convenience—will point you toward either a hardware or software wallet. That choice directly shapes how you'll handle your keys and seed phrase.

The Golden Rules for Key Management

There’s a popular saying in the crypto world: "Not your keys, not your crypto." It’s not just a catchy slogan; it's the fundamental principle of self-custody. How you manage your keys determines whether you actually own your assets.

Here are the non-negotiable rules I've learned over the years.

First, generate your keys offline. The absolute safest method is using a hardware wallet. These devices create and store your private keys in a secure, isolated environment, meaning they never touch your internet-connected computer where they could be snatched by malware or hackers.

Second, never, ever create a digital copy of your seed phrase. This is a rookie mistake that can cost you everything. Don't take a screenshot. Don't save it in a notes app, email it to yourself, or store it in the cloud. Any digital version is a honeypot for thieves.

Your seed phrase is your ultimate safety net. If your hardware wallet gets destroyed or lost, this 12 or 24-word phrase is the only way to recover your funds on a new device. Lose the phrase, and your crypto is gone for good.

Practical, Battle-Tested Storage Methods

So, what's the right way to store it? The answer is simple: physically and securely. Your goal is to protect it from everything—theft, fire, water damage, and even your own forgetfulness.

Here are a few proven methods for storing your phrase offline:

- Simple Paper Backup: Carefully write down your seed phrase on a high-quality piece of paper. I always recommend making at least two copies and storing them in completely different, secure locations, like a fireproof safe at home and a safety deposit box at a bank.

- Steel Plate Storage: For maximum resilience, you can stamp or etch your seed phrase into a metal plate. Companies like Cryptosteel and Billfodl make products specifically for this. They’re fireproof, waterproof, and crushproof, offering far more peace of mind than paper ever could.

The growing demand for secure, non-custodial wallets is a huge force driving the market. The global crypto wallet market was recently valued at USD 12.59 billion and is projected to skyrocket to USD 100.77 billion by 2033. This growth is fueled by people wanting to protect themselves from the risks of leaving funds on centralized exchanges. You can dig into more market trends and wallet adoption data to see the bigger picture.

For businesses, the next step is connecting these secure wallets to their payment systems. Our guide on how to add crypto payments to your website breaks down how you can use a self-custody wallet for commerce while keeping total control over your funds.

Activating and Testing Your New Wallet

Alright, you've got your securely stored seed phrase. Now for the exciting part: bringing your new wallet to life. This is where we move from theory to practice, and I promise it's less complicated than it sounds. For this walkthrough, let's use a popular software wallet like Exodus as a real-world example.

First things first, go directly to the official website to download the wallet software. I can't stress this enough: never, ever download from a third-party link or a random search result in an app store. Scammers are brilliant at creating fakes to snatch your info.

Once you install and open the app, you’ll typically see two choices: "Create a new wallet" or "Restore from backup." Since you’ve already done the hard work of generating your keys offline, you'll choose to restore or import using that 12 or 24-word seed phrase.

Importing Your Seed Phrase

This is a critical moment, so make sure you're in a private, secure space where no one can see your screen. The wallet will prompt you to type in your seed phrase words, one by one, in the exact order you wrote them down. Triple-check the spelling of every single word. A small typo will either throw an error or—even worse—generate a completely different, empty wallet.

After the wallet accepts your phrase, it will ask you to create a password. This password is just a local lock for the application on your device. It’s there to stop someone who grabs your phone or laptop from immediately opening the wallet and sending your crypto.

Crucial Tip: Remember, the password only protects the app on your device. Your seed phrase protects your funds everywhere. If someone gets your seed phrase, they can completely ignore your password by simply restoring your wallet on their own device. Guard that phrase like it’s gold.

The All-Important Test Transaction

Your wallet is now active! You should be looking at a dashboard showing a balance of zero. The next thing to find is your public address. Think of this as your crypto bank account number; it's the long string of characters you share to get paid. Most wallets display this with a handy QR code for easy scanning.

Now comes the single most important final step: the test transaction. Before you even dream of moving your life savings, send a tiny, insignificant amount of crypto to your new address. I'm talking a few dollars' worth of something with low fees, like Litecoin (LTC) or a stablecoin.

This little test does a few critical things:

- It proves you wrote down your public address correctly.

- It confirms your wallet is working and properly connected to the blockchain.

- Most importantly, it gives you the confidence that you know what you're doing before any real money is on the line.

When that small test amount shows up in your wallet (give it a few minutes), take a moment to congratulate yourself. You’ve just successfully created, secured, and activated your very own gateway to the crypto world.

Using Your Wallet for Business with BlockBee

So you've created a secure crypto wallet. That’s a huge first step, but its true power goes far beyond simply storing your assets. For any entrepreneur, freelancer, or online store owner, that same self-custody wallet can become a gateway to global commerce, letting you accept payments directly from anyone, anywhere, without a middleman.

The trick is to connect your wallet to a crypto payment processor. Think of it as the bridge between your secure vault and your business operations. A service like BlockBee provides this connection, enabling customers to pay you seamlessly while the funds go straight into the wallet that only you control.

Streamlining Customer Payments

You could, in theory, just give every customer your public wallet address. But that's a clunky and insecure way to do business. A proper payment gateway automates the entire process, making life easier for you and your customers.

When someone checks out and chooses to pay with crypto, BlockBee generates a fresh, single-use address for that one transaction. This isn't just a minor convenience; it's a game-changer.

- Boosts Your Privacy: Your main wallet address stays completely private, shielding your transaction history from prying eyes.

- Simplifies Your Bookkeeping: Every payment is automatically linked to a specific order, which makes accounting a breeze.

- Improves the Customer Experience: Your customers see a professional, trustworthy checkout flow, not a hastily copied-and-pasted address.

This isn't a niche concept anymore. Wallets are becoming a standard part of e-commerce. In fact, around 31 million crypto wallets are used for daily payments, and 17% of e-commerce sites now accept them. Stablecoins are leading the charge, accounting for roughly 68% of these online crypto purchases. You can dig deeper into the stats on crypto wallet adoption over at coinlaw.io.

Taking Full Control of Your Revenue

When you use a non-custodial payment processor, you never hand over your money. Unlike traditional payment systems where your revenue is held by a third party, crypto payments go directly from the customer to your personal wallet. You have 100% self-custody of your earnings the second the transaction is confirmed on the blockchain.

By integrating your wallet with a payment solution, you’re doing more than just accepting crypto. You’re building a more secure, efficient, and decentralized financial foundation for your entire business. It’s the "not your keys, not your crypto" mantra applied directly to your bottom line.

This setup is perfect for any business wanting to add modern payment options. For a more detailed walkthrough, our guide on how to accept cryptocurrency payments on your website breaks down exactly how to integrate these tools for the best results.

Answering Your Top Crypto Wallet Questions

Once you start digging into crypto wallets, you'll naturally have some questions. It's a new world for most people. Getting solid, no-nonsense answers is the best way to build your confidence and make sure you're doing things right from the start.

Let's walk through a few of the most common questions I hear from people who are just learning how to set up their own cryptocurrency wallet.

What's the Real Difference Between a Wallet and an Exchange Account?

This is a big one, and it's crucial to grasp the difference. When you create your own crypto wallet (a non-custodial one), you get something incredibly important: full and sole control over your private keys. You, and only you, can access and move your funds.

An account on an exchange like Binance or Coinbase works differently. It's custodial, meaning the exchange holds your private keys for you. While that's fine for trading, it's a huge risk. If the exchange is hacked, goes bankrupt, or freezes accounts, your crypto could vanish.

Creating your own wallet is the only path to true ownership of your digital assets. It’s the classic crypto saying: "Not your keys, not your coins."

Can I Get My Crypto Back If I Lose My Wallet?

Yes, you can, but it all comes down to one single thing: your seed phrase. Think of this 12 or 24-word phrase as the master key to your entire crypto life. It’s what you use to restore your wallet on a brand-new device if your original one gets lost, fried, or stolen.

If your phone falls into a lake or your hardware wallet breaks, you can get everything back in minutes as long as you have that seed phrase. But if you lose the seed phrase itself? Your crypto is likely gone forever. No one can help you recover it.

This is why we stress writing it down and storing it securely offline. Forgetting your wallet's password is an inconvenience; you can just restore it with the seed phrase and create a new password. Losing the phrase is a catastrophe.

How Many Wallets Should I Actually Use?

There's no magic number here. The right answer really depends on how you use crypto and your personal comfort level with security. I've found that most seasoned users end up with a multi-wallet setup to separate their funds for different jobs. This is a powerful security habit called compartmentalization.

A smart, practical setup often looks like this:

- A Hardware Wallet: This is your vault for long-term savings, or "cold storage." It’s where you should keep the majority of your crypto—the funds you don't plan on touching for a while.

- A Mobile Software Wallet: Perfect for your daily crypto spending, or "hot storage." It's like the cash you'd keep in your physical wallet—small amounts for quick, on-the-go payments.

- A Browser Extension Wallet: This one is dedicated to interacting with the world of DeFi and NFTs. Keeping these funds separate is a great way to limit your exposure if you ever accidentally sign a transaction on a shady website.

By splitting things up this way, you dramatically reduce your risk. If your mobile wallet somehow gets compromised, your life savings on the hardware wallet are still perfectly safe. It’s a proactive strategy for managing risk as your crypto journey evolves.

Ready to put that secure wallet to work? With BlockBee, you can accept crypto payments directly into the wallet you control, keeping you in charge of every cent. Start accepting crypto today.