Choosing a Payment Gateway for International Payments

Ready to take your business global? It's an exciting step, but it comes with one major hurdle: actually getting paid by customers in other countries. This is where a payment gateway for international payments becomes your most important tool. It’s the bridge that connects your business to a worldwide audience, finally solving the age-old headaches of high fees and painfully slow transfers.

Your Bridge to a Global Marketplace

Selling internationally isn't just a nice-to-have anymore; it's a core part of growing a modern business. But the financial plumbing behind it can get messy. How do you easily take a payment from someone in Japan when your company is in Germany? That's the exact problem an international payment gateway is built to solve.

Think of it as your financial translator and diplomat, all in one. It smoothly handles different currencies, navigates the maze of international banking networks, and makes sure every transaction is secure and compliant, no matter where it's coming from. Without it, you’d be stuck trying to manage a chaotic web of local bank accounts and wire transfers—a nightmare for you and a clunky experience for your customers.

Navigating the Hurdles of Cross-Border Sales

The old way of moving money across borders is notoriously slow, expensive, and confusing. Businesses trying to sell globally often run into the same frustrating walls, which a good payment gateway is designed to tear down.

- Painfully High Fees: Traditional systems pile on costs. You’ve got cross-border fees, currency conversion markups, and hidden charges from intermediary banks, all of which eat directly into your profits.

- Glacially Slow Settlements: Waiting for money to clear through multiple banks can take days, sometimes even weeks. This creates cash flow gaps and can seriously delay you from shipping orders.

- Regulatory Headaches: Every country plays by its own rules for payments, data security, and taxes. Trying to keep up with compliance on your own is a massive and constant burden.

This guide will walk you through what to look for, but if you want a deeper dive now, check out our post on how to accept international payments.

A great international payment gateway does more than just move money. It builds trust by giving your global customers a familiar, secure, and easy checkout experience—which in turn boosts your sales and keeps them coming back.

At the end of the day, picking the right payment gateway for international payments is a huge strategic decision. It’s not just about processing a transaction. It’s about laying a solid, efficient, and scalable foundation that lets your business truly thrive on the world stage.

What Exactly Is an International Payment Gateway?

Picture a payment gateway for international payments as your business's financial ambassador. When a customer from another country hits the "buy" button, this smart system steps in to translate the complicated financial conversation between their bank and yours. It’s not just a tool for moving money—it's a sophisticated service that juggles currency conversions, navigates foreign banking laws, and keeps every transaction locked down and secure.

Selling to someone in your own country is pretty simple. Their card details hit a gateway, which gives their bank a quick call to check for funds, and the money moves over. But selling across borders adds a whole new level of complexity. Suddenly, that gateway needs to be a multi-talented financial expert, handling everything from fluctuating exchange rates to international fraud prevention.

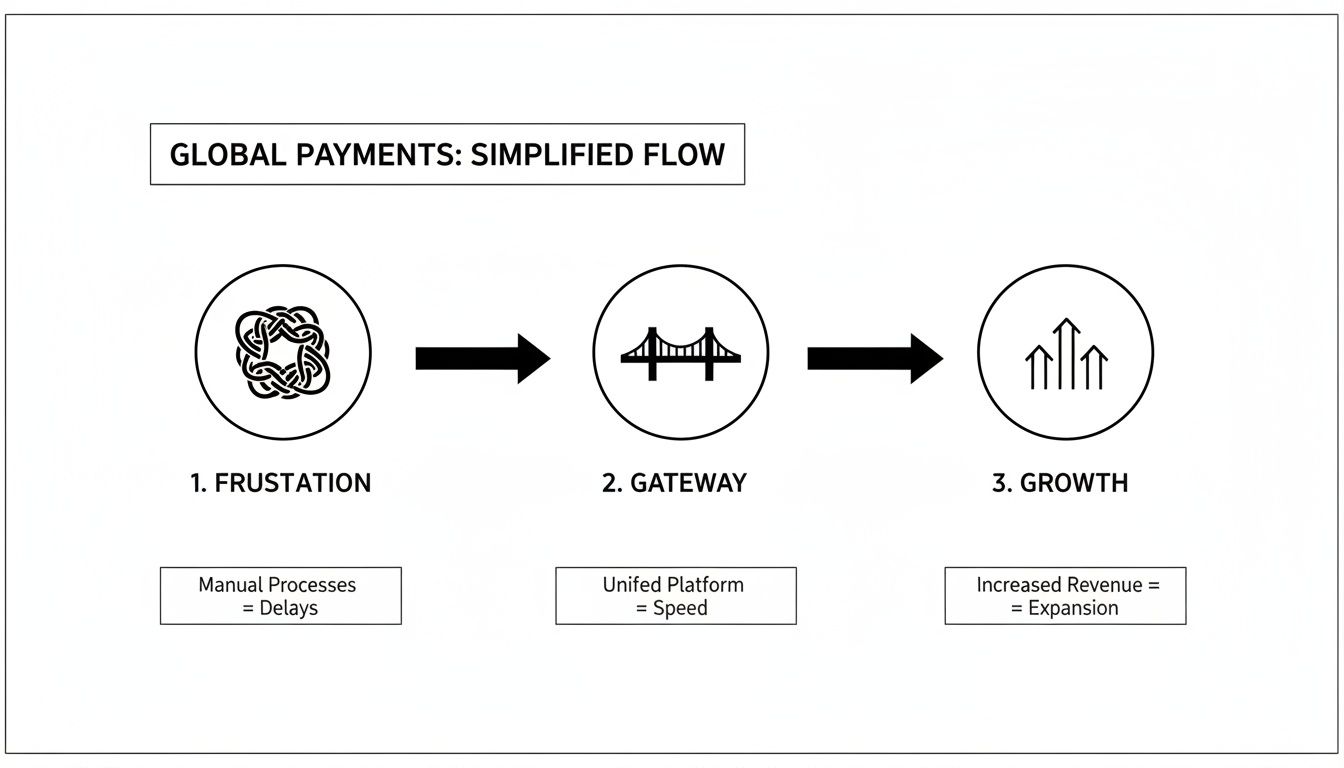

This diagram shows how a good gateway can take a tangled mess of global payment frustrations and straighten it into a clear path for growth.

As you can see, the gateway acts as the critical bridge, turning what could be a major headache into real, upward momentum for your business.

From Local to Global: A New Set of Rules

At its core, an international payment gateway shoulders the heavy lifting of global commerce so you don’t have to. Its job is much bigger than what a domestic processor does.

- Currency Conversion: The system has to accept payments in euros, yen, or pesos on the fly and settle them into your local currency, like US dollars, without a hitch.

- Global Security and Compliance: It must navigate a complex web of international security protocols, including KYC (Know Your Customer) and AML (Anti-Money Laundering) rules, to keep fraud at bay.

- Payment Method Localization: To really connect with customers, it needs to offer the payment methods they know and trust, whether that's iDEAL in the Netherlands or Bancontact in Belgium. This small touch can make a huge difference in conversion rates.

The real magic of a great gateway is making a complex, multi-step international financial process feel completely invisible to both you and your customer. It creates that smooth checkout experience that builds trust and keeps people coming back.

And the scale of this is just massive. The global cross-border payments market is already sitting at about $194.6 trillion and is expected to rocket to roughly $320 trillion by 2032. This incredible growth is pushing every payment gateway for international payments to be faster, more affordable, and way more transparent. You can get more insight into this huge market shift and what it means for businesses from this J.P. Morgan analysis.

The Technology Behind the Transaction

Under the hood, an international payment gateway is a secure tech platform. It encrypts sensitive customer information, like credit card numbers, to make sure it travels safely from the customer's browser to the banking networks. It then talks to a global web of banks and card issuers (like Visa or Mastercard) to get the payment authorized.

Once approved, it confirms the transaction and makes sure the funds land in your merchant account, all neatly converted and accounted for. This means you don't have to juggle multiple foreign bank accounts or become an expert in international finance. You can just focus on what you do best: growing your business.

Solving the Core Challenges of Global Transactions

Taking your business global is a massive step, one that unlocks a world of new customers. But with those opportunities come some serious financial headaches. This is where a top-notch payment gateway for international payments becomes your most valuable player. It's not just a nice-to-have; it’s a specialized tool built specifically to break down the walls that stand between you and your international revenue.

These challenges aren’t as simple as getting money from point A to point B. We're talking about a tangled web of currencies, hidden fees, slow transfers, and tricky regulations—all of which can quietly eat away at your profits if you don’t have the right setup.

Let's unpack the biggest problems a modern payment gateway is designed to fix.

H3: The Hidden Costs of Currency Conversion

The first hurdle you'll face is currency. A customer in France pays in Euros (€), but you need to see U.S. Dollars ($) in your bank account. This swap, known as foreign exchange (FX), is a notorious source of hidden costs.

Many old-school payment processors will handle the conversion for you, but they often do it at a padded exchange rate that lines their own pockets. That little difference between the real market rate and the rate you get can skim 1-3% or more off your top line from every single sale. Across thousands of transactions, that's a huge chunk of lost revenue. If you're wrestling with this manually, our guide on multi-currency payment processing can shed some more light on the subject.

H3: Untangling Complex and Opaque Fees

On top of bad exchange rates, the fee structures for international payments can feel like a maze. A single payment often gets hit with a stack of charges that are nearly impossible to track.

- Interchange Fees: This is the fee paid to the customer’s bank every time a card is used.

- Assessment Fees: Card networks like Visa or Mastercard take their own cut.

- Cross-Border Surcharges: Many processors tack on an extra fee, often around 1%, just because the payment crossed a border.

- Intermediary Bank Fees: If your money moves through the traditional SWIFT network, several "correspondent" banks can each dip in and take a slice along the way.

All these fees piled on top of each other make it impossible to know the true cost of a sale, turning your financial planning into a complete guessing game. A modern gateway strips this away, offering clear and simple pricing so you know exactly where your money is going.

The core value of a modern international payment gateway is its ability to bring clarity and efficiency to an otherwise chaotic process. It consolidates costs, speeds up fund settlement, and mitigates risks, allowing you to focus on growth.

H3: The Long Wait for Settlement

Ever wonder why an international wire transfer feels like it's traveling by snail mail? It's usually because of the ancient correspondent banking system. When money moves across borders using old-fashioned methods, it has to hop between several intermediary banks before it finally lands in your account.

Every stop adds more time and introduces a new chance for something to go wrong. This stretches settlement times from a few hours to several agonizing days. For a growing business, that lag can create serious cash flow problems, holding up everything from buying new inventory to making payroll.

The following table breaks down how a modern gateway solves these common pain points.

Comparing Traditional and Modern International Payment Solutions

This table highlights the common issues in legacy cross-border payment systems against the solutions offered by modern gateways like BlockBee.

| Challenge | Traditional System Impact | Modern Gateway Solution |

|---|---|---|

| Currency Conversion | Hidden markups on FX rates eat into profits, often 1-3% per transaction. | Transparent, near-market exchange rates or direct crypto settlement to eliminate FX fees. |

| Opaque Fees | A complex web of interchange, assessment, and cross-border fees makes costs unpredictable. | A simplified, flat-rate fee structure that is easy to understand and forecast. |

| Settlement Speed | Payments take days to settle due to multiple intermediary banks, causing cash flow delays. | Near-instant settlement using modern payment rails or blockchain technology. |

| Fraud & Compliance | Generic fraud detection is ineffective against localized threats; PCI compliance is a huge burden. | AI-powered, market-specific fraud detection and offloaded PCI compliance. |

Ultimately, a modern solution directly tackles the legacy issues that have slowed down global commerce for decades, giving you back control over your finances.

H3: Navigating Global Fraud and Compliance

Fighting fraud isn't a one-size-fits-all game. Scammers in different parts of the world use different tricks. A fraud prevention model that works perfectly in North America might be completely useless in Southeast Asia. A smart payment gateway for international payments uses machine learning to power localized fraud detection, spotting and stopping suspicious activity that’s relevant to each market you operate in.

Even more, compliance is a constantly moving target. Sticking to rules like PCI DSS (Payment Card Industry Data Security Standard) is an absolute must if you're handling credit card information. On top of that, there are practical issues to consider, like dealing with bank account blockages, which can bring your global operations to a grinding halt. The right gateway takes this entire burden off your shoulders, ensuring your systems are always secure and compliant with global standards. That peace of mind protects you from crippling fines and keeps your reputation intact.

How to Choose the Right International Payment Gateway

Picking the right payment gateway for international payments is a huge deal for any business looking to sell globally. It’s not just about getting paid; it’s about creating a smooth experience for your customers, keeping your money safe, and building a system that can grow with you. Think of it as the engine for your global business—the right one will hum along quietly, but the wrong one will cause constant headaches and breakdowns.

With so many choices out there, it's easy to feel lost. The trick is to tune out the marketing noise and focus on what actually matters for your bottom line and day-to-day operations. This checklist will walk you through the essentials so you can ask the right questions and make a choice you feel good about.

Supported Countries and Payment Methods

First things first: can the gateway even work where your customers live? Don't get distracted by a long list of countries. You need to dig a little deeper and see what local payment methods they actually support.

Sure, accepting credit cards is a great start, but in many parts of the world, local favorites are what really drive sales. For instance, Dutch shoppers often reach for iDEAL, while in Germany, Giropay is a popular choice. Offering these local options shows customers you're serious about their market, and that alone can give your conversion rates a serious boost.

Transparent Fee Structures

Fees are just part of the game, but they should never be a guessing game. Sneaky, hidden costs can quietly eat away at your profits, so you have to demand total transparency from the get-go.

Look for a provider with a simple, easy-to-understand pricing model. Be on guard for overly complicated fee schedules that try to nickle-and-dime you with things like:

- Cross-border fees tacked on just because a transaction came from another country.

- Currency conversion markups where the provider pads the exchange rate and keeps the difference.

- Monthly account fees or penalties if you don't process a certain volume.

A clear fee structure makes it way easier to forecast your finances and means you won't get any nasty surprises when the monthly statement arrives. To help you sort through this, we created an in-depth payment gateway fees comparison that shows you what to watch out for.

Transaction Speed and Settlement Times

In the world of online business, speed is money. You need to know how fast a payment gets confirmed, but more importantly, how long until that money actually lands in your bank account?

Old-school systems that bounce payments between different banks can leave you waiting 3-5 business days—or even longer—for your funds to settle. That kind of delay creates cash flow gaps that can seriously hamstring your ability to run and grow your business. Modern solutions, especially those using crypto, can offer nearly instant settlement. Always ask a potential provider about their average settlement times for your key markets.

A gateway's true value isn't just in its ability to accept a payment, but in its efficiency at getting that money into your hands. Slow settlements are a hidden operational cost that you can't afford to ignore.

Security and Compliance Standards

When it comes to security, there’s no room for compromise. A single data breach can shatter customer trust and saddle you with massive fines. Your gateway absolutely must be fully compliant with PCI DSS (Payment Card Industry Data Security Standard). This ensures they’re handling sensitive card data with the tightest security protocols, which takes a huge compliance burden off your shoulders.

Beyond that, look for smart fraud detection tools. A top-tier international gateway will use AI and machine learning to scan transactions in real-time, identifying and blocking shady activity before it becomes a problem. This kind of proactive defense is critical for keeping chargebacks low and protecting your revenue.

Integration and Developer Experience

Finally, think about how easily the gateway will slot into your website or app. A clunky, poorly documented integration can burn through weeks of development time and cause endless frustration for your team.

The best gateways have a well-documented, developer-friendly API (Application Programming Interface). Even better, see if they offer pre-built plugins or extensions for your e-commerce platform, whether you're on WooCommerce, Magento, or Shopify. These ready-made solutions can turn a complex project into a simple setup that takes minutes, letting you start accepting global payments almost immediately.

Integrating and Optimizing Your Global Payments

Picking the right payment gateway for international payments is just the start. The real magic happens when you integrate it into your business. A smart integration doesn't just process money; it creates a smooth, trustworthy checkout experience that can seriously boost your sales around the world. It’s how you turn a simple tool into a core part of your growth strategy.

The aim is to make someone in Tokyo or Berlin feel like they're buying from a local shop. This all begins at checkout. Instead of showing everyone prices in USD, a good integration automatically detects a customer's location and shows them the cost in their own currency. This one small change makes a huge difference, removing confusion and building the trust needed to get them to click "buy."

Building a Frictionless Checkout Flow

A seamless checkout is a profitable one. It's not just about currency, either. You need to offer payment methods people actually use in their home countries. For example, if you sell online, learning how to customize your WooCommerce checkout page to show relevant local options can dramatically reduce how many shoppers abandon their carts.

The behind-the-scenes work is just as important, and that’s where webhooks are a lifesaver. Think of a webhook as an automatic message from your payment gateway to your website. When a payment goes through, a webhook instantly pings your system to kick off other tasks.

- Immediate order fulfillment: Your shipping department or digital download system gets notified right away.

- Subscription activation: A new SaaS user gets their login details instantly, no manual effort required.

- Failed payment recovery: An automated email can ask the customer to update their card details.

This kind of automation is what allows you to scale up without hiring an army of people to manage orders.

Before you process a single real transaction, the sandbox is your best friend. A thorough testing phase is not just recommended—it's absolutely essential for a successful global launch.

Testing and Reconciliation Made Simple

Never, ever launch without testing first. A quality payment gateway will give you a sandbox environment, which is basically a private playground to test everything safely. Run fake transactions in different currencies, simulate failed payments to check your recovery process, and issue refunds to make sure it all works end-to-end. This is your chance to catch embarrassing and costly mistakes before your customers do.

Finally, let's talk about what happens after the sale: the accounting. Trying to reconcile payments from dozens of countries can be a headache. A first-class payment gateway for international payments solves this with clean, consolidated reports. You get a single dashboard that pulls all your global revenue together, making bookkeeping a whole lot simpler.

Meet BlockBee: A Modern Answer to Global Crypto Payments

After wrestling with the high fees, slow settlements, and general headache of traditional cross-border payments, it’s obvious that businesses need a better way. That’s exactly where BlockBee comes in. We built our payment gateway for international payments from the ground up to solve these problems using cryptocurrency. It's not just another option; it's a direct solution to the old-school inefficiencies holding back global commerce.

BlockBee fundamentally changes the economics of selling worldwide. Forget getting lost in a maze of interchange fees, currency conversion markups, and surprise surcharges. Our pricing is refreshingly straightforward, with transaction fees starting at an exceptionally low 0.25%.

This structure lets you keep more of your revenue. It's all possible because we use crypto rails, cutting out the expensive intermediary banks that drive up the cost of typical international transfers.

Get True Global Reach and Keep Full Control

To sell to the world, you have to be able to accept payments from the world. BlockBee gives you instant access to customers everywhere by natively supporting over 70 different cryptocurrencies. This means you can get paid by anyone, anywhere, without hitting the wall of local banking rules or declined credit cards.

Even more importantly, BlockBee is completely non-custodial. This is a huge deal for security and puts you, and only you, in charge of your funds.

With BlockBee, your customer’s payment goes directly into your personal wallet. We never touch or hold your money. This decentralized model eliminates the single point of failure you see with traditional platforms, offering you unparalleled security and peace of mind.

Your revenue is always yours, shielded from the risks that come with services that hold funds on your behalf. You get paid instantly—no more waiting around for days while settlements clear.

Simple Integration for Any Merchant or Developer

The most powerful tools are useless if they're a pain to set up. We designed BlockBee with a developer-first approach, offering a clean, well-documented API that makes custom integrations feel intuitive.

But you don't have to be a coder to use BlockBee. We offer a whole library of official, pre-built plugins for the most popular e-commerce platforms out there, making setup a snap.

- WooCommerce: Add crypto payments to your WordPress store with just a few clicks.

- Magento: Give your Adobe Commerce site a powerful global payment option.

- PrestaShop: Easily turn on cryptocurrency checkouts for your online shop.

- OpenCart: Quickly expand your payment methods to reach a worldwide audience.

- Odoo: Plug crypto payments right into your business management software.

These aren't flimsy third-party add-ons. Our team officially builds and supports every plugin, so you can count on them to work reliably right out of the box.

Advanced Tools for Today’s Business Demands

BlockBee is more than a simple checkout button. We've built in advanced features designed for the real-world operational needs of modern businesses, especially marketplaces and SaaS companies managing complex payment flows.

Our Mass Payouts feature is a great example. It lets you send payments in crypto to vendors, affiliates, or employees all over the world, all at once. Imagine paying hundreds of international partners simultaneously with nearly non-existent fees and instant settlement. That’s the kind of efficiency BlockBee delivers.

This tool turns what used to be a logistical nightmare into a simple, automated task, saving you a ton of time and money on wire fees. By combining ultra-low costs, non-custodial security, and straightforward integration, BlockBee offers a payment gateway for international payments that’s actually ready for the future of business.

Frequently Asked Questions

Stepping into global commerce always brings up a few questions. Let's break down some of the most common ones merchants have when they're looking for a payment gateway for international payments so you can make the right call for your business.

What Are the Typical Fees for an International Payment Gateway?

This is where things can get murky. Fees are all over the map, and many traditional gateways have complex, layered pricing that chips away at your profits. You’ll usually run into a combination of a percentage fee (say, 2.9%), a fixed fee per transaction, and then get hit with extra cross-border or currency conversion surcharges that can easily add another 1-2%.

On the flip side, modern crypto-based solutions like BlockBee keep it simple and transparent. With fees starting at just 0.25%, you sidestep most of the hidden charges baked into the old banking system. That means a lot more of your revenue stays right where it belongs: in your pocket.

How Do International Gateways Handle Currency Conversion?

Most gateways handle this automatically, but rarely for free. When a customer in Germany pays you in Euros, a traditional gateway converts it to your base currency (like USD) before it hits your account. The catch? They almost always use a marked-up exchange rate, which is just another way to charge you more.

A huge plus for crypto gateways is that they let you skip forced currency conversions entirely. Payments are made in a global digital currency, giving you the power to hold it or convert it to cash on your own schedule, at a rate you’re happy with.

This puts you back in the driver's seat, protecting your profit margins from the unfavorable exchange rates that payment providers often impose on every single sale.

How Difficult Is It to Integrate a Global Payment Gateway?

The integration headache really depends on the provider. The best ones are built with developers in mind, offering clean APIs and fantastic documentation. And for merchants who aren't coders, they provide simple plugins that get you up and running in no time.

For example, a payment gateway for international payments like BlockBee offers official, ready-to-go plugins for the biggest e-commerce platforms out there, including:

- WooCommerce

- Magento (Adobe Commerce)

- PrestaShop

- OpenCart

With these plugins, you can start accepting crypto payments from customers around the world in minutes. Seriously, it's often a copy-paste job with no code required, letting you expand your customer base almost instantly.

How Does a Non-Custodial Gateway Improve Security?

This is a game-changer. A non-custodial gateway like BlockBee gives you a massive security advantage because you—and only you—ever control your money. When a customer pays, the funds travel directly from their wallet to your personal crypto wallet. The gateway provider never touches it or holds your private keys.

This model eliminates the single point of failure you see in custodial systems, where the provider pools all merchant funds into a central account. With a non-custodial setup, your revenue is shielded from platform risks like hacks or freezes. It’s the ultimate peace of mind, giving you complete and total control over your funds.

Ready to simplify your global transactions with a secure, low-fee solution? Get started with BlockBee and see how easy it is to accept crypto payments from anywhere in the world. Visit https://blockbee.io to learn more.