A Guide to Multi Currency Payment Processing

Picture this: a potential customer in Tokyo is moments away from buying your product. They love it, they've added it to their cart, but at the final step, they bail. Why? They were shown a price in a currency they don't use, and the thought of surprise conversion fees was enough to make them leave. This happens all the time, and it’s a huge, yet fixable, roadblock for businesses selling online.

The solution is multi-currency payment processing.

Why Your Business Needs Multi-Currency Payments

At its core, multi-currency payment processing is the tech that lets you sell to anyone in the world in their local currency. Think of it as a financial translator. It shows a price in euros to someone in Berlin, yen to that shopper in Tokyo, and U.S. dollars to a customer in Chicago, all while you get paid in your preferred currency back home. This isn't just a fancy feature for massive corporations anymore; it's a must-have for any business with global ambitions.

For any company serious about selling overseas, adopting multi-currency payments goes hand-in-hand with smart ecommerce development services. It’s a foundational block for creating a global storefront that feels genuinely local to every single visitor.

Build Trust Through Familiarity

When a customer sees a price tag in their own currency, a major mental hurdle disappears. They don't have to stop, open a new browser tab, and wrestle with a currency converter just to figure out what something costs.

This simple act of showing a familiar price builds instant trust. It makes your brand look more professional and signals that you're a serious global player. In fact, one study found that over 90% of online shoppers would rather see prices in their local currency, and a huge chunk will simply walk away if they can't. It's a small touch that shows you're thinking about their experience.

Reduce Friction at Checkout

The checkout page is where you make or break a sale. Every ounce of friction, every moment of hesitation, increases the odds of cart abandonment. Forcing a customer to do mental math on exchange rates is a classic friction point.

Multi-currency processing smooths this out completely.

Here’s how a frictionless checkout helps:

- Price Transparency: Your customers know the exact amount they'll be charged. No nasty surprises on their bank statement from foreign transaction fees.

- Higher Conversion Rates: When you remove uncertainty, you make it that much easier for someone to click the "buy" button. More sales, plain and simple.

- Better Customer Satisfaction: A seamless, easy purchase leaves a great final impression, paving the way for repeat business and good reviews.

Offering localized payment experiences is no longer a luxury; it is a core requirement for competing in a global market. It’s about meeting customers where they are and speaking their financial language.

Ultimately, this technology is what turns your business from a local shop that happens to be online into a true international contender.

How Multi-Currency Processing Actually Works

Think of multi-currency payment processing as a high-speed financial translator. It’s the magic that happens in the background, turning a customer’s local currency into your business’s home currency in the split second between them hitting “buy” and seeing the confirmation screen.

Let's pull back the curtain and see how that money actually travels across borders.

The Key Players in a Global Transaction

Every single time a customer from another country buys from you, a small team of financial players springs into action. Each one has a critical job to do to get the money from their wallet to your bank account, safely and securely.

- The Customer's Bank (Issuing Bank): This is simply the bank that gave your customer their credit or debit card. Their job is to give the thumbs-up (or thumbs-down) by checking if the customer has enough money to cover the purchase.

- The Payment Gateway: This is the digital bridge connecting your website's checkout to the wider payment world. It grabs the customer's card details, encrypts them for safety, and passes them along to get the transaction approved.

- The Acquiring Bank: This is your bank. It receives the payment request from the gateway, talks to the customer's bank to get the green light, and finally, drops the converted funds into your business account.

These three parties, orchestrated by your payment processor, work in perfect sync. The real trick, though, is how the currency conversion fits into this lightning-fast process.

Two Paths for Currency Conversion

When it’s time to actually swap one currency for another, there are really two ways it can go down. The path you choose has a direct impact on everything from the customer’s experience to your own bottom line.

The first option is Dynamic Currency Conversion (DCC). Here, you list prices in your home currency. Then, right at the checkout, the customer gets a pop-up asking if they’d like to pay in their own local currency instead. The system does the math on the spot, showing them the final total in a familiar currency.

While it seems helpful, the exchange rates are set by the processor and are often not the best deal for the customer. It puts the decision—and the potential for a poor exchange rate—squarely on their shoulders at the most critical moment of the sale.

The second, and far more popular, model is Multi-Currency Pricing (MCP). This is where you, the business owner, take control. You set fixed prices for your products in multiple currencies. A shopper from France sees prices in Euros the entire time, while someone from Japan sees everything priced in Yen.

Multi-Currency Pricing (MCP) transforms the shopping experience from a foreign transaction into a local purchase. It completely removes the mental gymnastics of currency conversion, letting international customers shop and buy just as easily as your customers next door.

This approach creates a much smoother, more welcoming experience. It puts you in charge of your international pricing and, most importantly, eliminates sticker shock at the checkout. In fact, research shows that around 73% of shoppers are more likely to finish a purchase if the price is shown in their local currency from the very beginning.

At the end of the day, understanding this behind-the-scenes dance is key. Multi-currency payment processing isn't just about taking money from different places. It's about designing a global shopping experience that feels local, trustworthy, and effortless. By choosing the right model, you build that trust from the moment a customer lands on your site, instead of asking for it at the last second.

What Are the Real-World Benefits of Accepting Global Currencies?

Switching to a multi-currency system isn’t just about unlocking new markets—it's about delivering real, measurable results that directly boost your bottom line. Forget the technical jargon for a moment. The strategic upsides fundamentally change how international customers see and engage with your brand. These aren't just theories; they translate into more sales, happier customers, and a much stronger global footprint.

Think of it less as a minor tweak to your checkout page and more as a foundational shift in how you approach global commerce. It positions your business for serious, long-term international growth.

Skyrocket Your Conversion Rates

Let's cut to the chase: the single biggest advantage of multi currency payment processing is the incredible impact it has on conversion rates. The second an international shopper lands on your site and sees a price in a currency they don't recognize, a mental barrier goes up. This is "checkout friction," and it's a known killer of sales, causing customers to doubt, hesitate, and ultimately abandon their carts.

When you show prices in their local currency, you tear that barrier down. Suddenly, they don't need to open another tab for a currency converter. There’s no mental math, no guessing, and no nasty "sticker shock" when their bank statement arrives. You make the decision to buy as simple and painless as possible.

The data backs this up in a big way. The global payment processing industry, valued at around $61.1 billion in 2023, is on track to hit $147 billion by 2032, largely because of this cross-border boom. More importantly, a massive 93% of consumers say that seeing prices in their own currency is a major factor in their decision to buy.

Enhance the Customer Experience and Build Loyalty

A great customer experience is the bedrock of loyalty. When you offer prices in someone's home currency, you're sending a powerful message: "We get you, and we value your business." That small touch goes a long way toward building trust with a global audience.

This simple act triggers several positive outcomes:

- Deeper Trust: Familiar currency symbols make your business feel more established and legitimate in their part of the world.

- Total Price Transparency: Customers know the exact amount that will show up on their card. This avoids the frustration of discovering hidden foreign transaction fees after the fact.

- More Repeat Business: A smooth, transparent, and easy purchase process is one of the best ways to get customers to come back for more.

By removing the "foreign" feeling from the transaction, you turn a potentially intimidating international purchase into a comfortable, local one. Speaking your customer's financial language is a powerful way to build a loyal global following.

Strengthen Your Brand's Global Image

Adopting multi-currency payments does more than just drive sales—it elevates your entire brand image. It tells the world your business is a serious, professional player ready to compete on the international stage.

Having a sophisticated payment system shows you've invested in the right infrastructure to serve customers anywhere. That professional polish can easily be the deciding factor when a shopper is choosing between you and a competitor who only prices in a single currency. For a closer look at the nuts and bolts, our guide explains more about how to accept international payments the right way.

Simplify Your Financial Operations

While serving a global audience might sound messy from a financial standpoint, modern multi-currency solutions actually make your life easier. Instead of juggling a chaotic mix of transactions in different currencies, a good payment processor consolidates everything for you.

Here’s how it streamlines your backend:

- Centralized Reporting: You get detailed reports showing sales broken down by currency and region, all in one dashboard.

- Predictable Settlements: The processor handles all the complicated currency conversions on their end.

- Unified Payouts: All those different currencies are converted and deposited into your bank account in your preferred home currency, making accounting a breeze.

This operational efficiency frees up your time and energy. Instead of wrestling with international banking headaches, you can get back to what you do best: growing your business and serving your customers.

The Hidden Hurdles of Global Payments

Jumping into multi-currency payments opens up a world of opportunity, but it’s not a simple plug-and-play solution. Expanding your sales across borders means you're also taking on a new lineup of financial and logistical challenges. Knowing what these are from the get-go is the only way to build a strategy that actually protects your profits.

The biggest—and most obvious—headache is dealing with constantly shifting foreign exchange (FX) rates. These rates are always on the move, reacting to everything from economic news to political shifts. For any business, that constant motion spells financial risk.

Let's put that into perspective. Say you sell a product for €100. Today, that converts to $110. But if you wait a week to settle your funds and the rate drops, that same €100 might only be worth $107. A three-dollar difference on one sale is no big deal, but multiply that by a thousand transactions, and you can see how quickly FX risk starts eating into your margins.

Watch Out for Hidden Costs and Sneaky Fees

Beyond the exchange rates you see on the news, a whole host of other costs can pile up. These are the "hidden" fees that can turn a seemingly profitable sale into a loss, often buried deep in the terms and conditions of a payment processor's contract.

Keep an eye out for these common culprits:

- Cross-Border Fees: Many processors will tack on an extra percentage just because a transaction crossed a border—even after they've already converted the currency.

- Currency Conversion Markups: The rate you’re offered is almost never the real mid-market rate. Processors build in their own markup, which is how they make money on the conversion itself.

- Settlement Fees: You might even get hit with another charge just to move the money from the processor's account into your own local bank account.

These fees stack up fast. It’s why many businesses are looking for smarter alternatives to old-school methods like relying on banks or standalone exchange services, which can be slow and expensive. Instead, modern companies are turning to integrated platforms that handle everything automatically. To get a better sense of how these systems work, you can explore more about integrated payment platforms on Medius.com.

The real aim isn't just to accept global payments; it's to do it profitably. That means actively managing your FX risk and demanding total transparency on fees from your payment partners.

Getting International Tax Compliance Right

Another significant challenge is the tangled web of international tax laws. When you sell to a customer in another country, you could become responsible for collecting and paying their local taxes, like Value Added Tax (VAT) in Europe or Goods and Services Tax (GST) in places like Canada and Australia.

Tax rules are wildly different from country to country—different rates, different filing deadlines, different everything. A single mistake can lead to hefty fines and legal headaches. Trying to keep track of it all manually is a recipe for disaster. This is where a payment solution with built-in compliance tools becomes less of a "nice-to-have" and more of a "must-have" for any business serious about selling globally.

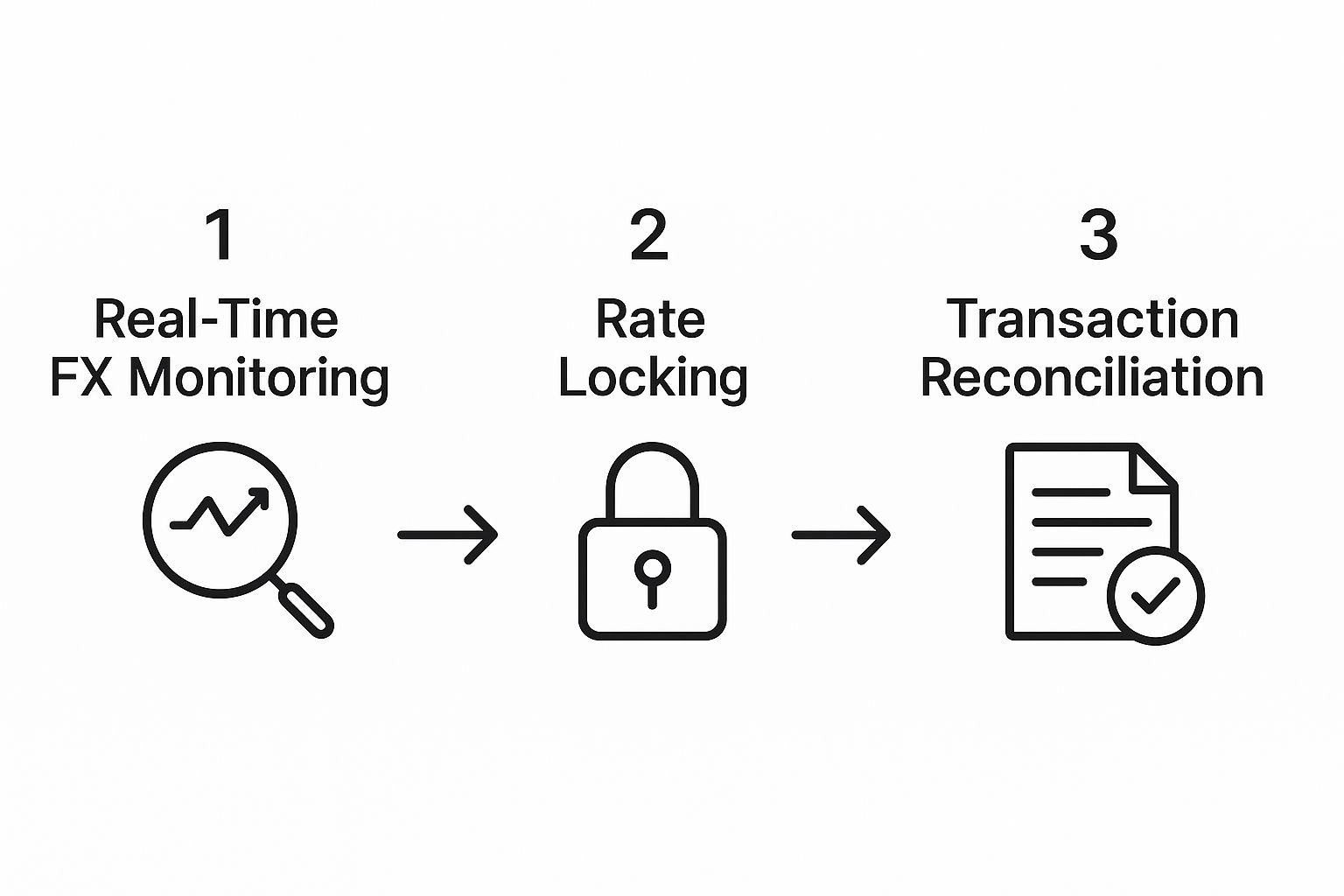

The image below gives a high-level look at how a modern payment system approaches FX risk management, from the moment a customer pays to the final settlement.

This workflow shows how technology like rate locking helps take the guesswork out of currency fluctuations. With the right tools and a clear understanding of the risks, you can turn these global payment challenges into a real competitive advantage.

Putting Multi Currency Payments Into Action, Step by Step

Jumping into global sales can feel like a massive undertaking, but it's much more manageable when you break it down into a clear roadmap. Implementing multi currency payment processing isn't about flipping a switch; it's a methodical process that starts with a hard look at your own business and ends with picking the right tech to help you scale.

This is all about making smart, strategic choices that line up with your expansion goals. If you follow a structured approach, you can open your digital doors to the world with confidence, knowing the experience will be smooth for both you and your new international customers.

Start with a Strategic Business Assessment

Before you even glance at a payment provider, you need to look inward. The first real step is figuring out where your biggest opportunities are. You can’t target the entire world at once, so you need data to focus your efforts where they’ll actually pay off.

Start by digging into your website traffic. Where are your international visitors coming from? Analytics tools can give you a clear map of countries already showing interest in what you sell. That’s your low-hanging fruit—markets where a customer base is already forming.

From there, do some market research to find high-potential regions. Look for countries with solid economies, a growing middle class, and a love for online shopping. It's far better to pick a few key markets to focus on initially than to try and conquer the globe overnight.

How to Select the Right Payment Service Provider

Once you know where you want to sell, you have to figure out how you'll get paid. This is where a Payment Service Provider (PSP) enters the picture. Think of your PSP as your partner in global commerce, which makes choosing the right one an incredibly important decision.

Not all PSPs are built the same. You need to line them up and compare them based on criteria that will directly affect your operations, your bottom line, and your customer's checkout experience.

Here’s what to look for:

- Currency Coverage: Does the provider actually support the currencies in your target markets? You want a platform that covers the big ones like the Euro or Japanese Yen, but also the currencies in emerging markets you might enter later.

- Transparent Fee Structures: Hidden fees are profit killers. You need absolute clarity on transaction fees, currency conversion markups, and any monthly or setup charges. No surprises.

- Seamless Integration: How easily will the platform plug into your current e-commerce setup, whether it's WooCommerce, Magento, or something else? A provider with pre-built plugins and developer-friendly APIs will save you a world of time and money.

- Security and Compliance: This is non-negotiable. The PSP must have rock-solid fraud protection and be fully compliant with global standards like PCI DSS. It’s about protecting your business and your customers' sensitive data.

Choosing a PSP is more than a technical decision; it's a strategic partnership. The right provider doesn't just process transactions—it gives you the tools and support you need to scale your business internationally.

Streamlining Global Payments with Modern Solutions

Let's be honest, traditional payment systems can be slow, expensive, and a headache to manage. Thankfully, modern platforms are built to smooth out these friction points, making global commerce a real possibility for businesses of all sizes. A perfect example of this shift is BlockBee, which brings a forward-thinking approach to multi currency payment processing.

BlockBee simplifies everything by bringing both traditional fiat currencies and cryptocurrencies under one roof. Because cryptocurrencies are essentially borderless digital money, they allow for nearly instant, low-cost transactions that sidestep many of the hurdles of old-school cross-border banking.

For a global business, this approach offers some serious advantages.

The BlockBee Advantage for Global Commerce

Platforms like BlockBee are designed for the modern global economy, with features purpose-built to boost efficiency and slash costs. For any business serious about expanding, these benefits can be a game-changer.

Think about these key features:

- No-Code Tools and Easy Integration: BlockBee offers officially supported plugins for all the major e-commerce platforms. That means you can get a sophisticated global payment system up and running without a team of developers, cutting your implementation time dramatically.

- Extremely Low Fees: By using efficient blockchain technology, BlockBee's transaction fees are often a fraction of what traditional credit card processors and wire transfers charge. More of every sale stays in your pocket.

- Instant Payouts: Forget waiting days for funds to clear. With crypto payments, transactions are confirmed on the blockchain and the money is in your wallet almost instantly. This is a massive improvement for your cash flow.

- Self-Custody for Full Control: Unlike many providers that hold onto your funds, BlockBee is non-custodial. Payments go directly from the customer to your own wallet, giving you complete control over your money at all times.

For businesses ready to embrace what's next in global payments, learning how to integrate these newer technologies is essential. To get started, you can learn more about how to accept crypto payments for your business in our detailed guide. This dual approach—supporting both old and new payment methods—is what truly future-proofs your operations.

The Future of Cross-Border Commerce

The pace of international payments is hitting overdrive. For any business with global ambitions, just accepting different currencies isn't the finish line anymore—it's the starting block. The real future belongs to merchants who can deliver transactions that are faster, smoother, and more secure, no matter where their customers are shopping from.

This isn't just a minor shift; it's a fundamental change driven by new technology and sky-high customer expectations. To keep up, you have to get ahead of these trends. The whole idea of multi currency payment processing has gone from a nice-to-have feature to an absolute must. It's the new baseline for playing on the world stage.

The Rise of Real-Time Payments

Let's be honest: nobody likes to wait for payments to clear. Customers today expect a cross-border purchase to feel just as quick as buying something from a local shop. This demand for speed is fueled by real-time payment networks popping up all over the globe, and they're completely changing the game.

The numbers don't lie. Back in 2022, instant payments accounted for 13% of all global non-cash transactions. Fast forward to 2028, and that figure is expected to jump past 22%. We're talking about a massive surge in volume, from 195 billion transactions in 2022 to a predicted 500 billion by 2027, according to payment industry statistics on Gr4vy.com.

The expectation for instant gratification has officially reached the checkout. Businesses that can’t deliver fast, seamless cross-border payments will quickly fall behind competitors who can.

Digital Currencies and Blockchain Are Removing Borders

Speed is one thing, but there's another revolution happening thanks to digital currencies and blockchain. This technology isn't just speeding things up; it's practically erasing the old financial borders that made international business so complicated. It offers a completely new playbook for handling multi currency payment processing.

Here's how it's shaking things up:

- Cutting Out the Middlemen: Blockchain allows a payment to go straight from a customer's wallet to a merchant's. This bypasses many of the banks and processors that add delays and tack on fees.

- Settling in Minutes, Not Days: Forget waiting for traditional bank transfers to clear. Crypto transactions are often confirmed in minutes, which is a huge boost for a company's cash flow.

- Slashing Transaction Costs: With fewer hands in the pot, blockchain payments can dramatically lower the cost of sending money from one country to another.

This is exactly where a platform like BlockBee comes into play, giving businesses a crucial edge. By weaving together both traditional fiat and modern crypto payment options, you can offer customers the best of both worlds. We explore this in much more detail in our article on the future of crypto payments.

Ultimately, getting your business ready for what's next means being flexible. The ability to handle multiple currencies—whether they're dollars, euros, or digital coins—is no longer a trend. It's the foundation of a resilient, future-proof global business.

Frequently Asked Questions

When you start thinking about selling internationally, a few questions always pop up. Let's tackle some of the most common ones that businesses have about handling payments from around the world.

What's the Difference Between a Multi-Currency Account and Multi-Currency Processing?

It's a common point of confusion, but the distinction is pretty simple. Think of it like this:

- A multi-currency account is essentially a bank account that can hold different currencies side-by-side. It’s like having separate wallets for your dollars, euros, and yen, all in one place. You can receive and store money in its original currency.

- Multi-currency processing, on the other hand, is the actual service that lets your customers pay you in their local currency in the first place. It’s the technology at your checkout that says, "Yes, we can accept your euros," and then handles the conversion into your preferred currency.

So, processing is the action of accepting the payment, while the account is the place where you might hold the funds afterward.

How Do Refunds Work with Different Currencies?

This is a great question. Refunds are almost always processed in the same currency as the original purchase. If a customer in Japan paid ¥10,000, you refund them ¥10,000.

The tricky part is the ever-changing exchange rate. The value of currencies shifts daily, so the amount of your home currency needed to cover that ¥10,000 refund might be more or less than what you originally received. This is a small but important risk—foreign exchange fluctuation—to keep in mind.

The Good News: Modern payment gateways often eliminate the need for you to open foreign bank accounts. They handle all the complex conversions behind the scenes and deposit the funds right into your local bank account, making your life a whole lot easier.

Can This System Work for B2B Sales Too?

You bet. The core technology for accepting payments works just as well for business-to-business (B2B) transactions as it does for direct-to-consumer (B2C) sales.

The main difference is usually the scale and complexity. B2B payments often involve much larger sums of money and can come with more stringent compliance and verification requirements compared to a typical online retail purchase.

Ready to simplify your global transactions and embrace the future of payments? BlockBee offers a secure, low-fee platform for accepting cryptocurrencies, giving you instant access to a worldwide customer base. Explore our powerful features at https://blockbee.io today.