How to Accept International Payments: A Complete Guide

If you've built a successful online store, it's easy to get tunnel vision and focus only on your local market. But what happens when a potential customer from another country tries to check out, only to find their payment method isn't accepted? You've just hit an invisible wall, and that customer is likely gone for good.

In today's economy, sticking to domestic-only sales is like running a race with one leg tied. The real growth isn't just about finding more local customers; it's about opening your doors to the entire world.

This isn't some far-off, futuristic idea. It's a critical decision that businesses face right now. Competitors who are already selling globally have a massive head start. The great news is that getting your business ready for international sales has never been easier.

Let's talk numbers for a second. The flow of cross-border payments hit a staggering $156 trillion in 2023. That figure alone shows just how much demand there is for international commerce. By simply expanding your payment options, you can start carving out your own piece of that enormous market. You can dig deeper into these global payment network statistics at Coinlaw.io.

To get started, you'll need to decide how you'll accept these payments. The main options are a traditional payment gateway, a modern crypto processor like BlockBee, or even direct bank transfers. Each one comes with its own mix of fees, transaction speeds, and availability in different countries.

Key Takeaway: Going global is more than just adding a few new payment options at checkout. It's a strategic move that opens up entirely new revenue streams, makes your customer base more diverse, and helps protect your business from the ups and downs of a single local economy.

Picking the Right International Payment Gateway

Choosing the right partner to handle your global transactions is one of the most critical decisions you'll make for your business. This choice has a direct line to your profitability, customer experience, and day-to-day operations. You’ve got a ton of options, from household names like Stripe and PayPal to modern crypto solutions like BlockBee, and each one has its own fee structure and perks.

It's easy to get fixated on that headline transaction fee, but the true cost of accepting international payments is usually buried in the fine print. You have to dig deeper and look at things like currency conversion markups, cross-border fees, and how long it takes to actually get your money.

For example, a 2.9% + $0.30 fee sounds simple enough. But when you realize you're also losing another 2-4% on the currency exchange and waiting days for the funds to clear, your profit margins start to look a lot thinner.

Traditional vs. Crypto Gateways: A Quick Comparison

Let's imagine you sell digital software to customers in Europe and Asia. A traditional payment gateway gives you broad credit card acceptance, which most people are comfortable with. The trade-off? You're exposed to chargeback risks and slower settlement times that can seriously tie up your cash flow.

Now, consider a crypto payment gateway like BlockBee. It presents a totally different value proposition. With crypto, transactions are final, which all but erases the risk of fraudulent chargebacks. On top of that, settlements are nearly instant. You get your money in minutes, not days.

The bottom line: The "best" gateway isn't just about the number of payment methods it accepts; it's about what works for your business model. For anyone selling high-volume, low-margin digital goods, the speed and security of crypto can be a massive advantage.

A Deeper Dive Into The Real Costs

To get a real picture of what you'll be paying, you need to break down every single fee that can pop up during a global transaction. Here’s a checklist of what to watch out for:

- Transaction Fees: This is your basic percentage or flat fee per sale.

- Cross-Border Fees: An extra charge, often 1-2%, tacked on just because your customer is in another country.

- Currency Conversion Markups: This is the hidden fee gateways apply when converting the customer's currency into yours. It's a huge profit center for many providers.

- Payout and Withdrawal Fees: The cost to move your money from the gateway's system into your actual business bank account.

These fees add up fast and can be a nightmare to track. For a side-by-side analysis, check out our payment gateway fees comparison guide to see how different options stack up. Trust me, finding a platform with transparent, low fees is non-negotiable if you want to protect your bottom line as you grow.

How to Get Started with Crypto Payments Using BlockBee

Jumping into the world of crypto payments can feel intimidating, but with the right tools, it's actually pretty straightforward. Integrating a service like BlockBee isn't about getting lost in lines of code; it's more like plugging in a new app. You can unlock a fast, global payment method without the usual headaches.

Your first step is to get your BlockBee account set up. This is a quick sign-up process that gives you access to the merchant dashboard. Think of this as your command center—it's where you'll manage settings, track payments, and grab your all-important API key. This key is what lets your store securely talk to the BlockBee network.

Connecting Your E-commerce Platform

With your API key in hand, the next move depends on what e-commerce platform you're using. The good news is that BlockBee has official plugins for the big names, which means you can sidestep custom development entirely.

- WooCommerce users: Just install the BlockBee plugin from the WordPress repository. From there, you'll head to your payment settings and simply paste in the API key.

- Magento or PrestaShop merchants: It's a very similar drill. You'll download and install the specific extension for your platform, then pop in your API credentials to configure it.

This plugin approach is designed for speed. In many cases, you can go from creating an account to accepting your first crypto payment in less than an hour. It’s a practical way for any merchant to tap into crypto's benefits without needing a development team.

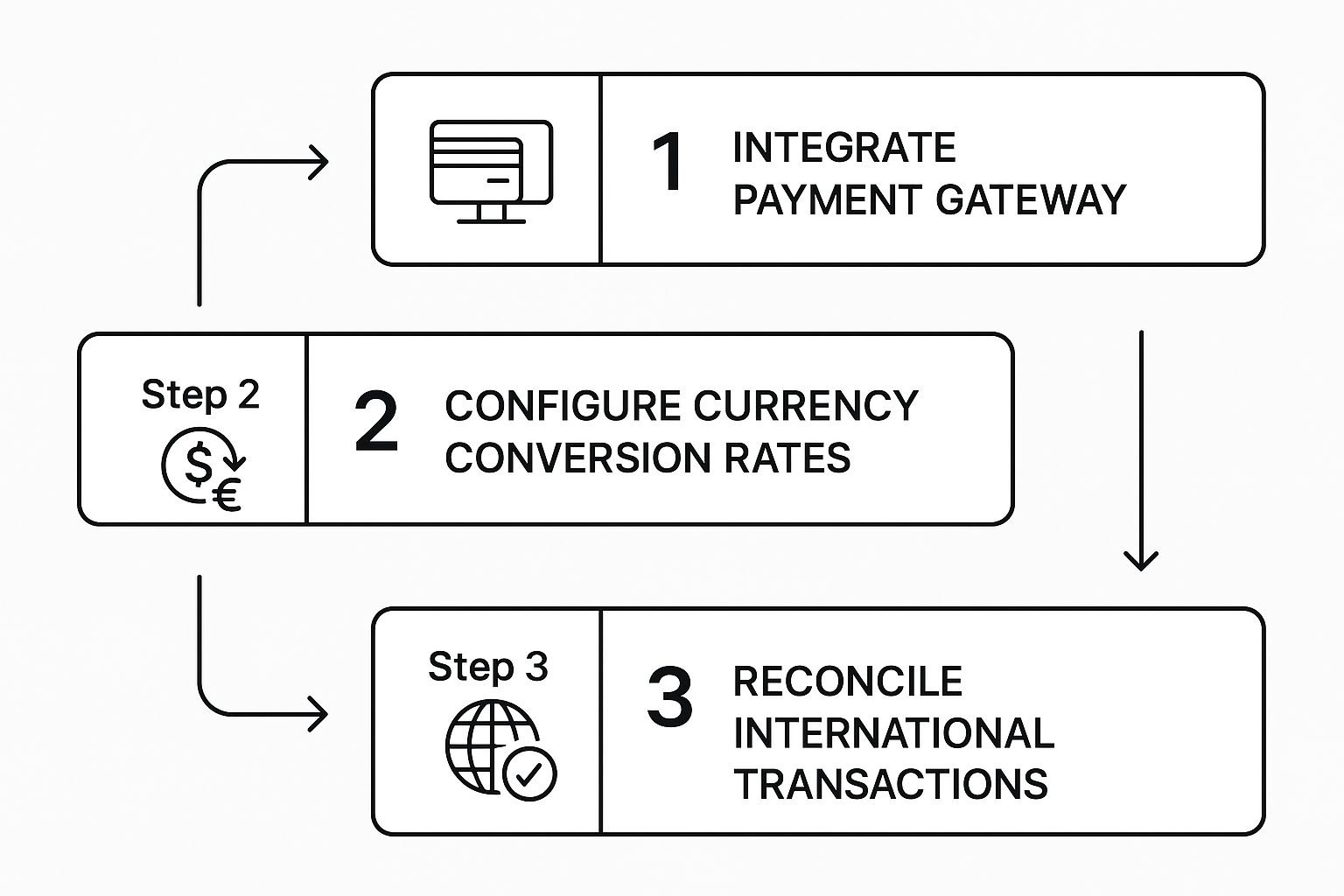

This visual breaks down the key stages for setting up any cross-border payment system, from the initial integration to final reconciliation.

As the flow shows, a successful integration is just the beginning. The real work is in the ongoing management, like handling different currencies and reconciling transactions to keep your operations running smoothly.

What Happens the Moment You Go Live

Once you activate BlockBee, you’ve fundamentally changed how you get paid by international customers. Forget waiting days for traditional card payments to clear. Crypto transactions are confirmed on the blockchain, and the funds go straight to your wallet, often within minutes.

The best part? BlockBee is a non-custodial gateway. This means we never hold your money. Payments go directly from your customer to you, giving you total control and removing the risk of a third-party processor freezing your funds.

This immediate access to your money, combined with low transaction fees starting at just 0.25%, gives your cash flow a direct boost and protects your profit margins on every single sale.

For a more detailed walkthrough, check out our guide on how to accept cryptocurrency payments. By following these simple steps, you can put a system in place that solves some of the biggest challenges in global e-commerce.

Navigating Cross-Border Compliance and Security

Selling globally is about more than just currency conversion; it's about getting a handle on international compliance and security. The regulations can seem like a tangled mess, but they're there for a good reason: to protect you and your customers from fraud and data theft.

Simply put, compliance is just playing by the rules. This means you need to get familiar with standards like Payment Card Industry Data Security Standard (PCI DSS) for handling credit card data, and run Know Your Customer (KYC) checks to confirm identities. These aren't just best practices—they're strict requirements designed to stop things like money laundering.

The amount of money moving across borders is staggering. To give you some perspective, global cross-border bank credit jumped by $1.5 trillion in early 2025, reaching an all-time high of $34.7 trillion. With that much cash in play, you can see why having ironclad security isn't just a good idea—it's essential. The Bank for International Settlements has some great data on this if you want to dig deeper.

The Chargeback Fraud Headache

For anyone running an e-commerce store, chargeback fraud is one of the biggest nightmares. It’s that frustrating scenario where a customer buys something, receives it, and then calls their bank to dispute the charge and get a refund. Fighting these disputes is a drain on your time and money, and too often, you end up losing the revenue.

This is where crypto payments really change the game. Every transaction is locked onto an immutable blockchain, which means it’s final. That finality all but eliminates the risk of someone trying to pull a fast one with a fraudulent chargeback, giving you a level of protection traditional payment methods just can't offer.

Key Insight: The irreversible nature of crypto payments is a massive win for merchants. It puts you back in control, shielding your business from a costly and all-too-common type of fraud in international e-commerce.

Why You Want to Hold Your Own Keys

At the end of the day, it's your money, and you need to keep it safe. That's why using a non-custodial payment processor like BlockBee makes so much sense. It means you always have complete control over your funds.

Think about it: with custodial services, your money sits in their accounts, leaving you vulnerable to their internal security risks. With a direct-to-wallet model, payments go straight from your customer into your personal wallet. No middleman, no waiting for funds to be released, and no worrying about your account being frozen.

By adopting these kinds of modern cross-border payment solutions, you’re not just accepting new currencies; you're building a more secure and resilient business from the ground up.

Designing a Checkout That Speaks Your Customer's Language

Getting the payment itself to go through is just one piece of the puzzle. The real challenge? Making sure your international customers feel comfortable enough to even try to pay. If your checkout process feels foreign, confusing, or just a bit shady, you'll see your cart abandonment rates soar.

The goal is to create an experience that feels local, no matter where your buyer is logging in from. It all starts with localization.

Show Prices They Understand

First things first: display prices in the customer's native currency. This is non-negotiable. Trying to make someone in Japan do the mental math from US dollars to yen is just adding unnecessary friction. Thankfully, modern payment gateways can handle this automatically, using live exchange rates to present pricing that feels instantly familiar and builds immediate trust.

Offer Payment Methods They Actually Use

Once you've got the currency right, you need to offer payment methods people in that region recognize and rely on. In North America, credit cards are king. But in many parts of Europe, digital wallets and direct bank transfers are far more common. In other regions, local instant payment networks are the go-to.

Don't underestimate the power of these real-time payment systems. Global instant payment volumes hit a staggering 195 billion in 2022 and are on track to blow past 500 billion by 2027. Integrating these options shows you've done your homework. You can dig deeper into these global payment trends and statistics at Gr4vy.com.

Of course, there's another way to approach this. You could offer a truly universal option like cryptocurrency, which completely sidesteps regional banking habits. A solution like BlockBee lets anyone, anywhere, pay with a single, borderless method. This move can simplify the entire checkout process for a growing number of tech-forward global shoppers.

Key Takeaway: A great global checkout experience is built on trust and transparency. Be completely upfront about all costs, including shipping and taxes. Nothing kills a sale faster than a surprise fee on the final page. Honesty is what builds the confidence needed to turn a one-time international buyer into a loyal customer.

Common Questions About International Payments

Even with the best tools in your corner, opening your doors to the global market naturally brings up some questions. It's smart to be prepared. Let's walk through a few of the most common hurdles I see merchants run into when they start accepting international payments, particularly with crypto.

The first thing on everyone's mind is usually currency volatility. It’s a fair question: what if a crypto's value plummets between when a customer clicks "buy" and the funds actually hit your account?

This is where a modern payment gateway proves its worth. Top platforms like BlockBee have features like instant conversion. The moment a payment is made, it can be automatically swapped for a stablecoin or your preferred local currency, completely shielding you from the market's ups and downs. The value is locked in, and the risk is gone.

Handling Technical and Practical Hurdles

Another common point of confusion is what "instant settlement" actually means for your day-to-day cash flow. We're so used to the traditional banking system, where you might wait several business days for funds to clear and become usable.

Crypto transactions are a different beast entirely. Since they're confirmed on the blockchain, a non-custodial gateway sends the funds directly to your wallet in minutes. This isn't just a minor perk—it's a massive operational advantage that gives you real-time access to your revenue.

Pro Tip: If you ever hit a snag with an API, go back to the basics before you start pulling your hair out. The culprit is often a simple mistake—like an expired API key or a firewall rule on your server that's accidentally blocking the connection. Check those first.

But what about human error? It happens. What if a customer fumbles and sends the wrong amount, or worse, to the wrong address? This is a legitimate fear for anyone new to the space. Thankfully, good payment systems are designed to prevent this.

Here’s how they create a safety net:

- Payment Validation: The system won't confirm an order until it verifies the correct amount was received. No more partial payments slipping through.

- Unique Addresses: A fresh, single-use payment address is created for every single transaction. This drastically reduces the risk of funds going astray.

- Clear Instructions: Customers are given simple, copy-and-paste instructions right on the checkout page, making it hard to mess up.

These safeguards are there to make the process smooth and secure for everyone involved.

Ready to simplify your global transactions with a secure, non-custodial crypto payment solution? BlockBee offers instant settlements, low fees, and easy integration. Start accepting international payments today.