Discover Top Cross Border Payment Solutions Today

If you’ve ever done business internationally, you know the feeling. You're waiting for a payment to clear, and it feels like an eternity. For too many businesses, this is the reality of global commerce. Traditional cross border payment solutions, like old-school bank wires, are notorious for multi-day delays and fees that can take a serious bite out of your revenue. It's a major headache in a world that otherwise moves at lightning speed.

The Old Way of Paying Is Broken

For decades, sending money from one country to another has been a clunky, roundabout process. Imagine trying to get from New York to London by taking a series of connecting flights on tiny regional airlines. Each stop adds time, has its own layover, and tacks on another fee. That’s essentially how legacy banking systems work.

Traditional wire transfers hop between a network of intermediary banks to reach their final destination. Each bank in the chain adds its own processing time and, of course, its own fee. This convoluted system creates a pile-up of problems:

- Painful Delays: It’s not uncommon for payments to be stuck in limbo for three to five business days. This can wreak havoc on your cash flow and put a strain on relationships with vendors and partners.

- Hidden Fees: What you think you're paying is rarely what you actually pay. A lack of transparency means surprise correspondent bank fees and less-than-ideal currency conversion rates can eat away at your transfer.

- A Logistical Nightmare: Manually tracking and reconciling these payments is a time-consuming chore that pulls your team away from more important work.

This outdated model just can't keep up anymore. The demand for cross-border payments is skyrocketing, thanks to the boom in e-commerce, the rise of remote work, and the global nature of modern services. The market was valued at a staggering $212.55 billion in 2024 and is on track to hit nearly $392.01 billion by 2033. You can dig deeper into these cross-border payment trends to see what's driving this incredible growth.

All this growth means businesses are desperate for a financial superhighway—a faster, cheaper, and clearer way to move money across the globe.

To put the difference into perspective, let's break down how old-school methods stack up against newer digital options.

Traditional vs Modern Cross Border Payments at a Glance

This table offers a side-by-side look at the key differences between the banking systems we've relied on for decades and the fintech and crypto solutions that are changing the game.

| Feature | Traditional Methods (e.g., Wire Transfers) | Modern Solutions (e.g., Fintech, Crypto) |

|---|---|---|

| Settlement Time | 3-5 business days | Minutes to same-day |

| Transaction Fees | High, with multiple hidden correspondent fees | Low, transparent, often a small flat fee or percentage |

| Transparency | Low; final amount and fees are often a surprise | High; real-time tracking and clear fee structures are standard |

| Accessibility | Limited to banking hours, requires bank account | 24/7/365, accessible via web or mobile app, less reliance on banking |

| Operational Overhead | High; requires manual tracking and reconciliation | Low; automated reconciliation and reporting simplify accounting |

As you can see, the contrast is stark. Modern solutions are built for the speed and transparency that today's global economy demands.

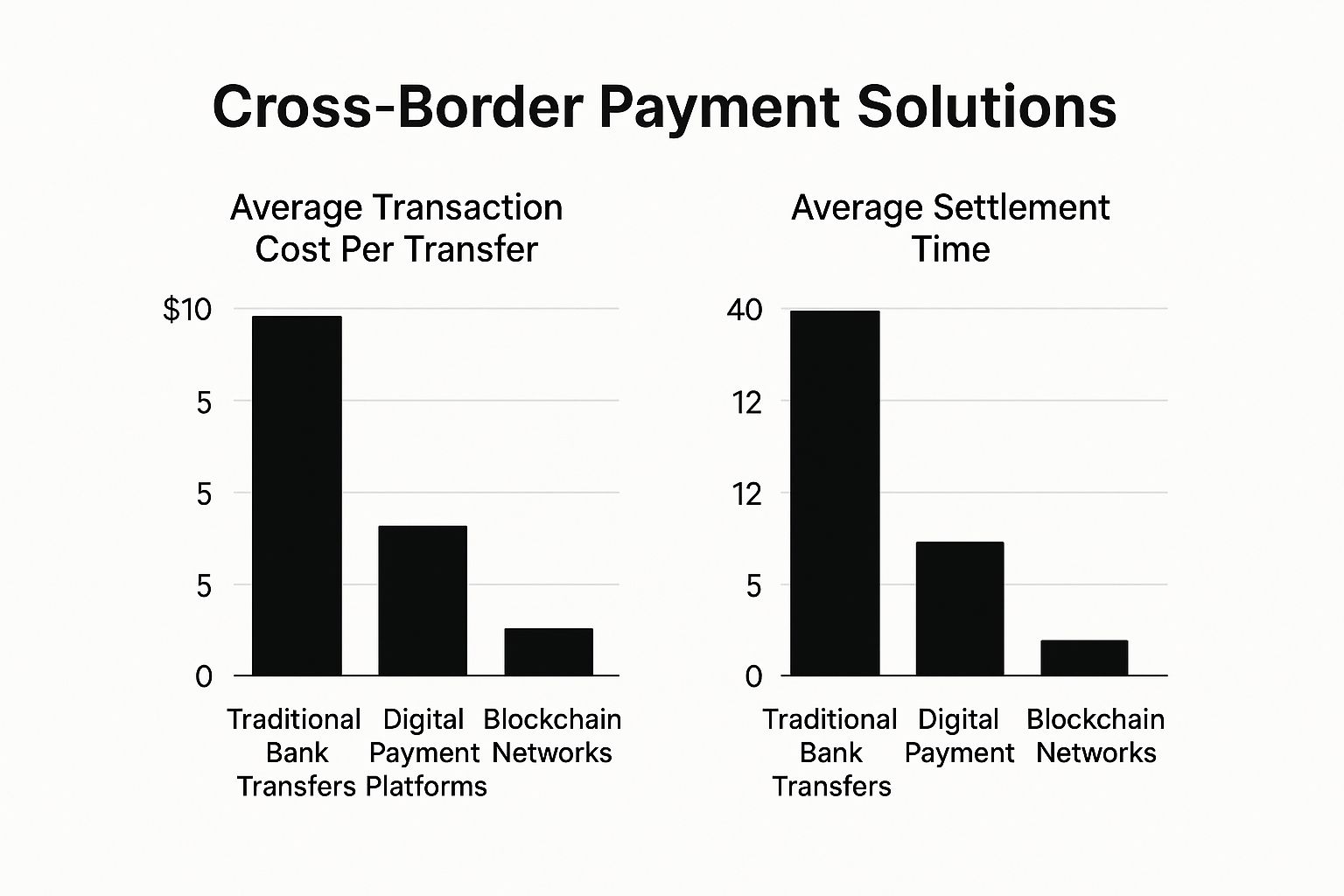

The data makes it crystal clear: both digital payment platforms and networks built on blockchain technology deliver massive improvements in speed and cost compared to standard bank transfers.

Modern cross border payment solutions aren't just a minor improvement—they represent a complete overhaul of how global money moves. They replace the slow, winding road with a direct, high-speed connection, opening up international business for everyone.

This fundamental shift has set the stage for technologies that make frictionless global transactions a part of everyday business. Innovative platforms, especially those using crypto, are leading the charge toward a future where sending money overseas is as quick and easy as sending an email.

The Hidden Costs and Delays in International Transactions

Ever wondered why sending money across borders feels so sluggish and expensive? For any business with a global footprint, this isn't just a minor frustration—it's a direct blow to the bottom line and a major drag on operations. The traditional banking system is saddled with problems that modern cross-border payment solutions are specifically designed to fix.

Picture a freelance designer in Southeast Asia who just wrapped up a project for a client in the United States. The invoice is out, but the payment takes a full five business days to land in their account. For nearly a week, that money is just… gone. Stuck in limbo. This kind of delay isn't just an outlier; it's a routine headache that highlights the fundamental flaws in how we’ve always moved money internationally.

Let's dig into the three biggest roadblocks businesses run into.

The Problem of Staggering Costs

The most obvious pain point is the cost. That initial fee you see for a bank wire? It's almost never the final price. The total cost gets bloated by a chain of hidden charges that are nearly impossible to track.

- Correspondent Bank Fees: Your payment doesn't fly directly from your bank to the recipient's. It hops between several intermediary banks, and each one shaves off a fee for its trouble. These "lifting fees" add up fast.

- Unfavorable Exchange Rates: Banks rarely give you the real, mid-market exchange rate you'd find on a currency converter. Instead, they bake a hefty margin into their rates, silently siphoning value from your transfer.

This lack of transparency makes it a nightmare to budget for international payments. For businesses trying to run a tight ship, these surprise costs can be a real killer.

The combination of intermediary fees and poor exchange rates can easily eat up 3-5% or more of a transaction's total value. On a $50,000 payment to a supplier, that’s a hidden loss of over $2,500.

The Frustration of Slow Speeds

In an age of instant everything, waiting days for money to arrive feels like a relic from the past. Traditional wire transfers are slow by design, relying on banking networks that only operate during business hours and don't talk to each other in real-time. Send a payment on a Friday afternoon, and it might not even start moving until Monday morning.

Think about a small e-commerce shop needing to pay its supplier in China to get the next shipment of inventory out. A three-day delay in payment means a three-day delay in production. That ripples into a three-day delay in getting products to customers, disrupting the entire supply chain and putting a strain on cash flow.

Navigating Complex Compliance Hurdles

Every country plays by its own financial rules. There are different anti-money laundering (AML) laws, unique reporting requirements, and a whole host of regulations to follow. For a business trying to operate globally, untangling this complex web is a massive challenge that demands specialized knowledge and resources.

Getting it wrong can lead to serious consequences, from hefty fines to frozen accounts. This regulatory maze often forces smaller companies to avoid international markets altogether or pay for expensive compliance services, adding yet another layer of cost. Finding a partner with a clear and straightforward approach to costs is crucial, which is why it's worth exploring different fee structures for payment processing.

These problems—high costs, slow speeds, and regulatory headaches—aren't just annoyances. They are the driving force behind the growing demand for better, more agile cross-border payment solutions that can actually support the speed of modern business.

Technologies That Power Instant Global Payments

If you've ever been frustrated by the slow pace and high costs of traditional banking, you're not alone. Thankfully, that old model is giving way to a new generation of cross-border payment solutions built for speed, savings, and transparency. But what’s the magic behind the curtain? A few key technologies have completely changed how money moves around the globe.

Getting a handle on these underlying mechanics demystifies the whole process. Instead of a tangled web of intermediary banks, modern systems forge direct, digital paths to get funds from point A to point B with remarkable efficiency.

The financial world is in the middle of a massive upgrade. Projections show the cross-border payments market is on track to grow at a compound annual growth rate of 9.5% through 2028, with revenues nearing $180 billion. The real win for businesses? These tech shifts are expected to slash average transaction costs by up to 30% in the next five years, making global commerce more accessible than ever.

Real-Time Payment Networks

Picture a payment system that never clocks out. That's the essence of Real-Time Payment (RTP) networks. These are domestic systems that run 24/7/365, clearing and settling transactions in a flash.

Unlike old-school bank transfers that get processed in batches during business hours, RTP systems handle them one by one, right as they happen. When countries start linking their domestic RTP networks, they create a superhighway for international payments. The result? Settlement times drop from days to mere seconds.

APIs as Financial Translators

If RTP networks are the highways, think of Application Programming Interfaces (APIs) as the universal translators that let different systems speak the same language. For decades, banks and financial institutions were locked into their own private, proprietary systems that didn't play well with others.

APIs tear down those walls. They create a standard, secure way for different software—from your accounting platform to a supplier’s payment portal—to connect and swap information.

- Here’s a simple example: An e-commerce store uses an API to link its checkout directly to a payment gateway. When you click "buy," the API instantly relays the transaction details, verifies the funds, and confirms the order without a single person having to lift a finger.

This instant connection automates workflows, cuts down on human error, and makes the entire experience smoother for everyone involved.

APIs are the essential connective tissue of modern finance. They empower different platforms to work together, creating integrated and efficient cross-border payment solutions that were impossible with the siloed systems of the past.

Blockchain as a New Global Ledger

The biggest game-changer might just be blockchain. At its heart, a blockchain is a decentralized, distributed digital ledger. Imagine a shared notebook that everyone in a network can see and write on, but no single person can control or alter past entries. That’s the core idea.

Each transaction is recorded as a "block" and cryptographically linked to the one before it, forming a "chain." This chain is constantly verified by participants across the network, creating an unchangeable and transparent record of every single payment. To truly grasp its impact, it's worth understanding what is the blockchain and its foundational principles.

This technology brings three powerful benefits to global payments:

- Cutting Out the Middleman: Since the ledger is shared and trusted by everyone, there’s no need for correspondent banks. This direct path dramatically slashes both costs and settlement times.

- Ironclad Security: The cryptographic links between blocks and the decentralized structure make transaction records incredibly difficult to tamper with, offering a huge leap forward in fraud prevention.

- Complete Transparency: Anyone involved in a transaction can see its status on the blockchain in real time. This gets rid of the frustrating "black box" of wire transfers, where money often seems to vanish for days.

By building on these powerful technologies, modern payment platforms offer a fundamentally better way to do business across borders. They are replacing the slow, costly, and murky systems of yesterday with a new standard of speed, efficiency, and clarity.

How BlockBee Makes Cross-Border Payments Simple

It’s one thing to understand the headaches of traditional global payments, but it’s another thing entirely to actually solve them. This is where a purpose-built platform like BlockBee comes in, using blockchain technology to directly tackle the high fees and slow speeds that drain a business's resources.

Instead of getting lost in the old, complicated web of correspondent banks, a crypto payment gateway forges a direct, digital line from you to your payee. It simply removes the middlemen who slow things down and take a cut, offering a much cleaner, more efficient way to handle money internationally.

From Days to Minutes: A Real-World Scenario

Let’s walk through a common situation. A company in the U.S. needs to pay a European contractor $5,000. With a traditional bank wire, the process is full of uncertainty. The money might take five business days to show up, and by the time it does, intermediary bank fees and a poor exchange rate have already taken a bite out of the original amount.

Now, let's run that back using BlockBee. The company sends the payment with a stablecoin like USDC, which is pegged 1:1 to the U.S. dollar, so there’s no worry about price volatility. The transaction flies across the blockchain and lands in the contractor's digital wallet in minutes. The fee? A tiny, transparent percentage—a fraction of what the bank wire would have cost.

This isn't some far-off future concept; it's how smart businesses are operating today. The contractor gets their money almost instantly, and the company saves a bundle on fees with total transparency. That’s the real-world value a modern crypto payment gateway delivers.

This example cuts right to the heart of why a crypto-powered platform works so well for global payments. It was built from the ground up to be faster, cheaper, and clearer than the old way of doing things.

The Tools That Make It Happen

BlockBee pulls this off with a set of powerful, yet surprisingly simple, features. It takes the complex world of blockchain and boils it down into tools anyone can use.

Here’s a breakdown of the core components that make it a go-to solution for cross-border payments:

- Multi-Currency and Stablecoin Support: With support for over 70 different cryptocurrencies, BlockBee offers incredible flexibility. More importantly, it supports stablecoins like USDT and USDC, letting you send and receive value globally without worrying about the price swings of other crypto assets.

- Settlement in Minutes, Not Days: Blockchain transactions are typically confirmed on the network in minutes. This is a game-changer for cash flow, ensuring you can pay suppliers, freelancers, and global partners on time, every time.

- Dramatically Lower Fees: By sidestepping the traditional banking system, BlockBee eliminates layers of hidden fees. Transaction costs are clear, upfront, and often under 1%. Compare that to the 3-5% (or more) you can lose with a standard bank wire.

The platform’s dashboard gives you a clear, real-time view of every transaction, so you're never left guessing. It's designed to be intuitive, letting anyone manage crypto payments without needing a degree in computer science.

More Than Just a Payment Button

BlockBee is more than just a way to send money; it’s a full toolkit for simplifying your financial operations.

For example, the platform offers automated invoicing and detailed payment tracking. Since every transaction is recorded on an immutable ledger, you get a perfect, auditable trail for every payment. This clarity makes bookkeeping a breeze and frees up your finance team from tedious administrative work. For businesses ready to get started, our guide on how to accept crypto payments for your business provides a detailed walkthrough.

Security is also fundamental to how BlockBee operates. It’s a non-custodial gateway, which is a fancy way of saying it never holds your funds. Payments go directly from the customer’s wallet to your wallet. You, and only you, have full control over your money at all times. This self-custody model gets rid of the risk that comes with trusting a third party to hold your assets.

By combining speed, low costs, and a truly useful set of features, BlockBee turns cross-border payments from a costly headache into a smooth, efficient part of your daily business.

The Future of B2B and Global Commerce

The way money moves around the world isn't just changing; it's getting faster every day. For any business with an international footprint, especially in the massive business-to-business (B2B) space, keeping up with payment technology is no longer just a good idea. It's now a fundamental part of staying competitive.

What's driving this? The sheer size of the B2B market. Cross-border payments between businesses are the lifeblood of global trade, with a market volume of around $39 trillion in 2023 expected to jump to $56 trillion by 2030. This isn't just a forecast—it's backed by demand. A staggering 92% of businesses are already planning to invest in real-time payment solutions, signaling a clear end to the era of slow, costly transactions.

This momentum is setting the stage for a few key developments that will shape how global payments work for years to come.

The Rise of Digital Currencies and Universal Standards

Central Bank Digital Currencies (CBDCs) are a huge deal. Think of them as the official, digital version of a country's fiat currency, backed directly by its central bank. As more governments get on board, CBDCs could build new, hyper-efficient pathways for international payments, effectively cutting out many of the slow, expensive middlemen in the traditional banking system.

Alongside this, the industry is finally rallying around a universal language for financial data. New standards like ISO 20022 are being adopted to help different payment systems communicate with each other flawlessly. It's like creating a universal translator that lets a bank in Japan and a fintech wallet in Brazil exchange detailed payment information instantly, with no room for error.

The ultimate goal here is interoperability—a future where sending a payment from one country to another is as straightforward as sending an email. This kind of seamless connection is what modern global commerce is built on.

The Impact of AI and Automation

Artificial intelligence is quickly becoming an indispensable tool in the payments world. AI algorithms are proving to be exceptionally good at identifying and stopping fraud in real time, catching suspicious patterns that a human could never spot. This adds a much-needed layer of security to cross-border payment solutions.

But AI is doing more than just playing defense. It’s also getting brilliant at optimizing payment routing. The technology can analyze countless potential paths for a single payment in a split second, finding the absolute cheapest and fastest route available. This ensures businesses aren't leaving money on the table. For companies operating globally, pairing this with sophisticated invoice automation software can make the entire payment cycle incredibly efficient.

All of these trends point toward a future that is more automated, secure, and deeply interconnected. As these technologies grow, they will naturally merge with the powerful capabilities of blockchain. The future of crypto payments is woven into these advancements, creating a potent new ecosystem for B2B transactions.

Embracing modern payment solutions isn't just about solving today's headaches. It's about getting your business ready for a global economy that will only demand more speed and efficiency tomorrow.

Frequently Asked Questions About Global Payments

After digging into the old, slow world of bank transfers and seeing how modern cross-border payment solutions are changing the game, you probably have some questions. It's only natural. Let's clear the air and tackle some of the most common things people ask when considering a switch.

Are Cryptocurrency Payments Actually Safe for Business?

Yes, they’re incredibly safe—as long as you’re working with a reputable payment gateway. Crypto transactions are built on some seriously advanced cryptography and recorded on a blockchain. Think of the blockchain as a public, decentralized bookkeeper that's almost impossible to tamper with. This inherent structure makes it highly resistant to the usual types of fraud.

Even better, most crypto payments are final. This practically eliminates the headache of chargeback fraud, where a customer disputes a valid payment to claw their money back. And when you use a platform like BlockBee, you get another layer of security. We operate on a non-custodial basis, which is just a fancy way of saying you—and only you—always have control over your funds.

Worried about the wild price swings of crypto? That's what stablecoins are for. These are digital currencies pegged to a stable asset, like the U.S. dollar, so their value doesn't jump around. You get all the speed and security of the blockchain without the volatility.

Using stablecoins is like getting the best of both worlds: the solid ground of traditional money with the speed of modern payment tech.

How Much Cheaper Are We Talking Compared to Bank Wires?

The difference isn't just noticeable; it can be staggering. Traditional bank wires are famous for their hidden fees. You're not just paying your bank. You’re paying a chain of intermediary banks, and on top of that, you’re often hit with a terrible exchange rate that quietly skims another percentage point or two off the top.

All in, it’s not unusual for those fees to stack up to 3-5% of the total amount, sometimes even more.

Modern solutions, especially those running on the blockchain, just cut out all those middlemen. This makes the whole process way more transparent and a lot cheaper.

- Crypto-based platforms: Fees are typically a tiny, flat percentage. We’re often talking less than 1%. On large B2B payments, that can literally mean thousands of dollars saved.

- Fintech platforms: Even those that still touch traditional banking rails have optimized the process so much that they still crush the costs of a direct bank-to-bank wire.

When you switch, you stop guessing what a payment will cost and turn it into a predictable, low operational expense.

Do I Need to Be a Crypto Guru to Use a Platform Like BlockBee?

Not at all. This is one of the biggest myths out there. The idea that you need to be a tech wizard to accept crypto is completely outdated. Modern payment gateways are built for regular people, making them just as easy to use for any business owner or finance department.

It's just like using your online banking app. You don't need to understand the complex financial plumbing behind it to send money—you just log in and use a simple interface. Crypto payment gateways are designed with the exact same philosophy.

These platforms do all the heavy lifting—the complex blockchain stuff—behind the scenes. All you see is a clean dashboard where you can:

- Create an invoice or a payment request in a couple of clicks.

- Send a simple payment link to your client or contractor.

- Watch the payment status update in real time.

- Get funds sent straight to your digital wallet.

If you can handle a basic web app, you’ve got all the skills you need.

How Fast Do Cross-Border Crypto Payments Really Settle?

This is where you'll feel the biggest difference. A traditional international bank transfer can leave you checking your account for 3-5 business days. With crypto, payments settle as fast as the blockchain network can process them. For most major coins and stablecoins, that means you'll see the money in minutes.

This near-instant settlement completely changes how you operate. Faster payments mean:

- Better Cash Flow: Your money is yours to use right away. You can pay suppliers, invest in your business, or cover expenses without waiting around.

- Happier Partners: Paying your international freelancers and suppliers on time, every time, builds immense trust and strengthens your business relationships.

- Peace of Mind: No more wondering where your money is. The blockchain’s transparency means you can see for yourself that the transaction is complete, almost instantly.

This speed turns cross-border payment solutions from a slow, nail-biting process into a smooth, reliable part of your day-to-day operations.

Ready to escape the high fees and slow speeds of traditional global payments? BlockBee offers a secure, fast, and affordable way to send and receive crypto payments worldwide. See how our non-custodial platform can empower your business.