Payment Gateway Fees Comparison for Smart Businesses

When you start comparing payment gateways, you’ll notice a familiar pattern. Most big names, like Stripe and PayPal, advertise a rate somewhere around 2.9% plus a fixed fee of about $0.30 per transaction. But that's just the headline number. The best gateway for your business really depends on your sales volume, average ticket price, and whether you sell internationally, because the other fees—monthly, hidden, and international—can completely change the math.

Decoding Payment Gateway Fee Structures

Choosing a payment gateway can feel like trying to solve a puzzle. The fee structures often seem deliberately complicated, so making a true apples-to-apples comparison means learning to read between the lines. It’s about more than just the advertised rate; you have to dig into every single charge that could hit your bottom line.

This isn't a small corner of the market, either. The payment gateway industry exploded from $26.0 billion in 2022 to an estimated $37.0 billion in 2024. With that kind of growth, it’s clear these services are the backbone of modern commerce. As more businesses move online, figuring out these fees isn't just a chore—it’s a genuine competitive advantage.

The Core Costs You Will Encounter

Every payment gateway builds its pricing model from a few key ingredients. You’ll almost always see a mix of percentage-based and fixed fees, but that’s just where it begins.

Here’s a breakdown of the usual suspects:

- Transaction Fees: This is the most visible cost. It's almost always a percentage of the total sale combined with a small, flat fee (e.g., 2.9% + $0.30).

- Monthly Fees: Some providers charge a recurring subscription just to keep your account active, no matter how much you sell.

- Setup Fees: This is a one-time charge for getting your account up and running. Thankfully, this is becoming less common as providers compete for new customers.

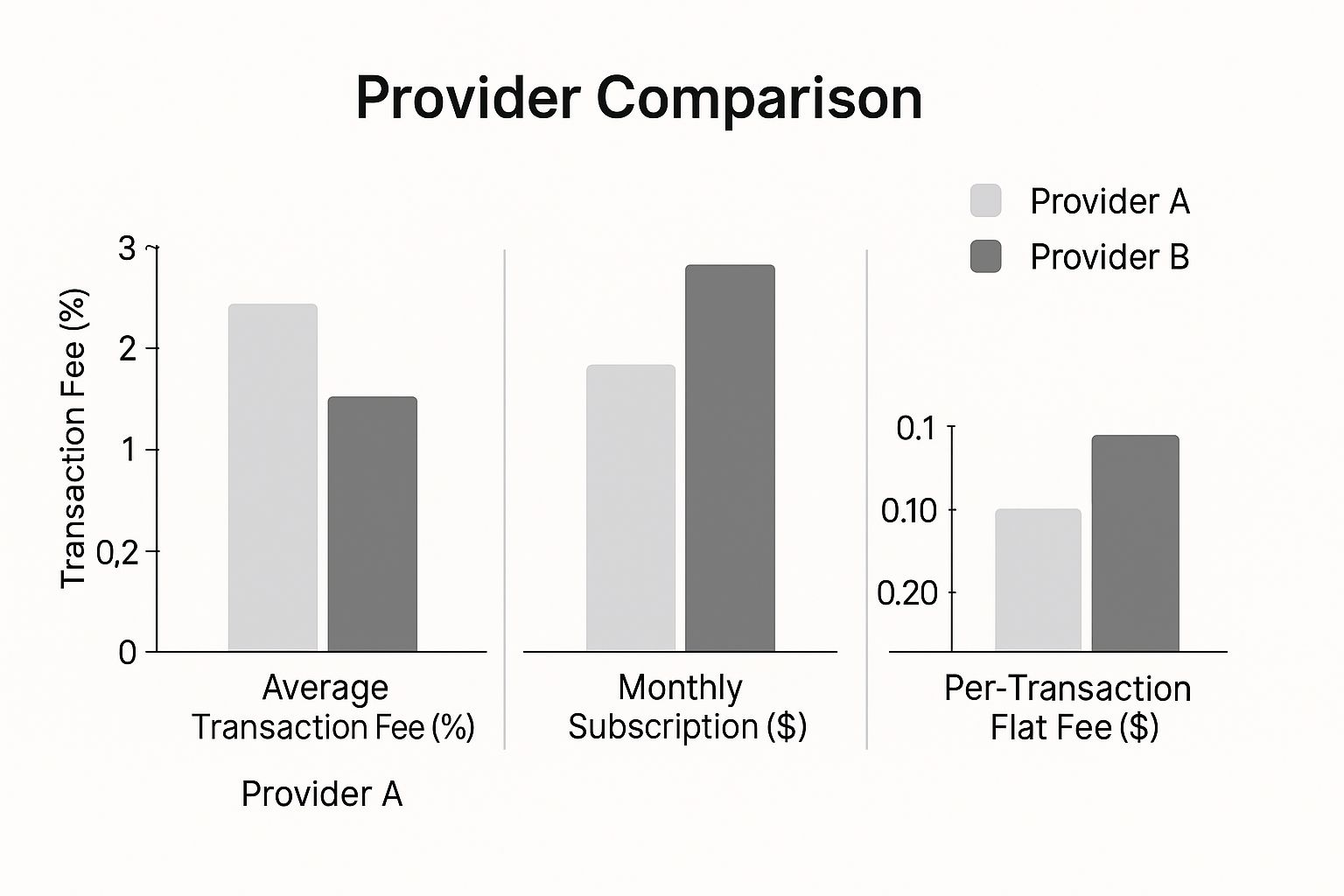

This image gives a great at-a-glance look at how some of the most popular gateways stack up with their standard rates.

As you can see, while the base transaction fees look similar, things get interesting when you factor in monthly fees or the cost of hardware. A gateway with no monthly fee might be the clear winner for a business with low sales volume, even if its per-transaction rate is a bit higher.

And if you're on a platform like Shopify, you'll need to understand their integrated solution. This comprehensive guide to Shopify Payments gateway, including its fees is a great resource for seeing how those platform-specific options work.

Key Insight: Never, ever pick a payment gateway based on the transaction percentage alone. The real costs are often hiding in the details—chargeback penalties, PCI compliance fees, and international surcharges can quickly make the "cheapest" option the most expensive.

To do a proper cost analysis, you have to look deeper. And if you’re exploring different payment types, it's worth seeing how alternative models work. For example, our cryptocurrency payment fees at https://blockbee.io/fees offer a completely different structure. Once you understand the terminology, you can see past the marketing slogans and find a solution that actually works for your profit margins.

Comparing Stripe vs PayPal vs Square Fees

When you're trying to figure out payment gateway fees, three names always pop up: Stripe, PayPal, and Square. They're all giants in the payment processing world, but their fee structures are where things get interesting. Looking past the headline numbers is the key to picking a platform that won't eat into your profits.

At first glance, their standard online transaction fees look nearly the same. But the real differences show up when you look at how they handle specific situations—like in-person sales, international payments, or even tiny transactions. That's where your money really goes.

Standard Online Transaction Fees

The most common fee you'll run into is for a basic online credit card payment. For years, Stripe and PayPal set the industry standard, and Square has kept pace, especially for businesses that sell both online and in-person.

- Stripe: Charges a flat rate of 2.9% + $0.30 per successful online card charge.

- PayPal: Also charges 2.9% + $0.30 for its standard digital payments.

- Square: Matches this with 2.9% + $0.30 for online transactions.

These numbers might seem identical, but the story changes as soon as you factor in things like high sales volume or customers from other countries. For example, while PayPal's domestic rate is 2.9% + $0.30, it tacks on an extra 1.5% for international payments. Stripe, on the other hand, offers volume-based discounts to merchants who process over $80,000 a month, making it a much better deal for fast-growing companies.

This visual breakdown gives you a clearer picture of how these fees and other costs really stack up.

As you can see, while the percentages are close, little differences in monthly costs or flat per-transaction fees can lead to big cost differences over time.

To make it even simpler, here's a side-by-side look at the most common fees.

Fee Structure Comparison: Stripe vs. PayPal vs. Square

This table breaks down the primary transaction fees, monthly costs, and special rates for each of the leading payment gateways, so you can see exactly how they compare.

| Fee Type | Stripe | PayPal | Square |

|---|---|---|---|

| Online Transactions | 2.9% + $0.30 | 2.9% + $0.30 | 2.9% + $0.30 |

| In-Person (POS) | 2.7% + $0.05 | 2.29% + $0.09 | 2.6% + $0.10 |

| International Fee | 1% + currency conversion | 1.5% | 1% |

| Monthly Fee | $0 | $0 (Standard) | $0 (Standard) |

| Micropayments Rate | None | 5% + $0.05 | None |

This comparison highlights that the "best" option really depends on how you do business. A primarily online store will have different priorities than a brick-and-mortar shop.

In-Person and Hardware Payments

If you have a physical storefront, the cost of point-of-sale (POS) hardware and its transaction fees is a huge deal. This is where Square really made its name, offering simple, easy-to-use hardware for small businesses.

Of course, Stripe and PayPal haven't been sitting on the sidelines; they've both rolled out their own terminal solutions, heating up the competition.

- Square: For payments made with a Square Reader or its POS system, the fee is a straightforward 2.6% + $0.10 per tap, dip, or swipe.

- Stripe Terminal: The fee for in-person payments is a bit higher at 2.7% + $0.05 per transaction.

- PayPal Zettle: Comes in with a very competitive rate of 2.29% + $0.09 for card-present transactions.

Key Takeaway: For a business that does most of its sales in person—think a coffee shop, local boutique, or market stall—Square or PayPal Zettle are often the more economical choice thanks to their lower rates for physical payments.

Nuanced Fees for Special Scenarios

Beyond the standard online and in-person rates, certain situations can trigger entirely different fees. These are the "hidden" costs that can catch you by surprise if you haven't dug into the details.

Micropayments are a perfect example. If your business sells low-cost digital items, PayPal has a special micropayments rate of 5% + $0.05 per transaction. For any sale under about $12, this is way cheaper than its standard fee. Stripe, however, doesn't offer a special rate for this, which could make it a more expensive option for this specific business model.

When you need to get into the weeds on these less common fees, checking out official resources like Stripe's platform documentation can clear things up quickly.

In the end, the right choice comes down to your unique sales patterns. A high-volume e-commerce store could save thousands with Stripe's volume discounts, while a freelancer with clients all over the world might find another provider's cross-border fees are a much better fit.

Uncovering Hidden Costs in Your Merchant Agreement

The transaction rate you see advertised is just the tip of the iceberg. I've seen countless merchants get a nasty shock when their first statement arrives, revealing that their actual processing costs are way higher than they were led to believe. This is almost always due to a laundry list of ancillary fees buried deep in the merchant agreement.

These so-called "hidden" charges can stack up fast, turning what looked like a great deal into a major expense. The only way to protect your profit margins is to know exactly what to look for before you sign on the dotted line. A proper payment gateway fees comparison has to go beyond the headline numbers.

The High Price of Chargebacks

A chargeback is what happens when a customer disputes a transaction directly with their bank, forcing a refund. This is a double whammy for you. Not only do you lose the original sale amount, but your gateway will also slap you with a separate, non-refundable penalty for their trouble.

- Chargeback Fees: Most major providers, from Stripe to PayPal, will charge you a penalty between $15 and $25 per incident. And get this—you pay that fee whether you win or lose the dispute.

- Increased Risk: A spike in chargebacks can get your account flagged as "high-risk." This could lead to your funds being frozen or, in the worst-case scenario, your account being shut down entirely.

Think about it. A small online shop that gets just five chargebacks in a month at $20 a pop is suddenly out an extra $100. That's pure cost, completely separate from the lost revenue. For businesses running on thin margins, that can be a painful, unexpected hit.

Critical Warning: Chargeback fees are one of the most common and damaging hidden costs out there. Before you commit to any provider, you absolutely must ask about their dispute process and the fees involved.

Compliance and Service-Related Fees

Beyond disputes, your monthly statement can be littered with other charges. These often relate to industry security standards, administrative tasks, or add-on features that aren’t part of the base package.

Here are a few you’ll run into:

- PCI Compliance Fees: If your gateway makes you responsible for maintaining your own PCI DSS compliance, you might see monthly or annual fees for validation. Failing to comply can trigger even bigger penalties, sometimes over $50 per month.

- Advanced Feature Costs: Need to set up recurring billing for a subscription service? Many gateways will charge you extra for that. PayPal, for example, charges $10 per month just for its recurring payments tool.

- Payout and Transfer Fees: Standard bank transfers are usually free, but they take a few days. If you need your money instantly, be prepared to pay. Instant payouts typically come with a fee around 1% of the total amount.

Let's take a SaaS company that needs recurring billing. That $10/month fee adds up to an extra $120 per year for a single, essential feature. It’s these "small" costs that show why a real payment gateway fees comparison means reading every single line of the fine print.

Finding the Right Gateway for Your Business Model

Everyone wants the "cheapest" gateway, but that's the wrong way to look at it. There's no single best answer. The truth is, a payment gateway fees comparison is only useful when you look at it through the lens of your own business.

What saves a high-volume retailer a fortune could sink a small subscription startup. It all comes down to your average transaction size, how much you sell each month, and where your customers are. Let's run the numbers for a few different business types to see just how much the "best" choice can change.

High-Volume Ecommerce Store

Let’s start with an online store doing serious volume—say, $90,000 a month with an average order value of $75. At this scale, tiny percentage differences add up to big money.

This is where a provider like Stripe really shines. Their standard 2.9% + $0.30 is pretty typical, but they’re known to offer volume discounts once you’re processing over $80,000 a month. If you can negotiate that rate down to 2.5% + $0.30, you’d be saving over $360 every single month compared to a competitor without volume pricing.

For a business this size, looking into interchange-plus pricing is also a smart move. It's a bit more complicated to understand, but it almost always results in lower costs once your sales volume is high enough. The trick is having the sales history to back up your negotiation.

Subscription SaaS Company

Now, let's picture a SaaS company with 500 customers each paying $20 a month. That's a respectable $10,000 in monthly recurring revenue, but the transaction profile is completely different: lots of small payments.

Here, that fixed per-transaction fee becomes a silent killer. On a $20 payment, a $0.30 fixed fee is a huge deal. It’s an extra 1.5% on top of the percentage fee. A standard 2.9% + $0.30 rate suddenly becomes an effective rate of 4.4%. That’s way too high.

Key Insight: When your average transaction value is low, like with many subscription models, the fixed fee often matters more than the percentage. Hunt for a provider with a lower cents-per-transaction cost, even if the percentage is a tiny bit higher.

This kind of business should also be looking for a gateway with excellent built-in recurring billing tools that don’t cost extra. Features like dunning management, which automatically handles failed payments, are worth their weight in gold for reducing customer churn.

Freelancer with International Clients

Finally, consider a freelancer invoicing $5,000 a month across five different clients, some in Europe and some in Asia. The biggest challenge here isn’t the transaction volume; it's the hidden costs of getting paid across borders.

A simple payment gateway fees comparison often misses this. Most gateways charge an extra 1% to 1.5% for international transactions, and that's before the currency conversion fee gets tacked on. Suddenly, that $1,000 invoice from a client in London could cost you an extra $25 just because it's not domestic. If you want to dive deeper, plenty of industry research breaks down these global payment trends.

For freelancers, the best gateways are those built for global payments. Look for ones with transparent, low cross-border fees. Some even let you hold funds in multiple currencies, so you can avoid forced conversion charges and withdraw your money when the exchange rate is favorable. Making the right choice here can easily save a freelancer hundreds of dollars a year.

How to Make an Informed Gateway Decision

Now that you understand how these fee structures work, it's time to put that knowledge into action. Choosing the right payment gateway isn't about chasing the lowest advertised rate—that's a rookie mistake. The real goal is to find the lowest effective rate for how your business actually operates.

The first step is to look inward. Before you even think about comparing providers, you need to get a crystal-clear picture of your own sales metrics. The best decisions are built on a solid foundation of your own data, specifically your average transaction value and your total monthly processing volume.

Your Pre-Decision Audit Checklist

Get these numbers figured out before you start scheduling sales calls. Walking into a conversation armed with your own data puts you in the driver's seat and helps you instantly see which pricing models are a good fit and which are a complete non-starter.

- Average Transaction Value (ATV): What's the typical ticket price for a single customer purchase?

- Monthly Sales Volume: How much money, in total, do you process in a typical month?

- Transaction Count: How many separate payments do you handle each month? This number is crucial for understanding the impact of those fixed per-transaction fees.

- Customer Location: Are most of your customers domestic, or do you have a significant international base?

- Essential Features: What can't you live without? Think recurring billing, invoicing tools, or physical card readers for in-person sales.

With this information, you can start to model your costs realistically. For instance, a business with a low ATV but tons of transactions will get crushed by high per-transaction fees. Likewise, if you have a lot of international customers, cross-border fees should be a top concern. This data-first approach takes the guesswork out of the equation.

And if you're looking beyond traditional payments, our guide on how to accept crypto payments for your business explores some of the newer transaction models out there.

Key Insight: Don't let a sales rep dictate the conversation. Come prepared. When you can confidently state, "We process X transactions a month at an average of Y dollars," you force them to give you a concrete, relevant cost breakdown instead of a generic sales pitch.

This simple preparation completely changes the dynamic. You're no longer just being sold a product; you're actively searching for a partner whose fee structure aligns with your business's financial reality. That’s how you make a smart decision that actually supports your growth.

A Few Final Questions About Gateway Fees

Even after digging into a detailed comparison, you're bound to have some lingering questions. The world of payment processing is notoriously murky, and it's smart to iron out the details before you commit. Let's tackle some of the most common questions merchants ask so you can make your final choice with confidence.

Think of this as the last step in clearing the fog.

Are Flat-Rate Fees Always Cheaper?

Absolutely not. While a flat-rate plan like the common 2.9% + $0.30 is wonderfully predictable, that simplicity often comes at a premium. It’s a great starting point, but it's not always the most cost-effective solution in the long run.

For businesses that have hit their stride and are processing over $80,000 a month, an interchange-plus model is almost always cheaper. It’s more complex, for sure, but it passes the direct wholesale cost of each transaction to you, which can lead to major savings as your volume grows.

What Is the Biggest Hidden Cost to Watch For?

Chargeback fees, without a doubt. They are the silent killers of profit margins. It's not just the penalty fee the provider hits you with for every dispute—usually between $15 and $25. What's worse is you often have to pay that fee even when you win the case.

But the real danger goes beyond the immediate financial hit. A high chargeback rate puts your entire merchant account at risk. It can get your business flagged as high-risk, leading to frozen funds or, in the worst-case scenario, account termination. Always check out a provider’s dispute process before you sign anything.

Key Insight: A chargeback isn't just a fee; it's a direct threat to your ability to do business. The best way to fight them is with solid fraud prevention tools and crystal-clear communication with your customers.

Can I Negotiate Payment Gateway Fees?

Yes, but you need to bring some serious volume to the table. If your business is consistently pulling in $80,000 to $100,000 or more in monthly processing, you've got leverage. At that level, providers are much more willing to discuss lower rates or build a custom pricing plan to win and keep your business.

If you're a smaller business, negotiation is pretty much off the table. Your energy is better spent finding a provider whose standard fee structure already fits your business model and sales patterns like a glove.

How Do International Transaction Fees Work?

When you sell to a customer in another country, providers usually tack on a couple of extra charges. First is the cross-border fee, which is an additional percentage (typically 1% to 1.5%) tacked on just because the customer's card was issued outside your country.

On top of that, if the payment has to be converted into your home currency, you'll also get hit with a currency conversion fee. These two can stack up quickly and make international sales less profitable than you first thought. As payment tech changes, it's smart to look at all your options; this guide on crypto payments for business explores an alternative with a very different fee structure.

At BlockBee, we simplify your payment processing with a transparent, low-fee structure designed for growth. Start accepting cryptocurrency payments securely and efficiently. Explore our platform.