Unpacking On Ramps Meaning for Fiat and Crypto

In the world of crypto, an on-ramp is simply a service that lets you swap traditional money—like U.S. dollars or euros—for cryptocurrency. Think of it as the essential bridge connecting the everyday financial world you know with the decentralized economy of digital assets.

What Exactly Is a Crypto On-Ramp?

Imagine you're at an airport, about to travel to a new country. Before you can buy anything, you have to stop at the currency exchange booth to trade your home currency for the local one. A crypto on-ramp does the exact same thing, but for the digital world. It's the front door for anyone looking to get started.

Without this bridge, crypto would be like an exclusive club, only open to people who already have digital assets. The very meaning of an on-ramp is tied to making crypto accessible to everyone. It's the mechanism that finally lets mainstream users and businesses get involved using the payment methods they already trust.

How an On-Ramp Actually Works

At its core, an on-ramp is a service built to make moving from one type of money to another incredibly simple. It takes care of all the messy, complicated stuff happening behind the scenes. The whole process usually boils down to a few key steps:

- Processing Your Payment: First, it accepts your money through familiar channels like a credit card, debit card, bank transfer (ACH, SEPA), or even a digital wallet like Apple Pay.

- Verifying Your Identity: To keep things secure and legal, the service runs the required Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This is a standard step to prevent fraud and comply with financial rules.

- Converting the Currency: Next, it executes the trade, converting your fiat money into the cryptocurrency you want at the current market price.

- Delivering Your Crypto: Finally, it sends the newly purchased crypto straight to your personal digital wallet address.

This smooth flow removes the biggest headache for newcomers. Instead of trying to figure out a complex trading platform, you can buy crypto as easily as you'd order a pizza online. For a deeper dive, check out our guide on the differences between fiat currency vs cryptocurrency.

An on-ramp transforms the abstract idea of "buying crypto" into a tangible, straightforward transaction. It’s not just a technical tool; it's the fundamental infrastructure that makes widespread crypto adoption possible for merchants and consumers alike.

Essentially, on-ramps are the welcome mat for the digital economy. They take something that sounds complicated—like acquiring Bitcoin or Ethereum—and wrap it in a familiar online checkout experience. This powerful function is what allows businesses to reach a global audience and what fuels the entire ecosystem's growth.

How an On-Ramp Transaction Actually Works

To really get what an on-ramp is, you have to look past the definition and see what's happening under the hood during a real transaction. From the moment a customer clicks "buy" to the crypto landing in their wallet, there's a complex dance happening behind the scenes. It's built to feel effortless for the user, but it's actually a precision-engineered process.

It helps to think of it like ordering something from an overseas shop. You pay in your local currency, and a whole system of banks and processors handles the currency conversion before the item ever gets shipped to you. An on-ramp is the crypto version of that, swapping digital assets for physical goods.

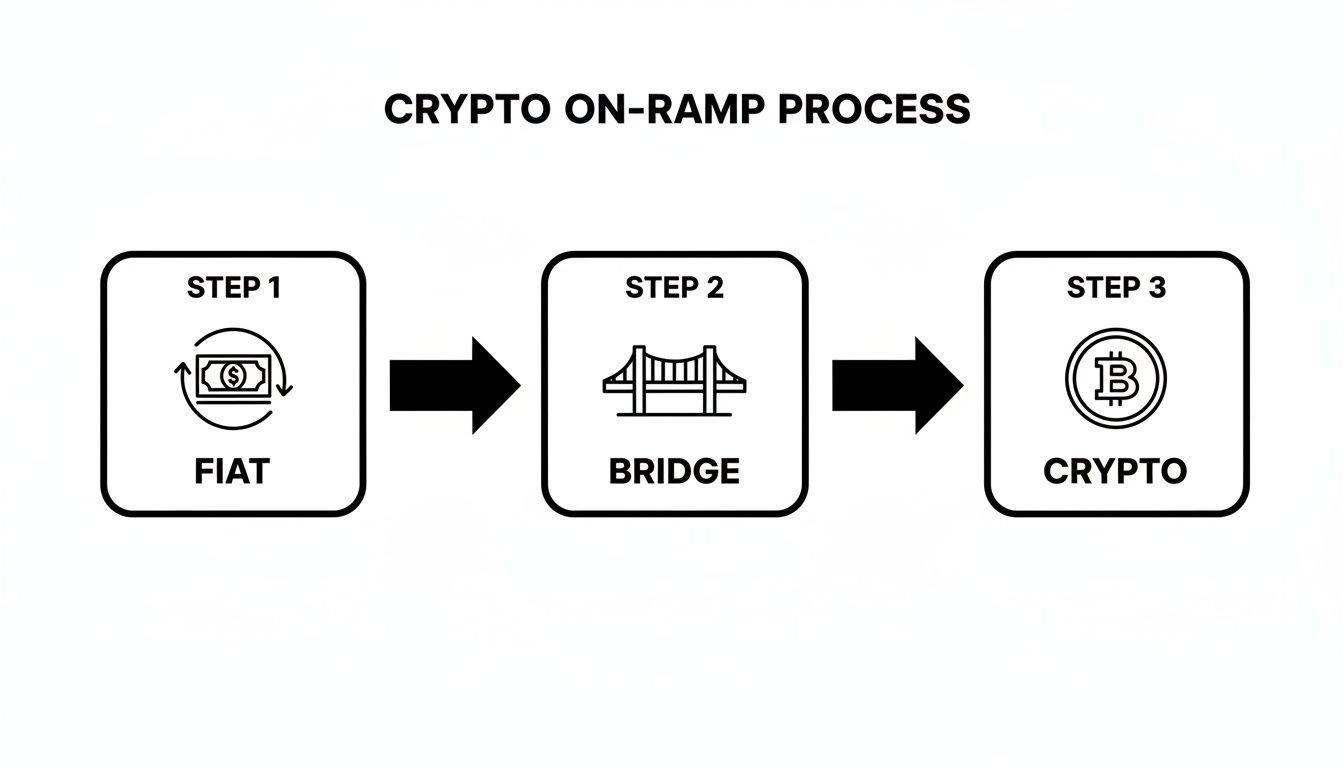

This diagram breaks down the basic journey, showing how traditional money gets converted into cryptocurrency.

As you can see, it boils down to three core stages: the user pays with familiar money, the on-ramp service acts as the bridge, and the crypto gets delivered to its final destination.

Step 1: Kicking Off the Purchase

It all starts on a merchant's checkout page, inside a crypto wallet app, or on a dApp. A user decides they need some crypto—maybe Bitcoin (BTC) to invest or a stablecoin like USDT to make a payment.

They’ll type in the amount they want to spend, say $100 USD. The on-ramp’s interface, which is often built right into the app or website, gives them a live quote showing exactly how much crypto they’ll get. This quote will lock in the exchange rate and spell out any fees.

Then, they just pick a payment method they already know and trust:

- Credit or Debit Card: The go-to choice for most people because it's fast and easy.

- Bank Transfer: Options like ACH in the U.S. or SEPA in Europe are great for moving larger sums of money.

- Digital Wallets: Paying with Apple Pay or Google Pay makes the whole thing a breeze, especially on mobile.

Step 2: Verification and Payment Processing

The moment the user clicks "confirm," the security and compliance gears start turning. For anyone using the service for the first time, this means a mandatory Know Your Customer (KYC) check. They'll likely be asked to upload a photo of their government ID and take a quick selfie to prove they are who they say they are. This isn't optional; it's how on-ramp providers stay compliant with global Anti-Money Laundering (AML) rules.

At the same time, the fiat payment is being processed just like any other online purchase. The on-ramp provider connects with traditional payment giants (think Stripe or Adyen) to get the funds authorized and captured from the user's card or bank account. Once the payment gets the green light, we're on to the final stage.

The true genius of an on-ramp is how it glues two completely different financial systems together. It navigates all the strict rules of traditional finance while seamlessly interacting with the permissionless world of blockchain, all within one smooth user experience.

Step 3: Buying and Delivering the Crypto

With the cash secured, the on-ramp provider goes to work. It instantly executes a trade on a major cryptocurrency exchange or through a liquidity partner to buy the exact amount of crypto the user requested at the current market price. This all happens in a flash.

The last step is the most important: delivery. The user provides their public crypto wallet address, which is just a unique string of letters and numbers that acts like a digital PO box. The on-ramp provider then broadcasts a transaction on the blockchain, sending the freshly purchased crypto straight to that address.

In just a few minutes, the crypto pops up in the user's wallet. It's now theirs to spend, use in dApps, or hold as an investment. The whole thing felt as simple as buying a t-shirt, but it was a coordinated effort between the merchant, the user, and the on-ramp provider to make it happen.

Why On-Ramps Are a Game-Changer for Your Business

Adding a crypto on-ramp is much more than just ticking a box for another payment method. It's a strategic move that can fundamentally change how your business grows by connecting you to a massive, and rapidly expanding, global market of digital currency users.

When you look past the technical jargon, you see the real power of an on-ramp: it's a tool for creating new customers, not just serving existing crypto enthusiasts. You’re removing the single biggest roadblock—the confusing and often intimidating process of buying crypto for the first time. Suddenly, anyone with a credit card or bank account can step into the digital economy, right from your website.

Tap into a Truly Global Customer Base

Think about the headaches of traditional cross-border payments: they're slow, riddled with hidden fees, and tangled up in currency conversions. An on-ramp cuts through a lot of that red tape. It opens the door to customers in places where standard payment options are spotty or just don't exist, instantly expanding your potential market.

Picture an online store selling digital art. A buyer in Southeast Asia can pay with their local currency, and the on-ramp instantly converts it to a stablecoin that lands in the artist's wallet. The whole process is faster and usually cheaper than waiting on an international wire transfer to clear.

By making it simple to get into crypto, on-ramps tear down the barrier to entry for a global audience. This turns casual interest into actual sales and can have a huge impact on your conversion rates.

This isn't just a small, niche benefit. The global crypto on-ramp market was valued at $3.6 billion and is on track to hit a staggering $18.4 billion by 2033, growing at an incredible 19.8% CAGR. What’s driving this? Mostly retail users—over 58% of the demand—who are new to the space. With an on-ramp, your business is perfectly positioned to welcome them. You can read more about the explosive growth of the on-ramp market to see the full picture.

Boost Conversions and Stop Losing Sales

Right now, the journey for a customer who wants to pay you with crypto is a mess. They have to leave your site, find an exchange, create an account, go through a lengthy verification process, buy the crypto, and then hurry back to your checkout page—all while hoping the price hasn't tanked. Every single one of those steps is a chance for them to give up and for you to lose a sale.

A good on-ramp squeezes that entire ordeal into a single, smooth flow right inside your checkout. That convenience is a powerful way to get more people to complete their purchase.

- No More Friction: Customers never have to leave your website or app to get the funds they need.

- Builds Trust: They're buying from you, in your branded environment, using familiar methods they already trust, like a Visa card or Apple Pay.

- Captures Impulse Buys: The ability to instantly buy and pay makes it easy for customers to act on the spot, preventing those "I'll do it later" moments that rarely happen.

By solving the crypto-buying problem right at the point of sale, you drastically cut down on abandoned carts and create a much better experience for your customers.

Add Flexibility and Signal Innovation

An on-ramp does more than just let you accept crypto; it sends a clear message that your business is modern and ready for the future. It gives you another payment channel that can offer some pretty unique advantages, especially for digital-first businesses.

Take a subscription-based software company, for example. It can use an on-ramp to accept payments from users all over the world, with all the funds settling as a stablecoin like USDC. This makes managing the company's money so much easier by bringing all that revenue into one stable digital asset, dodging the volatility of juggling dozens of different fiat currencies.

At the end of the day, an on-ramp isn't just a piece of tech. It’s a strategic asset that improves your user experience, opens up new markets, and future-proofs your entire payment system. It sets you up to succeed in an economy that's becoming more digital and decentralized every day.

How to Choose the Right On-Ramp Provider

Picking an on-ramp partner is one of the most critical decisions you'll make when you start accepting crypto. The right choice can make the whole process smooth, boosting sales and building trust with your customers. The wrong one? It can lead to abandoned carts, security nightmares, and a whole lot of frustration.

Frankly, the best on-ramps are the ones your customers barely notice. They just work.

To find the right fit, you need to cut through the marketing fluff and look at what really matters. Let’s break down the key areas to focus on so you can find a partner that genuinely aligns with your business.

H3: Start with the User Experience

Always begin by looking at the on-ramp through your customer’s eyes. A clunky, confusing interface is a surefire way to kill a sale. You want a process that feels like a seamless extension of your own checkout, not a jarring trip to some random third-party website.

Ask yourself these questions:

- Is it actually easy to use? The entire flow needs to be simple enough for a total crypto novice to follow without a guide.

- Does it work on a phone? So much shopping happens on mobile. The experience has to be perfect on a small screen.

- Is it fast? Slow loading times or a sluggish verification process will make people give up and go elsewhere.

A great user experience isn't just a nice-to-have; it directly leads to more completed sales. It gets rid of the friction that stops curious customers from making that final click.

H3: Dig Into Security and Compliance

When it comes to handling money and personal data, security is everything. There’s no room for compromise here. You need complete confidence that your on-ramp provider has ironclad security and is fully compliant with financial regulations.

This is where a provider’s commitment to Know Your Customer (KYC) and Anti-Money Laundering (AML) rules becomes essential. A reliable partner will manage all of this for you, tailored to the regions you serve. This shields your business from massive legal headaches and keeps you on the right side of the law.

A provider that takes compliance seriously isn't just ticking boxes. They're building a foundation of trust that protects your business and your customers from fraud and regulatory trouble.

Don't hesitate to ask potential providers for details about their specific licenses and security protocols.

H3: Get a Clear Picture of Fees and Rates

Hidden fees can instantly destroy a customer's trust. You absolutely must understand the entire fee structure. What looks cheap on the surface can often hide other costs that sour the experience for your users.

Make sure you get a clear breakdown of all the charges:

- Transaction Fees: The percentage or flat rate they take for each payment.

- Network Fees: The "gas fees" needed to get the transaction confirmed on the blockchain.

- Spread: The gap between the live market price of the crypto and the rate your customer is actually quoted.

The best providers are upfront about all these costs. They offer competitive, locked-in exchange rates so the customer knows exactly what they’re paying and what they’ll get. That kind of transparency is key to a good checkout experience. Choosing the right partner is like finding a specialized crypto payment processor for your business that handles all this complexity behind the scenes.

H3: Check the Tech Integration and Support

Finally, think about the practical side of things. How much work will it be to get this on-ramp running on your website or app? A service might look great, but if it takes a massive development effort to implement, it’s probably not the one for you.

Look for flexible integration options. Good providers offer well-documented APIs, pre-built SDKs, or simple plugins for popular platforms like Shopify or WooCommerce.

Solid technical support and clear documentation are also crucial—they can save your developers hours of headaches. The goal is to find a solution that’s easy to implement and even easier to maintain.

On-Ramp Provider Evaluation Checklist

To help you compare your options, here’s a quick checklist to guide your decision-making process. Think of it as a scorecard to evaluate potential partners against your specific needs.

| Evaluation Criteria | What to Look For | Why It Matters for Your Business |

|---|---|---|

| User Experience (UX) | Intuitive flow, mobile-first design, fast loading times, and minimal steps. | A smooth UX reduces cart abandonment and increases conversion rates. |

| Security & Compliance | Robust KYC/AML procedures, relevant financial licenses, and transparent security protocols (e.g., PCI DSS, SOC 2). | Protects your business from fraud and regulatory penalties, building trust with customers. |

| Fees & Exchange Rates | Clear, transparent fee structure with competitive, locked-in exchange rates. No hidden costs. | Transparent pricing builds customer trust and prevents negative surprises at checkout. |

| Supported Currencies | A wide range of both fiat currencies (USD, EUR) and cryptocurrencies (BTC, ETH, stablecoins) that your customers use. | Ensures you can serve a global customer base and meet their payment preferences. |

| Integration & Support | Well-documented APIs, SDKs, or no-code plugins. Responsive and knowledgeable technical support. | Reduces development time and costs, ensuring a smooth implementation and ongoing maintenance. |

| Transaction Limits & Speed | Reasonable daily/monthly limits for users and fast settlement times for transactions. | Accommodates both small and large purchases while ensuring a quick and efficient payment confirmation. |

| Reputation & Reliability | Positive industry reviews, a history of stable service (uptime), and a strong track record. | A reputable provider is less likely to have service disruptions that could impact your sales and brand. |

Using a structured approach like this will help ensure the on-ramp provider you choose is a true partner—one that supports your growth and makes the entire crypto payment process a breeze for everyone involved.

Real-World Examples of On-Ramps in Action

It’s one thing to understand the mechanics of an on-ramp, but it's another to see it solving real-world problems for actual businesses. The true meaning of an on-ramp comes to life when it turns a clunky, multi-step process into a smooth, valuable interaction.

So, let's step away from the theory and look at a few concrete examples where on-ramps are making a real difference in how companies operate, grow revenue, and keep their users happy.

E-commerce Checkouts Made Simple

Picture an online store that sells exclusive digital art to a global audience. Before, if a customer wanted to pay with crypto, they had a frustrating journey ahead. They’d have to leave the website, go to an exchange, buy the exact amount of crypto needed, and then, hopefully, come back to finish the purchase. It’s a leaky funnel that screams "abandoned cart."

Now, imagine that same store with an on-ramp built right into its checkout. A customer from France adds a $200 print to their cart and clicks "Pay with Crypto." The magic is they don't need to own any crypto beforehand.

- A simple on-ramp widget pops up, showing them the precise amount of USDC required.

- They enter their credit card details just like any other online purchase and complete a quick, one-time identity check.

- Behind the scenes, the on-ramp takes their Euros, converts them to USDC, and settles the transaction on the blockchain.

The whole thing happens in minutes, all on one page. The result? A sale that would have been lost. It’s a perfect example of how an on-ramp can directly boost conversions by making crypto payments as easy as using a credit card.

Smarter Subscription Payments for SaaS

Think about a global Software-as-a-Service (SaaS) company with users in dozens of countries. Trying to manage subscription payments in countless different fiat currencies is a nightmare. It means juggling exchange rate volatility and endless conversion fees, which can seriously complicate accounting.

By integrating an on-ramp, the platform streamlines everything. A subscriber in Brazil pays in Brazilian Reais (BRL), while another in Japan pays in Japanese Yen (JPY). The on-ramp seamlessly converts both payments into a stablecoin like USDT.

An on-ramp empowers businesses to accept local payments globally while settling funds in a single, stable digital asset. This drastically simplifies treasury management and reduces cross-border financial friction.

Suddenly, the company’s finance team is managing one unified stream of stablecoin revenue instead of a tangled mess of international currencies. This cuts down on operational costs and gives them a much clearer, more stable view of their monthly recurring revenue (MRR).

Expanding FinTech App Features

A popular fintech app wants to let its users buy crypto. It's a great way to boost engagement and open up a new revenue stream. But building a full-blown, regulated crypto exchange from the ground up is a massive undertaking. Instead, they integrate a third-party on-ramp solution.

Now, their users can buy Bitcoin and Ethereum directly inside the app using their linked bank accounts. This strategy doesn't just add a popular feature; it keeps users inside their ecosystem, making the app stickier and encouraging daily use. This model is booming, particularly in high-growth markets.

For example, the APAC region saw a massive 69% year-over-year jump in on-chain value, growing from $1.4 trillion to $2.36 trillion, a surge heavily fueled by the adoption of fiat on-ramps. With USD on-ramps alone hitting $2.4 trillion globally and Bitcoin accounting for 41% of US purchases, the opportunity for smart businesses is undeniable. You can dive deeper into these numbers in the 2025 Global Crypto Adoption Index.

Common Questions About Crypto On-Ramps

As crypto on-ramps move from niche tech circles into everyday business strategy, a few key questions always pop up. Whether you're a merchant, developer, or just trying to get a handle on things, getting straight answers is the first step.

Think of this as your quick-start guide to the most common questions we hear. Let's cut through the jargon and get right to what you need to know.

On-Ramp vs. Crypto Exchange: What's the Difference?

One of the biggest points of confusion is telling an on-ramp apart from a big cryptocurrency exchange like Coinbase or Binance. They both help people get crypto, but they’re built for completely different jobs and offer wildly different experiences.

An on-ramp is a specialized tool laser-focused on one thing: getting fiat currency converted into crypto as painlessly as possible. It's usually built right into a merchant's checkout, a dApp, or a crypto wallet. The whole point is to support a specific action, like buying just enough crypto to complete a purchase without ever leaving the page.

A crypto exchange, on the other hand, is a full-blown trading floor. It's a destination where users go to trade hundreds of different assets, stare at market charts, place complex orders, and manage a whole portfolio. It’s built for active traders and investors, not for someone who just needs to make a quick payment.

Here’s a simple way to think about it:

- On-Ramp: It’s like a currency exchange booth at the airport—a direct bridge for one specific transaction.

- Crypto Exchange: It’s like the entire stock market—a complex marketplace for trading.

For any business, plugging in an on-ramp means giving customers a smooth, in-context way to pay. That's a world away from telling them to leave your site, sign up for a trading platform, and come back later.

Who Handles KYC and AML Compliance?

This is a make-or-break question for any business looking at on-ramps. The regulatory side of crypto is complicated and always shifting. The short answer? The on-ramp provider is responsible for handling all Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

This is a massive benefit for you. Instead of trying to build and manage a costly, complicated compliance department yourself, you're essentially outsourcing that entire headache to a specialist. The on-ramp provider handles all the identity checks for new users, making sure every transaction is compliant with the rules in their operating regions.

By partnering with a compliant on-ramp provider, your business is shielded from the direct operational burden of KYC and AML. The provider manages the entire verification process, from document collection to fraud monitoring, allowing you to focus on your core business.

Choosing a partner with rock-solid compliance isn't just a good idea—it's non-negotiable for protecting your business and your customers. To get a better grasp of what's involved, you can dive into our detailed guide on the role of KYC in the crypto space.

What Are the Main Integration Methods?

Getting an on-ramp working on your platform doesn’t have to be a huge technical lift. Good providers offer several options to match your team's skills and business needs.

Here are the most common ways to get it done:

- API Integration: This gives you the most control and flexibility. By using the provider’s API (Application Programming Interface), your developers can build a completely custom, white-label on-ramp experience that fits your brand perfectly.

- SDKs (Software Development Kits): SDKs for web, iOS, and Android come with pre-built components that seriously cut down on development time. They take care of a lot of the frontend work, making the whole process faster and easier.

- No-Code Widgets or Plugins: This is the fastest route. For businesses on popular platforms like WooCommerce or Shopify, many on-ramp providers offer simple plugins or embeddable widgets. You can often get up and running with just a few clicks.

The best choice really hinges on what you’re trying to achieve—total customization, speed to market, or just the simplest setup possible.

What Is a Crypto Off-Ramp?

To understand the full picture, you also need to know about the on-ramp's counterpart: the off-ramp. If an on-ramp is the way into the crypto economy, an off-ramp is the way out.

An off-ramp is a service that lets users convert their cryptocurrency back into traditional fiat currency (like dollars or euros) and send it to their bank account. It closes the loop, giving people a way to cash out their gains, pay bills, or just move value back into the traditional financial system.

For example, a freelancer paid in crypto would use an off-ramp to turn their earnings into dollars to pay the rent. It’s a vital piece of the puzzle that makes crypto more practical for real-world finance. This infrastructure is becoming more robust as policy catches up—over 70% of jurisdictions are now moving forward with stablecoin regulations, which builds trust in these conversion services. This trend is also driven by user needs; a recent report found that 39% of US crypto holders now buy digital assets to hedge against inflation, highlighting the demand for easy on-and-off conversion. You can discover more insights about the current state of crypto adoption on gemini.com.

Ready to simplify your crypto transactions? With BlockBee, you can accept payments in over 70 cryptocurrencies with lightning-fast confirmations and instant payouts directly to your wallet. Our non-custodial platform gives you full control over your funds, while our easy-to-use APIs and e-commerce plugins make integration a breeze. Join thousands of merchants who trust BlockBee to power their digital payments. Get started with BlockBee today!