Fiat Currency vs Cryptocurrency: Key Differences Explained

At the heart of the matter, the real difference between fiat currency and cryptocurrency comes down to control and value. Fiat money, like the U.S. dollar, is the stuff we've used for decades. It's issued by a government, controlled by a central bank, and its value is essentially pinned to our collective trust in that authority. Cryptocurrency, however, is a different beast entirely. It's a decentralized digital asset, secured by complex math (cryptography), with its value driven purely by market forces and the consensus of its network.

Defining Today's Two Dominant Forms of Money

To really get into the fiat vs. cryptocurrency debate, you have to understand where each comes from. They aren't just different types of money; they represent fundamentally different philosophies about how money should work—how it's made, managed, and valued in our economy.

What Is Fiat Currency?

Fiat currency is simply money that a government declares to be legal tender. It isn't backed by a physical commodity like gold or silver. Its value comes directly from the trust and confidence people have in the government that issues it. When you pay taxes or settle a debt, you use fiat money.

This money takes two main forms in our daily lives:

- Physical: The coins and banknotes you carry in your wallet.

- Digital: The balances you see in your bank account, which you access with debit cards or online transfers.

Central banks, like the U.S. Federal Reserve, are the gatekeepers. They can print more money, set interest rates, and manage monetary policy, which directly impacts things like inflation. This centralized system offers a degree of stability, but it also means the currency's fate is tied to political and economic decisions. If you're curious about how we got here, our guide on the differences between fiat vs commodity money digs into the history.

What Is Cryptocurrency?

Cryptocurrency is a digital-only form of money that uses cryptography to secure transactions. Unlike fiat, it's completely decentralized and runs on a technology called blockchain—a shared, unchangeable ledger that's maintained by a global network of computers.

This decentralized structure is the key differentiator. No single entity—no bank, no government—is in charge. Transactions happen directly between users (peer-to-peer), get verified by the network, and are permanently recorded. It’s a system built to operate without needing to trust a middleman.

To kick things off, here’s a quick breakdown of how these two systems stack up on the fundamentals. Think of this as the high-level summary before we dive deeper into the nitty-gritty.

Fiat vs Cryptocurrency Core Differences

| Characteristic | Fiat Currency | Cryptocurrency |

|---|---|---|

| Issuer | Central Government/Bank | Decentralized Network |

| Control | Centralized Authority | Decentralized (No Single Entity) |

| Form | Physical and Digital | Exclusively Digital |

| Underlying Value | Trust in Government | Market Demand & Cryptography |

| Transaction Method | Through Financial Intermediaries | Peer-to-Peer (P2P) |

As you can see, the core principles are worlds apart. One relies on a top-down, trust-based system, while the other is built from the ground up on verifiable, trustless technology. Now, let's explore what these differences mean in the real world.

Stability and Long-Term Value: A Tale of Two Worlds

When you're trying to figure out where to put your money, whether for business or personal savings, stability is usually at the top of the list. You want something predictable. This is perhaps the biggest and most obvious dividing line between traditional fiat currency and the world of crypto.

Fiat currencies, like the U.S. dollar or the Euro, are built on a foundation of relative stability. They’re backed by governments and managed by central banks that use tools like interest rate adjustments to keep inflation in check and the economy on a predictable path. Of course, the system isn't perfect. For anyone dealing with international markets, managing foreign exchange risk is a constant challenge, but it's a known variable compared to the wild swings seen in crypto.

The Predictability of Fiat Money

Generally speaking, fiat money is far more stable day-to-day. While it's true that some currencies can face serious devaluation—the Zimbabwean dollar, for example, lost nearly 76% of its value in 2022—this is an extreme case. Most major currencies don't see that kind of shift in a decade, let alone a single year.

Cryptocurrencies like Bitcoin and Ethereum, on the other hand, are famous for their volatility. Their prices can surge or plummet dramatically in a matter of hours, driven by market sentiment, news, or pure speculation.

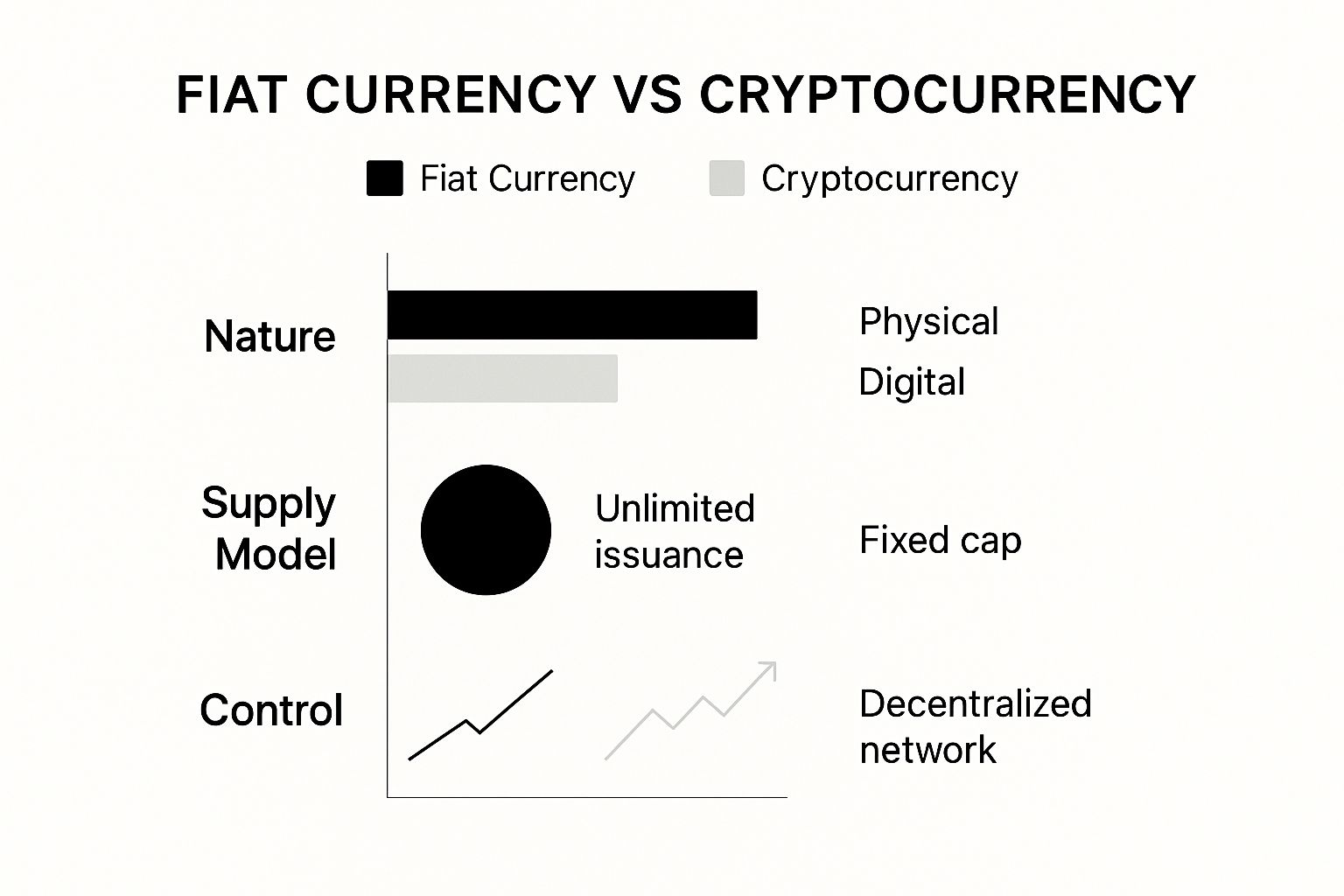

This image really drives home the core differences that fuel this stability gap, from how they're supplied to who's in control.

You can see the contrast right away: fiat's centralized control and unlimited supply versus crypto's decentralized nature and often-fixed supply. These fundamental designs explain why one is steady and the other is not.

Volatility in the Crypto Market

Most cryptocurrencies operate in a high-stakes environment where price volatility is the norm. A potent mix of investor speculation, regulatory news, and tech breakthroughs can send prices soaring or crashing without warning. This can create incredible opportunities for traders, but it poses a huge risk for everyday business.

Imagine a small business accepts Bitcoin for a major project. By the time they go to convert that payment into dollars to pay their suppliers, its value could have dropped by 10%. That kind of unpredictability is a serious roadblock for mainstream adoption.

Fiat currency is designed to be a stable way to store value and exchange goods. In contrast, many cryptocurrencies behave more like high-risk, speculative assets where the potential for big returns is tied directly to that stomach-churning volatility.

Stablecoins: The Bridge Between Worlds

To tackle this volatility problem head-on, a new type of crypto was created: stablecoins. The idea is simple but powerful. These are digital currencies designed to hold a steady value because they are pegged to a real-world asset, usually a major fiat currency like the U.S. dollar.

This creates a fascinating hybrid. You get the benefits of crypto technology—fast, cheap, global transactions—but with the price stability of old-school money. Stablecoins are essentially a bridge, letting people and businesses tap into the decentralized financial system without getting exposed to its wild price swings. To see how they're already making an impact, you can read more about https://blockbee.io/blog/post/the-role-of-stablecoins-in-cross-border-payments.

Centralized vs. Decentralized: Who's in Control?

When you get right down to it, the biggest divide between fiat currency and cryptocurrency comes down to a single idea: control. They are built on completely opposite philosophies of governance, which in turn shapes everything from how money is created to how transactions get approved. This structural difference is the most important one to grasp.

Fiat currency is a centralized, top-down system. Governments and their central banks—like the Federal Reserve in the U.S.—are in the driver's seat. They alone have the power to print new money, set interest rates, and steer monetary policy.

The whole system runs on trust. We trust our banks to keep our money safe, and we trust the government to manage the economy in a way that preserves the currency's value. Every time you swipe your card or send a wire transfer, a whole chain of intermediaries like banks and payment processors has to sign off on it.

A Radically Different Approach

Cryptocurrency turns that entire model upside down. It’s built on a decentralized foundation using distributed ledger technology, usually a blockchain. Instead of one central authority calling the shots, a worldwide network of computers works together to maintain and validate a shared record of every transaction.

This creates what’s known as a "trustless" environment. You don't have to rely on a bank or a government; the network's code and the consensus of its participants enforce the rules. It's a fundamental shift, moving power away from large institutions and putting it directly into the hands of users. You have total control over your assets and don't need anyone's permission to send or receive them.

In a centralized system, trust is placed in institutions and their promises. In a decentralized system, trust is placed in mathematics and open-source code, which can be verified by anyone. This change in trust fundamentally alters the power dynamics of finance.

How Transactions Get the Green Light

You can really see this difference in action when you look at how transactions are validated. Each system has a completely distinct method for making sure payments are legitimate and preventing fraud.

Fiat Currency Transactions

- Central Authority: When you pay for something, your bank checks your account to make sure you have the funds, then communicates with the seller's bank.

- Intermediaries: Companies like Visa or payment networks like SWIFT are the middlemen that help clear and settle the payment.

- Reversibility: A key feature here is that transactions can often be reversed by these authorities if there's a dispute, fraud, or an error.

Cryptocurrency Transactions

- Consensus Mechanisms: The network agrees on which transactions are valid through automated processes, most commonly Proof-of-Work (PoW) or Proof-of-Stake (PoS).

- Peer-to-Peer: Money is sent directly from one person's digital wallet to another. There’s no bank in the middle.

- Immutability: Once a transaction is confirmed and added to the blockchain, it’s there for good. It cannot be changed or reversed.

This immutable, peer-to-peer model is what makes crypto payments so efficient. By cutting out the layers of middlemen that slow things down and add fees in traditional finance, it creates a much more direct way to move value from point A to point B.

How Fiat and Crypto Are Used in the Real World

It’s one thing to talk about fiat and crypto in theory, but where do they actually fit into our lives? They’ve both settled into very different roles, and which one you use really comes down to what you’re trying to do.

Fiat currency is still the king of day-to-day life. It’s what you use to buy a coffee, pay your rent, or get groceries. Its stability and the fact that everyone accepts it make it the backbone of our local economies. Businesses depend on this predictability to handle things like payroll, ensuring their employees get paid exactly what they’re owed without any surprises.

When it comes to global business, fiat currencies rely on established, if sometimes clunky, systems like SWIFT. It might not be the fastest or cheapest way to move money, but it's the deeply embedded, regulated framework that facilitates massive international trade deals.

Where Cryptocurrency Comes Into Play

Cryptocurrency really starts to shine where traditional finance hits a wall. Think about sending money across borders. A crypto transaction can settle in minutes, not days, and the fees are often a fraction of what you’d pay through a bank.

This makes it a game-changer for remittances. A worker abroad can send crypto back to their family almost instantly. The family gets the funds quickly and doesn't lose a big chunk to fees from intermediary banks along the way.

In countries struggling with hyperinflation or economic turmoil, crypto often becomes a financial lifeline. It gives people a way to shield their savings from being wiped out when their local currency is collapsing.

You can actually see this in action by looking at Bitcoin trading data. Research on peer-to-peer exchanges found that over 70% of Bitcoin trading volume involves at least one person in the home country of the fiat currency being traded. This strongly suggests that people in nations with weak currencies or shaky banking systems are turning to Bitcoin as a necessary alternative. You can read more about how crypto adoption is linked to economic conditions in this detailed report.

Choosing the Right Tool for the Job

So, when it comes to fiat vs. crypto, it’s not about which one is better overall. It’s about picking the right one for the task at hand.

When to Stick with Fiat Currency:

- Daily Spending: For all your routine purchases, fiat is the obvious choice due to its universal acceptance and stable value.

- Standard Business Operations: Essential for things like payroll, rent, and paying suppliers where you can't afford price volatility.

- Safe, Short-Term Savings: An insured bank account is a secure, if low-growth, place to keep your money.

When to Consider Cryptocurrency:

- Quick International Payments: Nothing beats it for sending money across borders fast and cheap.

- Protecting Wealth from Devaluation: A smart hedge if you're in a country with an unstable national currency.

- Engaging with DeFi: It's your only ticket to the world of Decentralized Finance, where you can find new ways to lend, borrow, and earn yield.

At the end of the day, fiat provides the stable foundation our economy runs on. Crypto, on the other hand, offers a flexible, borderless alternative that fills the gaps where speed and self-sovereignty matter most.

Understanding Risks and Regulatory Hurdles

When we talk about fiat versus crypto, we're really talking about two completely different worlds of risk. Neither one is inherently "safe"—they just have different vulnerabilities you need to watch out for. Understanding this difference is key to navigating both systems, whether you're an individual or a business.

With fiat currencies, the risks are tied to old-school institutions. You're putting your trust in governments and central banks. On the plus side, this means you get established legal protections. Think of deposit insurance, like the FDIC in the United States, which backs your bank deposits up to a certain amount if the bank goes under. This creates a baseline of security that we often take for granted.

But that government backing is also fiat's biggest weakness. Its value is only as good as the economic stability and political decisions of the country issuing it. This leaves it vulnerable to inflation, which slowly eats away at your money's buying power, and sudden devaluation if monetary policy goes sideways. For any business operating internationally, solid foreign exchange risk management strategies aren't just a good idea; they're essential for survival.

Navigating the Unpredictable Crypto Landscape

Cryptocurrency, on the other hand, lives in a much wilder environment. It's a space defined by cutting-edge tech but also a serious lack of regulatory clarity. The number one risk everyone knows about is the insane market volatility. Unlike fiat, where central banks actively try to keep things stable, crypto prices are at the mercy of pure supply and demand, often fueled by market hype. This can lead to the kind of dramatic price swings that make headlines.

Then there's cybersecurity. The blockchain technology itself is incredibly secure, but that's not where most people run into trouble. The real weak points are the exchanges and digital wallets where you buy, sell, and store your crypto. These platforms are prime targets for hackers, and if an exchange gets compromised, your assets can vanish in an instant with very little chance of getting them back.

The core trade-off is clear: Fiat offers regulatory protection at the cost of centralized control and inflation risk. Cryptocurrency provides user autonomy but exposes individuals to market volatility and an evolving, often confusing, regulatory maze.

This regulatory maze is a real headache. The rules are a messy patchwork that varies wildly from one country to the next. Some nations are rolling out the red carpet for digital assets, while others are trying to ban them outright. For instance, Bitcoin's 24/7, borderless trading nature once led to massive price spikes on Chinese exchanges. This prompted Chinese authorities to clamp down hard back in 2013, while countries like the U.S. and Germany took a more wait-and-see approach.

As regulators slowly get their act together, compliance is becoming the new norm. Most reputable exchanges now require you to verify your identity to prevent money laundering and other illicit activities. This means understanding what KYC is in crypto is no longer optional—it’s a fundamental part of getting started. This growing overlap between decentralized tech and traditional financial rules is what defines the risk landscape for both systems today.

So, Which Financial System is Right for You?

Let's be clear: this isn't about picking a winner in some epic battle between old and new money. It's about knowing what you're trying to accomplish and picking the right tool for that specific job. For most people and businesses, the smartest approach isn't an "either/or" choice but a "both/and" strategy, using each system for what it does best.

For the vast majority of us, fiat currency is still the bedrock of our financial lives. You can't really escape it. Its stability and the fact that everyone accepts it make it the only realistic option for day-to-day expenses, building predictable savings, and running the core functions of a business, like payroll or paying suppliers. If your main goal is to protect what you have and make sure your money holds its value for near-term needs, you simply can't do that without fiat.

On the other hand, cryptocurrency opens up a completely different set of possibilities. It really comes into its own for people who have a higher tolerance for risk and are looking for significant growth through investment. Think of it as a way to diversify a portfolio, adding an asset that doesn't always move in lockstep with the traditional stock market.

At its heart, the decision boils down to a classic trade-off: stability versus growth potential. Fiat gives you predictability and the safety net of government regulation. Cryptocurrency offers a shot at financial independence and high returns, but you have to accept the wild price swings and complexity that come with it.

When to Use Fiat vs. Crypto

To put it into practice, think about what you're trying to do.

For everyday life and standard business operations: Stick with fiat. Its reliability is non-negotiable for paying your bills, getting your salary, and managing cash flow without worrying that your money will be worth 20% less tomorrow.

For long-term growth and portfolio diversification: This is where crypto can play a role. Dedicating a small, calculated portion of your investment portfolio to digital assets could provide some serious growth potential, as long as you're fully aware of the risks and prepared to lose what you put in.

For financial control and fast, global payments: If you value having direct control over your assets without a bank in the middle, or if you need to send money across borders quickly and without hefty fees, crypto has a clear edge over the slower, more expensive traditional banking system.

Ultimately, the whole "fiat vs. crypto" conversation isn't about one replacing the other. It’s about understanding their unique strengths and figuring out how they can fit into your own financial picture.

Got Questions? We’ve Got Answers

Digging into the fiat vs. cryptocurrency debate always brings up some important questions. Let's tackle a couple of the most common ones to clear things up.

Which Is Safer: Fiat or Crypto?

That’s a great question, but the answer really depends on what you mean by "safe." They're secured in fundamentally different ways.

Fiat currency gets its security from institutions. Think of government regulations and central banks. In the U.S., the FDIC insures your bank deposits up to $250,000, which is a powerful safety net if your bank goes under. This system protects you from institutional collapse, but it doesn't shield you from things like inflation slowly eating away at your money's value.

Cryptocurrency, on the other hand, relies on technology for its security. Powerful cryptography and the unchangeable nature of the blockchain make transactions themselves incredibly secure and tamper-proof. The real risk here is personal responsibility. If you lose your private keys or get tricked by a phishing scam, your funds are likely gone for good—there’s no bank to call for help.

The bottom line is this: Fiat security is built on trusting institutions, while crypto security is built on technology and your own diligence. Each one has its own unique set of threats you need to guard against.

Will Crypto Ever Actually Replace Fiat Money?

It’s fun to think about, but a complete replacement is probably not on the horizon. Fiat money is just too deeply woven into the fabric of our global economy, from how we pay taxes to how governments operate. That kind of stability, even with its flaws, is crucial for day-to-day life.

What’s far more likely is a future where the two systems work side-by-side, each playing to its strengths. Fiat will probably stick around for your everyday coffee run and as a stable way to save, while crypto continues to find its footing in other areas.

We’re already seeing this happen with:

- International payments: Crypto can move money across borders much faster and cheaper than traditional banking.

- DeFi (Decentralized Finance): It's building a whole new world of financial tools that don't rely on old-school banks.

- Digital investments: People are increasingly using it as a speculative asset or a way to hedge against the devaluation of their local currency.

Think of them as complementary tools in the financial toolbox, not rivals in a fight to the death.

Ready to bring crypto payments to your business? BlockBee offers a secure, non-custodial gateway so you can start accepting over 70 different cryptocurrencies with lightning-fast confirmations. Our tools are built for easy integration, giving you total control over your digital assets. Get started with BlockBee today!