Fiat vs Commodity Money Which System Is Better

The fundamental divide between fiat and commodity money boils down to a single question: where does its value come from? Commodity money has intrinsic value because it's made from a physical good, like gold. Fiat money’s value, on the other hand, is entirely based on government decree and the public’s trust in that government. The financial system you prefer ultimately depends on whether you value tangible, inherent worth over flexible, government-controlled economic policy.

What Is the Difference Between Fiat and Commodity Money

Grasping the core differences between these two monetary systems is crucial for understanding how modern economies function. Each is built on a completely different concept of value, which in turn affects everything from government policy to the risk of inflation.

The Foundation of Value

Commodity money's worth is straightforward because it’s made of something useful. Think of gold and silver coins—historically, they weren't just valuable for trade but also for their use in jewelry and other practical applications. With commodity money, the currency is the asset.

Fiat money, such as the U.S. dollar or the Euro, is the complete opposite. In its physical form, it’s basically worthless. A $100 bill only costs a few cents to print; its real purchasing power comes from the collective faith and credit of the government that backs it.

This is the key takeaway: commodity money is linked to a finite, physical resource, while a central authority can create or destroy fiat money whenever it deems necessary.

This very ability to manage the money supply is the main reason most modern economies have adopted fiat systems. It gives central banks a powerful tool to respond to economic recessions or spur growth. Of course, this flexibility introduces the risk of devaluation if the government prints too much money or if public trust falters.

A Quick Comparison

To really see the practical differences in the fiat vs. commodity money debate, it helps to look at their core traits side-by-side. One offers tangible security, while the other provides economic adaptability—a trade-off that has shaped monetary policy for hundreds of years.

| Feature | Commodity Money | Fiat Money |

|---|---|---|

| Source of Value | The physical material itself (e.g., gold, silver) | Government decree and public trust |

| Supply Control | Limited by natural scarcity and mining efforts | Controlled by a central bank or government |

| Inflation Risk | Generally lower and more stable | Higher, subject to monetary policy decisions |

| Economic Flexibility | Low; cannot be easily expanded or contracted | High; can be adjusted to manage the economy |

The journey from one system to the other is a huge part of financial history, and today's digital payment solutions are just the next step in that evolution. As you can see when learning more about BlockBee, financial innovations are constantly pushing us to rethink what truly gives a currency its worth.

A Head-to-Head Comparison of Monetary Systems

To really get to the heart of the "fiat vs commodity money" debate, we need to look past the basic definitions and see how these systems actually work under real-world pressure. Their core differences in what gives them value, how stable they are, and who's in control lead to dramatically different economic realities. Putting them side-by-side shows the fundamental trade-offs societies and governments accept when they pick a monetary system.

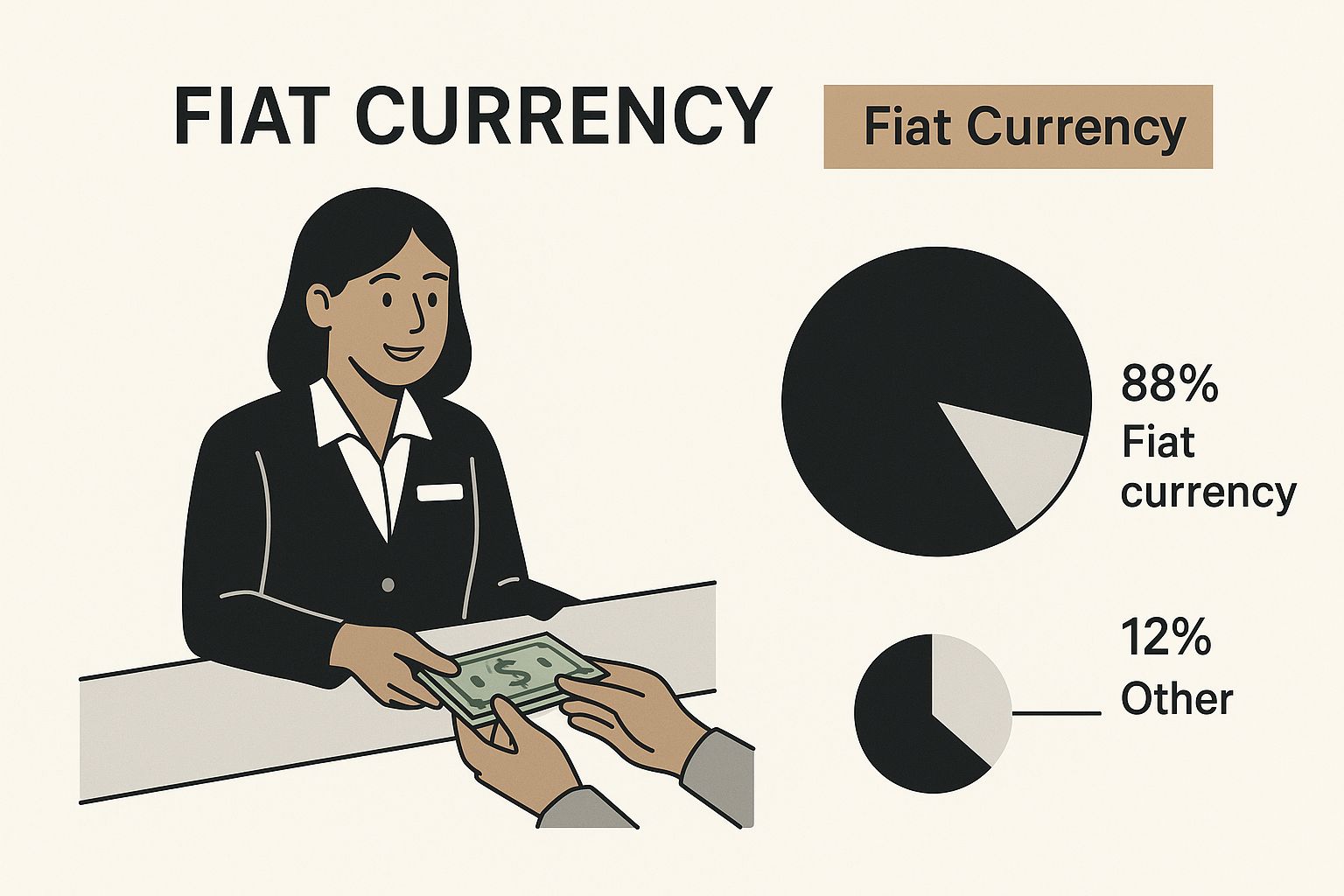

The image below shows the difference visually, highlighting how fiat money has become the default for our day-to-day transactions.

This really captures the essence of a fiat system: paper currency, backed by little more than a government's promise, is what keeps the economy moving every day.

The Source of Value

The biggest difference comes down to where the money gets its worth. Commodity money has intrinsic value. This means the material it's made from—gold, silver, or even salt back in ancient times—is valuable all by itself. Its worth is physical, tangible, and widely understood.

On the other hand, fiat money's value is extrinsic. A U.S. dollar bill or a Euro note is, at its core, just a special piece of paper or a number on a screen. Its purchasing power is born from government decree and our collective faith that it will be accepted for goods and services. The whole system hinges on trust in the institution that issues it.

Inflation Risk and Stability

Because commodity money is anchored to a physical asset with a finite supply, it naturally tends to be more stable and less susceptible to wild inflation. You can't just create more gold out of thin air, and that scarcity keeps the currency's value grounded.

Fiat systems, however, are much more vulnerable to inflation. A central bank can crank up the money supply whenever it wants, whether to jump-start a sluggish economy or finance government projects. While this flexibility can be a powerful tool, it comes with a major risk: print too much money, and you devalue the currency, wiping out people's savings in the process.

Key Differentiator: The core trade-off is between the tangible stability of commodity money and the economic flexibility of fiat money. One preserves value through scarcity, while the other enables active economic management at the risk of inflation.

Government Control and Flexibility

The degree of government control is another sharp dividing line.

- Commodity Systems: Governments have very little direct control over the money supply. How much money exists is determined by how much of the resource is available and how much it costs to get it, like mining gold. This ties a government's hands when trying to respond to an economic crisis.

- Fiat Systems: Central banks are in the driver's seat. They can manipulate interest rates and print money to manage everything from unemployment and recessions to funding massive public works.

To get a clearer picture of these distinctions, here’s a quick breakdown of their key attributes.

Fiat vs Commodity Money Key Differences at a Glance

| Attribute | Commodity Money | Fiat Money |

|---|---|---|

| Source of Value | Intrinsic value from the physical material (e.g., gold, silver) | Extrinsic value from government decree and public trust |

| Supply | Limited by natural availability and extraction costs | Unlimited; controlled by a central bank or government |

| Stability | Generally more stable, less prone to high inflation | Susceptible to inflation due to money supply changes |

| Government Control | Minimal; government cannot easily alter the supply | Maximum; central banks have full control over the supply |

| Flexibility | Inflexible; difficult to adjust in economic downturns | Highly flexible; can be used to manage economic conditions |

| Modern Usage | Mostly historical; used as a store of value (e.g., gold reserves) | The dominant form of money used by nearly all countries today |

This table neatly summarizes the fundamental trade-off. As detailed in NASDAQ's financial analysis, the choice between systems boils down to a preference for either inherent stability or economic adaptability.

This adaptability is precisely why almost every country on Earth now operates on a fiat system. It offers the tools needed to manage the complex, interconnected global economy we live in—even if it means staying constantly on guard to maintain public confidence and keep inflation in check.

The Historical Shift from Commodities to Fiat

To really get a grip on today’s economy, we have to look back at how money itself has changed. For thousands of years, societies ran on commodity money. This simply means that objects with their own built-in value were used for trade. Think of things like salt, cattle, or even seashells—items that were useful, durable, and widely accepted.

Over time, this system naturally gravitated toward precious metals. Gold and silver became the go-to commodities for money because they were scarce, didn't rust away, and were easy to carry around. The value of a gold coin wasn't based on a royal decree; it was based on the actual gold in your hand.

The Rise and Fall of the Gold Standard

As economies got bigger and more complicated, lugging around sacks of gold became a real problem. This practical challenge gave rise to representative money. These were paper notes, but they were essentially just IOUs—a promise that you could swap them for a specific amount of gold or silver sitting in a vault. This was the core idea behind the Gold Standard, a system that tied a country's currency directly to its gold reserves.

With the Gold Standard in place, governments couldn't just fire up the printing presses whenever they needed cash. The amount of money in circulation was limited by the actual, physical gold a nation owned. This was great for keeping inflation in check, but it also tied the government's hands. Their ability to manage a financial crisis was severely limited. To get the full picture, it's worth exploring the broader evolution of money and its different stages.

The core conflict of the Gold Standard was its rigidity. While it offered stability by preventing governments from devaluing their currency at will, it also made it nearly impossible to stimulate a struggling economy during a downturn.

The Nixon Shock and the Modern Fiat Era

The final, decisive break from money backed by physical goods happened in 1971. In what’s now called the "Nixon Shock," President Richard Nixon declared that the U.S. would no longer exchange dollars for gold at a fixed rate. That single announcement sliced through the last major tie between the world's most important currency and a physical commodity.

Nixon's move pushed the entire world into the age of fiat currency. Once the dollar was untethered from gold, other nations quickly did the same, and the global financial system flipped to a model based entirely on government decree. Central banks were now free to control their country's money supply based on economic goals, not on how much gold they had in the basement. This pivotal moment in history is why the debate between stability and flexibility is still at the heart of any fiat vs. commodity money conversation today.

How Each System Impacts Inflation and Money Supply

The very structure of a monetary system is what determines its economic stability, especially when it comes to inflation and the money supply. At its heart, the fiat vs commodity money debate boils down to a simple question: who controls the creation of new money, and what—if any—are the natural limits on that power? This control is the single biggest factor in whether a currency holds its value over the long haul or slowly loses it.

With commodity money, the supply is tied to the real world. You can't just wish more gold or silver into existence. It has to be found and mined, an expensive and time-consuming endeavor. This inherent scarcity provides a powerful brake on inflation, as the amount of money in circulation can only grow as quickly as new resources are pulled from the earth.

Fiat money, on the other hand, plays by a completely different set of rules. Central banks can essentially create new money out of thin air, adding it digitally to the supply without anything physical to back it up. This gives governments a flexible tool to respond to economic shocks, but it also carries the serious risk of runaway inflation.

Comparing Inflation and Supply Growth

History paints a pretty clear picture of how these two systems perform. When you line up economic data from periods under a commodity standard against our modern fiat era, the differences are impossible to ignore.

A deep dive into the economic history of 15 countries revealed that under fiat systems, the average annual inflation rate was a staggering 9.17%. In contrast, commodity standards held inflation to an average of just 1.75%. The money supply tells a similar story, growing by an average of 13.8% each year for fiat currencies versus 5.35% for commodity-backed ones. You can see the full breakdown in this detailed economic analysis.

The data makes a strong case that without a physical anchor, fiat currencies are simply more susceptible to losing their value over time. The power to expand the money supply might be a useful policy lever, but it has consistently resulted in higher inflation and a faster-growing pile of currency.

This reality has huge implications for everyone, from individuals to large corporations. In a high-inflation fiat economy, just holding onto your purchasing power becomes a daily struggle. It's a key reason why so many are looking toward alternative assets and new payment methods.

For business owners, getting a handle on these economic undercurrents is vital for smart financial planning. If you're looking for ways to shield your business from the effects of currency devaluation, our guide on how to accept crypto payments for your business is a great place to start. In the end, the choice between these systems reflects a basic trade-off: the stability and discipline of commodity money versus the flexibility of a government-managed fiat currency.

Cryptocurrency's Role in This Age-Old Debate

The classic debate of fiat vs. commodity money has found new life with the arrival of cryptocurrency. This new class of digital assets doesn't quite fit the old molds. Currencies like Bitcoin bring a fascinating mix of principles from both systems, forcing us to rethink what truly gives money its value in our digital world.

On one side, many cryptocurrencies echo a core feature of commodity money: scarcity. Take Bitcoin, for example. Its supply is capped forever at 21 million coins, a limit baked directly into its code. This built-in scarcity is a lot like the finite supply of gold, which is why some people see it as a hedge against the inflation that can devalue fiat currencies. No central bank can just decide to print more Bitcoin whenever it wants.

On the other hand, crypto also depends on a concept straight from the fiat playbook: collective belief. A digital coin has no physical substance and no real-world use like gold or silver. Its value comes entirely from the shared confidence of its users—the agreement that it can be used to buy things or hold wealth. If that collective trust were to vanish, the coin’s value would evaporate with it.

A New Hybrid in Town

You could argue that cryptocurrencies represent an entirely new, third category—a hybrid model that directly challenges traditional financial thinking. They cherry-pick features from both of the older systems to create something unique.

- Like a Commodity: Their supply is often strictly limited by code, not by a central bank. This creates a form of digital scarcity.

- Like Fiat: Their value isn't tied to a physical object but relies on the trust and agreement among the people in the network.

This dual nature is precisely what makes them so interesting and, to some, so disruptive. They offer the possibility of a global currency free from the control of any single government, but they also bring their own brand of volatility and risk. The entire system is built on trust in cryptographic proof rather than trust in an institution.

At its heart, cryptocurrency asks us to trust a different authority. Instead of placing our faith in a government (fiat) or a physical material (commodity), we’re asked to trust open-source code and a distributed network of computers to manage money predictably and transparently.

What This Means for Finance Today

This new model has big implications. For both businesses and individuals, it opens up a financial path that runs completely outside the traditional banking system. This is a powerful idea, especially when many have seen the purchasing power of their fiat currency slowly chipped away by inflation.

By blending digital scarcity with a framework of decentralized trust, cryptocurrencies force us to look at the fiat vs. commodity money argument through a modern lens. They demonstrate that value can be created and sustained in new ways, driven by technology and the power of networks. As more companies explore how to protect their assets and simplify global payments, understanding the diverse world of supported cryptocurrencies is becoming crucial. They challenge us all to think beyond old definitions and consider how technology is reshaping money itself.

Frequently Asked Questions

It’s natural to have questions when you're digging into how money really works. Let's tackle some of the most common ones that come up when people compare fiat and commodity money.

Is Cryptocurrency a Type of Commodity or Fiat Money?

Cryptocurrency is a bit of a hybrid—it doesn’t fit perfectly into either box but shares features with both.

On one hand, many cryptocurrencies act like commodity money. Take Bitcoin, for example. Its supply is intentionally limited, capped forever at 21 million coins. This built-in scarcity is a lot like the natural rarity of gold, which is why some people use it to hedge against inflation. You can't just "print" more of it.

On the other hand, its value, much like fiat money, comes from belief. There’s no physical object backing a digital coin. Its value is entirely based on collective trust and network consensus—people agreeing that it’s worth something. That’s the same core principle that gives a dollar bill its power.

Why Did the World Move Away from the Gold Standard?

The big shift away from the gold standard really boiled down to one thing: economic flexibility. Tying a currency directly to a country's gold reserves put governments in a serious straitjacket when it came to managing their economies.

When your money supply is limited by the gold in your vaults, you can't easily fund massive undertakings like wars or major infrastructure projects. More critically, it hamstrings your ability to fight off a recession.

The core reason for the transition was a desire for active economic management. By severing the link to gold, central banks gained the power to increase the money supply and adjust interest rates, giving them crucial tools to stimulate a struggling economy and combat high unemployment.

This all came to a head with the "Nixon Shock" in 1971. Breaking free from these "golden handcuffs" let governments use monetary policy to steer through economic ups and downs. It was a trade-off: sacrificing the hard stability of gold for greater adaptability.

What Are the Main Risks of a Fiat Money System?

The single biggest danger in any fiat system is inflation. Because a central bank can create money out of thin air, not tied to a physical commodity, there’s always the risk that it will create too much and devalue the currency.

When the money supply grows faster than the economy itself, each dollar, euro, or yen buys less than it did before. This loss of purchasing power can be a slow, creeping problem or it can escalate into hyperinflation—a catastrophic scenario where faith in the currency completely evaporates, wiping out savings and wrecking the economy.

This risk highlights the constant tightrope walk central banks perform. They have to carefully manage the money supply to encourage growth without letting inflation spiral out of control and destroy the very trust that the fiat system depends on.

Ready to step into the future of finance and shield your business from currency volatility? With BlockBee, you can seamlessly accept over 70 cryptocurrencies with low fees and instant payouts. Discover a more secure and efficient way to handle payments.