What is KYC in Crypto? Your Essential Guide to Verification

If you’ve ever opened a bank account, you’ve gone through a “Know Your Customer” or KYC process. In the crypto world, it’s pretty much the same idea. Exchanges and other platforms use KYC to verify your identity before you can start trading or using their services.

This might seem a bit at odds with crypto's early reputation for total anonymity, but it's become a crucial security measure. Think of it as the bouncer at the door, making sure everyone who comes in is who they say they are. It’s all about preventing fraud and other financial crimes.

Unpacking Crypto KYC: The Core Components

At its heart, KYC is a digital handshake. Before a crypto platform can do business with you, it needs to confirm your identity. This isn't just about ticking a regulatory box; it's about building a foundation of trust and security for everyone on the platform.

While it adds an extra step to the sign-up process, this verification is what separates legitimate operations from the wild west of crypto's past. It bridges the gap between the freewheeling innovation of digital assets and the time-tested security protocols of traditional finance, which ultimately helps more people feel comfortable getting into crypto.

The Three Pillars of Verification

A solid KYC process isn't just one step—it’s built on three distinct pillars that work together to create a full picture of who you are and how you use the platform.

Let's quickly break down these three essential components. The table below gives a simple overview of each pillar, its main goal, and the kind of information that's typically needed.

| Key Components Of Crypto KYC At A Glance |

| :--- | :--- | :--- |

| Component | Purpose | Typical Information Required |

| Customer Identification Program (CIP) | To collect basic identity details and confirm you are a real person. This is the starting line for verification. | Full name, date of birth, physical address, and a unique identification number (like a Social Security Number). |

| Customer Due Diligence (CDD) | To verify the information you provided and assess your potential risk level. It's about proving you are who you claim to be. | A government-issued photo ID (driver’s license, passport) and sometimes proof of address (utility bill). |

| Ongoing Monitoring | To keep an eye on account activity over time to spot unusual or suspicious behavior that might signal illicit activity. | Transaction analysis and behavior pattern recognition. No new documents are typically needed from the user. |

As you can see, each pillar builds on the last, creating a comprehensive security net. It’s a system designed to protect both the business and its genuine customers from bad actors.

This structured approach really works. Studies have shown that effective KYC procedures can slash crypto fraud risk by an impressive 38%. And thanks to better tech, the average verification time has dropped to a speedy 3.5 minutes, so it's no longer a huge hassle for new users.

These pillars ensure platforms can manage their user base with confidence. For a closer look at what this means for anyone signing up to a new service, you can learn more about why KYC is now mandatory for new users.

Why Crypto Exchanges Now Require KYC

The early days of cryptocurrency were a bit like the Wild West—unregulated, anonymous, and thrilling. But as crypto grew from a niche interest into a serious financial player, that lack of oversight became a massive headache. This evolution is the main reason nearly every major crypto exchange has brought KYC into the picture.

For the exchanges themselves, it’s a simple matter of survival and growth. To stay in business, they have to play by global Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) rules. Ignoring these regulations means facing crippling fines and legal battles that could shut them down for good. Implementing KYC not only keeps them compliant but also builds the credibility needed to partner with traditional banks.

Bridging Trust and Technology

For you as a user, KYC brings some very real advantages. It acts as a powerful lock on your digital assets, making it incredibly difficult for anyone else to get into your account. And if you ever do get locked out, having a verified identity gives you a clear and reliable way to recover your funds. This security blanket creates a much safer trading environment for everyone.

KYC is the bridge between the innovative spirit of cryptocurrency and the established trust of traditional finance. It’s what allows the ecosystem to grow sustainably by proving its commitment to security and regulatory compliance.

This shift toward regulation also mirrors what users have come to expect. Today, almost all centralized crypto exchanges are KYC compliant. In fact, a growing number of traders in markets like the US now actively seek out platforms that require verification, seeing it as a sign of legitimacy.

A Safer Ecosystem for Everyone

At the end of the day, KYC helps legitimize the entire crypto industry. It acts as a filter, keeping out bad actors who want to use these platforms for illegal activities. This, in turn, protects the integrity and stability of the market.

While some platforms offer tiered verification, it's helpful to understand the nuances, such as the relaxed KYC requirements for smaller transactions that many services use.

To really get the "why" behind KYC, it helps to have a good foundation in understanding how blockchain exchanges operate. It puts into perspective just how critical these verification steps are for keeping modern trading platforms secure and functional.

Navigating The Global Crypto Regulatory Maze

Think of the crypto world as a massive, sprawling city. Every neighborhood has its own local ordinances, and if you want to do business across town, you need to know the rules for each one. This is exactly what it's like to navigate the complex web of global crypto regulations.

At the heart of it all is the Financial Action Task Force (FATF). This isn't a government body that writes laws, but rather an international standard-setter for fighting money laundering. The FATF creates the blueprint, and its member countries are strongly encouraged to build their own national laws based on it.

From Global Standards to Local Laws

One of the FATF’s most impactful recommendations is the “Travel Rule.” It’s a simple but powerful idea: virtual asset service providers (VASPs)—think crypto exchanges and payment processors—must collect and share customer information for transactions that cross a certain threshold. The goal is to make crypto transfers as transparent as traditional bank wires.

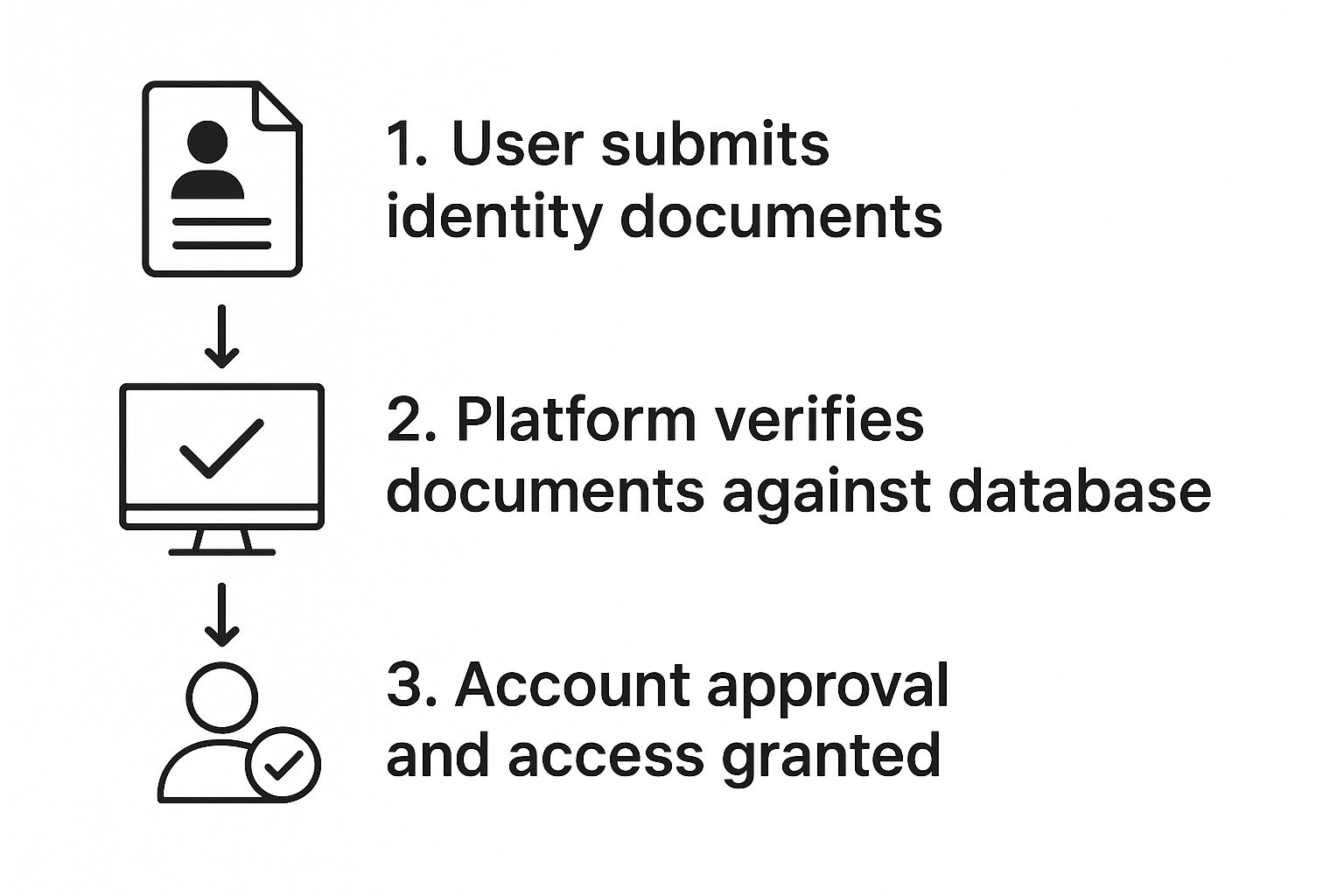

This process of identifying and verifying a user is the core of KYC, and it typically follows a clear path.

This three-step flow of submission, verification, and approval is the fundamental building block of almost any KYC system that aims to meet global regulatory standards.

These international guidelines have made a real difference. Since the FATF first issued its guidance for VASPs, compliance has shot up, especially in North America where exchanges have broadly implemented the Travel Rule.

From there, major economic hubs take these standards and turn them into concrete laws:

- In the United States: The Financial Crimes Enforcement Network (FinCEN) is the primary enforcer, applying bank-like regulations to crypto businesses.

- In the European Union: The Markets in Crypto-Assets (MiCA) regulation is creating a single, unified legal framework for the entire bloc.

Because the rules can vary slightly from one jurisdiction to the next, any crypto business with global ambitions needs a compliance system that's flexible enough to adapt on the fly.

Your Step-by-Step Guide to KYC Verification

So, you’re ready to sign up for a crypto service and see the "KYC verification" prompt. What does that actually involve? It might sound intimidating, but it’s really just a quick, secure onboarding process—think of it as setting up a bank account, but from your couch.

The whole thing usually takes just a few minutes. Let’s walk through what you can expect.

The Standard Playbook for Verification

Most platforms follow a similar, battle-tested procedure to confirm you are who you say you are. It almost always starts with the basics.

Step 1: The Personal Details

First up, you'll enter your foundational information: full legal name, current address, and date of birth. This creates the baseline for your account profile.Step 2: The ID Check

Next, you’ll need to prove it. This is where you snap a clear picture of a government-issued ID. Your passport or driver’s license is perfect for this.

The "Are You Really You?" Check

Once your documents are in, you'll hit the most high-tech part of the process: the biometric scan. The platform will ask you to take a selfie or a short video of your face.

This isn't for your profile picture. It’s a sophisticated liveness check designed to outsmart scammers. The system analyzes your facial features and movements in real-time to confirm you’re a living, breathing person, not a static photo or a convincing deepfake. It’s an incredibly effective way to shut down identity theft before it starts.

Completing KYC isn’t just about ticking a box. It’s your ticket to unlocking the platform's full power—think higher withdrawal limits, access to more features, and a much safer account.

After you submit everything, the platform's system gets to work. Often, an automated check gives you the green light almost instantly. Just like that, you're ready to fund your account and dive in, knowing your funds are secure. This simple security checkpoint is a perfect example of what KYC in crypto means in practice.

How Crypto Businesses Can Make KYC Painless

For any business in the crypto space, setting up a "Know Your Customer" system can feel like a massive, resource-draining headache. The secret to getting it right without pulling your hair out? Ditch the slow, manual checklists and embrace automation.

Picking the right technology partner is the real game-changer here. It's not just about ticking a compliance box; it's about minimizing human error, speeding up verifications, and keeping costs from spiraling out of control. Think of it as offloading the heavy lifting of compliance so you can focus on what you actually do best—growing your business.

Weave Compliance Directly Into Your Workflow

The smartest way to handle KYC is to build it right into the processes you already have, like your payment gateway. This approach makes compliance a seamless, almost invisible part of the customer journey instead of a clunky, frustrating hurdle they have to jump over.

The BlockBee dashboard, for example, lets merchants set and manage their KYC/AML rules right where they manage their payments. It’s all in one place.

As you can see, an integrated platform acts as a central command center for both payments and compliance. This simplifies the day-to-day admin work because every transaction is automatically checked against the rules you’ve set. It brings top-tier compliance within reach for businesses of all sizes, ensuring they know how to accept crypto payments both securely and in line with global standards.

The goal is to make robust KYC invisible to the end-user but invaluable to the business. A streamlined process not only ensures regulatory adherence but also builds customer trust by demonstrating a commitment to security.

Ultimately, a smooth KYC system delivers some serious wins for any crypto business:

- Slash Operational Costs: Automation drastically reduces the need for manual reviews, which saves a ton of time and money.

- Boost Accuracy: Let's be honest, an automated system is far better at spotting a fake ID or an inconsistency than the human eye.

- Scale Without Breaking a Sweat: As your business grows, an automated system can handle the surge in new customers without requiring a massive increase in your compliance team's budget.

Answering Your Crypto KYC Questions

Even after getting a solid grasp of what KYC is and why it's necessary, it’s completely normal to still have some questions. The whole idea of identity checks can feel at odds with the privacy-focused origins of cryptocurrency. Let's tackle some of the most common questions to clear up any lingering confusion.

A huge concern for many people is data security. Is handing over personal info to a crypto platform a recipe for disaster? The reality is, reputable exchanges sink a massive amount of money into top-notch security, like end-to-end encryption and heavily guarded data storage. Think of it as a digital Fort Knox; their entire reputation hinges on keeping your information locked down and safe from prying eyes.

What Does the Future Hold for Crypto KYC?

Another big question mark is what’s next for crypto rules. The trend is crystal clear: regulations are tightening and becoming more consistent worldwide. As the crypto market grows up, you can bet that KYC requirements will start looking more and more similar from one country to the next. This is actually a good thing—it builds trust and makes it easier for legitimate companies to operate, creating a safer space for everyone involved.

The tech itself is also getting a major upgrade. We're seeing a shift toward verification methods that are smarter, quicker, and a lot less annoying for the user. New developments in biometrics and privacy-focused verification systems are aiming to speed things up while giving you more say over who sees your data.

The old tension between crypto's anonymous roots and the demand for regulation is finally starting to find a balance. The future of KYC isn't about giving up privacy—it's about finding smart ways to build a secure, legitimate ecosystem without killing the spirit of digital assets.

Even with these improvements, the industry isn't out of the woods. Crypto-related fraud is still a massive global problem, which is exactly why strong KYC is more critical than ever. As fraud rates continue to climb in many parts of the world, solid identity verification is the first and best line of defense. You can discover more insights about these global fraud trends to see just how important compliance has become.

At the end of the day, KYC in crypto is a balancing act. It’s the bridge between the traditional financial world’s demand for security and the crypto world’s need for speed and openness. It’s what protects users, strengthens platforms, and ultimately clears the path for crypto to go mainstream.

Ready to implement a seamless and secure KYC process for your business? BlockBee provides the tools you need to stay compliant while offering a smooth user experience. Get started with BlockBee.