How to Accept Crypto Payments Your Complete Business Guide

You might be surprised at how straightforward it is to start accepting cryptocurrency. The whole process boils down to three key parts: picking a specialized payment processor like BlockBee, connecting it to your e-commerce store with a simple plugin, and then deciding how you'll handle the digital assets you receive. It's less of a technical hurdle and more of a strategic decision that can open your doors to a completely new, global customer base.

Why Your Business Should Start Accepting Crypto

Jumping into the world of digital currency payments can feel like a big leap, but the benefits for your business are real and can show up almost immediately. If you look past the hype, you'll find a solid business case for learning how to accept crypto payments. This isn't just about adding another button at checkout; it's about setting up your business for the future and connecting with a different kind of customer.

Making this move signals that your brand is modern and ready to meet the demands of a tech-savvy audience. The practical advantages are pretty compelling and solve some common headaches for online businesses today.

Tap into a Growing Global Market

The biggest win here is immediate access to a huge and fast-growing market of people who own cryptocurrency. These customers are often early adopters and enthusiastic online shoppers who specifically look for merchants that accept their preferred payment methods. By simply offering that option, you can stand out from the crowd.

The numbers really tell the story. In 2024, more than 560 million people—that's about 6.8% of the world's population—own crypto. This user base has exploded at a compound annual growth rate (CAGR) of 99% over the last five years, which completely overshadows the growth of traditional payment methods.

Reduce Costs and Eliminate Chargebacks

We all know that traditional payment methods, especially credit cards, chip away at your profits with transaction fees that usually fall between 1.5% and 3.5%. Crypto payments, when handled through a gateway like BlockBee, often come with much lower fees.

But the most powerful financial perk? Getting rid of fraudulent chargebacks entirely. Since cryptocurrency transactions can't be reversed, chargeback fraud—a massive and expensive problem for e-commerce stores—is no longer a concern. That kind of security brings peace of mind and directly protects your revenue.

To give you a better sense of what this looks like, the table below breaks down the key benefits.

Crypto Payments At a Glance for Your Business

| Benefit | What It Means for Your Business |

|---|---|

| Global Reach | Instantly access a worldwide market of 560 million+ crypto users without worrying about cross-border fees. |

| Lower Fees | Keep more of your revenue with transaction fees that are often significantly lower than credit card processing. |

| No Chargebacks | Eliminate fraudulent chargebacks completely, as all crypto transactions are final and irreversible. |

| Faster Settlement | Get your funds in minutes, not days. This improves your cash flow compared to traditional banking systems. |

| Enhanced Security | Benefit from the inherent security of blockchain technology, which protects both you and your customers. |

In essence, adopting crypto payments is an upgrade to your financial operations, not just another payment option.

This screenshot from the BlockBee homepage shows how the platform is built for secure, non-custodial payment solutions for businesses just like yours.

The dashboard is designed for simplicity and control, giving you a single place to manage various cryptocurrencies. When you implement a system like this, you're not just accepting a new currency—you're upgrading your entire payment setup to be more efficient and secure.

Choosing the Right Crypto Payment Gateway

Before you can even think about integrating crypto, you have to pick your payment gateway. This is easily the most critical choice you’ll make. It’s the engine that will power every single crypto transaction on your site, directly impacting your costs, your customers' experience, and even your day-to-day operations.

Think of it like choosing a shipping carrier for your e-commerce store. You wouldn't just grab the first one you see. You'd dig into their reliability, costs, and tracking. The same logic applies here—you need a partner that feels like a seamless extension of your business.

Core Factors to Evaluate

When you start to compare different payment gateways, a few key areas will have the biggest impact. If you’re running a small shop for handmade goods, your main focus might be on keeping fees low and the setup simple. But if you’re a larger business dealing with international suppliers, top-tier security and stablecoin support become non-negotiable.

Here’s what I always tell people to look for:

- Supported Cryptocurrencies: Does the gateway actually support the coins your customers want to use? You'll obviously want the big ones like Bitcoin (BTC) and Ethereum (ETH), but don't overlook stablecoins like USDC and USDT. They are absolutely essential for managing price volatility.

- Transaction Fees: This is where things can get tricky. Some platforms charge a flat rate, others a percentage. You need to do the math based on your own sales volume. A provider like BlockBee, for example, has a very clear fee structure starting at just 0.25%, which is hard to beat.

- Integration Ease: How much of a headache will it be to connect this to your store? Look for official plugins for platforms like WooCommerce, Shopify, or Magento. A clean, well-documented integration process will save you a world of pain down the road.

Your goal is to find that sweet spot between powerful features and ease of use. The platform needs to be robust enough for your needs but simple enough that you aren't spending all your time managing it. A gateway with responsive support can also be a lifesaver when you hit a snag.

Security and Support

Never, ever cut corners on security. This gateway is handling your money, so its security has to be rock-solid. This is why many experienced merchants lean towards non-custodial solutions like BlockBee. They ensure funds go directly from the customer to your personal wallet. You, and only you, have control over your assets.

Don't forget about support. When a payment issue pops up, you need help fast. Check if the provider has a dedicated support team that can actually answer technical questions quickly.

For a deeper dive into the world of crypto-specific providers, our guide on finding the https://blockbee.io/blog/post/best-crypto-payment-gateway is a great resource to help you narrow down the options.

The growth in this space is staggering. The global cryptocurrency transaction volume is on track to hit $10.8 trillion by 2025. This isn't just a niche market anymore; it's being driven by massive retail and institutional adoption. And with 87% of transactions happening on mobile devices, a smooth mobile checkout is no longer a "nice-to-have"—it's essential.

Alright, let's get into the nitty-gritty. We've talked about the why; now it's time for the how. This is where we roll up our sleeves and walk through the actual process of getting your e-commerce store ready to accept crypto payments.

We'll use BlockBee as our real-world example to show you how to go from zero to a fully functional crypto payment option on your site. And don't worry, this is much less complicated than you might think. For most setups, you won't need to write a single line of code. Your main job is to create an account, grab your API keys, and link it all to your online store.

First Things First: Setting Up Your BlockBee Account

Your journey begins at the BlockBee dashboard. This is your mission control for managing crypto payments. The sign-up is pretty standard—just the usual details to get your account created and secured.

Once you're in, the most critical piece of the puzzle is your API key. Think of it as a secure handshake between your website and the BlockBee network. You'll generate this key directly from your dashboard. A word of advice from someone who’s seen it all: treat this key like you would your bank password. Never, ever share it publicly.

One of the best things about working with a non-custodial gateway like BlockBee is that you’re always in control of your money. BlockBee never holds your funds. Instead, payments are sent directly to the crypto wallets you own. This means you’ll need to add your wallet addresses for each coin you want to accept right in your BlockBee settings.

After that’s done, you’re ready to connect it to your store.

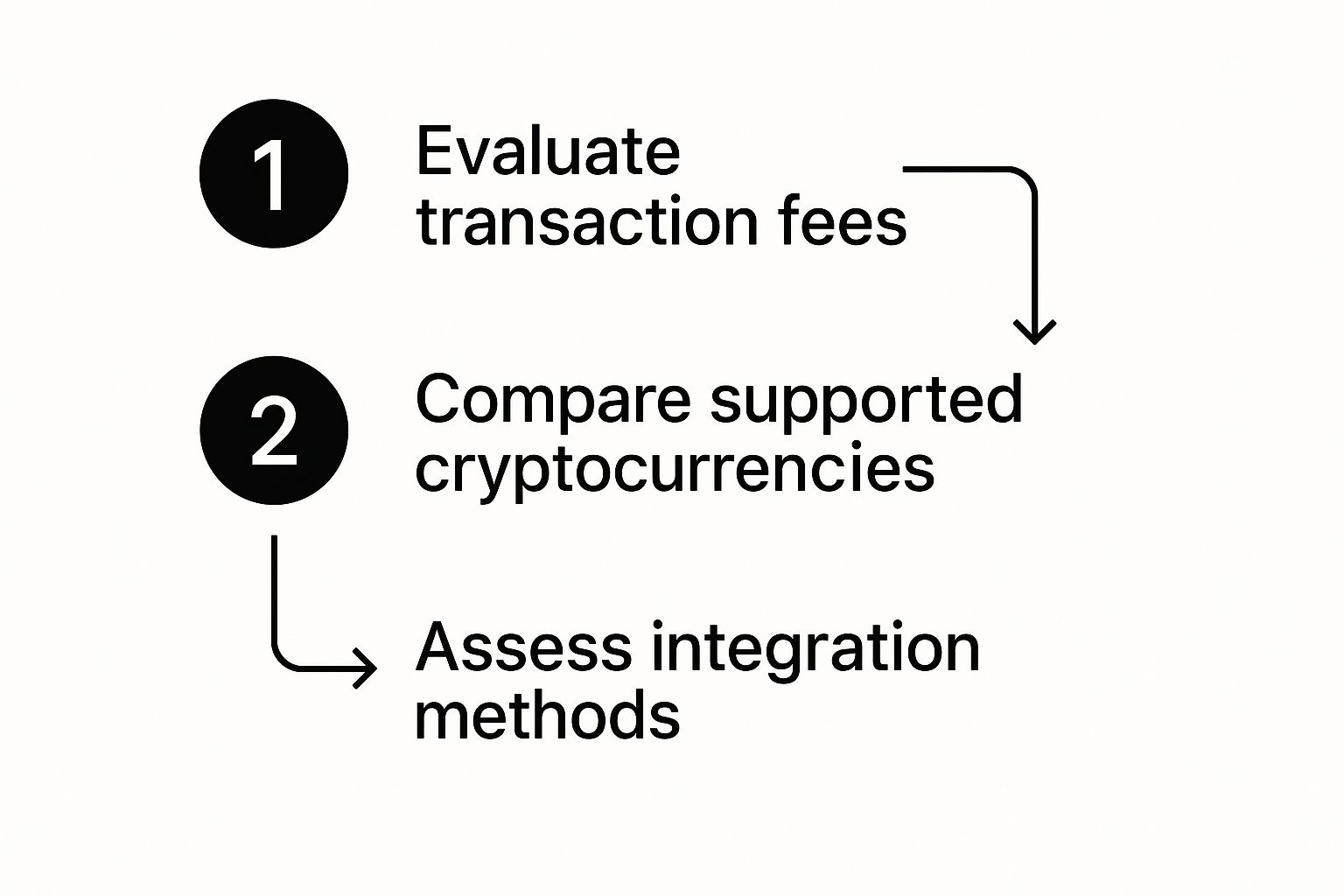

This visual helps frame the decision-making process before you even touch the technical side of things.

It’s a great reminder that a smart integration starts with a clear plan, weighing what you need in terms of fees, coin variety, and overall simplicity.

Connecting the Dots to Your E-Commerce Platform

The simplest way to get this done, by far, is to use a plugin. BlockBee has official plugins for all the major e-commerce platforms, which takes most of the heavy lifting off your plate.

Let's imagine you're running a store on WordPress with WooCommerce. Here’s how that would look:

- Install the Plugin: Head to your WordPress dashboard, search for the BlockBee for WooCommerce plugin, and install it.

- Plug in Your API Key: Once installed, go to the plugin’s settings. This is where you’ll paste that API key you just generated from your BlockBee dashboard.

- Choose Your Coins: Finally, you can flip the switch on the cryptocurrencies you want to offer. The plugin handles the rest, automatically adding them as a payment option on your checkout page.

Fine-Tuning the Details

With the basics in place, it’s time to dial in the settings. One of the most important things to configure is your callback URL, also known as a webhook. This is the mechanism BlockBee uses to ping your store the second a customer's payment is confirmed on the blockchain.

Setting this up properly is what allows your order status to automatically flip from "pending" to "paid" without you having to lift a finger. If you're new to webhooks and want to understand how they work under the hood, this general webhook integration guide is a fantastic resource for getting up to speed.

You can also get more advanced by setting up rules for things like currency conversion. For example, you could have all incoming Bitcoin payments instantly converted to a stablecoin like USDC. This is a common strategy to shield your revenue from crypto's famous price swings, making your income much more predictable.

By taking these steps, you’ll have a solid, reliable system ready to serve customers from anywhere in the world.

Managing Your Crypto Revenue and International Payments

Getting those first crypto payments feels great, but it’s really just the beginning. The next, and arguably more important, part is figuring out how to manage that new revenue. This is where you shift from a customer-facing mindset to an operational one, focusing on how to handle these digital assets efficiently. First up: tackling price swings.

The biggest headache for most merchants is volatility. An order paid in Bitcoin could be worth 5% less just a few hours later. That’s a risk most businesses can’t afford to take. The simplest and most effective way to sidestep this is by using stablecoins—digital currencies pegged to a stable asset like the U.S. dollar.

With a gateway like BlockBee, you can set this up to happen automatically. The instant a customer pays you, the crypto they sent gets converted into a stablecoin like USDC or USDT. Your $100 sale stays a $100 asset. Suddenly, your accounting is predictable and your revenue is secure.

Supercharge Your International B2B Payments

Once you're comfortable with customer sales, you can start using crypto to streamline your own business expenses. This is especially powerful when you're paying international suppliers or contractors. We’ve all dealt with traditional bank wires—they're painfully slow, taking days to clear, and loaded with hidden fees.

Now, imagine you need to pay an overseas supplier $5,000. Instead of a clunky bank transfer, you could send the equivalent in USDC. That transaction would probably settle in minutes, not days, and cost a tiny fraction of what a bank would charge. This kind of speed and cost-saving can genuinely transform your supply chain and B2B relationships.

The real power move is when you stop seeing crypto as just another way for customers to pay you and start using it for your own financial operations. It becomes a core part of how you move money globally, saving you time and cutting out unnecessary costs.

This isn't just a niche strategy anymore. In 2024, the total transaction volume for stablecoins hit a staggering $5.7 trillion. A huge chunk of that is driven by B2B payments, with major players reporting billions in transaction volume for international commerce. You can find more insights on how crypto payments for business are changing the game.

Cashing Out Your Crypto Earnings

At some point, you’ll probably want to move your digital earnings back into a familiar currency like USD or EUR. This process is called "off-ramping," and you have a few solid options to choose from. Centralized exchanges, peer-to-peer (P2P) platforms, or dedicated off-ramp services that wire funds directly to your bank account are all viable routes.

Each method comes with its own fee structure and settlement speed, so it’s worth exploring which one aligns best with your business's cash flow needs. Getting a handle on these simple financial operations lets you fully capitalize on the benefits of crypto. It’s all about choosing the right tools to stay in control, minimize risk, and make your business more financially agile.

Navigating Common Hurdles and Merchant Concerns

Diving into crypto payments is exciting, but like any new venture, you're bound to hit a few bumps in the road. It’s one thing to get everything set up; it’s another to handle the day-to-day realities of this new payment method. Let's talk through some of the practical questions and scenarios that pop up for merchants just like you.

Picture this: a customer sends a frantic email claiming they paid, but you see nothing in your wallet. It's a classic situation, especially for shoppers who are new to crypto themselves. Don't panic. Your first move is to investigate, not assume.

Head straight to your BlockBee dashboard to pull up the transaction details for that customer's order. With that information, you can pop over to a public blockchain explorer and see exactly what happened. These explorers are your best friend—they're an impartial source of truth that shows if the transaction was sent, where it landed, and how many network confirmations it has.

Managing Customer Expectations

When it comes to crypto, being proactive with communication is your best tool for heading off problems. Unlike a credit card charge, a crypto transaction is final. You can't just reverse it if a customer accidentally sends the wrong amount or chooses the wrong network.

A little bit of clear guidance at the checkout can save you a mountain of support headaches. Try adding a simple, direct message right on the payment page.

Important: Please double-check that you are sending the exact amount of crypto requested and that you are using the correct blockchain network (e.g., Ethereum Mainnet for ETH). Transactions sent to the wrong network may be lost forever.

This small step empowers your customers to get it right on the first try and can drastically cut down on support tickets.

Security and Fund Protection

Once you start receiving crypto, keeping it safe is just as critical as protecting the cash in your bank account. It’s smart to build a strong foundation by implementing essential website security best practices, but crypto has its own unique security needs.

Here are a few non-negotiable practices I always recommend:

- Use a Non-Custodial Gateway: This is a big one. A service like BlockBee is non-custodial, meaning payments go straight from the customer to your personal wallet. You hold the keys, you control the funds. There’s no middleman holding your money.

- Guard Your API Keys: Treat your API keys like the keys to your vault. Store them somewhere incredibly secure, and whatever you do, never embed them in your website’s front-end code where they could be exposed.

- Stay Vigilant Against Phishing: Scammers love targeting crypto users. Be extremely wary of any email or message asking for your login info or wallet keys. Always log in to your accounts by typing the official URL directly or using a trusted bookmark.

Even after you’re sold on the idea of crypto, some practical questions always pop up. It's completely normal. Let's walk through the most common concerns we hear from business owners, breaking down the day-to-day realities of accepting digital currencies so you can move forward with confidence.

Are Cryptocurrency Payments Legal and What Are the Tax Implications?

In most places, like the U.S. and the majority of Europe, accepting crypto is perfectly legal. The real question isn't about legality—it's about taxes. This is where you need to pay close attention.

Tax authorities, such as the IRS in the United States, don't see crypto as currency. They see it as property. This single distinction changes everything. It means every time you get paid, you have to log the crypto's fair market value in your local currency (say, U.S. dollars) at the moment of the transaction. That’s your taxable revenue.

If you hang onto that crypto instead of cashing it out, you're potentially setting yourself up for another taxable event later—a capital gain or loss when you finally sell. The rules are complex and they change. My best advice? Talk to a tax professional who knows their way around digital assets. It’s not optional; it’s essential for staying compliant.

How Do I Protect My Business from Cryptocurrency Price Volatility?

Worried about the infamous crypto price swings? The most straightforward way to sidestep that risk entirely is by using a payment gateway with an instant conversion feature. For most merchants, this is a non-negotiable tool for financial peace of mind.

Here’s how it works: A customer pays you in something volatile like Bitcoin. Your payment gateway can be set up to immediately swap it for a stablecoin (like USDC, which mirrors the U.S. dollar) or deposit it directly into your bank account as fiat currency.

This simple step locks in your sale's value on the spot. You get the exact amount you charged, eliminating any gamble on whether the crypto's price will plummet before you can convert it. It's a standard and critical feature in modern gateways like BlockBee, designed specifically to protect your bottom line.

What Happens if a Customer Has a Problem with a Crypto Payment?

This is a big one. Crypto transactions are final—there's no "reverse" button. That means your customer support needs to be built around education and preventing problems before they start.

Your checkout page is your first line of defense. Use it to provide crystal-clear instructions. A simple reminder for customers to double-check the payment amount and confirm they're using the correct blockchain network can save a world of headaches.

If something still goes wrong, like an underpayment or a payment sent to the wrong address, your payment gateway's dashboard is your go-to. It will have all the transaction data you need to figure out what happened. For trickier situations, you might have to walk the customer through using a public blockchain explorer to track their own transaction.

Ready to securely and easily accept crypto payments? BlockBee offers a non-custodial gateway with low fees, instant conversions, and official plugins for all major e-commerce platforms. Get started today and see how simple it can be at https://blockbee.io.