Finding the Best Crypto Payment Gateway for Business

If you're looking for the best crypto payment gateway, you're probably weighing a few key things: tight security, low transaction fees, and an integration process that doesn't require a computer science degree. A top-tier solution like BlockBee is built to deliver on these fronts, letting you accept digital assets without getting bogged down in the nitty-gritty of blockchain tech. It's about future-proofing your business and opening it up to a global customer base.

Why Your Business Needs a Crypto Payment Gateway

Dipping your toes into cryptocurrency payments can feel a bit like learning a new language. A crypto payment gateway is essentially your translator. Think of it as a universal adapter for money—a specialized service that takes crypto payments from your customers and converts them into tangible value for your business, smoothly and securely.

Without a gateway, your customer would have to send crypto directly to your personal wallet. That process can be slow, clunky, and surprisingly easy to mess up. A gateway, on the other hand, handles all the heavy lifting. It creates unique payment addresses for each transaction, watches the blockchain to confirm payments, and provides a checkout experience that feels just as seamless as using a credit card. Bringing this technology into your business isn't just a tech upgrade; it's a smart strategic move.

The Growing Demand for Crypto Payments

The move toward digital currencies isn't a fringe movement anymore; it's a real shift in how people transact. The global market for crypto payment gateways is booming, which tells you everything you need to know about the demand for faster, borderless payment options. In fact, market reports show the industry hit roughly $1.69 billion and is on track to reach $2.02 billion, growing at an impressive clip of 19.5% each year. This isn't just hype—it's driven by the growth of e-commerce, increasing trust in blockchain, and the very real appeal of lower fees.

This rapid adoption spells out a clear opportunity for any business owner. By integrating a gateway, you can:

- Slash Transaction Costs: Most crypto gateways charge fees around 1% or even less. That's a significant saving when you compare it to the 2-3% that credit card companies typically take.

- Say Goodbye to Chargebacks: Crypto transactions are final. This built-in feature protects you from the headaches and financial losses that come with chargeback fraud.

- Tap Into a Global Market: Cryptocurrencies don't care about borders. You can accept payments from anyone, anywhere in the world, without wrestling with currency conversion rates or international banking fees.

Making the Strategic Leap

Adding a crypto payment option is more than just another button on your checkout page. It's a signal to a growing, tech-forward audience that your business is in tune with their preferences. It opens up your brand to a whole new group of customers who value the privacy, security, and speed of crypto. If you're ready to take the next step, our guide on https://blockbee.io/blog/post/how-to-accept-crypto-payments-for-your-business walks you through the process with practical, easy-to-follow advice.

A crypto payment gateway is the essential bridge connecting your business to the world of digital finance. It manages the complex technical details so you can stay focused on what matters: running your business and delighting your customers.

For more expert takes on the role of digital payments in modern e-commerce and to keep up with what's new, you can find some great insights over at Deadwood Digital's e-commerce blog. Choosing the right gateway is a cornerstone for building a more efficient and resilient financial foundation for your company's future.

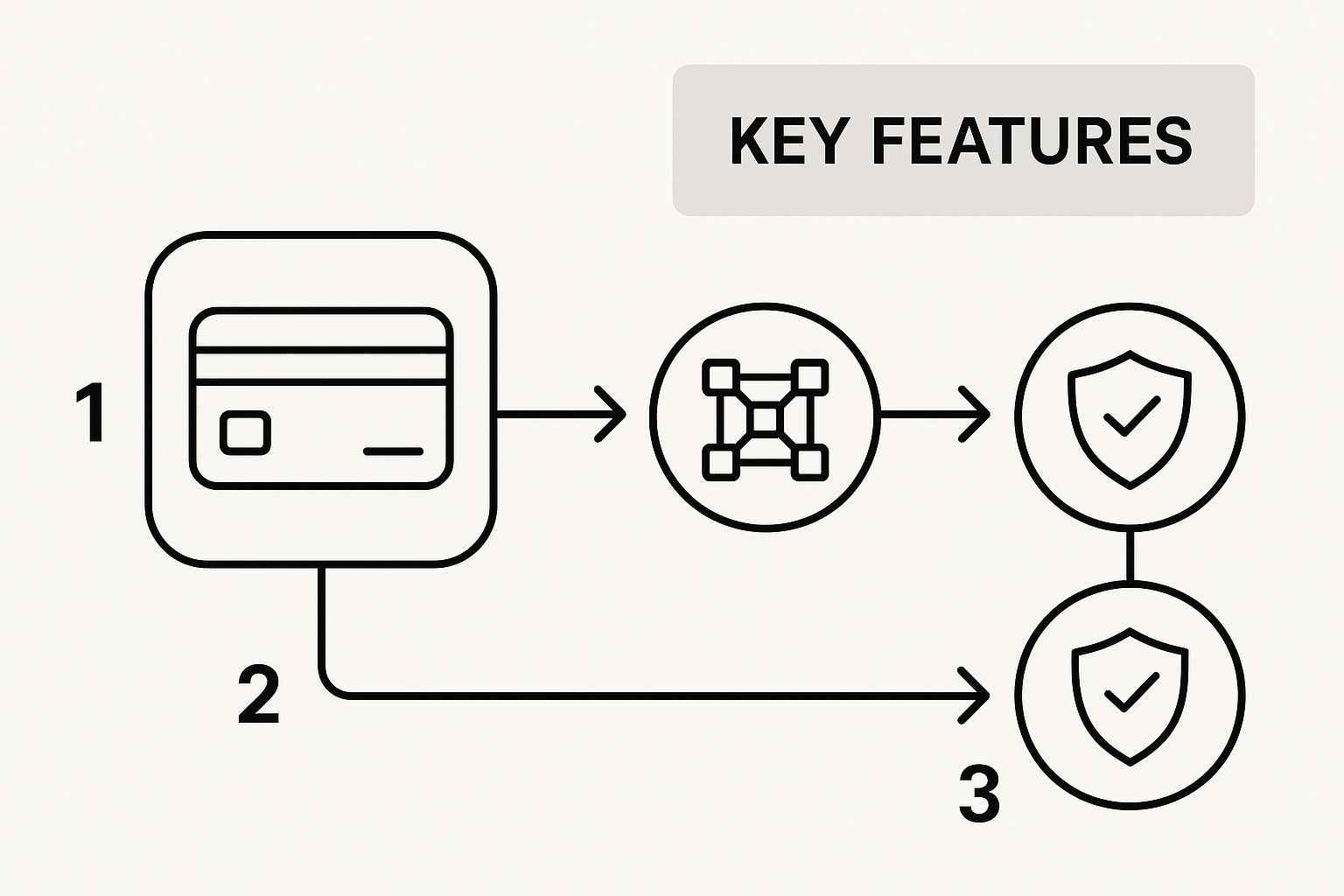

How a Crypto Transaction Actually Works, From Start to Finish

Ever wonder what really happens when a customer clicks that 'Pay with Crypto' button? It might seem complex, but the process is surprisingly straightforward and secure. Think of the payment gateway as a highly efficient, automated escrow service—it grabs the payment, makes sure it’s legitimate, and then delivers the value right into your hands.

Let's walk through the entire journey together. We’ll follow a payment from the moment your customer decides to buy, all the way until the money is settled in your account. The beauty of this system is its reliability; you can just focus on your business while the tech handles the heavy lifting.

This infographic breaks down the entire flow, showing how all the pieces, from security checks to blockchain verification, fit together perfectly.

As you can see, the gateway acts as the secure middleman, automating the tricky parts like verification and conversion to make life easier for everyone involved.

Step 1: Kicking Off the Payment

It all starts at your checkout. A customer has a full cart, they’re ready to pay, and they choose the crypto option. That single click is the trigger that brings your integrated payment gateway to life.

Instead of prompting for credit card numbers, the gateway generates a unique payment request on the spot. This isn't just a simple bill; it contains a few key pieces of information:

- The precise amount of crypto due, calculated against live exchange rates.

- A unique, single-use wallet address where the customer will send the funds.

- A handy QR code that mobile wallet users can scan to pre-fill all the payment details instantly.

That one-time address is a critical security measure. It links every payment directly to a specific order, which takes all the guesswork out of reconciliation and prevents mix-ups.

Step 2: Broadcasting and Confirming on the Blockchain

Once your customer hits 'send' in their crypto wallet, their payment is broadcast across the cryptocurrency's network. This is where the magic of the blockchain begins. The transaction joins a queue of pending payments, all waiting to be verified by network participants, often called miners or validators.

Your gateway doesn't just sit back and wait; it actively monitors the blockchain for that specific transaction. As soon as it's picked up and added to a "block," it gets its first confirmation. The number of confirmations needed for final approval can vary, but a good gateway will fire off a notification to you and your system the second the payment is considered valid—often within seconds.

A "network confirmation" is essentially a stamp of approval from the blockchain's decentralized team of accountants. Every new confirmation makes the transaction more permanent and irreversible, which all but eliminates the risk of chargebacks or fraud.

This confirmation process is the bedrock of crypto's security. After enough confirmations, the transaction is locked in for good.

Step 3: Settling Up and Getting Paid

With the transaction confirmed on the network, the final step is settlement. The gateway now has the crypto and will handle it based on the rules you've set up. You generally have a couple of choices here.

- Direct Crypto Deposit: The cryptocurrency lands directly in your business wallet. This is the way to go if you want to hold the asset for the long term.

- Automatic Fiat Conversion: The gateway immediately sells the crypto for your local currency (like USD or EUR) at the current market rate. The cash is then deposited right into your bank account.

This auto-conversion feature is a game-changer for businesses that want the perks of accepting crypto—like low fees and no borders—without being exposed to price swings. The best crypto payment gateway will lock in the exchange rate the moment the transaction starts, guaranteeing you receive the exact amount you charged. The whole process is designed to be fast, secure, and completely hands-off.

What to Look For in a Top-Tier Crypto Gateway

Choosing a crypto payment gateway is a big decision. You're not just picking a processor; you're choosing a partner for a core part of your business. The truth is, not all gateways are created equal. To find the right fit, you have to look past the marketing hype and really dig into the features that will affect your bottom line, your security, and your ability to grow.

Think of this as your buyer's checklist. We'll break down the absolute must-haves, explaining what they are and, more importantly, why they matter to you. It’s like popping the hood to inspect the engine instead of just kicking the tires.

Security and Who Holds Your Funds

When you're dealing with money, security is everything. In the crypto world, that conversation starts and ends with one simple question: who holds the keys to your funds? This is where you'll run into the crucial difference between custodial and non-custodial gateways.

A custodial gateway is a lot like a traditional bank—it holds your crypto for you. While that might sound convenient, it creates a single point of failure. If they get hacked, your funds are on the line.

On the flip side, a non-custodial gateway acts as a facilitator. It helps the transaction happen, but the funds move directly from your customer’s wallet into a wallet you control. This is the model used by platforms like BlockBee, and it puts you squarely in the driver's seat.

Why It Matters: With a non-custodial solution, you eliminate that third-party risk. You hold your own keys, which means you have the final say over your assets. Some even add extra security layers like multi-signature wallets, which require more than one person to approve a transaction, stopping unauthorized access in its tracks.

Clear and Honest Fee Structures

Nothing eats into profits like hidden fees. We all know the pain of traditional credit card processors, with their confusing fee structures that often land around 2.9% + $0.30 per sale. Crypto gateways are usually much simpler and more affordable, but you still need to pay attention to the details.

The best providers have a crystal-clear fee model. Most will charge a small, flat percentage on each transaction, typically somewhere between 0.5% and 1%. That kind of predictability makes it so much easier to forecast your finances.

Just be sure to watch out for any hidden charges that might be lurking in the fine print:

- Setup Fees: A one-time charge just for opening your account.

- Monthly Fees: A recurring bill you have to pay, even if you don't process any transactions.

- Settlement Fees: Costs for converting your crypto into dollars or euros and sending it to your bank.

A truly great gateway is upfront about every single cost. For instance, BlockBee has a straightforward fee structure that starts as low as 0.25%, so you get to keep more of every sale.

Supported Coins and Fiat Conversion

Sure, Bitcoin is the big one, but the crypto world is huge and diverse. To appeal to the widest possible audience, your gateway needs to support a good variety of cryptocurrencies, especially stablecoins.

- Cryptocurrencies: Getting the big names like Bitcoin (BTC) and Ethereum (ETH) is a given. But having support for other popular altcoins shows you’re ready to serve customers no matter what they hold.

- Stablecoins: Coins like USDT (Tether) and USDC are tied to real-world currencies like the US dollar. Accepting them gives you the best of both worlds—the low fees and speed of crypto without the rollercoaster of price volatility.

An essential feature for many businesses is seamless fiat conversion. This lets you accept a crypto payment, and the gateway automatically converts it to your local currency (like USD or EUR) and drops it right into your bank account. It’s the perfect setup if you want the benefits of accepting crypto without actually having to hold it.

Integration Tools and Real Human Support

A powerful gateway doesn't do you any good if you can't actually connect it to your store. The quality of a provider's integration tools says a lot about how much they care about making your life easier.

A good platform will have options for everyone, from complete beginners to seasoned developers.

| Integration Method | Ideal For | Key Benefit |

|---|---|---|

| Pre-built Plugins | E-commerce sites on WooCommerce, Shopify, Magento, etc. | Super fast, no-code setup. You can be up and running in minutes. |

| Well-Documented APIs | Custom websites and complex business software. | Gives you total control to build the exact payment experience you want. |

Finally, don't overlook customer support. When you have a problem with payments, you need to talk to a knowledgeable person who can solve it—fast. Things like a dedicated account manager or 24/7 support show that a provider is genuinely invested in your success.

A Practical Comparison of Leading Crypto Gateways

https://www.youtube.com/embed/hXuK6FxD2bo

When it comes to picking a crypto payment gateway, there’s no single "best" choice. The right one for you really depends on what your business needs. A small online shop using WooCommerce will have a completely different set of requirements than a large company that needs a powerful API for custom software.

This is where a side-by-side look at the top contenders comes in handy. We'll dig into the practical differences—fees, security, supported coins, and overall user experience—to give you a clear, honest picture. The goal is to help you confidently choose a gateway that fits your business like a glove, whether you need a simple plugin or a more robust, developer-focused solution.

Differentiating Gateways by Core Features

As you start exploring your options, you'll quickly see that not all gateways are created equal. Some are designed for absolute simplicity, offering plug-and-play solutions perfect for anyone who isn't a tech expert. Others are built from the ground up for developers, providing extensive APIs for deep, custom integrations.

The fee structures can also be wildly different. You might see a platform advertising a low 0.5% transaction fee, but they might also have hidden charges for converting crypto to fiat and sending it to your bank account. It’s the little details that count.

A crucial factor to consider is whether a gateway is custodial or non-custodial. A non-custodial gateway like BlockBee ensures funds go directly to your wallet, giving you full control and eliminating third-party risk. Custodial services hold your funds for you, which can be convenient but also introduces a central point of failure.

This distinction is absolutely fundamental. For many businesses, holding the keys to your own funds is a non-negotiable security advantage.

A Look at the Crypto Payment Landscape

The crypto payments scene is booming, with a yearly growth rate of about 22% and a projected market size of $4.5 billion. This isn't just hype; it's driven by real-world demand.

Bitcoin still leads the pack, accounting for 42% of all crypto payment transactions. However, stablecoins like USDT are quickly gaining traction because their price stability is a huge plus for both merchants and customers. These trends make it clear: you need a gateway that supports a solid mix of popular assets. You can get a better sense of the industry's direction from these in-depth crypto payment statistics.

Crypto Payment Gateway Feature Comparison

To help you see how different gateways stack up in the real world, we've put together a comparison table. It highlights the trade-offs between various providers, making it easier to pinpoint the best fit for your business model.

| Gateway | Typical Fee | Key Security Features | Supported Coins | Best For |

|---|---|---|---|---|

| BlockBee | Starts at 0.25% | Non-custodial | 70+ including BTC, ETH, USDT | Businesses of all sizes seeking low fees and full fund control. |

| Coinbase Commerce | 1% transaction fee | Custodial (Coinbase holds funds) | Limited major coins and stablecoins | Merchants already using the Coinbase ecosystem. |

| BitPay | 1% settlement fee | Custodial, KYC required | ~15 major coins and stablecoins | Larger enterprises needing established, regulated solutions. |

| NOWPayments | 0.5% + network fees | Semi-custodial options | 300+ coins | Businesses wanting the widest possible range of coin support. |

As you can see, your choice really boils down to your priorities.

If your main goal is keeping fees low and maintaining total control over your money, a non-custodial solution like BlockBee is a fantastic option. You hold your own keys, which is a massive win for financial independence.

On the other hand, if you prefer a more hands-off approach and don't mind a third party managing your funds, a custodial service like BitPay might work well, especially for larger companies needing serious compliance features.

Ultimately, the best crypto payment gateway is the one that perfectly aligns with your financial strategy and technical comfort level. For a deeper dive, check out our guide on accepting cryptocurrency payments for your business, which offers even more context for making this key decision.

Your Step-by-Step Integration Guide

Alright, let's move from theory to practice. This is where you see how a crypto payment gateway actually comes to life on your site. I'll walk you through the whole process using BlockBee as our example, showing you just how fast you can be ready to accept your first crypto payment.

The journey from signing up to seeing that first transaction come through is surprisingly quick. We'll cover creating your account, getting your API key, and installing a common eCommerce plugin like WooCommerce. Each step is straightforward, so don't worry if you're not a tech whiz.

As you plan your setup, it's smart to think about the bigger picture of Payment Gateway Integration and Maintenance. Considering the long-term management right from the start will save you headaches down the road and lead to a more reliable system for your business.

Getting Started with Your Account

First things first: you need an account. This will be your command center for everything related to your crypto payments. With a service like BlockBee, signing up takes just a couple of minutes and drops you right into your dashboard.

Think of the dashboard as your mission control. It's where you'll generate API keys, watch transactions as they happen, and decide how you want your funds handled.

Here’s a glimpse of what a typical dashboard looks like—it's designed to be clean and intuitive.

The layout puts the most important info, like wallet balances and recent payments, front and center. This kind of user-friendly design really helps take the intimidation out of financial tech.

Generating Your First API Key

An API key is basically a secure, secret key that lets your website talk to the payment gateway. It’s what proves that payment requests are actually coming from you, keeping the whole process secure.

Getting one is a piece of cake:

- Head over to the API section in your dashboard.

- Give your key a name you'll recognize, like "My WooCommerce Store."

- Click "Generate."

The system will give you a unique API key. Treat this key like a password. Keep it safe, don't save it in a public place, and never share it. You'll need it in the next step to hook up your store.

Installing a Plugin on Your Store

For most online businesses, the simplest integration method is a pre-built plugin. These handy tools do all the heavy lifting and coding for you. We'll use WooCommerce, one of the world's most popular eCommerce platforms, as our example.

The process usually looks like this:

- Download the Plugin: Grab the BlockBee for WooCommerce plugin directly from the official BlockBee website or the WordPress plugin directory.

- Install on Your Site: In your WordPress admin area, navigate to

Plugins > Add New, upload the file you just downloaded, and hit "Activate." - Enter Your API Key: Find the plugin's settings page. This is where you'll paste that secret API key you generated a moment ago.

Once you save those settings, your store is officially connected. Customers will now see a new option to pay with cryptocurrency when they check out.

Pro Tip: Before you go live, look for a "test mode" in the plugin settings. It lets you run through a few fake purchases to make sure everything works perfectly without using any real money.

Essential Post-Integration Tasks

Your work isn't quite done just because the plugin is active. A few final tweaks will make your payment system run smoothly and perfectly match your business needs.

Automated Fund Conversion: First, decide what you want to do with the crypto you receive. Do you want to hold it or cash it out? In your gateway’s dashboard, you can set up automatic conversions to send funds straight to your bank account as your local currency. This feature is a fantastic way to sidestep crypto price swings.

Instant Payment Notifications (IPNs): Next, get your notifications set up. IPNs are how the gateway tells your store, "Hey, this payment is confirmed!" This message automatically updates the customer's order status to "Paid" and kicks off your shipping or fulfillment process.

Monitoring Revenue: Finally, get comfortable with your dashboard's analytics. This is where you can track sales, see which coins your customers prefer, and watch your revenue grow over time. This data is pure gold for making smarter business decisions.

The Future of Digital Payments for Your Business

Adopting a crypto payment gateway is much more than just jumping on the latest tech trend. It's a strategic move to secure your business's place in the future of commerce. How we all buy and sell is changing fast, and digital currencies are at the heart of that shift.

Getting this technology integrated now is a direct investment in your company’s long-term health and ability to grow. You’re essentially future-proofing your operations against major shifts already in motion.

Think about the growing demand for instant, global transactions. Customers are tired of waiting days for an international payment to clear. A crypto gateway makes selling to someone across the world just as fast as selling to someone next door, opening up brand new markets without the usual banking headaches.

Emerging Trends and Tangible Opportunities

This evolution in digital payments is bringing some seriously powerful capabilities to the table. These aren’t just abstract ideas; they're emerging tools that can give your business a real competitive advantage. By getting ready now, you can translate these trends into concrete benefits for your bottom line.

A few key developments are shaping this new reality:

- AI-Powered Fraud Prevention: The smartest gateways are using AI to spot shady transaction patterns and block fraud before it happens. That’s a level of security old-school systems just can't match.

- Instant Global Settlements: Imagine receiving funds from anywhere in the world in seconds, not days. This is a complete game-changer for cash flow and makes expanding internationally so much simpler.

- A More Stable Regulatory Environment: As governments provide clearer rules for digital assets, the market matures. This reduces risk and builds confidence for both merchants and their customers.

These trends all point to one thing: a more efficient, secure, and globally connected financial world. For a business owner, this means lower operating costs, fewer losses to fraud, and the ability to reach a much larger customer base.

This isn't a small, niche market anymore. The crypto payment gateway market is projected to hit $6.03 billion, growing at a healthy 13.6% annually. This growth is driven by more people using crypto worldwide and a clear need for decentralized payment solutions that handle multiple currencies.

Your Strategic Investment in Tomorrow

Choosing the best crypto payment gateway is far more than a simple tech upgrade. It's a business decision that gives you the tools to succeed in the next era of digital commerce. It’s your ticket to a more efficient payment system, less exposure to problems like chargeback fraud, and a direct line to a new generation of global customers.

By making this move, you aren't just tacking on another payment option. You’re building a more resilient business prepared for sustained success. To dive deeper, check out our article on the future of crypto payments.

Got Questions About Crypto Payments? We've Got Answers.

Jumping into the world of digital currencies can feel like a big step, and it's natural to have questions. Let's clear up some of the most common things business owners wonder about when they're thinking about adding a crypto payment gateway.

"Do I Have to Hold Cryptocurrency Myself to Accept It?"

Nope, not at all. This is probably the biggest myth out there, and it holds a lot of businesses back. The reality is much simpler.

Modern payment gateways can instantly convert any crypto payment into your local currency, like US Dollars or Euros. So, a customer pays with Bitcoin, and you see the cash equivalent pop into your bank account. This setup gives you the best of both worlds: you can accept payments from anyone, anywhere, without ever having to worry about price swings in the crypto market.

"Are Crypto Transactions Actually Safe for My Business?"

Yes, and in many ways, they're even safer than traditional credit card payments. Every transaction is permanently recorded on a blockchain, which is like a digital ledger that can't be altered. Once a payment is made, it's final.

This is a game-changer for merchants. It almost completely wipes out the problem of chargeback fraud, which is a constant headache and a major expense for anyone who accepts credit cards. With crypto, you don't have that risk. Gateways can add even more layers of security with things like multi-signature wallets.

"How Hard Is It to Set Up a Crypto Gateway?"

You'd be surprised how easy it is. The best crypto payment gateway providers have put a ton of effort into making this a smooth process for everyone, regardless of their tech skills. If you're using a common e-commerce platform like Shopify, WooCommerce, or Magento, it's often as simple as installing a plugin with a few clicks.

And if you have a custom-built website or app? No problem. Good gateways provide developers with clean, well-documented APIs, making it straightforward for them to plug the payment system right into your existing setup.

"What About the Fees? How Do They Compare to Credit Cards?"

This is where you'll really see a difference. Crypto gateway fees are almost always lower. Credit card processors typically hit you with fees around 2.9% + $0.30 for every single sale.

In contrast, many crypto gateways charge a simple, flat fee of 1% or even less. Over time, especially for businesses doing a lot of sales or handling larger transactions, those savings add up in a big way.

Ready to unlock global markets and slash transaction fees with the best crypto payment gateway? BlockBee offers a secure, non-custodial solution with low fees and seamless integration. Get started today and see how easy it is to accept crypto payments.