Choosing a Crypto Payment Processor for Business

So, what exactly is a crypto payment processor for business? Think of it as a universal translator for money. It’s a service that lets you accept cryptocurrencies from customers and, in the blink of an eye, turns them into familiar cash like US dollars or Euros. It handles all the messy technical stuff and shields your business from price swings, so you don't have to be a blockchain guru to get started.

Why Your Business Should Consider Crypto Payments

Imagine opening your doors to a whole new world of tech-savvy, global customers practically overnight. That's the real power of a crypto payment processor. It’s not just another complicated piece of software; it's more like a universal adapter for modern commerce, plugging your business straight into a booming digital economy.

Bringing this technology into your business is more than just adding a new payment button to your checkout page—it's a smart move to keep your company ahead of the curve. The growth here is impossible to ignore. The global market for crypto payment gateways is set to explode as more businesses jump on board. This isn't a fad; it's a fundamental shift in how people spend and how smart businesses operate.

Access a Broader, Global Audience

One of the first things you'll notice is how you can blow past the old-school banking hurdles. For a lot of customers around the world, traditional payment methods are slow, expensive, or just not an option. A crypto payment processor for business smashes through those walls.

- Go Truly Borderless: You can take payments from anyone, anywhere, without getting bogged down by currency conversion headaches or cross-border delays.

- Connect with New Customers: This is a huge draw for a younger, digital-first crowd who actively look for businesses that speak their language and accept their preferred currencies.

- Simplify the Sale: For crypto users, a smooth and simple checkout experience means they're more likely to complete their purchase.

By getting rid of these geographical and financial roadblocks, you're essentially opening for business in a global market that might have been impossible to reach before, turning worldwide interest into real sales.

Improve Financial Efficiency and Security

Beyond just reaching more people, the day-to-day operational perks are a game-changer. Traditional payment systems have built-in costs and risks that crypto is perfectly designed to solve. Getting a handle on how different payment options affect your bottom line is key, especially when you're exploring advanced cash flow management strategies.

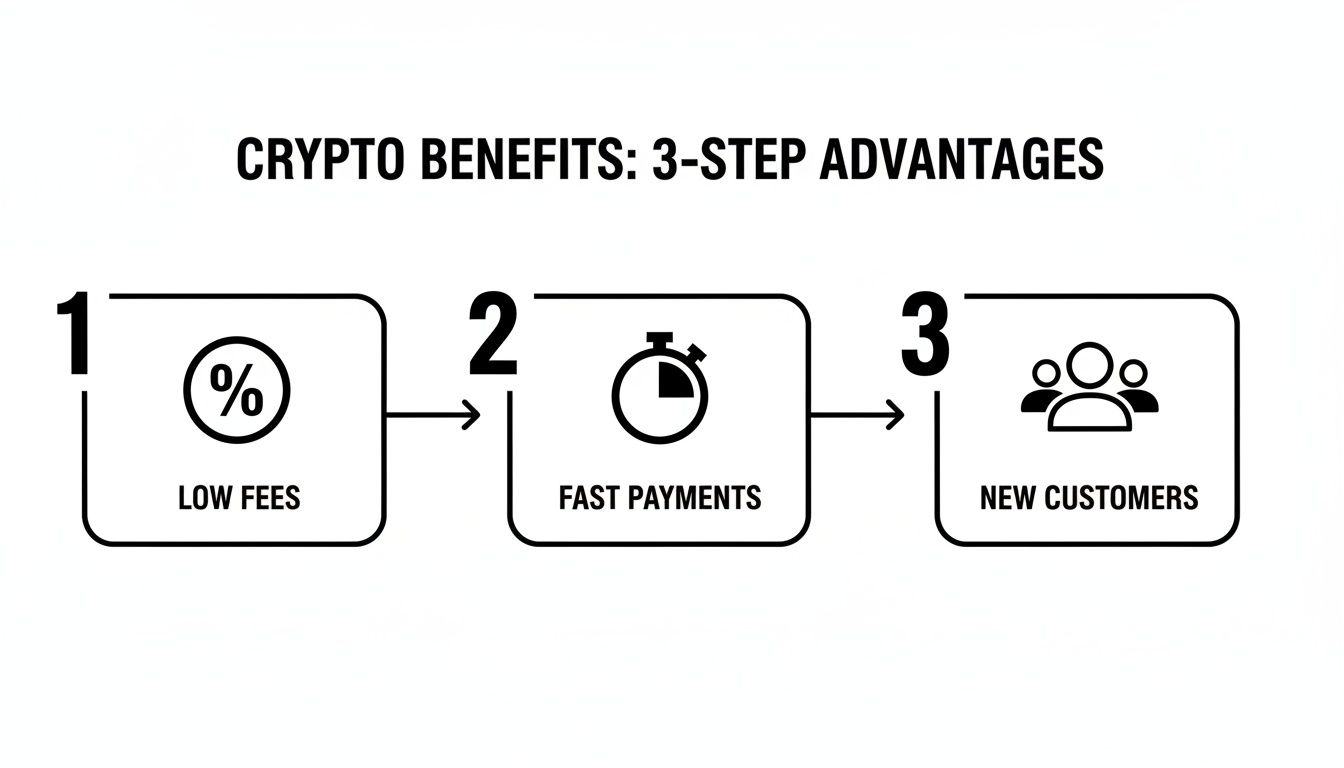

To get an idea of the immediate benefits, let's look at a quick summary.

Key Advantages of Using a Crypto Payment Processor

| Benefit | Impact on Your Business |

|---|---|

| Lower Transaction Fees | Directly boosts your profit margins by avoiding the typical 2-3% credit card fees. |

| No Chargeback Fraud | Crypto payments are final, which means chargeback scams become a thing of the past. |

| Faster Settlement Times | Money lands in your account in minutes or hours, not days, improving your cash flow. |

| Global Reach | Instantly accept payments from any country without the usual international banking friction. |

| Enhanced Security | Transactions are secured by cryptography on the blockchain, reducing the risk of data breaches. |

As you can see, the impact goes far beyond just accepting a new currency. For instance, those transaction fees really add up. Crypto fees are typically a fraction of the 2-3% that credit card companies take. That's pure profit going straight back into your business.

On top of that, the blockchain technology that powers these payments makes them irreversible. This simple fact all but wipes out the costly and frustrating problem of chargeback fraud. To dig deeper into how this works, take a look at our complete guide on the benefits of crypto payments for business. You’re not just cutting costs; you’re adding a serious layer of armor to your revenue.

How a Crypto Payment Processor Works Behind the Scenes

You might think accepting crypto payments is some kind of complicated, technical puzzle. In reality, it’s not that different from the online checkout process you already know. The best way to think of a crypto payment processor for business is as your personal currency translator—one that’s fluent in both traditional banking and the language of the blockchain.

This "translator" handles all the tricky conversations in the background. When a customer is ready to buy, it steps in to make sure the entire exchange is smooth and secure. It’s the bridge between your customer's digital wallet and your business bank account, managing every detail so the experience feels effortless for everyone.

Step 1: The Payment Request

Everything kicks off at your checkout page. Once a customer chooses to pay with crypto, the processor springs into action, instantly creating a unique payment request. This is much more than a simple bill; it’s a smart, dynamic package of information tailored for a single transaction.

This request usually contains:

- The exact amount of a specific cryptocurrency (like Bitcoin or Ethereum).

- A unique, one-time wallet address for the payment.

- A scannable QR code for a quick mobile experience.

- An expiration timer to lock in the current exchange rate and avoid payment mix-ups.

This setup is designed to prevent common errors. It makes sure the customer sends precisely the right amount to the right place, taking the guesswork out of the equation.

Step 2: The Customer Transfer

With the payment details on their screen, the customer just scans the QR code or pastes the address into their crypto wallet. They hit "send," and the funds start their journey across the blockchain.

From your perspective, this part is completely hands-off. Your payment processor is already watching the network, waiting to catch the incoming payment.

The real magic for your business is what this simple process unlocks: lower fees, quicker access to funds, and a whole new base of potential customers.

Each benefit—from cutting operational costs to improving your cash flow—is a direct result of how efficiently blockchain technology works under the hood.

Step 3: Blockchain Confirmation and Settlement

After the customer sends the crypto, the transaction is broadcast to its blockchain. This is where a worldwide network of computers gets to work, verifying the payment and adding it to the public ledger. It’s this decentralized confirmation process that makes the transaction irreversible and secure.

A great crypto payment processor won't leave you or your customer hanging. It uses smart monitoring to spot the payment almost immediately, often confirming the order after just a couple of network confirmations. This keeps the checkout experience fast and frustration-free.

But the work isn't done yet. As soon as the processor receives the crypto, it can instantly convert it to your local currency, like USD or EUR. This completely insulates your business from price swings. You always get the exact amount you charged, no matter what the crypto market is doing.

Finally, the processor gathers your funds and deposits them straight into your bank account on a schedule you choose—daily, weekly, or monthly. The entire journey, from a crypto wallet on the other side of the world to cash in your bank, is handled for you. You get all the benefits of crypto without ever having to manage it yourself.

What to Look For in a Crypto Payment Processor

Choosing the right crypto payment processor is a big decision for your business. Think of it less like picking a software tool and more like selecting a financial partner. The right one makes accepting crypto a breeze and can even open up new markets for you. The wrong one? It can create headaches, security risks, and a clunky experience for your customers.

Let's cut through the marketing fluff and get down to what really matters. This is your practical checklist for evaluating any processor, focusing on the core features that will directly impact your security, your workflow, and your bottom line.

How Many Coins and Networks Can You Accept?

First things first: what crypto can you actually accept? The whole point is to give your customers options, so a processor that only supports a handful of coins is already limiting your reach. You want to meet your customers on their terms, and that means offering the digital currencies they actually use.

A solid processor should give you access to:

- The Big Two: Bitcoin (BTC) and Ethereum (ETH) are the absolute baseline. They have the largest market share and are what most people think of when they hear "crypto."

- Popular Altcoins: Offering well-known coins like Litecoin (LTC), Ripple (XRP), or Cardano (ADA) shows you're catering to a broader, more crypto-savvy audience.

- Stablecoins (This is a big one!): Coins like USDT (Tether) and USDC (USD Coin) are pegged to fiat currencies. They're perfect for customers who want the speed of crypto without the rollercoaster of price swings.

- Multiple Networks: This is a more technical point, but it's crucial. A single stablecoin like USDT can live on different blockchains (like Ethereum, Tron, or Solana). Supporting multiple networks means your customers can choose the one with the lowest transaction fees, which they'll definitely appreciate.

Security and Who Holds the Keys (Custody)

When you're dealing with digital money, security is everything. A great processor is your first line of defense, using tough security measures to protect every single transaction. Look for things like multi-signature (multi-sig) wallets, which require more than one person to approve a transaction. This simple feature prevents a single point of failure and makes it much harder for anyone to move funds without authorization.

Beyond that, you have to make a huge decision about the custody model. This just means deciding who actually holds the private keys to your crypto—in other words, who has the final say over the funds.

The choice between a custodial or non-custodial processor is one of the most important you’ll make. It’s a fundamental trade-off between convenience and control. What's right for you really depends on how comfortable your business is with the technology and what your security philosophy is.

Let's break down how the two models stack up.

Comparison of Custodial vs. Non-Custodial Processors

This table gives you a clear, side-by-side look at the two approaches. Use it to figure out which model best fits your company's operational style and comfort level with managing digital assets.

| Feature | Custodial Processor | Non-Custodial Processor |

|---|---|---|

| Control of Funds | The processor holds your private keys and manages the funds for you. | You keep full control of your private keys and funds. Always. |

| Simplicity | Very easy to set up and use, much like a traditional bank account. | Requires a bit more know-how to manage your own wallet securely. |

| Security Risk | You're trusting the processor's security. If they get hacked, your money is at risk. | You are in charge of your own security. The risk comes from losing your keys. |

| Payouts | Payouts are sent from the processor's main pool on a schedule (e.g., daily). | Funds arrive directly in your wallet almost instantly after the transaction confirms. |

For any business that puts a premium on having total control and immediate access to its money, a non-custodial solution is the obvious choice. You never have to lose sleep over a third party freezing your account or getting hacked.

The Nitty-Gritty: Fees, Payouts, and Integrations

Finally, let's talk about the practical stuff that affects your daily operations. A processor's fee structure needs to be crystal clear. Most charge a simple transaction fee, usually somewhere between 0.5% and 1%. Watch out for sneaky hidden charges like setup fees, monthly minimums, or high markups when converting currencies.

The market for these services is growing fast. The global crypto payment apps market was valued at $623.92 million in 2023 and is on track to hit over $2.95 billion by 2035. This boom is fueled by more and more businesses getting on board, with Bitcoin expected to grab over 67.8% of the market thanks to its unmatched security and brand recognition. If you're interested in the data, you can explore the full market analysis on Research Nester.

Getting your money out is just as important. Can the processor instantly convert crypto to fiat so you don't have to worry about price volatility? Can you choose to get paid in USD or EUR? Can you set a daily or weekly payout schedule? The more flexibility you have, the better.

Lastly, it has to work with your existing setup. A good processor will have simple, plug-and-play integrations for major e-commerce platforms like WooCommerce, Shopify, and Magento. If you have a custom-built site, you'll need a well-documented and powerful API that lets your developers build a smooth checkout process without tearing their hair out.

Your Step-By-Step Integration Guide

Alright, let's move from theory to practice. Bringing a crypto payment processor for business into your operations is far more straightforward than most people think. The journey from making the decision to accepting your first crypto payment can be boiled down to a few clear, manageable steps. This guide will give you a simple roadmap without all the confusing technical jargon.

Think of it like setting up any other modern payment system. You don't need to understand the deep mechanics of a credit card network to add Stripe to your checkout, and the same idea applies here. Your chosen processor will do the heavy lifting, leaving you with just a few key decisions and a simple setup.

Let's walk through the four essential phases.

Step 1: Choose the Right Processor

This is the most important decision you'll make. You need a partner that actually fits how your business works. As we’ve covered, things like supported coins, security, and the custody model are huge. For businesses that want full control and top-tier security over their funds, a non-custodial processor like BlockBee is the way to go. This model ensures payments land directly in your wallet, cutting out any third-party risk.

When you're comparing options, create a shortlist based on these points:

- Fees and Transparency: Look for a simple, flat-rate fee. No hidden charges, no surprises.

- E-commerce Compatibility: Does it have ready-made plugins for your platform (like WooCommerce or Shopify)?

- Security and Control: Decide if a custodial or non-custodial model fits your comfort level with risk.

- Support: Is there a real person you can talk to when you need help? Check for dedicated business support.

Step 2: Complete Your Account Setup

Once you've picked your processor, it's time to create your account. This part is usually quick. You'll provide some basic business information and connect the crypto wallet where you want to receive your payments.

This is also where compliance kicks in. Any reputable processor will have built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. It might sound a bit intimidating, but the platform guides you through it, usually just asking for standard business documents. This step is non-negotiable for operating legally and securely—it protects you and your customers, and it's the mark of a truly professional service.

Step 3: Integrate the Payment Gateway

Now for the "techy" part—which is surprisingly simple for most people. The best processors offer one-click plugins for major e-commerce platforms. Installing a crypto payment gateway is often as easy as adding any other app to your online store.

For example, if you run on WooCommerce, you'd just:

- Download the processor's official plugin.

- Upload it to your WordPress dashboard.

- Activate it and pop in the API keys from your processor account.

That’s it. Seriously. For most businesses, this whole process takes minutes, not days. There's no custom coding or development work needed. The goal is to make accepting crypto just as easy as accepting a credit card.

If you have a custom-built website, you'll want a solid Application Programming Interface (API). A well-documented API gives your developers the tools they need to build the payment gateway directly into your existing checkout. You can learn more about how a flexible crypto payment gateway API makes a tailored integration possible.

Step 4: Configure Payouts and Go Live

The last piece of the puzzle is setting up your payout preferences. This is where you decide how you want to handle the crypto you receive. The best processors give you complete control here.

You can create rules to:

- Instantly convert all crypto payments into a fiat currency like USD or EUR to sidestep any price volatility.

- Hold certain cryptocurrencies if you want to start building a portfolio of digital assets.

- Split funds, automatically converting a portion to fiat while keeping the rest as crypto.

Once your preferences are locked in, run a couple of test transactions to make sure everything is working perfectly. After a successful test, you're ready to flip the switch. Now all you have to do is let your customers know you're accepting crypto and get your team ready for this next chapter.

Navigating Security and Compliance with Confidence

Let’s be honest. For any business owner thinking about crypto, the big three concerns are always security, volatility, and the ever-changing maze of regulations. These aren't small hurdles, but a solid crypto payment processor for business is designed to tackle them head-on.

Think of a good processor not just as a tool, but as your partner in risk management. It wraps a protective layer around every transaction, handling the technical and legal complexities so you don't have to. This isn't just about avoiding problems; it's about turning potential liabilities into a real operational advantage.

Your Shield Against Market Volatility

The number one question most merchants ask is about crypto’s infamous price swings. What happens if you accept Bitcoin for a $100 product, and an hour later it's only worth $90? A professional processor solves this instantly with a feature called instant fiat conversion.

The moment a customer's crypto payment is confirmed, the processor can automatically convert it into your local currency, whether that's US Dollars, Euros, or something else. It all happens behind the scenes.

This means you are completely insulated from market swings. You receive the exact fiat value of the sale, every single time, removing all guesswork and financial risk from the equation.

This feature is a true game-changer. It lets you welcome customers from the global crypto community—and benefit from low fees and quick settlements—without forcing you to become a crypto trader. You get all the upside with none of the downside.

Mastering Regulatory Compliance

Keeping up with financial regulations is another massive headache. Rules for Know Your Customer (KYC) and Anti-Money Laundering (AML) are non-negotiable, and getting them wrong can lead to serious fines.

This is where a top-tier processor really earns its keep. It builds these verification steps right into the payment flow, ensuring your business stays on the right side of the law without creating more work for you. Since the rules are constantly evolving, staying informed is key; a great starting point is this global guide to stablecoin regulation.

By outsourcing these complex requirements, the processor helps you:

- Mitigate Legal Risks: You can rest easy knowing you're meeting your legal obligations.

- Build Trust: Following the rules shows customers you're a serious, legitimate business.

- Save Time and Resources: You avoid the enormous cost of building a compliance department from scratch.

For a deeper dive into why these checks and balances matter, check out our guide on the importance of KYC in the crypto space.

Winning the Fight Against Chargeback Fraud

Anyone who has ever accepted a credit card knows the pain of chargeback fraud. A customer can dispute a charge weeks or even months later, triggering a forced refund and extra fees, even when the claim is completely baseless.

This is one area where crypto has a fundamental, built-in advantage. Because they are recorded on an immutable ledger, crypto transactions are final. Once a payment is confirmed on the blockchain, it cannot be reversed by the sender.

This finality wipes out the risk of traditional chargeback fraud. For businesses selling digital goods or operating in high-risk sectors, this is a huge relief. It protects your hard-earned revenue and cuts down on administrative chaos, offering a level of security that old-school payment systems just can't match.

Future-Proofing Your Business for the Digital Economy

Bringing a crypto payment processor into your business isn't just about adding another button to your checkout page. It's a fundamental move that signals you’re ready for the next chapter of commerce. You’re telling the world that your brand is an innovator, not just playing catch-up.

By opening your doors to digital currencies, you’re instantly connecting with a younger, tech-fluent, and global customer base. This is a crowd that actively looks for companies that fit their digital-first lives. For them, seeing a crypto payment option isn't just a minor convenience—it's a clear sign that you get it.

The Rise of Stablecoins in Global Commerce

Beyond winning over new customers, the practical benefits are massive, especially if you do business across borders. This is where stablecoins—digital currencies tied to stable assets like the US dollar—are becoming indispensable. They give you the best of both worlds: the speed and low fees of the blockchain, plus the price stability of traditional money.

This mix is a perfect recipe for international trade. It lets you settle payments with overseas partners in minutes, not days, sidestepping the frustrating delays and hefty fees that come with old-school bank transfers and currency conversions.

For any business with a global footprint, stablecoins are a game-changer. They strip the friction out of international commerce, making it faster, cheaper, and far more reliable to work with anyone, anywhere.

Emerging Trends Beyond Simple Payments

If we look down the road, the tech powering a crypto payment processor for business is already moving past simple transactions. The real excitement isn't just about how you get paid; it's about what you can do with that money once it’s in your hands.

Here are a few trends to keep an eye on:

- DeFi Integrations: Think of a payment gateway that does more than just process sales. In the near future, integrations with Decentralized Finance (DeFi) protocols could let you put your idle cash to work, automatically earning interest and turning your payment system into a profit center.

- Programmable Money: Smart contracts are set to unlock incredibly sophisticated and automated payment systems. This could be anything from instantly splitting royalties on a creative project to triggering milestone-based payments for freelancers, all handled with complete transparency on-chain.

- Seamless Cross-Chain Swaps: The technology is getting better at letting different blockchains talk to each other. Soon, a customer could pay you with a token on one network, and you could receive it as an entirely different coin on another network—all happening instantly and invisibly in the background.

At the end of the day, adopting crypto payments is about building a more nimble, resilient, and future-ready business. It’s a foundational step that puts you firmly ahead of the curve, ready for whatever comes next in the digital economy.

Frequently Asked Questions

Jumping into a new payment technology naturally brings up a few questions. Let's walk through some of the most common and practical things business owners wonder about when they're looking at a crypto payment processor for business. My goal here is to give you clear, straightforward answers so you can feel confident moving forward.

Is Accepting Cryptocurrency Safe for My Business?

Absolutely, as long as you partner with a reputable processor. Think of these platforms as your expert guide—they handle all the tricky blockchain stuff behind the scenes, using top-notch security to keep every transaction safe.

The real game-changer for safety is a feature called instant fiat conversion. This means the moment a customer pays you in crypto, the processor can instantly convert it to your local currency, like USD or EUR. This completely protects you from the price swings crypto is known for. On top of that, blockchain payments are final, which is a powerful defense against the chargeback fraud that plagues credit card transactions.

Do I Need Technical Knowledge to Set This Up?

Not in the slightest. The best crypto payment gateways are designed to be incredibly user-friendly. If you're running your store on a platform like Shopify, WooCommerce, or Magento, getting set up is usually as simple as installing a plugin and copying in your API keys.

The whole process is meant to feel as familiar as adding Stripe or PayPal. You definitely don't need to be a developer or a blockchain whiz to get up and running.

The whole point of a modern crypto payment processor is to make this technology available to everyone. All the complex work happens in the background, so you can stay focused on what you do best: running your business.

How Do I Handle Taxes for Crypto Payments?

This part is much less complicated than it seems, especially with the right tools. Good processors give you detailed transaction reports and dashboards that make bookkeeping a breeze. And if you use that instant fiat conversion feature we talked about, your accounting process barely changes.

You just log the fiat amount you received for the sale, exactly like you would with any other payment. That said, tax rules for digital assets can be different depending on where you are. It's always a good idea to have a quick chat with a tax professional who gets crypto to make sure you're ticking all the right boxes.

Will My Customers Actually Pay with Crypto?

You might be surprised. The global community of crypto users isn't just big; it's growing incredibly fast. This is often a tech-savvy and affluent crowd that goes out of its way to support businesses that fit their digital-first lifestyle.

By adding crypto as a payment option, you're doing more than just expanding your checkout. You're sending a clear message that your business is modern and thinking ahead. This can really set you apart, helping you attract new customers from all over the world—especially in international markets or with younger shoppers—who you might have otherwise missed.

Ready to unlock global markets and reduce transaction fees? With BlockBee, you can start accepting crypto payments securely and easily. Our non-custodial platform gives you full control over your funds with simple plugins for all major e-commerce platforms. Get started with BlockBee today!