kyc in crypto: A Practical Guide for Businesses

Think of crypto KYC (Know Your Customer) as the digital version of showing your ID to open a bank account. It's the standard procedure crypto exchanges and other financial services use to make sure you are who you say you are. This isn't just about ticking regulatory boxes; it's about building a safer, more trustworthy financial ecosystem for everyone.

Bridging Trust in the Digital Asset World

For a long time, crypto had a reputation as the "wild west" of finance, a place where total anonymity was the main draw. But for digital assets to really hit the mainstream, they had to earn the trust of everyday users, regulators, and traditional banks. This is where KYC comes in.

KYC acts as a crucial bridge, connecting the decentralized ideals of early crypto with the security and compliance demands of the global financial system. The process is straightforward: platforms collect and verify your information to confirm your identity. By doing this, they can dramatically cut down on the risk of the illegal activities that used to be a major headache for the industry.

The Core Purpose of KYC

At its heart, KYC is all about managing risk. The main goal is to stop bad actors from taking advantage of the system and to keep consumers safe. Implementing these checks is a direct way to fight serious financial crimes that threaten the integrity of the entire crypto world.

The key objectives are pretty clear-cut:

- Preventing Money Laundering: By linking transactions to a real person, KYC makes it incredibly difficult for criminals to wash their dirty money.

- Fighting Terrorist Financing: It gives authorities a way to trace and cut off the money flowing to terrorist groups.

- Combating Fraud: Verifying identities helps protect users from all sorts of trouble, including scams, identity theft, and having their accounts taken over.

If you want to dig deeper into the fundamentals, this guide to KYC and KYB for businesses does a great job of breaking down the core concepts that apply everywhere, not just in crypto.

By linking digital transactions to real-world identities, KYC transforms crypto from an anonymous frontier into a more accountable and transparent financial network. This shift is critical for attracting institutional investment and fostering widespread public trust.

Getting a handle on the basic https://blockbee.io/blog/post/kyc-meaning-crypto is the first step for any business that wants to operate safely in this space. As the industry grows up, these verification steps have become less of a regulatory chore and more of a badge of honor.

They show customers and partners that a platform is serious about security, compliance, and building for the long term. This foundation of accountability is exactly what the digital asset economy needs to ensure its continued health and growth.

The Global Regulations Driving Crypto KYC

The push for KYC in crypto isn't happening in a vacuum. It’s a coordinated global response to the unique challenges that come with digital assets. This regulatory movement is all about bringing cryptocurrency up to the same standards as traditional finance, making the whole ecosystem a lot safer for everyone.

Think of it this way: at the heart of this global effort is the Financial Action Task Force (FATF). They’re an intergovernmental body that sets the international playbook for fighting money laundering and terrorist financing. Essentially, the FATF is the architect drawing the blueprints for global financial security.

The FATF and the Crucial Travel Rule

The FATF’s biggest splash in the crypto world came from its "Travel Rule." Don't let the name fool you; this has nothing to do with planes or passports. It’s all about information traveling alongside a financial transaction.

The Travel Rule requires Virtual Asset Service Providers (VASPs)—think crypto exchanges and wallet services—to collect and share identifying info for both the sender and recipient on transactions over a certain amount, usually around $1,000.

This single rule was a game-changer. It effectively put an end to the days of anonymous, high-value transfers on regulated platforms. By creating a transparent data trail, it gives law enforcement a path to follow, just like they have in the traditional banking system. This makes it incredibly difficult for bad actors to move dirty money without getting caught.

National Laws Putting Standards into Action

While the FATF draws up the international standards, it’s up to individual countries to turn them into actual, enforceable laws. This approach creates a powerful, multi-layered regulatory environment that leaves crypto businesses with no choice but to take KYC seriously.

Know Your Customer (KYC) requirements are no longer a 'nice to have' feature; they are a fundamental cornerstone of compliance for any crypto exchange or VASP. This change is driven by directives like the FATF's updated Recommendation 15, which extends Anti-Money Laundering (AML) duties—including KYC and the Travel Rule—to virtual assets worldwide. You can learn more about the critical compliance demands for crypto exchanges on KYC-Chain.com.

Two major legal frameworks really highlight this global trend:

The Bank Secrecy Act (BSA) in the United States: This is a foundational piece of U.S. financial law. It requires all financial institutions, including crypto exchanges that serve American customers, to help the government detect and prevent money laundering. This means they have to build out AML programs, report suspicious activity, and keep detailed records on their customers.

The EU’s Anti-Money Laundering Directives (AMLDs): Across Europe, a series of directives create a unified legal framework for all member states. The more recent versions, like the 5th and 6th AMLDs, specifically name crypto exchanges and custodian wallet providers as "obliged entities." This subjects them to the same strict rules as banks, forcing them to perform customer due diligence and report any fishy transactions.

Together, these international standards and national laws are weaving a regulatory net that is steadily closing old loopholes. For any crypto business that wants to be taken seriously and achieve long-term success, strong KYC in crypto is no longer optional. It’s the price of admission to the mainstream financial world.

How the Crypto KYC Process Actually Works

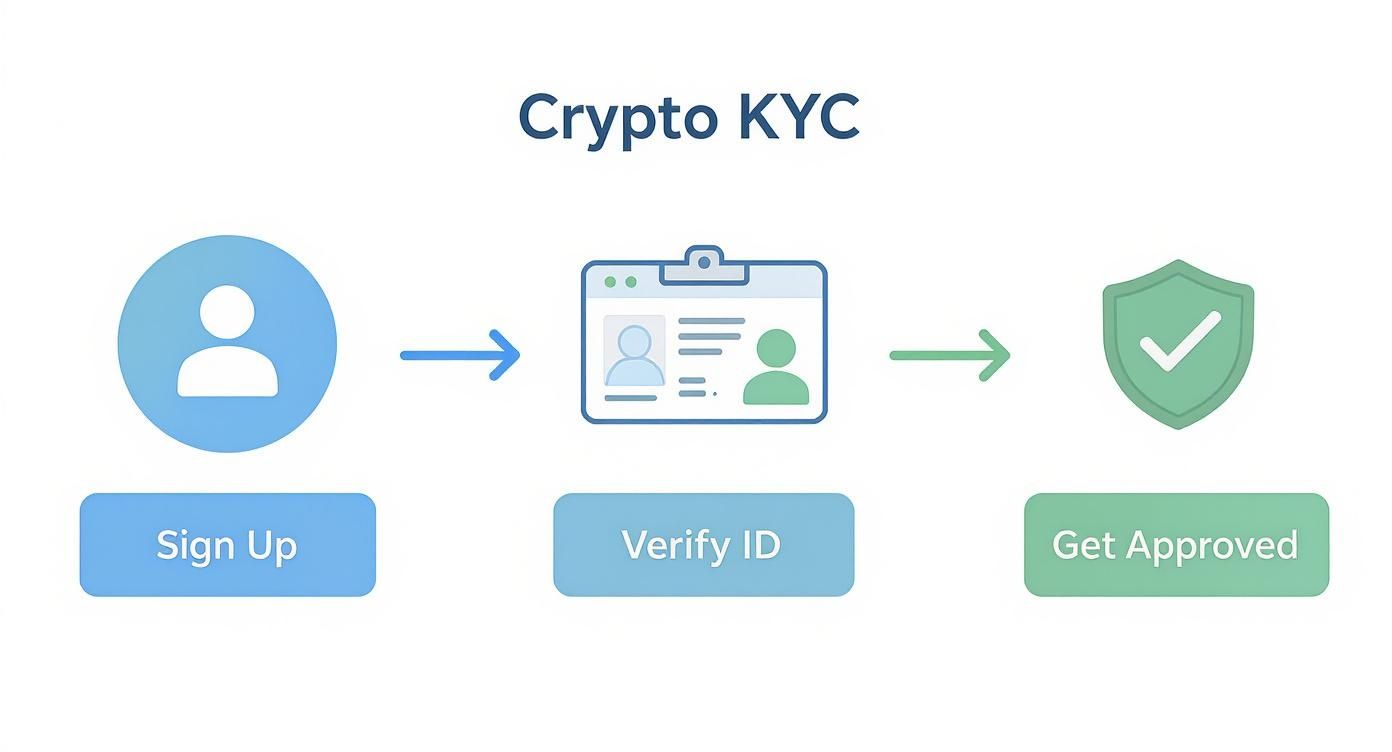

So, what does this all look like from your side of the screen? For anyone signing up to a new crypto platform, the KYC process feels like a series of digital checkpoints. It’s designed as a step-by-step journey, starting with the basics and asking for more information only as you need access to more features. This tiered approach is a smart way to balance user-friendliness with serious regulatory requirements.

The first step is almost always a breeze. You’ll hand over an email address or a phone number to get your account set up. This initial layer is really just about giving you a unique spot on the platform, and it's often enough to let you poke around or maybe make a tiny deposit.

But to get to the good stuff—like actually trading or cashing out—you have to start climbing the verification ladder. This is where the real KYC in crypto kicks into gear.

The Tiers of Identity Verification

Most exchanges and other virtual asset service providers (VASPs) don’t just have a one-size-fits-all verification. Instead, they use a tiered system. Each level you unlock requires a bit more personal info, but in return, you get higher transaction limits and access to more of their services. Think of it like a security pass: a basic pass gets you in the lobby, but you need a higher-clearance one to access the trading floor.

To give you a better idea of how this usually plays out, we've broken down the common verification levels.

Crypto KYC Verification Tiers Explained

This table shows how a typical tiered KYC system works, outlining what information you'll need to provide and what you get in return at each stage.

| KYC Level | Information Required | Typical Account Features |

|---|---|---|

| Level 0 (Pre-KYC) | Email address or phone number | Account creation, platform exploration, sometimes very small crypto deposits. |

| Level 1 (Basic) | Full legal name, date of birth, country of residence | Limited trading, low-value deposits and withdrawals, screening against sanctions lists. |

| Level 2 (Full) | Government-issued ID (passport, driver's license) | Higher transaction limits, access to most trading features, full deposit/withdrawal capabilities. |

| Level 3 (Advanced) | Proof of address (utility bill, bank statement) and/or biometric selfie ("liveness check") | The highest transaction limits, access to all platform features, including OTC desks or advanced trading options. |

This tiered structure ensures that the verification process matches the level of risk. A user just exploring the platform doesn't need to hand over a passport, but someone moving significant funds will undergo a much more thorough check.

Working away in the background is some pretty sophisticated software. AI-powered tools scan your documents in real-time, checking for fakes, verifying that the data matches up, and using facial recognition to confirm your selfie matches your ID. This tech makes the whole process faster and way more secure than old-school manual reviews ever could be.

KYC isn't just a one-and-done setup process. It’s the start of an ongoing relationship. Platforms continuously monitor accounts for strange activity, which is a crucial part of keeping everyone's funds safe.

This initial identity check is just the first line of defense. Once you're verified, exchanges rely on other tools to keep an eye on the money moving through their systems. A great next step is to understand how crypto transaction monitoring works, as this is the process that detects and flags suspicious financial activity. It's the perfect partner to KYC, working 24/7 to create a safer crypto ecosystem for all of us.

The Real Business Impact of Implementing KYC

For any business in the crypto space, bringing KYC into the fold isn't just about ticking a compliance box—it's a major strategic move with real consequences. You're constantly weighing the costs against the benefits, knowing that the road to becoming a legitimate, trusted player involves some serious trade-offs. Think of it less as a regulatory chore and more as an investment in the future of your entire operation.

Let's start with the challenges, because they're very real. As regulators have gotten stricter, the cost of compliance has shot up. Crypto firms are pumping more and more money into their identity verification budgets just to stay on the right side of the law. These costs aren't trivial; they cover everything from sophisticated software and dedicated compliance teams to audits and legal advice across multiple countries. There's also the user experience to consider. A complicated sign-up process can be a deal-breaker, with some data suggesting that around 25% of potential crypto customers will simply give up and walk away if KYC feels too cumbersome.

This visual gives you a clear picture of what that user journey looks like, from the moment someone signs up to when they're fully verified.

As you can see, it's a multi-step process designed to build a foundation of trust and ensure every user is properly vetted.

The Strategic Upside of Robust KYC

Despite those hurdles, the reasons for embracing a solid KYC framework are compelling. The most immediate win is building trust. When a user sees you're taking identity verification seriously, it sends a powerful message: you're a secure, professional platform they can rely on. In a market as noisy as crypto, that trust is what creates loyal customers and sets you apart.

Beyond customer perception, strong KYC opens doors that would otherwise be bolted shut. Traditional financial players like banks and payment processors are extremely wary of partnering with crypto companies that look like the "wild west."

A well-documented KYC program is non-negotiable for securing banking services, enabling seamless fiat-to-crypto on-ramps and off-ramps. It’s the key that opens the door to the mainstream financial system.

A solid compliance setup also makes your business far more appealing to institutional investors. Venture capitalists and big investment funds do their homework, and a clear, auditable KYC process shows them you're managing risk properly and are built to last. It’s a signal of legitimacy that's crucial for getting the capital you need to scale and innovate. As you grow, you'll also want to figure out how to accept crypto payments for business in a way that's both compliant and efficient.

At the end of the day, the costs of KYC in crypto are real, but the strategic return on that investment is undeniable. It's what helps a business evolve from a high-risk venture into a trusted, bankable, and investable company poised for long-term success.

How KYC Is Evolving for Global Tax Compliance

Know Your Customer checks are no longer just about security. While they started as a way to fight money laundering and fraud, KYC in crypto is now being pulled into a much bigger arena: global tax compliance. Tax authorities around the world are waking up to digital assets, and they see KYC as the key to bringing the crypto world into the fold. This shift is all about creating a new level of financial transparency and weaving crypto deeper into the fabric of the traditional economy.

Leading the charge is the Crypto-Asset Reporting Framework (CARF), an international standard that’s a real game-changer. Think of CARF as a global pact between countries to make sure crypto users can't simply hide their assets from the taxman by using offshore exchanges. It forces crypto platforms to collect user data and share it with tax agencies, creating a single, standardized rulebook for everyone to follow.

A New Layer of Reporting for Businesses

So, what does this mean for crypto businesses? In short, a whole new set of responsibilities. It’s no longer enough to just verify someone’s identity to tick the anti-fraud box. Now, these platforms are being deputized as data collectors for tax authorities.

This trickles down to the onboarding process. Businesses now need to dig a little deeper and ask users for specifics about their tax residency. All this information gets bundled up and sent to the right government agencies, making sure crypto profits are taxed just like gains from stocks or real estate.

CARF is a coordinated global push to close the tax loopholes that have existed in the crypto economy for years. For businesses, compliance is no longer just about stopping bad actors—it's now a fundamental part of tax administration.

What This Means for Crypto Users

If you’re a regular crypto user, this evolution means you'll be asked to share more about yourself. When signing up for an exchange, you’re already used to providing a government ID and a selfie. Now, you’ll also likely have to self-certify which country you pay taxes in. It's an extra step, but it’s what allows these platforms to meet their obligations and helps you stay on the right side of your local tax laws.

This international push for transparency is picking up steam fast. Over 60 countries, including every single G7 member, have signed on to CARF and are aiming to have it in place by 2027-2028. Under these new rules, crypto service providers won't just collect tax residency info; they'll need detailed transaction data, too. This dramatically expands their KYC duties. You can read more about the CARF global crypto framework to get a sense of just how big this change is.

Ultimately, baking tax compliance directly into KYC is a sign that the crypto industry is growing up. It’s a clear signal that regulators now view digital assets as a serious, legitimate part of the global financial system.

Building a Crypto Compliance Strategy That Lasts

If you're building a serious business in the crypto space, you have to think about compliance proactively. For any legitimate company, implementing solid KYC in crypto isn't just a box to check—it's the foundation for building trust and achieving long-term success.

The real trick is finding the right balance. You have to meet strict regulatory rules and maintain tight security, all without making the sign-up process a nightmare for new users. A clunky, slow verification experience will send potential customers running for the hills, but weak compliance opens you up to massive legal and financial headaches.

The Path Forward for Businesses and Users

For businesses, the smart move is to see KYC as a strategic investment, not just a cost. Getting compliance right from the start opens doors to critical partnerships with banks and payment processors. It also attracts serious institutional investors and builds a reputation for security that users genuinely appreciate.

For users, the trade-off is pretty straightforward: sharing some identity information gets you into a safer, more reliable financial ecosystem.

As the crypto industry merges more with traditional finance, clear and efficient identity verification will be the very thing that separates the next generation of trusted platforms from the rest.

Ultimately, a strategy built to last is one that treats regulation as an opportunity, not an obstacle. It's about combining smart technology with a user-focused design to create an environment that feels both seamless and secure. This is what will distinguish the enduring players from the short-lived projects in the ever-changing world of crypto.

Your Top Questions About Crypto KYC, Answered

Jumping into the world of crypto usually brings up a lot of questions, especially around identity and security. Let's break down some of the most common things people ask about KYC in crypto to give you a clearer picture.

Can I Still Buy Crypto Without KYC?

Yes, you can, but it’s a path that comes with serious trade-offs and higher risks. You’ll find that decentralized exchanges (DEXs) and some peer-to-peer (P2P) platforms let you trade without formal ID checks. The catch? These venues often lack the security measures and consumer protections you'd find on a regulated exchange.

Most major exchanges—the ones that connect to the traditional banking system—now require KYC. They have to, in order to comply with global anti-money laundering (AML) laws. For the average user, sticking with these regulated platforms is almost always the safer and more dependable choice.

How Do Crypto Exchanges Keep My KYC Data Safe?

Legitimate exchanges take the security of your personal data very seriously. They use a whole host of advanced measures to lock down your information and prevent anyone from getting unauthorized access.

Here are a few of the security practices they rely on:

- End-to-end encryption scrambles your data from the moment you send it, making it unreadable to anyone else.

- Secure offline "cold storage" is used for the most sensitive documents, keeping them completely disconnected from the internet and out of reach of hackers.

- Strict internal access controls mean that only a small number of vetted employees can ever view your information, and only when absolutely necessary.

Of course, no system is 100% perfect, but established exchanges have built their reputations on protecting user data. As a good habit, you should always add another layer of security yourself by enabling two-factor authentication (2FA) on your account.

The security of your data is a top priority for legitimate crypto platforms. Their commitment to robust encryption and access controls is a cornerstone of building user trust and ensuring long-term viability in a regulated market.

Why Does One Exchange Ask for More Info Than Another?

You've probably noticed that the amount of information required can be wildly different from one platform to another. This usually boils down to a couple of key factors. First is the exchange's home base—platforms operating out of heavily regulated areas like the United States or the European Union will naturally have stricter rules to follow. For a comprehensive approach to combating financial crime, executives should also consult a detailed AML compliance checklist to fortify their crypto compliance programs.

The other big reason is tiered verification. Most exchanges have different levels. A basic tier might just ask for an email and phone number, giving you limited functionality. If you want to unlock higher withdrawal limits or use more advanced trading features, you'll need to complete the full identity check, which typically means submitting a government-issued ID and proof of address.

Ready to integrate secure and efficient crypto payments into your business? BlockBee offers a non-custodial solution with low fees and easy integration for major e-commerce platforms. Streamline your crypto transactions with BlockBee today.