Understanding KYC Meaning Crypto: Why It Matters for Traders

If you’ve ever signed up for a crypto exchange and been hit with a "KYC" prompt, you might have wondered what it means. It’s simple: KYC stands for Know Your Customer.

Think of it just like opening a new bank account. The bank needs to see your ID to prove you are who you say you are. KYC in the crypto world is the exact same idea—it’s a standard identity check required by trading platforms.

Decoding KYC in the World of Crypto

At its heart, KYC is a set of rules and procedures that crypto exchanges and other services use to collect and confirm user information. This process acts as a crucial bridge, connecting the pseudonymous nature of crypto with the established regulations of the global financial system.

It's not just a box-ticking exercise. KYC is a foundational layer of security and trust, designed to make the entire crypto ecosystem safer for everyone involved. The rise of KYC requirements directly mirrors crypto's own journey from a fringe hobby into a serious financial industry. As the stakes got higher, so did the need for accountability.

Why KYC Became So Important

In the early days, one of crypto's biggest draws was its anonymity. But that same privacy also opened the door for criminals to exploit the system for illegal activities.

To clamp down on this, regulators across the globe started mandating that crypto businesses verify their users' identities. This is why you see KYC everywhere now. For a deeper dive into the specifics and how it differs from business verification, this comprehensive guide on KYC and KYB is a great resource.

So, why do exchanges go through all this trouble? The main goals are pretty clear-cut:

- Fight Financial Crime: KYC is the first line of defense against money laundering, terrorist financing, and other fraudulent activities.

- Stay Compliant: To operate legally, platforms must adhere to strict Anti-Money Laundering (AML) laws. Failing to do so can result in crippling fines and shutdowns.

- Protect Their Users: By verifying identities, exchanges add a powerful layer of security that helps prevent scams and protect your account from being compromised.

- Build Trust and Legitimacy: A transparent, compliant market is one that attracts serious investors—both individuals and large institutions. It’s what helps crypto grow up.

For a quick overview, here's a simple breakdown of the core components.

Crypto KYC at a Glance

| Component | What It Is | Why It Matters |

|---|---|---|

| Identity Verification | The process of confirming a user's identity using official documents like a driver's license or passport. | It ensures that users are real people, preventing the creation of fake or anonymous accounts for illicit purposes. |

| Customer Due Diligence (CDD) | A background check to assess a user's risk profile. This can include looking at their financial history or country of residence. | Helps platforms identify high-risk individuals and monitor their transactions for suspicious activity. |

| Ongoing Monitoring | The continuous review of user accounts and transactions to spot unusual patterns that might indicate financial crime. | Financial crime isn't a one-time event. Ongoing checks ensure the platform stays secure and compliant over the long term. |

Ultimately, getting to grips with what KYC means is essential for anyone who wants to trade or invest in crypto today. It’s a key part of what’s making the industry more mature, stable, and ready for mainstream adoption.

The Unseen Forces Behind Crypto's KYC Shift

The move from optional to mandatory KYC in the crypto world didn't just happen overnight. It was a direct response to some powerful global pressures that came with the industry’s explosive growth and, let's be honest, the shadier side of its anonymous beginnings. For crypto exchanges to grow up from niche forums into legitimate financial players, they had to start following the same rules as everyone else.

The biggest push came from the need to fight financial crime. As crypto took off, so did its appeal for illegal activities like money laundering and funding terrorism. The ability to send money across borders with no name attached became a massive headache for governments and regulators everywhere. This kind of negative spotlight forced the industry to clean up its act and put real controls in place.

The Global Watchdog Steps In

The key player in this whole shift is the Financial Action Task Force (FATF). You can think of the FATF as the world’s financial police. It’s an inter-governmental body that sets the global standards for Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT).

The FATF’s rules aren't just gentle suggestions; they form the bedrock of financial law for over 200 countries. So, when the FATF decided its rules also applied to "virtual asset service providers" (VASPs)—which is regulator-speak for crypto exchanges—it was a seismic event for the industry.

To fall in line, exchanges had no option but to start verifying who their customers were. If you want to go deeper into the regulatory maze, a comprehensive guide to KYC and AML compliance is a great place to start.

Comply or Die

Beyond just avoiding the regulator's wrath, KYC quickly became a simple matter of survival. For a crypto exchange to operate, it needs a bridge to the traditional financial system—it needs bank accounts. And banks, which are held to the same strict AML laws, are incredibly careful about who they do business with.

An exchange without a proper KYC program is a huge red flag for a bank. It’s seen as a major risk, making it almost impossible to get the banking partners needed to handle fiat currencies like the US Dollar or Euro. Suddenly, the incentive to comply became crystal clear.

- Securing Bank Accounts: Banks simply won't partner with platforms that could get them into trouble for facilitating money laundering.

- Dodging Massive Fines: Regulators in the U.S., E.U., and elsewhere are not shy about handing out multi-million dollar penalties for non-compliance.

- Building Trust: A solid KYC process tells everyone—users, investors, and potential partners—that you're a serious and trustworthy business.

At the end of the day, KYC adoption is a sign that crypto is growing up. It’s the cost of entry to the global financial stage and a crucial step in protecting the entire ecosystem from bad actors.

How the Crypto KYC Process Actually Works

Going through KYC verification on a crypto exchange can feel a bit intimidating, but it’s really just a standard identity check. Think of it like opening a new bank account—the platform needs to confirm you are who you say you are before letting you move money around. It's a structured process designed to be secure and straightforward.

The whole thing kicks off when you sign up. You'll start by providing some basic personal information, like your full legal name, date of birth, and home address. This first step is simple, but it creates the foundation for the rest of the verification.

The Core Verification Steps

Once you've entered your basic details, you'll need to prove they're real. This is where you upload official documents to back up your claims. The requirements are pretty standard across most platforms:

- A Government-Issued ID: You’ll need to take a clear picture of your passport, driver's license, or national ID card. The system uses this to confirm the name and birthdate you provided match an official record.

- A "Liveness" Check: To make sure it's really you (and not just someone with a stolen photo), you'll usually be asked to take a selfie or a short video of yourself. This is a quick biometric scan that adds a powerful layer of security against fraud.

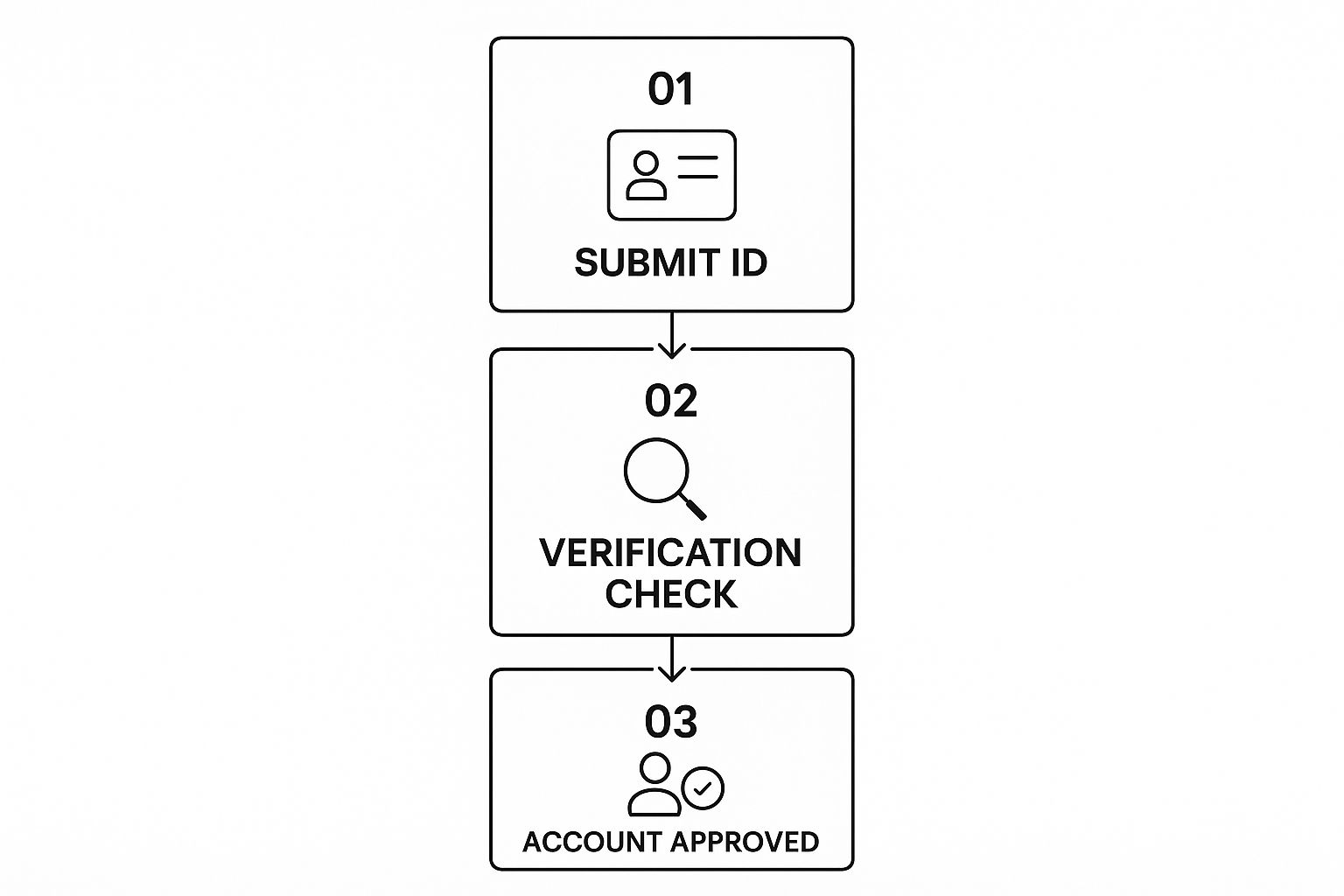

This simple flow shows just how streamlined the process usually is, from submission to approval.

As you can see, it’s a direct path designed to get you verified securely and without a lot of hassle.

Understanding KYC Tiers and Limits

KYC isn't always an all-or-nothing deal. Most exchanges use a tiered system, which means the more information you provide, the more access you get. This lets you choose a level of verification that fits how you plan to use the platform.

This tiered structure creates flexibility. A casual user who only wants to dabble with small amounts might be perfectly happy with a basic level of verification, while a serious trader will want to complete the full process to unlock higher withdrawal limits and advanced features.

Here's a look at how these verification tiers typically break down on a crypto exchange.

Understanding KYC Verification Tiers

| KYC Level | Required Information | Typical Daily Limit | Features Unlocked |

|---|---|---|---|

| Tier 1 | Email Address, Phone Number | $100 - $1,000 | Basic crypto deposits and small withdrawals |

| Tier 2 | Full Name, DOB, Address, Government ID (e.g., Driver's License) | $10,000 - $50,000 | Higher withdrawal limits, fiat (USD, EUR) deposits |

| Tier 3 | Liveness Check (Selfie), Proof of Address (e.g., Utility Bill) | $100,000+ | Unrestricted access, OTC trading, margin trading |

By offering different levels, exchanges make it easier for people to get started without immediately having to hand over a ton of personal data.

In fact, some platforms are pushing this idea further. You can read more about how some are implementing relaxed KYC requirements for low and mid-tier transactions to make crypto more accessible.

Ultimately, completing the highest KYC tier gives you the keys to the kingdom—full, unrestricted access to trade, withdraw, and use every feature the platform has to offer.

Connecting KYC to the Global Fight Against Fraud

To really get why KYC is so important to crypto exchanges, you have to look at the problem it was built to solve. KYC isn't just some bureaucratic hoop to jump through. It's a direct response to a very real and growing global issue: financial crime in the crypto space.

As digital assets weave themselves into the mainstream, they naturally become a bigger and bigger target for bad actors. This isn't a small problem, either. The numbers paint a pretty clear picture of a world scrambling to keep up with illicit activity.

A recent report revealed that global crypto fraud has jumped by an average of 48% in recent years. This spike isn't happening evenly, though. Some parts of the world are in a much tougher fight against financial crime than others. You can dig into the data and see how crypto KYC helps combat these trends.

This data really drives home a critical point: without strong identity verification, crypto platforms can accidentally become safe havens for illegal activity. That's a massive risk for both the exchange and every legitimate user on it.

A Regional Look at the Fraud Problem

The fight against crypto fraud looks completely different depending on where you are in the world. It’s a complex global puzzle, and each region is dealing with its own unique set of challenges that call for different security and regulatory game plans.

Let's break down the dramatic increases we've seen in specific areas:

- Africa: This region saw a mind-boggling 112% increase in crypto-related fraud. It's a stark reminder of how quickly bad actors can exploit emerging markets.

- United States and Canada: North America wasn't far behind, with an 86% jump, proving that even well-established financial markets are far from immune.

- The Middle East: A 79% rise here shows just how widespread this problem has become.

These numbers make it obvious why KYC is seen as the first line of defense. By simply confirming who their users are, platforms make it immensely more difficult for criminals to hide in the shadows.

How Regulators Are Responding

As you’d expect, governments and international bodies aren’t just sitting back and watching this happen. They're rolling out stricter rules to clamp down on the problem.

One of the biggest moves we’ve seen is the EU's "Travel Rule." This rule forces crypto service providers to collect and share information about who is sending and who is receiving funds for every transaction. It's a direct link to KYC, making identity data a fundamental part of every crypto transfer.

The relationship is simple: as crime goes up, the demand for tougher compliance follows. This is precisely where tools for anti-money laundering transaction monitoring become absolutely essential. They help exchanges automatically flag sketchy activity as it happens. This regulatory push is fundamentally changing the security standards for the entire crypto industry.

How KYC Helps with Global Tax Compliance

KYC in the crypto world isn't just about stopping criminals and money launderers anymore. It's now a fundamental piece of the puzzle for tax authorities around the globe who are working to bring digital assets into the fold of traditional financial transparency.

Think of KYC as the bridge connecting your real-world identity to your on-chain activities. This connection is exactly what governments need to ensure everyone is playing by the same rules and paying their fair share of taxes.

The days of crypto’s Wild West-style anonymity are fading fast. As the market has grown up, so has the demand for accountability. Tax agencies from the US to Japan are now looking at crypto exchanges as crucial sources of information to close tax loopholes. KYC provides the verified, real-world data that makes this possible.

The Rise of CARF and Global Tax Reporting

A huge driver behind this shift is the Crypto-Asset Reporting Framework (CARF). Developed by the Organisation for Economic Co-operation and Development (OECD), CARF is a global standard designed for the automatic exchange of tax information between countries.

Simply put, CARF requires crypto exchanges to collect KYC data from their users and report transaction activity to local tax authorities. That information then gets shared with the user's home country, effectively shutting down the old strategy of hiding crypto gains offshore.

This framework elevates KYC from a basic security check into a powerful tool for international tax compliance. The details you provide during verification—your name, address, and tax ID number—are the very data points that make this entire system work.

And this isn't some far-off idea; it's happening now. By 2025, over 60 countries, including all G7 nations, have committed to adopting CARF to standardize how crypto transactions are reported. You can dig deeper into how global cryptocurrency tax rules are being implemented to see just how widespread this initiative is.

Ultimately, KYC's growing role in tax compliance is a clear sign that the crypto industry is maturing. While it might feel like an overreach to some long-time crypto users, it's an essential step toward making sure the market operates with the same level of integrity as any other financial sector. This transparency is key to building lasting trust and stability.

Finding the Balance Between Privacy and Security

The whole world of crypto was built on big ideas like individual privacy and decentralization. So, when exchanges started making KYC mandatory, it felt like a betrayal of those core principles for a lot of people. For early adopters and staunch privacy advocates, the idea of handing over personal documents to a centralized company introduces the very risks cryptocurrency was meant to eliminate.

This clash has sparked a huge debate within the community. On one hand, you have users who are completely justified in worrying about their personal information. Data breaches happen all the time, and creating a centralized treasure trove of passports and driver's licenses on an exchange's server is like painting a giant target for hackers. It’s a reminder of why understanding how to protect your digital life is so important, from mastering private key security to just reducing your digital footprint overall.

How Reputable Exchanges Protect Your Data

In response to these very real concerns, any crypto platform worth its salt invests a ton of money and effort into serious security measures. They aren't just tossing your information into a digital filing cabinet; they're building complex systems designed to keep it locked down tight. This isn't just about good ethics—it's a survival mechanism for staying compliant and in business.

Here's what that protection usually looks like:

- End-to-End Encryption: Your data gets scrambled the second you hit "submit," making it gibberish to anyone who doesn't have the specific keys to unlock it.

- Secure Storage: Information is kept in isolated, heavily guarded digital vaults with multiple layers of defense.

- Strict Access Controls: Only a small, heavily vetted group of employees can ever access sensitive user data, and every single action they take is logged and monitored.

- Compliance with Data Laws: Exchanges operating around the world have to follow strict rules like GDPR in Europe, which legally forces them to protect your privacy.

Think of it this way: these security protocols are the foundation of trust. Without them, an exchange could never land the banking partners or operating licenses it needs to function. Strong data protection is a non-negotiable part of the game.

The Future of Private Verification

The good news is that the industry is hard at work trying to solve this privacy vs. compliance puzzle. The most exciting development on the horizon? Zero-knowledge proofs, or ZK-proofs.

Imagine you could prove to an exchange that you’re over 18 and not on a government watchlist without ever telling them your name, birthday, or where you're from. That’s the incredible promise of ZK-proofs. This sophisticated type of cryptography allows one party to prove something is true to another party, without revealing any of the underlying data that makes it true.

While the technology is still young, ZK-proofs point toward a future where you could meet all KYC requirements while your personal data stays completely private. This could finally be the bridge that connects a regulated crypto world with the privacy-focused ideals it was founded on.

Clearing Up Common Questions About Crypto KYC

Let's be honest—when you're diving into the world of crypto, terms like KYC can feel a little intimidating. It's totally normal to have questions about what it means, why it’s there, and what it means for your privacy.

We're going to tackle some of the most common questions head-on to help you get comfortable with the process.

Is It Safe to Give My ID to a Crypto Exchange?

This is probably the biggest question on everyone's mind, and for good reason. Handing over your personal information requires trust. The good news is that reputable crypto exchanges take this responsibility very seriously and pour a ton of resources into protecting your data.

Think of it like a bank. They use heavy-duty security measures like end-to-end encryption and have to follow strict data protection laws like GDPR. While no system is ever 100% foolproof, you can dramatically lower your risk by taking a few smart steps:

- Stick with the big players: Choose established, regulated exchanges with a proven history of keeping user data safe.

- Turn on 2FA: Always enable Two-Factor Authentication. It's a simple step that adds a massive layer of security to your account.

- Create a powerhouse password: Use a long, unique password for your exchange account. Never reuse passwords from other websites.

Following these simple rules makes a huge difference in keeping your information locked down.

Can I Still Buy Crypto Without Doing KYC?

Yes, you absolutely can, but it’s a different ballgame. Your options are more limited, and you’re often taking on more risk.

You'll mainly be looking at decentralized exchanges (DEXs) or peer-to-peer (P2P) platforms. These are great for smaller, private transactions, but they can be tricky to navigate and often lack the customer support and fraud protection you get from a major exchange.

For anyone serious about crypto—especially if you plan to trade larger amounts or cash out into dollars or euros—going through KYC on a centralized exchange is pretty much a must.

How Long Does the KYC Verification Process Take?

It really depends. Many of the top exchanges have slick, automated systems that can get you verified in a matter of minutes. You upload your documents, their AI gives it a once-over, and you’re good to go.

However, sometimes it can get held up. If the photo of your ID is blurry or if something flags a manual review, it could take a few hours or even a couple of days. My advice? Get your KYC done well before you’re in a rush to make a trade.

At BlockBee, we get that secure and smooth transactions are everything. Our non-custodial payment gateway lets businesses accept over 70 different cryptocurrencies with super-fast confirmations, instant payouts, and low fees. To make your crypto payments simple, check us out at https://blockbee.io.