Merchant Accounts Ecommerce: Your Complete Guide to Online Payments

Think of an ecommerce merchant account as the crucial link between your customer's wallet and your business bank account. It's not the same as your regular business checking; it’s a special type of account designed specifically to handle the flow of money from online credit and debit card payments.

What Is an Ecommerce Merchant Account Anyway?

If you're new to selling online, you might wonder why you can't just have customers pay directly into your business bank account. The short answer comes down to risk. A standard bank account is built to hold money, but it isn't equipped to manage the fast-paced, complex, and security-sensitive world of online card processing.

That's where the merchant account comes in. It’s the secure go-between that connects your customer's bank, the credit card networks (like Visa and Mastercard), and your own bank account. When a customer clicks "buy," the money doesn't just appear in your account. First, it goes into this merchant account for verification.

A great way to picture it is like a digital waiting room for your money. When a payment arrives, it sits in this waiting room to be checked and cleared by security before being allowed into the main office—your business bank account.

This brief holding period is absolutely essential. It gives the payment processor and card networks a moment to run security checks, authorize the charge, and protect both you and your customer from fraud.

The Core Purpose of a Merchant Account

At its heart, an ecommerce merchant account exists to give your business a safe and reliable way to accept online payments that aren't cash. Of course, before you worry too much about getting paid, you need a place to sell. If you're starting from scratch, learning how to build a website to sell stuff is the first critical step.

Once your store is ready, this specialized account handles three key jobs for you:

- Payment Authorization: It pings the customer's bank in a split second to make sure they have the funds available to cover the purchase.

- Fund Settlement: It gathers all your approved sales from different customers into a single pot.

- Money Transfer: After a short holding period, it moves the collected funds securely from the merchant account into your main business bank account.

Without this piece of the puzzle, your online store simply couldn't take card payments, which means you’d miss out on the vast majority of potential customers. It’s the engine that powers your online checkout.

Tracing a Transaction from Cart to Account

Ever wonder what happens the instant a customer clicks "Buy Now"? It's not magic, but it's close. That simple click triggers a lightning-fast, multi-step financial relay race that happens in the blink of an eye. For the sale to go through, a series of digital handshakes have to happen perfectly between several key players.

It all starts with your payment gateway. Think of it as the secure, digital version of a credit card terminal at a physical store. The moment your customer types in their card details, the gateway grabs that sensitive info, encrypts it, and kicks off the whole process.

The Authorization Phase

From the gateway, the encrypted data zips over to the payment processor. The processor acts like a switchboard operator, quickly routing the request to the right card network—think Visa, Mastercard, or American Express. The network then forwards the request to the bank that issued the card to your customer, aptly called the issuing bank.

The issuing bank is the real decision-maker here. In a split second, it runs a few critical checks:

- Sufficient Funds: Does the customer actually have the money or available credit for this purchase?

- Valid Card Details: Are the card number, expiration date, and CVV code all correct?

- Fraud Risk: Does this transaction look legitimate, or does it trigger any red flags based on the customer’s history?

If everything looks good, the bank sends back an approval code. That code travels all the way back down the line—from the bank to the card network, to the processor, and finally back to your payment gateway. This whole round trip usually takes less than two seconds. On your customer's screen, a "Payment Successful" message pops up, and the transaction is officially authorized.

From Authorization to Settlement

But here's a crucial point: the money hasn't actually moved yet. An authorization simply means the customer's bank has put a hold on the funds. All of your approved transactions from the day get bundled together into a batch, waiting to be processed in one go.

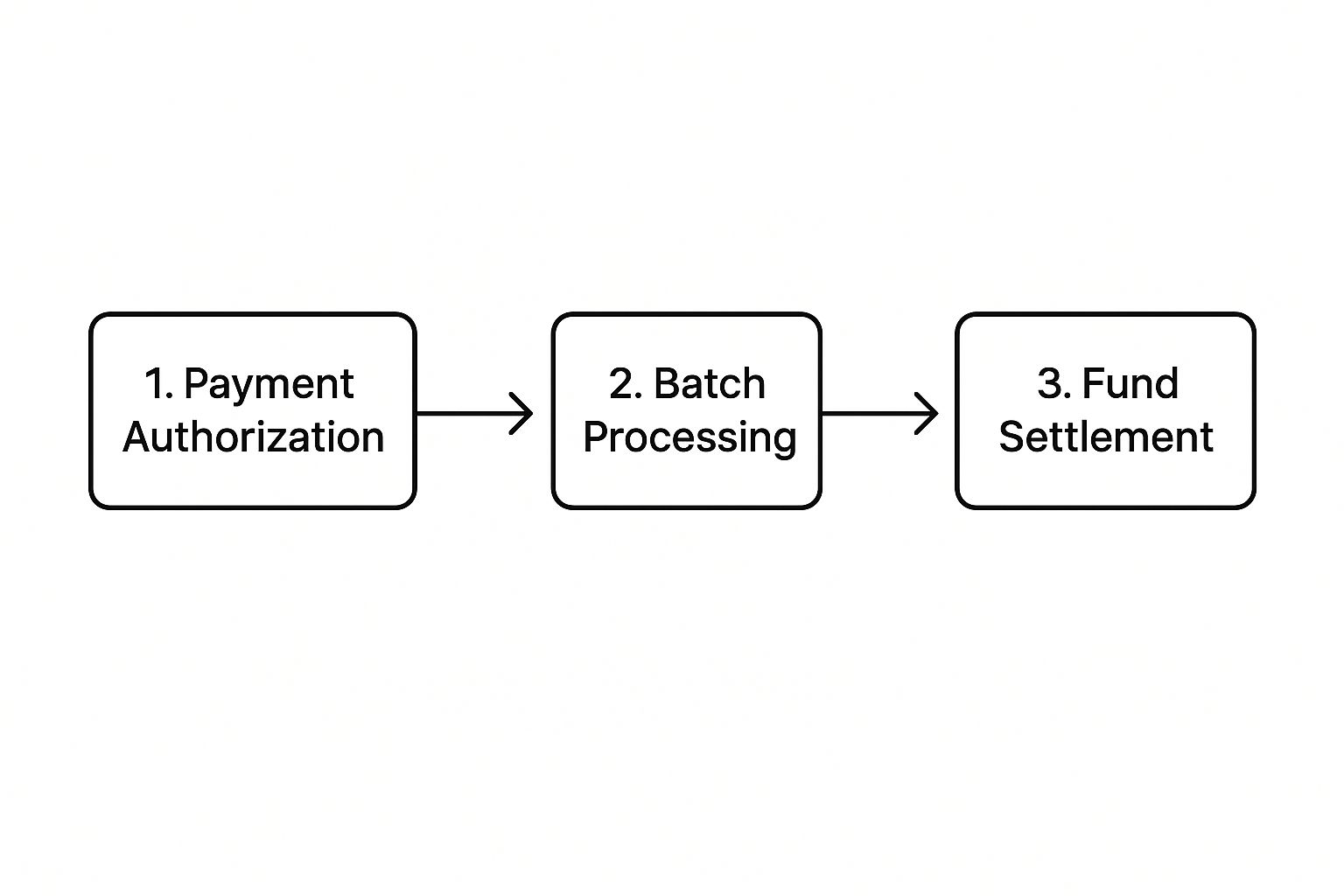

This infographic breaks down the main stages that follow that initial approval.

As you can see, authorization is just the beginning. The money still needs to be batched up and officially settled.

The settlement process is where your ecommerce merchant account finally takes center stage. At the end of the day (or another set interval), your payment processor sends the entire batch of transactions to the card networks. The networks then coordinate the actual transfer of money from all those individual customer banks into your single merchant account.

Key Takeaway: Your merchant account is essentially a dedicated holding account. It's designed to collect all the funds from your daily sales in one place before they're transferred over to your main business bank account.

This final step—the transfer from your merchant account to your business bank account—is what's known as funding. It typically takes anywhere from one to three business days. This is also when all the transaction data gets logged, which is vital for your bookkeeping. To dive deeper into how businesses track these complex money movements, check out our guide on what is payment reconciliation. The whole system is built to make sure every dollar is accounted for, from checkout to your bank.

Choosing the Right Merchant Account Provider

Picking a provider for your ecommerce merchant account feels a lot like choosing a business partner. The right one can be a silent engine for your growth, offering smooth integrations and fair pricing. But the wrong one? They can become a major headache, trapping you with hidden fees and leaving you stranded when you need support.

That’s why you have to look past the shiny, advertised rates. This decision digs right into your profit margins and shapes your customer's checkout experience, so it’s worth taking the time to get it right.

Decoding the Fee Structure

Let's be honest: the fees are often the most confusing part. Merchant accounts don't come with a simple price tag. Instead, you'll find a cocktail of different charges that can pile up if you're not careful.

Here's a quick rundown of what you’ll typically see:

- Per-Transaction Fees: This is the big one—a percentage of the sale plus a small fixed amount (like 2.9% + $0.30). You'll pay this on every single transaction.

- Monthly Fees: Think of this as a subscription. Many providers charge a flat monthly rate for things like account maintenance, gateway access, or just for sending you a statement.

- Incidental Fees: These are the "gotchas." They pop up for things like chargebacks, penalties for not being PCI compliant, or if you try to end your contract early.

A word of caution: if a provider is advertising an unbelievably low transaction rate, be skeptical. They're often making their money back with high monthly minimums or nasty incidental fees that catch you by surprise.

Always ask for a complete, itemized fee schedule before you sign anything. It’s the only way to accurately forecast your costs and avoid a shock when you get your first statement.

Evaluating Key Features and Support

Once you get a handle on the costs, it's time to look at what you’re actually getting for your money. A merchant account is useless if it doesn't play nicely with your ecommerce platform, whether you're on Shopify, WooCommerce, or something else. A clunky integration is a recipe for lost sales and late-night tech support calls.

You also need a partner who gets where the market is heading. The global digital payment market was valued at around $20.09 trillion in 2025, with mobile commerce alone driving over $2.2 trillion in sales. More importantly, 51% of shoppers say they’ll ditch their cart if they can't use a digital wallet. You can dive deeper into these trends with this report on ecommerce payments statistics.

What does that mean for you? Your provider must support the payment methods your customers actually use, like Apple Pay and Google Pay. Security is another dealbreaker. Make sure any provider you consider is fully PCI DSS compliant—this protects both your business and your customers' sensitive data from fraud.

Finally, don't overlook customer support. When something inevitably goes wrong with payments, you need to know you can get a real human on the line to help you fix it fast. Look for 24/7 support through phone or live chat so that a simple glitch doesn’t shut down your sales. Our guide on the best payment gateway for ecommerce can help you weigh these different factors.

When you're ready to start comparing providers, it helps to have a clear checklist of what to look for.

Merchant Account Provider Feature Comparison

This table breaks down the essential features to evaluate when choosing between different ecommerce merchant account providers, helping you make a side-by-side comparison.

| Feature | What to Look For | Why It Matters |

|---|---|---|

| Transaction Fees | A clear breakdown of percentage-based, fixed, and interchange-plus rates. Look for tiered pricing options. | This is your primary cost. Unclear fee structures can hide expensive charges that eat into your profit margins. |

| Integration | Pre-built integrations or plugins for your specific ecommerce platform (e.g., Shopify, WooCommerce, Magento). | A seamless integration prevents technical issues, reduces cart abandonment, and simplifies your day-to-day operations. |

| Payment Methods | Support for all major credit/debit cards, plus digital wallets (Apple Pay, Google Pay) and international payments. | Meeting customer expectations at checkout is crucial. Lacking a preferred payment option is a major reason for lost sales. |

| Security & PCI | Full PCI DSS compliance, tokenization, and advanced fraud detection tools. | Protecting customer data is your responsibility. A breach can lead to massive fines and irreparable brand damage. |

| Customer Support | 24/7 access to knowledgeable support via phone, email, and live chat. Check reviews for response times. | When payments fail, your business stops. You need immediate, effective help to resolve issues and minimize downtime. |

| Contract Terms | No long-term lock-ins, clear early termination fees (ETFs), and transparent terms. | You need the flexibility to switch providers if your business needs change or if the service is poor. |

Ultimately, finding the right provider is about striking the perfect balance between cost, functionality, and reliable support. Using a framework like this ensures you're asking the right questions and making a decision that will truly support your business as it grows.

Protecting Your Store from Fraud and Chargebacks

For any online business, security isn't just a feature—it’s the bedrock of customer trust and financial health. A solid ecommerce merchant account is your first line of defense, giving you the tools to safeguard every transaction and protect your hard-earned revenue from the constant threat of online fraud.

If you don't have strong protections in place, you're leaving your store wide open to everything from stolen credit card numbers to dishonest customers filing bogus claims. This is where security standards and fraud prevention tools become your most valuable allies.

Understanding PCI DSS Compliance

The single most important security standard in the payments world is the Payment Card Industry Data Security Standard (PCI DSS). It’s essentially a security rulebook that every business handling credit card data must follow. Your merchant account provider is required to be PCI compliant, which thankfully means they handle a lot of the heavy lifting.

But it’s a shared responsibility. You still need to make sure your own website and business practices meet the standard. That means using secure connections (HTTPS) and never, ever storing sensitive card info like CVV codes on your servers.

PCI compliance isn't just about ticking boxes. It's about creating a secure environment that shows customers their information is safe with you. A single breach can lead to massive fines and, even worse, a loss of customer trust that’s incredibly difficult to win back.

Common Types of Ecommerce Fraud

Fraudsters are always coming up with new schemes, but most of their tactics fall into a few familiar categories. Knowing what to look for is the first step in stopping a problem before it costs you money.

- Classic Fraud: This is the one we all think of—a criminal gets their hands on stolen credit card details and uses them to buy something from your store.

- Friendly Fraud: This is a tricky one. It happens when a real customer makes a purchase but then calls their bank to dispute the charge. They might claim they never got the item or didn't authorize the payment, even when they did.

- Chargeback Abuse: This is a lot like friendly fraud, where customers take advantage of chargeback policies, often just to get a product for free. It has become a massive headache for merchants everywhere.

In fact, the latest data shows that rising refund rates and fraud-related policy abuses are top-of-mind concerns for online sellers. And while smaller businesses might see fewer types of fraud, they're often the least prepared to deal with them. You can dive deeper into these trends in the 2025 Global eCommerce Payments and Fraud Report.

Your Defensive Toolkit

The good news is your merchant account provider gives you a whole suite of automated tools to fight back. These systems work silently in the background during checkout, verifying every transaction in a split second.

Here are the key players:

- Address Verification System (AVS): This tool simply checks if the billing address the customer entered matches the one their bank has on file. A mismatch is a red flag.

- Card Verification Value (CVV): Asking for that three or four-digit code on the back of the card is a simple way to prove the customer actually has the physical card.

- AI-Powered Fraud Detection: Modern systems use smart algorithms to analyze hundreds of data points in real-time, instantly flagging transactions that look like known fraud patterns.

These tools work together to form a powerful security net. To see how these checks fit into the bigger security puzzle, check out our guide on what is transaction monitoring. Being proactive with these defenses is the absolute best way to protect your bottom line.

Getting Your Merchant Account Approved and Set Up

Applying for an ecommerce merchant account is a bit like a high-stakes interview for your business. The provider is essentially deciding if they want to go into business with you, so they’ll put your company through a process called underwriting. Think of it as a deep-dive financial background check where they assess their risk.

A smooth approval really comes down to one thing: being prepared. Having all your ducks in a row before you even start the application shows you're a serious, professional operation, and it can dramatically speed up the whole process.

The Underwriting Checklist

To verify your business is legitimate and financially sound, providers will ask for a handful of key documents. While the exact list can vary a little from one provider to the next, you’ll definitely want to have these ready to go:

- Business License: This is your official proof that you’re legally registered to do business.

- Articles of Incorporation or DBA: These documents confirm your company’s legal structure and its official name.

- Federal Tax ID (EIN): Your business’s unique social security number, used for all tax purposes.

- Business Bank Account Statements: They'll want to see your cash flow. Plan on providing three to six months of recent statements to prove your financial stability.

- A Functional Website: Your site needs to be live and look the part. This means clear product descriptions, transparent pricing, and easily accessible terms of service. It’s their first real look at how you operate.

Get these documents scanned and organized in a folder before you start. A messy, incomplete application is one of the quickest ways to get your approval delayed.

Technical Integration and Go-Live Timeline

After you get the green light, the final piece of the puzzle is hooking everything up to your website. Your merchant account provider will give you API keys or a plugin to connect their payment gateway with your ecommerce platform. If you're using a major platform like Shopify or WooCommerce, this is often as simple as installing an app and plugging in your credentials.

It’s a common myth that you can get approved and start taking payments on the same day. While an approval can sometimes come back in 24 hours, the full journey—from application to your first real transaction—usually takes anywhere from three to ten business days.

This timeline gives everyone enough breathing room for the underwriting, the technical setup, and a final round of testing. It's crucial to set realistic expectations for your store's launch. Rushing the integration is just asking for checkout errors, which is a surefire way to lose sales and frustrate customers. A proper setup ensures that when you finally flip the switch, the entire system—from your merchant accounts ecommerce provider all the way to your bank—is working perfectly.

Creating a Checkout Experience Customers Trust

Think of your ecommerce merchant account as more than just a backend utility for moving money around. It's the engine behind one of the most crucial moments in the entire customer journey: the checkout. A slow, confusing, or sketchy-looking payment page is a surefire way to kill a sale right at the finish line. Your goal should be to make paying feel like a natural and secure final step, not a chore.

The key is to remove as much friction as you can. A clean, mobile-friendly design isn't just a "nice-to-have" anymore—it's essential, with so many people shopping on their phones. Offering a good mix of payment methods is just as important for meeting a wide range of customer preferences.

That final click on "Pay Now" is a huge leap of faith for a customer. Every single element on your checkout page, from the payment logos to the security seals, needs to work together to earn that trust.

When you offer familiar, one-tap options like Apple Pay or Google Pay, you make it incredibly easy for people to buy. This simple addition can dramatically cut down on abandoned carts.

Instilling Confidence at Checkout

Building a sense of security is everything. When a customer sees trust badges from well-known security companies or the logos of payment methods they recognize (like Visa or Mastercard), it gives them instant visual reassurance. These small symbols send a powerful message: "Your data is safe with us."

One of the most effective ways to boost conversions is to customize your WooCommerce checkout page to feel professional and reliable from start to finish. It shows you've invested in creating a top-notch experience.

The ecommerce world is massive and still growing, with projections showing the global market will top $6.86 trillion by 2025. With over 28 million online stores competing for that business, having reliable merchant accounts ecommerce solutions is absolutely vital. In the end, a thoughtfully designed checkout does more than just process payments—it becomes a powerful tool for building customer loyalty and driving real growth.

Common Questions About Ecommerce Merchant Accounts

Let's be honest, diving into the world of merchant accounts can feel a bit overwhelming when you're just trying to run your business. You've got questions, and I've got answers. Here are some of the things I get asked about most often.

How Quickly Do I Get My Money?

This is the big one, right? The money question. While you see a payment get approved in just a few seconds on your end, the cash doesn't hit your bank account that same instant.

At the end of the day, all your approved sales get bundled together in a "batch." From there, the whole settlement process—from your customer's final click to the funds actually landing in your business account—usually takes about 1-3 business days. That little buffer gives the banks time to do their security checks and move the money around securely.

Do I Still Need a Merchant Account If I Use PayPal or Stripe?

This is a classic "yes and no" situation. When you use services like Stripe or PayPal, you're working with what's called a payment aggregator. They've already done the heavy lifting of setting up a master merchant account, and they let you use a small piece of it.

You aren't applying for your own traditional merchant account, but you're still using one that belongs to them. It makes getting started incredibly easy, but the trade-off can be less control and potentially higher fees down the road compared to having your own dedicated ecommerce merchant account.

What’s the Difference Between a Merchant Account and a Payment Gateway?

It's easy to get these two mixed up, but they have very different jobs.

Think of the payment gateway as the digital version of a physical credit card reader you'd see in a shop. It’s the secure tool on your website that grabs the customer's card info, encrypts it, and sends it off for approval.

The merchant account is the special bank account that's set up to actually receive the money once that transaction gets the green light. You can't have one without the other; they have to work as a team to complete a sale.

Ready to simplify your online payments with a secure, non-custodial solution? BlockBee offers instant payouts, low fees, and seamless integration with major ecommerce platforms. Learn more and get started with BlockBee.