Choosing the Best Payment Gateway for Ecommerce

Choosing the best payment gateway for ecommerce isn't a one-size-fits-all decision. For many, the choice boils down to Stripe for its deep customization, PayPal for its unmatched brand recognition, or a specialist like BlockBee for its lean crypto processing. This decision is huge—it directly shapes your conversion rates, customer experience, and operational costs.

Why Your Payment Gateway Is a Critical Ecommerce Decision

Picking a payment gateway is so much more than just ticking a box on your setup checklist. Think of it as the financial heart of your online store; it’s the crucial link between your customer’s wallet and your bank account. Get it right, and the sales flow smoothly. Get it wrong, and you could be staring at cart abandonment rates as high as 70%.

Today's payment world is packed with options, from established giants to nimble newcomers. Each one comes with its own unique blend of pros and cons.

- Customer Trust: People spend money where they feel safe. A familiar payment logo can be the final nudge a hesitant buyer needs to click "Confirm Purchase."

- The Real Cost of Fees: Those tiny percentage points on transaction fees don't seem like much at first. But they add up, and over a year, they can easily eat away thousands of dollars from your profit margin.

- Smooth Integrations: You need a gateway that plays nice with your e-commerce platform. A system that scales with you as you grow is essential, saving you major technical headaches down the road.

- Selling to the World: Can your gateway handle multiple currencies? Your choice here literally defines the borders of your market.

Just to give you a sense of the landscape, established players still hold incredible sway. As of early 2025, PayPal alone processes a staggering 45% of all global online payments. That’s more than major competitors like Stripe and Shopify combined. This dominance is built on decades of trust and being everywhere customers expect them to be. You can dive deeper into these numbers with these ecommerce payment statistics.

This guide will unpack these critical factors, putting traditional payment processors head-to-head with modern crypto solutions. We’ll look at how Stripe, PayPal, and BlockBee serve different types of businesses, helping you find the perfect fit for your store.

| Gateway Type | What It's Known For | Perfect For... | Something to Keep in Mind |

|---|---|---|---|

| Traditional (Stripe) | Powerful, developer-first tools | Businesses wanting total control via APIs. | International transaction fees can be higher. |

| Wallet-Based (PayPal) | Huge brand trust and recognition | Stores aiming for the widest possible audience. | Their account holds and dispute process can be tricky. |

| Crypto (BlockBee) | Ultra-low fees and zero chargebacks | Sellers of digital goods or those with global customers. | It's a growing payment method, but still niche. |

Understanding How Payment Gateways Actually Work

Before you can pick the right payment gateway, you need to get what it's really doing behind the scenes. Think of it as the digital bouncer for your online store—it stands between your customer's bank and your business, making sure all the sensitive financial data is handled securely. It’s essentially a high-tech version of the credit card terminal you see at a coffee shop.

The moment a customer hits "buy," the gateway springs into action. It encrypts their payment details, scrambling them into a secure code that’s unreadable to anyone else. This encrypted package is then zipped over to the payment processor, who has a quick chat with the customer's bank to check for funds and get the green light. The whole dance takes just a couple of seconds.

The Key Stages of a Transaction

An online payment isn’t just a one-and-done event; it’s a carefully choreographed sequence. Knowing these steps helps you pinpoint where things might go wrong and why some gateways are better than others.

There are three main stages to every transaction:

- Authorization: This is the first handshake. The gateway pings the customer's bank to ask, "Does this person have the funds or credit?" The bank then sends back a simple "yes" or "no."

- Capture: Once authorized, the funds are officially reserved for you. This step basically confirms the purchase and gets the money ready to move.

- Settlement: This is the final leg of the journey, where the money actually leaves the customer’s account and lands in your merchant account. How fast this happens can vary wildly between providers.

At the end of the day, a payment gateway's number one job is to protect sensitive data. It does this with encryption, which scrambles card details as they travel, and tokenization, which swaps the real card number for a unique, secure token for things like recurring payments.

The Role of Security and Integration

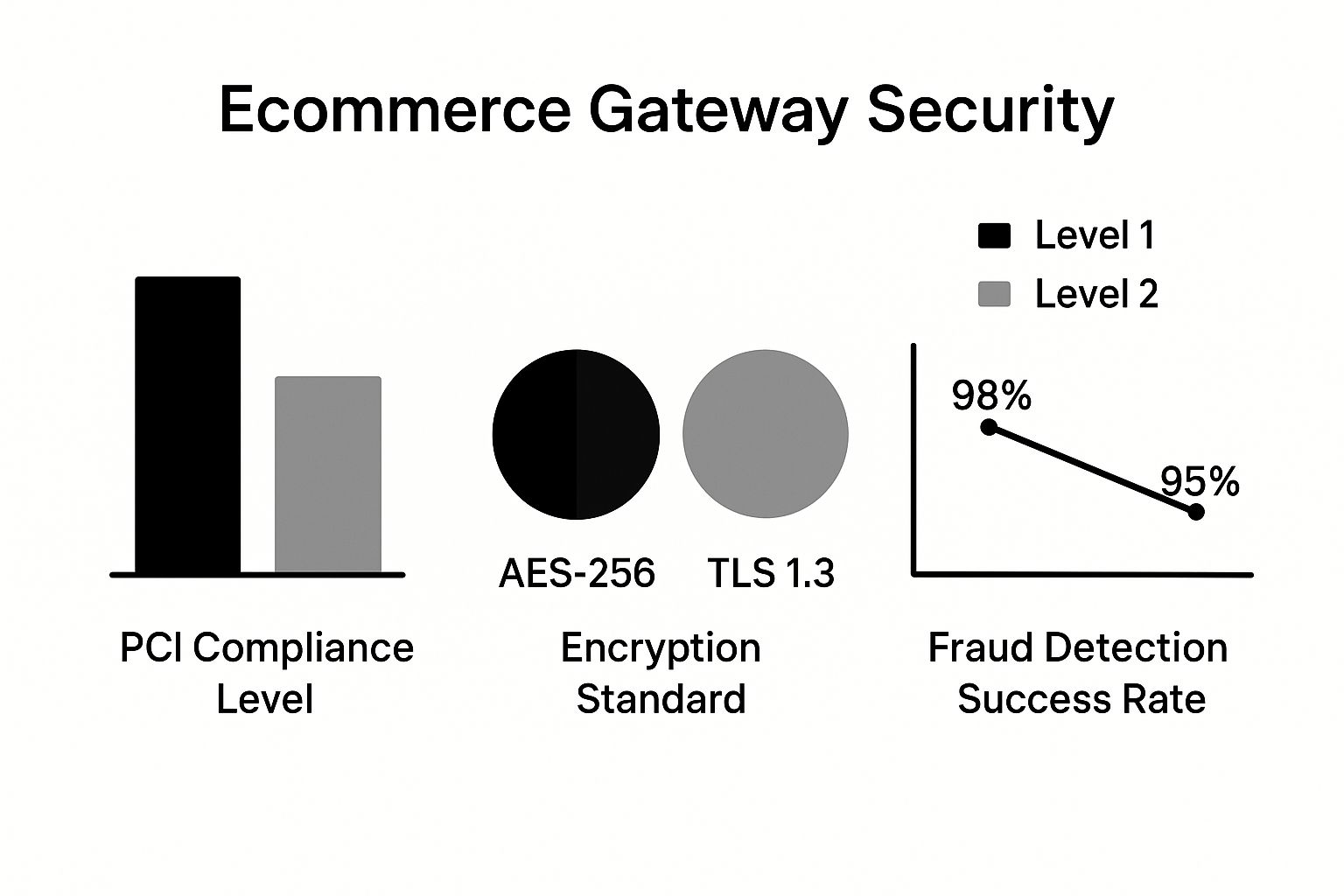

When it comes to payments, security is absolutely non-negotiable. Gateways must be PCI DSS (Payment Card Industry Data Security Standard) compliant. This isn't just a fancy acronym; it's the gold standard for protecting your business and your customers from fraud. One data breach can do serious damage to your reputation.

Just as important is how the gateway actually talks to your website. This connection is made through an API (Application Programming Interface), which is the bridge between your e-commerce platform and the payment service. The quality of this integration dictates everything from the checkout flow to how reliable your payments are. For a deeper dive into how this works in practice, looking at examples like Stripe integrations can be really helpful. If you’re ready to get into the technical weeds, you can learn more about https://blockbee.io/blog/post/payment-gateway-api-integration.

Comparing the Top Traditional Payment Gateways

When it's time to pick a payment gateway, online merchants usually find themselves weighing the same few big names. Stripe, PayPal, and Authorize.net are the dominant players, but they each come at payment processing from a completely different angle. Choosing the right one means looking past the surface-level fees and really digging into what makes them tick.

The global e-commerce payment gateway market is growing at a staggering pace. It’s projected to leap from USD 6.21 billion in 2024 to an incredible USD 44.62 billion by 2034. That kind of growth highlights just how critical it is to pick a partner that can scale with you.

Stripe: The Developer's Playground

Stripe has carved out a reputation as the top choice for businesses that want total control over their checkout experience. Its real power lies in its incredibly well-documented and flexible API, which lets developers build payment flows that feel like a natural part of their website, not a clunky add-on.

Instead of shipping customers off to another site to pay, Stripe keeps them right where they are. This is a huge win for reducing checkout friction and boosting conversions. Their pricing is a straightforward flat-rate (2.9% + 30¢ for most online transactions), which makes financial planning easy, though it might not be the most cost-effective for businesses with massive sales volume.

Stripe’s whole philosophy is built around its API. They don't just see payments as a transaction; they see it as a programmable part of your business, giving you the tools to innovate.

Here's a look at Stripe's modern, tech-focused dashboard, which is clearly designed for businesses that value both powerful tools and a clean user experience.

PayPal: The Symbol of Trust

Let's be clear: PayPal's biggest selling point isn't its technology. It's trust. With over 400 million active users, that little blue logo is one of the most recognized and trusted symbols in online shopping.

For a new or small store trying to build credibility, that built-in trust can be the difference between a sale and an abandoned cart. The trade-off? PayPal often redirects customers to its own website to finish the payment, which can interrupt the shopping flow. You can get around this with their pro-level products, but that usually means tacking on a monthly fee.

Authorize.net: The Legacy Powerhouse

As a Visa-owned company, Authorize.net is one of the original players in the payment gateway space. It works a bit differently than the others. It’s a gateway only, meaning you still need a separate merchant account from a bank.

This extra step adds some complexity, but it also gives you more negotiating power on your processing rates. This makes Authorize.net a fantastic option for established, high-volume businesses that can lock in favorable "interchange-plus" pricing. It’s known for being rock-solid and secure, even if its interface and developer tools feel a bit dated compared to Stripe.

To help you see how they stack up at a glance, we've put together a quick comparison.

Feature and Fee Comparison of Leading Payment Gateways

| Gateway | Transaction Fee (Online) | Monthly Fee | Best For | Key Feature |

|---|---|---|---|---|

| Stripe | 2.9% + 30¢ | $0 | Tech-savvy businesses & startups wanting customization | Powerful, developer-first API for seamless checkout integration |

| PayPal | 2.99% + 49¢ | $0 (for standard) | New or small businesses needing instant credibility | Immense brand recognition and consumer trust |

| Authorize.net | Varies (plus gateway fee) | $25 | High-volume merchants with a separate merchant account | Flexibility to negotiate processing rates with your own bank |

Ultimately, there's no single "best" gateway—only the one that’s best for your business.

Choosing between them really boils down to your priorities. For a much more detailed breakdown of how their different pricing models work in the real world, check out our guide on understanding payment gateway fees. The right decision will always be a balance between cost, customer experience, and your technical needs.

Are Crypto Payment Gateways the Modern Answer?

You've seen how the traditional gateways work, but there's another path gaining real momentum. Crypto payment gateways are more than just a novelty; they represent a completely different way of thinking about money, moving away from the old-school financial rails. For an ecommerce business trying to cut costs and reach a global audience, they’re a compelling alternative.

These platforms act as the missing link, letting your customers pay with assets like Bitcoin or Ethereum while you can still get paid in good old-fashioned dollars if you want. This isn't just about being trendy—it's about tackling some of the biggest headaches that come with standard payment processing. If you sell digital products or have customers all over the world, the benefits become obvious very quickly.

Why Should You Even Consider Crypto?

Let's get straight to the point: the biggest win for most sellers is the dramatic drop in fees. Credit card processors routinely take a cut of around 3%, sometimes more. With crypto, you're often looking at fees of 1% or even less. For a business with decent volume, that difference adds up to real money in your pocket at the end of the year.

Then there's the chargeback problem. It’s a constant thorn in the side of online merchants. With crypto, it’s gone. Blockchain transactions are final, which means fraudulent chargebacks—where a customer disputes a legitimate charge to get their money back—are a thing of the past. That’s a huge relief for anyone tired of fighting to keep the revenue they’ve earned.

Accepting crypto isn't just about adding a new button to your checkout page. It's an invitation to a global, tech-forward community that actively looks for and supports businesses that use digital currencies. It’s a way to stand out.

The broader payment industry is exploding. It was valued at USD 22.09 billion back in 2020 and is on track to hit USD 87.44 billion by 2027, thanks to the non-stop growth of online shopping. Inside that boom, crypto payments are growing by about 16% every year, which tells you a lot about where customer habits are heading.

Making Crypto Payments Simple

You don't need to be a blockchain genius to get started. Modern platforms like BlockBee are built to make accepting crypto just as easy as using Stripe or PayPal. They handle the tricky stuff so you don't have to.

Here’s what they typically bring to the table:

- Automatic Conversion: Get paid in Bitcoin but worried about price swings? No problem. The gateway can instantly convert it to your local currency, like USD or EUR, so you're protected from volatility.

- Easy Integration: Most offer simple plugins for platforms like WooCommerce and Shopify. Installation is usually straightforward and doesn't require a developer.

- Secure Wallets: Good gateways provide secure, non-custodial wallets. That's a fancy way of saying you—and only you—have full control over your funds. No third party is holding your money.

For any business searching for the best crypto payment gateway with low fees and no borders, these solutions make a very strong argument. It’s a model that bypasses the high costs and fraud risks of the legacy system, offering a much leaner, more secure way to do business.

BlockBee vs. Traditional Gateways: Which Is Right for Your Business?

Picking a payment gateway isn't a "one-size-fits-all" decision. The best choice for your business depends entirely on what you sell, who you sell to, and what your biggest operational headaches are. Think of it less as picking a winner and more like matching the right tool to the right job.

At their core, traditional gateways like Stripe and crypto gateways like BlockBee operate on fundamentally different philosophies. One works within the established, regulated banking system—with all its consumer protections and associated costs. The other bypasses it entirely, creating a more direct and often cheaper path for money to move from A to B.

Let's break down a couple of real-world scenarios to see where each one truly shines.

Scenario One: The International Digital Creator

Imagine you're a developer selling software licenses or a designer selling premium templates to a global audience. Your biggest nightmare? Chargebacks. One fraudulent dispute can instantly erase the profit from multiple legitimate sales, and fighting them is an uphill, time-consuming battle.

This is precisely the kind of situation where BlockBee becomes a game-changer.

- Zero Chargeback Risk: Blockchain transactions are final. Once a payment is confirmed, it's yours. The entire concept of a fraudulent chargeback simply disappears, protecting your revenue completely.

- Drastically Lower Cross-Border Fees: Selling to someone in another country through a traditional gateway often means getting hit with extra fees for international transactions and currency conversions. Crypto, on the other hand, is borderless by design, slashing the costs of doing business globally.

- Near-Instant Payouts: Forget waiting several business days for funds to settle in your merchant account. With crypto, payments land directly in your wallet, often in a matter of minutes.

For this type of international, digital-first business, the absolute security against fraud and the lower overhead from BlockBee easily outweigh the universal familiarity of something like PayPal.

When your revenue is constantly threatened by chargeback fraud and eaten away by international fees, a crypto gateway isn't just an alternative; it's a direct solution to your most expensive problems.

Scenario Two: The Local Retailer Moving Online

Now, let's picture a local boutique taking its first steps into e-commerce. They sell physical products to a mostly domestic customer base, many of whom aren't crypto-savvy. For them, the top priority isn't shaving a percentage point off fees—it's building trust and making the checkout process as frictionless as possible for first-time online buyers.

Here, a traditional gateway is the clear and practical choice.

- Customer Trust and Familiarity: Seeing a familiar logo like Stripe or PayPal at checkout is an instant signal of trust. It tells shoppers their financial data is being handled by a secure, well-known processor.

- Maximum Accessibility: Nearly every online shopper has a credit or debit card ready to go. Requiring them to use a payment method they don’t understand or trust adds a massive barrier, which is a surefire recipe for abandoned carts.

- Built-in Buyer Protection: While merchants dread chargebacks, that same system gives consumers the confidence to buy from a store they've never heard of before. It's a safety net that encourages conversion.

For this retailer, the risk of confusing or alienating their core customer base with an unfamiliar payment option is far greater than any potential savings on transaction fees. The goal here is simple: make buying easy and familiar.

| Business Type | Key Challenge | Best Gateway Type | Why It's the Right Fit |

|---|---|---|---|

| Global Digital Goods Seller | Chargeback fraud, high international fees | Crypto (BlockBee) | It completely eliminates chargebacks and makes cross-border costs negligible. |

| Local Brick-and-Mortar | Building trust with new online customers | Traditional (Stripe/PayPal) | It provides a familiar, widely trusted payment experience that maximizes conversions. |

Making the Right Choice for Your Business

So, how do you pick the best payment gateway? The truth is, it comes down to looking inward at your own business. What's your average transaction value? Who are you selling to, and where are they located? Your answers to these questions are what really guide the decision.

There isn't a single "best" gateway, just the one that's the most strategic fit for where you are now and where you're headed.

To cut through the noise, here are some straightforward recommendations based on common business needs:

- Go with Stripe if API flexibility is your top priority. If you have developers ready to build a highly customized, scalable checkout experience, their toolkit is second to none.

- Pick PayPal when you need instant trust. For converting first-time or cautious buyers, PayPal’s brand recognition is a massive advantage. It's a name people know and feel safe with.

- Choose BlockBee to unlock global crypto payments. If your goal is to eliminate chargebacks, drastically cut cross-border fees, and tap into a new, tech-forward customer base, a crypto gateway is a lean and powerful option.

The right gateway isn't just a tool to process payments; it's a strategic partner that aligns with your growth trajectory, reduces operational friction, and enhances the customer experience.

Remember that payments are just one piece of the puzzle. Optimizing other core functions, like setting up automated shipping compliance, is just as critical for smooth, scalable growth.

By weighing your specific business needs against the distinct strengths of each platform, you can select your next payment partner with confidence.

Frequently Asked Questions

Picking the right payment gateway feels like a huge decision, and it is. You're balancing security, cost, and the checkout experience for your customers. Let's tackle some of the most common questions that come up when merchants are in the hot seat.

Are My Customers’ Payment Details Secure?

Absolutely. Any payment gateway worth its salt is built like a fortress. They have to comply with the Payment Card Industry Data Security Standard (PCI DSS), which is a non-negotiable set of security protocols for handling card data.

They use heavy-duty tools like encryption and tokenization to scramble sensitive information from the second a customer types it in. This means the actual card details are never exposed, making the whole process incredibly safe.

Will I Be Charged Hidden Fees?

This is where you need to put on your detective hat. The best providers are upfront about their costs, but "hidden" fees can pop up if you don't read the contract carefully.

Look out for things like monthly account fees, setup charges, cross-border fees for international sales, and especially chargeback penalties. Always ask for a complete fee schedule so you can calculate what you'll really be paying.

Your effective transaction rate is what truly matters. This is the total cost you pay—including all transaction, monthly, and incidental fees—divided by your total sales volume. Don't just focus on the advertised percentage.

How Hard Is It to Switch Payment Gateways?

It really depends. If you're using a major e-commerce platform like Shopify or WooCommerce, switching can be surprisingly painless. Many gateways have plug-and-play integrations that are just a few clicks away in your dashboard.

But if you have a custom-coded website, the process gets more hands-on. You'll likely need a developer to disconnect the old API and integrate the new one, which can take time and resources.

What Is Required to Accept International Payments?

To sell to customers around the world, you need a gateway that’s built for it. The key feature to look for is multi-currency processing. This lets your international shoppers see prices and pay in their own currency, a simple change that can seriously boost conversions.

The gateway takes care of the currency exchange behind the scenes, usually for a small additional fee. Top-tier international gateways will also support popular local payment methods, which can be a game-changer in certain markets.

Ready to slash your transaction fees and eliminate chargebacks for good? BlockBee offers a secure, non-custodial crypto payment solution with seamless integrations and instant payouts. Get started today at https://blockbee.io.