What Is Payment Reconciliation Explained

Think of payment reconciliation as the business equivalent of balancing your checkbook. It’s the critical process of making sure the money you think you have in your records actually matches the statements from your bank, payment processor, or crypto wallet. Every dollar—or satoshi—that comes in and goes out needs to be accounted for.

What Is Payment Reconciliation and Why It Matters

Have you ever tried to find your way through a new city without a map? You might get there eventually, but you’ll probably hit a few dead ends, waste a bunch of time, and feel stressed out. Running a business without regular payment reconciliation is a lot like that—you’re navigating your finances blind.

At its core, it’s about ensuring your internal sales records line up perfectly with external transaction data from sources like your bank, credit card processor, or a crypto payment gateway.

This isn't just about good bookkeeping; it's a financial reality check. It confirms that the revenue you recorded from a sale has actually made it into your account. Without this crucial step, your business is left open to a whole host of silent problems that can slowly eat away at your bottom line.

The True Cost of Unreconciled Books

When your records don’t match up, you create dangerous blind spots in your financial vision. These little discrepancies aren't just numbers on a spreadsheet; they represent real money that could be missing due to simple errors, sneaky fees, or even fraud. A single unreconciled transaction might be an honest mistake, but it could also be the tip of a much bigger iceberg.

Staying on top of this financial health check brings some massive benefits to the table:

- Spotting Fraud Early: It helps you catch unauthorized charges or weird activity fast, protecting your funds before any real damage is done.

- Getting Real Cash Flow Clarity: Knowing exactly what cash you have on hand is vital. Accurate reconciliation prevents you from running into unexpected shortages and is a cornerstone of effective working capital management.

- Fixing Mistakes Quickly: You can uncover everything from a simple typo in data entry to an incorrect payment amount, letting you fix it before it becomes a bigger headache.

- Generating Accurate Financial Reports: You can't have trustworthy financial statements without reconciled accounts. This affects everything from trying to get a loan to keeping your investors happy.

To really nail this down, you need to pull information from a few key places.

Key Data Sources for Reconciliation

Here’s a quick look at the essential data sources you'll be working with. Each one provides a piece of the puzzle needed to get a complete financial picture.

| Data Source | What It Shows | Example Document |

|---|---|---|

| Internal Sales Records | All transactions you've processed. | Sales ledger, order management system export |

| Bank Statements | Fiat deposits, withdrawals, and fees. | Monthly bank statement (PDF or CSV) |

| Payment Processor Reports | Detailed transaction data, fees, and payouts. | Stripe, PayPal, or Square transaction report |

| Blockchain Explorer | Public record of all crypto transactions. | Etherscan for Ethereum, Blockchain.com for Bitcoin |

Matching these sources is what gives you confidence in your numbers.

Reconciliation isn't just about accounting. It's what turns a pile of financial data into a reliable tool for making smart business decisions. It’s the difference between guessing where you stand financially and knowing for sure.

As businesses increasingly accept new forms of payment like crypto, having a solid reconciliation process is more important than ever. It's moved from being just a good habit to an absolute necessity for survival and growth.

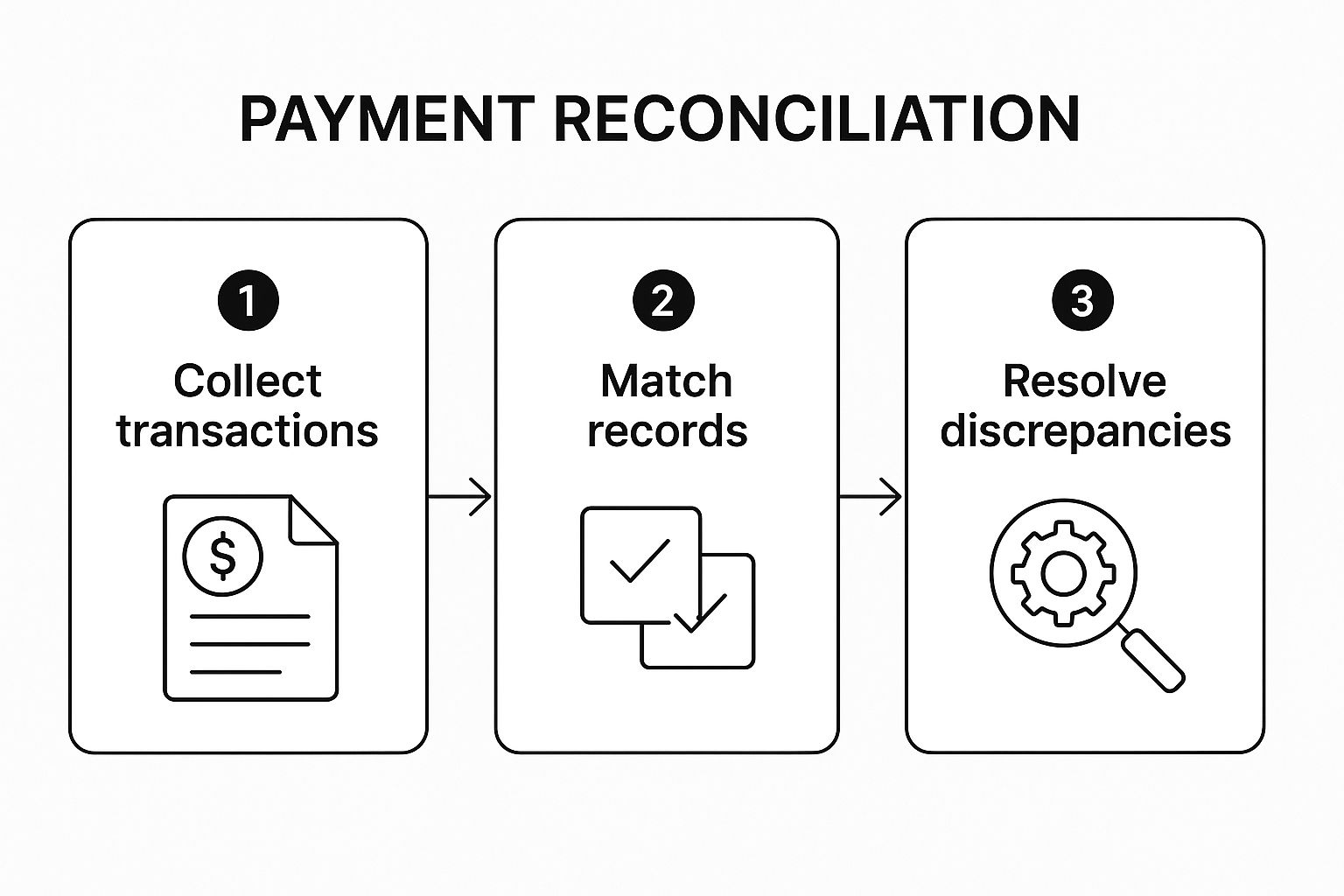

Walking Through the Traditional Reconciliation Process

To really get why automation is such a game-changer, let’s imagine we’re a small e-commerce merchant named Alex who’s still doing things the old-fashioned way. For Alex, the first of the month isn't about celebrating last month's wins. It's about diving headfirst into a mountain of financial detective work—a cascade of frustrating, time-sucking tasks.

It all starts with gathering the data. Alex has to log into the business bank account, then the Stripe dashboard, and finally the company’s internal sales ledger. Each system spits out a different report in its own unique format, creating a data jumble that has to be cleaned up and standardized before the real work can even begin.

The Painstaking Matching Game

With all the data finally wrangled into one giant spreadsheet, the "fun" begins. Alex now has to manually match every single sale from the ledger to a corresponding deposit in the bank statement. It's a grueling line-by-line comparison, a digital scavenger hunt where every dollar and cent matters.

A $100 sale rarely shows up as a clean $100 deposit. More often, it’s buried inside a larger $850 payout from Stripe, which lumps together dozens of other sales and subtracts all the processing fees.

This is where the real headaches start.

The image above breaks down the core stages, but the reality is that each step is loaded with potential for errors and delays. The real challenge pops up when things inevitably don't line up perfectly.

Hunting for Discrepancies

And they almost never do. Soon enough, Alex finds mismatches. Maybe a customer refund processed last week wasn't actually deducted from a payout, or a surprise chargeback fee appeared out of thin air. Each discrepancy sends Alex on another wild goose chase, digging through transaction IDs and customer emails to pinpoint the source of the problem.

This manual grind is a breeding ground for human error. A simple typo, a copy-paste slip-up, or one misplaced decimal point can throw the entire month's books out of whack.

For many businesses, manual payment reconciliation isn't just another task; it's a major operational bottleneck. The hours spent staring at spreadsheets are hours not spent growing the business, talking to customers, or innovating.

What seems like a straightforward job quickly spirals into a full day's work, or even more. Alex's monthly struggle is the perfect example of why so many businesses are desperate to move on from this outdated method. The process is slow, expensive when mistakes happen, and simply can't keep up with the speed of modern commerce. It perfectly sets the stage for a better, automated way of doing things.

The Hidden Complexities of Modern Payments

From the outside, modern payments look easy. A customer clicks "buy," and money appears in your account. Simple, right? But behind the scenes, it's a completely different story—a tangled web of systems that can create massive headaches for any business trying to scale.

The biggest culprit here is data fragmentation. Imagine trying to build a puzzle, but every piece comes from a different box, and there’s no picture on any of them to guide you. That’s what it’s like for your finance team.

Every payment gateway you use, whether it's Stripe, PayPal, or a traditional bank transfer, speaks its own language. One sends you a neat CSV file, another a convoluted PDF statement, and a third makes you pull data directly from its API. This forces your team to manually translate and piece together all these different data streams just to get a single, clear picture of your company's finances.

Navigating a Sea of Discrepancies

This mess of fragmented data isn't just an inconvenience; it's a serious operational hurdle. In fact, a staggering 47% of firms point to it as their number one obstacle to accurate financial reporting.

The problem starts with the basics: each provider delivers data in different formats (CSV, API, PDF) with inconsistent field names, time zones, and transaction details. Your team ends up wasting hours just cleaning and standardizing the data before the real work of reconciliation can even begin.

Beyond formatting issues, a handful of common problems introduce variances that need to be carefully untangled:

- Currency Conversion: Exchange rates are always moving. The amount a customer pays in Euros rarely matches the exact dollar amount that hits your bank account after conversion.

- Processing Fees: Every payment processor takes a cut. The final deposit you receive is always less than the original sale price, and you have to account for that difference.

- Refunds and Chargebacks: These reverse transactions don't just subtract revenue; they often come with their own penalty fees, creating negative entries that have to be meticulously tracked.

- Multi-Channel Complexity: If you sell on your website, a mobile app, and in a physical store, you're just adding more layers of data that all need to be consolidated.

The real danger is how these small, everyday complexities multiply. A tiny data mismatch on one transaction might seem harmless, but when it happens hundreds or thousands of times a day, it snowballs into wildly inaccurate reports, flawed cash flow projections, and operational gridlock that can genuinely hold your business back.

Why Manual Methods Fail at Scale

Trying to untangle this knot by hand with spreadsheets is a losing battle as your business grows. The sheer volume of transactions, combined with all the different data sources and formats, makes manual checks incredibly slow and, worse, full of errors.

Today’s payment systems are built on APIs, which means managing the technical side of things is more important than ever. Understanding how to test REST APIs, for example, is a key part of making sure your data integrations are solid. Without reliable systems in place, businesses are stuck making critical decisions with incomplete or just plain wrong financial information.

This is exactly why the conversation has to change. We need to stop asking "what is payment reconciliation" and start asking "how can we automate it" to build a foundation for accuracy and growth.

Reconciling Crypto Payments Is a Different Ballgame

When you start accepting cryptocurrency, you're not just adding a new payment option—you're stepping into a completely different world of financial reconciliation. The goal is the same, of course: make sure the money you received matches what you sold. But how you get there is nothing like reconciling a bank transfer.

Forget downloading familiar statements from Stripe or PayPal. With crypto, your record book is the blockchain, a public, decentralized ledger.

Every single transaction gets its own unique digital receipt called a transaction hash (TxID). It's permanent and publicly viewable, which offers a kind of radical transparency you just don't get with traditional banking. But that transparency comes with its own headaches, and your old accounting software isn't built for it. To really get a handle on this, it's helpful to understand the fundamentals of blockchain development and how these public records actually work.

Unique Hurdles in Crypto Reconciliation

Merchants dipping their toes into digital assets for the first time quickly find out that reconciling crypto is about more than just matching dollar amounts. A few unique quirks make the whole process much trickier and demand specialized tools to get it right.

Here’s what you’re up against:

- Pseudonymous Addresses: Bank accounts are tied to a person's name. Crypto transactions, on the other hand, move between pseudonymous wallet addresses—those long, random-looking strings of letters and numbers. Trying to connect a payment from an anonymous address to a specific customer's order is a huge challenge without a proper system.

- Network Fees (Gas Fees): To send a transaction on a blockchain, you have to pay a network fee, often called a "gas fee." This fee gets taken out of the total amount sent. So, the payment that lands in your wallet is always a little less than what the customer actually paid. It's like a processing fee, but far more unpredictable.

- Price Volatility: This is the big one. The value of crypto can swing wildly in a matter of minutes. A payment worth $100 when the customer hits "send" could be worth $98 or even $105 by the time it confirms in your wallet. These are the kinds of discrepancies that give accountants nightmares.

Payment reconciliation in crypto means you stop looking at bank statements and start using blockchain explorers. You're tracking TxIDs, accounting for gas fees, and dealing with value changes as they happen.

These challenges make trying to reconcile crypto by hand a recipe for disaster. It’s exactly why businesses need to figure out how to accept cryptocurrency payments with the right infrastructure from day one.

Without a system built to handle these variables, your books will become a tangle of mismatched numbers and loose ends. This is the point where automation goes from being a "nice-to-have" to an absolute necessity.

How Automation Transforms the Reconciliation Workflow

If you've ever felt the pain of manual reconciliation, you know it’s a tedious, error-prone grind. Moving to an automated workflow isn't just a minor improvement; it completely changes how you manage your company’s finances.

Forget about your team spending hours downloading reports and forcing them into a standard format. Modern software becomes your financial command center, using APIs to pull in data from every source automatically.

No more copy-pasting from clunky spreadsheets or fighting with mismatched file types. The system grabs data from your bank, payment gateways, and even blockchain explorers as it happens. The result? A single, clean view of every transaction. This is the first step in turning a reactive monthly chore into a proactive daily health check for your business.

The Power of Intelligent Matching

With all your data in one place, the real magic begins. Smart algorithms and AI go to work, sifting through thousands of transactions in seconds to match sales records with payouts. It’s far more sophisticated than just looking for identical amounts; it intelligently accounts for tricky variables like processing fees, currency conversions, and refunds.

This kind of automation cuts down the manual work dramatically. Instead of a person poring over every line item, the software handles the vast majority of matches on its own. The only transactions that need human attention are the genuine outliers—the rare exceptions that the system flags for a closer look.

Automated reconciliation frees your finance team from the drudgery of data entry. It lets them focus on what actually drives growth: strategic analysis, cash flow forecasting, and spotting new financial opportunities.

The effect of this change is huge. The global reconciliation software market is expected to jump from $1.75 billion in 2023 to $6.44 billion by 2032. This growth is fueled by technology that can reduce manual reconciliation time by up to 80%. It’s not just about saving time; it’s about gaining real-time financial clarity that manual methods can never deliver. To see how this works in the crypto space, you can learn more about how blockchain payment solutions are paving the way for this automated future.

By embracing automation, businesses are transforming the answer to "what is payment reconciliation" from a frustrating necessity into a powerful tool for smart financial management.

Make Your Payments Flow with BlockBee

Knowing the theory of payment reconciliation is great, but actually putting a simple, automated system in place? That's a whole different ball game. This is exactly where a tool like BlockBee comes in, designed specifically to tackle the complexity and scattered nature of modern business payments. It’s built to turn what is often a messy, error-filled manual task into a smooth, automated workflow.

At its core, BlockBee gives you a single source of truth. It pulls all your fiat and crypto transactions together into one clean, easy-to-read dashboard. This means you can finally stop downloading, reformatting, and merging endless reports from different payment processors. Forget juggling spreadsheets—you get a clear, live picture of your entire financial world.

Bringing Fiat and Crypto Reconciliation Together

BlockBee’s real power is how it handles the unique challenges of both traditional money and cryptocurrency. For your standard fiat payments, it automatically matches up your sales records with your bank payouts. When it comes to crypto, it tackles those specific hurdles without missing a beat.

Here’s how it gets it done:

- Automatic Transaction Tracking: Every single payment is logged and sorted the moment it happens. This creates a perfect, clean data trail from the get-go.

- Real-Time Conversion Data: Worried about crypto price swings? BlockBee nails down the exact value at the moment of the transaction, which solves one of the biggest headaches in crypto reconciliation.

- Consolidated Reporting: You can generate a single, comprehensive report that includes all your payment types. This gives you a complete financial overview without any of the manual grunt work.

A unified dashboard isn't just a time-saver—it gives you the clarity you need to make smart financial decisions. When all your data is in one place, you're not guessing anymore. You're in full control of your revenue.

Turning a Complex Problem into a Simple Fix

If you look at how reconciliation technology has evolved, it’s all moving toward "touchless" automation. The top software out there can now match transactions in real-time with over 95% accuracy, completely getting rid of the need for manual processing. This is a massive leap forward for running a tight financial ship.

BlockBee delivers this exact level of automation to any business that accepts both old-school and new-school currencies. By acting as your central payments hub, it takes care of all the tedious reconciliation mechanics for you, freeing you up to focus on growing your business.

To get started on building a truly efficient system, take a look at our guide on choosing the best crypto payment gateway. Ultimately, BlockBee takes the complicated answer to "what is payment reconciliation" and turns it into a simple, automated reality.

Got Questions? Let's Talk Payment Reconciliation

Even with a solid grasp of the basics, some practical questions always pop up. Let's tackle a few common ones to help you see how payment reconciliation fits into your day-to-day business operations.

How Often Should I Be Reconciling Payments?

Honestly, this all comes down to your transaction volume. There's no single right answer, but there are some solid rules of thumb.

If you're running a high-volume business like an e-commerce store or a busy online service, daily reconciliation isn't just a good idea—it's essential. This habit lets you spot errors, flag suspicious activity, and keep a tight grip on your cash flow in almost real time.

For businesses with fewer transactions, a weekly or monthly schedule might be perfectly fine. The key isn't the frequency itself, but the consistency. Sticking to a regular schedule stops tiny mismatches from turning into massive accounting headaches later on.

What's the Real Difference Between Bookkeeping and Reconciliation?

It helps to think of it like writing and then editing a book.

Bookkeeping is the act of writing the story. You're recording every single financial transaction as it occurs, creating a daily diary of your company's financial life.

Payment reconciliation is the editing and fact-checking phase. This is where you take your story (your internal books) and compare it line-by-line against an external source (like a bank or crypto wallet statement) to confirm every detail is accurate. Bookkeeping is what you think happened; reconciliation is what proves it happened.

Can't I Just Use a Spreadsheet for All This?

You can, but the real question is, should you? For a tiny business with just a handful of sales, a spreadsheet might get the job done. But as soon as you start to grow, it becomes a serious bottleneck.

Spreadsheets are where scalability and accuracy go to die. They lack the automation needed for modern commerce, can't handle complex fee structures, and are notoriously prone to human error.

For any business that's serious about its financial health, dedicated software is the way to go. It’s built to manage the kind of complexity that spreadsheets just weren't designed for, making it a far more reliable and secure choice.

Ready to stop wrestling with spreadsheets and get your reconciliation on autopilot? BlockBee brings all your fiat and crypto payments into one clear dashboard, giving you a single source of truth and complete financial clarity. Get started with BlockBee today.