A Guide to Blockchain Payment Solutions

Imagine sending money across the globe as easily as you send an email.It's instant, direct, and doesn't involve a lineup of costly middlemen. This is the core promise of blockchain payment solutions, a fresh alternative to the traditional payment systems we've all grown accustomed to—the ones often bogged down by slow settlement times, high fees, and a frustrating lack of transparency.

The Future of Global Transactions

For decades, the way we've moved money hasn't changed all that much. It still relies on a tangled web of banks and clearinghouses, a system that, while functional, was built for a pre-internet world. This old-school setup creates delays that can stretch for days on international transfers and tacks on fees at every step, chipping away at profits and personal remittances. A standard international wire transfer, for example, can easily set you back $25 to $50.

Blockchain payment solutions completely sidestep this outdated model. Think of a traditional payment as sending a physical package: it goes through multiple sorting hubs, gets handled by different carriers, and is scanned repeatedly before it finally arrives. A blockchain payment, on the other hand, is like sending a secure digital file directly from your device to the recipient's. No one else needs to touch it.

This direct, peer-to-peer approach brings some powerful, immediate advantages to the table:

- Drastically Lower Costs: When you cut out the intermediaries, you cut out their fees. This is a game-changer for everything from micropayments to international trade, where traditional fees can make certain transactions impractical.

- Serious Speed: We're talking about transactions confirming in minutes, not days. This system is always on, 24/7, which means your money is never stuck in limbo waiting for a bank to open or a batch settlement to clear.

- Rock-Solid Security: Every transaction is locked down with advanced cryptography and permanently recorded on an unchangeable public ledger. This design makes fraud incredibly difficult and provides a crystal-clear, auditable trail of every cent.

A New Way to Think About Value

This guide is your map to this new financial landscape. We'll get into the nuts and bolts of how the technology works, look at its real-world benefits with concrete examples, and walk through the practical considerations for getting it set up.

The big idea here is simple but incredibly powerful: blockchain lets us move value with the same speed and efficiency we've come to expect when moving information. It swaps institutional trust for mathematical certainty.

Ultimately, getting a handle on blockchain payment solutions means recognizing a fundamental shift in how commerce is done. We're moving away from a system defined by institutional gatekeepers and toward one powered by open, decentralized networks. By the time you're done with this guide, you’ll see exactly how your business can tap into this technology to operate more efficiently on a global scale.

How Blockchain Payments Actually Work

Let's break down how blockchain payments work with a simple analogy. Think of it like a digital notebook that's shared across thousands of computers all over the world. Every time someone makes a transaction, a new entry gets added to every copy of that notebook. Here's the magic part: once that entry is written, it's sealed with a complex digital lock (cryptography) and can never be changed or deleted.

That shared digital notebook is the blockchain. It’s a ledger, but unlike a bank's private records, this one is open, transparent, and maintained by a community, not a single company. This core difference is what makes blockchain payments so fundamentally different from the systems we use every day.

The whole thing rests on three key ideas that, when combined, create a remarkably secure and efficient way to send value without needing a traditional middleman.

The Power of Decentralization

In our current financial system, everything flows through a central authority—a bank, a credit card company, or a payment processor. They're the gatekeepers we have to trust to handle our money correctly. Blockchain flips that model on its head by getting rid of the central gatekeeper.

Instead of one organization holding the ledger, thousands of participants, known as nodes, each have an identical copy. When you want to send a payment, these nodes all work together to check if you actually have the funds and if the transaction details are correct. Because everyone has to agree, no single person or company can block your payment, freeze your account, or suddenly change the rules.

This idea isn't just theoretical anymore. In 2023, the adoption of cryptocurrency for payments jumped by a massive 55%, and now over 1,200 major businesses accept digital currencies like Bitcoin or stablecoins. This isn't just a niche trend; it’s a clear signal that the world is looking for payment systems where trust is shared, not concentrated. You can find more data on this shift and what it means for global business.

Securing Transactions with Cryptography

So, if there's no bank watching over everything, how can you be sure the payments are secure and legitimate? The answer is cryptography. Every person on the network gets a pair of digital keys: a public key, which is like your bank account number that you can share freely, and a private key, which is like a top-secret password that proves you own the account.

When you send a payment, you use your private key to create a unique digital signature for that specific transaction. This signature is like a mathematical fingerprint, proving it came from you and nobody else. It's practically impossible to fake, which bakes security right into the system's DNA.

At its heart, blockchain technology combines two incredibly powerful concepts: immutability (once a transaction is recorded, it's set in stone) and transparency (anyone can view the public record of verified transactions). This duo creates a "trustless" environment where people can deal directly with each other, knowing that the rules are enforced by math and code, not a person or institution that could make a mistake.

This cryptographic foundation makes sure every single transaction is:

- Authentic: Proven to come from the person who actually owns the funds.

- Tamper-Proof: Sealed into a "block" of information that's cryptographically linked to the one before it, creating a chain that can't be broken.

- Final: Once the network confirms a payment, it's done. It can't be reversed, which gets rid of headaches like chargeback fraud for merchants.

This powerful framework doesn't ask you to trust a bank; it asks you to trust math. That's what allows people and businesses to exchange value directly and confidently, anywhere in the world.

The Core Benefits of Blockchain Payments

It’s one thing to understand the technical architecture of a blockchain payment system, but what really matters is how it can concretely improve your business. Shifting away from traditional financial rails isn’t just a tech upgrade; it’s about unlocking real-world advantages that simply weren’t possible before. These benefits tackle some of the oldest and most frustrating pain points in global commerce, from sky-high costs to mind-numbing delays.

At its heart, the value of blockchain payments comes down to four massive improvements: dramatically lower fees, settlement in minutes, superior security, and unmatched transparency. Each one is a direct and powerful upgrade over the aging systems most businesses still depend on to move money around the world.

Slashing Transaction Fees

One of the first things businesses notice is the immediate and significant drop in transaction costs. If you’ve ever sent an international wire transfer, you know it involves a chain of intermediary banks, and every one of them takes a slice of the pie. It's not uncommon for fees to run anywhere from $25 to $50 per transaction, a cost that really stings for companies making regular overseas payments.

Blockchain payment solutions get rid of most of those middlemen. By creating a more direct line between you and the person you're paying, the system sidesteps that long, expensive chain of correspondent banks. The result is real savings. For example, sending a payment with a stablecoin often comes with a network fee that’s just a tiny fraction of what a traditional bank would charge, especially for larger B2B transfers.

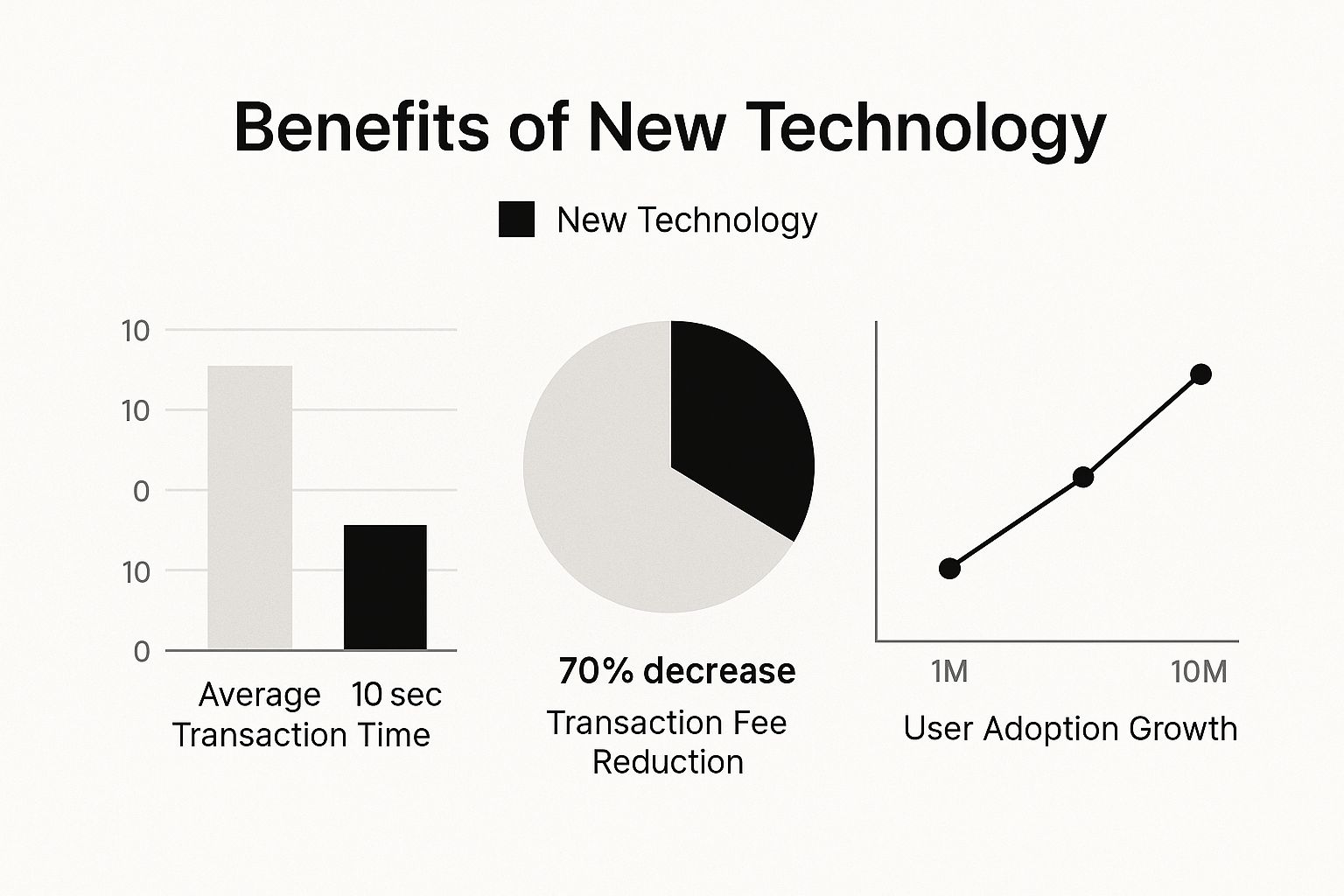

This image really drives home just how much better blockchain is when it comes to speed and cost, not to mention its rapid growth in adoption.

The numbers don't lie. When it comes to the metrics that directly impact your operational efficiency, blockchain technology just performs on another level.

Achieving Near-Instant Settlement

Beyond saving money, the speed of settlement is a total game-changer for managing cash flow. A standard cross-border payment can take a painful three to five business days to finally clear. During that time, your money is in limbo, navigating different banking hours, time zones, and settlement procedures. This waiting game ties up capital and creates needless uncertainty.

In contrast, blockchain networks never sleep—they operate 24/7/365. Transactions are usually confirmed and settled in a matter of minutes, sometimes even seconds, no matter the time of day or day of the week. This near-instant finality means the recipient has access to the funds almost immediately, which boosts liquidity and lets your business move with much more agility. It turns the global payment process from a multi-day waiting period into an on-demand function.

This shift has been especially profound in the cross-border payments sector. The market for blockchain-based international payments has been growing at an astonishing annual rate of 48%, and it's projected to hit $5 trillion by 2025. It's not hard to see why when this model can cut transaction fees by 60% to 70% compared to old-school banking.

Blockchain Payments vs Traditional Banking Systems

To really put these advantages into perspective, let's look at a side-by-side comparison of how blockchain and traditional banking stack up for a typical international transaction.

| Feature | Blockchain Payment Solutions | Traditional Banking |

|---|---|---|

| Transaction Speed | Settlement in minutes, 24/7 | 3-5 business days, restricted by banking hours |

| Associated Costs | Low network fees, minimal intermediaries | High fees from correspondent banks |

| Global Access | Accessible anywhere with an internet connection | Dependent on established banking relationships |

| Security Model | Cryptographically secured and immutable | Reliant on centralized fraud detection systems |

| Transparency | Publicly verifiable on the ledger | Opaque, with limited tracking visibility |

This table lays it out clearly: the decentralized model offers a major operational edge. For any business focused on optimizing its financial operations, exploring these solutions is a logical and powerful next step. If you're starting to think about what this could look like for your company, check out our ultimate guide to accepting cryptocurrency payments for your business.

4. A Look at Real-World Blockchain Payment Types

Alright, we've covered the mechanics and benefits of blockchain payments, but that's only half the story. The real question is: which digital asset should you actually use? The world of blockchain payments isn't a one-size-fits-all solution. It's a diverse ecosystem, and each type of digital currency has its own personality, strengths, and ideal use cases.

To make the right call for your business, you need a practical understanding of the main players. Let’s break down the three primary categories you'll encounter: the originals like Bitcoin, value-stabilized assets called stablecoins, and the newer, government-backed digital currencies.

The Original Cryptocurrencies

When someone says "blockchain payment," your mind probably jumps straight to Bitcoin (BTC) or Ethereum (ETH). These are the pioneers, the decentralized currencies that started it all. They run on public blockchains, are secured by a worldwide network of computers, and their value is set entirely by the open market.

While they are fantastic for showing off the raw power of decentralized transactions, their wild price swings (volatility) make them a tricky choice for everyday business. Imagine receiving a payment in Bitcoin that's worth 10% less by the time you close your books for the day. That can create some serious accounting headaches and cash flow problems.

Because of this, while some forward-thinking businesses accept them to attract a crypto-savvy crowd, they aren't usually the go-to for core business transactions or managing company finances.

The Rise of Stablecoins

This is precisely where stablecoins come into play, solving the volatility problem in a very elegant way. Just as their name implies, stablecoins are built to hold a steady value because they are pegged to a real-world asset—most often, a major fiat currency like the U.S. dollar.

Think of a stablecoin as a digital dollar that lives on a blockchain. One token, like a USDC or USDT, is designed to always be worth one dollar. This simple but powerful concept gives you the stability of traditional money combined with the speed and global reach of blockchain.

This stability makes them incredibly useful for a huge range of business needs:

- B2B Payments: Paying an international supplier becomes dead simple. An invoice for $10,000 paid with a dollar-pegged stablecoin is received as $10,000. No currency fluctuation risk, no surprise fees.

- Treasury Management: Companies can move large sums across borders instantly without worrying about the market dipping. This frees up capital and makes operations much more fluid.

- Merchant Payments: Your customers can pay with a stable asset, and you can receive it knowing its value won't have evaporated by morning.

Stablecoins have quickly cemented their place in modern finance. Though their daily transaction volume of around $30 billion is still under 1% of total global money flows, their total circulation has doubled in the last 18 months—a clear sign of rapid adoption. For more on this trend, you can explore insights on how tokenized cash is enabling next-gen payments from McKinsey.

Central Bank Digital Currencies (CBDCs)

There's a third category on the horizon: the Central Bank Digital Currency (CBDC). Unlike decentralized crypto, a CBDC is a digital version of a country's official money, issued and guaranteed by its central bank. A digital dollar, for instance, would be a direct liability of the U.S. Federal Reserve, just like a paper bill.

Right now, most countries are still in the research or pilot phase with CBDCs. But they represent a possible future where official, government-backed money moves on blockchain-inspired technology. They would promise the full faith and credit of a sovereign currency, paired with the efficiency of digital payments.

For businesses, CBDCs could one day become another fantastic, government-approved option for blockchain payments. For today, however, stablecoins are the most mature and widely used tool for anyone needing stable-value transactions on the blockchain.

So, you're sold on the idea of blockchain payments. The big question now is, "How do I actually get this up and running for my business?" From the outside, it can seem like a daunting technical challenge, but the path to getting started is more straightforward than you might think. For most businesses, it really comes down to two main options, each with its own pros and cons in terms of control, cost, and the technical work involved.

Your final choice will hinge on your company's resources, technical know-how, and what you're trying to achieve in the long run. One path is all about simplicity and getting to market quickly, while the other is for those who need total customization and control.

Choosing Your Integration Path

The most common route, by far, is partnering with a crypto payment gateway. You can think of this as the "plug-and-play" solution. Providers like BlockBee do all the complicated technical work behind the scenes. They give you ready-made tools, APIs, and plugins for popular e-commerce platforms like WooCommerce and Magento, which means you can start accepting crypto payments in a snap.

This approach is perfect for businesses that want all the advantages of blockchain payments but don't have—or want to hire—a dedicated team of blockchain developers. It takes care of everything from generating the checkout page to confirming transactions and handling currency conversions.

The second path is to build a custom, in-house integration from the ground up. This option gives you maximum control and flexibility, letting you design a payment experience that’s perfectly suited to your unique operations. But make no mistake, it demands serious technical expertise, a lot of development resources, and a long-term commitment to maintaining and securing the system. It's a fantastic option for large enterprises or tech-focused companies with the talent to pull it off.

For the vast majority of businesses, especially in e-commerce, using a payment gateway is the most practical and efficient way to begin. It lowers the barrier to entry, minimizes risk, and gets you up and running fast, so you can focus on your business instead of blockchain infrastructure.

Key Considerations for a Smooth Rollout

Once you've decided on your approach, a successful launch depends on thinking through a few key operational details. Getting these right from the start will make the whole process smoother for both you and your customers.

1. Managing Wallet Security Security is everything. You absolutely need a secure method for storing your digital funds. With a non-custodial wallet, you hold your own private keys, which means you—and only you—can access your crypto. This is the gold standard for security, but it also means the responsibility for keeping those keys safe is entirely on your shoulders. The alternative is a custodial service, where a third party manages the keys for you. It's more convenient, but you have to place your trust in that provider. Many businesses find that a non-custodial gateway offers the best of both worlds: user-friendliness combined with complete control over their money.

2. Handling Price Volatility Let's face it: cryptocurrency prices can swing wildly. To protect your revenue from these fluctuations, you have a couple of great strategies:

- Lean on Stablecoins: You can encourage customers to pay with or even exclusively accept stablecoins like USDC or USDT. Because they're pegged to fiat currencies (like the US dollar), their value doesn't bounce around, effectively eliminating price risk.

- Use Instant Conversion: Many payment gateways offer instant conversion to fiat. The moment a customer pays you in a volatile crypto like Bitcoin, the service can automatically convert it into your local currency or a stablecoin, locking in the value right then and there.

3. Navigating Regulatory Compliance The rulebook for digital assets is still being written and varies from place to place. It's critical to stay on top of the regulations in your area concerning taxes, Anti-Money Laundering (AML), and Know-Your-Customer (KYC) requirements. Working with a compliant payment provider can make this much easier, as they often have tools and processes built in to help you meet your legal obligations. For a complete walkthrough, read our guide on how to accept crypto payments for your business to make sure you’ve got all your bases covered.

Getting Ready for a Decentralized World

After digging into blockchain payment solutions, one thing becomes crystal clear: this isn't just another way to send money around. We're talking about a massive shift toward a global economy that's more direct, efficient, and open for everyone. The old-school financial systems, bogged down by slow processing times and a crowd of middlemen, are finally facing a real challenge from technology built for today's pace.

Adopting these solutions is more than just a tech upgrade; it’s a strategic move that puts your business ahead of the curve. It’s about tackling those stubborn inefficiencies that eat away at your profits and drag down your operations. When you bring this technology into your business, you're not just swapping out a system—you're getting ready for a future where value flows as seamlessly as information does today.

Your Next Smart Move

The best way forward is to jump in and embrace this change. Ideas like decentralization, cryptographic security, and nearly instant settlements aren't just for tech talks anymore; they are practical tools you can use right now. They offer real, measurable benefits like lower costs, better security, and healthier cash flow, all of which give you a serious competitive edge.

Here's the bottom line: blockchain gives businesses the power to take back control of their own finances. It gets rid of the pointless friction and builds a system based on trust that's written in code, leveling the playing field for companies all over the world.

Sitting on the sidelines and waiting isn't really an option anymore. The tools are ready, the platforms are stable, and the business case is stronger than ever. Taking the first steps, like working with a non-custodial payment gateway like BlockBee, is designed to be simple. You can start reaping the rewards without needing a PhD in computer science.

This technology isn't some far-off dream; it's about giving your business an advantage, starting now. The companies that will lead the pack are the ones who see this potential and do something about it. To keep learning and get a better sense of what's on the horizon, dive deeper into the future of crypto payments in our detailed article. The decentralized future is already knocking—are you going to answer the door?

Frequently Asked Questions About Blockchain Payments

It’s only natural to have questions when you’re looking at bringing a new technology into your business. Let’s walk through some of the most common practical concerns people have about blockchain payments so you can feel confident moving forward.

Are Blockchain Payments Truly Secure?

Absolutely. The security isn't an add-on; it's baked into the very foundation of the technology. Think about it this way: a traditional payment hangs on a single, private ledger controlled by a bank. A blockchain payment, on the other hand, is verified and confirmed by a whole network of computers. To slip a fraudulent transaction past that many digital witnesses is practically impossible.

On top of that, every payment is sealed with heavy-duty cryptography. This process creates a permanent, tamper-proof record on the blockchain, delivering a level of security and transparency that centralized systems just can't offer.

Blockchain's core security comes from decentralization and cryptography. With no single point of failure to attack and every transaction mathematically locked in, it's a fundamentally more resilient system.

How Can My Business Handle Crypto Price Volatility?

That’s a big, valid concern for many businesses, but thankfully, it's a problem that has been solved with the right tools. The most straightforward solution is to use stablecoins. These are cryptocurrencies designed to hold their value by being pegged 1:1 to a stable asset, like the U.S. dollar. Using them completely sidesteps the issue of price swings.

Another great strategy is to work with a payment gateway that offers instant conversion. The second a customer pays you in a crypto like Bitcoin, the service can immediately convert it into your local currency. This locks in the value right away, so you're never exposed to the market's ups and downs.

What Are the First Steps to Accept Crypto?

You really don't need to be a blockchain wizard to get started. The simplest way in is to partner with a crypto payment gateway. These services provide ready-made tools, like simple plugins for e-commerce platforms, that take care of all the technical heavy lifting for you.

Here’s what that looks like in practice:

- Find a reputable, non-custodial payment provider.

- Integrate their tool into your website or invoicing system—it's often just a few clicks.

- Decide how you want to handle volatility, whether that’s by accepting stablecoins or using an auto-conversion feature.

This approach lets you tap into all the benefits of blockchain payments without getting bogged down in the complexities.

Ready to unlock faster, cheaper, and more secure global transactions? BlockBee provides a secure, non-custodial payment platform that makes it incredibly easy to accept over 70 different cryptocurrencies. Get started today and see just how simple it is to prepare your business for the future of payments. Learn more at BlockBee.