How to transfer crypto to bank account: A quick, secure guide

So, you've got crypto and you want to turn it into cash in your bank account. It's a common goal, but the path you take matters. You can go through a centralized exchange, find a direct buyer on a peer-to-peer marketplace, or just spend it like cash with a crypto debit card. Each option strikes a different balance between speed, cost, and convenience.

Bridging Your Digital and Traditional Finances

The real question isn't if you can move crypto to your bank, but how to do it smartly. This guide cuts through the noise and shows you the most practical ways to convert your digital assets into dollars, euros, or whatever currency you use for bills, investments, and daily life.

We'll lay out the main pathways and help you figure out which one makes the most sense for what you're trying to do. Whether you're a freelancer cashing out a client payment or a business managing digital sales, this is your roadmap for a smooth crypto-to-fiat journey.

Choosing Your Off-Ramp Strategy

The "best" way to transfer crypto to your bank really boils down to what you value most. Is it speed? Low fees? Privacy? Each method has its own distinct pros and cons.

- Centralized Exchanges (CEXs): This is the go-to for most people. They offer deep liquidity, making it easy to sell your crypto and kick off a standard bank withdrawal.

- Peer-to-Peer (P2P) Platforms: These connect you directly with buyers, often giving you more flexibility on payment methods and sometimes even better exchange rates.

- Crypto Debit Cards: The most direct route. They let you spend your crypto at any merchant that accepts cards, completely skipping the bank transfer step.

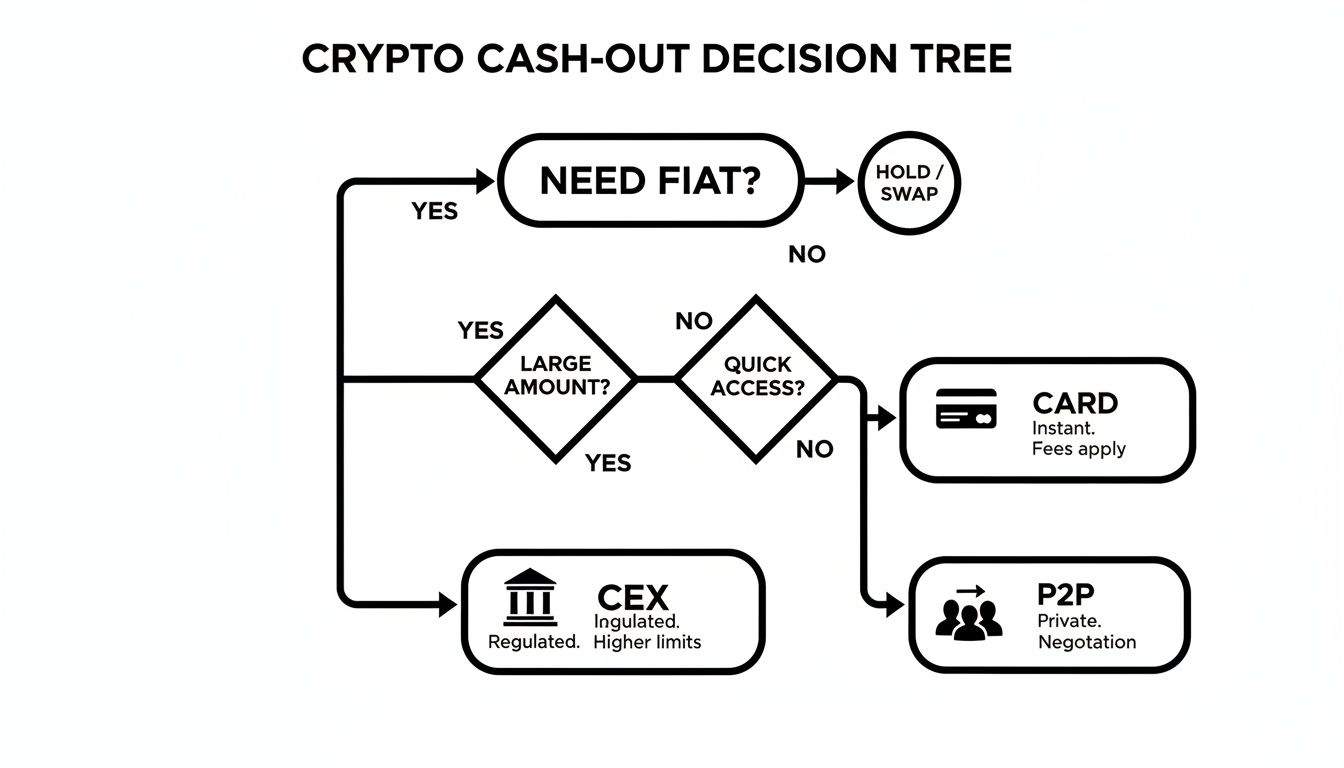

This decision tree gives you a quick visual on which path might be right for your specific situation, depending on how much control you want, how fast you need the money, and the size of your transaction.

As you can see, CEXs are a solid bet for straightforward, secure withdrawals. P2P platforms really shine when you need more payment options. And for sheer convenience in daily spending, nothing beats a crypto card.

To make this even clearer, here's a quick rundown of the main off-ramp methods.

Quick Comparison of Crypto Off-Ramp Methods

This table summarizes the main ways to convert crypto to fiat, helping you choose the best option at a glance.

| Method | Best For | Typical Speed | Average Fees | Key Consideration |

|---|---|---|---|---|

| Centralized Exchange | Standard, secure transfers; high liquidity | 1-5 business days | 0.1% - 1.5% | Requires KYC; withdrawal limits may apply |

| P2P Platform | Payment method flexibility; potentially better rates | Minutes to hours | 0% - 1% | Higher risk of scams; requires direct user interaction |

| Crypto Debit Card | Direct spending and ATM withdrawals | Instant | 1% - 3% + network fees | Convenience comes at a cost; not a true "bank transfer" |

| OTC Desk | Large volume trades (over $100,000) | 1-3 business days | Varies (often <0.5%) | High minimums; personalized service |

| Mass Payouts | Businesses paying multiple recipients | Varies by provider | Platform-specific | Scalable solution for payroll, rewards, or affiliate payouts |

Ultimately, the right choice depends entirely on your specific needs—a small, quick conversion has different requirements than a large, institutional one.

The Growing Need for Smooth Crypto-to-Fiat Conversion

The demand for simple, reliable ways to cash out crypto is absolutely booming. By June 2025, it's estimated that 6.8% of the world's population—that's around 540 million people—will own cryptocurrency. This huge user base is what's driving the need for better bridges into traditional banking, especially for things like cross-border payments.

Stablecoins, in particular, have become a critical part of this equation. Their total supply has exploded from just $5 billion five years ago to a projected $305 billion by September 2025. You can get a deeper dive into the growth of blockchain payments on bvnk.com.

The core challenge has shifted from simply acquiring crypto to integrating it into our daily financial lives. An effective off-ramping strategy is no longer a niche requirement—it's an essential tool for anyone participating in the digital economy.

This incredible growth underscores why knowing how to get your funds from a crypto wallet to a bank account is more crucial than ever. It’s this ability to move between the two financial worlds that makes crypto a truly practical asset.

Using Centralized Exchanges for Direct Withdrawals

For most folks, the crypto journey starts and ends on a centralized exchange (CEX). It’s probably the most well-trodden path for turning your crypto back into cash. Think of platforms like Coinbase, Kraken, or Binance as the main bridges connecting your digital assets to your regular bank account. They offer what is usually the most straightforward and regulated way to cash out.

The whole process is designed to feel familiar, a lot like using a standard online brokerage account. At its core, it’s simple: you send crypto to the exchange, sell it for a traditional currency like US dollars or Euros, and then pull that cash out to your linked bank account.

Getting Set Up on an Exchange

Before you can pull any money out, you obviously need an account with a reputable exchange that operates where you live. If you’ve already got one, you're ahead of the game. If not, picking the right one is your first big decision. You’ll want to look for an exchange with a solid security reputation, fair fees, and good word-of-mouth from other users.

Once you’ve picked your platform, you’ll have to go through the Know Your Customer (KYC) and Anti-Money Laundering (AML) verification. There's no getting around this; it's a hard-and-fast regulatory requirement for any legitimate exchange.

Typically, you'll be asked to provide:

- A government-issued photo ID (a driver's license or passport usually works)

- Proof of your address (like a recent utility bill or bank statement)

- A quick selfie to prove it's really you

This can be over in a few minutes or sometimes take a couple of days, so don't leave it to the last minute. After you're verified, you link your bank account. This usually involves either making a tiny test deposit or securely logging into your online banking through a third-party service like Plaid.

The Conversion: From Crypto to Cold, Hard Cash

With your account ready to go, the next step is getting your crypto onto the exchange.

Let's walk through a real-world example. I once helped a freelance developer who was paid 1.5 ETH into his self-custody wallet. He needed to turn that into USD to pay for some business software.

First, he sent the ETH from his private wallet to the unique Ethereum deposit address provided by his exchange account. Here’s a pro tip I always give: always, always send a small test amount first. Sending just 0.01 ETH to make sure everything is working can save you from a heart-stopping mistake. Once that small amount safely landed in his exchange account, he sent the rest.

With the crypto on the exchange, it’s time to sell. You generally have two ways to do this:

- Market Order: This is the "sell it now" button. You sell your crypto instantly at the best price available at that moment. It's fast and guarantees the sale goes through, but you're a price-taker.

- Limit Order: This gives you a bit more control. You set the exact price you’re willing to sell at. Your order just sits there until the market hits your price. This is great if you think the price might tick up a bit and you aren't in a huge hurry.

The developer I was helping was in a rush, so he went with a market order. He sold his 1.5 ETH for USD, and the cash showed up in his exchange's fiat wallet almost immediately.

Pulling the Money Out to Your Bank

The final leg of the journey is moving that cash from the exchange to your bank. You just have to find the "withdraw" section, pick your currency (USD in this case), select your linked bank account, and type in how much you want to transfer.

Now, this is where you need to pay close attention to two things: the fees and the timing.

Key Takeaway: An exchange’s fee structure is more than just trading costs. Always look at both the trading fee (for selling the crypto) and the withdrawal fee (what they charge to send cash to your bank). They can definitely add up.

For instance, an exchange might charge a 0.5% fee to trade and a flat $5 fee for a bank transfer. If you were cashing out $3,000, that would be $15 for the trade plus the $5 for the withdrawal, totaling $20.

Withdrawal times can also be all over the map. Some transfers using ACH (in the U.S.) or SEPA (in Europe) can show up in a few hours or the next business day. But a standard bank wire could easily take 3-5 business days, especially if it has to cross international borders. Make sure to plan for this if you need the money by a certain date.

You can explore a broader overview of how to cash out crypto in our detailed guide for more methods.

All in all, centralized exchanges offer a dependable, regulated, and pretty painless answer for anyone wondering how to get their crypto into a bank account. For most people, it's the perfect place to start.

Exploring Peer-to-Peer Platforms for Flexible Transfers

Sometimes, a centralized exchange can feel too rigid, or maybe you're in a country where direct bank withdrawals are a headache. This is where peer-to-peer (P2P) platforms really shine. Think of them less like a big, faceless bank and more like a bustling digital marketplace that connects you directly with people who want to buy the crypto you're selling.

What's great about this is the sheer variety of payment options. On platforms like Binance P2P or Paxful, you can find buyers ready to pay you through a local bank transfer, a digital wallet like Wise, or even with cash in person. For many people, that kind of flexibility is a total game-changer.

How P2P Crypto Transfers Work

The process is definitely more hands-on than using a standard exchange, but it’s all built around one critical feature: escrow. When you find a buyer and start a trade, the platform steps in and locks your crypto in a temporary holding account.

This escrow system is the bedrock of trust in the P2P world. It means you aren't just sending your coins into the void and hoping for the best. Your crypto is only released to the buyer after you’ve confirmed their payment has safely landed in your bank account.

The whole thing usually plays out like this:

- Find Your Match: You can post your own "for sale" ad, setting your price and the payment methods you'll accept. Or, you can browse ads from buyers and pick one that works for you.

- Lock it In: Once you and a buyer agree to a trade, your crypto is automatically moved into the platform's secure escrow.

- Get Paid: The buyer then sends the money directly to you using your chosen method, whether that's a bank transfer, PayPal, or something else.

- Confirm and Release: You check your account and see the money has arrived. Only then do you hit the button on the platform to release the crypto from escrow to the buyer.

This setup puts you firmly in the driver's seat. The crypto doesn't move until you say so.

A Real-World P2P Scenario

Let’s take a freelance web developer in Southeast Asia who gets paid by international clients in USDT (a stablecoin). Cashing out through a traditional bank means slow wire transfers and hefty fees that nibble away at their earnings.

Instead, they jump onto a P2P marketplace. They post an ad to sell $500 USDT for their local currency. A buyer in their own city who needs crypto sees the ad and accepts the deal. The developer’s $500 USDT is instantly locked in escrow.

The buyer then makes a simple local bank transfer. Within minutes, the developer sees the full amount in their bank account—no international fees, no waiting for days. Once they’ve confirmed the funds are there, they click "release crypto," and the trade is complete.

Key Insight: P2P platforms give power back to the user, especially in underserved financial markets. They let you sidestep the old, inefficient banking system and tap into global liquidity on your own schedule.

This whole process can take less than an hour, turning digital earnings into usable local cash quickly and cheaply.

Staying Safe on P2P Platforms

The direct, person-to-person nature of P2P trading means you need to be a little more careful. While the platform's escrow is a fantastic safety net, your own security habits are what ultimately keep you protected.

Crucial Safety Measures:

- Vet Your Counterparty: Always take a moment to check a buyer's profile. How many trades have they completed? What's their feedback score? Sticking with experienced users who have a high rating (over 98%) is just smart practice.

- The Golden Rule: Never, ever release your crypto from escrow until you have logged into your bank account independently and physically seen the money. Don't rely on screenshots or "payment confirmation" emails from the buyer; these can be faked with ease.

- Communicate on the Platform: Keep all your chats inside the P2P platform's built-in messaging system. This creates an official record of everything, which is invaluable if you ever need to raise a dispute with customer support.

For anyone looking to dive deeper into the various ways you can turn crypto into cash, our guide on how to cash out cryptocurrency provides a much broader overview. By being vigilant and using the tools provided, P2P trading can be an incredibly powerful way to manage your digital assets.

Spending Crypto Directly with Debit Cards

What if you don't actually need to get your crypto into a bank account? What if you just want to spend it? For everyday stuff—grabbing coffee, buying groceries, or filling up the car—the whole process of selling crypto, waiting for the fiat to clear, and then moving it to your bank feels ridiculously slow.

This is exactly where crypto debit cards come in. They act as a direct bridge between your digital assets and the real world, letting you bypass the bank entirely.

You've probably seen them offered by major players like Coinbase and Crypto.com. Since they run on the Visa or Mastercard networks, you can use them at millions of merchants around the globe, just like any other card in your wallet. The real magic happens behind the scenes the moment you tap to pay.

Instead of you manually selling crypto and waiting for the transfer, the card provider handles it all instantly. It converts just enough of your chosen cryptocurrency into fiat on the spot to cover the purchase. This makes your crypto holdings just as liquid and ready-to-use as the cash in your checking account.

The Major Upsides of Using a Crypto Card

The biggest advantage here is instant access. Plain and simple. There are no more multi-day waiting periods for bank transfers to clear. Your crypto becomes a spendable currency the second you need it, which is a game-changer for anyone looking to make digital assets part of their day-to-day finances.

But the rewards are often the main event. Many of these cards offer perks that can easily outshine what traditional credit cards bring to the table.

- Crypto-Back Rewards: Forget earning airline miles or a piddly percentage of cash back. With these cards, you can earn rewards in Bitcoin, Ethereum, or other digital assets. Getting 1% to 4% back on your spending in a potentially appreciating asset is a far more compelling proposition.

- Additional Perks: Some of the premium-tier cards throw in extra benefits like rebates on streaming services (think Spotify or Netflix) or even airport lounge access, adding a ton of real-world value.

This model completely flips the traditional off-ramping process on its head. Instead of a clunky, multi-step withdrawal, you get a seamless, single-step spending solution.

Navigating the Potential Downsides

Of course, all this convenience comes with a few trade-offs. The main thing you have to keep an eye on is the cost. While you might not see an explicit "withdrawal fee," the conversion from crypto to fiat at the point of sale isn't always free.

Important Consideration: The "spread," or conversion fee, is where these providers often make their money. It might be a tiny percentage on each transaction, but it adds up. You absolutely need to understand how it's calculated and whether it applies to every single purchase you make.

On top of that, these cards have limits you need to be aware of before you start relying on them.

Common Limitations to Check:

- Daily/Monthly Spending Limits: To manage their own risk, providers put caps on how much you can spend or pull from an ATM each day or month.

- ATM Withdrawal Fees: You can definitely get cash from an ATM, but there are usually fees involved, especially once you go over a certain monthly allowance.

- Regional Availability: This is a big one. Not all cards are available in every country, so the first thing you should do is verify that a provider actually services your location.

Ultimately, a crypto debit card isn't a formal method for transferring crypto to a bank account. It’s about making your digital assets a practical, integrated part of your financial toolkit. It offers unmatched convenience for daily use, but it's essential to weigh the fees and limits against the massive benefit of instant spending.

Automated Crypto Payouts for Businesses and Developers

If you're a merchant, developer, or any business managing digital assets, you've probably realized the standard ways of cashing out crypto just don't cut it. They're slow, manual, and frankly, a headache at scale. The real challenge isn't just one transfer; it’s building a smooth, repeatable financial workflow. This is where automated payout solutions come in, transforming simple exchanges into serious financial infrastructure.

While Over-The-Counter (OTC) desks are great for offloading large, single trades without tanking the market, the real game-changer for day-to-day operations is a programmable payment API. These tools are built specifically to streamline how you handle crypto revenue and send out payments.

Using APIs to Actually Scale Your Operations

Let's get practical. Imagine you run a global SaaS company that accepts crypto. At the end of every month, you owe money to dozens of international contractors. Doing this manually—converting your crypto revenue piece by piece and then sending individual bank wires—would be an administrative nightmare. It's not just tedious; it's expensive and wide open to human error.

This is exactly the problem that payout APIs were designed to solve. Platforms like BlockBee give you the tools to programmatically swap incoming crypto into stablecoins, instantly protecting you from market volatility. From there, the API can trigger fiat payouts to your vendors, employees, or partners all over the world, often landing directly in their local bank accounts.

Think of it this way: you're turning your company's crypto treasury from a static pile of assets into a dynamic hub for global financial operations. It’s all about working smarter and faster, without ever losing control of your funds.

This kind of automation drastically cuts down on manual work, shrinks the risk of costly mistakes, and slashes cross-border transaction fees. It’s a fundamental upgrade from just "cashing out" to truly managing your digital finances.

Why a Non-Custodial Approach Matters

One of the most important features to look for in a modern payout solution is that it’s non-custodial. This is a big deal. Unlike a typical centralized exchange that requires you to deposit funds onto their platform, a non-custodial system means you always keep full control of your assets in your own wallet. The payment gateway simply facilitates the transactions without ever holding your private keys.

This model gives you some serious advantages:

- Better Security: You completely remove the risk of losing your funds if a third-party platform gets hacked or goes under.

- Total Control: Your money is your money. You decide when and how it moves, no questions asked.

- Clear Audits: Every transaction is recorded on the blockchain, creating an unchangeable and transparent record for your accounting team.

This setup offers the best of both worlds: powerful automated tools combined with the fortress-like security of self-custody. If you're looking to scale your business this way, our guide on choosing an https://blockbee.io/blog/post/instant-payout-payment-gateway can give you a much deeper dive into how these systems work.

A Real-World Example of a Payout API in Action

Picture an e-commerce marketplace that pays its sellers every week. The platform gets paid in all sorts of crypto—Bitcoin (BTC), Ethereum (ETH), and a mix of stablecoins.

By integrating a payout API, the marketplace can set up a workflow that, on its own, will:

- Gather all incoming crypto payments into a single, central company wallet.

- Convert volatile coins like BTC and ETH into a stablecoin like USDC at set times to lock in their value.

- Execute mass payouts by sending fiat transfers to hundreds of sellers' bank accounts at once, all based on their sales data.

This entire sequence can run with almost no one lifting a finger, turning what would be a complex, multi-day accounting chore into a seamless, automated function. For any business exploring this path, it's also key to understand the nuts and bolts of seamless payment integration with platforms like Flutterwave and other financial service providers that bridge the gap between crypto and traditional banking.

The Big Picture: Global Scale and Market Integration

The demand for these solutions is exploding. For subscription businesses, programmable payments are a powerful way to automate crypto-to-bank flows and boost efficiency. The numbers are staggering—USD on-ramps are already processing an estimated $2.4 trillion in volume, helping businesses manage volatility while connecting with a global user base of over 540 million crypto owners.

A transparent, non-custodial ecosystem is what allows this growth to happen, turning crypto liquidity into stable, bankable assets without putting your funds at risk. At the end of the day, automated crypto payouts are more than just another way to get money to a bank account. They represent a strategic upgrade for any business serious about operating efficiently in both the digital and traditional financial worlds.

Managing Taxes, Fees, and Security

Getting your crypto into a bank account is one thing, but doing it safely, cheaply, and legally is what really counts. Too many people gloss over these details and end up paying for it later, either in lost funds or headaches with the taxman. Let's make sure that doesn't happen to you.

Don't Forget About Taxes

The biggest tripwire for most people is taxes. In the U.S. and many other countries, selling your crypto for fiat currency like dollars or euros is a taxable event. You're not just moving money around; you're selling an asset, which means you're on the hook for capital gains taxes on any profit you've made.

This is why keeping detailed records is absolutely essential. You need to know when you bought each asset, the price you paid, and the price you sold it for. Getting a handle on the simplified crypto tax reporting requirements is a must, but honestly, my best advice is to talk to a tax professional who knows their way around crypto. It's a small investment that can save you a fortune.

Understanding the Full Cost of Your Transfer

On top of taxes, every single off-ramping method has its own set of fees. It’s a classic rookie mistake to see a low trading fee and think you've found a great deal, only to get hit with other costs down the line.

Here’s a quick rundown of what you need to look out for:

- Trading Fees: The percentage the exchange or P2P platform takes for the actual crypto-to-fiat sale.

- Withdrawal Fees: This is a separate, often flat, fee for moving the cash from the platform to your bank.

- Network Fees: The cost to move your crypto from a personal wallet to an exchange in the first place. This can vary wildly depending on the blockchain and how busy it is.

- Spread/Conversion Fees: Crypto debit cards are notorious for these. It’s the hidden fee baked into the exchange rate they give you, which is often worse than the true market rate.

A platform might boast about low trading fees but have sky-high withdrawal fees. Always add up all the costs to find the truly cheapest option for your specific transaction.

Your Personal Security Checklist

Finally, let's talk security. When you’re moving crypto, there are no do-overs. One wrong move, and your funds can be gone forever. I’ve seen it happen. That's why I follow a strict personal checklist for every single transaction, and you should too.

- Set Up 2FA (The Right Way): Use an authenticator app like Google Authenticator or Authy. SMS-based 2FA is better than nothing, but it's vulnerable to SIM-swap attacks.

- Triple-Check Every Address: This is non-negotiable. When sending crypto to an exchange, copy the deposit address, then visually confirm the first few and last few characters match. For any significant amount, I always send a small test transaction first. It’s worth the extra network fee for the peace of mind.

- Watch Out for Phishing: Scammers are incredibly good at making fake emails and websites that look real. Never, ever click a link from an email claiming to be from your exchange. Always go to the site by typing the URL directly into your browser.

- Use Unique, Strong Passwords: Don't reuse passwords across different platforms, especially financial ones. A good password manager makes this a breeze.

Got Questions? We’ve Got Answers

Even with the best plan, you'll probably still have a few questions when it comes time to move your crypto into a bank account. Let's tackle some of the most common ones that come up.

How Long Does This Actually Take?

The honest answer? It depends. The path you choose makes all the difference.

If you’re using a standard centralized exchange, you’re typically looking at a wait time of 3-5 business days for the funds to clear. It really comes down to the traditional banking system at that point.

On the other hand, peer-to-peer (P2P) platforms can be lightning-fast. I've seen transactions wrap up in less than an hour once a buyer is found and confirmed. Crypto debit cards are instant for spending, but that's not quite the same as a direct transfer to your bank.

Are There Limits on Cashing Out?

Absolutely. Almost every platform will have some kind of cap on how much you can move.

- Exchanges usually tie your daily or monthly withdrawal limits to your verification level. The more KYC info you provide, the higher your limits.

- P2P platforms have limits too, but they're often set by the individual traders you're dealing with.

If you're planning to move a significant sum—think $100,000 or more—an Over-The-Counter (OTC) desk is the way to go. It's the professional standard for large transfers, helping you avoid the price slippage you'd see on a public exchange and bypassing those typical platform limits.

What’s the Cheapest Way to Get My Cash?

Finding the "cheapest" method is all about balancing fees, rates, and the size of your transaction.

P2P platforms can be a great option for smaller amounts, sometimes offering better exchange rates and lower fees than big exchanges, particularly in areas where traditional banking costs are high.

But for a large conversion, nothing beats an OTC desk. You get to negotiate a fixed rate directly, which almost always works out to be the most cost-effective approach for big sums. My best advice is to always do the math first: compare the trading fees, withdrawal fees, and the final exchange rate you'll get before locking in your transaction.

Ready to make your crypto operations smoother? BlockBee provides a secure, non-custodial payment solution that helps businesses handle crypto payments and process mass payouts without the headache. Find out more about how BlockBee can help.