How Do You Cash Out Crypto Currency? A Practical Guide

When it's time to turn your crypto profits into real-world cash, you've got a few solid options. The main ways to do it are by selling on a centralized exchange for fiat currency (like US dollars), finding a buyer directly through a peer-to-peer platform, or even using a crypto ATM for instant cash.

Ultimately, the right choice for you will hinge on what you value most: speed, low fees, or keeping your transaction private.

Your Roadmap to Turning Crypto into Cash

Figuring out how to get your digital assets from a crypto wallet into your bank account can seem daunting at first, but it's actually pretty straightforward once you know the lay of the land. This guide is your map, breaking down each method so you can confidently pick the one that fits your situation.

Before we get into the nitty-gritty, let's look at the main paths you can take. Each one has its own set of trade-offs when it comes to how fast you get your money, what you'll pay in fees, and how much personal info you'll need to share.

Comparing Your Cash-Out Options

The four most common ways to cash out your crypto are through centralized exchanges (CEXs), peer-to-peer (P2P) platforms, crypto ATMs, and crypto debit cards. Each one is built for a different need, whether you're making a large, secure withdrawal or just need some quick cash for daily spending.

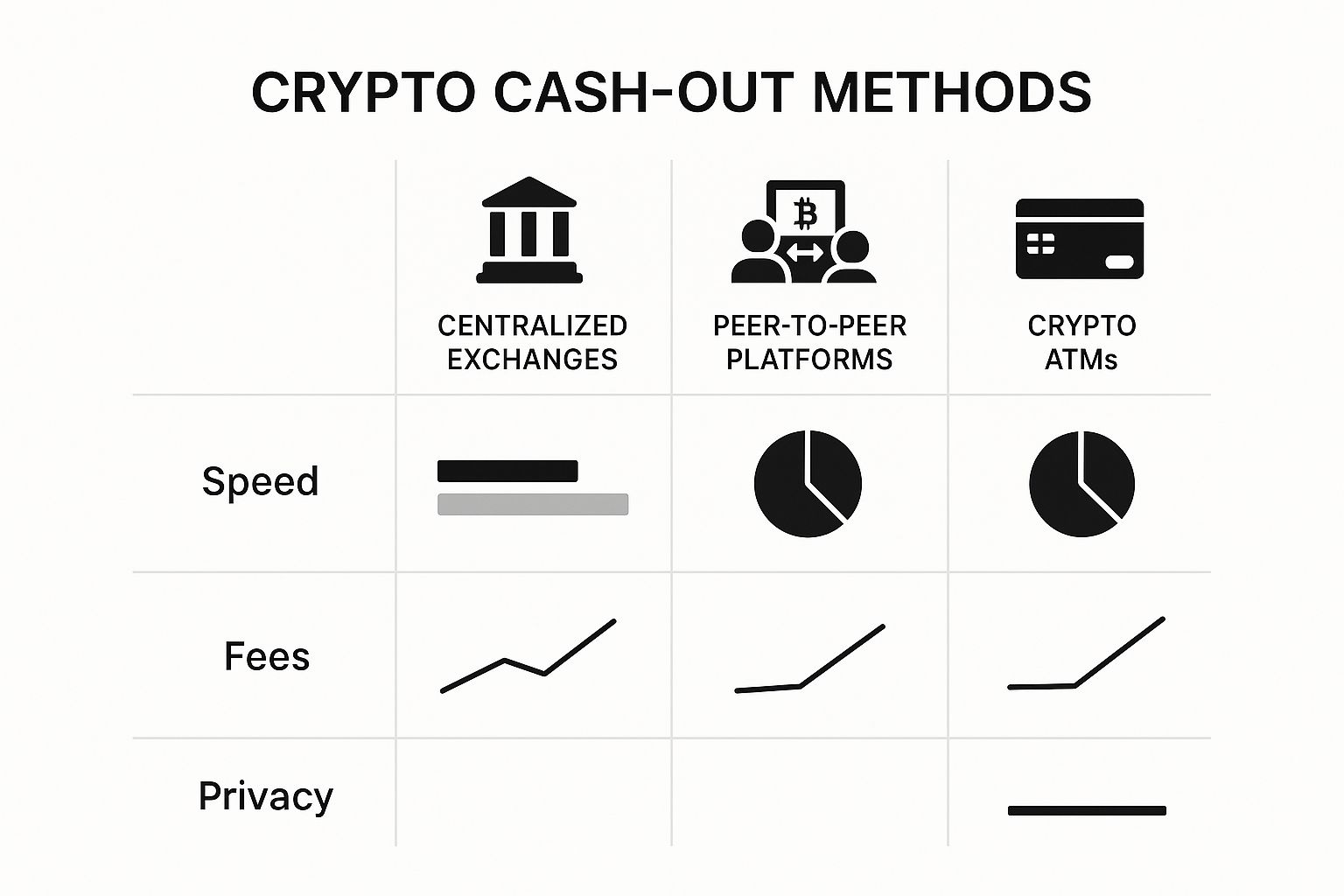

This infographic gives a great visual breakdown of the key differences, zeroing in on speed, fees, and privacy.

As you can see, centralized exchanges strike a good balance, while ATMs are all about speed but come with higher fees. P2P platforms, on the other hand, offer more control and privacy.

To make things even clearer, let's compare these methods side-by-side.

Crypto Cash-Out Methods at a Glance

This table gives you a quick comparison of the most common ways to convert your crypto, highlighting what each method does best.

| Method | Best For | Typical Speed | Average Fees |

|---|---|---|---|

| Centralized Exchange (CEX) | Large withdrawals and beginners | 1-5 business days | 0.1% - 1.5% |

| Peer-to-Peer (P2P) | Privacy and payment flexibility | Varies (minutes to hours) | 0% - 1% |

| Crypto ATM | Instant, small amounts of cash | Instant | 7% - 20% |

| Crypto Debit Card | Everyday spending | Instant | Varies by card |

Looking at the table, it’s easy to see how the trade-offs play out. What you gain in speed with an ATM, you lose in fees. What you gain in privacy with P2P, you might trade for the simplicity of a CEX.

The Role of Centralized Exchanges

For most people, centralized exchanges are the default choice. They've long been the primary on-ramp and off-ramp for converting crypto into fiat. To give you an idea of the scale, Bitcoin alone saw over $4.6 trillion in fiat inflows between July 2024 and June 2025, dwarfing other tokens. This kind of volume shows just how integral these platforms are.

Key Takeaway: The fundamental choice you'll make is between convenience and control. Exchanges offer a simple, regulated path, while alternatives provide more flexibility and privacy but often require more diligence from the user.

Getting a handle on this landscape is the first step. And as financial technology keeps moving forward, new solutions are always popping up. For those looking to explore a wider range of financial products, platforms like the klinkfinance homepage can be a good starting point.

Now, let's dive into the practical steps for each of these cash-out methods.

Using Centralized Exchanges to Get Your Cash

If you're wondering how do you cash out cryptocurrency, centralized exchanges (CEXs) are probably the first place you'll look. Platforms like Coinbase, Kraken, or Binance are the most common on-ramps and off-ramps, acting as a bridge between your digital assets and the traditional banking system.

They offer a familiar, structured way to turn your crypto into fiat currency, like US dollars or Euros. It's a well-worn path for a reason.

Think of a CEX like a currency exchange booth at the airport. You give them your crypto, and they give you cash, taking a small cut for their service. It’s a process built for convenience and security, which is why millions of people rely on it.

Getting Started The Right Way

Before you can cash out, you’ve got to get your account set up properly. This means tackling the one step every regulated exchange requires: Know Your Customer (KYC) verification.

This isn't just the exchange being nosy; it's a legal requirement to prevent fraud and money laundering. You'll need to submit a government-issued ID like a driver's license or passport and sometimes a utility bill for proof of address. It might feel like a hassle, but completing KYC is what gives you access to higher withdrawal limits and the platform's full features.

- Basic Verification: Usually lets you deposit and trade but often comes with tight restrictions on withdrawals.

- Full Verification: This is where you want to be. It unlocks much higher daily or monthly withdrawal limits, often $50,000 or more, depending on the exchange.

Once you're verified, the next move is getting your crypto from a private wallet (like MetaMask or a hardware wallet) onto the exchange. This is a straightforward transfer. Just find the "Deposit" button on the exchange, pick the crypto you want to sell, and the platform will generate a unique deposit address for you.

Pro Tip: Always, always send a small test amount first. Crypto transactions are irreversible. Sending funds to the wrong address or using the wrong network is a painful—and permanent—mistake. Once you see that small test deposit arrive safely, you can send the rest with confidence.

The Selling and Withdrawal Process

With your crypto now sitting in your exchange wallet, you're ready to sell. Head over to the trading or "Sell" section. This is where you'll pick the crypto you're selling and the fiat currency you want to get back.

Let's say you want to sell 0.5 Ethereum (ETH) for US Dollars (USD). You’d find the ETH/USD trading pair, enter the amount of ETH you want to offload, and execute the trade. The exchange will show you the current market rate and give you a close estimate of what you'll receive in USD after fees.

After the sale goes through, the cash will pop up in your exchange's fiat balance. The final piece of the puzzle is simply withdrawing that cash to your linked bank account.

Understanding Fees and Timelines

Cashing out on a CEX isn't free, and the fees can definitely add up if you're not paying attention. Knowing what to expect helps you plan your exit strategy.

Common Exchange Fees:

| Fee Type | What It Is | Typical Cost |

|---|---|---|

| Trading Fee | A percentage the exchange takes for executing your sell order. | 0.1% - 1.5% |

| Withdrawal Fee | A flat fee for moving the fiat currency out to your bank. | $0 - $25 (depends on method) |

| Spread | The difference between the buy and sell price, which is a hidden cost. | Varies by asset liquidity |

Withdrawal times are another key factor. In the United States, an ACH transfer is the most popular method. It's often free but can take 1-3 business days to hit your account. If you need your money faster, a wire transfer can land the same day, but it'll cost you more—usually around $25.

Ultimately, centralized exchanges are a solid, user-friendly choice for cashing out. They might not be the absolute cheapest or most private option out there, but their security and direct link to the banking world make them a go-to for beginners and experienced crypto users alike. To get a better sense of all the tools out there, it's worth checking out the best crypto converter options available.

Exploring Alternative Cash-Out Routes

Centralized exchanges might be the main highways for cashing out crypto, but they aren't the only roads. Sometimes you need a different route—one that offers more flexibility, raw speed, or a bit more privacy. These alternative methods sidestep the traditional order-book system and come with their own unique advantages.

Let's dive into two of the most common alternatives I turn to: Peer-to-Peer (P2P) platforms and the ever-convenient crypto ATM. Each has its place, and knowing which to use and when is a key part of managing your crypto assets effectively.

Going Direct with Peer-to-Peer Platforms

Think of Peer-to-Peer (P2P) platforms like Paxful or Noones as a marketplace where you're not selling to an exchange, but directly to another person. The platform just plays referee, holding your crypto in escrow until the buyer confirms they’ve sent the money.

This direct-to-human model throws the door wide open to payment options you'll never see on a standard exchange. I've seen it all:

- Bank Transfers: The classic, straightforward option.

- Digital Wallets: People are always trading using PayPal, Skrill, or Cash App.

- Gift Cards: Need an Amazon gift card in a hurry? You can often trade your crypto for one.

- Cash in Person: If you’re privacy-conscious, you can even arrange a face-to-face cash meetup.

The real beauty of P2P is the control it gives you. You can scroll through listings, compare the rates offered by different buyers, and pick a payment method that suits your exact needs. Buyers are competing for your crypto, and it’s not uncommon to see them offer rates slightly above the going market price to stand out.

But with this freedom comes a bit of homework. The main thing to watch out for is counterparty risk—the chance that the person you're trading with won't follow through. The platform's escrow service is a huge safety net, but you still need to be smart. My rule of thumb? Only trade with users who have a solid reputation, plenty of positive feedback, and a long transaction history.

Real-World Scenario: Let's say you need to pay a freelancer who only takes PayPal, but your cash is tied up in Bitcoin. Instead of selling on an exchange, waiting for the bank transfer, and then moving it to PayPal, you can jump on a P2P platform. Find a buyer willing to send you PayPal funds for your BTC, and you’ve solved the problem in a single, direct step.

The Unbeatable Speed of Crypto ATMs

When you need physical cash in your hand right now, nothing beats a crypto ATM. These machines are the ultimate shortcut. You can walk up, scan a QR code from your wallet, send your crypto, and get cash in minutes. They are a lifesaver when you can't wait for a bank transfer to clear.

The process feels almost too easy. You tap the "Sell" option on the screen, tell it how much you want to cash out, and it gives you a wallet address. Send your crypto there, wait for a few blockchain confirmations, and the machine starts dispensing your cash.

This instant gratification comes at a cost, though. And it’s a steep one. Crypto ATMs are notorious for their eye-watering fees, which can range anywhere from 7% to a staggering 20%. This makes them a terrible choice for cashing out large sums. I always tell people to think of them like a convenience store for crypto—you're paying a massive premium for the accessibility. They're perfect for turning a small amount of crypto into pocket money, not for liquidating a serious investment.

Choosing the Right Alternative

So, P2P platform or crypto ATM? The choice really boils down to your immediate needs—it's the classic trade-off between cost, speed, and flexibility. The good news is that the growing availability of these options gives you more control than ever. While Bitcoin ATMs have popped up globally for instant cash, research confirms their double-digit fees make them a choice of convenience, not cost-effectiveness. On the other hand, P2P platforms give you more privacy and payment variety, but you have to be more careful about who you trade with. If you're looking to learn more, you can discover more insights about crypto cash-out options on Opendue.com.

Here’s a quick cheat sheet I use to decide.

When to Use Which Method

| Situation | Best Choice | Why It Works |

|---|---|---|

| Need cash in under 10 minutes | Crypto ATM | It's the fastest way to get physical cash, period. Perfect for emergencies or small, urgent needs. |

| Want to use a specific payment method | P2P Platform | You can find buyers using PayPal, bank transfers, gift cards, and more, giving you unmatched flexibility. |

| Cashing out a small, non-urgent amount | P2P Platform | The fees are much lower than an ATM, and you can often get a better exchange rate. |

| Prioritizing privacy | P2P Platform | Many P2P trades, especially smaller ones or cash-in-person deals, require less personal information than a CEX. |

| Cashing out more than a few hundred dollars | P2P Platform | The high percentage-based fees on ATMs make them prohibitively expensive for larger withdrawals. |

Ultimately, having these alternative routes in your back pocket is a game-changer. They provide elegant solutions for those times when a traditional exchange just doesn't cut it, giving you direct control over turning your crypto into cash.

Spending Crypto Directly with Debit Cards

What if the most practical way to "cash out" your crypto didn't involve cashing out at all? Instead of fussing with exchanges and waiting for bank transfers, a new class of financial tools lets you spend your digital assets just like you would with cash from your bank account. This is about bridging the gap between your crypto wallet and the real world, making your holdings immediately useful for everything from your morning coffee to online shopping.

This approach completely sidesteps the traditional withdrawal process. You're integrating your crypto directly into your daily spending habits, offering a surprisingly seamless way to use your assets without all the extra hoops to jump through.

The key to this magic? The crypto debit card. These cards are almost always backed by major networks like Visa or Mastercard and link straight to your crypto balance on a given platform. When you make a purchase, the conversion from crypto to fiat happens instantly in the background.

How Crypto Debit Cards Work

Think of a crypto debit card as a real-time currency converter that lives in your wallet. When you go to make a purchase—say, a $5 coffee—the card provider instantly sells just enough of your crypto to cover that $5 and pays the merchant in their local currency.

You don't have to pre-sell anything. The card handles the conversion automatically right at the point of sale, making the experience feel exactly like using a regular bank card. Most platforms even let you pick which crypto to spend from their app, giving you total control over which assets you want to offload.

Real-World Scenario: Let's say you find a flight online for $350. You pull out your crypto debit card and enter the details. The platform automatically sells about $350 worth of your Bitcoin or Ethereum at the current market rate, settles the payment with the airline in dollars, and you’re booked. It’s a completely friction-free way to use your crypto gains.

Understanding the Fees and Rewards

As convenient as they are, these cards aren't free. You really have to dig into the fee structure before you start swiping, because the costs can vary wildly from one provider to another.

- Conversion Fees: This is the big one. Most issuers charge a fee for that real-time crypto-to-fiat conversion, often baked into the exchange rate as a "spread."

- Monthly or Annual Fees: Some of the more premium cards come with recurring fees, though plenty of solid free options exist.

- ATM Withdrawal Fees: Just like a traditional bank card, using your crypto card to pull cash from an ATM will almost always cost you a fee.

But here's the fun part: the rewards. The competition in this space is intense, which is great for users. Card providers are rolling out some seriously attractive perks to get you on board. It’s pretty common to find cards offering 1% to 5% cashback on every purchase, paid out in crypto. This can be an incredible way to passively stack more assets just by doing your everyday spending.

Comparing Different Card Providers

Not all crypto cards are created equal. It's easy to get drawn in by a high cashback rate, but you need to look at the entire package to find the right fit.

Here’s a quick breakdown of what to keep an eye on.

| Feature | What to Consider | Why It Matters |

|---|---|---|

| Supported Cryptocurrencies | Does the card support the coins you actually hold and want to spend? | It’s a dealbreaker if the card can't access your primary crypto bags. |

| Fee Structure | How clear and reasonable are the conversion, ATM, and monthly fees? | High fees can easily wipe out any cashback rewards you earn. |

| Cashback Rewards | What percentage do you earn, and in which cryptocurrency? | This is a key benefit, so make sure the rewards align with your goals. |

| Availability | Can you actually get the card in your country or region? | Many cards have geographic restrictions, so this should be your first check. |

The Future of Spending Crypto

Crypto debit cards represent a massive shift in how we think about accessing our digital wealth. They turn a clunky, multi-step process into a single, instant transaction at the checkout counter. This is all part of a larger trend where the walls between crypto and traditional finance are crumbling. The end goal is to make digital assets as easy to use as the dollars sitting in your checking account.

This change is also happening on the merchant side. As more businesses figure out how to accept crypto payments directly, the need to "cash out" will fade even more. You can already see this trend picking up when you learn about what companies accept Bitcoins and other major cryptocurrencies. Direct spending isn't just a futuristic idea anymore; it's a practical reality.

For anyone looking to actively use their crypto for day-to-day life, a debit card is one of the most practical tools you can get today. It offers a simple, effective, and often rewarding way to turn your digital portfolio into real-world purchasing power.

Navigating Security and Compliance Risks

Figuring out how to cash out your crypto successfully is about much more than just chasing the best exchange rate. You have to protect your funds every step of the way and understand the rules of the game. If you ignore security and compliance, a profitable exit can quickly turn into a painful loss.

Let's start with the basics. The crypto space is, unfortunately, a playground for scammers. One of the oldest tricks in the book is the phishing scam, where an attacker creates a perfect-looking clone of a major exchange's login page. You'll get an urgent-looking email, click the link, and hand over your credentials without a second thought. My rule? Never click login links from emails. Always type the exchange's URL directly into your browser.

Here's another critical habit I've drilled into my own process: triple-check every single withdrawal address. Crypto transactions are final. One wrong character in that long string of code and your money is gone for good, sent into the digital abyss. I always copy, paste, and then visually confirm the first five and last five characters of the address before I even think about hitting 'send'. It takes ten seconds and can save you a fortune.

Protecting Yourself in P2P Transactions

Peer-to-peer (P2P) platforms are fantastic for flexibility, but they introduce a different kind of risk: the person on the other side of the trade. The biggest danger is dealing with a dishonest counterparty.

This is why you should never, ever release your crypto from escrow until you have personally confirmed the money is sitting in your bank account.

- Confirm the Payment Yourself: Don't trust a screenshot or an email confirmation from the buyer—those are ridiculously easy to fake. Log into your own bank's website or app to see the deposit with your own eyes.

- Beware of Chargebacks: Be extra careful with payment methods like PayPal. A common scam is for a buyer to send the payment, get your crypto, and then immediately file a chargeback, reversing the transaction and leaving you with nothing.

- Check Their Rep: Your best defense is a good offense. Only trade with users who have a high completion rate and a long history of positive feedback. Their reputation is your most reliable signal of trustworthiness.

Key Insight: Real security isn't about fancy software; it's about disciplined habits. Simple checks, like verifying a wallet address or confirming a payment before releasing escrow, are what make the difference between a smooth cash-out and a total disaster.

The Compliance Side of Cashing Out

Beyond personal security, you have to be mindful of the regulatory landscape. Centralized exchanges are financial institutions, which means they are legally required to monitor for suspicious activity under Anti-Money Laundering (AML) laws.

This is the whole reason you have to go through Know Your Customer (KYC) verification. If you want a deeper dive, our guide on what is KYC in crypto breaks down the entire process.

Exchanges use sophisticated tools to flag transactions that might be connected to illicit sources. While direct transfers from criminal wallets to exchanges have dropped from over 40% of illicit activity in 2021 to around 15% by mid-2025, the problem hasn't vanished. A staggering $7 billion from illicit sources still found its way to exchanges in the first half of 2025 alone, so platforms are on high alert.

A sudden, massive deposit from an account that's been dormant for years, or a flurry of high-volume trades, can easily trigger an alert. If your account gets flagged, the exchange might freeze your funds while they investigate. It’s not personal—they're just following their legal obligations.

To round out your defenses, it's wise to apply these essential cybersecurity tips for securing your digital footprint across all your online financial activities. By combining smart security habits with a clear understanding of compliance, you can ensure your crypto cash-out is not only profitable but also safe and hassle-free.

Cashing Out Crypto: Your Questions Answered

Even when you know the ropes, a few common questions always seem to surface right when you're ready to convert your crypto into cash. Getting these details sorted out beforehand is the difference between a smooth withdrawal and a stressful one.

Let's walk through the most frequent concerns I hear from people, so you can handle your crypto-to-fiat conversions with confidence.

Do I Have to Pay Taxes When I Cash Out My Crypto?

In most parts of the world, that’s a hard yes. When you sell crypto for a fiat currency like the US dollar, it's almost always a taxable event. You're "realizing" a capital gain (or loss), and your local tax authority will want its cut.

The actual tax you'll owe isn't a flat rate. It really boils down to a few things:

- How long you held it: Did you hold the asset for more than a year? That’s typically a long-term gain, which often comes with a lower tax rate. Less than a year is a short-term gain, and you'll likely pay more.

- Your income: Capital gains taxes are usually tied to your overall income bracket.

- Where you live: Tax laws for digital assets can be wildly different from one country to another, and sometimes even between states or provinces.

My best advice? Keep meticulous records of every single transaction—dates, amounts, and the fiat value at the time you bought and sold. And honestly, don't try to navigate this alone. Find a qualified tax professional who actually understands crypto. It's a small investment that can save you a massive headache later.

Are There Limits on How Much Crypto I Can Withdraw?

Yes, and you'll run into them on pretty much any platform that touches fiat currency. These limits aren't there to annoy you; they're in place for serious security and regulatory reasons, mainly to prevent fraud and money laundering.

On a centralized exchange, the limits you face are almost always tied to your account's verification level. A brand-new account might be stuck with a cap of just a few thousand dollars a day. But once you go through the full Know Your Customer (KYC) process, providing your ID and other documents, those limits can jump significantly—often to $100,000 per day or even higher.

My Pro Tip: If you're planning a large withdrawal, get your account fully verified weeks in advance. The last thing you want is to be stuck waiting for a verification process to clear when you urgently need the funds.

Crypto ATMs are a different story, with much tighter limits, often only a few thousand dollars per transaction. If you're looking to move a really large sum—we're talking six figures or more—an Over-the-Counter (OTC) desk is your best bet. They are built for exactly that kind of volume.

What Should I Do if My Crypto Withdrawal Is Taking Forever?

First, take a breath. Delays happen, and they're usually not a sign of a major problem. Your first step should always be to find the transaction ID (TxID) and paste it into a blockchain explorer for that specific coin.

If the explorer shows your transaction is "pending" or has zero confirmations, the bottleneck is probably just network congestion. The blockchain might be swamped with activity. In this case, you just have to wait it out until a miner or validator picks it up.

What if the blockchain says it's confirmed, but the money isn't in your bank account? Now the delay is likely on the traditional finance side of things. It could be the exchange’s payment processor or the old-school banking network. Standard bank transfers can take 1-3 business days, so don't panic after just a few hours. If that time passes and you still see nothing, it's time to open a support ticket with the exchange, armed with all your transaction details.

For any business dealing with digital assets, managing crypto payments and payouts without a hitch is non-negotiable. BlockBee offers a secure, non-custodial platform that makes crypto transactions simple, with instant payouts and low fees. See how you can streamline your crypto operations.