Find the Best Crypto Converter for Seamless Transactions

Picture yourself at an international airport, needing to swap your home currency for the local one. You'd head to a currency exchange booth, right? A crypto converter does pretty much the same thing, just for digital money. It's a tool built for one simple job: making it easy to swap one digital asset for another.

Whether you're looking to trade Bitcoin for Ethereum or cash out your crypto into U.S. dollars, the converter is what makes that exchange happen behind the scenes.

What Is a Crypto Converter and Why Use One?

At its core, a crypto converter is a bridge. It connects different cryptocurrencies to each other, and just as importantly, it connects the entire crypto ecosystem to the traditional financial world we all use every day. It takes what could be a really complicated, multi-step process and boils it down to just a few clicks.

This kind of tool is essential for anyone who deals with digital assets. Traders, for example, rely on them to quickly shift their holdings, maybe moving out of a risky coin and into a more stable one when the market gets choppy. For online businesses, it's a game-changer. They can accept payments in dozens of different cryptocurrencies from customers anywhere in the world, then instantly convert everything into a single currency for easier bookkeeping.

Who Needs a Crypto Converter?

You’d be surprised how many different people rely on these tools for very different reasons. The user base is broad, but it generally falls into a few key groups:

- Investors and Traders: For anyone actively managing a crypto portfolio, speed is everything. A converter lets you react to market news in real-time, swapping assets to lock in profits or sidestep potential losses.

- E-commerce Businesses: Imagine accepting a payment in Dogecoin and another in Solana. A converter can automatically funnel both into a stablecoin like USDC or your local fiat currency, protecting you from price volatility.

- Freelancers and Global Workers: Getting paid by international clients in crypto is becoming more and more common. A converter gives you a simple way to turn those digital earnings into spendable cash in your bank account.

The sheer volume of transactions happening every day shows just how vital these tools have become. In the first half of 2025 alone, global crypto exchange trading volume rocketed to an incredible $9.36 trillion—the highest it’s been since 2021. That massive number is a clear sign of how many people and businesses depend on reliable conversion tools. If you're curious, you can explore additional details about recent crypto trading volumes to see the full picture.

A crypto converter removes complexity. It’s not about intricate trading charts or order books; it's about making a direct, simple swap from asset A to asset B at the current market rate.

In the end, choosing the right crypto converter isn't just about picking a piece of software. It’s a foundational step for anyone who wants to operate safely and efficiently in the constantly expanding world of digital finance.

Key Features of the Best Crypto Converters

When you start digging into crypto converters, it's easy to get lost in a sea of tools all promising lightning-fast speeds and dead-simple interfaces. But to find a converter that’s truly great, you have to look past the marketing noise and focus on the features that actually protect your money and make your life easier.

Think of it like shopping for a car. Pretty much any car will get you from point A to B. But the best car for you depends on what you need—is it performance, safety, or just great gas mileage? The same logic holds true for crypto converters. You need a way to evaluate what really counts.

Asset Variety and Trading Pairs

The first thing to check is the menu of supported cryptocurrencies. A converter that only handles Bitcoin and Ethereum is like a currency exchange that only swaps US dollars and euros. It works, but it’s incredibly limited. A top-tier converter needs to offer a wide selection of digital assets.

This isn't just about collecting different coins. For an investor, having access to lots of assets means you can easily rebalance your portfolio, shifting into promising altcoins or moving into stablecoins to reduce risk. For a business, it means you can accept payments from customers all over the world, no matter which cryptocurrency they prefer to use.

- Diverse Coin Support: Don't just settle for the top 10 coins. Look for platforms that support dozens, or even hundreds, of assets across different blockchains.

- Fiat On/Off-Ramps: The ability to convert crypto directly to and from traditional money (like USD, EUR, or GBP) is absolutely essential. It's your bridge for cashing out profits or buying your first crypto.

Speed and Reliability

In the crypto world, prices can swing wildly in a matter of seconds. A slow or clunky converter can end up costing you real money. The best tools execute swaps almost instantly, locking in your exchange rate to protect you from price slippage—that annoying difference between the price you thought you were getting and the one you actually got.

This is especially critical for businesses. Fast conversions ensure that the value of a customer's payment doesn’t drop before the funds even hit your account. You can learn more about getting this set up in our guide to accepting crypto payments for your business. A reliable platform also means transactions won't fail or get stuck in limbo, which is key for building trust.

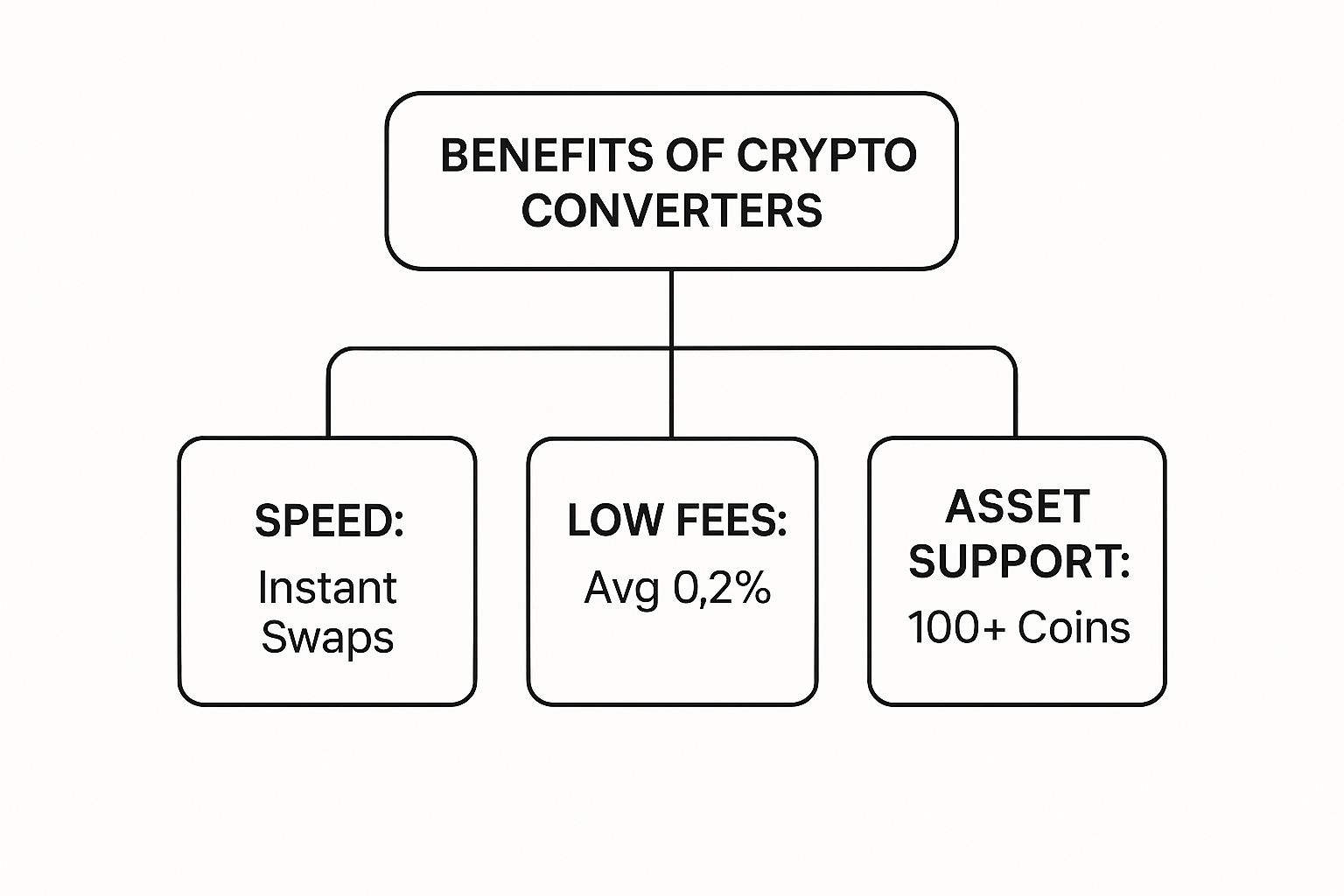

This image breaks down the core benefits a quality converter should deliver—namely, speed, cost, and asset support.

As you can see, the sweet spot is where near-instant swaps meet low fees and a huge variety of available coins.

User Interface and Experience

A powerful tool is worthless if it's a nightmare to use. The best crypto converters have a clean, intuitive design that makes swapping assets feel completely natural, even if you’re a total beginner.

A confusing interface can lead to expensive mistakes, like sending funds to the wrong address or misunderstanding the fee structure. The best platforms present everything clearly: what you’re swapping, the exact exchange rate you’re getting, all the fees involved, and the final amount you’ll receive. The whole process should feel transparent and simple from start to finish.

To help you vet your options, we've put together a quick checklist.

Crypto Converter Feature Comparison Checklist

When you're trying to pick the right tool, it helps to have a clear framework. Use this table to compare different crypto converters and see how they stack up on the features that matter most for your needs.

| Feature | What to Look For | Why It Matters |

|---|---|---|

| Supported Assets | A wide range of cryptocurrencies, including major coins, altcoins, and stablecoins. | More options give you greater flexibility for trading, investing, or accepting diverse payments. |

| Trading Pairs | Direct crypto-to-crypto pairs and fiat on/off-ramps (e.g., BTC to USD). | Direct pairs are more efficient, while fiat ramps are crucial for moving between crypto and traditional finance. |

| Transaction Speed | Near-instant or very fast execution times (seconds, not minutes). | Locks in your price quickly to avoid slippage, which is critical in volatile markets. |

| Reliability | High uptime, low transaction failure rates, and clear status updates. | You need to trust that your funds won't get stuck or lost, especially during important transactions. |

| User Interface | A clean, intuitive, and easy-to-navigate design. | A simple UI reduces the risk of user error and makes the entire process less stressful. |

| Fee Transparency | A clear breakdown of all fees (network, exchange, etc.) before you confirm. | Hidden fees can eat into your returns. You should always know the total cost upfront. |

By methodically checking each of these boxes, you can move beyond flashy marketing and find a converter that is genuinely reliable, efficient, and suited to your goals.

Decoding Fees and Hidden Conversion Costs

When you’re looking at a crypto converter, the exchange rate you see on the screen is rarely the whole story. To find the best crypto converter, you have to dig a bit deeper and understand what a transaction will actually cost you. If you don't, hidden fees can quietly eat into your funds.

Think of it like booking a flight. The initial ticket price seems like a bargain, but then you get hit with baggage fees, seat selection charges, and other surprise costs at checkout. Crypto conversion can feel a lot like that, with various fees that aren't always front and center.

Unpacking the Common Fee Types

When you swap one cryptocurrency for another, a few different charges can pop up. The best platforms are upfront about these, but it always helps to know what to look for yourself.

- Conversion or Exchange Fees: This is the platform's direct cut for handling the swap, usually a small percentage of the transaction value. It's the fee you'll see advertised most often.

- Network Fees (Gas Fees): Every blockchain transaction has a cost, which goes to the miners or validators who process and secure it. This isn't a fee the converter controls; it changes based on how congested the network is at that moment.

- Withdrawal Fees: Some services charge you a flat fee to move your crypto from their platform to your own personal wallet.

Knowing the difference is key. A converter might attract you with a super-low exchange fee but then make up for it with steep withdrawal charges. Always focus on the total cost. For a great example of a transparent model, you can see exactly how BlockBee’s fees work.

The Hidden Cost of Slippage

Beyond the standard fees, there’s a sneakier cost called slippage. This is what happens when the market price of an asset moves between the moment you hit "confirm" and the moment your transaction is actually processed on the blockchain.

Slippage is the difference between the price you expected to get and the price you actually got. In volatile markets, even a few seconds of delay can result in a less favorable exchange rate.

Let's say you agree to swap 1 ETH for $3,000 USDC. But in the few seconds it takes to finalize, the price of ETH dips. You might end up with only $2,995 USDC. That $5 difference is slippage. While it might seem small on one trade, it can add up to a significant amount over time, especially with larger transactions.

The best crypto converters work to minimize this risk by executing trades incredibly fast, essentially locking in your rate. A trustworthy platform will always warn you about potential slippage before you commit, keeping you in complete control.

Prioritizing Security and Regulatory Compliance

When you're dealing with digital assets, it's easy to get caught up in the appeal of speed and low fees. But let's be honest—none of that matters if your funds aren't safe. Using a crypto converter isn't just about swapping one coin for another; it's an act of trust. You're handing your assets over to a platform, and for that reason, security isn't just a feature. It’s the bedrock of the entire service.

Choosing the best crypto converter means putting on your security goggles first. The dangers are very real, from individual account takeovers to full-blown exchange hacks that make headlines. This is why you have to know what separates a truly secure platform from a potential disaster waiting to happen.

Essential Security Measures

Your first line of defense is always your own account, and a good converter gives you the right tools to lock it down.

- Two-Factor Authentication (2FA): Think of this as non-negotiable. 2FA requires you to provide a second piece of proof that it's really you, usually a code from your phone, before you can log in. This one simple step thwarts the vast majority of unauthorized access attempts.

- Cold Storage of Funds: Serious platforms don't leave all their crypto sitting online where hackers can get to it. Instead, they keep the bulk of it in cold storage—basically, secure offline vaults completely disconnected from the internet. This dramatically lowers the risk of a catastrophic loss if the platform is attacked.

- Platform Insurance: Some of the top converters go the extra mile and get insurance. This can help cover user losses if a security breach does happen, giving you an added layer of financial protection and, just as importantly, peace of mind.

When you see these features, it's a clear signal that a platform is serious about protecting your money. They aren't just nice-to-haves; they are absolute must-haves for any service you're considering.

The Role of Regulatory Compliance

Beyond the technical nuts and bolts of security, how a platform handles regulations speaks volumes about its maturity and stability. The crypto world may have started with a wild-west vibe, but today, playing by the rules is a sign of a legitimate, long-term operation.

A platform's commitment to regulatory frameworks like Know Your Customer (KYC) and Anti-Money Laundering (AML) isn't about adding friction; it's about building a safe and sustainable environment for everyone.

These rules require platforms to verify user identities to shut down fraud, money laundering, and other shady activities. Sure, it adds an extra step when you sign up, but it’s a crucial one for kicking bad actors out of the ecosystem. For any business using a crypto converter that also touches traditional fiat money, knowing how to handle crypto chargebacks is also a vital piece of the puzzle.

Choosing a converter that embraces regulation isn't just about following the law; it’s a smart way to protect your assets for the future. You’re betting on a platform that’s built to last, not one that might disappear overnight due to legal troubles.

Integrating a Crypto Converter for Your Business

For entrepreneurs and developers, entering the crypto market isn't just about following a trend. It's a smart, strategic move that can open your doors to a global customer base without borders. A few years ago, adding a cryptocurrency converter to your business might have felt like a daunting technical project. Today, it’s a straightforward way to streamline payments and cut down on operational costs.

Think about it: you can instantly connect with a whole new segment of customers who prefer using digital assets. By plugging in the best crypto converter or a payment gateway with one built-in, you can start accepting dozens of different coins. This immediately expands your reach far beyond the constraints of traditional credit cards, which are often burdened with higher fees and geographic limitations.

Choosing Your Integration Path

When you're ready to start accepting crypto, you’ll find there are two primary ways to get it done. The path you choose really comes down to your technical know-how and how much control you want over the final experience.

- API Integration: If you have a development team or need a deeply customized checkout process, an Application Programming Interface (API) is the way to go. An API acts as a direct line of communication between your system and the payment processor, giving you total command over the user interface and branding.

- E-commerce Plugins: For those running on popular platforms like WooCommerce, Magento, or PrestaShop, plugins are your best friend. These are ready-made solutions that you can install in just a few clicks, adding crypto payment options to your store without touching a line of code.

This flexibility means that whether you’re operating a bespoke, custom-built platform or a standard online store, there’s a clear path to accepting crypto. It's a fundamental step in making your business resilient and ready for an increasingly diverse payment world.

The Strategic Business Advantage

This isn't just about adding another payment button at checkout. A crypto converter provides real, tangible benefits. It handles the entire conversion process behind the scenes, so a customer can pay in their favorite coin while you receive the funds in a stable currency like USDC or even your local fiat. This completely sidesteps the headache of price volatility.

The market itself tells a compelling story. In July 2025 alone, cryptocurrency exchange volumes bounced back to hit $1.77 trillion for the month. This isn't just a number; it’s a powerful signal of a healthy, active market and growing adoption. Such a massive volume of transactions proves why reliable conversion tools are no longer a "nice-to-have" but a necessity.

A dedicated payment gateway with a built-in converter, like BlockBee, automates this whole workflow. It takes what could be a complex technical puzzle and turns it into a genuine competitive edge by removing the risk and friction.

At the end of the day, integrating a crypto converter is about making your business more accessible, efficient, and forward-thinking. To see exactly how you can put this into practice, our guide on how to accept cryptocurrency payments offers a great, practical starting point for any merchant.

Frequently Asked Questions About Crypto Converters

Diving into the world of crypto can bring up a lot of questions. Let's tackle some of the most common ones so you can feel confident using crypto converters.

What Is the Difference Between a Crypto Converter and an Exchange?

Think of a crypto converter as the express lane at the supermarket. It’s built for one specific job: swapping one currency for another as quickly as possible at the current market rate. If you just want to trade some Bitcoin for Ethereum without any fuss, a converter is your best bet.

A full-blown crypto exchange, on the other hand, is more like a professional trading desk. You’ll find complex charts, order books, and advanced trading options like limit and stop-loss orders. While powerful, it's often overkill for a simple swap. For most people and businesses, a converter is the simplest and best crypto converter for the job.

Are Cryptocurrency Conversions Truly Instant?

From your perspective as a user, a good converter makes the swap feel instant. But there's a bit more going on under the hood. Every single transaction has to be recorded and confirmed on its blockchain, which can take a few seconds or sometimes a few minutes depending on network traffic.

The "instant" feeling comes from the fact that a reliable converter locks in your exchange rate the moment you agree to the swap. This protects you from any sudden price jumps while the blockchain does its work. For businesses, a payment gateway handles this seamlessly, making the whole thing feel immediate for the customer.

Key Takeaway: The user experience is designed to be "instant" by locking in your rate, but the final settlement on the blockchain takes a short amount of time. A reliable platform manages this delay so you don't have to.

Can I Convert My Crypto Back into Cash?

Yes, absolutely. Turning your crypto back into traditional fiat currency (like U.S. Dollars or Euros) is a fundamental feature known as "off-ramping." It's one of the most important things a flexible crypto converter can do.

To cash out, you’ll need a regulated platform that supports crypto-to-fiat pairs. This usually means completing a Know Your Customer (KYC) identity check to meet financial regulations. After you're verified, you can sell your crypto and have the cash sent right to your bank account.

How Does a Service Like BlockBee Help Merchants with Conversion?

This is where things get really interesting for businesses. A service like BlockBee acts as a payment gateway that puts the entire conversion process on autopilot. Instead of a merchant having to juggle wallets for dozens of different coins, they can accept payments from customers all over the world in whatever crypto they prefer to use.

BlockBee then instantly converts those payments into a single currency the business wants, whether that’s a stablecoin like USDC or their local fiat currency. This automation completely sidesteps the headache of managing multiple cryptos and the risk of price volatility. It lets businesses tap into the benefits of crypto—lower fees, global reach—without having to be blockchain experts.

Ready to simplify your business payments? With BlockBee, you can accept over 70 cryptocurrencies with lightning-fast, secure conversions. Get started today and see how easy crypto can be.