Your Guide to Instant Payout Payment Gateways

In today's economy, speed isn't just a feature—it's everything. An instant payout payment gateway is a system that lets businesses send money to freelancers, partners, or customers in seconds, completely sidestepping the sluggish 3-5 business day cycles of traditional banking.

Why Payout Speed Matters More Than Ever

Let's be real: nobody likes waiting for money. We live in a world of instant messaging and on-demand everything, so why should financial transactions be stuck in the past? This expectation for immediacy is the new normal, especially in high-velocity industries.

Think about the gig economy, where contractors rely on quick payments to manage their cash flow, or e-commerce, where an instant refund can salvage a poor customer experience and win back their loyalty.

This isn't just a matter of preference; it's a massive market trend. The real-time payments market is projected to skyrocket at a compound annual growth rate of 35.4% from 2025 to 2032. That's not just growth—it's a clear signal of a fundamental shift in how money moves.

The Old Way vs The New Way

Traditional batch payouts feel like old-school snail mail. A business would collect all its outgoing payments, bundle them up, and ship them out at the end of the day or week. The money then crawls through a complex, multi-step banking network, finally landing in the recipient's account days later. This lag creates friction, uncertainty, and frustration.

An instant payout payment gateway, on the other hand, is like a direct, secure text message. The moment a payout is triggered, the system finds the quickest path to get the funds where they need to go, often wrapping up the transfer in under a minute. This isn't just a nice-to-have; it's a competitive advantage that sharpens cash flow, boosts efficiency, and keeps everyone happy. To better understand why rapid capital is so vital, it's worth exploring the different fast funding options for small businesses available today.

Traditional vs Instant Payouts At a Glance

The table below really puts the differences into perspective, showing just how much has changed.

| Feature | Traditional Payment Gateway | Instant Payout Payment Gateway |

|---|---|---|

| Settlement Time | 2-5 business days | Seconds to minutes |

| Cash Flow Impact | Creates delays and uncertainty | Provides immediate liquidity |

| Recipient Satisfaction | Lower, due to long wait times | High, boosting loyalty and trust |

| Operational Efficiency | Requires manual tracking and reconciliation | Automated and streamlined |

| Availability | Business hours and weekdays only | 24/7/365, including holidays |

Ultimately, this move from delayed settlement to real-time access isn't just a technological upgrade. It's completely changing how companies operate, manage relationships, and deliver value.

How an Instant Payout Gateway Really Works

To get a real feel for what happens behind the scenes with an instant payout, think about sending an urgent package. You’ve got two choices: drop it at a big warehouse that groups packages and ships them out in big batches, or call a direct courier who grabs it and takes it straight to its destination. This is a pretty close analogy for the two main ways an instant payout payment gateway can be built.

At their core, these gateways are just incredibly smart digital dispatchers. Their whole purpose is to get money from you to someone else in seconds, not days. They pull this off using modern payment networks and some clever logic, but how they do it can make a huge difference in your control, security, and day-to-day operations.

The two fundamental models you need to understand are custodial and non-custodial. Getting this difference is the most important step in picking the right partner for your business.

Custodial Gateways: The Bank Vault Approach

A custodial gateway is a lot like a financial middleman or a bank vault. Before you can send any payouts, you have to deposit a lump sum of your money into an account that the gateway provider owns and manages. This pre-funded account is where all your future payouts will be drawn from.

So, when you need to pay a contractor or a customer, you tell the gateway, and they just subtract the amount from your balance in their system and send it on. The key phrase here is that the provider takes temporary custody of your funds.

- The upside? This can sometimes make accounting a bit simpler, since everything is coming from one central pot of money.

- The downside? You lose direct control. A chunk of your working capital is now sitting in someone else's account, and you're completely reliant on their security measures and financial stability.

This model introduces what’s known as counterparty risk—if the provider runs into trouble, your funds could be stuck or, in a worst-case scenario, lost.

A custodial system asks you to trust a third party to hold your money before it gets where it's going. It can be convenient, but it also creates a single point of failure and strips you of direct control over your own assets.

Non-Custodial Gateways: The Secure Courier Model

A non-custodial gateway, on the other hand, works more like a secure, automated courier. It never actually holds your money. Not even for a second. Instead, it acts as a facilitator, creating a direct, secure pipeline from your wallet or bank account to the recipient's.

It’s best to think of it as a set of secure instructions. Your system tells the gateway, "Send X amount from my account to this recipient," and the gateway provides the secure tech to make that happen instantly, without ever taking possession of the funds. This is exactly how advanced crypto payment platforms like BlockBee operate.

With this approach, you always maintain full control and self-custody of your funds. Money only moves when you say so, going directly from you to the recipient. This completely sidesteps the counterparty risk of custodial models because there’s no third-party vault holding your capital hostage.

Settlement Routing: The GPS for Your Money

Beyond the custody debate, the real secret sauce of a great instant payout gateway is its settlement routing logic. The best way to picture this is as an intelligent GPS for your money. Its only job is to find the fastest, cheapest, and most reliable path for a transaction to get from you to the person you're paying.

The moment you initiate a payout, the system is crunching several variables in real-time:

- Network Congestion: Are certain payment networks, like a specific blockchain or a banking system, bogged down with traffic right now?

- Transaction Fees: Which route is the cheapest at this very second?

- Recipient Compatibility: What kind of payment can the recipient’s bank or wallet actually accept?

- Geographic Location: Are we dealing with a cross-border payment that has its own set of rules?

Based on this split-second analysis, the gateway routes the payment through the best possible channel—maybe it's a real-time payment network like RTP, a specific blockchain for a crypto payment, or another instant option. This dynamic routing is what guarantees a near-instant settlement, avoiding the slow, one-size-fits-all pathways of traditional banking. It's this technology humming in the background that makes an instant payout gateway such a powerful tool.

The Business Case for Adopting Instant Payouts

It's one thing to understand the technical nuts and bolts of an instant payout gateway, but it’s another to see the massive impact it can have on a business. Moving from the "how" to the "why" reveals just how powerful this shift can be. Adopting instant payouts isn’t just a small operational tweak; it’s a fundamental upgrade that makes your entire business stronger.

The ripple effects touch everything from your financial stability to the happiness of your customers and partners. This is a huge reason why the global payment gateway market, valued at USD 27.0 billion, is expected to skyrocket to USD 106.06 billion by 2033. That kind of growth signals a clear market-wide demand for faster, more reliable ways to move money. You can dig into more of the data and future projections for payment gateways on straitsresearch.com.

Supercharge Your Business Cash Flow

For any business, cash flow is the lifeblood. Traditional payout systems, with their built-in waiting periods, act like a dam, holding back capital that you could be using for growth, inventory, or just handling the unexpected. An instant payout solution completely demolishes that dam.

Think about a dropshipping e-commerce store. With standard payouts, the owner pays their supplier upfront but then has to wait days for the customer's payment to clear. An instant payout gateway flips that script. Funds from a sale are available right away, letting them cover supplier costs, reinvest in marketing, or make payroll without touching a line of credit.

Build Unbreakable Partner Relationships

In the gig economy, speed is everything. Freelancers, creators, and affiliates rely on getting paid on time to manage their own lives. When your business pays instantly, you become the partner everyone wants to work with, helping you attract and keep the best talent.

Take a freelance marketplace, for example. If a graphic designer finishes a project and has to wait a week to get paid, they’ll probably start looking at other platforms. But if the marketplace uses an instant payout gateway, that designer can get paid the moment the client hits "approve." That simple act builds incredible trust and loyalty, and it’s a game-changer for reducing churn.

When you remove payment friction for your partners, you're not just sending money—you're sending a powerful message of reliability and respect. This fosters a more motivated and dedicated workforce that is invested in your success.

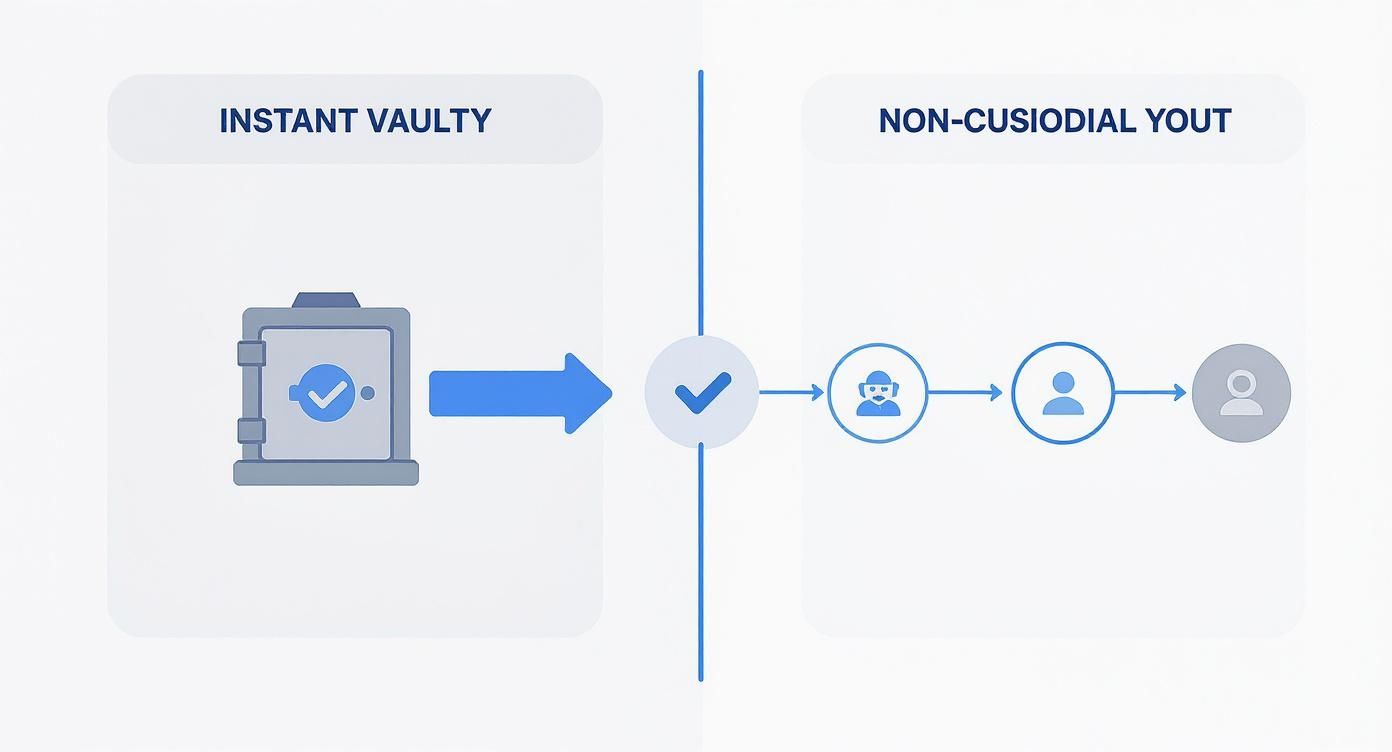

The diagram below shows the core difference between custodial and non-custodial models, which is central to how quickly and securely you can manage these payments.

As you can see, the non-custodial approach gets rid of the intermediary vault, creating a much more direct and immediate transfer of funds.

Boost Customer Loyalty with Instant Refunds

A product return is a make-or-break moment. A slow, clunky refund process can sour a customer on your brand for good. On the other hand, an instant refund can turn a negative experience into a surprisingly positive one. When customers get their money back in minutes, it tells them you respect their time.

An online clothing store that processes refunds immediately really stands out. The customer is far more likely to use that refunded cash to buy something else from the same store or come back later, knowing they can trust the company to do the right thing.

Slash Administrative Overhead

Finally, think of all the manual work that automated payouts eliminate. Reconciling accounts, chasing down payment statuses, and answering endless emails about missing funds are all huge time sinks. An instant payout system automates that entire headache.

- Reduces Manual Entry: Payouts are triggered automatically by predefined rules, which cuts down on human error.

- Simplifies Reconciliation: With real-time transaction data, balancing the books becomes faster and far more accurate.

- Cuts Down on Support Tickets: When people get paid instantly, those "Where is my payment?" questions pretty much vanish.

For businesses sending payments to many people at once, it’s worth looking into tools designed for the job. You can learn more about how to handle this efficiently by exploring different mass payout solutions that automate and secure bulk payments.

Understanding the Risks and How to Manage Them

While the upsides of an instant payout gateway are huge, jumping in means facing a new set of risks. The very speed that makes customers happy can also open the door for bad actors if you're not careful. The first step to building a solid payout system is to look these challenges straight in the eye.

The biggest headache is the increased risk of fraud. Traditional bank transfers often have a window for reversal, but instant transactions are final. Once the money is sent, it's gone for good. This makes these systems a prime target for fraudsters trying to take over accounts or pull off other scams.

This irreversibility forces a change in mindset. You can no longer react to fraud after it happens; you have to stop it before it even starts.

The Challenge of Fraud and Finality

When a transaction settles in seconds, there’s simply no time for a human to review and halt a suspicious payment. This reality makes automated, real-time security an absolute must-have for any instant payout system. Your defenses have to be quick enough to spot and block fraud before a single cent leaves your control.

To handle this, smart businesses use a layered defense. This usually involves sophisticated tools that analyze user behavior, device fingerprints, and transaction patterns to flag anything out of the ordinary in a split second. Strong identity verification right from the start is also key to making sure you’re always paying the right person.

The golden rule for managing instant payout risk is this: your security has to be as fast as your payments. If your fraud detection lags by even a minute, the money is already lost.

Navigating the Compliance Landscape

Beyond fraud, instant payouts come with serious compliance duties. Regulators across the globe are cracking down on money laundering and terrorist financing. That means your business needs ironclad Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

These rules require you to confirm the identity of everyone you pay and constantly screen transactions for red flags. Dropping the ball here can lead to crippling fines and a damaged reputation that's tough to rebuild. Proper anti-money laundering transaction monitoring isn't just a good idea—it's the law.

Mitigating Risk with Smart Strategies

The good news is that with the right approach and tools, you can keep these risks under control. A secure instant payout system is built on a foundation of smart technology, clear processes, and the right partners.

Here are three core strategies to put in place:

- Use AI-Powered Monitoring: Implement automated systems that use machine learning to scan every single transaction as it happens. These tools can pick up on subtle fraud patterns that a person would never catch, stopping bad payments in their tracks.

- Enforce Strict Identity Verification: Build strong KYC checks into your onboarding process for any new payee. This confirms you know exactly who you're sending funds to, drastically cutting the risk of payments going to a scammer's account.

- Choose a Secure Gateway Partner: Work with a payment gateway that puts security first. Look for providers with built-in fraud detection, solid compliance features, and a non-custodial model that ensures you always maintain full control over your funds.

By taking these proactive steps, you can tap into the full potential of instant payouts while protecting your business and your customers.

How to Choose the Right Instant Payout Partner

Picking the right partner for your instant payouts isn't just a technical choice—it's a business decision that will echo through your operations, security, and growth potential. Get it right, and you’ll see immediate benefits. Get it wrong, and you're in for a world of integration headaches, security risks, and frustrated users.

The stakes are higher than ever. The global payment gateway market has ballooned from USD 37.0 billion to USD 47.0 billion recently, a sign of its massive 20.5% compound annual growth rate. Everyone is jumping on board faster payments. If you want to dive deeper into these numbers, you can explore more payment gateway statistics on scoop.market.us. This explosive growth gives you more options, but it also means you have to be much more careful about who you trust.

Core Technical and Security Evaluation

Before you even think about pricing or features, you have to put the provider’s tech and security under a microscope. This is the bedrock of your payout system, and there’s absolutely no room to cut corners.

First up, security protocols. Is the provider PCI DSS compliant? If not, walk away. It's the bare minimum for handling payment data. But don't stop there. Look for modern fraud prevention tools, like AI that monitors transactions in real-time and solid identity verification processes (KYC/AML) to keep bad actors out.

Next, get your developers to dig into their API documentation. Is it actually helpful? A messy, poorly documented API can turn what should be a simple integration into a project that drains time and money. The best partners offer clean documentation, plenty of code examples, and a support team that actually answers questions. For more on what to look for in a technical partnership, this guide on choosing the right fintech development company is a great resource.

Operational and Business Considerations

Once you're confident the tech is solid, it's time to see how the provider fits with your actual business. Think about scale. Can their system handle your transaction volume today and a year from now when you’ve grown? Don't just take their word for it—ask for performance data or case studies from businesses like yours.

Your checklist should also include these make-or-break points:

- Global Reach and Supported Currencies: Does their network cover the countries and currencies you need? This is critical if you're paying international freelancers, affiliates, or customers.

- Fee Structure: Get them to lay all their cards on the table. Are there hidden setup fees, monthly minimums, or confusing per-transaction costs? You need to understand the total cost of ownership to see if it fits your model.

- Customer Support: What happens when something inevitably goes wrong? You need to know you can get a real person on the line who can solve your problem quickly. Check their support channels—do they offer a dedicated manager or 24/7 tech support? What are their typical response times?

Choosing a partner is more than just buying a piece of software; it's entering a long-term relationship. Prioritize providers who demonstrate a commitment to your success through excellent support and transparent practices.

Custodial vs Non-Custodial: A Key Decision

Finally, you'll need to make one of the most important calls: go with a custodial model or a non-custodial one? As we've covered, this choice dictates who holds the keys and, ultimately, who carries the risk.

The table below breaks down the core differences to help you decide which path is right for you.

Provider Type Comparison: Custodial vs Non-Custodial

A comparative analysis of custodial and non-custodial instant payout gateways to help businesses decide which model best suits their security, control, and operational needs.

| Feature | Custodial Gateway | Non-Custodial Gateway |

|---|---|---|

| Fund Control | You pre-fund an account held by the provider. | You retain full control; funds move directly from your wallet. |

| Counterparty Risk | Higher; your funds are exposed to the provider's stability. | Eliminated; you are never reliant on the provider's solvency. |

| Security Model | You trust the provider's security to protect your funds. | You control your own security and private keys. |

| Ideal For | Businesses that prefer a hands-off, all-in-one solution. | Businesses prioritizing security, control, and decentralization. |

Ultimately, a custodial solution offers convenience by managing the funds for you, while a non-custodial gateway puts you firmly in the driver's seat, offering unparalleled security and control.

A Modern Approach to Instant Crypto Payouts

Theory is great, but seeing an instant payout payment gateway in action is where the real value becomes obvious. The latest generation of crypto-native platforms has cracked many of the classic payout headaches, offering more than just simple transactions. They’ve built entire ecosystems that are efficient, secure, and genuinely easy for developers to work with. Let's look at how a platform like BlockBee cuts through the noise.

One of the biggest sticking points in finance, both old-school and crypto, has always been the custodial model—where you have to hand your money over to someone else to manage. By contrast, a strictly non-custodial approach, like the one BlockBee uses, means your funds never leave your control. They stay in your own wallet, completely eliminating the risk that comes with letting a third party hold your assets.

This is a game-changer. You aren't just trusting a provider to handle a transaction; you maintain total ownership of your capital right up until the payout is sent.

Tackling Crypto-Specific Hurdles

Let's be honest: crypto has its own unique set of challenges. Things like network congestion and wildly fluctuating transaction fees can throw a real wrench in the works, and generic payment gateways just aren't built to handle them. A truly modern solution has to tackle these issues head-on.

For example, a sudden spike in network fees can easily eat up your profit on a payout. To counter this, advanced gateways use smart fee estimation to find that sweet spot—the perfect fee to get your transaction confirmed quickly without overpaying. This is then coupled with a reliable callback system (often called a webhook) that pings your system the second the transaction is confirmed on the blockchain. No more guesswork, no more manual checking.

Suddenly, a process that felt chaotic and unpredictable becomes a smooth, automated workflow.

Real-World Use Cases in Action

Once you have a streamlined crypto payout system in place, you can start doing some powerful things. The applications are pretty broad, helping businesses run leaner and faster on a global scale. Here are a few common scenarios where this tech really shines:

- Global Team Payments: Forget slow, expensive cross-border bank transfers. Pay your international contractors and freelancers instantly in their crypto of choice.

- Automated Affiliate Rewards: Imagine triggering affiliate commission payouts the exact moment a sale is confirmed. It’s a huge motivator and builds incredible loyalty.

- Instant Customer Rebates: Process refunds or rebates in crypto to give customers a surprisingly fast and positive experience. It’s a small touch that can create a lasting impression.

These examples show that an effective instant payout payment gateway is much more than a technical tool. It becomes a strategic asset for building better relationships and cutting down on operational drag.

By automating payouts with a non-custodial crypto gateway, businesses can significantly reduce administrative overhead while enhancing security and control. The direct wallet-to-wallet transfer model simplifies reconciliation and eliminates the vulnerabilities of holding funds in a centralized third-party account.

Making Integration Straightforward

Complexity is the enemy of adoption. A well-designed platform knows this and prioritizes a clean, well-documented API. The whole point is to make sending a crypto payout feel as simple as any other standard API call.

For instance, the logic for initiating a payout might be distilled down into a simple request like this:

{

"api_key": "YOUR_API_KEY",

"coin": "USDT.TRON",

"payouts": [

{

"address": "RECIPIENT_WALLET_ADDRESS",

"amount": "100.00"

}

],

"callback_url": "https://your-domain.com/payout-callback"

}

This kind of simplicity empowers developers to plug sophisticated payout functionality into their applications without a massive time investment, getting products to market much faster. For anyone looking to connect the dots between digital currency and traditional finance, understanding how to transfer crypto to a bank account provides crucial context for building out a complete payment ecosystem. It's this focus on accessibility that makes advanced payment tech a realistic goal for businesses of any size.

Common Questions About Instant Payouts

Thinking about adding an instant payout gateway to your business? It's a big move, and it's smart to have questions. Switching to a real-time payment model changes how your business operates, so getting the right answers is crucial before you dive in. Let's tackle some of the most common things business owners ask.

What Is the Real Difference Between Instant and Standard Payouts?

It all boils down to one thing: settlement time.

Standard payouts, the kind that run on old-school networks like ACH, typically leave you waiting 2-5 business days for the money to actually show up. That’s a long time for your hard-earned capital to be stuck in limbo, completely out of your reach.

Instant payouts, on the other hand, close that gap. We're talking seconds or minutes, not days. The moment a payment is sent, the funds are there. This simple change completely erases the frustrating cash flow delay, giving you and your partners immediate access to your money.

Are Instant Payout Gateways Secure?

They have to be. Any serious gateway provider treats security as its number one job, building in multiple layers of protection to keep every transaction safe. It all starts with the basics, like meeting strict PCI DSS standards for managing payment data.

But it goes much deeper than that. Modern gateways use a whole suite of advanced tools to keep you safe:

- Encryption: Every piece of data is scrambled from end to end, making it useless to anyone who shouldn't have it.

- Fraud Detection: Smart algorithms watch transactions as they happen, looking for red flags and stopping suspicious activity before it can cause a problem.

- Non-Custodial Models: This is a huge one for crypto gateways. A non-custodial system means you never hand over control of your funds to a third party. Your money stays your money.

How Difficult Is Integration?

This used to be a real headache, but not anymore. Modern gateways are built from the ground up for developers. Thanks to clean, well-documented APIs (Application Programming Interfaces), the whole integration process is far more manageable.

Most services provide detailed developer guides, ready-to-use code snippets, and even simple plugins for platforms like Shopify or WooCommerce. This means your tech team can get the system plugged into your existing setup without a ton of custom work or late nights.

A good partner will hand you everything you need—clear API docs, helpful examples, and a support team that actually answers the phone—to make integration as painless as possible.

Can I Use These for International Payments?

Absolutely. In fact, this is where instant crypto payouts really pull ahead of the pack. Traditional international payments are a mess—they're slow, expensive, and get tangled up in a web of intermediary banks and painful currency conversion fees.

An instant crypto payment gateway sidesteps that entire broken system. You can send digital currency to anyone, anywhere in the world, and have it arrive in minutes. This slashes transaction costs and cuts out all the waiting, making global business genuinely fast and affordable.

Ready to stop waiting for your money and take back control? BlockBee offers a secure, non-custodial instant payout payment gateway that makes crypto transactions simple. Learn more and get started today at blockbee.io.