How to Transfer Bitcoin to Cash A Practical Guide

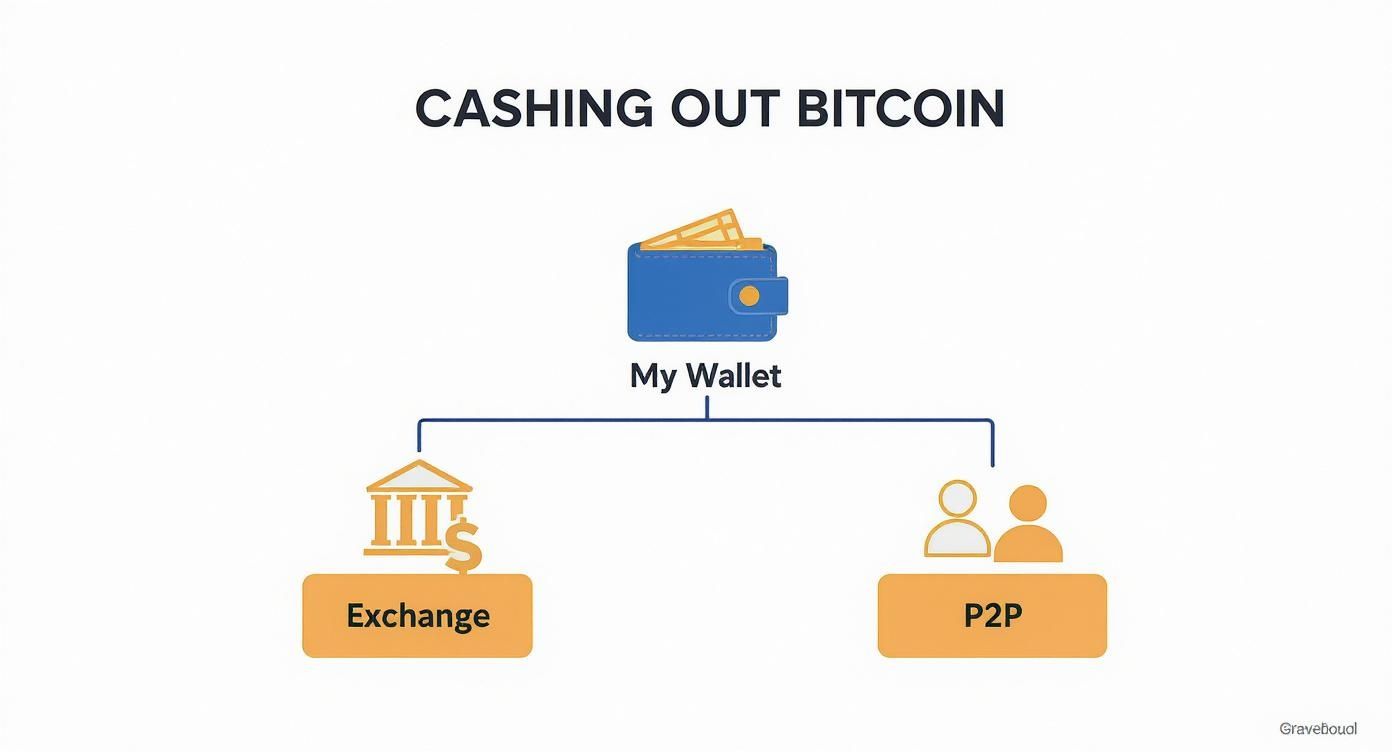

Ready to turn your Bitcoin into cash? The basic idea is simple: you'll move your BTC from your personal wallet to a crypto exchange or a peer-to-peer (P2P) platform, sell it for your preferred currency, and then pull those funds out into your bank account.

Choosing the right path is crucial. A centralized exchange is usually the faster route, but a P2P marketplace can give you more flexibility with payment methods.

Preparing to Cash Out Your Bitcoin

Before you even think about hitting that 'sell' button, a little prep work can save you a world of trouble. Getting your ducks in a row first makes the whole process of cashing out your Bitcoin way smoother and safer. Think of it less as a suggestion and more as a critical first step to protect your assets.

First thing's first: make sure your Bitcoin is in a wallet where you control the private keys. If your coins are just sitting on an exchange, you need to move them. Why? Because on an exchange, you don't truly own your crypto—the exchange does. Transferring your BTC to a wallet you personally control is non-negotiable for security and real ownership. If you're not sure how to do this, it’s worth learning https://blockbee.io/blog/post/how-to-create-a-bitcoin-wallet to get full control over your funds.

Gather Your Essential Documents

With your Bitcoin safely in your wallet, it’s time to handle the paperwork. Pretty much any legitimate platform that lets you sell crypto for fiat currency is legally required to verify who you are. This is all part of a standard process called Know Your Customer (KYC).

You can get ahead of the game by having these documents ready to go:

- A government-issued photo ID, like a driver's license or passport.

- Proof of your address, which could be a recent utility bill or a bank statement.

- Your Social Security Number or equivalent national ID number.

Having clear digital copies of these on hand will make the account verification process much faster. Don't be surprised if this takes a day or two—it's standard practice.

A quick word of warning: If a platform claims you can cash out large sums of Bitcoin with no ID required, you should see that as a massive red flag. These services are almost always operating outside the law, which puts your money at serious risk.

Understand the Basics First

Finally, a bit of background knowledge can be a huge help. Before jumping in, it's a good idea to explore a range of cryptocurrency resources to get a handle on the bigger picture.

One of the most important things to realize is that selling Bitcoin is often a taxable event. You don't need to become a tax law guru overnight, but being aware of this from the start will remind you to keep good records of your transactions.

Once your Bitcoin is secure and your documents are ready, you’re in a great position to pick your "off-ramp"—the service you'll use to convert your crypto into spendable cash.

Choosing Your Best Path to Cash

So, you're ready to turn your Bitcoin into cash. Great. But what's the best way to do it? The honest answer is: it depends entirely on what you need. Are you looking for lightning speed, the lowest possible fees, or maximum privacy?

There are a few well-trodden paths you can take:

- Centralized exchanges are the go-to for most people, offering speed and a familiar trading interface.

- Peer-to-peer (P2P) marketplaces give you more control, letting you set your own terms directly with another person.

- Bitcoin ATMs are fantastic for quick, small amounts of cash, but they'll cost you.

- Crypto debit cards bridge the gap, letting you spend your BTC just like you would with a regular bank card.

Let's break down what each of these really means for you and your wallet.

The Big Players: Centralized Exchanges

When you think of trading crypto, you probably picture a platform like Coinbase or Binance. These centralized exchanges are the most popular route for a reason. They offer deep liquidity, meaning you can almost always find a buyer for your Bitcoin instantly, and they connect directly to your bank account for easy withdrawals.

Transactions typically wrap up in minutes. The trade-off? Fees. You're usually looking at trading fees around 0.1% to 0.5%, plus whatever they charge you to withdraw your cash. These costs can add up, especially on larger trades, so it's something to keep an eye on.

Going Direct: Peer-to-Peer Marketplaces

If you prefer to cut out the middleman, P2P platforms are your arena. You're not trading with the exchange; you're trading directly with another individual. This gives you a ton of flexibility—you can set your own exchange rate and choose from a wide variety of payment methods, from bank transfers to PayPal or even in-person cash meetups.

The key here is caution. You're dealing with a stranger, so you have to be smart about it.

My rule of thumb is to trust but verify. Always check a user's trade history and feedback before you even think about starting a transaction.

Here’s a quick checklist I run through on P2P platforms:

- Only work with buyers who have a solid reputation—think 100+ successful trades and a clean dispute history.

- Never, ever release your Bitcoin from the platform's escrow until you have confirmed the payment has fully cleared in your account.

- If something feels off, don't hesitate to use the platform's dispute resolution system. That's what it's there for.

Comparison of Bitcoin to Cash Conversion Methods

Trying to decide which path is right for you can feel overwhelming. To make it a bit clearer, I've put together a simple table that lays out the pros and cons of each method at a glance. Think about what matters most to you—is it getting your money in the next ten minutes, or is it saving a few percentage points on fees?

| Method | Average Speed | Typical Fees | Best For |

|---|---|---|---|

| Centralized Exchange | 10–60 minutes | 0.1–0.5% + withdrawal | Fast, high-volume trades and reliability. |

| Peer-to-Peer (P2P) | Minutes to hours | 1–3% market spread | Users who prioritize privacy and flexible terms. |

| Bitcoin ATM | Instant | 7–20% | Getting small amounts of cash in a hurry. |

| Crypto Debit Card | 1–3 business days | 1–3% per transaction | Seamlessly spending crypto on everyday purchases. |

This table should give you a good starting point. For most people doing a standard conversion, a centralized exchange is a solid bet. But if you have specific needs around privacy or payment type, P2P is definitely worth exploring. And for those "I need cash right now" moments, an ATM can be a lifesaver, as long as you can stomach the fees.

You can dive deeper into these conversion strategies with Redotpay's 2025 guide for a more detailed look.

If you're a visual person, this decision tree can help you quickly map your priorities to the best option.

As you can see, the high-volume trader and the privacy-conscious user will likely end up on completely different paths.

On-the-Go Cash: Bitcoin ATMs and Debit Cards

Bitcoin ATMs are the closest thing you'll get to instant cash. Walk up, scan a QR code, and walk away with fiat currency. It’s incredibly convenient, but that convenience comes at a steep price. The fees can be brutal, often climbing from 7% to as high as 20%. They also have pretty low withdrawal limits, so they're really only practical for small amounts.

Crypto debit cards, on the other hand, are designed for spending, not just cashing out. Services like BitPay let you link a card to your crypto wallet and use it anywhere Visa or Mastercard is accepted. It feels just like using a regular debit card, but behind the scenes, your BTC is being converted with each purchase. Just be aware of the 1% to 3% conversion fee on every transaction—it can add up faster than you think.

A lot of people love the instant access these methods provide, but it's crucial to remember that those fees will eat into your funds over time.

Before you pull the trigger on any transaction, take a moment to do the math. Add up the trading fees, network fees, and any withdrawal charges.

A clear cost breakdown ensures you won’t be surprised by hidden fees. It’s the difference between a successful cash-out and a frustrating one.

Using a Crypto Exchange to Sell Bitcoin

If you're looking to cash out your Bitcoin, a centralized crypto exchange is almost always the simplest and most reliable way to go. These platforms are essentially the marketplaces of the crypto world, connecting huge numbers of buyers and sellers. This ensures you can sell your Bitcoin almost instantly and get a fair market price.

Think of an exchange like a secure middleman. They handle the complexities of the transaction, making the whole process—from depositing your BTC to getting cash in your bank account—feel straightforward and secure.

Getting Your Exchange Account Ready

First things first, you'll need an account. You'll start with the basics: your email and a very strong password. But the single most important step here is setting up two-factor authentication (2FA). Do not skip this. Use an app like Google Authenticator to add a critical security layer that can save you from a lot of potential headaches.

After that, you'll have to go through identity verification, what the industry calls Know Your Customer (KYC). This means uploading a government-issued ID and maybe a utility bill to prove your address. It might feel a bit invasive, but it's actually a good sign. It shows the exchange is playing by the rules and complying with financial regulations, which ultimately protects you and your money. This verification can be done in minutes, but sometimes it takes a day or two.

Moving and Selling Your Bitcoin

With your account verified, it’s time to move your Bitcoin from your personal wallet over to the exchange. In your exchange dashboard, look for a "Deposit" or "Receive" button. Clicking this will give you a unique Bitcoin wallet address tied directly to your account.

This is the most crucial part, so pay close attention:

- Double-check the address. I can't stress this enough. Copy it carefully, as one wrong character means your Bitcoin is gone forever.

- Always send a small test transaction first. Before I move a large amount to a new address, I always send a tiny fraction—something like 0.0001 BTC—to make sure it arrives safely. Once I see it in my exchange account, I'll send the rest.

- Expect a short wait. It's not instant. Depending on how busy the Bitcoin network is, your deposit could take anywhere from 10 to 60 minutes to be confirmed and show up in your account.

Here’s a look at a typical exchange dashboard. As you can see, they’re designed to be pretty intuitive, with clear options for managing your portfolio.

Once your Bitcoin has landed, you're ready to sell. You'll generally find two ways to do this.

A market order is the "sell it now" button. It offloads your Bitcoin immediately at the best price available on the market. It's fast and easy. A limit order, on the other hand, lets you set the price. The sale only goes through if Bitcoin hits that price, giving you more control but requiring more patience.

For most people just looking to cash out, a market order is the perfect tool for the job. If you're a bit more strategic and want to squeeze every last dollar out of your sale, a limit order might be your better bet. If you're still deciding on a platform, check out some in-depth reviews of the best crypto converter options out there.

Withdrawing Your Cash

The final step is getting that money into your bank account. In your exchange's dashboard, find your fiat wallet (USD, EUR, etc.) and look for the "Withdraw" option. From there, you'll select your linked bank account, type in the amount, and confirm the transaction.

Withdrawals are typically sent via bank transfer (ACH in the US, SEPA in Europe). Keep in mind that it usually takes 1-5 business days for the money to appear in your account. Also, be aware of any withdrawal fees the exchange might charge. Once those funds hit your bank, you're all set—you’ve officially turned your Bitcoin into cash.

Navigating Peer To Peer P2P Platforms Safely

Peer-to-peer platforms let you sell Bitcoin directly to another person instead of a big exchange. You decide the price and pick from various payment methods—ideal if your local banks aren’t crypto-friendly. Plus, these services handle escrow for every trade.

The platform holds your Bitcoin in escrow until the buyer’s payment clears, adding an extra safety net.

Creating And Managing Your Sell Offer

When you’re ready, build your listing by specifying how much Bitcoin you’re selling and which fiat currency you want in return. Decide on the payment options you’ll accept—bank transfer, PayPal, Wise, or others.

Your reputation drives demand. A clear, well-written offer and a track record of problem-free trades attract serious buyers.

You can lock in a fixed price or tie your rate to the market. For example, setting market price + 1.5% gives you a buffer against sudden drops.

Vetting Buyers And Avoiding Scams

Before confirming a trade, take a quick look at the buyer’s profile:

• Trade History: Over 100 completed transactions suggests experience.

• Feedback Score: Aim for at least 98% positive reviews.

• Account Age: Older accounts tend to be more reliable.

A minute spent here can prevent big headaches later. For more on secure transfers, check out our guide on how to send crypto.

The golden rule of P2P trading is simple: NEVER release your Bitcoin from escrow until you have logged into your bank or payment account independently and confirmed the funds have fully arrived and cleared. Do not rely on screenshots or emails from the buyer as proof of payment.

Using Escrow And Dispute Resolution

Once a buyer initiates a trade, the platform moves your Bitcoin into escrow. Meanwhile, the buyer sends the agreed payment directly to you.

After you’ve confirmed the funds in your account, hit “release,” and the platform forwards the Bitcoin to the buyer. If the buyer claims they paid but you see nothing, open a dispute. The support team reviews both sides and makes the final call.

Finalizing the Details: Fees, Security, and Taxes

Alright, you've made the trade. But you're not quite done yet. A successful cash-out means navigating the final, crucial details: the fees, security measures, and tax obligations that come with it. Getting these wrong can quickly turn a profitable sale into a headache.

As of October 2025, you're not alone in this—over 490 million people now hold crypto worldwide. But even with this mainstream adoption, some hurdles remain. Exchange fees, for example, typically hover between 0.1% and 0.5% per trade, and that’s before you even think about withdrawal fees. All these little costs can eat into your profits if you're not paying attention. You can dig deeper into these kinds of Bitcoin stats over at Coinlaw.io.

Mind the Hidden Costs

When you convert your Bitcoin to cash, a few different fees will pop up. Knowing what they are is the first step to minimizing them.

- Network Fees: Think of this as a toll paid to Bitcoin miners for processing your transaction and adding it to the blockchain. These fees aren't fixed; they go up and down depending on how busy the network is.

- Exchange Trading Fees: This is the commission the platform takes for handling your sell order. It's almost always a small percentage of your total trade amount.

- Withdrawal Fees: Once your Bitcoin is sold for fiat, the exchange will charge you a flat fee to send that cash over to your bank account.

A good pro tip? Try to time your Bitcoin transfer to the exchange for when the network is less congested. You can use a Bitcoin fee estimator online to find a good window and potentially save a few bucks.

Staying Secure During the Process

It goes without saying, but security is everything in crypto. Phishing scams are rampant, with attackers setting up convincing fake login pages for major exchanges to steal your credentials. Make it a habit to always double-check the URL in your browser before you type in a single letter of your password.

Your private keys and two-factor authentication (2FA) codes are for your eyes only. A legitimate exchange employee will never ask for them. Ever. Remembering this one simple rule will protect you from the vast majority of scams out there.

The Inescapable Reality of Taxes

And now for everyone's favorite topic: taxes. In most countries, selling Bitcoin for cash is considered a taxable event. If you sold your BTC for more than you originally paid, you’re looking at a capital gain, and you'll likely owe tax on that profit.

This is where meticulous record-keeping becomes your best friend. You absolutely need to track the date you bought the Bitcoin, its value at that time, the date you sold it, and the price you sold it for. This data is essential for calculating your capital gains or losses correctly. If you're an active trader, crypto tax software can be a lifesaver. And when in doubt, spending a little money to consult a tax professional who gets crypto is a very smart move.

Common Questions About Cashing Out Bitcoin

Even the most seasoned crypto users pause when it’s time to turn Bitcoin into dollars. I remember my first sale—I had everything planned, yet still wondered how long the funds would actually hit my bank. Breaking the process into clear stages helped me stay calm and focused.

Most of the wait happens on the banking side. Here’s a typical timeline:

- Bitcoin Network Confirmation: 10–60 minutes

- Exchange Sale: Instant

- Bank Withdrawal: 1–5 business days

The blockchain leg moves quickly, but once your exchange initiates a bank transfer, you’re at the mercy of traditional finance.

Choosing The Right Method For Your Needs

If I’m watching fees, I head straight to a large, high-volume exchange. They tend to charge lower trading fees and offer affordable bank withdrawals (ACH, SEPA, etc.).

• Centralized Exchanges

- Competitive fee tiers

- Predictable schedule

• Peer-to-Peer Platforms

- Potentially better rates if you match with the right buyer

- More negotiation, more risk

• Bitcoin ATMs

- Quick and easy for under $200

- Fees of 7–20% make them a last resort

Quick Tip: For small, urgent cashouts, ATMs work—just stick to well-lit spots and expect steep fees.

For anything over a few hundred dollars, an online exchange is the smarter, safer bet.

Understanding Tax Obligations

Selling Bitcoin almost always counts as a taxable event. I learned this the hard way—missing a small capital gains entry on my tax return led to a headache with my accountant.

Keep a spreadsheet or use a crypto-friendly bookkeeping tool to track:

- Purchase date and cost basis

- Sale date and proceeds

- Fees paid

When you tally your gains or losses, the difference between what you paid and what you received determines your tax bill. If you’re unsure about local rules, a quick call with a crypto-savvy tax pro can save you time and stress.

At BlockBee, we help businesses handle crypto transactions without fuss. For non-custodial payment solutions you can trust, check out BlockBee.