How to Send Crypto Safely A Practical Guide

Sending crypto might feel a little intimidating at first, but it really comes down to just two things: a digital wallet where you keep your funds and the recipient's unique wallet address. Think of it like sending an email—that address is what guarantees your funds land in the right place. Getting that part right is everything.

Your First Crypto Transfer: A No-Nonsense Guide

Learning how to send crypto for the first time is a game-changer. It unlocks a whole new way to exchange value directly with anyone, anywhere in the world. It’s a core skill for navigating the digital economy, and honestly, it’s much simpler than most people imagine.

Before you jump in, it’s a good idea to spend a little time understanding blockchain technology. That’s the engine running under the hood, the powerful ledger system that makes all these transfers secure and verifiable without a bank getting in the way.

The Core Components of a Crypto Transaction

At its most basic level, every crypto transfer has a sender, a receiver, and the network that makes it all happen. The whole concept of how to send cryptocurrency really hinges on digital wallets and the specific blockchain network you're using.

It’s not a niche activity anymore. As of early 2025, there are over 560 million crypto users globally, a testament to how many people are using this for transfers. You can dive deeper into these numbers in the Q1 2025 crypto report. All you need to join them is a wallet and the recipient's public address—that long string of letters and numbers—to send the coins to.

Let's break down what you'll be working with.

Key Takeaway: If you remember one thing, make it this: always double-check the recipient's address. Crypto transactions are irreversible. Once you hit send, there's no "undo" button. A simple typo can mean your funds are gone for good.

A Real-World Scenario: Sending Bitcoin

Let’s say you owe a friend 0.001 BTC. The first thing you do is ask them for their Bitcoin wallet address. They'll copy it from their wallet app and send it to you via a secure message.

From there, you just open your own wallet, hit "Send," and select Bitcoin. You'll then paste their address into the recipient field, enter the amount (0.001 BTC), and take a quick look at the network fee before confirming. That's it! The Bitcoin network handles the rest, validating your transfer and etching it onto the blockchain forever.

Before you make that first transfer, getting familiar with these core pieces will make the process feel much more intuitive.

Crypto Transaction Essentials at a Glance

| Component | What It Is | Your Key Action |

|---|---|---|

| Your Wallet | A digital app or device that stores your crypto and allows you to send/receive it. | Keep your seed phrase secure and never share it. |

| Recipient's Address | A long, unique string of letters and numbers for a specific cryptocurrency. | Copy and paste it carefully; avoid manual typing. |

| Network Fee | A small payment required to process your transaction on the blockchain. | Adjust based on how quickly you need the transfer confirmed. |

| Transaction ID (TxID) | A unique code that acts as a receipt for your transfer on the blockchain. | Use it to track the status of your transaction on a block explorer. |

Once you understand these four components, you've grasped the fundamentals of nearly every cryptocurrency transaction you'll ever make. They are the building blocks for everything that follows.

Securing Your BlockBee Account and Wallet

Before you can even think about sending crypto with a tool like BlockBee, you need to lock things down. Getting your security right from the start isn’t just a "best practice"—it's the foundation for every single transaction you'll make.

The absolute first thing you should do after creating your account is switch on two-factor authentication (2FA). Seriously. Think of it as adding a deadbolt to your digital front door. It’s a simple move that dramatically cuts your risk of someone getting unauthorized access.

Don't put it off. Make implementing two-factor authentication your immediate priority. This adds a crucial layer of verification, typically a code from your phone, that stops would-be intruders in their tracks. It’s a non-negotiable for modern account security.

Connecting Your Wallets to BlockBee

With your account properly secured, it's time to link up your crypto wallets. BlockBee gives you a couple of options here: you can connect wallets you already use, or you can generate fresh receiving addresses right from the dashboard. The right choice really just depends on how you run your operations.

If you have existing wallets for your business, you can simply plug their addresses into BlockBee. This is a great way to centralize your payment processing without having to shuffle funds around or change your established setup.

On the other hand, generating new addresses within BlockBee can be a clean way to keep your business transactions separate and neatly organized.

Expert Insight: Remember, BlockBee is a non-custodial service. This is a big deal. It means you always hold your own private keys. BlockBee helps move the money, but it never actually takes control of your funds, leaving you with complete sovereignty over your assets.

Hot Wallets vs. Cold Wallets: A Practical Comparison

Not all wallets are built the same, and picking the right type is a balancing act between easy access and rock-solid security. This decision has a direct impact on how you'll manage your crypto day-to-day.

Here’s the breakdown:

Hot Wallets: These are wallets connected to the internet, like desktop or mobile apps. They're fantastic for handling frequent, smaller payments because they’re so convenient. An e-commerce site, for instance, would likely use a hot wallet for daily customer purchases.

Cold Wallets: These are offline hardware devices. They offer the highest level of security you can get, making them perfect for storing large amounts of crypto you don’t need to touch often. This is your business's main vault.

From my experience, the smartest strategy is to use both. Keep a smaller, working amount of funds in a hot wallet linked to BlockBee for your daily operations. Then, on a regular basis, sweep the bulk of your earnings into a secure cold wallet for long-term safekeeping. This hybrid approach gives you the best of both worlds: speed for business and a fortress for your profits.

Automating Crypto Payments with BlockBee's API

Sending a one-off crypto payment is simple enough. But what happens when you’re dealing with dozens—or even hundreds—of transactions? Think about paying out affiliate commissions, settling invoices with suppliers, or managing regular payroll. Manual transfers just don't scale.

This is where you move beyond the basics and start building a real, professional workflow. By using an API to send crypto programmatically, you can turn a tedious, error-prone task into a fully automated process. This is exactly what BlockBee's API was built for: letting you plug crypto payment capabilities straight into your own apps and backend systems.

If you're new to this, a comprehensive crypto payments API guide is a great place to get a solid footing on the core concepts and best practices.

Your First API Payment Request

Let's make this real. Say you owe a freelance developer 0.1 ETH. Instead of pulling up your wallet and copy-pasting addresses, you can trigger the payment with a simple API call. Even better, you can tie this call to an event, like an invoice getting approved in your accounting software.

Here’s a quick look at what that request might look like using Python:

import requests

api_key = "YOUR_BLOCKBEE_API_KEY" payout_address = "0xRecipientEthereumAddress..." amount_to_send = 0.1 coin = "eth"

This URL is where BlockBee will notify your system once the payment is done.

callback_url = "https://your-system.com/payment-confirmations"

response = requests.get(url)

print(response.json())

The request itself is straightforward—you just define who you're paying, how much, and with what crypto. The real game-changer here is the callback_url.

The Callback: Your Automation Superpower. The

callback_urlis the secret to true "set it and forget it" automation. Once the transaction is confirmed on the blockchain, BlockBee pings this URL with a notification. That’s your system’s cue to automatically update its records, mark an invoice as paid, or release a customer's order. No human intervention needed.

Building Payment Workflows That Scale

This automated notification system is the foundation for building scalable operations. It transforms a simple crypto transfer into a smart, event-driven workflow. This is a critical piece of the puzzle for any business that needs to not only send but also accept crypto payments efficiently, creating a complete, closed-loop financial system.

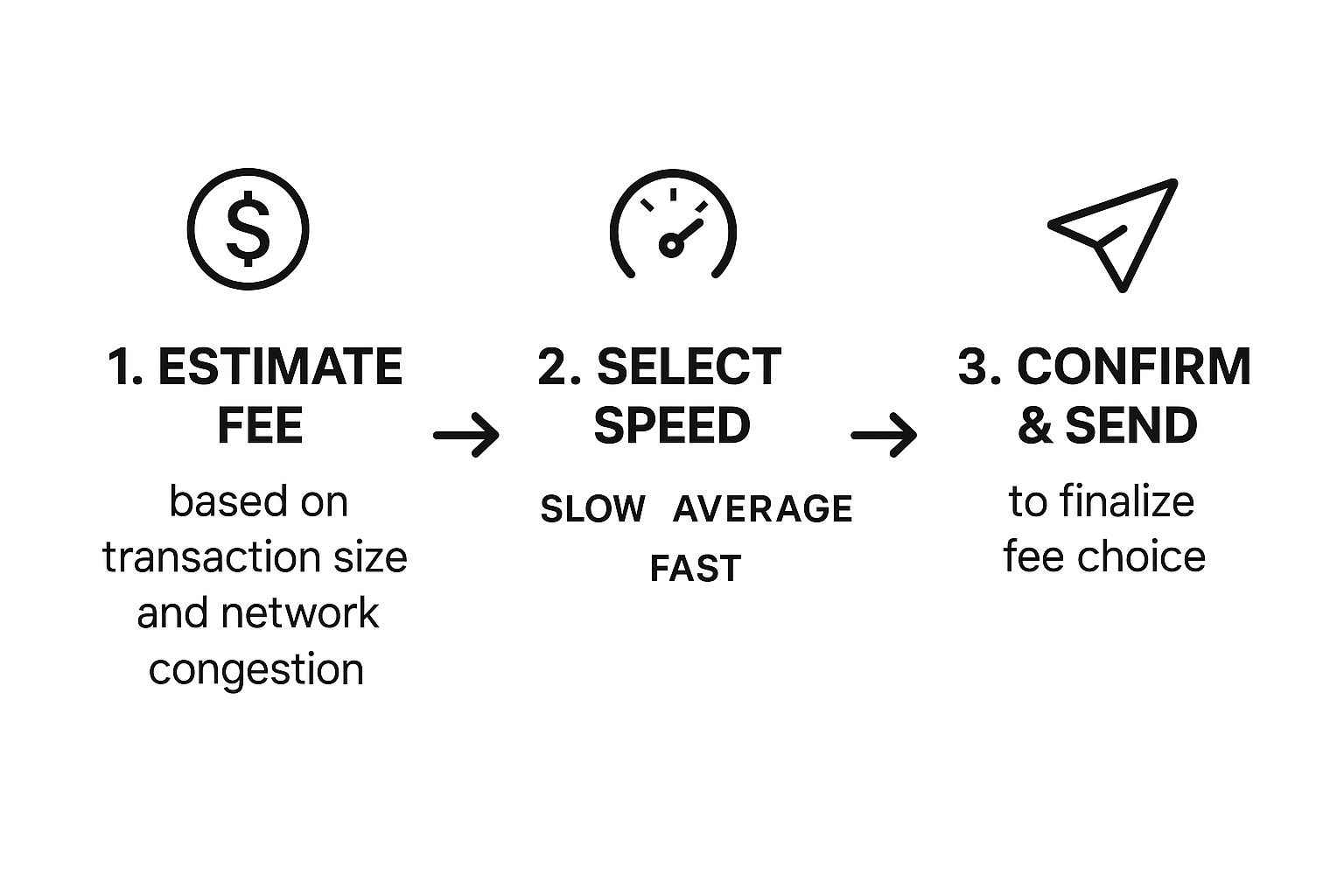

Before sending any transaction, you have to think about fees. This is always a balancing act between cost and speed.

The API lets you bake these decisions right into your code. You can programmatically set fee levels based on how urgent a payment is. A time-sensitive payout to a partner might get a higher fee to ensure it confirms quickly, while routine, low-priority transfers can be sent with a lower fee to save on costs.

By codifying these rules, you eliminate guesswork and build a reliable, intelligent payment system that runs itself.

Confirming Your Transaction Reached Its Destination

Alright, you've sent the crypto. That "send" button is clicked, but your work isn't over just yet. A critical part of handling any cryptocurrency transfer is making absolutely sure it arrived safe and sound. This isn't just about calming your nerves; it's a non-negotiable step for sound accounting and keeping your operations running smoothly.

So, how do you track your funds on their journey from your wallet to their final destination? I always use a two-pronged approach: a quick check on the service dashboard, followed by a deeper dive into the public blockchain itself. Doing both is just good practice.

Using the BlockBee Dashboard for Real-Time Status

Think of your BlockBee dashboard as your command center. It’s built to give you a quick, at-a-glance update on every single payment you’ve made. As soon as you send the funds, you'll see the transaction pop up, usually with a 'pending' status.

This simply means your transaction has been broadcast to the network and is waiting in line to be processed by miners or validators. Once it gets the required number of network confirmations (this number changes depending on the crypto), the status will flip to 'confirmed'. That's your first sign of success.

Becoming Your Own Detective with a Block Explorer

While the dashboard is fantastic for a quick status check, the real proof is always on the blockchain. Verifying it there is like getting a notarized receipt from the network itself—an independent, trustless confirmation that the transfer is final and can't be reversed.

Every blockchain has its own search engine, known as a block explorer, that lets you look up this information. You just need to know which one to use.

- For Bitcoin (BTC), you’d use something like Blockchain.com or Blockstream.

- For Ethereum (ETH) and any ERC-20 tokens, the go-to is Etherscan.

- Other networks have their own dedicated explorers, like Solscan for Solana or TRONSCAN for TRON.

My Advice: Never just trust a "sent" notification. Make it a habit to grab the Transaction ID (also called a TxID or hash) that BlockBee gives you and paste it directly into the right block explorer. This gives you irrefutable proof that the transaction is complete.

Getting this dual-verification process down—a quick glance at the dashboard, followed by final confirmation on a block explorer—is what separates amateurs from professionals. It removes all doubt and ensures every cent (or satoshi) is accounted for.

Understanding Crypto Fees and Transaction Speeds

If you've spent any time in crypto, you’ve probably seen it: one transaction costs a few cents, while the next one stings you for $50. What gives? This all comes down to network fees, and they're a core part of how every blockchain works.

When you send crypto, you’re not just flicking digital coins from one wallet to another. You’re paying for a service. These fees, often called "miner fees" on Bitcoin or "gas fees" on Ethereum, are your payment to the people running the computers that validate and add your transaction to the blockchain. Think of it as paying for a spot in a secure, digital ledger.

The Trade-Off Between Cost and Speed

In the world of crypto, you're constantly faced with a choice: how much are you willing to pay versus how fast you need it to happen? It’s a classic balancing act.

When a network gets busy—say, during a hyped-up NFT mint or a major market move—everyone is trying to get their transaction processed at once. This competition drives up the price. If you want to jump to the front of the line, you can offer a higher fee. Validators are incentivized to pick up the highest-paying transactions first, meaning yours could get confirmed in minutes.

On the flip side, if you’re not in a hurry, you can set a lower fee and save some money. The catch? Your transaction might sit in the "mempool" (a sort of digital waiting room) for a while, sometimes for hours, until the network calms down and validators get to the cheaper transactions.

Comparing Costs Across Different Blockchains

Not all blockchains charge the same. In fact, the network you choose can make a massive difference in what you pay. It’s a bit like choosing between shipping services—some are premium and fast, others are budget-friendly.

- Established Networks (Bitcoin, Ethereum): These are the titans of the industry. They offer unmatched security and decentralization, but that comes at a cost. Their popularity means they often have high traffic, leading to higher and more volatile fees.

- Low-Cost Networks (Solana, TRON): These newer players were built for speed and high volume. As a result, their transaction fees are often just fractions of a penny. This makes them a fantastic choice for things like micropayments or any application that involves a lot of small, frequent transfers.

My Practical Advice: Match the network to your needs. If you're moving a large amount of value and security is your absolute top priority, paying a bit more for a transaction on Bitcoin or Ethereum is probably worth the peace of mind. But if you’re running a business that processes hundreds of small payments a day, a low-cost network like TRON or Solana is the only way to go.

Tools like BlockBee give you a clear view of this landscape before you commit. You can see a detailed breakdown of BlockBee's transaction fees to get a real-time look at the costs, helping you make a smart decision every time you send.

Essential Security Habits for Sending Crypto

When you're dealing with crypto, you become your own bank. That's a powerful idea, but it also means security rests entirely on your shoulders. It's not about theory; it's about building practical, unbreakable habits for every single transaction.

The most fundamental rule is also the simplest: always triple-check the recipient's wallet address.

Crypto transactions are final. There’s no customer service line to call, no bank to reverse the charge, and absolutely no "undo" button. If you send funds to the wrong address, they are gone forever. This isn't just a suggestion; it's the golden rule of transacting in this space.

Defending Against Clipboard Hijackers

One of the sneakiest threats out there is clipboard hijacking malware. This nasty bit of code runs silently on your device, waiting for you to copy a crypto address. The moment you do, it instantly replaces the legitimate address on your clipboard with one belonging to a scammer.

You then paste what you think is the correct address, hit send, and unknowingly route your crypto straight to a thief. It’s a silent, brutally effective attack that exploits our tendency to trust our copy-paste function. Your best defense is simple diligence: after pasting an address, always visually compare the first few and last few characters with the original source.

My Personal Rule: I never, ever send a significant amount of crypto without first sending a tiny test transaction. Sending just $1 worth of crypto to confirm it arrives safely is a tiny price to pay for the peace of mind that your larger payment won't vanish into the digital void. This one habit has saved countless people from very costly mistakes.

Building Your Security Checklist

Before every single transaction, run through a mental checklist until it becomes muscle memory. This is your best defense. For those building more complex systems, diving into a comprehensive guide to cryptocurrency payment solutions can offer deeper insights into setting up secure operational workflows.

Here’s what your personal security routine should look like:

- Verify the Address Manually: Always double-check the pasted address against the source. Don't just glance—compare the beginning and end.

- Send a Test Transaction: For any new recipient or large payment, send a small "feeler" payment first.

- Use Secure Communication: Only get wallet addresses through trusted, encrypted channels. A text message or unverified email is a huge risk.

- Keep Your Software Updated: Make sure your wallet software, antivirus programs, and operating system are always running the latest versions.

Treating every transaction with this level of care is how you protect your assets and send crypto with real confidence.

Common Questions About Sending Cryptocurrency

Even with the best instructions, sending crypto for the first time can feel a little nerve-wracking. It’s totally normal to have questions. Let's walk through some of the most common ones I hear, so you can feel more confident hitting that "send" button.

One of the biggest fears is sending funds to the wrong address. What happens then? The hard truth is that because blockchain transactions are designed to be irreversible, those funds are almost certainly gone for good. There’s no bank to call and no "undo" button.

This is exactly why I always stress the importance of double-checking (or triple-checking!) the address and sending a small test amount first. It’s a simple step that can save you a world of hurt.

Another thing people always want to know is how long a transaction will take. The speed really boils down to two things: which crypto network you’re using and how much you paid in network fees. A Bitcoin transaction might take anywhere from 10 minutes to an hour or more during busy times. In contrast, a payment on a faster network like Solana or TRON can be confirmed in just a few seconds.

Are There Limits on How Much I Can Send?

From a technical standpoint, most cryptocurrency networks don't really have a maximum limit on how much you can send in a single go. However, the wallet or exchange you're using might impose its own daily or per-transaction limits for security or compliance reasons.

Key Insight: Even though you can send a massive amount in one transaction, it's not always the best idea. Large transfers can attract unwanted attention. For significant sums, I'd personally recommend breaking the payment into smaller batches and always, always sending from a secure hardware wallet.

Splitting up large transfers isn't just about security; it also makes the accounting and tracking a whole lot cleaner on your end.

Ready to streamline your crypto payments with a secure, non-custodial solution? BlockBee offers an intuitive platform with low fees and instant payouts, perfect for businesses of any size. Get started with BlockBee today