How to Create a Bitcoin Wallet

So, you're ready to create a Bitcoin wallet. This is where you get your own digital address to send and receive Bitcoin, putting you in the driver's seat of your own finances.

Let’s walk through what that really means before we get into the setup.

Your First Steps into Bitcoin Ownership

It helps to think of a Bitcoin wallet less like the leather one in your pocket and more like a high-tech keychain for your digital money. The wallet itself doesn't actually "store" your Bitcoin. Instead, it holds the secret cryptographic keys that prove you own your funds on the blockchain and give you the power to spend them.

Understanding this from the get-go is a game-changer. It means you are in full control, and your journey starts with a few key ideas that are the foundation of self-custody.

The Building Blocks of a Wallet

Every Bitcoin wallet, no matter the type, is built on three core pieces. Getting your head around these is your first real step toward financial independence.

- Private Keys: This is the big one. Your private key is a long, secret string of letters and numbers that unlocks your ability to spend your Bitcoin. If someone else gets this key, they get your funds. Protecting it is your number one job.

- Public Address: This is what you share with others when you want to receive Bitcoin. Think of it like your email address or bank account number—it’s totally safe to give out. It's mathematically generated from your private key, but it's impossible to reverse-engineer.

- Seed Phrase: You'll also see this called a recovery phrase. It's a list of 12 to 24 random words your wallet gives you during setup. This phrase is a master key that can restore your entire wallet on a new device if your old one is ever lost, stolen, or broken.

The whole idea of a user-controlled wallet has been around since the very beginning. Satoshi Nakamoto’s original 2009 software was the first-ever Bitcoin wallet, and it completely changed how we could manage digital currency.

Custodial vs. Non-Custodial Wallets

One of the first choices you'll make is whether to use a custodial or a non-custodial wallet. With a custodial wallet, a third party—usually a crypto exchange—holds your private keys for you. It's convenient, sure, but you're trusting them to keep your assets safe.

This guide is all about setting up a non-custodial wallet. This type of wallet gives you, and only you, control over your private keys and seed phrase. It's the true embodiment of Bitcoin's philosophy: "Be your own bank." It comes with more responsibility, but the security and control you get are second to none.

The shift toward self-management has been huge. The number of blockchain wallet users skyrocketed from just over 3 million in 2015 to roughly 68 million by 2021. You can dig deeper into the global rise of crypto wallet adoption on Statista.com.

Choosing the Right Bitcoin Wallet for Your Needs

Before we jump into creating a Bitcoin wallet, it’s critical to understand one thing: not all wallets are the same. The "best" wallet really depends on what you plan to do. Are you a long-term holder, or are you looking to make frequent, everyday transactions?

Your answer to that question will point you toward the right tool for the job. You're looking for that sweet spot between iron-clad security and practical accessibility. Let's dig into the main types so you can find the perfect fit.

Software Wallets for Everyday Use

Software wallets are just what they sound like—applications you run on your computer or phone. They're often called "hot wallets" because they stay connected to the internet, which makes sending and receiving Bitcoin incredibly fast and convenient.

- Desktop Wallets: These are programs that live on your PC or laptop. They usually offer a solid blend of robust security features and a straightforward user interface, making them a great choice for active traders or anyone who manages their crypto primarily from their main computer.

- Mobile Wallets: If you need to transact on the move, a mobile wallet is essential. These apps effectively turn your smartphone into a pocket-sized bank, letting you pay for things simply by scanning a QR code.

The big trade-off here is that their constant internet connection opens them up to a small amount of risk. Still, for day-to-day spending, their convenience is hard to beat.

The sheer variety of wallets available today is a direct result of crypto's explosive growth. Consider this: the number of blockchain wallet users skyrocketed from just over 3 million in 2015 to more than 68 million by early 2021. That's a clear sign of just how many people are taking control of their own digital assets. You can find more crypto wallet statistics on socialcapitalmarkets.net.

Hardware Wallets for Maximum Security

Now, if you're holding a significant amount of Bitcoin or you're in it for the long haul, a hardware wallet isn't just a good idea—it's essential. These are small, physical devices that keep your private keys stored completely offline, shielding them from online threats like viruses and phishing attacks.

Think of a hardware wallet as your personal digital vault. It only connects to your computer or phone when you need to sign a transaction, and even then, you have to physically press a button on the device to approve it. This creates a powerful, tangible barrier against hackers.

They do come with a price tag, typically between $60 and $200+, and they aren't as slick for quick payments. But the peace of mind they provide is priceless. For anyone serious about protecting their crypto wealth, this is the industry standard. To learn more, check out our guide on what is a hardware wallet.

Bitcoin Wallet Types At-a-Glance

Choosing your wallet ultimately comes down to balancing your personal need for security against your desire for convenience. This table breaks down the main options to help you decide.

| Wallet Type | Security Level | Convenience | Best For |

|---|---|---|---|

| Software | Good | High | Daily transactions and getting started |

| Hardware | Excellent | Medium | Long-term saving and holding large amounts |

| Paper | High (if done right) | Low | Deep cold storage (much less common now) |

In my experience, many people end up using a combination of both. They'll keep a small amount of "spending money" in a mobile wallet for quick access and store the bulk of their savings in a hardware wallet, like a digital savings account. This hybrid approach really does give you the best of both worlds.

A Practical Walkthrough of Wallet Creation

Enough theory. Let's get our hands dirty and actually create your first non-custodial wallet. You’ll be surprised at how quick the process is. For this walkthrough, we'll use a popular mobile wallet as our example so you know exactly what to expect on screen.

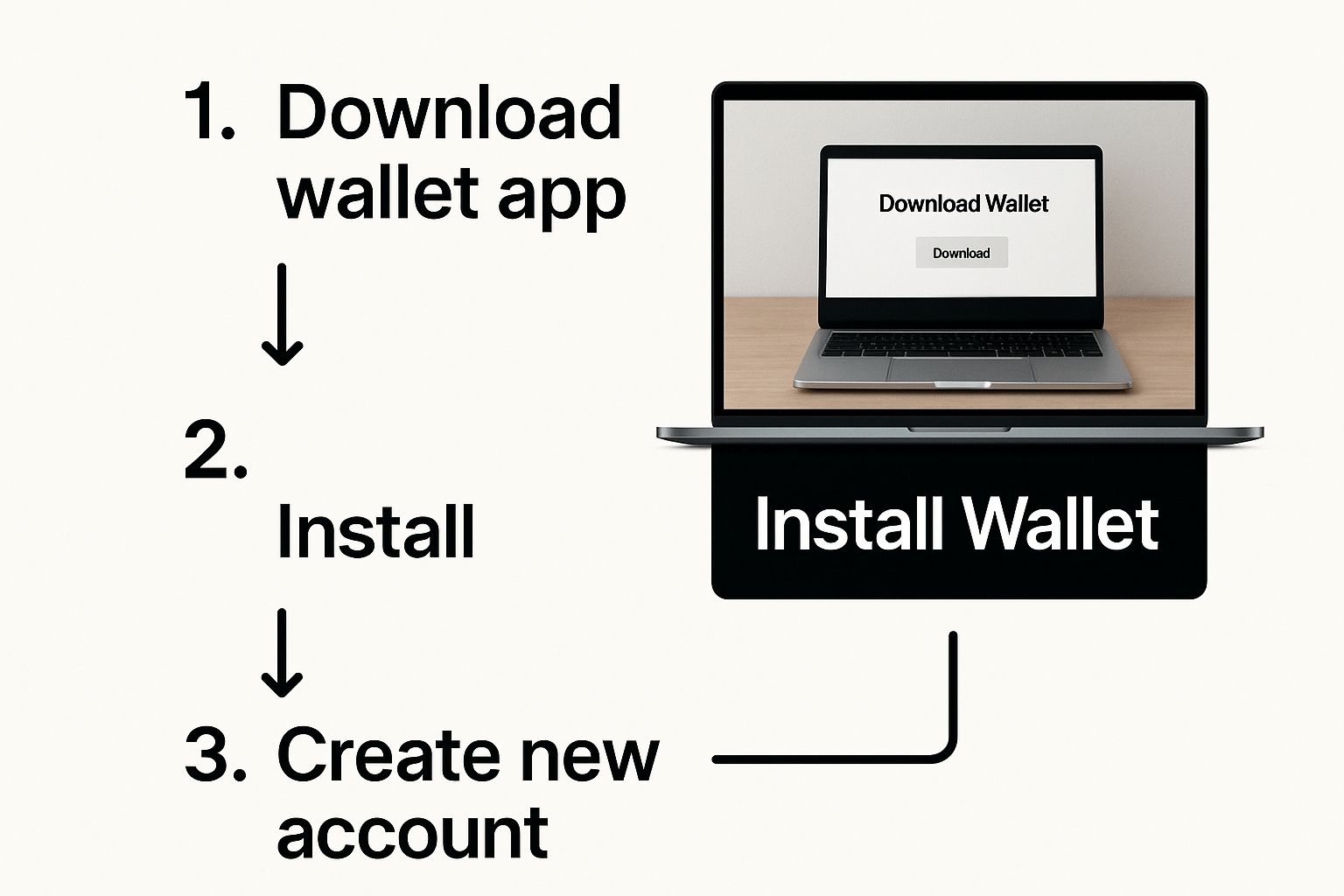

First things first, and this is non-negotiable: download the wallet software only from its official source. This means going directly to the official website or using their verified links for the Apple App Store or Google Play Store. Scammers love to distribute malicious, fund-stealing versions of popular wallets on sketchy third-party sites. Don't fall for it.

This image lays out the simple, safe starting point for getting your wallet installed.

Seriously, starting from the official source is the single most important thing you can do to ensure you're not downloading a compromised app.

The Most Important Moment: Securing Your Seed Phrase

Once the app is installed, open it up. You'll see options like "Create a new wallet" or "Import an existing wallet." Since you're starting fresh, go ahead and create a new one. The wallet will immediately generate your unique 12 or 24-word seed phrase.

Pay attention, because this is the single most critical moment in your crypto journey. This string of words is the master key to everything in your wallet.

- If you lose your phone, this phrase lets you recover all your funds on a new device.

- If someone else gets their hands on this phrase, they can (and will) steal all your funds.

Your wallet will give you a stark warning: never share this phrase with anyone and never store it digitally (no screenshots, no text files, no cloud storage). Treat this as gospel. Your financial sovereignty is on the line.

The best way to handle this is surprisingly low-tech. Grab a pen and paper. Write the words down, in the correct order, and double-check every single letter. Store that piece of paper somewhere safe from fire, water, and anyone you don't trust with your money.

Finalizing Your Wallet Setup

After you've written down your phrase, the wallet will probably give you a quick quiz, asking you to re-enter a few of the words to prove you backed it up correctly. Don't skip this—it’s your final check to make sure your backup is perfect.

With your seed phrase safely offline, you're just a couple of taps away from being done.

- Set a Strong PIN: This is your day-to-day password for opening the app on your device. It's a local security layer, but your seed phrase remains the ultimate failsafe.

- Enable Biometrics: If your phone has it, using a fingerprint or Face ID is both convenient and secure for quick access.

And that's it. You're in! You’ll be greeted by a clean dashboard showing a zero balance and options to send or receive crypto. Your wallet is officially active, and you now have a public address you can share to receive funds. If you're curious about the mechanics behind that string of characters, our guide on what is a Bitcoin address breaks it all down.

Congratulations, you are now in complete control of your own digital assets.

Mastering Wallet Security and Best Practices

Just getting a Bitcoin wallet set up is crossing the starting line; the real race is in protecting it for the long haul. Once your wallet is live, your focus has to shift immediately from setup to building smart, consistent security habits. This is how you build the digital fortress that keeps your assets safe.

The responsibility of holding your own keys can feel a bit intimidating at first, but it really just boils down to a few core principles. Think of it like developing digital muscle memory. These practices aren't complicated, but they are absolutely non-negotiable for anyone serious about protecting their wealth.

Your Non-Negotiable Security Checklist

Your first and best line of defense is creating layers of protection that work in tandem. Putting these measures in place right after setup is the best way to kick off your self-custody journey on solid ground.

- Create a Strong Password: This is your gatekeeper. Forget simple words and go for a long, unique mix of uppercase and lowercase letters, numbers, and symbols. A good password manager can be a lifesaver here.

- Enable Two-Factor Authentication (2FA): If your wallet offers it, turn on 2FA right away. This adds a crucial second verification step, usually a time-sensitive code from an app on your phone, making it exponentially harder for anyone to get in.

- The Unbreakable Seed Phrase Rule: Treat your seed phrase like the master key to your entire financial life—because it is. Never share it with anyone, for any reason. Store your physical paper backup somewhere extremely safe, thinking about protection from fire, water damage, or theft.

These practices are more critical than ever in a market that has exploded in size. As of 2024, the number of active blockchain wallets has rocketed past 400 million worldwide. That kind of growth attracts both legitimate users and a whole lot of bad actors, making your security paramount. You can see more on the global scale of blockchain wallet usage on Statista.com.

Avoiding Common Threats

Beyond the initial setup, you have to stay vigilant against the social engineering tricks scammers use to get their hands on your crypto. They are incredibly creative and are constantly coming up with new ways to separate people from their funds.

Phishing attacks are one of the most common threats you'll face. They often appear as official-looking emails or DMs urging you to click a link to "verify your wallet" or "claim a prize." These links lead to convincing-looking fake websites designed to steal your password or, even worse, your seed phrase.

The golden rule is simple: If an offer seems too good to be true, it absolutely is. No legitimate wallet provider, exchange, or support agent will ever ask for your seed phrase or private keys. Ever.

A healthy dose of skepticism is your best friend in this space. Always double-check website URLs before entering any information and be immediately suspicious of any unsolicited request for your credentials.

Ultimately, your private keys are the final line of defense for your Bitcoin. We have a detailed guide that dives deeper into this, and I highly recommend you read it to fully grasp why it's the cornerstone of self-custody: private key security. By staying vigilant and sticking to these best practices, you ensure your digital assets remain exactly where they belong—under your control.

Using Your Wallet for Business with BlockBee

So, you’ve set up your non-custodial Bitcoin wallet. That's a great first step, but the real power comes when you use it for business. For any merchant, freelancer, or developer, that new wallet is your direct line to accepting payments from anywhere in the world. The trick is to connect it to a payment API like BlockBee, which automates the whole process without you ever having to hand over control of your funds.

This connection is what turns your wallet from a simple digital piggy bank into a serious commercial tool. Once you're comfortable creating and securing your wallet, the next move for any entrepreneur is figuring out how to accept Bitcoin payments for your business. Integrating with a service like BlockBee opens up a completely new way to get paid, connecting you with a growing global base of customers who prefer to use crypto.

The Magic of the Extended Public Key

To link your wallet to BlockBee securely, you need one critical piece of information: your xPub, which stands for Extended Public Key.

The easiest way to think of the xPub is as a "read-only" master key for your public wallet addresses. When you give it to a service like BlockBee, you’re essentially granting it permission to generate a brand-new, unique receiving address for every customer invoice. It's a game-changer for privacy and accounting.

- It keeps your finances private. Using a different address for every payment makes it incredibly difficult for anyone to track all your business income back to one wallet.

- It makes bookkeeping a breeze. Since each payment has its own address, you can instantly see which invoice was paid by which customer. No more guesswork.

The most important thing to grasp is that an xPub can only generate public addresses. It has zero access to your private keys and cannot be used to spend your Bitcoin. This is what lets you safely delegate payment processing without risking a single satoshi.

Connecting Your Wallet to BlockBee

Finding your xPub is usually pretty simple. Most non-custodial wallets built for serious use, like Exodus or Electrum, have an option buried in the settings menu that says something like "Show xPub" or "Export Account Public Key." Just find that long string of letters and numbers, and you're ready to go.

Next, you'll head over to your BlockBee dashboard to add a new receiving wallet.

The interface is clean and straightforward. You'll see exactly where you need to paste your wallet's xPub to get started.

All you have to do is copy your xPub and paste it into that field. That’s it. BlockBee’s system now has what it needs to generate fresh addresses for your customers, and every payment will land directly in the non-custodial wallet that you—and only you—control. You’ve just turned a personal Bitcoin wallet into a professional payment engine for your business.

Lingering Questions About Your New Bitcoin Wallet

Alright, so you've got your wallet set up. Even after a smooth setup, it’s natural to have a few questions nagging at you. Thinking through the "what-ifs" is a crucial part of getting comfortable with this technology. Let's tackle some of the most common concerns I hear from people new to this space.

Getting this right means you're truly in control of your money. Knowing the rules of the road is the last step before you can manage your assets with real confidence.

What If My Phone or Laptop Gets Lost or Stolen?

This is usually the first worry that pops into everyone's head, but the answer is surprisingly comforting—as long as you’ve done your homework. If you created a non-custodial wallet and have your 12 or 24-word seed phrase safely backed up offline, your funds are completely secure.

All you have to do is grab a new device, download the same wallet app, and choose the "restore" or "import" option. Once you enter that seed phrase, you’ll see all your Bitcoin reappear, safe and sound. This is precisely why that little scrap of paper or metal plate holding your phrase is the most important part of this whole process.

Can I Use More Than One Wallet?

Not only can you, but you probably should. It's a smart strategy that a lot of seasoned crypto users rely on to organize their funds and tighten up their security. In the industry, we often call this segregation.

For example, you might keep the bulk of your Bitcoin in a hardware wallet that stays offline—this is your "cold storage," like a savings vault. Then, you could use a simple mobile wallet for day-to-day spending—your "hot wallet." This approach dramatically reduces your risk, since only a tiny portion of your crypto is ever on a device connected to the internet.

Ever wonder about the difference between a private key and a seed phrase? Think of it this way: the seed phrase is the master key that can recreate all the individual private keys in your wallet. A single private key just unlocks the funds at one specific address. You only need to back up that one seed phrase to control everything.

Is It Safe to Use My Wallet on Public Wi-Fi?

While today’s wallet apps have solid encryption, I'd strongly advise against it. Using any financial app on public Wi-Fi is just asking for trouble. These unsecured networks are playgrounds for "man-in-the-middle" attacks, where a thief could potentially intercept your data.

Whenever possible, use a trusted private network or your phone's cellular data for any transactions. If you're in a pinch and have absolutely no other choice, make sure you're running a reputable VPN to add a crucial layer of protection.

Ready to put that personal wallet to work for your business? With BlockBee, you can accept crypto payments that go directly into the non-custodial wallet you now control. Get started with BlockBee today!