What Is a Bitcoin Address? Your Complete Guide

Your Digital Mailbox for Sending and Receiving Bitcoin

Think of a Bitcoin address like a digital PO Box for your crypto. It's a unique string of 26 to 35 letters and numbers that tells the Bitcoin network where to send funds. If you want someone to send you an email, you give them your email address. If you want someone to send you Bitcoin, you give them your Bitcoin address. Simple as that.

This unique identifier is what you share with others. It's generated by your crypto wallet and acts as a public destination for payments. It’s a one-way drop box; people can put Bitcoin in, but they can't see who owns it or take anything out without the corresponding private key.

To help ground these concepts, let's compare them to things you already know. The table below breaks down the core ideas with some real-world analogies.

Bitcoin Address Concepts at a Glance

| Concept | Real-World Analogy | Core Function |

|---|---|---|

| Bitcoin Address | Your email address or a P.O. Box number | A public destination for receiving funds. |

| Public Key | The lock on your mailbox | A cryptographic key used to create your address. |

| Private Key | The key to your mailbox | A secret key that proves ownership and lets you spend funds. |

| Transaction | Sending a package | The act of sending Bitcoin from one address to another. |

This structure ensures you can safely receive payments without ever exposing the "key" that gives you access to your funds.

How an Address Really Works

Behind the scenes, a Bitcoin address is more than just a random string. It's the public-facing part of a pair of cryptographically linked keys. The process starts with a private key—a secret number that gives you control over your funds. From that, a public key is generated. Finally, your wallet runs the public key through a hashing algorithm to create the Bitcoin address you see and use.

This cryptographic chain is what makes Bitcoin secure. An address is intentionally easy to create from a public key, but it's practically impossible to reverse the process and figure out the private key from an address alone.

Key Takeaway: Your Bitcoin address is for receiving. It's public. Your private key is for spending. It's a secret. Never, ever share your private key.

Why You Need More Than One

Here’s a pro tip that many beginners miss: you should use a brand-new Bitcoin address for every single transaction you receive. Why? Privacy.

Reusing the same address allows anyone to look it up on a public blockchain explorer and see every payment you've ever received. By generating a fresh address for each transaction, you make it much harder for others to connect the dots and trace your financial activity. It's a simple, powerful step to protect your privacy.

For businesses, this practice is non-negotiable. Manually creating a new address for every customer order would be a nightmare, which is why payment gateways are so essential. If you’re exploring this for your company, our guide on how to accept cryptocurrency payments for your business explains how to automate this process. Using a unique address per invoice not only boosts privacy but also makes your accounting a whole lot easier.

The Different Flavors of Bitcoin Addresses

Just like software gets updated, Bitcoin addresses have evolved over time. They aren't all built the same, and understanding these different "flavors" is key to saving money on fees and making sure your transactions are handled efficiently. Each new format represents a technical upgrade designed to improve the Bitcoin network.

This evolution is a big part of what keeps Bitcoin relevant and growing. In fact, better wallet tech and address formats have helped fuel adoption, with recent data showing that 12.4% of internet-connected adults have interacted with crypto. Mobile crypto wallets alone have been installed over 982 million times—a 13.8% jump in just one year. You can dig deeper into these trends in this detailed report from CoinLaw.io.

These improvements have resulted in a few distinct address types you're likely to see out in the wild.

The Main Bitcoin Address Formats

Think of these formats like different file types for an image, such as .JPG or .PNG. They all display a picture, but each has slightly different properties under the hood. The same idea applies to Bitcoin addresses.

Legacy (P2PKH): The original. These are the classic Bitcoin addresses that always start with the number ‘1’. They work with every wallet and service out there, but they're the least efficient and come with the highest transaction fees.

Nested SegWit (P2SH): This was a clever bridge to newer technology. These addresses, which start with a ‘3’, are more efficient than Legacy but were designed to be backward-compatible so older wallets could still send funds to them without a problem.

Native SegWit (Bech32): This is the modern gold standard. You can spot these addresses because they start with ‘bc1’. They offer the absolute lowest transaction fees and have better error detection, making them both the cheapest and most reliable format to use.

Why It Matters: Simply choosing a wallet that supports the modern Native SegWit (Bech32) format can directly lower the cost of every single transaction you make. Those small savings really start to add up over time.

Most of the time, your wallet will automatically pick the right format when you send Bitcoin. But knowing the difference helps you understand why one transaction might cost more than another and gives you the knowledge to pick services that support the most current, cost-effective standards.

How Your Wallet Creates and Manages Your Addresses

Ever wondered where a Bitcoin address actually comes from? It’s not just a random string of characters pulled out of thin air. Your crypto wallet generates it through a clever, highly secure process that works instantly behind the scenes. The whole system hinges on the critical link between your private key, your public key, and the final address.

Let’s break it down with an analogy. Think of your private key as the one and only master key to a secure vault. You guard this key with your life and never share it. From that master key, your wallet can create a whole set of specific keys for different deposit boxes—these are your public keys. Each public key is then mathematically transformed into a unique, publicly shareable deposit slot—your Bitcoin address.

Anyone can put Bitcoin into that slot, but only you, with your secret master key, can unlock the vault and access what's inside.

Your wallet is built to manage all this complex cryptographic heavy lifting for you. It keeps your private key locked down and generates fresh, clean addresses whenever you need one. This setup means you get a smooth, secure experience without ever having to touch the raw technical stuff.

The Typical User Journey

So, what does this look like when you actually want to receive some Bitcoin? The whole process is designed to be incredibly simple and safe.

- Generate a New Address: You just open your wallet and hit "Receive." Instantly, your wallet creates a brand-new, unused address for this specific transaction.

- Share the Address Safely: Copy this address and send it to whoever is paying you. It's always a good idea to use a fresh address for every payment to maximize your privacy.

- Wait for Confirmation: As soon as the sender pays, the transaction gets broadcast to the entire Bitcoin network. You'll see it show up in your wallet, usually marked as "pending."

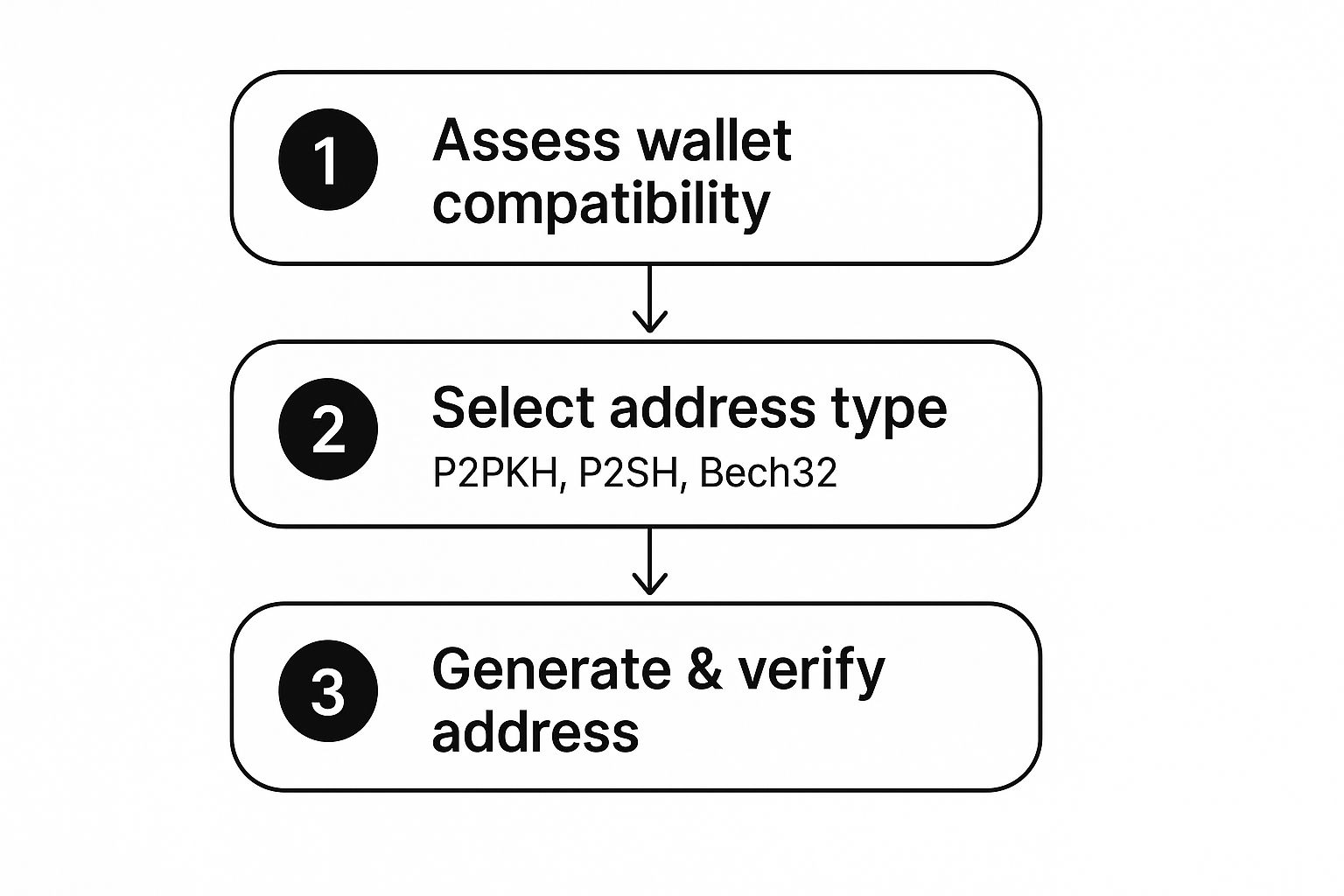

This flow is what makes receiving crypto so straightforward. The chart below gives you a visual of the key steps involved from the user's perspective.

As the visual shows, picking the right wallet and address type are the first crucial decisions. Once the transaction is confirmed on the blockchain—meaning it's been verified by the network—the funds are officially yours, secured by your private key.

Keeping Your Bitcoin Safe With Smart Address Habits

When you get into cryptocurrency, you quickly realize you’re in charge of your own bank. That’s a powerful feeling, but it also means security is completely on you. While your Bitcoin address is public information, the private key that controls it is the most important secret you'll ever keep. It's like your home address versus your front door key—anyone can know where you live, but only you should have the key to get inside.

A simple but incredibly effective habit to adopt is using a new address for every single transaction. Why? Because reusing an address lets anyone on the internet trace all your payments on the blockchain. This creates a detailed financial profile that you probably don't want to be public. Generating a fresh address for each payment snaps that link, giving your privacy a massive boost.

Avoiding Costly Mistakes

One of the easiest and most painful ways to lose your funds is by sending Bitcoin to the wrong address. Sometimes it's a simple copy-paste error. Other times, it's something more sinister, like an address poisoning attack. This is a sneaky trick where scammers send a tiny amount of crypto (called "dust") from an address that looks almost identical to one you've used before. They're hoping you'll see it in your transaction history and accidentally copy their address for your next big payment.

Seriously, always double-check the full address before you hit send. Don't just glance at the first and last few characters. Your funds depend on you verifying the entire string.

The stakes couldn't be higher because Bitcoin transactions are final. There is no "undo" button and no customer support to call. Once your crypto is gone, it's gone. If you want to get comfortable with the process, our guide on how to send crypto walks you through it step by step.

Hot Wallets vs. Cold Storage

Where you keep your Bitcoin matters just as much as how you send it. The right storage method really depends on how much you're holding.

- Hot Wallets: Think of these as software wallets on your phone or computer. They're always connected to the internet, making them convenient for small, frequent payments. However, that connection also makes them more exposed to online hacks.

- Cold Storage: This refers to offline hardware wallets, which look a lot like a USB drive. They store your private keys completely disconnected from the internet, offering the best possible security for large amounts of Bitcoin.

If you're holding a significant amount, a cold storage wallet is the gold standard—no question. For your daily spending crypto, a hot wallet is perfectly fine. Just treat it like you would the cash in your physical wallet: don't carry your life savings around in it.

What Bitcoin Addresses Tell Us About Market Trends

A Bitcoin address is more than just a destination for payments. For those who know how to read the signs, it's a powerful lens into the health and momentum of the entire Bitcoin network. Analysts and seasoned investors don't just see a random string of characters; they see crucial economic indicators right on the blockchain.

When you start analyzing address activity, you can get a real feel for market sentiment and even spot potential shifts before they happen. For example, a sudden jump in newly created addresses often points to a wave of new users entering the ecosystem. This influx can signal growing demand and hint at upward price movement.

Conversely, a high number of active addresses—wallets that are actually sending or receiving BTC—suggests a healthy, engaged community. It's a sign of a robust network, not just speculative interest.

Reading the Market's Pulse

These aren't just abstract theories; this data directly mirrors real-world market behavior. The number of active Bitcoin addresses, for one, often moves in lockstep with major market cycles.

We saw this play out clearly in April 2021. As Bitcoin surged during a major bull run, the number of active addresses peaked, reflecting the immense transaction volume and excitement at the market's high. On any given day, it's common to see between 700,000 and 1,000,000 addresses interacting on the network, which really shows the sheer scale of its daily activity. You can dig into more of this data with these Bitcoin address statistics from Statista.

This perspective elevates the answer to "what is a Bitcoin address" from a technical definition to a practical tool for market analysis. It shows how every single address is part of a massive, transparent story about adoption and economic energy.

For businesses, grasping these trends is vital when deciding on payment infrastructure. We explore how to apply these insights in our guide to finding the best crypto payment gateway for WooCommerce, helping you turn market data into smart business moves.

Common Questions About Bitcoin Addresses

As you start getting the hang of Bitcoin addresses, a few practical questions always pop up. Getting these answers straight is key to using crypto safely and with confidence. Let's walk through some of the most common ones you'll run into.

How Many Bitcoin Addresses Can I Have?

The short answer? A virtually infinite number. Your crypto wallet is designed to generate a brand new, unique address for you anytime you need one. This happens instantly and doesn't cost a thing, so there’s really no limit to how many you can create.

This isn't just a neat feature; it’s a fundamental part of good privacy. As we've touched on, using a fresh address for every payment you receive is a smart habit. It makes it much harder for anyone watching the public blockchain to connect all your transactions, adding a strong layer of privacy to your financial activity.

Is My Bitcoin Address Truly Anonymous?

This is a critical point: a Bitcoin address is pseudonymous, not anonymous. Think of it like a pen name. The address itself doesn't have your name, email, or home address attached to it. However, every transaction is permanently recorded on the public blockchain, visible to anyone.

If your address ever gets linked to your real identity—maybe through an ID verification process (KYC) on an exchange—then all of your past and future transactions on that address can be traced back to you. This is exactly why generating new addresses is so important for protecting your privacy.

What Happens If I Send Bitcoin to the Wrong Address?

This is the scary one. Bitcoin transactions are irreversible. There's no "undo" button, no customer support to call, and no bank that can reverse the payment. If you send funds to the wrong address, those coins are, in almost every case, gone for good.

This is why you must always double-check the full address before you hit send. A nasty scam called "address poisoning" is becoming more common. A scammer will send you a tiny amount of crypto from an address that looks almost identical to one you've paid before, hoping you'll accidentally copy their address from your history for your next real payment. Always verify every single character.

The Golden Rule of Crypto: Once you send a transaction, it's final. The responsibility is 100% on you, so take those extra few seconds to be absolutely sure the destination address is correct.

Should I Reuse the Same Bitcoin Address?

In a word, no. You should get into the habit of never reusing addresses. Beyond the major privacy issues we've discussed, it also paints a clearer target on your back for anyone trying to analyze your finances. Each new transaction adds another piece to the puzzle, building a more detailed financial profile over time.

Modern wallets make generating new addresses completely effortless. Take advantage of that feature—it’s one of the simplest and most effective security habits you can build.

Ready to handle your crypto payments with top-tier security and privacy? BlockBee gives you automated, unique addresses for every single transaction, making your business operations both smooth and secure. Integrate with BlockBee today and discover how easy accepting crypto can be.