What Is a Hardware Wallet and How Does It Work?

Picture a personal, offline vault for your cryptocurrency. That's a hardware wallet in a nutshell. It's a small, physical device built for one primary job: signing your crypto transactions in a completely secure, internet-free zone.

This simple act of keeping things offline is its greatest strength.

Why Your Crypto Needs Offline Protection

Think of a regular software wallet like the wallet you carry in your pocket—it's handy for everyday use, but you wouldn't keep your life savings in it. Hardware wallets, on the other hand, are like a bank vault for your digital assets.

Software wallets store your private keys on devices that are always connected to the internet, like your computer or smartphone. This constant connection opens them up to all sorts of nasty risks, from malware and phishing scams to direct hacking attempts. A hardware wallet breaks that vulnerable link.

The Offline Advantage in Action

So, how does it work? Your private keys—the secret codes that give you access to your crypto—are created and stored on a specialized, secure chip inside the hardware wallet itself. The critical part is that they never leave the device. They never touch your computer, and they certainly never touch the internet.

When you want to send crypto, the transaction details are put together on your computer or phone. But to be approved, those details are sent to the hardware wallet. You then have to physically press a button on the device to sign and confirm it. Only the secure, signed transaction is sent back to your computer to be broadcast to the blockchain network.

This offline signing process is what the industry calls 'cold storage', and it’s the gold standard for crypto security. It means that even if your computer is completely compromised with a virus, a hacker still can't get to your keys because they're physically and electronically separate.

To make the distinction crystal clear, here’s a quick rundown of how the two wallet types stack up.

Hardware Wallet vs Software Wallet At a Glance

| Feature | Hardware Wallet | Software Wallet |

|---|---|---|

| Key Storage | Offline, on a dedicated physical device | Online, on a computer or mobile phone |

| Security | Highest level; isolated from online threats | Lower; vulnerable to malware and hacks |

| Convenience | Less convenient; requires physical device | Very convenient for quick, daily transactions |

| Cost | Typically requires a one-time purchase | Usually free to download and use |

| Best For | Securing large amounts and long-term holds | Small amounts and frequent trading |

Ultimately, while software wallets offer convenience, hardware wallets provide the peace of mind that comes with superior security.

The Growing Demand for Secure Storage

This robust security is exactly why the hardware wallet market is booming. The global market was valued at around USD 474.7 million and is expected to skyrocket to an estimated USD 2.435 billion as more people and businesses get serious about protecting their assets.

You can dig into the numbers yourself in the IMARC Group's hardware wallet market report. This explosive growth points to an undeniable trend: the more valuable digital assets become, the greater the need for security that software alone just can't offer.

How Offline Signing Keeps Your Crypto Safe

At the heart of every hardware wallet is a brilliant security process called offline signing. Think of it like this: you have a highly confidential document to sign. Instead of signing it on a park bench where anyone could be looking over your shoulder, you step into a locked, secure vault. You sign the document inside, then hand only the finished, signed paper back out. The signature is public, but the act of signing was completely private and secure.

That's exactly how a hardware wallet handles your crypto. It's your personal, digital vault. The transaction details are first put together on your computer or phone—your "online" device. This unsigned transaction is then sent over to the hardware wallet.

This next part is the most important. The hardware wallet will display the transaction details, and you have to physically confirm it, usually by pressing a button on the device itself. Only then does the wallet use your private key, which is stored safely inside, to create the digital signature.

The "Air Gap" Advantage

This whole process creates a protective "air gap" around your private keys. They never, ever touch the internet or your potentially compromised computer. The only thing the hardware wallet sends back to your computer is the final, unchangeable signature. That signed transaction is then broadcast to the blockchain to be confirmed.

Because of this physical separation, it's virtually impossible for a hacker to get their hands on your keys, even if your computer is riddled with malware.

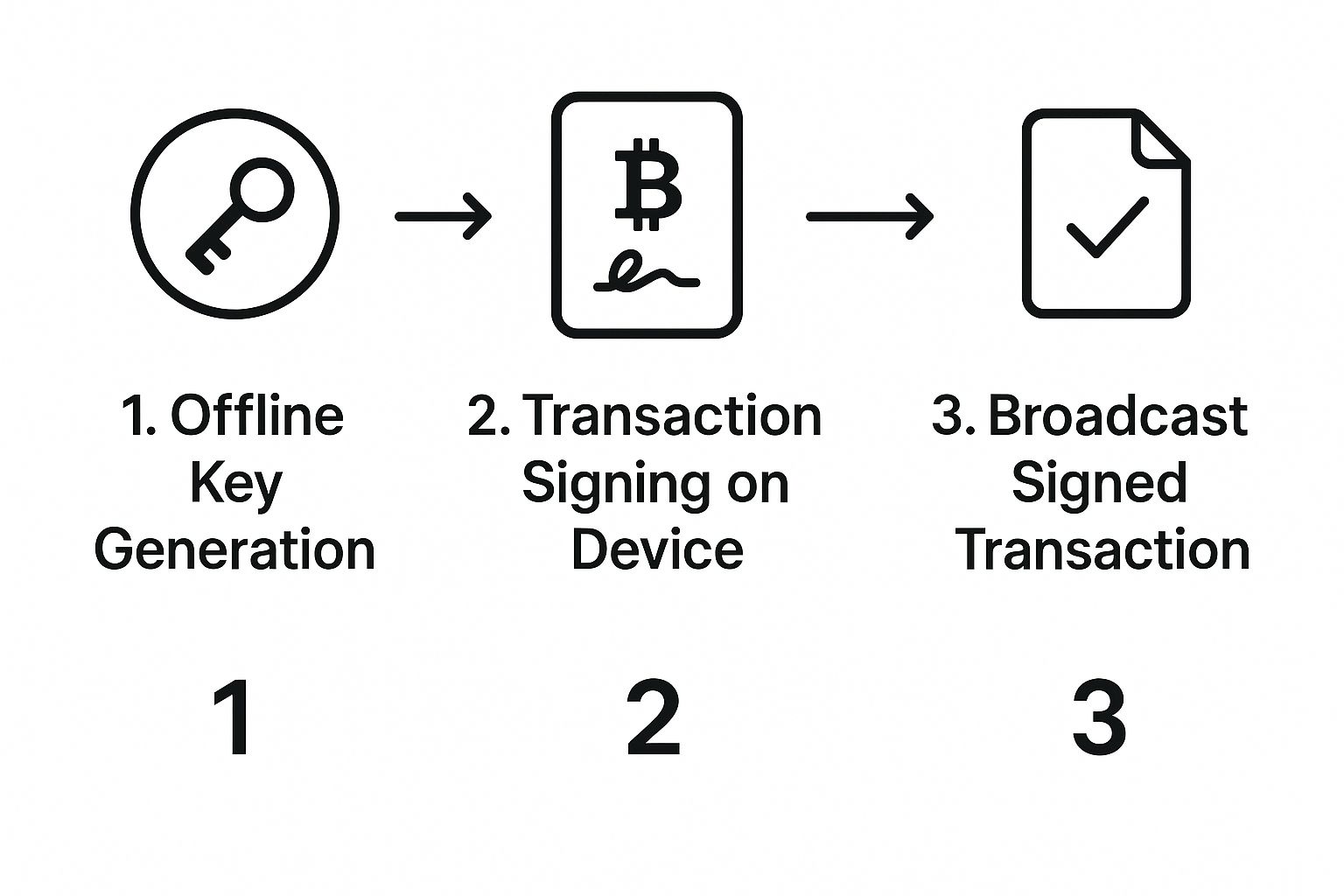

This is the simple, three-step flow that keeps your assets safe.

As you can see, the critical signing step is completely isolated on the hardware device, which breaks the chain of vulnerability.

Inside the Digital Fortress

How does it pull this off? Hardware wallets are built around special, secure microcontrollers designed for one job: protecting your keys. This dedicated chip acts as a shield against the viruses and keyloggers that are a constant threat to software wallets.

By design, you authenticate every transaction on the device itself, physically confirming the details are correct. This ensures your all-important cryptographic keys are never exposed to the outside world.

By signing transactions offline, you maintain absolute control over your funds. This concept of self-custody is a cornerstone of crypto—it empowers you to truly be your own bank.

This approach is the core difference between custodial and non-custodial services. You can learn more about how non-custodial services give you full control over your crypto assets, a freedom that hardware wallets make possible.

What Makes Your Hardware Wallet So Secure?

A hardware wallet isn't just one magic trick; its power comes from several layers of defense that work together to build a digital fortress around your crypto. Let's break down the three security pillars you need to understand to keep your funds safe.

The first and most immediate line of defense is your PIN code. This is a simple number you set up, but it's crucial for stopping anyone who gets their hands on your physical device. Without the PIN, a thief can't just plug it in and send your crypto away. Most wallets will even wipe themselves clean after too many wrong guesses.

You Have the Final Say with Physical Confirmation

Next up is a brilliantly simple yet effective feature: physical confirmation. No transaction leaves your wallet without you manually pressing a button on the device itself. This single action is a powerful backstop against hackers.

Even if your computer is riddled with malware trying to sign a transaction behind the scenes, it can't push that physical button. You, and only you, have the final say. This concept is a core part of understanding 2-Factor Authentication, where something you have (the device) is required along with something you know (the PIN).

Hardware wallets are also engineered to be tough. They use strong encryption for your PIN and are often designed to self-destruct their data if someone tries to tamper with them. On top of that, they can manage multiple cryptocurrencies at once and are completely immune to computer viruses.

Your recovery seed phrase is the master key to all your crypto. It's the ultimate backup, allowing you to restore your funds even if your device is lost, stolen, or completely destroyed.

The Ultimate Backup: Your Recovery Phrase

Last, but most importantly, is the recovery seed phrase. When you first set up your wallet, it will give you a list of 12 to 24 random words. This isn't just a password; it's the master key to every single private key stored on your device.

Think of it this way: if your hardware wallet is the safe, the recovery phrase is the blueprint to rebuild that exact safe and everything inside it. If your device is lost, stolen, or smashed, you can simply buy a new one, enter your recovery phrase, and all your crypto will be right there waiting for you.

This makes protecting your phrase the single most critical job you have. Never, ever store it digitally. Don't take a picture of it, don't save it in a text file, and don't email it to yourself. Write it down on paper and store it somewhere incredibly safe and offline.

So, you're trying to figure out whether to go with a hardware or software wallet. It really comes down to one of the oldest debates in the book: security versus convenience.

Think of it like this: a hardware wallet is your own personal bank vault. It's built like a fortress. A software wallet, on the other hand, is more like the wallet you carry in your back pocket—super handy for everyday use, but not where you'd stash your life savings.

Software wallets, which you'll often hear called "hot wallets," are just apps you install on your computer or phone. Because they're always connected to the internet, they're fantastic for quick, everyday transactions, zipping in and out of trades, or diving into the world of decentralized finance (DeFi). The downside? That constant online connection makes them a tempting target for hackers and nasty bits of malware.

Security: The Real Game-Changer

When you get right down to it, the biggest difference is security. A hardware wallet is all about "cold storage," meaning it keeps your precious private keys completely offline. This creates an actual, physical gap between your crypto and any online threats. Your computer could be riddled with viruses, but your funds would still be untouchable.

This is why hardware wallets are the undisputed champion for anyone looking to secure a significant amount of crypto or simply hold on for the long haul (HODL!).

Software wallets, in contrast, keep your keys on a device that's hooked up to the internet. That exposure opens up a whole category of risks that simply don't exist when your keys are stored offline.

The question you need to ask yourself is simple: What's more important right now? Do you need lightning-fast access for frequent transactions, or do you need bulletproof security to protect serious value? Your answer will almost always point you to the right choice.

Convenience and Cost: The Practical Side

This is where software wallets really pull ahead. Most are completely free to download, and you can be sending and receiving crypto in just a few seconds. For active traders or anyone using crypto to buy a coffee, that speed is everything.

Hardware wallets, being physical gadgets, come with a price tag—usually somewhere between $60 and $200. They also add a deliberate extra step to your transactions; you have to physically connect the device and press a button to approve anything. It's a bit slower, but that's by design. That extra step is a powerful security feature.

To make things even clearer, let's break down the key differences head-to-head.

Detailed Feature Comparison Hardware vs Software Wallets

This table lays out the core distinctions to help you see exactly where each type of wallet shines.

| Criteria | Hardware Wallet (Cold Storage) | Software Wallet (Hot Storage) |

|---|---|---|

| Primary Use Case | Long-term holding and securing large sums of assets | Daily spending, active trading, and DeFi interactions |

| Security Level | Highest. Private keys are stored offline and isolated from internet risks. | Lower. Keys are stored on a connected device, making them vulnerable to malware. |

| Convenience | Lower. Requires a physical device and manual confirmation for every transaction. | Highest. Fast and easy access for quick payments directly from a phone or computer. |

| Cost | One-time purchase of the physical device. | Typically free to install and use. |

In the end, it’s not always about picking one and ditching the other. Most seasoned crypto users do both. They keep a small, "walking around" amount in a software wallet for daily convenience and lock the vast majority of their assets away safely in a hardware wallet. It's the best of both worlds.

Bringing Hardware Wallets into Your Business

Hardware wallets aren't just for personal hodlers; they're an absolute must for any business serious about accepting crypto. Think of it this way: you need a cash register for daily sales, but you wouldn't leave all your earnings in it overnight. That’s where a smart, two-part strategy comes in, giving you both speed for daily operations and a fortress for your profits.

For everyday transactions, a payment gateway is your best friend. It handles customer payments smoothly, funneling them into a "hot" wallet. This online wallet gives you the flexibility you need for immediate tasks like issuing refunds or paying suppliers. It keeps business moving without a hitch.

But here's the catch: leaving large sums of crypto in a hot wallet is like leaving the vault door wide open. The smart move is to set up a routine for sweeping those funds to safety.

Locking Down Your Company's Crypto

Whether you do it daily, weekly, or monthly, the process is the same. You'll move the bulk of your revenue from that operational hot wallet over to your offline hardware wallet. This simple action shifts your money into cold storage, taking it completely off the internet and away from hackers and malware.

This hybrid model gives you the perfect balance:

- Front-End Agility: Your hot wallet, connected to a payment processor, manages the day-to-day flow of customer payments.

- Back-End Security: Your hardware wallet acts as the company's main vault, safeguarding the majority of your capital from online threats.

This approach makes the hardware wallet more than just a concept—it becomes a practical, powerful tool for any business in the crypto space. A payment gateway like BlockBee can make collecting those initial funds incredibly simple.

The BlockBee dashboard gives you a clean, at-a-glance view of all your incoming payments, making it easy to manage your operational wallet.

This clear interface helps you keep track of your balances right before you sweep them into the rock-solid security of your hardware wallet.

By keeping your daily transaction funds separate from your main treasury, you're essentially building a financial firewall. Even if your day-to-day systems were ever compromised, your company's core assets would remain untouched and secure in cold storage.

This isn't just a good idea; it's an essential practice for any serious enterprise. To get started with your payment setup, check out our guide on how to accept crypto payments for your business.

Common Questions About Hardware Wallets

Even after getting the hang of how hardware wallets work, some practical questions always seem to pop up. Let's walk through the most common ones so you can feel completely comfortable using these devices to protect your crypto.

What Happens If I Lose My Hardware Wallet?

This is the first question on everyone's mind, and the answer is reassuring: if your hardware wallet is lost, stolen, or broken, your crypto is still perfectly safe. Your funds aren't actually stored on the little device; they live on the blockchain.

You can simply get a new hardware wallet—it doesn't even have to be the same brand—and use your secret recovery phrase to get full access back. This is exactly why keeping that recovery phrase safe and offline is the most critical step of all.

Can a Hardware Wallet Get Hacked?

Hardware wallets are built from the ground up to be incredibly tough to hack. They feature specialized secure chips and run very basic software, which means there's no way for viruses or malware to get a foothold.

Your private keys never, ever touch an internet-connected computer when you make a transaction. They stay locked away inside the wallet, totally isolated from online attacks, even if the computer you're using is riddled with malware.

The core idea is simple: Your private keys never leave the secure bubble of the hardware wallet. This physical separation is its best defense against digital threats, making a remote hack practically impossible.

Do I Really Need One for a Small Amount of Crypto?

While it’s true the bigger your portfolio, the more you need one, using a hardware wallet is a great security habit to build no matter how much crypto you have.

An amount that feels small today could be worth a whole lot more down the road. Spending a bit on a hardware wallet now buys you peace of mind and sets you up with a solid security routine from the very start.

Can I Use My Wallet on Multiple Computers?

Absolutely. You can plug your hardware wallet into any computer, even one you don't fully trust, without any risk. The computer is just a dumb terminal in this process—it helps prepare the transaction details and then broadcasts the finished transaction to the network.

If you want a deeper dive on this, our guide explains how to send crypto step-by-step. The magic happens when you physically sign the transaction inside your hardware wallet, which keeps your private keys completely safe and sound.