A Guide to Digital Payment Solutions for Modern Business

At its core, a digital payment solution is simply the tech that lets businesses and people send and receive money electronically. No cash, no paper checks—just digital transactions. This isn't just a minor upgrade; it's a fundamental change in how we handle money, trading paper for pixels to gain incredible speed, better security, and a truly global reach. How your business gets paid is just as important as what you sell, making a smart payment strategy an absolute must.

Why Digital Payment Solutions Matter Now More Than Ever

Let's be honest—relying on a single payment method is like having a storefront with only one door. You’ll get some customers, sure, but you're missing out on everyone else who prefers a different way in. Commerce has long since moved past cash-only operations, and getting a handle on digital payments is now a critical move for both survival and growth.

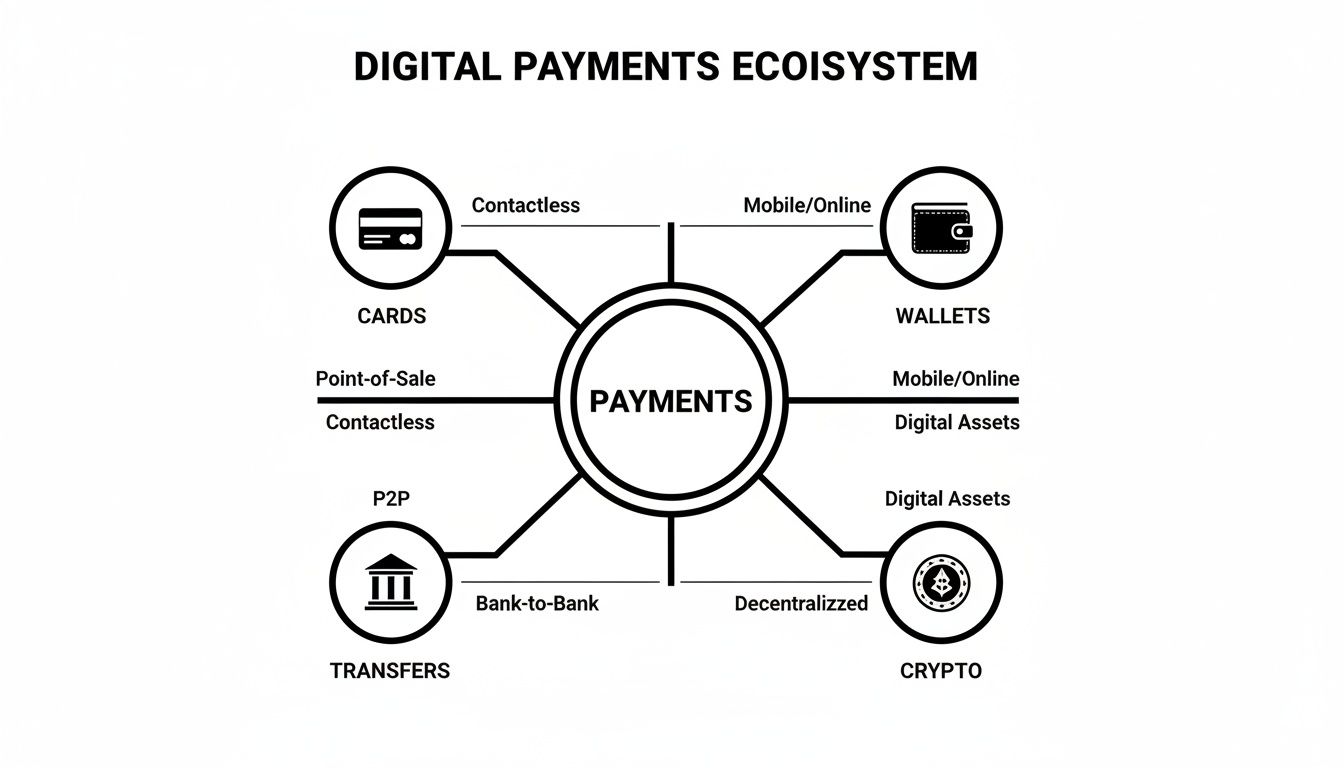

Think of the modern payment landscape as a set of different checkout lanes, each one built for a specific type of customer. These lanes include:

- Credit and Debit Cards: The old reliable, universally accepted standard for most people.

- Digital Wallets: The "one-tap" convenience lane that dramatically improves conversion rates.

- Bank Transfers: The secure, heavy-duty lane perfect for large B2B transactions.

- Cryptocurrency: The express lane to global markets, often with lower fees and quicker settlement times.

This deliberate shift away from physical cash does more than just update your checkout process; it opens up entirely new ways to make money. When you offer multiple ways to pay, you remove friction at the moment of truth, which directly leads to fewer abandoned carts and happier, more loyal customers.

A business that embraces diverse payment methods is a business that puts customer experience first. By meeting people where they are—whether they prefer to tap their phone, swipe a card, or pay with crypto— you build trust and show them you value their time and convenience.

The Economic Shift to Digital

This global move away from cash isn't just a fleeting trend; it's a massive economic realignment. The digital payments market is on track to hit $3.0 trillion by 2029, and that's even with a ton of new players jumping in.

This explosion is driven by a steep decline in cash usage, which fell to just 46% of worldwide payments in 2023. At the same time, account-to-account (A2A) payments, often the engine behind digital wallets, now represent about 30% of all global point-of-sale volume. You can dig into more of this data in a recent McKinsey report on global payments. The message here is crystal clear: businesses that don't adapt are at risk of being left behind.

Putting a solid digital payment strategy in place—one that includes innovative options like crypto—gives you a serious competitive edge. It simplifies your operations, cuts down on tedious manual reconciliation, and sets you up for easy international growth. We've actually put together a guide on how blockchain for payments is shaking up this entire space. Consider this your starting point for turning a simple checkout process into a powerful strategic asset.

A Look at Your Digital Payment Options

Trying to figure out which digital payment solutions to offer can feel overwhelming. There are so many choices, and it's not always clear which ones will actually work for your customers and your business. Let's break down the main categories in a practical way so you can see what makes sense for you.

Think of the digital payments world as having four main branches. Each one serves a different purpose and meets a unique customer need.

The best payment strategies don't just pick one; they blend these options to create a seamless experience for every type of customer, whether they prefer tapping their phone or sending crypto.

Credit and Debit Cards: The Universal Standard

For years, credit and debit cards have been the default way we pay for things without cash. They're trusted by billions of people around the globe. For any online business, accepting cards from major players like Visa, Mastercard, and American Express is pretty much table stakes.

These transactions travel through a complex web of issuing banks, acquiring banks, and payment gateways. It’s a reliable system, but it’s not free—you’ll pay processing fees, typically between 1.5% to 3.5%, and you have to deal with the occasional chargeback. Still, their universal acceptance makes them an essential piece of the puzzle.

Digital Wallets: The Rise of Convenience

Digital wallets like Apple Pay, Google Pay, and PayPal have completely changed the game. By storing a customer's payment details, they enable simple one-tap or look-to-pay purchases. This isn't just a minor convenience; it's a major conversion booster, as it gets rid of the annoying step of typing in card numbers.

The numbers don't lie. In 2024, up to 59% of consumers have used a digital wallet recently, and 29% now say it's their go-to method for online shopping. This shift is happening because people trust the biometric security—like fingerprint and facial recognition—that powers them.

Account-to-Account (A2A) Bank Transfers

Account-to-Account (A2A) payments do exactly what the name suggests: they move money straight from a customer's bank account into yours. By bypassing the traditional card networks, you often get a break on transaction fees. This makes A2A a fantastic option for businesses dealing with large-value orders or B2B invoices.

A2A payments are perfect for high-ticket items, recurring subscriptions, and invoicing. They offer a secure and cheaper alternative to cards, though you might have to wait a bit longer for the funds to settle, depending on the banks involved.

Cryptocurrency Payments: The Global and Efficient Frontier

What once felt like a niche hobby has grown into a genuinely powerful payment solution. For businesses serving a worldwide audience, crypto unlocks some incredible advantages:

- Borderless Transactions: Forget about currency conversions and international wire fees. Accept payments from anyone, anywhere.

- Lower Fees: Crypto transaction fees are often a fraction of what you'd pay for card processing, especially for cross-border sales.

- Instant Settlement: Money from card sales can take days to hit your account. Crypto transactions are confirmed on the blockchain and available almost instantly.

Platforms like BlockBee have made accepting crypto incredibly straightforward. Their non-custodial approach means payments go directly from the customer to your private wallet. You always have full control of your money—the provider never touches it. This direct-to-wallet flow removes the risk of a middleman getting hacked and gives you immediate access to your revenue.

If this is new territory for you, getting a handle on the key differences between cryptocurrency vs. fiat currency is a great place to start. Offering crypto is no longer a technical headache; it's a strategic decision for any business that wants to operate globally and control its own finances.

Comparing Digital Payment Methods at a Glance

To make sense of these options, it helps to see them side-by-side. This table breaks down the key characteristics of each payment method from a merchant's perspective.

| Payment Method | Typical Fees | Settlement Speed | Best For | Key Challenge |

|---|---|---|---|---|

| Credit/Debit Cards | 1.5% – 3.5% | 2–3 business days | Universal e-commerce, retail | High fees, chargeback risk |

| Digital Wallets | Varies (often tied to card fees) | Instant (for user), 2–3 days (for merchant) | Mobile-first checkouts, boosting conversion | Dependency on underlying cards |

| A2A Bank Transfers | <1%, often flat-fee | 1–5 business days | B2B, high-value orders, subscriptions | Slower settlement, less consumer familiarity |

| Cryptocurrency | <1%, sometimes negligible | Near-instant (minutes) | Global payments, mass payouts, B2B | Price volatility, regulatory uncertainty |

Ultimately, the right mix depends entirely on who your customers are and where you do business. A balanced approach that includes a few of these options is usually the most effective way to make sure you never miss a sale.

How to Choose the Right Payment Provider

Picking a payment provider is one of the most critical partnerships you'll form. This isn't just about plugging in some tech; it's a long-term relationship that directly touches your revenue, your customers' trust, and your ability to grow. It’s easy to get tunnel vision and focus only on transaction fees, but the right partner brings a lot more to the table than just a low rate.

Think of your payment provider as the central nervous system for your sales. When it’s working perfectly, you don’t even notice it’s there. But the moment it hiccups, everything grinds to a halt. A great partner gives you a secure, seamless, and dependable system that not only keeps up with your business but helps you adapt to whatever comes next.

Beyond the Transaction Fee

Cost is obviously important, but a cheap provider with lousy service will cost you a fortune in lost sales, security headaches, and frustrated customers. A truly smart evaluation looks at the whole picture, focusing on three core pillars: security, integration, and support.

Rock-Solid Security: Non-negotiable. Your provider absolutely must be PCI DSS compliant to handle card data. But look for more advanced stuff, like tokenization (which swaps sensitive card numbers for secure tokens) and smart fraud detection that can spot and block sketchy transactions. If you’re dealing with crypto, a non-custodial provider is a game-changer because it means you always hold your funds, cutting out third-party risk entirely.

Seamless Integration: How smoothly will this system fit into what you're already using? A good provider offers clean, well-documented APIs for custom work and ready-made plugins for platforms like Shopify, WooCommerce, or Magento. The whole point is to create a checkout experience so slick your customers barely have to think about it.

Reliable Support: When payments go down, you need help now, not in two business days. Before you commit, test their support. Can you get a real, knowledgeable human on the line 24/7? This can make or break your business during a crisis.

Matching the Provider to Your Business Model

The "best" provider is entirely relative—it all depends on what you actually do. A blogger selling a few e-books has completely different needs than a global gaming platform that has to pay thousands of affiliates every month.

For example, a small Shopify store is probably looking for a simple, plug-and-play checkout. Ease of use and reliability are their top priorities.

On the other hand, a business like a gaming network or an affiliate platform needs powerful tools like Mass Payouts. This is where a non-custodial crypto solution really shines, letting them send instant, low-fee payments to thousands of users worldwide, right to their personal wallets. Your business model should dictate the features you can’t live without.

Choosing a payment provider isn't about finding the one with the longest feature list. It's about finding a partner that solves your specific problems. Don't get distracted by bells and whistles you'll never use. Focus on what will make life easier for your customers and your team.

Your Evaluation Checklist

Before you sign on the dotted line, make sure any potential provider can pass this simple check.

- Fee Structure: Is it crystal clear? Be on the lookout for hidden charges like setup fees, monthly minimums, or nasty chargeback penalties. For a deep dive into what to expect, our payment gateway fees comparison breaks it all down.

- Global Reach: Can you take payments from customers in your key markets? Does it handle different currencies and the payment methods people actually use in those regions?

- Scalability: Will this provider grow with you? You need to know their system can handle a massive spike in traffic during a Black Friday sale without crashing.

- User Experience: Take a hard look at their checkout flow. Is it clean, fast, and easy to use on a phone? A clunky interface is one of the biggest reasons people abandon their carts.

Getting this choice right from the start saves you an incredible amount of time and money down the road, freeing you up to focus on what really matters: building your business.

Setting Up Your Digital Payment System

Alright, you've picked your payment provider. Now comes the exciting part: actually bringing your payment system to life. This is where the rubber meets the road, and a little careful planning goes a long way toward creating a smooth, secure, and customer-friendly experience.

Get this stage wrong, and you risk a clunky checkout flow or, even worse, security gaps that can shatter customer trust and kill sales. Think of it like building the checkout lanes in your digital store. You’ve got two main blueprints to follow: go with a pre-built plugin or build a completely custom setup using an API.

Plugins vs. Custom API Integration

For most businesses running on platforms like Shopify or WooCommerce, pre-built plugins are the quickest way to get up and running. They're designed to be plug-and-play, often taking just a few clicks to connect your store with the payment provider. This approach keeps development costs low and lets you start accepting payments almost instantly.

The trade-off? Plugins can be a bit rigid, offering limited control over the look and feel of your checkout.

If you want total control, a custom API integration is the way to go. This route lets your developers build a payment flow from the ground up, tailored perfectly to your brand and your customers' journey. It's the ideal choice for businesses with unique billing models or those aiming for a deeply integrated system. For instance, if you're looking to weave an affiliate program directly into your payment setup, understanding building a custom Stripe payment integration can provide some invaluable insights.

The choice between a plugin and an API isn't just a technical one—it's strategic. A plugin gets you to market fast. An API gives you ultimate control and customization. It really comes down to your team's skills and your long-term vision.

Fortifying Your System with Security

Security isn’t just a feature; it’s the bedrock of any trustworthy payment system. A single breach can do massive damage to your reputation, so locking things down from day one is non-negotiable.

Your security strategy should be built around two powerful technologies:

Tokenization: This is a clever process that swaps sensitive data, like a full credit card number, for a unique, non-sensitive stand-in called a "token." This token can be used for future transactions without ever exposing the actual card details, drastically cutting your risk if your system is ever compromised.

Fraud Detection: Modern payment gateways use smart algorithms and machine learning to scan transactions as they happen. These systems are trained to spot red flags—like unusual purchase amounts or odd locations—and can block fraudulent payments before they ever go through.

Putting these defenses in place protects both you and your customers, building the kind of trust that keeps people coming back.

Navigating Compliance and Regulations

Finally, you can't talk about payments without talking about rules. Setting up your system means navigating a complex web of financial regulations. This isn't just about dodging fines; it's about operating as a responsible and legal business in every market you serve.

Here are the big ones to keep on your radar:

- PCI DSS: The Payment Card Industry Data Security Standard is a must-follow set of security rules for any business that handles cardholder data.

- GDPR: If you have customers in the European Union, the General Data Protection Regulation dictates how you must handle their personal information.

- Local Rules: Every country can have its own financial quirks and regulations that you’ll need to follow when processing payments there.

A good payment provider will give you tools that are already compliant with major regulations, which is a huge help. But at the end of the day, the responsibility for compliance falls on your business. Taking the time to understand your obligations now will save you from major headaches later and cement your reputation as a merchant customers can trust.

Unlocking Advanced Payment Strategies

Once your basic payment system is up and running, it's time to start thinking bigger. A modern payment stack is far more than just a tool for collecting money. It’s a strategic asset that can solve thorny business problems, sharpen your operations, and open up growth channels that traditional banking simply can't touch.

The goal is to move beyond just processing transactions and start architecting intelligent financial workflows. By tapping into advanced features, especially those native to cryptocurrency, you can turn your payment infrastructure from a necessary expense into a serious competitive advantage.

Automating Global Payouts at Scale

Let’s get practical. Imagine you run a gaming platform, a creator marketplace, or a global affiliate network. One of your biggest operational headaches is paying hundreds, maybe even thousands, of people scattered all over the world. Old-school methods like bank wires are painfully slow, notoriously expensive, and buried in administrative friction.

This is where a crypto-native feature like Mass Payouts really shines.

Using a non-custodial provider like BlockBee, you can handle these complex payout schedules with a single action. Forget initiating thousands of individual bank transfers. Instead, you can send instant, low-fee payments to an unlimited number of recipients directly to their personal crypto wallets.

Here’s what that really means for your business:

- Speed: Payouts settle in minutes, not days. This is a huge deal for keeping your partners and creators happy.

- Cost Efficiency: You can slash those exorbitant cross-border wire fees and currency conversion costs.

- Security and Control: Because the system is non-custodial, you keep full control over your funds in your own secure wallet right up until the moment of disbursement.

Enhancing Efficiency with Programmable Payments

Beyond mass disbursements, modern digital payment solutions bring a new level of intelligence to how businesses manage incoming funds. Two of the most powerful concepts here are programmable payments and reusable deposit addresses, which offer incredible flexibility for businesses with unique billing needs.

A reusable deposit address is exactly what it sounds like: a static, dedicated address assigned to a specific customer. Think of it like a personal account number that never changes. For a SaaS company, this means a client can top up their account or pay invoices by sending funds to the same address every time. This drastically simplifies reconciliation and makes for a much smoother user experience.

Programmable payments transform static transactions into dynamic, automated workflows. This allows you to build custom billing logic—like metered usage, tiered subscriptions, or milestone-based payments—directly into your payment system, reducing manual intervention and financial errors.

For any business managing complex or variable billing cycles, this kind of automation is a game-changer. It lets you scale without having to hire a massive finance team to keep up.

Meeting Modern B2B Demands

This move toward more efficient, automated, and global financial tools isn't just a consumer trend—it's rapidly reshaping the B2B landscape. Businesses are finally ditching paper checks and embracing digital methods to get more done.

Recent data shows that a whopping 87% of organizations now make cross-border payments, a massive jump in just a few years, while the use of checks has plummeted. This shift is creating huge demand for embedded payment solutions that make B2B commerce simpler. You can dive deeper into how B2B payments are changing with this research on financial professional trends.

For global enterprises and SaaS firms, tools like BlockBee’s Mass Payouts are no longer a niche curiosity. They are becoming a core part of operating efficiently at an international scale. By enabling secure, instant disbursements directly to wallets, these advanced systems give businesses the financial agility and control they need to thrive.

Your Top Questions About Digital Payments, Answered

Jumping into the world of digital payments can feel like learning a new language. You're hit with technical terms and strategic choices that seem overwhelming at first. This section is here to clear things up.

We've gathered the most common questions we hear from business owners and developers and answered them in plain English. No jargon, no fluff—just direct, practical advice to help you move forward with confidence. Let's tackle the big concerns, from security to the real-world impact of choosing one technology over another.

Are Digital Payment Solutions Really Secure?

Yes, absolutely. In fact, modern digital payment systems are often far more secure than swiping a physical card. They’re built with multiple, sophisticated layers of defense to protect both you and your customers from fraud.

Two of the most critical technologies are encryption and tokenization. Encryption scrambles payment data the moment a customer hits "pay," turning it into unreadable code while it travels to the payment processor. Tokenization takes it a step further, replacing the actual credit card number with a unique, one-time-use "token." So, even in the unlikely event of a data breach, thieves would only get their hands on a bunch of useless tokens, not your customers' sensitive information.

On top of that, providers use smart, AI-powered systems that watch transactions in real-time, flagging and stopping suspicious activity before it becomes a problem.

Cryptocurrency payments bring another powerful layer of security, especially with a non-custodial provider. In this setup, payments go directly from your customer to your private wallet. The payment provider never actually holds your money, which completely removes the risk of you losing funds if their systems are ever compromised. It gives you the ultimate control.

Is Accepting Crypto Payments Too Complicated for My Business?

That’s a common myth, but the reality is that accepting crypto is now incredibly simple. A few years ago, you might have needed a developer on speed dial, but today’s platforms have made it easy for anyone, no matter their tech skills.

For most businesses running on popular e-commerce platforms like WooCommerce or Shopify, you can get started by simply installing a plugin. It’s a true "plug-and-play" experience.

Think of it this way: you don't need to understand the inner workings of the Visa network to accept a credit card. The same logic applies here. You don't have to be a blockchain expert to accept crypto payments. A good provider takes care of all the heavy lifting for you.

All the complex stuff—like monitoring the blockchain to confirm a payment or handling different types of cryptocurrencies—happens automatically in the background. You just see the payments appear in your dashboard as they come in, with the funds landing directly in your wallet. It’s a low-effort way to open your doors to a whole new global customer base.

What Are the Biggest Headaches When Integrating a New Payment Gateway?

Even with the best tools, switching or adding a payment gateway can have a few bumps in the road. Knowing what to look out for can make the whole process much smoother. The three main hurdles we see are tricky technical integrations, a clunky customer experience, and potential downtime during the switch.

A tough technical integration usually comes down to one thing: bad API documentation. If your developers can't find clear instructions, the process drags on and becomes a massive headache. This is exactly why choosing a provider known for being developer-friendly is non-negotiable.

The next hurdle is the customer experience. A slow, confusing, or awkward checkout is the number one reason people abandon their shopping carts. Every extra click or moment of confusion costs you a sale. Your payment flow has to be fast, intuitive, and look great on both desktop and mobile.

Finally, nobody wants to lose sales because their payment system is down. A poorly managed transition can temporarily shut down your ability to get paid. Here's how to sidestep these problems:

- Pick a provider with a reputation for excellent, responsive technical support.

- Always test the new system thoroughly in a "sandbox" or staging environment before you go live.

- Prioritize a solution that’s praised for its clean, efficient, and user-friendly checkout design.

What Does "Non-Custodial" Actually Mean for My Business?

Understanding this term is crucial, especially if you're getting into crypto payments. Put simply, non-custodial means you, and only you, are in control of your money at all times.

Let's break it down with a comparison. A traditional custodial provider acts like a middleman. When a customer pays you, the money goes into the provider’s account first. They take "custody" of it, holding it for a few days before sending it to you.

A non-custodial crypto solution flips this model on its head. When a customer pays, the funds move directly from their wallet to your personal crypto wallet. The payment provider helps make the connection, but they never touch or hold the money.

This direct-to-wallet approach gives your business two huge advantages:

- Superior Security: Your funds can't be frozen or lost if your payment provider gets hacked, goes out of business, or runs into regulatory trouble. Since they never have your money, their problems can't become your problems.

- Immediate Access: The money is yours the second the transaction is confirmed on the blockchain. No more waiting for settlement periods or batch payouts.

Ultimately, going non-custodial dramatically reduces your risk and gives you true ownership and autonomy over your revenue.

Ready to take full control of your payments with a secure, non-custodial solution? BlockBee makes it easy to accept over 70 cryptocurrencies with low fees, seamless integrations, and powerful tools like Mass Payouts. See how it works at blockbee.io.