Cryptocurrency vs Fiat Currency for Merchants

When you stack cryptocurrency against fiat currency, the real difference comes down to one thing: who's in charge. Fiat currency is government-issued money, like the U.S. Dollar, which is managed by central banks. On the other side, cryptocurrency is a decentralized digital asset, like Bitcoin, secured by complex math on a blockchain. As a merchant, your choice boils down to whether you prefer the stability of a central system or the efficiency of a decentralized one.

Understanding Digital vs Traditional Currency

To make the right call for your business, you need to get a handle on how both fiat and crypto actually work. They’re built on completely different ideas about how money should be created, managed, and moved around.

Fiat currency is the money we all know and use daily. A government declares it legal tender, but it isn’t backed by a physical good like gold. Its value is entirely based on the trust people have in that government and its central bank. For merchants, this means working with familiar institutions like banks and payment processors, which can often be slow and expensive.

Cryptocurrency, however, is a whole different beast. It’s purely digital and runs on a decentralized network, so no single bank or government pulls the strings. Instead, a global network of computers verifies and records transactions on a public ledger called a blockchain. This setup is what makes crypto transactions faster, more secure, and usually cheaper. You can dive deeper into how this tech is changing payments in our guide on blockchain for payments.

A Foundational Comparison

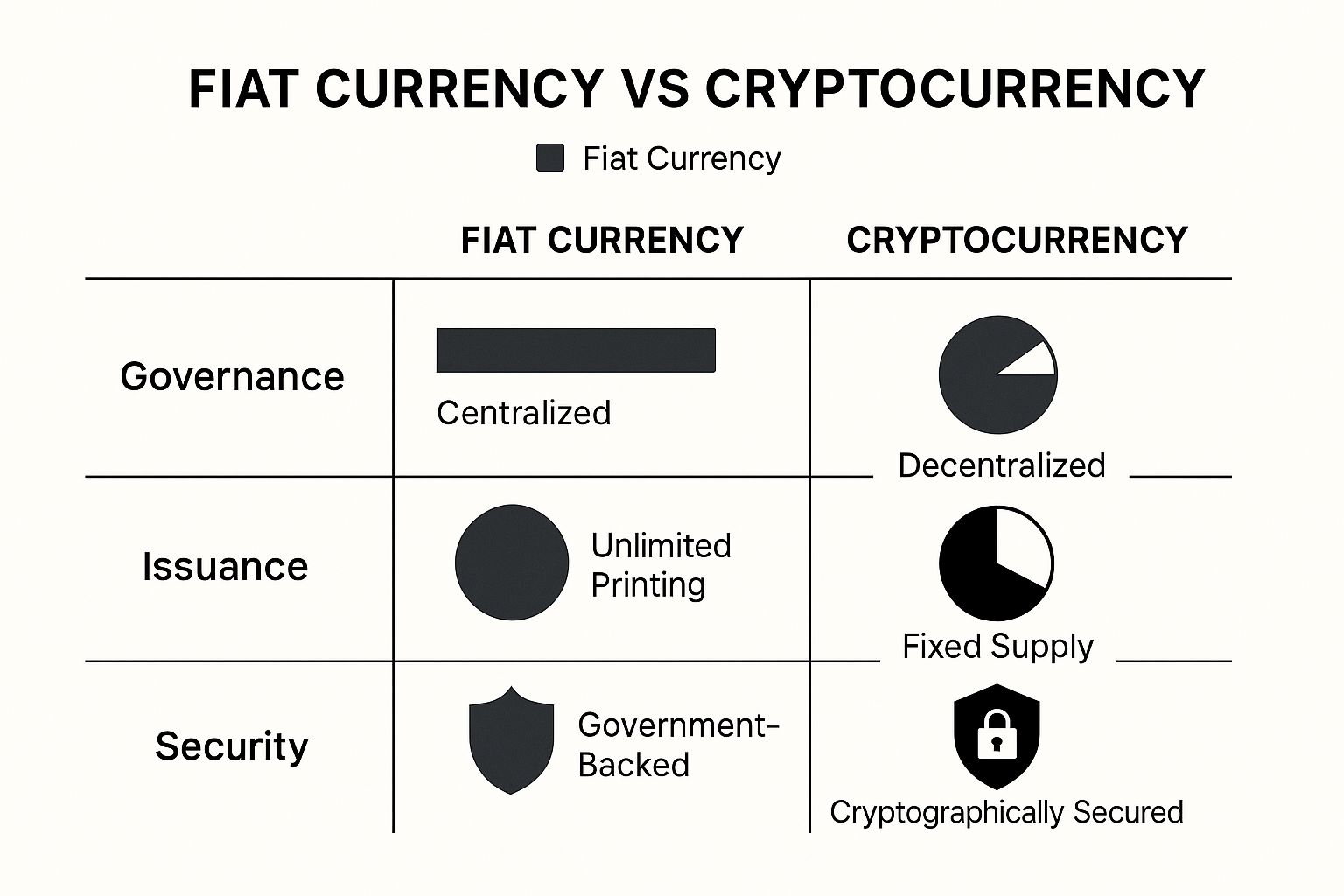

This infographic breaks down the essential differences in how fiat and cryptocurrency are governed, created, and secured.

As you can see, the centralized control and unlimited supply of fiat currency are a stark contrast to the decentralized, fixed-supply nature of crypto.

At a Glance Comparison Fiat vs Crypto

For a quick summary, here’s a table that highlights the core differences between these two currency types. It’s a handy reference for understanding the fundamental trade-offs.

| Attribute | Fiat Currency (e.g., USD) | Cryptocurrency (e.g., Bitcoin) |

|---|---|---|

| Control | Centralized (Governments, Central Banks) | Decentralized (Distributed Network) |

| Issuance | Unlimited, controlled by central authorities | Limited/Finite, controlled by algorithms |

| Backing | Trust in the issuing government | Cryptography and network consensus |

| Transaction Method | Intermediaries (Banks, Processors) | Peer-to-Peer (P2P) directly on a blockchain |

| Transparency | Opaque, transactions are private | Transparent, transactions on a public ledger |

| Physical Form | Yes (coins, banknotes) and digital | No, purely digital |

This table makes it clear: fiat relies on institutional authority, while crypto operates on technological proof. Understanding this distinction is the first step in building a payment strategy that truly fits your business.

The appeal of this decentralized model is undeniable, and its adoption is skyrocketing. The global user base for cryptocurrencies is exploding, with some estimates showing a growth of nearly 40 million identity-verified users in just the second half of 2024. At this pace, the number of people actively using crypto is on track to blow past 500 million worldwide by the end of the year. That's a massive shift in how consumers are choosing to transact.

The key takeaway for merchants is simple: one system relies on institutional trust, while the other is built on verifiable technology. Understanding this distinction is the first step toward optimizing your payment strategy.

This operational split is playing out worldwide. For a real-world look at how digital currencies are being integrated, examining how South African cryptocurrency exchange platforms operate offers great insight into regional adoption. For any business, getting to grips with these foundational differences is essential for keeping up with the evolving world of payments.

A Detailed Comparison of Core Attributes

When you peel back the layers, cryptocurrency and fiat currency aren't just different forms of money; they're built on entirely different philosophies. Their core attributes—how they're governed, created, and moved—directly impact everything from your risk exposure to your day-to-day operational costs. Getting a handle on these distinctions is crucial for any business owner thinking about their payment stack.

Let's break down the practical implications of these differences for your business, moving beyond the surface-level definitions.

Governance and Control Models

The most profound split between crypto and fiat is who’s in charge. Fiat currency runs on a centralized governance model. A central bank or government authority calls all the shots—they control the money supply, set interest rates, and write the financial rulebook. For merchants, this creates a predictable, albeit restrictive, environment where you play by rules set from the top down.

Cryptocurrency, on the other hand, is usually governed by decentralized network consensus. No single person or group is in control. Instead, the rules are baked into the code and upheld by a global network of computers. This design sidesteps the need for a central authority, distributing power across the network itself. Changing the rules requires massive agreement, which makes the system inherently resistant to censorship or manipulation by any one entity.

Fiat's value is anchored to the stability and decisions of a central authority, making it vulnerable to political shifts and economic policy. Cryptocurrency's value stems from network consensus and open market forces, creating a system that operates outside of direct government control.

This isn't just a technical detail—it's the philosophical heart of the debate. One system is built on institutional trust, the other on mathematical certainty and community agreement.

Issuance and Supply Mechanics

How new money enters the system is another stark contrast. Fiat currencies have an unlimited or inflationary supply. Central banks can essentially "print" more money whenever they see fit, whether to juice the economy or fund government spending. While this offers flexibility, it comes with the built-in risk of inflation, which steadily chips away at the value of your money. The cash in your register today will likely be worth less tomorrow.

In contrast, many major cryptocurrencies, like Bitcoin, have a fixed or predictable supply. Bitcoin is famously hard-capped at 21 million coins, a limit that’s enforced by its own code and cannot be changed. This engineered scarcity is what gives it a deflationary quality, meaning its value could theoretically increase as demand rises against a finite supply. It’s often compared to digital gold for this very reason.

This difference creates a unique set of economic trade-offs.

- Fiat Currency Risk: The constant threat is inflation. As more money is created, each dollar buys a little less, which has real consequences for your savings and long-term financial plans.

- Cryptocurrency Risk: The big one here is volatility. Even with a fixed supply, market demand can swing wildly, leading to dramatic and unpredictable price changes.

As a business, you're essentially weighing the slow, predictable value erosion of inflation against the sudden, sharp shocks of market volatility.

Transaction Mechanics and Intermediaries

Finally, let's look at how a simple payment actually works. Fiat transactions are crowded with intermediaries. When a customer swipes a credit card, that payment snakes its way through a whole chain of entities: a payment processor, a card network like Visa or Mastercard, and both the acquiring and issuing banks. Each middleman adds complexity, time, and, of course, fees.

Cryptocurrency transactions are designed to be peer-to-peer (P2P). A payment travels directly from a customer's digital wallet to the merchant's. The decentralized network verifies the transaction and adds it to the blockchain, cutting out the traditional financial gatekeepers entirely. This direct model is what makes crypto payments potentially faster and cheaper—fewer hands are in the pot. For a merchant, that can translate to getting your money faster and keeping more of it.

How Each Payment System Impacts Merchants

Beyond the technical jargon and big-picture ideas, the choice between crypto and fiat hits your business where it counts: the bottom line. The way you get paid directly influences your cash flow, operational costs, and even your vulnerability to fraud. These aren't minor details; they're core to your profitability.

Especially in the fast-paced world of e-commerce, digging into these practical differences is crucial. Let’s break down how each system stacks up in the areas that matter most to a business owner.

Comparing Transaction Costs

One of the first things any merchant looks at is the cost of getting paid. Traditional fiat transactions, especially credit cards, are notorious for their complex fee structures that chip away at every sale you make.

With fiat, you're typically looking at a 2-3% cut going to processing fees. This isn't just one fee; it's a stack of them—interchange fees, assessment fees, and the processor's own markup. For a business running on thin margins, that percentage adds up to a huge operational expense over time.

Cryptocurrency, on the other hand, works differently. Instead of paying a percentage to a middleman, you pay a small network fee (often called a "gas fee") to the miners or validators who keep the blockchain running. This fee is often just a few cents or a tiny fraction of a percent, depending on the coin and how busy the network is at that moment.

The savings really stand out on big-ticket items or international sales, where traditional banking systems pile on extra charges for currency conversion and cross-border transfers.

Settlement Times and Cash Flow

How fast does your money actually become your money? This is a massive factor for cash flow, and the timelines for fiat and crypto couldn't be more different.

Fiat payment systems are slow. It’s just how they’re built. When a customer swipes their card, those funds don't land in your account right away. They have to travel through a multi-day gauntlet of clearing and settlement between various banks. It often takes 1 to 3 business days—and even longer if a weekend or holiday gets in the way.

This built-in delay in the traditional banking system means your revenue is temporarily held hostage by intermediaries, creating a lag in your cash flow that can hinder your ability to reinvest, pay suppliers, or manage daily expenses.

Cryptocurrency transactions settle almost instantly. Once a payment is confirmed on the blockchain, which can take anywhere from a few seconds to a few minutes, it’s final. The funds are in your digital wallet, they're yours, and they're ready to use. There are no arbitrary holding periods, giving you immediate control over your revenue and radically improving your cash flow.

The Critical Issue of Chargeback Fraud

For any online merchant, chargebacks are a constant, expensive headache. A customer can dispute a perfectly legitimate charge, and the credit card company often sides with them, pulling the money back. This leaves you without the product and without the revenue, plus you get hit with a penalty fee for your trouble.

This is a uniquely fiat-based problem because the transactions are reversible. In 2023 alone, businesses lost billions to this kind of fraud, a hit that many small operations can't easily absorb.

Cryptocurrency payments, by their very design, are irreversible. Once confirmed on the blockchain, a transaction cannot be undone or disputed by the sender. This completely sidesteps the risk of traditional chargeback fraud. For businesses selling digital goods or operating in high-risk sectors, this is a massive advantage. It adds a powerful layer of financial security, and by accepting crypto payments for your business, you can protect your revenue from this all-too-common threat.

Analyzing Global Adoption and Market Trends

The theoretical debate over crypto versus fiat currency sharpens considerably when you look at how people are actually using them. Fiat is, without question, the foundation of the global economy. But it’s also playing a fascinating, critical role as the main entryway into the world of digital assets. For any merchant trying to keep up with consumer payment habits, understanding this relationship is key.

The movement of money from traditional bank accounts into crypto isn't a trickle; it's a flood. This "on-ramping"—where someone converts fiat like USD into Bitcoin—has built a massive, and growing, bridge between these two financial systems.

The Scale of Fiat to Crypto Conversion

The sheer volume of these conversions tells a powerful story. Crypto isn't some niche hobby anymore. It's attracting serious capital from the mainstream financial world, which points to a deep and lasting interest from everyday people and big institutions alike. This flow of money is a strong signal of where payment habits are headed.

The numbers are staggering. Between July 2024 and June 2025, centralized exchanges processed an incredible $4.6 trillion in fiat converted into Bitcoin. To put that in perspective, that’s more than double the volume for the next largest category, which was still an impressive $3.8 trillion. You can dig deeper into the data in the latest global crypto adoption report from chainalysis.com.

This massive influx of traditional money is a direct vote of confidence in digital assets. It shows that consumers are getting comfortable with these new financial tools, and they're getting comfortable fast.

Regional Differences in Adoption

Adoption isn’t happening the same way everywhere. Different parts of the world show unique patterns, often shaped by local economic stability, regulations, and even cultural views on technology. For merchants, looking at these regional quirks can offer real insight into potential new markets.

The United States, for example, is the undisputed leader in the fiat-to-crypto pipeline. It functions as the biggest on-ramp by a huge margin, funneling over $4.2 trillion into crypto during that same 2024-2025 period. That's more than four times the volume of the next country on the list, South Korea.

These regional differences reveal a few important things for businesses:

- Market Maturity: High volumes in the U.S. suggest a well-established connection between traditional finance and crypto, likely fueled by institutional investment.

- Investment Styles: A market like South Korea might have a smaller total volume but is known for a very active retail trading scene that often focuses on different assets than U.S. investors.

- Emerging Needs: In regions with unstable local currencies, crypto adoption often isn't about speculation. It’s about finding a reliable way to store value or make cheaper international payments.

The undeniable trend is the increasing integration of cryptocurrency with the traditional financial system. For merchants, this isn't just a market curiosity—it's a clear signal that a growing segment of the global consumer base is becoming comfortable and proficient with using digital currencies.

This blending of financial worlds points to a broader shift. As more fiat gets converted into digital assets, the line between the two systems blurs, creating a future where customers will expect to pay seamlessly with either.

Wrestling with Volatility and Wall Street's Influence

When you stack crypto up against fiat money, the technical details are one thing, but what really hits a merchant's bottom line are the market's wild mood swings and the big players calling the shots. Crypto's price rollercoaster and fiat's slow-drip inflation are really just two different flavors of financial risk. At the same time, big-money investors are jumping into crypto, which is changing the game entirely—making it feel more legitimate but also introducing a whole new set of market dynamics.

For any business owner, this isn't just theory. It's about protecting your cash flow and spotting opportunities as the old and new financial worlds start to collide.

The Crypto Volatility Problem

Let's be blunt: the biggest headache for any merchant dipping a toe into crypto is the price volatility. One day your Bitcoin or Ethereum payment is worth one thing, and the next, it's taken a nosedive. This makes everything from calculating profit margins to managing inventory a real challenge.

This constant fluctuation happens because crypto markets are still young, driven by speculation, and can react dramatically to a single news story or tweet. For a business that needs reliable income to pay the bills and keep the lights on, this kind of unpredictability is a serious risk.

Stablecoins: Your Bridge to Sanity

This is where stablecoins come in and save the day. Think of them as a special kind of crypto designed to hold a steady value because they're pegged to a real-world asset, usually the U.S. Dollar. For every digital coin like USDC or USDT, there's a dollar sitting in a bank account somewhere.

It’s a simple concept that gives you the best of both worlds:

- The Stability of Fiat: You can accept a payment and sleep at night, knowing its value won't vanish before morning.

- The Efficiency of Crypto: You still get all the good stuff—fast transactions, lower fees, and no more chargeback fraud.

By using stablecoins, you can sidestep the whole volatility issue while still cashing in on the core benefits of blockchain payments.

For merchants, stablecoins are the perfect on-ramp. They take the gambling out of accepting crypto, letting you use the efficient tech without becoming an unwilling day trader.

Fiat's Silent Killer: Inflation

While we think of fiat currency as "stable," it has its own long-term problem: inflation. Central banks print more money, and over time, the cash sitting in your business account slowly loses its buying power. What buys a full tank of gas today might only get you three-quarters of a tank next year.

This slow decay is a hidden tax on your savings. It chips away at your profits and forces you to constantly rethink your pricing. In the great crypto vs. fiat debate, it's a choice between crypto's sudden shocks and fiat's guaranteed, gradual decline.

Wall Street is Coming, and That Changes Everything

One of the biggest signs that crypto is growing up is the arrival of institutional investors. With regulated products like spot Bitcoin ETFs now on the market, the floodgates have opened for hedge funds, corporations, and major asset managers to pour in. This "big money" is having a huge impact.

This shift is boosting trading volumes and bringing a much-needed dose of maturity to the market. North America, especially the U.S., has become the epicenter of this trend. From 2024 to 2025, the region saw 26% of all global crypto transaction value, which translates to a staggering $2.3 trillion changing hands. Much of this was driven by institutional investors and ETF activity, a clear signal that crypto is merging with mainstream finance. You can dive deeper into these numbers in the Chainalysis report on North American crypto activity.

For merchants, this is a green light. It shows that digital assets are becoming less of a wild west and more of a legitimate financial tool. It also points to a future where your customers—especially the more savvy ones—will simply expect to see a "pay with crypto" option at checkout.

Choosing the Right Payment Strategy for Your Business

Deciding between crypto and fiat isn't an all-or-nothing game. It's about figuring out what your business actually needs. The smartest move isn't usually about picking one over the other, but weaving them together in a way that aligns with your customers, your goals, and how much risk you're willing to stomach.

There’s no magic bullet here. A solid strategy starts with looking at your own operations and seeing where each currency type can give you a real, tangible edge.

When a Fiat-Only Strategy Makes Sense

For a lot of businesses, sticking with traditional fiat payments is still the most straightforward and sensible option. This is especially true for companies that need stability above all else and serve a well-established local market.

Think about these situations:

- Low-Risk Tolerance: If your business operates on razor-thin margins, the wild price swings of most cryptocurrencies are more of a liability than an asset. You simply can't afford the risk to your cash flow.

- Non-Tech-Savvy Customer Base: Does your business cater to a crowd that's more comfortable with cash and cards than QR codes and digital wallets? Pushing crypto on them could just create confusion and drive away loyal customers.

- Simple, Local Operations: A small neighborhood shop with a regular, in-person customer base probably won't see much upside from adding a whole new, complex payment system.

In these cases, the familiarity and rock-solid infrastructure of fiat currency create a smooth and predictable experience for everyone involved. No friction, no surprises.

Situations Where Crypto Offers a Clear Advantage

On the flip side, bringing cryptocurrency into the mix can be a game-changer, opening up new markets and streamlining your finances. This is particularly true for any business bumping up against the built-in limits of the traditional banking system.

The decision to integrate crypto is less about chasing trends and more about solving real-world business problems like high fees, slow cross-border payments, and chargeback fraud.

Crypto gives you a competitive advantage in scenarios like these:

- International E-commerce: If you're selling to customers around the globe, crypto blows the doors off traditional finance. It gets rid of expensive currency conversion fees and settlement delays that can take days, meaning you get paid faster and keep more of what you earn.

- High-Chargeback Industries: Merchants in digital goods, subscriptions, or other "high-risk" sectors can almost completely wipe out chargeback fraud. Blockchain transactions are final, period.

- Attracting a Tech-Forward Audience: Accepting crypto sends a clear signal: your business is modern and in-tune with a growing base of digitally-savvy consumers. And if your business handles digital assets, learning some effective crypto trading strategies is key to managing them well.

Taking it slow is often the best approach. You could start by accepting stablecoins, which give you the key benefits of crypto—like low fees and instant settlement—without the gut-wrenching volatility. This lets you dip your toes in the water and fine-tune your checkout before diving in completely. For a closer look at the costs, see our deep dive in this payment gateway fees comparison.

Common Questions, Answered

When you're thinking about adding crypto payments, a lot of questions pop up. It's a new frontier for many, so let's clear up some of the most common points of confusion merchants have when comparing crypto and fiat.

Is Cryptocurrency Actually Legal Tender?

This is a big one, and the answer isn't a simple yes or no. In most of the world, cryptocurrency is not considered legal tender. That official status is usually reserved for a country's national currency. El Salvador is a famous exception, having made Bitcoin an official currency.

For everyone else, governments typically classify crypto as a digital asset or property. This has important implications for taxes, but it absolutely does not stop you from legally accepting it as payment.

Think of it this way: you can legally accept a gift card or a bar of gold as payment for a service. Neither is legal tender, but they are legitimate assets. Crypto falls into a similar category for merchants in most places.

What’s the Single Biggest Risk for a Merchant Accepting Crypto?

Without a doubt, it’s price volatility. The value of cryptocurrencies can swing dramatically, even within a single day. A payment that was worth $100 when your customer clicked "buy" could be worth $90 by the time you check your accounts. That kind of fluctuation can eat directly into your profit margins.

The good news is that this risk is almost completely avoidable. A good crypto payment processor can instantly convert the crypto payment into a stablecoin or your local fiat currency, locking in the value at the moment of the transaction.

How Does a Business Actually Start Accepting Crypto Payments?

Getting set up is much simpler than most people think. You don't need to be a blockchain expert. The easiest way is to use a crypto payment gateway.

Here's the basic process:

- Find a Payment Gateway: Look for one that integrates easily with your e-commerce platform, whether it’s WooCommerce, Magento, or something else.

- Set Up Your Account: This usually just involves signing up and entering your business and payout details.

- Install the Plugin: Most providers offer a simple plugin you can add to your website in a few clicks.

- Activate and Go: Once it's active, a "pay with crypto" option appears on your checkout page. The gateway takes care of the rest.

This method lets you sidestep all the technical headaches and focus on what you do best—running your business.

Ready to eliminate high fees and chargebacks? BlockBee provides a secure, non-custodial payment gateway that lets you accept over 70 cryptocurrencies with ease. Integrate in minutes and take full control of your revenue. Start accepting crypto today.