Blockchain for Payments A Practical Guide

Have you ever felt like it's faster to ship a physical package across the world than it is to send money? You're not alone. The friction in traditional payment systems—from sneaky fees to mind-numbing delays—is a universal headache for both businesses and everyday people. Blockchain for payments is a direct response to these issues, acting like a shared digital notebook that lets value zip around the globe as easily as an email.

Why Traditional Payments Are Due for an Upgrade

For years, our global financial system has been propped up by a tangled web of middlemen. When you wire money internationally, it doesn't just go from your bank to theirs. It bounces between several "correspondent" banks along the way, with each one taking a slice of the pie and adding days to the journey. This old-school infrastructure is the real culprit behind so many of our modern payment frustrations.

The push for better, faster systems is already happening. We're seeing a huge industry-wide effort toward optimizing real-time money transfers, which shows just how badly a modern solution is needed.

The Pain Points of Legacy Systems

The cracks in conventional payment methods are impossible to ignore. For businesses especially, these systems create operational gridlock and surprise costs that can stunt growth.

Let's break down the key problems:

- High Transaction Costs: Every intermediary—from banks to currency converters—takes a cut. These fees stack up quickly, especially on cross-border payments.

- Slow Settlement Times: International payments can take a glacial 3-5 business days to actually clear. This ties up working capital and makes managing cash flow a guessing game.

- Lack of Transparency: Ever sent a wire and wondered where it went? The process is a black box, leaving both the sender and receiver completely in the dark until the money finally lands.

These legacy systems were designed for a world without the internet. They simply weren't built for the instant, global economy we live in now, which makes the case for a new approach crystal clear.

How Blockchain Offers a Modern Fix

This is exactly where blockchain for payments shines. It completely sidesteps that complicated network of middlemen by creating a direct, peer-to-peer path for money to travel. Using a distributed ledger, every transaction is logged securely and permanently across a whole network of computers.

This isn't just a small tweak; it's a fundamental change in how we move value. Instead of depending on a chain of trusted institutions, the system relies on cryptographic proof. This is the core difference between government-issued money and digital assets. To dig deeper, check out our guide on fiat currency vs cryptocurrency.

Ultimately, blockchain brings a level of efficiency, security, and transparency that traditional payment rails just can't compete with.

Traditional vs Blockchain Payments At a Glance

To put it all in perspective, here's a quick comparison of the two systems side-by-side.

| Feature | Traditional Payment Systems | Blockchain Payment Systems |

|---|---|---|

| Intermediaries | Multiple (banks, clearinghouses, processors) | Minimal to none (peer-to-peer network) |

| Settlement Speed | 3-5 business days for international transfers | Minutes to seconds |

| Transaction Costs | High, with multiple fees from each intermediary | Low, typically a small network fee |

| Transparency | Opaque; difficult to track payment status | Fully transparent; transactions are public on the ledger |

| Global Access | Limited by banking infrastructure and country-specific rules | Borderless; accessible to anyone with an internet connection |

| Operational Hours | Restricted to standard banking hours and business days | 24/7/365 |

This table makes the differences obvious. While traditional systems are bogged down by their very structure, blockchain was built from the ground up for a fast-paced, digital world.

How Do Blockchain Payments Actually Work?

Let's cut through the jargon for a minute. The easiest way to think about a blockchain is as a shared digital receipt book. Every single time a payment is made, a new line item gets added. But here's the clever part: instead of one person holding the book, a copy is sent to thousands of computers all over the world.

This simple idea is what makes blockchain so powerful. It's not one person's version of the truth; it's a collective record that everyone on the network agrees on. A transaction isn't considered "done" until the network gives it the green light, creating a system built on group consensus instead of a single gatekeeper.

Decentralization: The Power of Having No Single Owner

The most important concept to wrap your head around is decentralization. With traditional payments, a bank or a payment processor sits in the middle of everything, controlling the entire flow. This creates a huge single point of failure—if their server goes down or they decide to block your transaction, the whole process grinds to a halt.

Blockchain completely flips that model on its head. Because the digital receipt book (the ledger) is spread across countless computers, known as nodes, there’s no central weak spot to attack. This design means the system is always on and can't be shut down or controlled by any one person, company, or government.

The resilience this creates is incredible. Even if hundreds of nodes were to suddenly go offline, the network just keeps humming along, processing payments 24/7. It’s a world away from the 9-to-5 business hours of the traditional banking system.

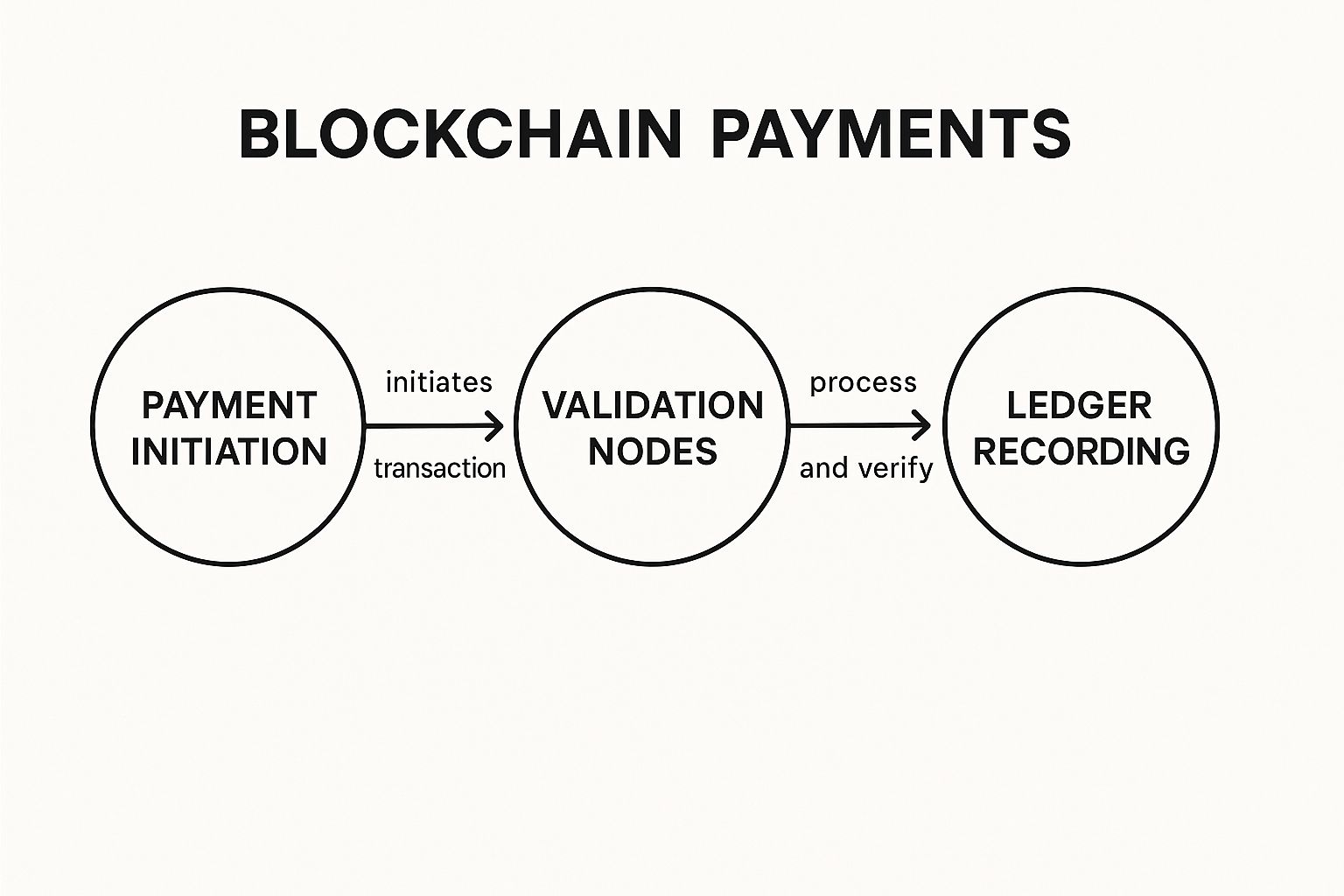

The image below gives you a clear picture of how a transaction travels from the moment it's started to when it's permanently recorded.

As you can see, the journey is logical. It starts with a user, gets verified by the network, and only then becomes a permanent part of the record.

Cryptography: The Digital Lock and Key

Okay, so if this receipt book is public, what stops someone from snooping on transactions or just stealing money? The answer is cryptography, the science of secure communication. It’s essentially the digital lock and key for every payment on the blockchain.

When you send a payment, it's "signed" with your private key—think of it as a secret password that proves you own the funds. This digital signature is unique for every single transaction and mathematically proves that you, and only you, authorized that payment.

It's a bit like this: Your public address is your bank account number; you can share it with anyone. Your private key is your secret PIN code; you never, ever give that out. Cryptography makes sure only the person with the right PIN can get into the account.

This cryptographic signature is also what creates the "chain" in blockchain. Each new batch of transactions (a "block") is cryptographically tied to the one before it, creating an unbreakable, unchangeable chain of events. Once a payment is on the chain, it's there for good. This immutability is what makes blockchain payments so tough against fraud and chargebacks.

Smart Contracts: Putting Trust on Autopilot

Beyond just sending money from A to B, blockchains can run what are known as smart contracts. Forget dusty legal documents; these are self-executing contracts where the rules of an agreement are written directly into code.

Imagine an automated escrow service that doesn't require a middleman. A smart contract can be programmed to hold funds and release them automatically only when specific, pre-agreed conditions are met. For example, in an e-commerce sale, a smart contract could release the payment to the seller the very instant a shipping company's system confirms the package has been delivered.

Here’s a simple breakdown of how it works:

- Agreement: Two people decide on the terms (e.g., "if the product is delivered, then the payment is released").

- Coding: A developer writes these rules into a smart contract on the blockchain.

- Execution: The contract then sits and waits, automatically watching for the trigger event. The moment it sees the delivery confirmation, it executes the payment—no humans required.

This kind of automation gets rid of the need for intermediaries to enforce rules, which slashes both costs and the potential for arguments. The code does exactly what it was told to do, creating a system of trust built on pure logic, not institutions. If you're curious about how this is applied, you can explore various blockchain payment solutions that are already putting these concepts to work.

The Real-World Benefits of Blockchain Transactions

It's one thing to understand the mechanics of blockchain, but it's another thing entirely to see how it actually solves real problems. This is where the value clicks. All the theory about decentralization and cryptography translates into real-world advantages that tackle the biggest headaches in traditional finance. This is where blockchain for payments stops being an abstract idea and becomes a practical tool for businesses and individuals.

By creating a direct line for payments that cuts out the usual army of intermediaries, blockchain brings a level of efficiency that old-school systems just can't touch. We’re not talking about a small tweak here; it’s a total overhaul of how money moves around the globe.

Slashing Costs by Removing the Middlemen

Think about a typical cross-border payment. It's notoriously expensive for a reason. A single transaction gets bounced between multiple "correspondent" banks, and every single one takes a cut. These fees, often buried in terrible exchange rates and vague service charges, can eat up a surprising chunk of the money you’re sending.

Blockchain completely flips this script by getting rid of those middlemen. Since the transaction happens directly between peers on a network, the only real cost is the small network fee paid to validators who keep the ledger secure. This fee is usually just a fraction of what banks charge, especially for bigger international transfers.

This cost-saving is huge for remittances—money people send home to their families. The World Bank estimates that blockchain can slash these costs by up to 60%, which is life-changing for people in regions like Africa and Latin America where fees have always been sky-high. With the cross-border payment market expected to hit $320 trillion by 2032, the potential savings are massive. You can dig deeper into these transformative blockchain statistics to see the full picture.

Achieving Near-Instant Settlement Times

One of the most frustrating parts of the old financial world is the waiting game. An international wire transfer can take 3-5 business days to actually settle. For those entire days, the money is just stuck in limbo, useless to both the sender and the receiver. For a business waiting on a payment from an international client, this kind of delay can create serious cash flow problems.

Blockchain transactions, by contrast, are done and dusted in minutes, sometimes even seconds, depending on the network.

- The payment is sent and broadcast to the network.

- Nodes around the world validate that the transaction is legitimate.

- Once confirmed and added to a block, it’s final. The money is in the recipient’s wallet, ready to go.

This isn't just a faster wire transfer. It's a complete shift from a "promise to pay" system to one of immediate, final settlement. The funds don't just look like they're there—they are there, fully settled and ready to use, 24/7/365.

Enhancing Security and Building Trust

The very way a blockchain is built provides a level of security and transparency that's tough to replicate with a centralized database. Each transaction is cryptographically chained to the one before it, creating a permanent, tamper-proof record. Once a transaction is on the books, it can't be changed or erased.

This transparency means everyone involved can see and verify the transaction on the public ledger without needing to trust a central gatekeeper. It bakes trust right into the system. For any business, this is a godsend for things like audits or resolving payment disputes because there's a single, unchangeable source of truth for every payment ever made.

Promoting Greater Financial Inclusion

Finally, blockchain offers a powerful way to bring more people into the global economy. Billions of people worldwide don't have access to basic banking, which locks them out of so many opportunities. Opening a traditional bank account often requires a stack of documents, a physical address, and a minimum deposit—hurdles that many simply can't clear.

Blockchain sidesteps all of that. All you really need to join this new financial world is a smartphone and an internet connection. This simple access allows people in underserved communities to:

- Receive payments from anywhere in the world.

- Securely store their money without being at the mercy of a volatile local currency.

- Tap into financial services like lending and borrowing through decentralized finance (DeFi) platforms.

This ability to "bank the unbanked" is arguably one of the most profound benefits of using blockchain for payments. It's about creating economic opportunity where it didn't exist before.

See Blockchain Payments in Action Today

All the theory is great, but the real power of blockchain comes to life when you see it solving actual financial headaches. This isn't some far-off future concept; innovative startups and even global financial giants are using blockchain right now to move money faster, cheaper, and more efficiently. These practical applications show how the core ideas of decentralization and transparency translate into real business advantages.

From untangling international trade to empowering individual creators, blockchain is already making its mark. It provides tangible solutions for payment challenges that have stumped traditional finance for decades. Let's look at some of the most impressive examples out in the wild today.

Fixing Cross-Border B2B Payments

Ask anyone in a global business about cross-border payments, and you’ll likely get an earful about high fees and agonizingly slow settlement times. Companies like Ripple and Stellar have built entire networks specifically to fix this. Their platforms connect financial institutions directly, cutting out the sluggish and expensive correspondent banking system.

The difference is night and day. Instead of a payment taking 3-5 business days to clear, a transaction on these networks can settle in just a few seconds. For a business, that means unlocking working capital and managing international cash flow with incredible precision.

This isn't a niche trend, either. In the Asia-Pacific region, countries like India and China have become massive hubs for blockchain innovation. An estimated 263 million users in this area are driving 32% of all global digital asset development. That same region saw a 69% year-over-year jump in on-chain crypto activity, highlighting the massive appetite for better financial tools. You can dig deeper into the trends in global crypto adoption.

Empowering the Creator Economy with Micropayments

The creator economy—full of artists, writers, streamers, and musicians—has always had a monetization problem. Traditional platforms take a hefty slice of the pie, and tiny "micropayments" are often impossible because of high transaction fees. Blockchain completely flips this script.

By enabling direct, peer-to-peer payments, blockchain lets fans support creators with small amounts of money without losing a big chunk to a middleman. This opens the door to entirely new ways for creators to earn a living.

- Direct Tipping: A reader can send a few cents directly to a writer for an article they loved.

- Pay-per-Access: A musician can charge a tiny fee for a single stream of their new song.

- NFT Royalties: An artist can earn automatic royalties every single time their digital art is resold.

Blockchain gives creators true ownership over their financial relationship with their audience. It removes the gatekeepers and makes sure more of the value flows directly to the person who created it.

This is a fundamental shift that helps build a more sustainable creative ecosystem. As more platforms adopt these features, we’re seeing a real change in how creative work is valued online. Understanding who accepts Bitcoin for payment and other cryptocurrencies is becoming more important than ever for creators, a topic we cover in our guide on crypto acceptance.

Streamlining Enterprise Treasury Operations

It's not just startups and individuals reaping the benefits. Some of the world's biggest financial institutions are using blockchain to clean up their own internal operations. A perfect example is J.P. Morgan's JPM Coin, a private, permissioned blockchain system built for their own use.

JPM Coin allows the bank's institutional clients to transfer U.S. dollars held in their accounts instantly, 24/7. They use this for all sorts of wholesale payment activities, including:

- Intraday Repurchase Agreements: Settling short-term borrowing deals on the spot.

- Corporate Treasury Payments: Helping multinational corporations move cash between global subsidiaries without delay.

- Securities Settlement: Slashing the time it takes to settle transactions for bonds and other securities.

By using a private blockchain, large corporations can get the speed and efficiency benefits of instant settlement while still maintaining the control and privacy they need. These real-world examples prove that blockchain payments are a versatile tool, already solving major financial challenges across completely different industries.

Navigating the Hurdles to Adoption

For all its promise, the path to making blockchain for payments the new normal is filled with real-world obstacles. It's not a simple flip of a switch. For every advantage blockchain offers, there's a corresponding challenge that developers and businesses are actively trying to solve.

Taking an honest look at these hurdles is key. We're talking about scalability bottlenecks, a confusing and ever-shifting regulatory scene, technical integration headaches, and a user experience that can feel downright intimidating. These aren't reasons to dismiss the technology; they're the growing pains of a powerful new system finding its footing.

The Scalability Trilemma

One of the biggest conversations in the blockchain world revolves around the "blockchain trilemma." It's a simple but profound idea: a blockchain network struggles to deliver on three crucial promises at the same time: security, decentralization, and speed (or scalability).

Think of early blockchains like Bitcoin. They are incredibly secure and decentralized, but they crawl when it comes to transaction speed, handling just a handful per second. That's a world away from the tens of thousands a major credit card network processes. This creates a serious bottleneck for any payment system aiming for mass adoption.

"The trilemma is the central puzzle developers are trying to solve. You can easily have two of the three, but achieving all three at once is the holy grail for mass adoption."

So, how do we get around this? The most promising answer lies in Layer-2 solutions. Picture the main blockchain as a busy highway. A Layer-2 solution is like a high-speed express lane built on top. It bundles tons of smaller transactions together off the main road and then settles them all in one go back on the main highway. This move massively boosts speed and cuts costs without watering down the core security of the main network.

An Evolving Regulatory Landscape

Another giant hurdle is the lack of clear, consistent rules. Governments and financial watchdogs across the globe are still trying to get their heads around cryptocurrencies and blockchain. The result is a messy patchwork of regulations that can change overnight and vary wildly from one country to the next.

This legal fog makes businesses nervous. It's tough to pour millions into building a new payment infrastructure when a new rule tomorrow could throw a wrench in the entire operation. While there have been positive signs—like the U.S. Office of the Comptroller of the Currency (OCC) giving banks a green light for crypto custody and stablecoin payments—the global picture is still far from settled.

Interoperability and User Experience Gaps

Finally, we hit the practical, day-to-day challenges. Right now, not all blockchains can communicate with each other. This is the interoperability problem. It’s like not being able to send an email from a Gmail account to a Yahoo account. This creates walled gardens that limit the technology's reach, though many projects are now focused on building "bridges" to connect these separate networks.

Then there's the user experience, which can still feel clunky and technical. Managing private keys, copying long wallet addresses, and understanding transaction fees just isn't as simple as swiping a card. For blockchain for payments to truly catch on, it needs to be so easy that your grandma can use it without thinking about the complex tech humming away in the background.

To better understand these roadblocks and how the industry is tackling them, let's break them down.

Common Blockchain Adoption Challenges and Potential Solutions

This table gives a clearer picture of the main obstacles and the smart solutions emerging to overcome them.

| Challenge | Description | Emerging Solution |

|---|---|---|

| Scalability | The "trilemma" where networks struggle to balance speed, security, and decentralization, leading to slow and costly transactions. | Layer-2 Networks: Off-chain solutions like Rollups and State Channels that bundle transactions to increase throughput and reduce fees. |

| Regulatory Uncertainty | A lack of clear, consistent global regulations creates risk and hesitation for businesses looking to adopt the technology. | Industry-Led Standards & Regulatory Sandboxes: Proactive development of best practices and collaboration with regulators to shape sensible policies. |

| Interoperability | Different blockchains can't easily communicate or share assets, creating a fragmented ecosystem that limits utility. | Cross-Chain Bridges & Protocols: "Bridges" that allow assets and data to be securely transferred between independent blockchain networks. |

| User Experience (UX) | Complex concepts like private key management and wallet addresses make the technology intimidating for non-technical users. | Smart Wallets & Account Abstraction: Simplified wallet designs with social recovery and easier interfaces that mimic traditional web applications. |

| Security Concerns | The risk of smart contract bugs, hacks, and scams can deter both businesses and individual users from participating. | Auditing & Formal Verification: Rigorous code audits by third-party security firms and mathematical proofs to ensure smart contracts work as intended. |

As you can see, for every major challenge, dedicated teams are building innovative solutions. These efforts are gradually paving the way for a more scalable, user-friendly, and secure blockchain-powered financial future.

The Future of Money and Blockchain Payments

When we look past today's use cases, it’s clear that blockchain is poised to do more than just improve existing payment systems. We’re talking about a fundamental shift in how money works. The technology is graduating from a niche alternative to a core piece of the next generation of finance. Several key trends are already taking shape that will redefine everything from government-issued currency to the very concept of ownership.

The real story here isn't just about making old processes a little better. It's about building entirely new financial rails that allow for a more programmable, open, and connected economy.

The Rise of Central Bank Digital Currencies

One of the most profound changes on the horizon is the emergence of Central Bank Digital Currencies (CBDCs). Simply put, a CBDC is a digital version of a country's official currency—think of a digital dollar or a digital euro—issued and fully backed by the central bank itself. It’s like cash, but it lives on a digital ledger.

But this is much more than just swapping paper for pixels. It’s a complete upgrade to our monetary infrastructure. For governments, a CBDC could mean:

- Instantly sending stimulus funds or social benefits directly into a citizen's digital wallet, bypassing slow, traditional banking systems.

- Getting a clearer, real-time picture of economic activity to make smarter policy decisions.

- Building a more secure and efficient national payment backbone.

Tokenization and the Internet of Value

Another massive shift is asset tokenization. This is the process of taking a real-world asset—like a commercial building, a famous painting, or even a share of a private company—and converting the ownership rights into a digital token on a blockchain. This seemingly simple act has incredible consequences. Suddenly, illiquid assets become easily tradable. Instead of needing millions to invest in an apartment complex, you could buy a small, tokenized fraction of it.

This concept expands beyond simple payments and into what many are calling the "Internet of Value," where any asset can be moved around the globe as frictionlessly as an email. The big institutions are already moving in this direction. BlackRock, for example, has launched its own tokenized fund, and we're seeing a clear trend toward institutional adoption. In fact, recent surveys show that 15% of CFOs in North America expect to accept stablecoins within the next two years, purely for the speed and cost benefits in cross-border payments. You can get a deeper look at the state of blockchain adoption in finance.

The future isn't just about faster payments; it's about programmable money and intelligent assets. Blockchain provides the rails for this new, interconnected economy.

Finally, think about how this all connects with the Internet of Things (IoT). Picture a world where your smart fridge notices you're out of milk, orders more, and pays for it automatically. Or imagine your electric car pulling into a charging station and handling the payment on its own. By embedding payment logic directly into devices, blockchain can power a seamless, autonomous machine-to-machine economy, cementing its place as the financial backbone of tomorrow.

Common Questions About Blockchain Payments

It's completely normal to have a few questions when you're first digging into how blockchain can be used for payments. Let's tackle some of the most common ones head-on to clear things up.

Are Blockchain Payments Genuinely Secure?

Yes, they are incredibly secure, and it all comes down to how they're built. The security of a blockchain rests on two main pillars: cryptography and decentralization. Every single transaction is encrypted and then chained to the one before it, creating a permanent, unchangeable record.

Think of it like a digital ledger that's copied and distributed across thousands of computers all over the world. To cheat the system, a bad actor would need to somehow gain control of over 51% of that massive, global network just to approve one fraudulent payment. On a major blockchain, that's a near-impossible feat, making it a powerful defense against the kinds of fraud that plague traditional finance.

Since there’s no single, central database to target, the entire network polices itself. Security isn't an add-on; it's woven directly into the system's DNA, which is a fundamental shift from the vulnerable, centralized models we're used to.

Is This Technology a Good Fit for Small Businesses?

Absolutely. In many ways, small businesses stand to benefit the most, especially if they operate internationally or sell online. Using blockchain for payments lets you sidestep the hefty fees from credit card companies and international wire transfers, which can make a real difference to your bottom line.

Beyond the cost savings, you also get paid almost instantly. That immediate settlement is a game-changer for cash flow—something every small business owner knows is vital. With more and more user-friendly crypto payment gateways hitting the market, getting set up is no longer a complex technical hurdle.

What Kind of Crypto Is Actually Used for Payments?

While Bitcoin started it all, its wild price swings and slower confirmation times don't make it the best tool for routine business transactions. The good news is, the industry has evolved and created cryptocurrencies specifically designed for payments.

Here’s what businesses are actually using today:

- Stablecoins: Coins like USDC and USDT are the clear favorites. They are pegged 1:1 to a stable asset like the U.S. dollar, which completely removes the price volatility problem. You know exactly what you're sending and what the other person is receiving.

- Payment-Focused Cryptocurrencies: Others, like XRP and XLM, were engineered from day one to do one thing exceptionally well: move money across borders quickly and cheaply.

These types of digital currencies give you all the benefits of blockchain—the speed, the low fees, the global reach—without the headaches of price instability.

Ready to simplify your crypto transactions? BlockBee provides a secure, non-custodial payment platform that makes it easy to accept over 70 cryptocurrencies with lightning-fast confirmations and instant payouts. Join thousands of merchants growing their business with our easy-to-integrate solutions. Get started with BlockBee today!