Accepting Crypto Payments for Business A Practical Guide

Offering crypto payments is no longer a niche idea reserved for tech startups. It's a smart, practical way for any business to connect with a growing wave of consumers who prefer digital currencies. By using a service like BlockBee, you can seamlessly add crypto options to your checkout, often benefiting from lower transaction fees and saying goodbye to chargeback fraud for good. This is about expanding your reach and future-proofing your business.

Why Accepting Crypto Is a Smart Business Play

Let's cut through the noise. Deciding to accept crypto payments has moved from a novelty to a genuine competitive advantage. For anyone running an e-commerce store or a business with a global footprint, this is about preparing for the future and meeting a new generation of customers on their terms.

You don't need to become a blockchain expert overnight. This is simply about recognizing a major shift in how people want to pay and making sure your business is ready. The reasons to make the switch are pretty compelling:

- Reach a New Crowd: You immediately open your doors to a market of buyers who actively look for businesses that accept crypto.

- Lower Your Costs: Crypto transaction fees are often a fraction of the 2-4% credit card companies typically charge. That adds up.

- Kill Chargeback Fraud: Crypto payments are final. This completely protects you from the headache and financial loss of fraudulent chargebacks.

- Get Paid Faster, Globally: International payments settle in minutes, not days. You can bypass the slow, expensive traditional banking system entirely.

For a clearer picture, here’s a quick breakdown of how these advantages translate into real-world business impact.

Key Benefits of Accepting Crypto Payments

| Benefit | Business Impact |

|---|---|

| Global Reach | Instantly accept payments from anyone, anywhere, without currency conversion or cross-border fees. |

| Reduced Fees | Keep more of your revenue by avoiding high credit card processing fees. |

| No Chargebacks | Eliminate revenue loss and administrative costs associated with fraudulent disputes. |

| Faster Settlement | Improve your cash flow with funds that settle in minutes instead of days. |

| Attract New Customers | Appeal to a tech-savvy and affluent demographic that prefers transacting in crypto. |

These aren't just minor perks; they're substantial improvements to your bottom line and operational efficiency.

Tapping Into a Growing Market

The number of people using crypto is exploding. As of 2025, about 28% of American adults—that's roughly 65 million people—own cryptocurrency. That user base has almost doubled since late 2021, and 67% of current owners say they plan to buy more. The trend is undeniable.

By adding a crypto payment option, you're sending a clear message: your business is innovative and understands its customers. It's a simple yet powerful way to build loyalty with an audience that's only getting bigger.

The Long-Term Strategic Value

This is about more than just a single transaction. It’s about building a better customer relationship that lasts. When you let people pay in the way they feel most comfortable, you reduce friction and make them happier.

To really get a handle on how this impacts your business over time, you need to look at metrics like customer lifetime value. You can even use a dedicated Customer Lifetime Value Calculator to see the numbers for yourself. Ultimately, adopting crypto isn't just about adding another button to your checkout page—it's an investment in a more flexible, resilient, and globally competitive business.

How to Choose the Right Crypto Payment Gateway

So, you’re ready to let customers pay with crypto. The first major decision is finding the right partner to handle the technical side of things. While you could technically manage your own crypto wallets, it’s a seriously complex and risky road for a business.

This is where a crypto payment gateway comes in. It’s the smart choice, acting as the essential bridge between your customer's crypto wallet and your business funds.

Think of a gateway as your digital currency version of Stripe or PayPal. It takes care of verifying the transaction on the blockchain and gives your customer a smooth, familiar checkout process. This leaves you free to focus on what you do best—running your business—instead of getting bogged down in the nuts and bolts of blockchain technology. This is exactly what services like BlockBee were designed for: removing the friction for merchants.

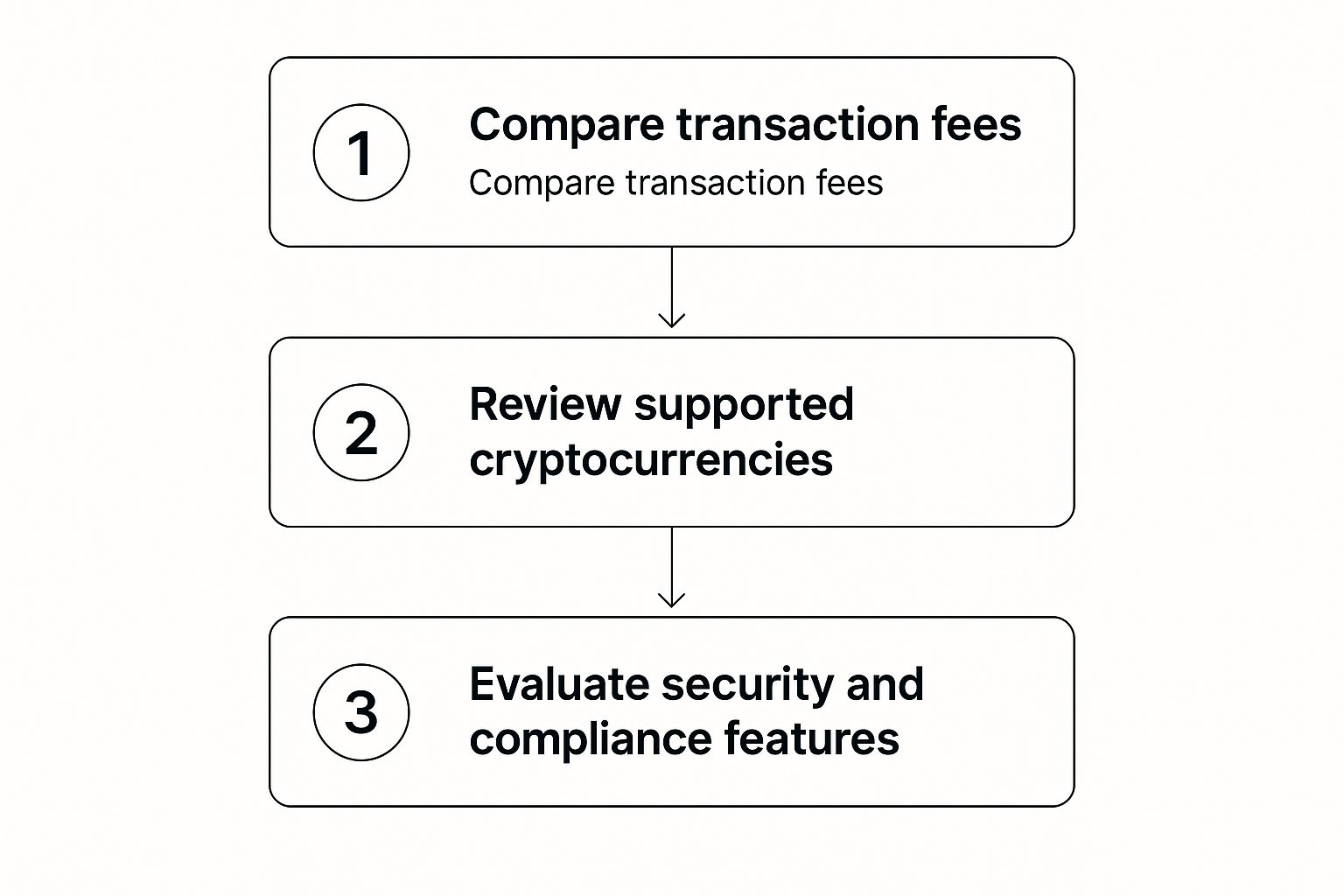

What to Look For in a Provider

When you start comparing different gateways, it's easy to get lost in all the technical jargon. My advice? Cut through the noise and focus on a handful of core features that will actually impact your daily operations and your bottom line.

A good partner should make your life easier, not more complicated. Here’s what I’d consider non-negotiable on your checklist:

- Broad Coin Support: Your customers won't just be using Bitcoin. A solid gateway needs to support a wide array of popular cryptocurrencies like Ethereum and Litecoin, plus stablecoins like USDT. The more payment options you provide, the more customers you can attract.

- Easy E-commerce Integration: This is a big one. The gateway absolutely must connect seamlessly with your existing online store. Look for official plugins for platforms like Shopify, WooCommerce, or Magento. A simple, no-code integration can save you a ton of time and developer headaches.

- Airtight Security: Your provider must be the one doing the security heavy lifting, from secure wallet management to transaction monitoring. A non-custodial gateway is an excellent choice here because it means you—and only you—always maintain full control over your funds.

- Transparent Fee Structure: Watch out for hidden fees that can chip away at your profit margins. You need a provider with a clear, upfront pricing model. Some charge a percentage per transaction, others a flat fee. Make sure you understand exactly what you’ll pay for processing and any add-ons like currency conversion.

A great gateway simplifies everything from the moment a customer clicks "pay with crypto" to the funds settling in your account. The goal is automation and peace of mind, allowing you to reap the benefits of accepting crypto payments for your business without the associated headaches.

Making the Final Call

Choosing the right partner is probably the most critical step you'll take in this process. Your ideal provider will offer flexibility without burying you in complexity.

For a more detailed breakdown of what to expect, our guide on how to accept crypto payments for your business is a great next read. In the end, the right choice will always be the one that aligns with your specific business goals, your available tech resources, and—most importantly—the payment preferences of your customers.

Getting Your BlockBee Account Up and Running

Alright, let's get down to business. It's time to take the idea of accepting crypto payments and make it a reality for your store. This is where the rubber meets the road. I'll walk you through the entire BlockBee setup from start to finish, showing you exactly what to click and where to go. Think of me as looking over your shoulder, guiding you through it.

The whole point is to get you from a brand-new account to a fully configured payment gateway that's ready for your first crypto-paying customer. The great news? This process was clearly designed for a business owner, not a developer, so it’s something you can absolutely handle yourself.

First Look: Creating Your Account

Your first stop is the BlockBee homepage. Kicking things off is a simple registration—just the usual email and password. Once you’re in, you land on the main dashboard. This is your mission control for everything crypto payment-related.

Here's what you'll see right after signing in. It's clean and gives you a bird's-eye view of your activity.

The interface is incredibly intuitive. Your balance, recent transactions, and quick links to integrations are front and center. I’ve worked with a lot of payment gateways, and a cluttered dashboard can be a real headache. BlockBee avoids that, focusing on what you actually need: receiving payments, managing wallets, and grabbing the API keys to connect your store. This smart design means you'll get the hang of it in no time.

Generating Your API Keys

The API Key is the magic ingredient that securely links your website to your BlockBee account. You can think of it as a unique, secure password that lets your e-commerce platform talk to the payment gateway to create and confirm transactions. Without it, nothing works.

To get your key, just head to the "API" section from the menu on your dashboard. BlockBee makes it dead simple—you can generate a new key with a single click.

A Quick Word of Advice: Treat your API key with the same care you would any sensitive password. Never share it in a public place or post it online. BlockBee’s system ties this key directly and uniquely to your account, so keeping it safe is crucial for your security.

Once it's generated, copy that key and keep it handy. You're going to need it in a bit when we connect the plugin for your specific e-commerce platform, whether that’s WooCommerce, Shopify, or something else. This key is what authenticates every single payment request, ensuring all transactions are legitimate and get credited to your account correctly.

Customizing Your Payment Settings

Okay, your account is live and you've got your API key. Now for the fun part: tailoring the payment settings to fit your business like a glove. This is where you decide exactly how you want to accept crypto.

Navigate over to the "Settings" area in your dashboard. You’ll find a few really important options to configure:

- Choose Your Cryptocurrencies: You get to pick and choose which digital currencies you want to offer at checkout. You can stick with the big names like Bitcoin (BTC) and Ethereum (ETH), or you might want to add stablecoins like Tether (USDT). From my experience, businesses selling internationally often find that offering stablecoins helps reduce customer anxiety over price swings.

- Set Up Email Notifications: This is a must. You can configure automatic email alerts to ping you the second a new payment is received or confirmed. It's a simple way to stay on top of new orders without having to live inside your BlockBee dashboard.

- Configure Your Callback URL: This one sounds a bit technical, but it's a game-changer for automation. You can give BlockBee a specific URL on your site to send automatic updates about payment statuses. This is what lets you automate your fulfillment. For example, it can tell your WooCommerce store to automatically mark an order as "Paid" once the crypto transaction is fully confirmed on the blockchain.

By spending a few minutes dialing in these settings, you’re creating a payment process that works seamlessly with your existing workflow. It makes life easier for you and provides a smoother experience for your customers. With this done, your account is officially prepped and ready for integration.

Integrating Crypto Into Your Website or Online Store

Alright, you’ve got your BlockBee account ready to go. Now for the exciting part: plugging it into your website or online store where your customers can actually use it. This is the step that brings everything to life, turning your site into a fully-functional business that is accepting crypto payments for business.

The whole point is to create a payment experience that feels smooth, trustworthy, and completely natural for your customers, regardless of what platform your website is built on.

Luckily, you don't have to be a tech wizard to make this happen. Modern payment gateways are designed to be incredibly straightforward.

Connecting to Popular E-commerce Platforms

If you're like most online merchants, you're probably using a popular platform like WooCommerce or Shopify. The good news? Getting BlockBee up and running is as easy as installing a simple plugin. You won’t need to touch a single line of code.

Here's the typical process:

- Find the Plugin: Head over to your platform's app or plugin marketplace and search for BlockBee.

- Install and Activate: Add the plugin to your site with a click, just like any other app or extension.

- Enter Your API Key: Dive into the plugin's settings. You'll see a field where you can paste the API key you generated earlier in your BlockBee dashboard. This is what securely links your store to your account.

That’s it. Once you save the settings, the plugin automatically adds the crypto payment option to your checkout page. It works behind the scenes, generating a unique payment address for every order and talking to your BlockBee account to confirm when the payment goes through. It's truly a "set it and forget it" solution.

This simple integration is your gateway to a huge market. As of 2024, more than 659 million people around the world owned cryptocurrency. On-chain transaction volume on blockchain networks soared past $10 trillion, a figure that’s climbing fast as more businesses get on board. You can find more of these eye-opening blockchain and crypto statistics at Webisoft.

Integration for Custom-Built Websites

What if you're not using a big-name platform? Maybe you have a custom-built site. No problem at all. This is where BlockBee’s powerful API (Application Programming Interface) shines.

This path does require a bit of help from a developer, but it gives you total control to build a checkout experience that perfectly matches your brand.

Here’s a look at how the API works:

- Request a Payment Address: When a customer clicks "pay with crypto," your website pings the BlockBee API to get a fresh, unique crypto address for that specific order.

- Display Payment Details: Your site then shows the customer that address and the exact amount to send. For convenience, this is usually displayed as a scannable QR code.

- Receive Automatic Updates: BlockBee uses the callback URL you set up earlier to instantly notify your website the moment the payment is confirmed on the blockchain.

Of course, whenever you're dealing with payments, security is non-negotiable. Take some time to review this essential guide to keeping your website secure to make sure you have all your bases covered.

For a deeper dive into the technical side, our guide on how to add crypto payments to your website offers more detailed steps and examples. This API-driven approach ensures that even the most unique online stores can offer a polished and secure crypto payment option.

Let’s be honest: the two things that make most business owners hesitate to accept crypto are the wild price swings and the accounting headaches. And those are completely fair concerns. The good news is, you don't need to become a crypto day trader or a tax wizard to make this work. The right tools can solve both problems.

The simplest way to handle volatility? Don't hold the crypto. A payment gateway like BlockBee can take a customer's payment and instantly convert it into your local currency, whether that’s USD, EUR, or something else. This means you get the exact amount you charged, every single time, without ever having to worry about market dips.

Sidestep Volatility with Instant Settlement

Think about it this way: you sell an item for $100. A customer pays you in Bitcoin. If you were holding it yourself, by the time the payment clears, that Bitcoin might only be worth $95. That's a loss you just have to eat.

Instant settlement flips the script. The second that transaction is confirmed on the blockchain, the gateway locks in the value and converts it to $100 in cash, which then heads to your bank account.

This gives you a powerful advantage:

- You open your doors to a whole new group of customers who prefer paying with crypto.

- Your revenue stays predictable and stable, just like with any other payment method.

It's no secret that corporate adoption of crypto is on the rise, even if executives are still cautious. A 2025 Deloitte survey found that 43% of CFOs named price volatility as their biggest worry. But here's the kicker: only 1% said they see no long-term role for crypto at all. Tools that eliminate volatility risk are what will close that gap. You can dig into more of the findings from the 2025 CFO Signals survey at Deloitte.com.

Streamlining Your Financial Reporting

Getting your books right is not optional. The IRS, for instance, treats cryptocurrency as property. That means every single transaction—from receiving a payment to cashing it out—is a taxable event. Trying to track all of that by hand is a recipe for disaster.

This is where a payment gateway becomes your best friend. BlockBee gives you detailed transaction reports that log every payment automatically, capturing the crypto's exact market value at the moment of the transaction.

These reports are precisely what your accountant needs to keep your books clean and your tax filings accurate. You can easily export a full history showing dates, amounts, and fair market values. This data is also crucial for payment reconciliation, making sure the numbers in your accounting software perfectly match what lands in your bank.

What was once a massive accounting challenge becomes a simple, automated part of your workflow. You get to spend less time buried in spreadsheets and more time actually running your business.

Common Questions About Taking Crypto Payments

Even with a clear path forward, it's completely normal to have some questions floating around. Let's dive into a few of the most common things I hear from business owners who are on the fence about crypto.

Are Crypto Payments Actually Secure?

Yes, they are—and in some ways, even more so than traditional payments. Each crypto transaction is locked with heavy-duty cryptography and recorded on the blockchain. This makes it incredibly difficult to alter and practically eliminates the chargeback fraud that plagues so many online businesses.

When you bring a trusted payment gateway like BlockBee into the mix, you're adding another robust layer of security. They manage the technical side of things, from secure wallets to transaction confirmations, so you don't have to worry about the complexities.

What Kind of Fees Am I Looking At?

This is where crypto really shines. You're probably used to seeing traditional credit card fees around 2.9% + $0.30 for every single transaction. With crypto gateways, the processing fees are typically much, much lower—often somewhere between 0.5% and 1%.

It's also worth noting that the blockchain's own "network fees" (sometimes called gas fees) are paid by the customer, not you. Some platforms, like BlockBee, even offer a no-fee structure for basic processing and only charge for extra services you might choose, like currency conversion.

The savings on fees alone can be a game-changer. For businesses with tight margins or a high volume of sales, keeping that extra 1-2% on every transaction adds up fast and directly boosts your bottom line.

Do I Have to Hold on to Bitcoin or Other Cryptocurrencies?

Not at all. This is probably the biggest myth that keeps businesses from getting started. You don't have to deal with the price swings or worry about managing a digital wallet if you don't want to.

Modern gateways like BlockBee have a feature called auto-conversion. It’s simple: a customer pays you in Ethereum, and the system instantly converts it to your local currency, like USD or EUR. That money then lands right in your business bank account. You get all the benefits of reaching a global, crypto-savvy audience without ever touching a volatile asset.

Ready to open your doors to more customers and cut down on transaction costs? BlockBee offers a simple, secure way to get started. You can begin accepting crypto payments in minutes.