Your Guide to a Cryptocurrency Payment Gateway

So, what exactly is a cryptocurrency payment gateway?

Think of it as the ultimate middleman for digital money, connecting the world of crypto with everyday business. It’s a service that lets merchants accept digital currencies from customers, often converting them automatically into a familiar currency like USD or EUR. This completely removes the need for you to become a blockchain expert just to make a sale.

What Is a Cryptocurrency Payment Gateway

You're already familiar with credit card processors. When a customer swipes their card, a whole system kicks into gear behind the scenes to check funds and move money from their bank to yours. A cryptocurrency payment gateway does the same job, but for assets like Bitcoin, Ethereum, and various stablecoins.

The whole point is to automate the tricky parts. Instead of you personally having to track blockchain confirmations, generate wallet addresses, and calculate network fees, the gateway bundles it all into a simple interface for you and your customer. It creates a unique payment request, watches the network for the transaction, and gives the all-clear once the payment is complete.

Bridging the Gap for Modern Commerce

At its core, a crypto payment gateway is designed to smooth out the entire process. For your customer, it means a clean checkout experience—often as simple as scanning a QR code with their phone. For you, the merchant, the benefits are even bigger:

- Volatility Management: The gateway can instantly convert a cryptocurrency into a stablecoin or fiat money, protecting your revenue from the wild price swings crypto is known for.

- Simplified Operations: You get easy-to-read reports and can manage everything from one central dashboard, just like you would with Stripe or PayPal.

- Expanded Customer Base: It opens your doors to a global, tech-savvy audience that actively prefers to pay with digital assets.

Essentially, the gateway acts as a trusted go-between. It lets you tap into the awesome benefits of crypto—like super low fees and zero chargebacks—without having to wrestle with the risks or technical headaches.

A non-custodial gateway like BlockBee takes this a step further by making sure you always have full control over your money. Payments go directly into your own wallet, not a third-party account, which is a massive boost for security and gives you instant access to your funds.

This approach really offers the best of both worlds. You get the operational ease of a managed service while holding onto the self-custody that is so central to the spirit of crypto. By plugging in a solution like this, any business can confidently step into the future of payments, cut down on costs, and give customers more choice at checkout. The gateway makes crypto simple, safe, and practical for real-world business.

A Step-by-Step Look at a Crypto Transaction

To really grasp what a crypto payment gateway brings to the table, let's walk through how a transaction actually happens. The blockchain tech humming away in the background is complex, sure, but the experience for you and your customer is surprisingly straightforward.

Think of the gateway as the middleman that handles all the complicated stuff, making the entire process feel effortless.

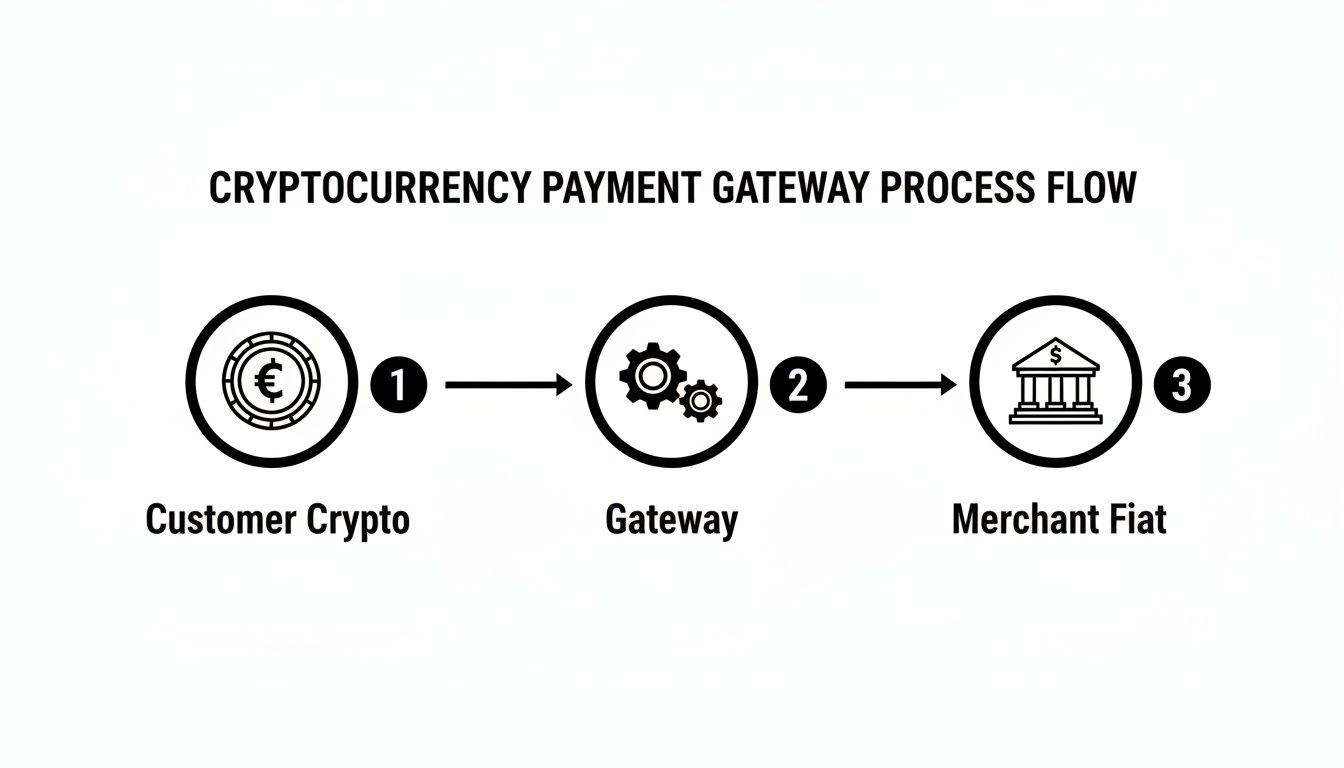

This diagram shows a simple, three-step flow where the gateway acts as the bridge, translating the customer's crypto payment into a completed order for the merchant.

Stage 1: The Customer Checks Out

Everything starts just like any other online sale. A customer fills their cart and heads to checkout. Right there, next to Visa and PayPal, they see an option to "Pay with Crypto" and they click it.

This is where the gateway kicks in. Clicking that button isn’t just a simple action; it sets a dynamic process in motion. The gateway instantly generates a unique payment request just for this one transaction.

Stage 2: The Gateway Creates a Payment Invoice

Your customer is then shown a clean, simple payment interface. This invoice usually has a few key things:

- A Unique QR Code: This scannable code contains everything needed to make the payment—the wallet address and the exact crypto amount.

- A Wallet Address: For those on a desktop, the full address is there to copy and paste.

- A Precise Amount: The gateway calculates the exact amount of crypto required to match the fiat price of the order. It even locks in this exchange rate for a few minutes to protect both you and the customer from price volatility.

This removes any chance of human error. The customer can't accidentally send the wrong amount or mistype a long wallet address, which are common headaches with manual crypto transfers.

The gateway essentially acts as a hyper-efficient cashier. It presents the bill in the customer's chosen currency (crypto) in a foolproof way, guaranteeing the right amount lands in the right place, every single time.

Stage 3: The Customer Sends the Crypto

Now it's the customer's turn. They open their personal crypto wallet, scan the QR code, and watch as all the payment details fill in automatically. One tap to confirm, and the funds are on their way.

That’s it—their job is done. This action sends the transaction out to the blockchain network to be verified.

Stage 4: The Gateway Watches and Verifies

This is where the cryptocurrency payment gateway really earns its keep. Instead of you having to stare at a confusing blockchain explorer, the gateway’s systems are constantly monitoring the network for that specific payment.

It patiently waits for the transaction to get enough "confirmations" on the blockchain to be considered final and irreversible. Once the gateway has verified the funds are secure, it instantly sends an update to your e-commerce platform.

Your store’s backend automatically marks the order as "Paid," which can kick off your shipping process and send a confirmation email to the customer. For you, the merchant, the entire process is completely hands-off. Solutions like BlockBee are built for lightning-fast payment confirmations, ensuring there are no awkward delays for anyone involved.

What's In It for Your Business? Real-World Benefits You Can't Ignore

Adding a crypto payment option is much more than just putting another button on your checkout page. It's a smart business decision that can directly impact your bottom line, open up new markets, and fix some of the biggest headaches that come with traditional payment systems. By embracing the tech behind crypto, you can solve real-world financial problems.

The market itself is telling a clear story. The crypto payment gateway space is projected to hit USD 1,684.7 million in 2025 and swell to USD 6,030 million by 2035. That’s a compound annual growth rate of 13.6%. You can dig into more data on this expanding market to see where things are headed.

Radically Lower Transaction Fees

Let’s talk about the most immediate win: slashing your transaction fees. Every time a customer pays with a credit card, you're handing over 2% to 4% of that sale to processors. Those fees nibble away at your profits, day in and day out.

Crypto payment gateways just work differently. They cut out the middlemen—the banks, the card networks—which means the fees are a fraction of the cost. A platform like BlockBee, for example, has transaction fees that start at a tiny 0.25%. That means more of the money you earn actually stays with you.

Think about it: On a $1,000 sale, a typical credit card fee might be $35. With a low-fee crypto gateway, that cost could plummet to just $2.50. That's not just pocket change; it's a serious boost to your financial health.

Say Goodbye to Fraudulent Chargebacks

If you sell anything online, you know the pain of chargebacks. A customer disputes a payment, often long after the fact, and suddenly the money is clawed back from your account. The burden is on you to prove the charge was legitimate, and it's a draining, expensive process.

This is where crypto really shines for merchants. Cryptocurrency transactions are final. Once a payment is verified on the blockchain, it cannot be reversed. This feature single-handedly wipes out the risk of fraudulent chargebacks, giving you peace of mind that once you're paid, you stay paid.

Get Paid Instantly, From Anywhere in the World

Selling internationally with traditional methods means waiting. And waiting. It can take days for money to navigate the maze of international banking, tying up your cash flow and making your accounting a nightmare. Crypto payments, on the other hand, settle as fast as the network can confirm them—usually in minutes.

- Better Cash Flow: Your money arrives almost immediately, so you have working capital when you need it.

- Truly Borderless Sales: You can sell to anyone, anywhere on the globe, without worrying about settlement delays or sky-high currency conversion fees.

- Smoother Operations: Faster payments mean you can reconcile your books and ship orders faster, confident the funds are secure.

This near-instant settlement makes doing business globally as simple as a local sale. It's about building a business that's more nimble, more secure, and ultimately, more profitable.

How to Choose the Right Crypto Gateway

Picking a crypto payment gateway is a big deal for your business. Think of it less like choosing a piece of software and more like finding a long-term partner for your finances. The right one will feel like a natural extension of your business, fitting your technical setup, security standards, and operational flow perfectly.

Get this wrong, and you could be looking at lost sales, security scares, or just a constant operational headache. To get it right, you have to look past the flashy marketing and dig into the core features that actually affect your money and your time.

A smart decision now will set you up for growth. This space is expanding fast—by 2025, it's estimated that around 40% of small and medium-sized businesses will be accepting crypto payments. They're drawn to benefits that old-school finance simply can't match. You can discover more insights about the crypto payment market's future to see just how big this is getting.

Custodial vs Non-Custodial Security

The first and most important question you need to ask is: who holds the money? This is the fundamental difference between custodial and non-custodial gateways.

- Custodial Gateways: These services hold your crypto for you in their own accounts. It might sound simpler, but it introduces a huge risk. If they get hacked, go bust, or freeze your account, your funds could be gone for good. You're essentially trusting someone else to keep your money safe.

- Non-Custodial Gateways: This is the self-sovereignty model. Payments go directly from your customer's wallet to your wallet. The gateway provider never has access to your funds. You keep 100% control over your private keys, which is the absolute gold standard in crypto security.

For any business that puts security first, a non-custodial solution like BlockBee is the only way to go. It completely removes that third-party risk, giving you total control and peace of mind.

Supported Coins and Currencies

Next up, what coins can you actually accept? Sure, Bitcoin (BTC) and Ethereum (ETH) are the big ones, but the crypto world is incredibly diverse. The more coins you support, the more customers you can serve.

Look for a gateway that offers a wide variety of popular coins and, just as importantly, stablecoins like USDT and USDC. Because their value is tied to fiat currencies like the US dollar, they protect both you and your customers from wild price swings. A checkout page with plenty of crypto options means fewer people will click away simply because their favorite coin isn't listed.

Fees and Pricing Structure

Fees eat directly into your profits, so you need to understand exactly what you'll be paying. Most gateways charge a small percentage per transaction—usually much lower than credit card fees—but the devil is in the details.

Be on the lookout for hidden costs. Some gateways tack on extra fees for things like withdrawals, currency conversions, or even monthly subscriptions. A transparent, easy-to-understand fee structure is the mark of a provider you can trust.

Always compare different pricing models. Some platforms have tiered pricing that drops as your volume increases, while others stick to a simple flat rate. For a sense of what's out there, you can look at examples like Copycat247's pricing to see how different companies approach it. This kind of clarity helps you forecast costs accurately and find a model that grows with you.

Integration and Ease of Use

Finally, how easy is it to get this thing working? A clunky, complicated setup process is a non-starter. The best gateways give you options that match your technical comfort level.

- No-Code Plugins: If you run an e-commerce store on a platform like WooCommerce, Magento, or PrestaShop, plugins are your best friend. You can add crypto payments to your shop in a few clicks, no coding required.

- APIs: For businesses with custom-built websites or apps, a well-documented API (Application Programming Interface) is essential. It gives your developers the freedom to create a fully customized checkout experience that fits your brand perfectly.

A provider like BlockBee that offers both easy-to-use plugins and a powerful API gives you the best of both worlds. You can get started fast and then build out more custom solutions as your business needs change.

To help you put all these pieces together, we've put together a quick comparison table.

Feature Comparison for Choosing a Crypto Gateway

When you're weighing your options, it helps to compare them side-by-side. This table breaks down the most important features to look for, what they mean for your business, and how BlockBee stacks up.

| Feature | What to Look For | Why It Matters | BlockBee's Approach |

|---|---|---|---|

| Security Model | Non-custodial, direct-to-wallet payments. | You retain full control of your funds, eliminating third-party risk. | 100% Non-Custodial. Payments go straight to your wallet; we never touch your funds. |

| Supported Coins | A wide variety of major coins, altcoins, and stablecoins. | Caters to more customers and provides stable payment options. | Supports 20+ major cryptocurrencies, including BTC, ETH, TRON, stablecoins (USDT, USDC), and more. |

| Fee Structure | Transparent, low, and predictable fees with no hidden costs. | Protects your profit margins and makes financial planning easy. | A clear, competitive fee structure. You always know what you're paying. |

| Integration Options | Easy-to-install plugins and a flexible, well-documented API. | Ensures you can get started quickly and customize as your business grows. | Offers ready-made plugins for major e-commerce platforms and a powerful, developer-friendly API. |

| Ease of Use | An intuitive dashboard and straightforward setup process. | Saves you time and reduces the chance of operational errors. | A user-friendly dashboard designed for both technical and non-technical users to manage payments effortlessly. |

Choosing the right gateway comes down to matching its features to your specific business needs. A platform that excels in security, flexibility, and transparency is one that will support you for the long haul.

For a deeper dive, be sure to read our in-depth guide on finding the best crypto payment gateway tailored to your situation.

Integrating a Gateway Into Your E-Commerce Store

Getting a cryptocurrency payment gateway up and running on your site is probably a lot more straightforward than you think. The days of needing a dedicated development team for every little tweak are long gone. Today, you really have two main paths to choose from, each catering to different technical skills and business models.

The whole point is to make accepting crypto feel just as simple as adding PayPal or Stripe to your checkout. Whether you’re running a store on a popular e-commerce platform or have a completely custom-built site, there's a solution that will fit right into your workflow.

Let’s break down the most common ways to get integrated.

The No-Code Path with E-Commerce Plugins

For the vast majority of online store owners, plugins are the quickest and easiest way to start accepting crypto payments. If your store is built on a major platform like WooCommerce, PrestaShop, Magento, or OpenCart, you can often get set up in just a few clicks.

Think of these plugins as little bridge-builders. They are small pieces of software designed to connect your store directly to the payment gateway's services, no coding required.

Here's how simple the process usually is:

- Find the Plugin: You can typically find the official plugin in your platform’s marketplace or download it directly from the gateway provider’s website.

- Install and Activate: Just like any other plugin, you install it on your site and click "activate." This usually takes less than a minute.

- Enter Your API Key: From your gateway dashboard (like your BlockBee account), you’ll copy a unique API key and paste it into the plugin's settings. This is what securely links your store to the payment service.

- Configure Settings: Finally, you can tweak a few basic settings, like choosing which cryptocurrencies you want to offer at checkout.

And that's it. In a matter of minutes, a "Pay with Crypto" option will appear on your checkout page, fully functional and ready to go. This approach is perfect for merchants who want a reliable solution without any technical headaches.

The Custom Path with API Integration

For businesses with unique requirements or entirely custom-built platforms, a direct API integration offers total control and flexibility. An API (Application Programming Interface) is essentially a set of rules that lets your software talk directly to the gateway's software. This path is definitely for developers or businesses with a technical team on hand.

Using an API lets you build a payment experience from the ground up. You can design a checkout flow that perfectly matches your brand, embed payment options right into your mobile app, or even create complex logic for things like recurring subscriptions or automated invoicing.

An API gives you the building blocks to construct a payment system that does exactly what you need it to. While it requires technical knowledge, the payoff is a deeply integrated and fully customized cryptocurrency payment gateway solution.

A well-documented API from a provider like BlockBee is key here. Clear documentation, code examples, and solid developer support make the integration process worlds easier. Developers can quickly figure out how to generate payment addresses, check for transaction confirmations, and handle all the necessary back-and-forth communication with the gateway. This method provides the ultimate power to tailor every single aspect of the payment journey.

To dig deeper into this, our detailed guide on e-commerce payment gateway integration offers more technical insights and practical steps.

Choosing the Right Integration Method for You

So, plugin or API? The decision really boils down to your business’s specific needs and what kind of technical resources you have. Neither option is "better" — they just serve different purposes.

- Choose a Plugin if: You use a standard e-commerce platform, you want to get started fast, and you don’t have a developer on standby.

- Choose an API if: You have a custom-built website or app, need to create a unique user experience, or require advanced payment logic that a standard plugin can't handle.

Ultimately, a quality cryptocurrency payment gateway should offer both. This flexibility means that as your business grows and your needs change, your payment system can scale right along with you, giving you a simple starting point and a powerful path for future customization.

Navigating Security and Risk Management

When you're taking payments, trust is the name of the game. In the crypto world, that means managing security and risk isn't just a good idea—it’s absolutely critical for protecting your business and your reputation. The biggest decision you’ll face right away is a simple but profound one: who actually holds the money?

This single choice splits gateways into two very different camps. A custodial service holds your crypto for you in their own wallets. It can seem convenient, but it introduces a massive risk. If they get hacked or go under, your funds are at their mercy. On the other hand, a non-custodial gateway like BlockBee sends payments straight to a wallet you control. You hold the keys, you own the crypto. It’s that simple.

Managing Volatility and Compliance

Once you've sorted out who controls the funds, the next major hurdle is price volatility. We all know crypto prices can swing wildly, but your revenue shouldn't have to. This is where gateways really prove their worth by offering instant settlement. The moment a customer's payment is confirmed, the gateway can automatically convert the crypto into a stablecoin (like USDT) or your local fiat currency.

This simple feature locks in the value at the point of sale, completely shielding you from market dips. Beyond the market risks, you also have to navigate a maze of regulations. Strong cybersecurity is a given, but crypto gateways have their own set of rules to follow. For instance, businesses in Australia need to know how to navigate financial information security regulations like APRA CPS 234.

The core principle of crypto security is self-sovereignty. A non-custodial approach aligns perfectly with this, removing the counterparty risk that plagues traditional finance and custodial crypto services. Your keys, your crypto.

To keep things secure and above board, gateways also lean on Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. These verification checks are essential for stopping fraud and making sure everyone is playing by the rules. We’ve put together a guide that explains the importance of KYC in crypto and how it helps create a much safer environment for merchants.

Ultimately, a solid risk management plan comes down to combining the right tech with smart habits:

- Choose a Non-Custodial Gateway: Why introduce a middleman? Keep control of your funds and eliminate third-party risk.

- Utilize Instant Settlement: Protect your business from price swings by converting crypto to a stable asset right away.

- Secure Your Wallet: Use multi-factor authentication and be religious about keeping your private keys safe. It's your digital vault.

Your Crypto Payment Questions, Answered

Thinking about adding crypto payments? It's natural to have questions. From security to those famous market swings, getting straight answers is key before you jump in. Let's break down the most common things merchants ask when considering a crypto payment gateway.

My goal here is to give you clear, practical answers so you can see what's what and decide if it's the right move for your business.

Are Crypto Payments Actually Safe for My Business?

Yes, they can be incredibly secure—often more so than traditional card payments. The big win here is that crypto transactions are final. This means no more fraudulent chargebacks, which are a constant headache for anyone accepting credit cards. Once a payment hits your wallet, it’s yours.

The real key to security, though, is picking the right kind of gateway.

The safest route is always a non-custodial gateway. With a service like BlockBee, the crypto goes straight from your customer into your own private wallet. The gateway provider never actually holds your funds. This simple difference removes a huge risk—if their service gets hacked, your money is safe because it was never there. You keep 100% control, always.

How Do I Deal with the Wild Price Swings?

That’s probably the number one concern I hear, and it’s a valid one. But modern gateways have a simple, built-in fix: instant auto-conversion. You don’t have to gamble with your revenue.

Here’s how it works: The moment a customer pays you in crypto, the gateway instantly converts it into a stable asset. You can choose to convert it into:

- Stablecoins: Think of currencies like USDT or USDC. They are pegged 1:1 to a real-world currency, usually the US dollar, so their value doesn't fluctuate.

- Fiat Currency: You can also have it converted directly into your local currency (USD, EUR, etc.) and sent to your bank account.

This process locks in the exact value of the sale right away. You charge $100, you get $100. Simple as that.

Is This Going to Be a Technical Nightmare to Set Up?

Not at all. The days of needing a blockchain developer to get started are long gone. Today's tools are designed for everyone, regardless of their technical know-how.

For most businesses running on platforms like WooCommerce, Magento, or PrestaShop, it’s as easy as installing a no-code plugin. You’re usually up and running in a few minutes—it's often just a matter of copying and pasting an API key to connect your store. If you have a custom-built website or app, developers will find that well-documented APIs give them everything they need to create a seamless payment flow.

Ready to unlock lower fees, eliminate chargebacks, and reach a global customer base? BlockBee offers a secure, non-custodial cryptocurrency payment gateway with easy-to-install plugins and a powerful API. Get started for free today and see how simple accepting crypto can be.