Mastering Ecommerce Payment Gateway Integration

Integrating a payment gateway is how you connect your online store to a payment processor so you can actually get paid. Think of it as the digital cash register for your e-commerce site. But it's more than just a technical hookup; getting it right creates a smooth, trustworthy checkout experience that can make or break a sale.

Why Seamless Payment Integration Drives Growth

A clunky checkout doesn't just annoy customers—it actively sends them running to your competitors. That’s why you have to stop seeing ecommerce payment gateway integration as just another IT task. It's a core business strategy. A flawless payment process builds instant trust and removes friction right when it matters most.

The moment a customer hits "buy now," any little hiccup can plant a seed of doubt. A confusing form, a slow-loading page, an unexpected error—these are the moments that kill sales. On the flip side, a fast and intuitive payment flow reassures them they made the right choice and that your brand is professional and secure.

Slash Your Cart Abandonment Rates

The effect on abandoned carts is both immediate and easy to see. Nothing screams "untrustworthy" louder to a shopper than a complicated or sketchy-looking payment page. By integrating a clean, professional gateway like BlockBee, you get rid of those red flags.

This simplified process tells customers their financial data is in good hands, which is often all the encouragement they need to finalize their purchase. For a deeper dive, our guide on https://blockbee.io/blog/post/how-to-reduce-cart-abandonment offers more practical tips to keep your customers on track.

Boost Conversions and Build Lasting Trust

At the end of the day, every tweak to your checkout is aimed at boosting conversions. A seamless integration helps you do this in a few key ways:

- Fewer Steps: Less clicking and typing means less chance for a customer to get distracted or frustrated and leave.

- More Choices: Offering various payment methods, including a range of cryptocurrencies, lets customers pay how they want to pay.

- Rock-Solid Reliability: A gateway that processes payments instantly and without errors prevents the nightmare of failed transactions and the support tickets that follow.

A frictionless payment experience isn't just a nice feature anymore; it’s a basic expectation. I've consistently seen that merchants who invest in a smooth checkout process see a direct and positive impact on their conversion rates, customer loyalty, and ultimately, their bottom line.

This is exactly why the global ecommerce payment gateway market is on track to hit $161 billion by 2032, growing at a staggering 20.5% each year. It’s a clear sign of just how vital these systems are for any business selling online.

To give you a clearer picture, here's how a well-thought-out integration can directly affect your business metrics.

How Strategic Integration Impacts Your Bottom Line

This table breaks down the tangible business benefits of investing in a high-quality payment gateway integration, offering a quick snapshot for merchants.

| Key Benefit | Direct Business Impact | Metric You Can Measure |

|---|---|---|

| Reduced Friction | Fewer shoppers abandon their carts at the final step. | Cart Abandonment Rate (%) |

| Increased Trust | Customers feel more secure sharing their payment info. | Conversion Rate (%) |

| Faster Checkout | A quicker process leads to more completed sales. | Average Time to Purchase (minutes) |

| Higher Approval Rates | Fewer legitimate transactions are mistakenly declined. | Transaction Success Rate (%) |

| Improved Loyalty | A positive experience encourages repeat business. | Customer Lifetime Value (CLV) |

As you can see, the benefits go far beyond just a simple technical setup; they translate into real, measurable growth for your store.

When you're ready to improve your own checkout, it’s worth your time to compare various payment gateways to find one that truly fits your business. Platforms like BlockBee are built specifically to solve these common merchant headaches, turning a potential weak spot into a powerful advantage. This kind of strategic thinking is what separates the thriving e-commerce stores from the ones that never quite figure out why their carts are always half-full.

Preparing Your Store for Crypto Payments

Before you even think about touching a line of code or installing a plugin, you need to lay the groundwork. Think of this as your pre-flight check for a smooth ecommerce payment gateway integration. Getting these foundational pieces right from the start will save you a ton of headaches down the road and ensure your crypto payment system is both secure and efficient.

First things first, you’ll need a BlockBee account. It’s a quick sign-up, but this account is your command center for everything crypto-related, from managing your API keys to checking your transaction history.

Once you’re in, the next move is to generate your API keys. These keys are what let your e-commerce store talk to the BlockBee network. Treat them like the keys to your digital vault—keep them safe, secure, and never, ever share them publicly.

Strategically Selecting Your Cryptocurrencies

It’s tempting to enable all 70+ coins BlockBee supports, but more isn't always better. You need to think like your customers. Are they mostly holding big names like Bitcoin (BTC) and Ethereum (ETH), or are they more interested in altcoins with lower fees and faster transactions, like Litecoin (LTC) or Monero (XMR)?

A little strategy here goes a long way. I always suggest clients consider a few key things:

- Who are your customers? A tech-focused audience might expect a wide range of altcoins, but a more general customer base will likely only recognize the major players.

- What are you selling? For smaller, everyday purchases, using coins with low network fees and quick confirmation times is just a better customer experience. Nobody wants to pay a $10 fee for a $15 t-shirt.

- What does your brand stand for? The coins you accept can say a lot. For example, supporting privacy coins can be a huge plus for customers who value discretion.

Making a smart choice here cleans up your checkout process and shows you understand your target audience. You can always expand your offerings later based on what your customers are actually using.

Getting the initial setup right is more than just a technical exercise; it's about aligning your payment options with your business strategy. A well-configured callback URL, for example, is the difference between an order being automatically confirmed and a customer service ticket waiting to happen.

Configuring Your Callback URL for Reliability

Now for what I consider the most critical, and most frequently overlooked, part of the setup: the callback URL. A callback (or webhook) is simply how BlockBee tells your store, "Hey, this payment just went through!" Without this crucial signal, your system has no idea when to change an order's status from "pending" to "paid."

Trust me, an incorrectly configured callback URL is the number one cause of integration issues. It’s what leads to those frustrating moments where a customer has paid, but their order is stuck in limbo because your store never got the memo. This creates a terrible experience for them and a manual fix for you.

To get this right, you absolutely must double-check that the URL you enter in your BlockBee dashboard is correct and publicly accessible. It needs to point directly to the part of your website that’s listening for these payment notifications.

Nailing this step is what makes the whole system automated and seamless. As soon as a payment is confirmed, the customer gets their order confirmation, and you can get to work on shipping. For a deeper dive into the whole process, our guide on how to add crypto payments to your website step-by-step walks you through everything.

Alright, let's get down to the nitty-gritty of connecting BlockBee to your online store. This is where the magic happens—moving from theory to a live, working crypto payment option for your customers. Thankfully, you won't need to write a single line of code. BlockBee has ready-made plugins for giants like WooCommerce and Magento, which makes the whole process surprisingly straightforward.

This isn't about generic advice; it's a hands-on guide designed to walk you through the exact steps for your platform, so you can start accepting crypto payments quickly and confidently.

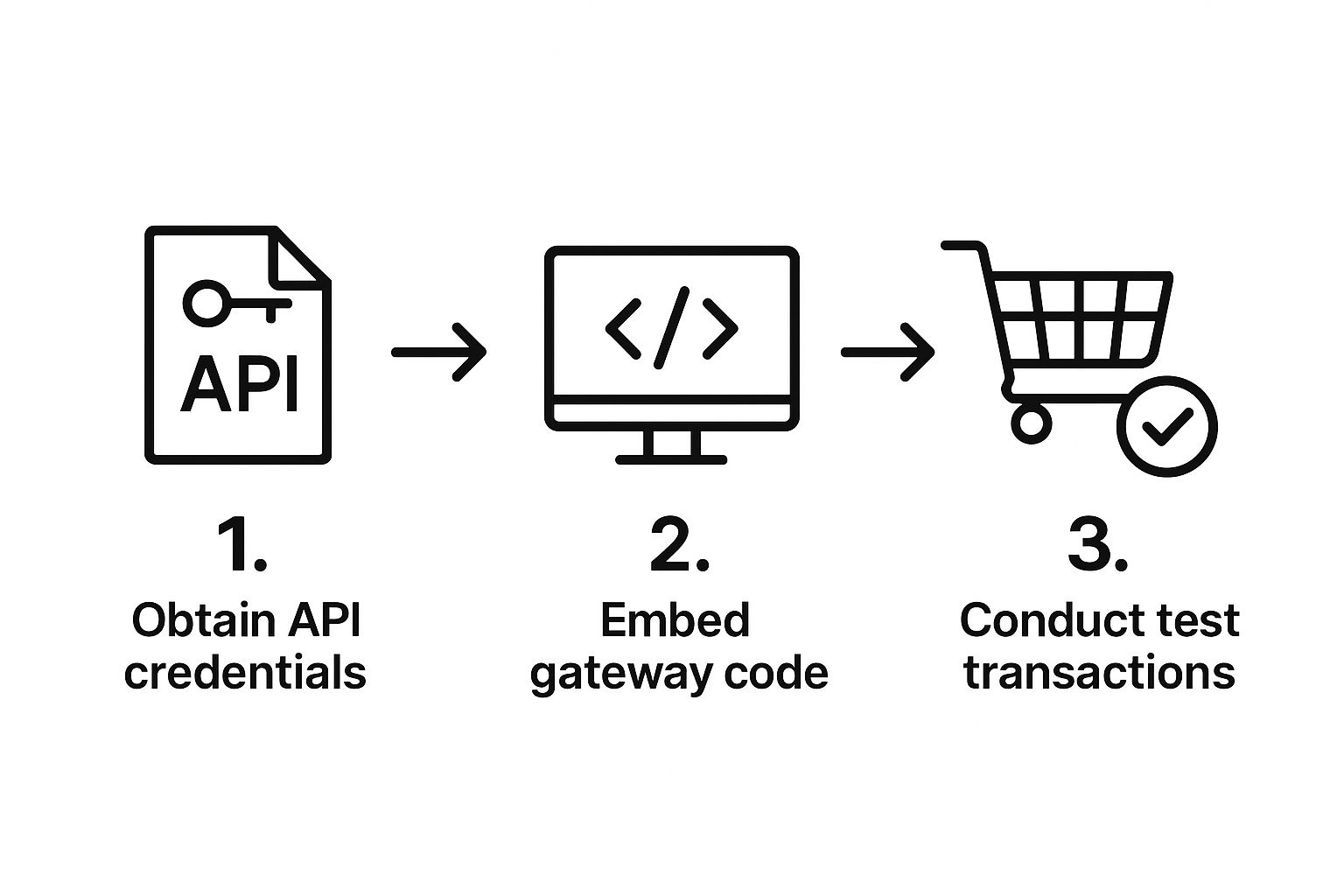

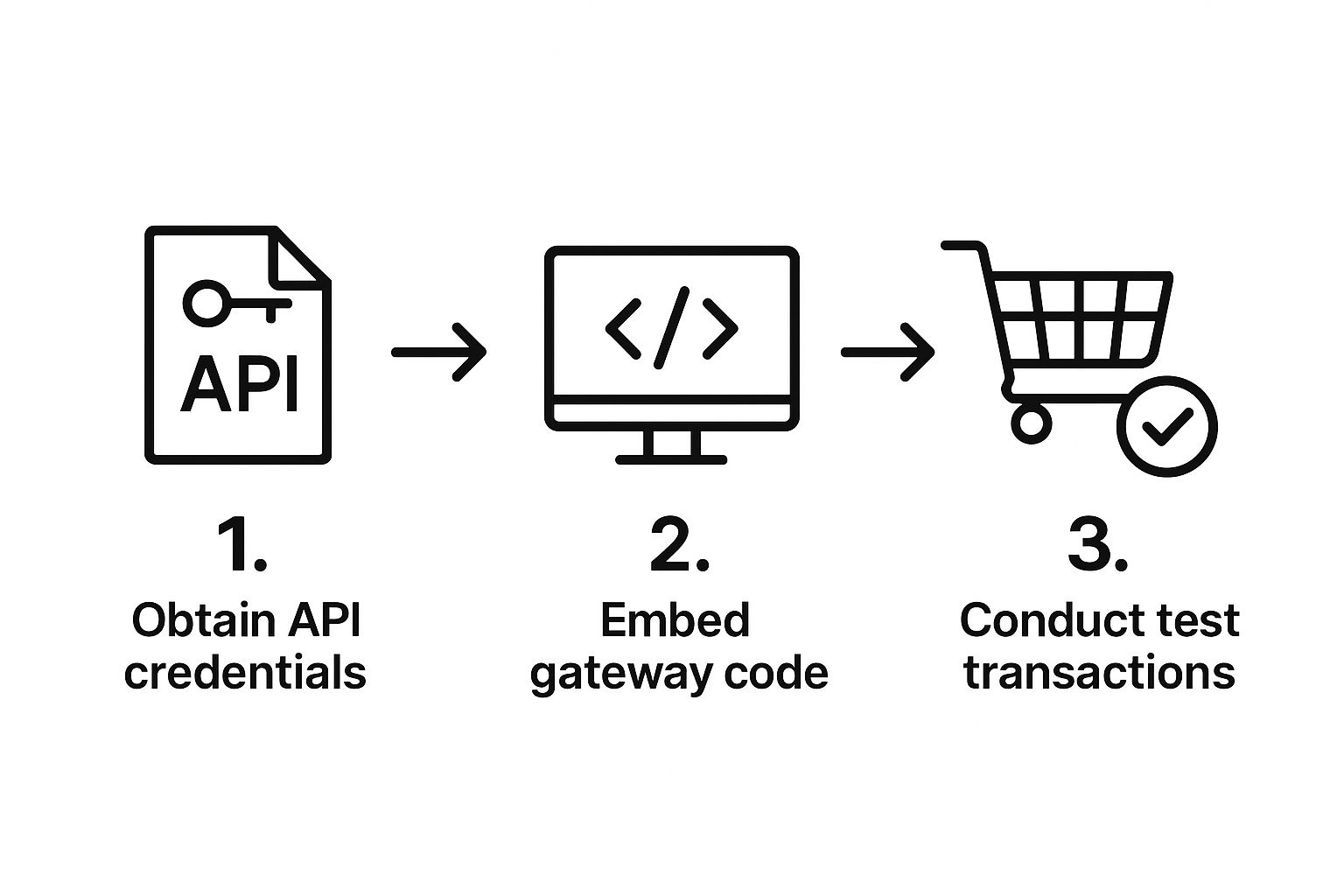

To give you a bird's-eye view, the process of integrating any payment gateway generally follows the same core path. This visual breaks it down nicely.

Think of it as a roadmap: get your credentials, plug in the gateway, and run some tests. This is the basic framework for a successful setup, no matter the platform.

Getting Started with WooCommerce

For the millions of shops running on WordPress, the BlockBee for WooCommerce plugin is your express lane to accepting crypto. If you’ve ever installed a WordPress plugin before, you’ll feel right at home.

You can grab the official plugin from the WordPress repository or download it straight from the BlockBee site. Once it's installed and activated, you’ll see a new "BlockBee" option under WooCommerce's payment settings. This is where you’ll drop in the API key you generated earlier.

I’ve worked with many businesses selling digital goods, like e-books or software licenses, where instant delivery is everything. For them, you can configure the plugin to automatically change the order status to "Completed" as soon as BlockBee confirms the payment. This means your customers get their downloads immediately, with zero manual work on your end.

Configuring Your Magento Storefront

Magento is a powerhouse known for its flexibility, and integrating BlockBee is no different. There’s a dedicated extension for Magento 2 that brings the full suite of crypto processing features directly into your store's admin panel.

After you install the extension (either via Composer or by uploading the files), you’ll find the configuration panel under Stores > Configuration > Sales > Payment Methods. This is where you’ll enter your API key and dial in your payment preferences.

Now, imagine you're shipping physical products. Your needs are completely different from a digital seller. You could set up the integration to:

- Update Order Status: Automatically flip the order to "Processing" once payment is confirmed.

- Notify Your Team: Send an automated email to your fulfillment crew to kick off the packing and shipping process.

- Handle Invoicing: Instantly generate and send a "Paid" invoice to the customer.

This kind of automation, all handled within the Magento admin, is a huge time-saver and seriously cuts down on the potential for human error.

Leveraging Pre-Built Solutions

One of the best things about BlockBee is its massive library of pre-built integrations. This means you’re not starting from scratch, whether you’re on a major platform or a more niche solution.

The screenshot below gives you a glimpse of just a few of the officially supported platforms, which also include names like PrestaShop, OpenCart, WHMCS, and Odoo.

This broad support really shows BlockBee's commitment to making crypto payments accessible to pretty much any business out there.

The real power of a plugin-based integration is speed. I’ve seen merchants go from having no crypto payment option to accepting their first Bitcoin transaction in under an hour. This rapid deployment minimizes disruption and gets you to your ROI that much faster.

Best Practices for a Smooth Plugin Integration

While plugins make life easier, following a few best practices will ensure your ecommerce payment gateway integration is rock-solid from day one. These tips are universal, whether you're using WooCommerce, Magento, or something else.

First, and I can't stress this enough, do your setup on a staging site. A staging site is a private copy of your live store where you can test things without any risk. It lets you iron out all the wrinkles before your customers ever see it.

Next, be meticulous with your API key and callback URL. A single typo can bring everything to a halt. Always copy and paste the API key directly. For the callback URL, make sure it’s the exact URL provided in the plugin’s instructions.

Finally, run a few test transactions with tiny amounts. Process a payment, see how a refund works, and make sure the order statuses are updating correctly in your admin dashboard. Confirming this entire flow gives you the peace of mind to flip the switch and go live.

Customizing Payments with the BlockBee API

While our ready-made plugins are fantastic for getting you up and running quickly, sometimes an "out-of-the-box" solution just won't cut it. Your business might have unique needs, a custom-built storefront, or a payment flow that doesn't fit a standard mold.

This is exactly where a direct integration using the BlockBee API becomes your most powerful tool. It hands you the keys to build a completely bespoke checkout experience, giving you total control.

When an API Integration Makes Sense

Choosing to build with the API instead of grabbing a plugin isn't just a technical decision—it's a strategic one. You're essentially trading the simplicity of a plugin for near-limitless flexibility. From my experience, this is the right path in a few common scenarios.

You'll want to go the API route if:

- You have a custom-built storefront. If your e-commerce site isn’t built on a common platform like WooCommerce or Shopify, a pre-built plugin simply won’t exist. The API is your bridge to connect BlockBee's power to your unique codebase.

- You need complex subscription logic. Imagine a service where billing changes based on usage, or you have tiered plans with dynamic pricing. An API lets you programmatically handle these intricate payment requests and verifications with precision.

- You're building a marketplace. If you need to split payments between multiple vendors, manage complex commission structures, or automate payouts, the API provides the granular control you need to build a reliable system from the ground up.

The real beauty of an API-driven integration is that you’re no longer limited by someone else’s design. You can build a checkout experience that’s a perfect extension of your brand and is tailored specifically to how your customers want to pay.

As blockchain payment gateways become more mainstream, features like real-time processing and AI-driven fraud detection are setting new standards. These systems offer lower transaction costs and greater transparency, which is a huge draw for a growing base of tech-savvy consumers. A custom API integration puts you in the perfect position to take full advantage of these advancements.

Generating Payment Addresses Programmatically

The first core function you'll tackle is generating a unique payment address for every single order. This is a crucial step; it’s how you tie an incoming transaction on the blockchain directly to a specific customer's purchase in your system.

Let's walk through a real-world example. A customer is checking out and needs to pay 0.001 BTC. Your server-side code will make a quick call to the BlockBee API, asking for a new Bitcoin address just for this transaction.

Here’s a simplified PHP snippet that shows how this works in practice:

// Your API Key and Callback URL $apiKey = 'YOUR_BLOCKBEE_API_KEY'; $callbackUrl = 'https://yourstore.com/callback.php'; $coin = 'btc';

// Construct the API request URL $requestUrl = "https://api.blockbee.io/{$coin}/create/?callback=" . urlencode($callbackUrl) . "&apikey={$apiKey}";

// Make the request and get the response $response = file_get_contents($requestUrl); $data = json_decode($response, true);

// Extract the payment address $paymentAddress = $data['address_in'];

// Display this address to the customer echo "Please send your payment to: " . $paymentAddress;

This code fires off a request to BlockBee, which instantly returns a freshly generated Bitcoin address. Your job is to display this paymentAddress on the checkout page, along with the amount due. For a deeper dive, our guide on payment gateway API integration breaks it down even further.

Verifying Transactions and Handling Callbacks

Okay, so the customer has the address and sends their crypto. What's next? Your system needs to know the payment was successful. This is where your callback URL comes into play.

As soon as BlockBee detects the transaction on the blockchain, it sends a notification—what we call a "callback"—to the URL you provided earlier.

Your callback script then has a critical job: it must verify that this notification is legitimate and then update the order status in your database. This is a non-negotiable security step. You have to validate the data to be certain it came from BlockBee and wasn't spoofed.

Your callback handler should run through a few key checks:

- Verify the Secret Key: Make sure the callback contains a secret key that matches the one you set up in your BlockBee dashboard. This confirms its origin.

- Check Payment Status: The callback data will include a status. You'll want to check if the payment is fully confirmed.

- Validate the Amount: Did the customer send the exact amount? Cross-reference the amount received with what was expected for the order. This is vital for properly handling underpayments or overpayments.

A truly robust system is built to handle the unexpected. What if a customer only sends half the required amount? Your API integration should be smart enough to recognize this partial payment, perhaps notify the customer of the error, and wait for the remaining balance before you mark the order as complete. This is the kind of fine-tuned control that only a custom API solution can offer.

Managing Crypto Payments After You Go Live

Getting your ecommerce payment gateway integration up and running is a fantastic first step, but the real journey starts now. Your focus shifts from setup to the daily rhythm of managing your new crypto payment system. This is all about creating a smooth, secure, and sustainable operation for both you and your customers.

That first crypto payment hitting your wallet is a thrill, but it's the smooth experience after the sale that builds real trust. This means having solid processes for keeping an eye on transactions, helping customers with their questions, and keeping your books in order.

Effective Transaction Monitoring

Think of your BlockBee dashboard as your mission control. It's a good habit to check it daily. You can watch payments come in, see their confirmation status on the blockchain, and make sure everything lines up perfectly with the orders on your e-commerce platform.

This hands-on approach lets you catch small snags before they turn into customer headaches. For example, if you notice a payment is confirmed on the blockchain but the order in your shop hasn't updated, you can jump on it right away. More often than not, this points to a tiny hiccup with the callback URL configuration that's easy to fix.

This kind of vigilance is more important than ever. In 2025 alone, global payment transactions through e-commerce gateways reached a staggering $2.78 trillion—a 16.4% increase from the year before. With mobile payments accounting for 51% of that volume, a well-oiled payment system is non-negotiable. If you're curious, you can dive deeper into these payment gateway statistics to see just how big the opportunity is.

Providing Stellar Customer Support for Crypto Users

Once you open the door to crypto, you’re going to get new kinds of questions. Customers will wonder about blockchain confirmation times or why their transaction says "pending." Getting your support team ready to answer these questions with confidence is essential.

Here are a few common situations you'll want to prepare for:

- "Why is my payment taking so long?" Your team should be ready to explain that confirmation times can vary depending on the coin and how busy the network is. The best move is to show them how to use a block explorer, giving them a link to track their transaction themselves.

- "I sent the wrong amount." Decide on a clear policy ahead of time for underpayments and overpayments. Will you issue a partial refund? Or will you ask the customer to send the remaining balance?

- "Is this secure?" This is your chance to reassure them. Talk about the security measures you have in place and briefly explain the built-in security of blockchain technology.

Being able to answer crypto-specific questions confidently is a massive trust-builder. It shows customers you’re not just jumping on a bandwagon; you're genuinely invested in providing a great payment experience. You can turn a moment of confusion into a positive interaction that strengthens your brand.

Wallet Security and Record-Keeping Best Practices

BlockBee is a non-custodial service, which means your funds are always in your control. That freedom comes with the responsibility of securing them. Following wallet security best practices isn't just a suggestion—it's critical.

For any significant amount of funds, use a hardware wallet. And turn on two-factor authentication (2FA) on every account that offers it.

When it comes to accounting, be meticulous. Regularly export your transaction data from both the BlockBee dashboard and your e-commerce platform. This paper trail is invaluable for bookkeeping, tracking your revenue, and making tax time much less painful. A simple spreadsheet logging the date, order ID, crypto amount, and its fiat value at the time of sale will save you a world of trouble down the road.

Wrestling with Payment Integration Questions? You're Not Alone.

Even the most straightforward integration can leave you with a few lingering questions. That's perfectly normal. Let's tackle some of the most common ones we hear from merchants setting up their crypto payments. Think of this as a quick-reference guide to help you smooth out the final wrinkles in your setup.

We'll get straight to the point on the practical issues that often come up both during and after you go live, so you can handle them with confidence.

How Long Until a Crypto Payment is Actually Confirmed?

This is the big one, and the honest answer is: it really depends on the coin and how busy its network is at that moment.

A Bitcoin (BTC) transaction, for example, could take anywhere from 10 to 60 minutes to be fully confirmed. On the other hand, a payment on a faster network like Litecoin (LTC) or TRON (TRX) often wraps up in just a couple of minutes. The good news is that BlockBee watches the blockchain for you and pings your store the second the required confirmations are hit, so your order status gets updated automatically.

It's a smart move to manage customer expectations right on the checkout page. A simple message like, "Heads up: Crypto payments are confirmed on the blockchain, which can take a few minutes," can save you a mountain of support emails.

What if a Customer Doesn't Send the Full Amount?

Underpayments happen more often than you'd think. Maybe a customer mis-typed the amount or forgot to account for a network fee. How you deal with this moment is key to keeping them happy.

BlockBee will still log the transaction, but the notification it sends to your system will clearly show that the amount received is less than what was due. Your store won't automatically flag the order as paid.

This puts the ball in your court, giving you a few solid options:

- Reach out directly: The simplest path is often to just contact the customer and ask them to send the difference to the same wallet address.

- Set up an automated alert: If you're building a deeper API integration, you could trigger an automatic email to the customer explaining the underpayment and what to do next.

- Cancel and refund: Sometimes, it’s just cleaner to refund the partial payment and have the customer start a fresh transaction.

My advice? Figure out your internal policy for handling these before one happens. This way, your support team has a clear playbook and can offer a consistent, professional solution every time, turning a potential hiccup into a smooth recovery.

Can I Refund a Crypto Payment?

Absolutely, but it's not a one-click process like voiding a credit card charge. Cryptocurrency transactions are final and can't be reversed once they're on the blockchain.

To process a refund, you'll need to create a brand new transaction from your wallet back to the customer. This requires getting a destination wallet address from them first. You'll also need a policy for handling price volatility—do you refund the exact crypto amount they sent, or its dollar value at the time of the refund?

Managing refunds manually like this gives you full control and a clear paper trail for your records.

Ready to build a flexible and secure crypto payment experience? With BlockBee, you get robust tools, a developer-friendly API, and dedicated support to make your ecommerce payment gateway integration a success. Explore our features and get started today!