Best Payment Processors for Small Business

When you're trying to pick the best payment processor for your small business, it often feels like you're juggling simplicity, cost, and features. The big names like Square, PayPal, and Stripe are popular for a reason—they offer fantastic all-in-one solutions. At the same time, newer players like BlockBee are opening up exciting possibilities for accepting cryptocurrency.

Ultimately, the best choice really boils down to your unique business, your sales channels, and where you see yourself growing.

Choosing Your Financial Partner for Growth

Selecting a payment processor is so much more than a simple technical setup. You’re essentially choosing a core partner for your business's financial health. Think of it as the central nervous system for your money, managing every single dollar that flows from a customer's click to your bank account.

This guide is designed to cut through the noise and confusing jargon. We'll focus on what actually matters when you're evaluating the best payment processors for a small business like yours.

A good partner can seriously improve your cash flow, build that all-important trust with your customers, and scale right alongside you. The payment technology industry is exploding—it's projected to nearly triple from $61.1 billion in 2023 to a staggering $147 billion by 2032. That tells you just how critical this piece of your business puzzle is.

In fact, around 72% of small businesses now see their payment processing company as a primary partner for managing financial services. That really drives home how vital this decision is. You can dig deeper into these payment processing industry statistics to see what they could mean for your own strategy.

Your Decision-Making Roadmap

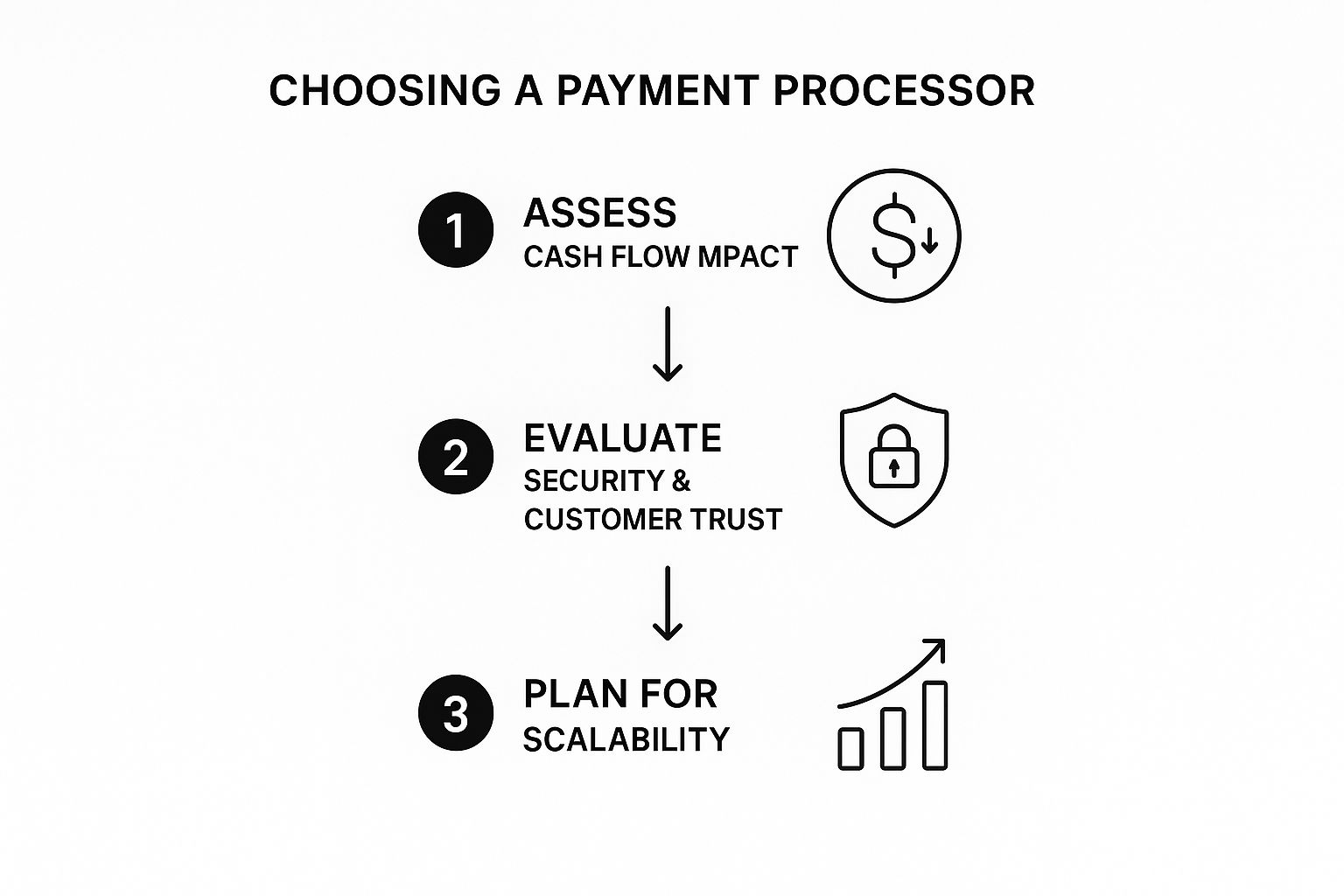

Our goal here is to help you feel confident in picking a partner that not only secures your transactions but actively helps you grow. To make this easier, we can break down the decision-making process into three core stages.

This visual guide walks you through the key steps, from figuring out your immediate needs to planning for what's next.

As the infographic shows, a smart decision isn't just about the fees you pay today. It’s about understanding the long-term impact on customer trust and your ability to scale up without headaches. When you’re selecting a payment gateway for your small business, you have to give all these factors equal weight.

A payment processor shouldn't just be a utility; it should be a growth engine. The right system reduces friction for your customers and provides you with the financial clarity needed to make smarter business decisions. It’s a foundational choice that impacts everything from customer satisfaction to operational efficiency.

How Payment Processing Actually Works

So, what really happens when a customer taps their card or clicks "Buy Now"? It feels instant, but behind the scenes, a rapid-fire sequence of events kicks off. Think of your payment processor as the high-speed messenger making sure everyone involved—from the customer's bank to yours—gets the right information securely.

It acts as the crucial link between your business and the vast financial networks of giants like Visa and Mastercard. This whole journey, from the customer’s click to the money hitting your account, is a marvel of speed and security. Let's pull back the curtain.

The Four Key Players in Every Transaction

Every single time a card is used, there are four essential parties working in concert. Knowing who's who helps you understand exactly how money finds its way from your customer's wallet into your business account.

- The Merchant: That's you and your business. You're the one selling the product or service.

- The Customer: The person making the purchase, also known as the cardholder.

- The Issuing Bank: This is the customer's bank (like Chase or Citi) that issued their credit or debit card.

- The Acquiring Bank: This is your business bank, the one that takes in the payment on your behalf.

The payment processor is the technology that allows all these players to talk to each other safely and in real-time. It connects your checkout page or card reader to the entire financial system.

At its heart, a payment processor's job is to authorize, verify, and settle the transaction. It checks if the customer has the funds, screens for fraud, and makes sure the money gets transferred correctly.

The Journey of a Single Payment

Let's follow the money. When a customer pays, your payment processor zips an authorization request over to their issuing bank.

In just a couple of seconds, the customer's bank checks for sufficient funds or credit and sends back a simple "yes" or "no." Once you get the green light, the processor lines up the final step: settlement. This is when the actual funds are moved from the customer's bank to your business account, which usually takes 1-3 business days.

This whole process relies on two core components: the payment gateway and the merchant account. For a more in-depth look, check out the complete definition of a payment platform in our detailed guide.

Critical Factors for Comparing Processors

Choosing the right financial partner can feel overwhelming, but it really boils down to just a few key areas. When you're trying to find the best payment processor for your small business, a clear, systematic approach is your best friend. It helps you cut through the marketing noise and focus on what actually impacts your daily operations and, most importantly, your bottom line.

Think of it like buying a car. You wouldn't just glance at the sticker price, right? You'd dig into the fuel efficiency, potential maintenance costs, safety ratings, and whether it actually fits your family. A payment processor is no different—its true value is hidden in the details, not the single rate they advertise.

Let's walk through the essential checklist for making a smart decision. To get started, you can gain a deeper understanding of payment processing to build a solid foundation.

Decoding Transaction Fees and Pricing Models

Honestly, the most confusing part for most business owners is the fee structure. A super-low advertised rate can easily hide a dozen other costs that quietly eat away at your profits. Getting a handle on the three main pricing models is the first real step toward clarity.

Comparing Payment Processor Fee Structures

Understanding how you'll be charged is crucial. Most processors use one of these three models, and the right one for you depends entirely on your business's sales volume and transaction types.

| Pricing Model | How It Works | Best For |

|---|---|---|

| Flat-Rate Pricing | You pay a single, predictable percentage plus a small fixed fee for every transaction (e.g., 2.9% + 30¢). No surprises. | New businesses or those with lower monthly sales volume who need predictable, easy-to-understand costs. |

| Interchange-Plus Pricing | This transparent model passes the direct wholesale cost from card networks (the "interchange") to you, then adds a fixed markup. | Established businesses with higher sales volume, as it often results in the lowest overall processing costs. |

| Tiered Pricing | Transactions are grouped into different rate "tiers" (e.g., qualified, non-qualified). It's often complex and can be less transparent. | This model is rarely the most cost-effective and can lead to unexpected high fees for certain card types. |

At the end of the day, what matters is the total cost.

The real cost of payment processing isn't just the percentage you see upfront. It's the total amount you pay after all fees—interchange, assessments, and processor markups—are calculated. Always ask for a full fee schedule.

Essential Integrations and Hardware Needs

A payment processor should slot right into your existing business workflow, not create more work. If it doesn't play nice with the tools you already use, it's probably not the right fit.

Think about it: does it integrate smoothly with your accounting software like QuickBooks? That connection alone can save you hours of mind-numbing data entry. If you're running an online store, you'll need a seamless plugin for platforms like Shopify or WooCommerce. This kind of connectivity keeps everything in sync, from the moment of sale to your final financial reports.

For brick-and-mortar businesses, the hardware is just as critical. Your needs might be as simple as a mobile card reader for selling at a local market, or you might need a full-blown point-of-sale (POS) terminal for your retail counter. Make sure the processor offers reliable, user-friendly, and affordable hardware that actually matches how and where you do business.

Security and Support When You Need It Most

When it comes to payments, trust is everything. Your processor absolutely must be PCI compliant, which is the non-negotiable industry standard for protecting sensitive customer card data. A compliant processor takes on the heavy lifting of security, shielding your business from the catastrophic risk of a data breach.

Finally, don't forget the human element. What happens when a transaction fails during your busiest hour on a Saturday? That’s when you’ll be thankful for solid customer support. Look for processors that offer 24/7 help through multiple channels—like phone, chat, and email—so you know someone has your back the moment you need it.

Top Payment Processor Reviews for Small Business

Now that we’ve covered the fundamentals, let's look at some of the top players in the game. Finding the best payment processors for small business isn’t about picking the most popular one; it's about matching a provider’s strengths to how you actually run your business.

What works for a local coffee shop will likely be a terrible fit for a global e-commerce brand, and vice-versa.

This breakdown will walk you through the industry leaders, highlighting who they’re built for. We’ll cover the go-to options like Stripe and Square before diving into modern solutions like BlockBee, designed for businesses ready to step into the future of payments.

Stripe for Online and Developer-First Businesses

Stripe has pretty much become the gold standard for any business that lives and breathes online, especially if you have a developer on hand or love to tinker. Think of it less as a plug-and-play tool and more like a powerful payment engine you can fine-tune to fit your exact business model.

It's a favorite for tech-savvy owners because its APIs allow for incredibly deep integrations. Stripe really hits its stride with:

- Customizable Checkouts: You can build a payment experience that feels like a natural part of your brand, not a clunky third-party add-on.

- Global Reach: It easily handles payments in over 135 currencies, making it simple to sell to customers anywhere in the world.

- Subscription Management: If you run on recurring revenue, Stripe’s tools for managing subscriptions are second to none.

The flip side? All that power can feel a bit overwhelming for total beginners who don't have technical help.

Square for In-Person and Hybrid Retail

Square is a fantastic all-in-one solution, and it truly shines for businesses with a physical footprint, whether that's a storefront, a market stall, or a pop-up shop. Its biggest strength is how seamlessly its hardware, software, and payment processing work together. No duct-taping different systems together.

It's the perfect choice for retailers, cafes, and service providers who need one unified system to run their entire operation. Square’s standout features include:

- Free POS Software: The point-of-sale app is incredibly intuitive and packed with features for ringing up sales, tracking inventory, and managing customer lists.

- Simple Pricing: The predictable, flat-rate fees are a lifesaver for new businesses trying to get a handle on their costs.

- Versatile Hardware: From a tiny card reader that plugs into your phone to a full-blown cash register, Square has a hardware option for every setup.

Choosing between Stripe and Square often comes down to one question: Is your primary sales channel online or in-person? Stripe is built for the web, while Square excels at unifying physical and digital sales.

For a more detailed comparison of different platforms, this guide on the 10 best payment processing solutions for small businesses is a great resource.

PayPal for Brand Recognition and Trust

You’d be hard-pressed to find someone who hasn’t heard of PayPal. That global recognition is its superpower. When a customer sees the PayPal button, it builds instant trust, which can genuinely boost your checkout conversion rates.

It's an excellent, reliable option for e-commerce stores that want to give customers a familiar and fast way to pay. In fact, as of 2025, PayPal leads the global online payment processing market with a commanding 45% market share—a testament to its massive user base. You can discover more insights about online payment platforms on Statista.

BlockBee for Modern Crypto Payments

For businesses wanting to get ahead of the curve and slash transaction costs, accepting cryptocurrency is becoming a smart strategic move. BlockBee is a non-custodial platform that strips away the usual complexity, making it surprisingly simple to accept crypto payments.

Here’s a look at the BlockBee dashboard, which is designed to make managing crypto transactions straightforward.

The entire interface is built around clarity. Merchants can easily track payments and manage their funds without needing to be a blockchain expert. The key benefits are huge:

- Lower Transaction Fees: Since crypto payments don't go through traditional banking networks, the fees are often dramatically lower. You can see how they stack up in our payment gateway fees comparison.

- No Chargebacks: Blockchain transactions are final. This completely eliminates the risk and headache of fraudulent chargebacks that can plague online businesses.

- Instant Settlement: The money goes directly to your wallet. Instantly. This is a massive improvement to cash flow, skipping the typical 1-3 day waiting period for bank settlements.

BlockBee is a fantastic fit for businesses with a global customer base or those selling digital products, where fast, secure, and low-cost transactions are everything.

Future-Proof Your Business with Crypto Payments

https://www.youtube.com/embed/w-HDzwS52J0

Taking the plunge beyond credit cards and bank transfers might feel like a big step, but accepting cryptocurrency is quickly becoming a serious strategic advantage for small businesses. This isn't just a niche trend anymore; it's a practical way to slash operational costs and connect with a whole new wave of tech-savvy customers.

Think of it like opening a new, faster lane on the financial highway.

For anyone selling to customers around the globe, crypto payments are a game-changer. They completely sidestep the usual headaches of international transactions—no more surprise cross-border fees or frustrating delays while different banking systems try to talk to each other. Payments arrive directly and efficiently, which can do wonders for your cash flow.

Taming Volatility and Making it Easy

Of course, the first thing most business owners worry about is the infamous price volatility of crypto. It’s a totally valid concern. Luckily, modern payment processors have built-in solutions to handle it. A good crypto processor acts as a shield, protecting you from the market's ups and downs.

For example, a processor like BlockBee can instantly convert any crypto payment you receive into your preferred local currency, like USD or EUR. This means you get the exact amount you charged, every single time. You pocket all the benefits of crypto with none of the risk from price swings.

This kind of automatic conversion turns what sounds complex into a simple, secure transaction. It lets you tap into a global market of crypto users who are actively searching for places to spend their digital assets.

The Real-World Perks of Accepting Crypto

So, what does this actually mean for your business? Integrating crypto payments offers some very real advantages that can directly boost your bottom line and make your operations smoother. This is about making smarter financial decisions, not just about being trendy.

Here’s a breakdown of what you stand to gain:

- Dramatically Lower Fees: Crypto transactions don't rely on the traditional card networks, so the processing fees are significantly lower. This can add up to huge savings over time, especially as your sales grow.

- Zero Chargebacks: Blockchain transactions are final. This completely wipes out the risk of fraudulent chargebacks, a common and expensive headache for anyone selling online.

- Instant Access to Your Money: Forget waiting days for payments to settle. Crypto funds are sent right to your digital wallet, giving you near-instant access to your revenue and a major boost to your cash flow.

Ultimately, choosing one of the best payment processors for small business that supports crypto, like BlockBee, is a move that prepares you for where commerce is headed. It’s a practical step that cuts costs, tightens security, and opens your doors to a growing global economy.

So, How Do You Make the Final Call?

Alright, you've done the homework. You've peeked behind the curtain of transaction fees and compared some of the heavy hitters in the payment processing world. Now comes the moment of truth: pulling it all together to pick the right partner for your small business.

This isn't just about choosing a popular brand. It's about finding a processor that fits your business like a glove. The right choice will hum along quietly in the background, making your life easier and keeping customers happy. The wrong one? It can create daily friction, unexpected costs, and headaches you just don't have time for.

Your Decision-Making Checklist

To cut through the noise and make a choice you feel good about, run through these final questions. Be honest with your answers—they'll point you directly to the best fit.

Where does the money actually change hands? Are you 100% online? Do you run a brick-and-mortar shop? Or maybe you do a bit of both at local markets and through your website? Your answer will determine if you need a top-notch e-commerce gateway, a slick POS system, or a flexible, all-in-one solution.

What software can’t you live without? Make a list of the tools you already depend on, like your accounting software, inventory manager, or CRM. Your new payment processor absolutely must play nice with them. Otherwise, you’re signing up for a world of manual data entry and reconciliation nightmares.

What’s the real cost per transaction? Forget the flashy advertised rate for a second. Pull out a calculator and figure out the total cost based on your average sale price and monthly volume. Don't forget to factor in any monthly fees, hardware costs, or other little charges that can add up.

Will this processor grow with you? Think about where you want your business to be in five years. Do you have dreams of selling internationally, launching a subscription box, or opening another location? Make sure your chosen partner can support that vision without forcing you to switch providers down the line.

Making a thoughtful choice here is a big deal, especially when you look at the big picture. The payment processing market in the U.S. was valued at a massive $47.42 billion in 2024, and it's expected to explode to $306.38 billion by 2034. By picking a partner who’s ready for the future, you’re making sure your business is, too. You can discover more insights about payment processing solutions on Precedence Research.

Got Questions? We've Got Answers

Stepping into the world of payment processing can feel a little confusing at first. Let's tackle some of the most common questions that pop up, so you can feel totally confident in your choice.

What's the Difference Between a Merchant Account and a Payment Processor?

Think of a merchant account as a special kind of bank account, almost like a secure holding area. When a customer pays you with a card, the money lands here first before it gets moved over to your regular business bank account.

The payment processor is the company that makes the whole transaction happen. It's the go-between, securely carrying the payment information from your customer's bank, through the card network (like Visa or Mastercard), and finally to your merchant account. These days, all-in-one solutions like Stripe or Square bundle both of these services together, which makes life a lot easier for small business owners.

How Fast Will I Actually Get Paid?

This can vary, but the standard waiting time is usually around 1 to 3 business days. For a small business, knowing when your money will arrive is a huge part of managing cash flow.

Many of the top processors now offer faster options like next-day or even instant deposits, which can be a lifesaver. Just keep in mind they sometimes charge a small extra fee for the speed. On the other hand, if you're looking for nearly immediate access to your funds, crypto payments handled by services like BlockBee often settle in minutes, not days.

Do I Really Have to Worry About PCI Compliance?

Yes, but it's not as scary as it sounds. The best part is that a good payment processor does most of the heavy lifting for you.

PCI DSS (which stands for Payment Card Industry Data Security Standard) is a non-negotiable set of security rules designed to protect your customers' card details.

When you use a processor that's already compliant and stick to their approved hardware and software, you're essentially handing off the biggest security headaches. They're the ones responsible for protecting the sensitive data on their secure systems, which dramatically lowers your risk and what you need to manage.

Ready to offer your customers more ways to pay while cutting down on transaction fees? BlockBee makes accepting cryptocurrency simple and secure, opening you up to a global audience. Get started with our easy-to-integrate payment solutions at https://blockbee.io.