Payment Platform Definition Your Business Needs to Know

Let's break down what a payment platform really is. Forget the complex jargon for a moment. Think of it as the central nervous system for your business's financial transactions. It's the digital infrastructure that securely connects your customer's payment method to your bank account, handling all the complicated steps in between.

So, What Is a Payment Platform?

At its heart, a payment platform is the invisible engine that powers modern commerce. From the second a customer hits the "Buy Now" button to the moment the money lands in your account, the platform is working hard behind the scenes. It communicates with banks, credit card networks like Visa and Mastercard, and multiple security layers to make sure every single payment is processed safely and efficiently.

This isn't just a simple tool for taking money. It’s a complete solution built to manage the entire payment journey. Instead of trying to patch together different services for processing, security, and managing funds, a good platform bundles everything into a single, seamless package.

Having a solid system like this is no longer a luxury—it's a necessity. The global digital payment market was valued at USD 114.41 billion and is expected to soar to USD 361.30 billion by 2030. That's a massive shift in how people buy things, and businesses need a reliable way to keep up.

To get a clearer picture of how these platforms work, let's look at the essential functions they perform. The following table breaks down the core roles a payment platform plays in every transaction.

Core Functions of a Payment Platform at a Glance

| Function | What It Does for Your Business |

|---|---|

| Transaction Authorization | Checks with the customer's bank to ensure they have enough funds to complete the purchase. |

| Data Security | Encrypts sensitive information like credit card numbers to protect against fraud and data breaches. |

| Fund Settlement | Manages the transfer of money from the customer's account, through the networks, and into your business account. |

| Reporting & Analytics | Provides detailed reports on sales, transaction volume, and customer trends to help you make smarter decisions. |

As you can see, a payment platform does a lot more than just move money from point A to point B. It’s a comprehensive system designed to secure and simplify your entire sales process.

The Key Components Working Together

To really understand what a payment platform is, you need to know its main parts. A great starting point is understanding payment processors like those used by Shopify, as they form the core of these systems. Typically, a platform combines a few critical services:

- Payment Gateway: This is the secure, customer-facing part of the puzzle. Think of it as your digital cash register. It’s the online checkout page or the physical card reader that captures payment details.

- Payment Processor: This component is the messenger. It securely shuttles the transaction data between your gateway, the customer's bank, the card network, and finally, your bank. It does all the heavy lifting to get approvals.

- Merchant Account: This is a special kind of bank account required for businesses that accept card payments. It temporarily holds the funds from a transaction after it's approved and before they are officially transferred to your primary business bank account.

A payment platform is not just a piece of software; it's a foundational business partner that enables growth, builds customer trust, and secures your revenue streams from end to end.

How a Payment Platform Actually Works

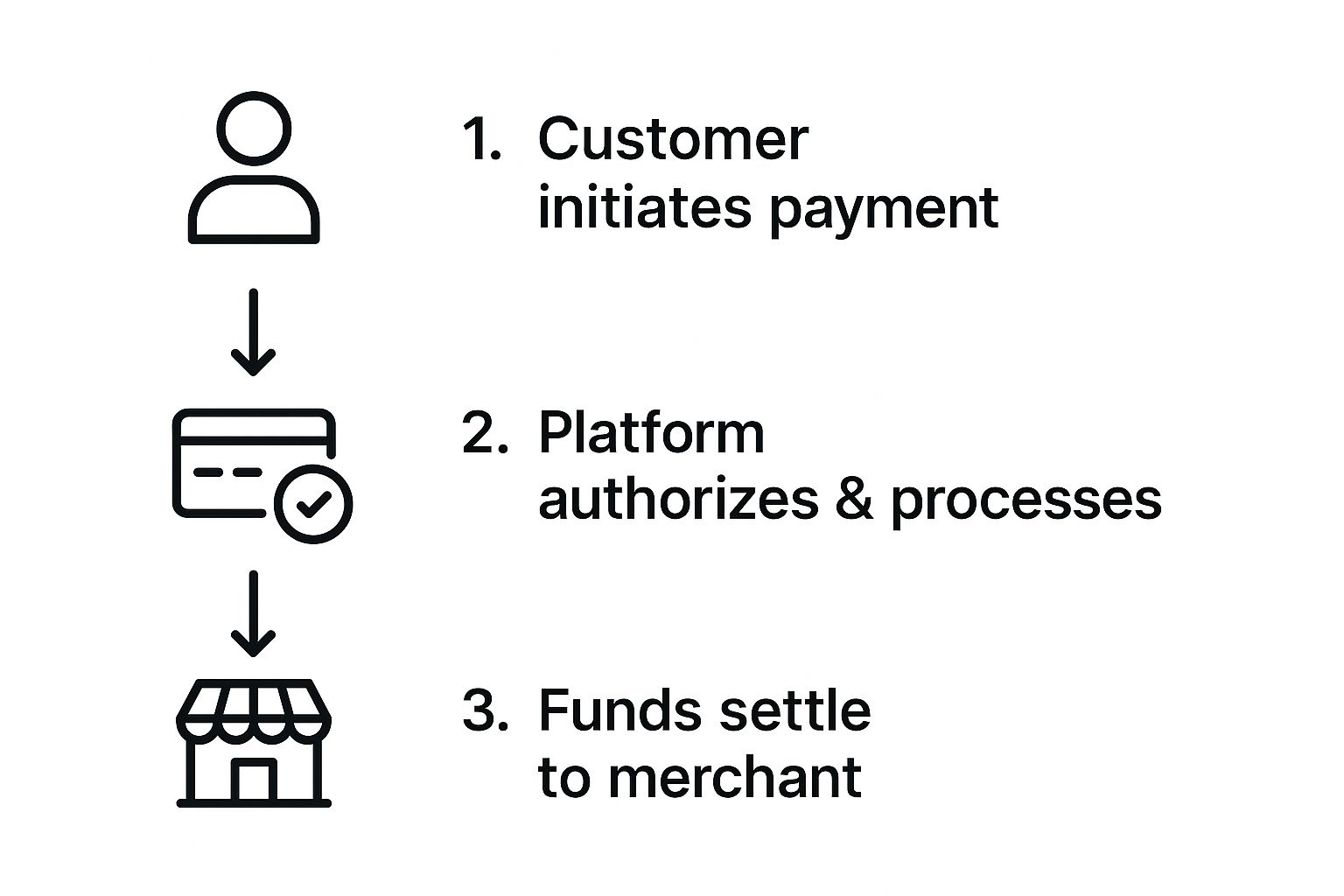

So, what happens behind the scenes when a customer hits "buy"? It's easy to think of a payment platform as a single tool, but it’s more like a highly coordinated team working in perfect sync. In just a few seconds, a whole series of events kicks off to move money securely from your customer to you.

Let's break down the key players on this team.

The Core Components in Action

First up is the payment gateway. Think of this as the digital version of a high-tech cash register. When a customer types in their card details online or taps their card at a terminal, the gateway is the first point of contact. Its main job is to securely grab that sensitive information, encrypt it, and send it down the line. It's your front-line security, making sure payment data is locked down from the very start.

Next, the gateway passes the encrypted data to the payment processor. This is the armored truck of the financial world. The processor's role is to shuttle the transaction details between all the necessary parties—the customer’s bank, the credit card networks (like Visa or Mastercard), and your bank. It’s the processor that officially asks, "Does this person have the funds?" and waits for the green light.

Once the transaction gets a thumbs-up, the money doesn't just appear in your business account. It first lands in a merchant account, which is a special kind of bank account built specifically to hold funds from card payments. After a short holding period for everything to clear—usually a couple of business days—the money is finally settled and transferred into your primary business bank account.

This whole sequence—authorization, processing, and settlement—is the backbone of virtually every transaction. It might sound complicated, but it all happens in the blink of an eye from the customer's perspective.

As you can see, the platform’s job is to manage this entire flow so it feels seamless. For a deeper dive into the technical side, you can explore more about how payment gateway API integration works to see how these systems are connected. It's this efficiency that has fueled incredible growth; the global payment processing market, valued at USD 173.38 billion, is expected to soar to USD 914.91 billion by 2034.

Key Takeaway: The real magic of a payment platform is that it bundles the gateway, processor, and merchant account into a single, cohesive service. This orchestration is what turns a complex financial process into a simple, reliable tool for business owners.

Seeing Payment Platforms in Action

It’s one thing to know the technical parts of a payment platform, but it’s another to see it all come together. These platforms are the invisible engines powering our daily lives, from grabbing a morning coffee to paying for a streaming service. Their whole purpose is to make buying and selling feel completely seamless.

So, let's follow a simple online purchase to see exactly what happens behind the curtain.

From Cart to Confirmation: A Customer's Journey

Picture this: you've found the perfect pair of headphones online. You punch in your credit card details, hit "Pay Now," and in the blink of an eye, the payment platform kicks into gear.

- Locking Down Your Data: First, the payment gateway acts like a digital armored truck. It instantly encrypts your card details, scrambling them into a secure code that’s useless to anyone trying to intercept it.

- Getting the Green Light: Next, the payment processor takes that encrypted code and zips it through the card networks to your bank. Your bank quickly checks if you have the funds and, if all is good, sends back an approval signal.

- Confirming the Purchase: That approval signal travels all the way back to the website, which then shows you that satisfying "Payment Successful" message. The entire round trip often takes less than two seconds.

This incredible speed and security are powered by giants in the industry. Take Stripe, for example. It’s a dominant force, handling payments for a huge slice of the internet—it holds about 45% of the U.S. online payment processing market and supports over 1.31 million live websites.

Platforms like Stripe manage all the complex security and banking communication so that business owners don't have to. You can dive deeper into Stripe's role in the global economy to see just how big their footprint is.

At the end of the day, a great payment platform should be so smooth and reliable that the customer barely notices it’s there. It turns a complicated financial dance into a simple, trustworthy click of a button.

Why the Right Platform Is a Game Changer

Picking a payment platform is one of those decisions that feels technical, but it's actually a huge strategic move. It directly impacts how you grow, how much customers trust you, and how smoothly your business runs day-to-day. Think of it less like an expense and more like an investment that pays you back in multiple ways.

One of the biggest wins is security. A solid platform takes the headache of Payment Card Industry (PCI) compliance off your plate. These are the complex, non-negotiable security rules for handling credit card information. Getting this right protects you from catastrophic data breaches and shows customers you’re serious about their safety.

Then there's the checkout experience itself. We've all been there—a clunky, slow payment process makes you want to abandon your cart. A seamless platform makes paying fast and easy, which can seriously bump up your conversion rates and put more money in your pocket.

Unlocking Global Reach and Efficiency

A great payment platform does more than just process local payments; it tears down geographical walls. By supporting multiple currencies, you're suddenly open for business to a global audience. When customers see prices in their own currency, it removes a major point of friction and makes them far more likely to buy.

Better yet, integrating the platform with your other business tools connects all the dots. This means:

- Automated Reconciliation: Sales data flows right into your accounting and inventory software without you lifting a finger.

- Reduced Manual Entry: Say goodbye to tedious data entry and the costly human errors that come with it.

- Centralized Reporting: You get a single, clear picture of your company's financial health, no more piecing together different reports.

The right platform acts as a silent growth partner, handling the complex financial mechanics so you can focus on what you do best—building your business and serving your customers.

Of course, you also need to understand the costs. To get a clear idea of what you might pay, it's worth digging into a payment gateway fees comparison to see how different providers stack up. In the end, it’s not just about taking money; it’s about doing it securely, efficiently, and on a global scale.

The Rise of Cryptocurrency Payments

The way we handle money is changing, and fast. Digital currencies like Bitcoin aren't just for tech enthusiasts anymore; they're becoming a serious part of the global economy. For businesses that want to stay ahead of the curve, this shift has sparked the need for a new kind of payment platform—one that connects the world of traditional finance with digital assets.

Enter the crypto payment gateway. Think of it as the missing link that makes accepting cryptocurrencies just as easy as swiping a credit card. You don't need a PhD in blockchain to get started. Pioneers in this space, like BlockBee, are designed to manage all the heavy lifting behind the scenes, so you can focus on running your business.

Here’s a glimpse at how simple the BlockBee dashboard is for merchants.

This clean interface is a perfect example of how the right platform can take a complex process and make it completely straightforward.

Why Merchants Are Making the Switch

Adopting crypto isn't just about looking modern—it's a smart business move with real, tangible benefits. Integrating a crypto payment option immediately opens your doors to a global, tech-forward customer base that actively prefers to pay with digital assets.

But the appeal goes way beyond reaching new customers. Let's talk numbers. Credit card companies often take a 2-3% cut from every sale. Crypto transactions can slash those fees significantly. Even better, they completely eliminate the problem of chargebacks, a notorious headache and revenue drain for online businesses. Once a crypto transaction is confirmed, it's final. That means more security and predictability for your bottom line.

By cutting out the middlemen, cryptocurrency payments create a more direct, secure, and affordable way to do business. It's not just another payment option; it's a strategic tool for growth.

To really understand the difference, let’s compare the old and the new side-by-side.

Traditional Payments vs Crypto Payments via BlockBee

The table below breaks down the key distinctions between conventional payment systems and a modern crypto gateway like BlockBee. It highlights exactly where businesses can gain an edge.

| Feature | Traditional Payment Platforms | Crypto Payments (with BlockBee) |

|---|---|---|

| Transaction Fees | Typically 2-3% per transaction, plus other potential fees. | Significantly lower fees, often a fraction of traditional rates. |

| Chargebacks | A common risk, leading to revenue loss and disputes. | Eliminated. All transactions are final and irreversible. |

| Global Reach | Can be restricted by regional banking and currency conversion. | Borderless. Accept payments from anyone, anywhere in the world. |

| Settlement Time | Can take several business days for funds to clear. | Near-instantaneous. Funds are available much faster. |

| Security | Relies on centralized systems vulnerable to data breaches. | Decentralized and cryptographically secure, reducing fraud risk. |

| Customer Base | Limited to customers with traditional bank accounts/cards. | Opens access to a growing global market of crypto users. |

This comparison makes it clear: integrating crypto payments isn't just an alternative, it's an upgrade. It provides a more efficient, secure, and cost-effective way to operate in a digital-first world.

If you're ready to tap into these benefits and future-proof your business, a great first step is to learn more about the specifics of accepting cryptocurrency payments.

Common Questions About Payment Platforms

When you start digging into what a payment platform really is and how it could fit into your business, a few questions always seem to pop up. It's natural. Let's walk through some of the most common ones to clear up the confusion and help you feel confident about finding the right fit.

Payment Gateway vs. Payment Platform: What’s the Real Difference?

This is probably the biggest point of confusion for most people. Is a gateway the same as a platform? Not quite.

Think of a payment gateway as the engine in a car. It's the powerful, secure component that does one specific job very well: it encrypts a customer's card details and safely sends them off for approval. It’s essential, but it can't get you anywhere on its own.

A payment platform, on the other hand, is the entire car. It’s the complete package that includes the engine (the gateway), the transmission (the payment processor), the anti-theft system (fraud protection), and the registration (your merchant account)—all working together as one seamless system.

How Do These Platforms Keep My Data Safe?

Security is, without a doubt, a top concern. You're handling sensitive customer and business information, so how do these platforms lock it all down? It's a multi-layered approach.

The foundation for any reputable platform is PCI DSS compliance. This is a non-negotiable set of rigorous security standards for any business that handles credit card information. But the protection goes much deeper.

- Tokenization: This is a clever process that swaps out a customer's actual card number for a unique, randomly generated "token." If a data breach ever happened, hackers would only get a handful of useless tokens, not valuable financial data.

- Encryption: From the second a customer hits "pay," their information is scrambled into unreadable code. It stays that way as it travels from their browser to the payment network, making it gibberish to anyone trying to intercept it.

- AI Fraud Detection: Modern platforms have gotten incredibly smart. They use advanced algorithms to watch transactions in real-time, learning your normal sales patterns. If a strange or suspicious payment comes through, the system can flag or block it instantly, stopping fraud before it ever happens.

A great payment platform isn't just a tool for taking money. It's your digital bodyguard, constantly on patrol to protect your customers and your bottom line.

Can I Use the Same System for My Website and My Store?

Absolutely. This is one of the biggest advantages of today's platforms. Business owners often worry about juggling separate systems for their online sales and their in-person transactions, but that’s no longer a concern.

Modern payment platforms are built to be "omnichannel," meaning they unite all your sales channels under one roof. Companies like Square or Stripe offer everything from sleek card readers for your countertop to the software that powers your e-commerce checkout. The best part? All that data flows into a single dashboard, giving you a complete, real-time picture of your business's financial health.

Ready to bring that same level of security and convenience to the world of crypto? BlockBee gives you a simple, non-custodial platform that keeps you in full control. Check out our features and see just how easy it is to start accepting cryptocurrency payments.