Choosing a Payment Gateway for Small Business

Getting paid online should be a straightforward part of running your business, but let's be honest—navigating the options can feel like a maze. At its core, a payment gateway for small business is your digital cash register. It’s the behind-the-scenes tech that securely connects your website to your customer's bank, making online sales happen.

Think of it as the critical link in your entire sales process. Without it, there's no way to move money from your customer's pocket to yours.

Why Your Business Needs a Payment Gateway

Every online store has an unsung hero, and it's usually the payment gateway. While you're busy perfecting your products and marketing your brand, this technology is working 24/7 to make sure you get paid safely and on time. It’s no longer just a nice-to-have feature; it's the engine for your e-commerce growth, customer trust, and healthy cash flow.

Trying to run an online business without a solid payment gateway is a recipe for abandoned carts, fraud headaches, and a frustrating experience for your customers. On the flip side, the right gateway can be a game-changer.

- You'll make more sales. When you offer a variety of ways to pay—credit cards, digital wallets like Apple Pay, and even cryptocurrency—you meet customers where they are. Fewer people will drop off at the last second because their preferred payment method is missing.

- You'll build trust. A professional, secure checkout page sends a powerful message: "Your information is safe with us." That confidence is often the final nudge a customer needs to click "buy."

- You'll save time. The gateway automates everything from authorizing the payment to transferring the funds. That means less time spent chasing invoices and more time spent growing your business.

The Numbers Don't Lie

The move to digital payments isn't just a trend; it's a massive, permanent shift in how we do business. The global payment gateway market was valued at around USD 35.17 billion in 2024 and is expected to soar to USD 152.26 billion by 2032.

And who's driving this growth? Small and medium-sized businesses like yours, which make up roughly 45% of the market share. You can dive deeper into the data on the global payment gateway market to see the full picture. These figures make it clear: a reliable gateway isn’t just about keeping up, it’s about setting your business up for the future.

A payment gateway doesn't just move money. It builds the seamless, trustworthy experience that turns a first-time visitor into a repeat customer.

Choosing the right partner for this is a foundational business decision, one that directly affects your profit margins, operational workload, and customer happiness. This guide will walk you through everything you need to know—from the absolute basics to the finer points of integration—so you can make the right choice with confidence.

How a Payment Transaction Actually Works

Ever wonder what happens in that split second after a customer clicks "Buy Now"? It seems like magic, but it’s actually a lightning-fast, highly secure dance between several financial players. Think of a payment gateway for a small business as the project manager of this whole operation.

It’s the digital equivalent of a secure courier who speaks the language of your website, your customer's bank, and your own business bank account. The gateway's entire job is to securely package sensitive payment details, whisk them away for approval, and return with a simple "yes" or "no"—all in the blink of an eye. This is what makes the whole process feel so seamless and safe.

The Customer Kicks Things Off

The entire journey starts right at your checkout page. A customer finds something they love, heads to the cart, and enters their credit card details—the number, expiration date, and that little three or four-digit CVV code on the back.

The moment they hit that final purchase button, your website’s shopping cart wraps up this information in a tight, encrypted bundle. We're talking serious security here, typically using protocols like TLS (Transport Layer Security) to scramble the data so no one can intercept it. This encrypted package is then handed off to the payment gateway to begin its journey.

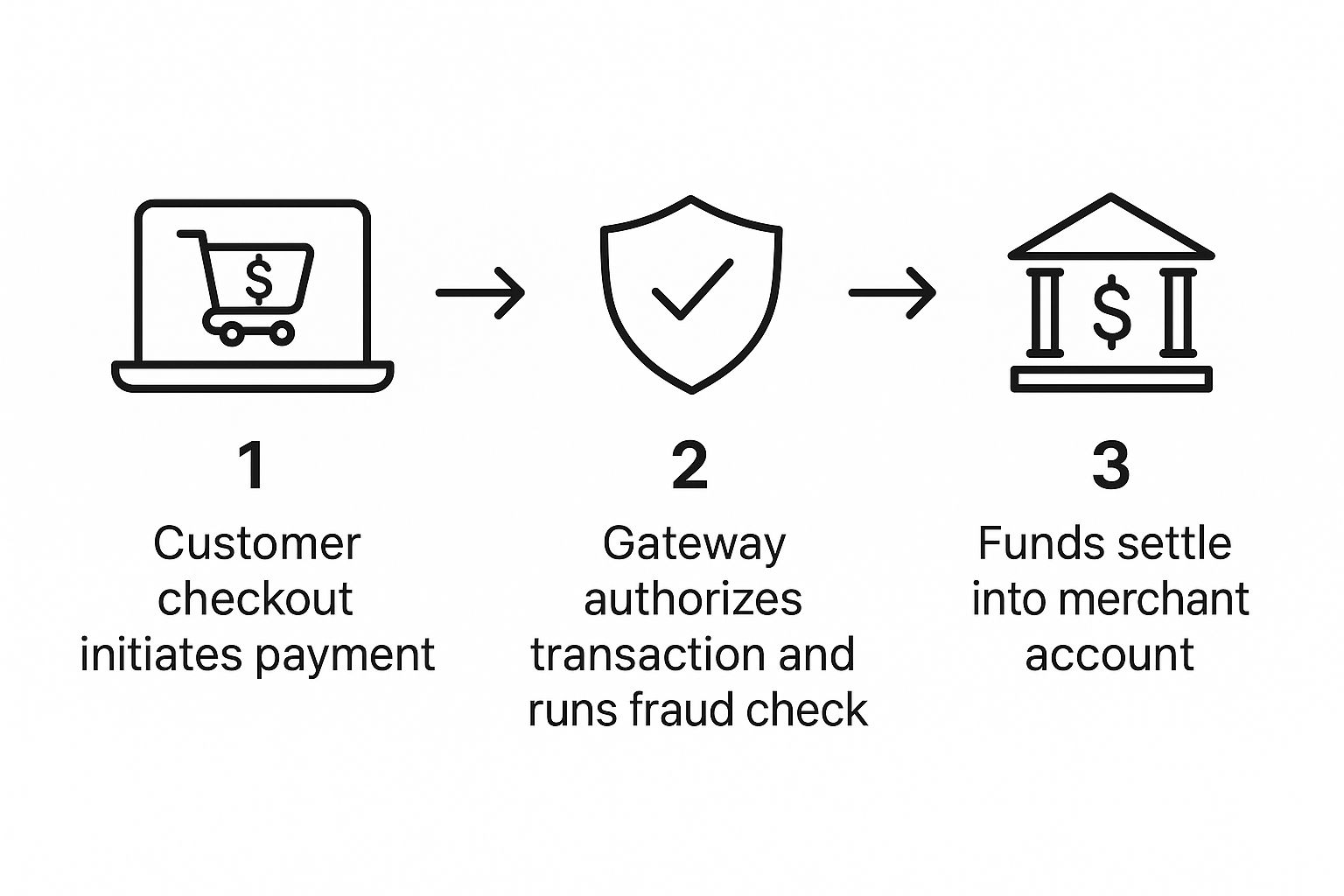

This visual shows the simple three-step flow, from the initial click to the final settlement.

As you can see, the gateway sits right in the middle, making sure everything is legitimate before any money actually changes hands.

Authorization and Verification in an Instant

This next part is where the real speed comes in, usually happening in just two or three seconds. The payment gateway shoots the encrypted data over to the payment processor. The processor then acts as a go-between, connecting with the major card networks like Visa or Mastercard.

From there, the request is routed to the customer's issuing bank—the bank that actually gave the customer their credit card. This bank is the one that has the final say. It runs a few critical checks in a flash:

- Funds Check: Does the customer have enough money or available credit?

- Security Check: Do the details line up? This is where AVS (Address Verification System) and CVV checks come into play.

- Fraud Analysis: Does this purchase look odd based on their normal spending habits or location?

Based on these checks, the issuing bank sends back an approval or denial code. That code zips back through the same chain: from the issuing bank to the card network, to the payment processor, and finally back to your payment gateway.

The gateway essentially acts as the ultimate translator, turning complex bank codes into a straightforward "Approved" or "Declined" message that both your website and your customer can understand.

This immediate response is what allows your site to show a confirmation screen and start preparing the order, even though the actual cash hasn't landed in your account just yet.

The Final Step: Settlement and Funding

While the approval felt instant, getting the money into your bank account—a process called settlement—takes a little more time. At the end of the day, your gateway gathers up all your approved transactions into a single batch and sends them off to the payment processor.

The processor then gets to work, arranging the fund transfers from all the different customer banks. The money moves from the customer's issuing bank over to your merchant bank (where you hold your business account). This final leg of the journey typically takes 24 to 72 hours. Once the funds arrive, the transaction is officially complete. This whole, intricate process is what makes secure online shopping possible.

Hosted vs. Integrated Gateways for Your Business

When you’re setting up online payments, one of the first big forks in the road is choosing between a hosted or an integrated gateway. They both get the job done—getting you paid—but they work in very different ways, and that difference has a huge impact on your customers' experience and your own workload.

To put it simply, think of it like this:

A hosted gateway is like buying a beautiful, fully-furnished model home. It's ready to move into, the security system is top-notch and already installed, and you don't have to worry about a thing. An integrated gateway is more like hiring an architect to design a custom dream home. You control every last detail, but it’s a bigger project that requires more expertise.

Neither one is universally "better." The right choice really comes down to what your business needs most right now: speed and simplicity, or total control and branding.

The Plug-and-Play Simplicity of Hosted Gateways

With a hosted gateway, when a customer clicks "Buy Now," they are gently redirected to a secure page hosted by the payment provider (think PayPal or Stripe Checkout). They enter their card details there, on a page they likely recognize and trust, and once the payment is complete, they're sent right back to your website.

This approach is a lifesaver for many small businesses for a few big reasons:

- Hands-Off Security: The gateway provider handles all the heavy lifting for security and PCI DSS compliance. Since you never handle raw credit card data on your servers, your risk is drastically lower.

- Lightning-Fast Setup: Getting started is usually a breeze. Most offer simple plugins that you can install in minutes, letting you accept payments almost immediately without needing to write a single line of code.

- Built-In Customer Trust: Seeing a familiar logo like PayPal can give shoppers the confidence they need to complete a purchase, especially if your brand is new.

This ease of use is a major reason why hosted solutions are so popular. In 2022, they generated a massive $15.34 billion of the $26 billion global payment gateway market. They remove a huge technical burden, which is exactly what you need when you're focused on growing your business.

The Power and Control of Integrated Gateways

An integrated gateway, which typically uses an API, keeps your customer on your website for the entire checkout process. They enter their payment information directly into a form on your site, creating a smooth, uninterrupted experience that feels completely part of your brand.

This method gives you a different, more powerful set of advantages:

- Complete Brand Control: You dictate the look and feel of every step. The checkout process becomes a seamless extension of your brand, not an interruption.

- Fewer Abandoned Carts: By keeping customers on your site, you eliminate that jarring redirect that can make some shoppers nervous and cause them to abandon their purchase. It's all about reducing friction.

- Ultimate Flexibility: APIs open the door to custom payment flows. This is perfect for businesses with unique needs, like subscription models, or those looking to offer a wide variety of payment methods. For any business, a seamless ecommerce platform integration is key to a professional customer experience.

This flexibility is especially crucial if you want to accept alternative payments. For instance, our guide on the https://blockbee.io/blog/post/best-crypto-payment-gateway explores options that often rely on this type of deep integration.

To make the decision clearer, let's break it down side-by-side.

Comparison of Hosted vs. Integrated Payment Gateways

This table highlights the fundamental trade-offs between the two approaches, helping you map your business priorities to the right solution.

| Feature | Hosted Gateway (e.g., PayPal Standard) | Integrated Gateway (e.g., Stripe API) |

|---|---|---|

| User Experience | Customer is redirected to a third-party site to pay. | Customer stays on your website for the entire checkout process. |

| Setup & Maintenance | Very easy, often just a plugin. Minimal technical skill needed. | Requires development work (API integration). More complex to set up. |

| Security (PCI) | Provider handles most compliance, greatly reducing your burden. | You share more responsibility for security and PCI compliance. |

| Branding & Control | Limited customization. Checkout page uses the provider's branding. | Full control over the look, feel, and flow of the checkout experience. |

| Conversion Rates | The redirect can sometimes lead to cart abandonment. | Generally higher, as the process is seamless and frictionless. |

| Best For | Small businesses needing a quick, simple, and secure solution. | Businesses that want to own the brand experience and need customization. |

Ultimately, the choice comes down to a simple trade-off: Hosted gateways offer convenience and peace of mind in exchange for less control, while integrated gateways provide a superior, fully-branded user experience at the cost of more complexity.

Think about your priorities. Is getting up and running quickly your main goal? Or is a perfectly polished, on-brand checkout a must-have for your customer journey? Your answer will point you straight to the right gateway for you.

What to Look for When Comparing Payment Gateways

Picking a payment gateway for your small business is a bit like choosing a business partner. You need someone you can trust, who’s upfront about the costs, and who can keep up as you grow. Forget the flashy marketing for a moment—the real decision comes down to the nuts and bolts.

Think of this as your essential checklist. Each point directly impacts your bottom line, your customers' experience, and your own sanity. Getting this right from the start means finding a system that works for you, not against you.

Let's dive into the four critical areas you need to scrutinize.

Transaction Fees and Pricing Models

First up: the cost. How much of every sale will you be handing over? Transaction fees can quietly chip away at your profits, so it's vital to understand how providers structure their pricing.

- Flat-Rate Pricing: This is the most straightforward model. You pay a set percentage plus a small, fixed fee per transaction (think 2.9% + $0.30). It’s predictable and perfect for businesses just starting out.

- Interchange-Plus Pricing: A little more complex, but often more transparent. This model passes the direct "interchange" fee from the credit card companies to you, plus a small markup from the processor. It can be a real money-saver as your sales volume increases.

Don’t just look at the advertised rate. Always demand a full fee schedule. You need to know about any potential monthly fees, chargeback penalties, or surcharges for international sales.

Hidden fees are the classic "gotcha." A low transaction rate might catch your eye, but it's worthless if you're also getting hit with charges for setup, support, or basic compliance.

Security and PCI Compliance

This one’s a deal-breaker. Your payment gateway is the digital vault protecting your customers' sensitive financial information. A security breach is more than just a headache; it can destroy your reputation and lead to crippling fines. This is where PCI DSS (Payment Card Industry Data Security Standard) comes into play.

PCI DSS is a strict set of security rules for any business that handles credit card data. The good news? A solid gateway, especially a hosted one, takes care of most of this for you. They spend millions on security so you don’t have to. When you're comparing options, make sure the provider is Level 1 PCI DSS compliant—that’s the highest standard there is.

Remember, the gateway is only one piece of the puzzle. It's crucial to ensure your entire website is secure, particularly if you're using WordPress. Following a comprehensive WordPress security checklist is a great way to lock down your site and protect customer data from all angles.

Accepted Payment Methods

Today's shoppers expect choices. Only offering one or two ways to pay is like turning customers away at the door. A modern payment gateway for a small business needs to support a wide range of options to capture every possible sale.

Make sure your choice covers these key areas:

- Credit and Debit Cards: This is the bare minimum. You need to accept all the major players: Visa, Mastercard, American Express, and Discover.

- Digital Wallets: Services like Apple Pay, Google Pay, and PayPal are no longer a novelty. They’re essential for fast, convenient checkouts, especially for mobile shoppers.

- Cryptocurrencies: Want to attract a global, tech-savvy audience? Accepting digital currencies like Bitcoin or Ethereum can give you a serious edge. Our guide on https://blockbee.io/blog/post/how-to-add-crypto-payments-to-your-website-a-step-by-step-guide can show you how to get started.

- Alternative and Local Methods: Depending on who you sell to, things like "Buy Now, Pay Later" (BNPL) plans or local bank transfer options can make a huge difference in your conversion rates.

The easier you make it for people to give you their money, the fewer abandoned carts you'll see. It’s that simple.

Seamless Platform Integration

Finally, your new gateway has to get along with the technology you already use. If your store runs on a platform like Shopify, WooCommerce, or Magento, the integration should be quick and painless.

Look for a provider that offers pre-built plugins or apps for your specific platform. This "plug-and-play" capability can save you a fortune in custom development costs and prevent a lot of technical headaches down the road. A smooth integration means your payment system talks directly to your inventory, order fulfillment, and accounting software, creating an automated and efficient workflow.

Top Payment Gateway Providers for Small Businesses

Picking the right partner to handle your money is a huge decision for your online store. With so many options out there, the trick is to find a payment gateway for a small business that really fits what you do—whether you need something that’s super easy to set up, offers endless customization, or lets you serve a global, tech-savvy audience.

To make things easier, I’ve broken down a few of the most trusted and effective players in the game. Each one has its own strengths, making them a great fit for different kinds of small businesses. Let's dig in and see which one could be right for you.

Stripe for Ultimate Customization

Think of Stripe as the gold standard for businesses that want total control over how their checkout looks and feels. It's built "API-first," which is just a fancy way of saying it's designed for developers to create a completely seamless payment process. Your customers never have to leave your site.

If you care a lot about a polished user experience and have the tech skills (or use a platform with a great Stripe integration), it's a fantastic choice.

- Best For: Businesses focused on a fully branded checkout, subscription models, and those with some development muscle.

- Key Features: Powerful APIs, amazing documentation, support for tons of payment methods (including digital wallets), and top-notch fraud protection tools.

- Pricing: The standard fee is 2.9% + $0.30 per successful online card transaction.

PayPal for Widespread Trust

Everyone knows PayPal. That household name is its biggest asset. When shoppers see the PayPal button, they instantly feel safer, which can do wonders for your conversion rates, especially when you're just starting out.

As a hosted gateway, it handles a lot of the security and setup for you. Customers are briefly sent to PayPal's secure site to pay, which means you have fewer PCI compliance headaches to worry about.

- Best For: New businesses that want to build instant credibility and get set up quickly.

- Key Features: High brand trust, easy integration with most e-commerce platforms, and solid buyer and seller protection policies.

- Pricing: Expect to pay 2.99% + $0.49 per transaction for sales within the US.

Square for Omnichannel Sellers

For businesses that sell both online and in-person, Square is the undisputed champ. Its real magic is its unified system—your online store, your physical shop, and your inventory all talk to each other and stay in sync.

If you run a cafe that also sells branded mugs online or a boutique that does pop-up markets, Square’s ability to connect everything is a lifesaver. It’s the perfect payment gateway for a small business with a physical presence.

- Best For: Retailers, restaurants, and service pros who juggle both online and offline sales.

- Key Features: Free point-of-sale (POS) software, integrated hardware like card readers, and one dashboard to see all your sales data.

- Pricing: Online transactions are 2.9% + $0.30, while in-person payments are a bit lower at 2.6% + $0.10.

The market for these tools is massive, especially in North America. In 2024, the U.S. payment processing solutions market was valued at an eye-watering USD 47.42 billion. With 69% of U.S. online adults regularly using digital payments, offering the right mix of options isn't just nice—it's essential. You can dive deeper into the growth of the payment processing market to see where things are headed.

BlockBee for Cryptocurrency Payments

Looking ahead? Accepting cryptocurrency is no longer a fringe idea; it’s a smart business move. BlockBee is a non-custodial gateway built to make crypto payments simple and secure, giving you a serious edge with a modern, global customer base.

The platform is all about direct wallet payouts and supporting a huge range of cryptocurrencies, giving merchants the control and flexibility they need.

Because it's non-custodial, the money goes straight into your own crypto wallet. No middleman holding your funds. You’re always in full control of your assets.

- Best For: E-commerce stores, SaaS companies, and any business with a global footprint looking to attract a modern audience and slash transaction costs.

- Key Features: Non-custodial payments (direct-to-wallet), support for over 70 cryptocurrencies, low fees, and simple plugins for platforms like WooCommerce and Magento.

- Pricing: Fees are clear and competitive, often providing a huge cost saving compared to traditional card networks.

Answering Your Top Questions About Payment Gateways

Diving into payment gateways can feel like learning a new language. As you get closer to choosing one for your business, a few last-minute questions are bound to pop up. That’s perfectly normal.

This section is all about clearing up that final bit of confusion. We'll tackle the most common questions and concerns small business owners have, giving you the confidence to make the right call.

What Exactly Is PCI Compliance?

You've probably stumbled across the term PCI DSS (Payment Card Industry Data Security Standard). It sounds complex, but the idea behind it is simple: it’s a set of security rules created by the major credit card companies to keep customer data safe. If you accept card payments, you have to play by these rules.

For a small business owner, that sounds like a massive headache. The good news? You don't have to handle it alone.

Modern payment gateways are built to take this burden off your shoulders. When you use a hosted solution like PayPal or an integrated one like Stripe Checkout, the customer’s sensitive card details are sent directly to their ultra-secure servers, completely bypassing yours. This one step drastically reduces your security risk and makes compliance much, much easier.

When you’re talking to potential providers, lead with this question: "Are you Level 1 PCI DSS compliant?" A confident "yes" means they meet the absolute highest standard of security. That’s your peace of mind, protecting both your customers and your business from a disastrous data breach.

Can I Use More Than One Payment Gateway?

Not only can you, but you probably should. Think of it less as an either/or decision and more as a smart business strategy. Offering a few different ways to pay isn't just a nice-to-have; it's a direct path to more sales.

For instance, you could use Stripe for all your standard credit card transactions, but also have PayPal as an option. Millions of people love the convenience of logging into their PayPal account and paying with a single click.

This multi-gateway approach gives you two huge advantages:

- Fewer Abandoned Carts: We've all done it—gotten to a checkout, not seen our preferred payment method, and just closed the tab. By offering multiple options, you catch those sales you would have otherwise lost.

- A Reliable Backup Plan: Tech has its bad days. If your main gateway goes down for an hour, having a second option ready means you can keep taking orders. You won't lose money because of a technical glitch that's completely out of your hands.

The only real trade-off is having to check a couple of different dashboards to track your money. For most businesses, that tiny bit of extra admin is well worth the boost in sales and the security of having a backup.

How Do I Start Accepting Cryptocurrency Payments?

The idea of accepting crypto can seem intimidating, but specialized gateways have made it incredibly simple, even if you know nothing about digital currencies. Services like BlockBee were designed from the ground up to make it accessible for anyone.

Getting started is surprisingly fast. You'll sign up for an account, get an API key (which is just a unique code that connects your website to the service), and then plug in the public addresses for your crypto wallets. That’s where the money goes.

From there, most providers offer simple plugins for e-commerce platforms like WooCommerce, Shopify, or Magento. You install the plugin, configure a few settings, and a crypto payment option magically appears at checkout. The gateway does all the heavy lifting—giving the customer a payment address, watching the blockchain for the transaction, and marking the order as paid.

If you're curious to see it in action, our guide on how to accept crypto payments for your business breaks down every single step.

What Are the Most Common Hidden Fees?

The transaction rate you see advertised is almost never the full story. To really understand what you'll be paying, you need to dig deeper and look for the little fees that can quietly drain your profits.

Make sure you ask every potential provider about these common extra costs:

- Monthly Fees: Some gateways charge you a flat fee every month just for having an account, whether you make a sale or not.

- Chargeback Fees: When a customer disputes a charge, you get hit with a fee—often $15 to $25—even if you ultimately win the dispute.

- International Fees: Selling to customers overseas? Expect to pay an extra 1-2% on top of the normal rate for cross-border payments and currency conversions.

- PCI Compliance Fees: Believe it or not, some companies will charge you an extra fee just for helping you stay compliant with the security rules.

- Statement Fees: You might even get dinged a few bucks a month just to receive your own financial statement.

Never take the headline rate at face value. A good, transparent provider will be upfront about all their costs, helping you avoid nasty surprises when your first bill arrives.

Ready to embrace the future of payments with a secure, flexible, and low-cost solution? BlockBee offers a non-custodial gateway that puts you in full control of your funds, supporting over 70 cryptocurrencies with seamless e-commerce integration. Get started with BlockBee today and give your customers the payment freedom they deserve.