What Is Token in Cryptocurrency? A Clear Explanation

A cryptocurrency token is a type of digital asset that's built on top of an existing blockchain, rather than having its own dedicated one. It's a subtle but crucial distinction.

Here's a simple way to think about it: if Bitcoin is like a US dollar that works on its own independent financial system, a token is like an arcade ticket. It's only valuable inside a specific arcade, where you can use it to play games or claim prizes. These tokens are designed to unlock features and represent value, but only within their own specific digital ecosystem.

What Defines a Crypto Token

At its heart, a token represents a particular asset or a specific use case, but it doesn't run on its own network. Instead, it "piggybacks" on the security and established infrastructure of a major blockchain, like Ethereum or Solana. This is the single biggest difference between tokens and "coins" like Bitcoin or Ether, which are the native currencies of their respective blockchains.

This design is incredibly practical. It allows developers to create new digital assets without shouldering the immense cost and technical headache of building a brand-new blockchain from scratch. As the crypto market has matured, the role of tokens has exploded. A 2025 crypto report from CoinGecko gives a great overview of just how much this space has expanded.

To really grasp how tokens and coins differ, let's break it down with a quick comparison.

Cryptocurrency Tokens vs Coins At a Glance

The table below highlights the fundamental distinctions between native blockchain coins and the tokens built on top of them.

| Characteristic | Coins (e.g., Bitcoin, Litecoin) | Tokens (e.g., UNI, SHIB, LINK) |

|---|---|---|

| Foundation | Operate on their own independent blockchain. | Built on an existing blockchain (like Ethereum). |

| Primary Role | Act as the native currency for network fees (gas) and store of value. | Represent a specific asset, utility, or right within an ecosystem. |

| Creation | Requires building a new blockchain, a complex and resource-intensive process. | Relatively simple to create using established smart contract standards. |

| Analogy | A country's official currency (USD, EUR). | A company's loyalty points or an event ticket. |

As you can see, while both are digital assets, their purpose and technical underpinnings are completely different. Coins are the foundation, while tokens are the applications built on that foundation.

Fungible vs Non-Fungible Tokens

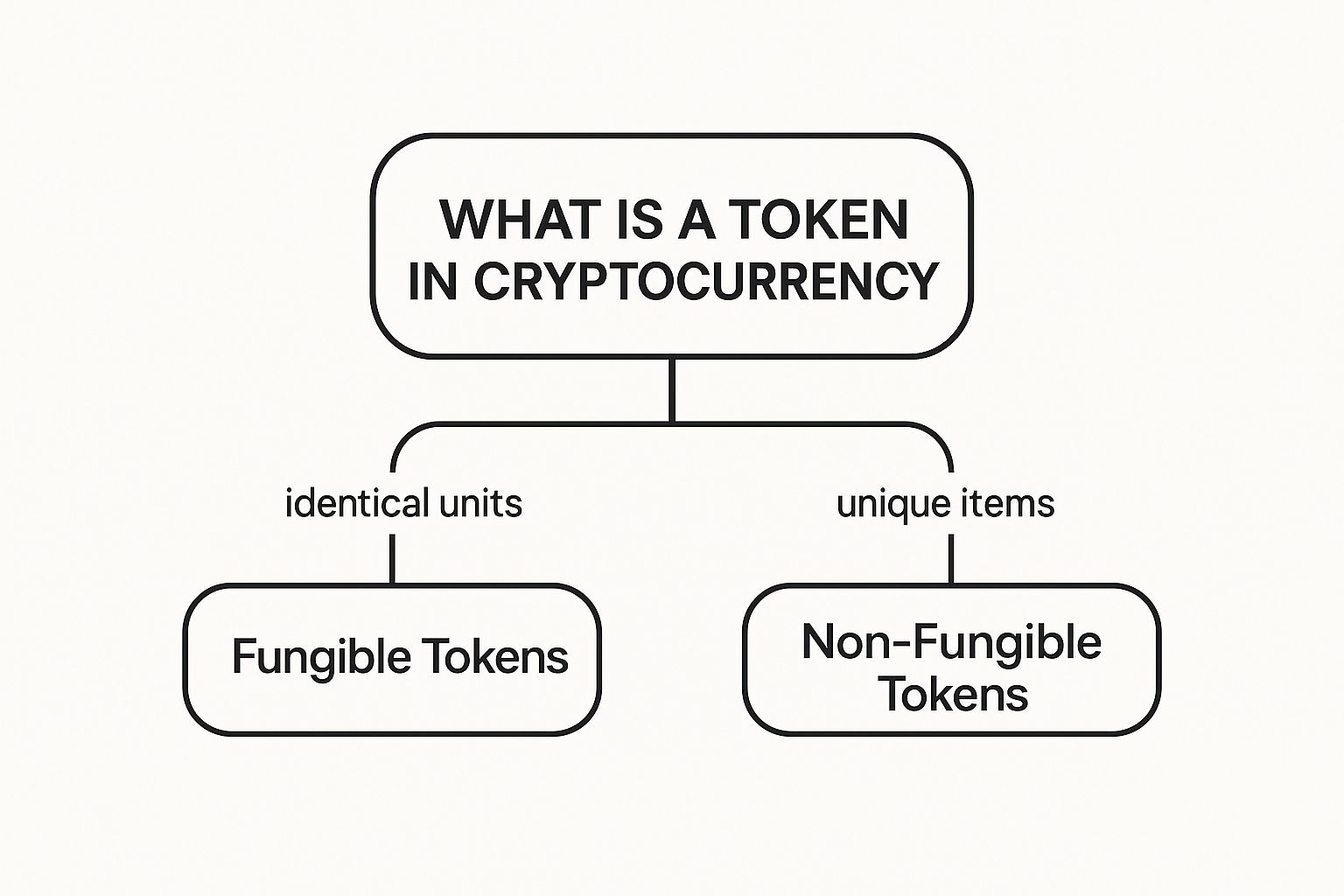

Tokens generally fall into two main buckets: fungible and non-fungible. Understanding this split is key to seeing their vastly different applications and how they derive their value.

- Fungible Tokens: These are interchangeable. Every unit is identical to the next. Think of it this way: one UNI token is exactly the same as any other UNI token, just like one dollar bill is the same as any other dollar bill. They are valued for what they are, not which one they are.

- Non-Fungible Tokens (NFTs): These are entirely unique and cannot be replaced with another. Each NFT acts as a digital certificate of ownership for a one-of-a-kind item, whether that's a piece of digital art, a specific plot of virtual land, or a rare in-game sword.

This visual helps break down the main difference between these two types of tokens.

The infographic shows that while both are tokens, their properties—being either identical or unique—completely dictate how they function. If you want to explore this further, our guide on what is a cryptocurrency token dives deeper into how they are reshaping digital interactions. This fundamental distinction is what opens the door to an incredible variety of applications on the blockchain.

How Tokens Actually Work on a Blockchain

You don't need to be a developer to get how tokens work. The whole system hinges on something called a token standard. Think of it as a shared blueprint or a set of rules that everyone on a specific blockchain agrees to follow. It’s a lot like a universal power adapter for an entire country; the standard guarantees that any new appliance (a token) can plug into any outlet (a wallet, exchange, or app) without a problem.

This shared framework is what allows thousands of different tokens to exist and interact seamlessly on a single network like Ethereum. Instead of every developer building their own little island, they all build according to the same rulebook. This ensures everything works together predictably, which is absolutely vital for a healthy digital economy.

Can you imagine the chaos without these standards? Every new token would need a custom-built wallet and specialized exchange integrations. It would be like every electronics brand creating its own unique power plug—nothing would be compatible.

The Rules of the Game: Token Standards

So, what do these standards actually do? They spell out the core functions of a token, dictating exactly how it should behave on the blockchain. These rules are baked into a smart contract—a self-executing agreement that runs automatically when its conditions are met.

A token standard typically defines fundamental actions, including:

- Total Supply: The maximum number of tokens that will ever exist.

- Transfer Rules: The process for sending tokens from one wallet to another.

- Balance Inquiry: How an application can check the token balance of any wallet address.

- Approval Function: A way for a user to let another smart contract spend their tokens, which is essential for decentralized apps (dApps) to work properly.

This standardization is the secret sauce. It guarantees that any wallet or dApp designed for a specific standard—like Ethereum's famous ERC-20—can instantly support any new token built on that same template.

Key Takeaway: Token standards create a common language for all tokens on a blockchain. This allows them to "talk" to each other and interact with wallets and apps without needing custom code for every single token.

Common Token Standards You Should Know

While there are many blockchains, a few token standards have become household names because of the popularity of their home networks. Each standard is tailored for a specific job, which helps explain the difference between a simple payment token and a unique digital collectible.

For instance, the ERC-20 standard on the Ethereum blockchain is the undisputed king for creating fungible tokens. These are tokens that are identical and interchangeable, just like a dollar bill. Most of the utility tokens and governance tokens you come across are built on this framework.

Then you have the ERC-721 standard, which is the engine behind Non-Fungible Tokens (NFTs). Its rules make sure every single token is unique and can't be divided, making it perfect for representing ownership of one-of-a-kind digital items like art, music, or virtual land. These foundational blueprints are a core part of what a token is in cryptocurrency, paving the way for the incredible diversity we see in the market today.

A Look at the Main Types of Crypto Tokens

Now that we have a handle on the technical side of what a token is, let's get into the fun part: what they actually do. It's a mistake to lump all tokens together. That would be like saying a speedboat, a freight train, and a race car are all just "vehicles"—sure, it's technically true, but it misses the entire point of their unique functions.

The token world is just as diverse. Each type is designed to solve a specific problem or create a certain kind of value. By understanding these core categories, you'll see why a business might choose one over another and how they power their respective ecosystems.

Let's break down the four most common types you'll run into.

Utility Tokens: The Keys to the Kingdom

Utility tokens are probably the most widespread type out there. The best way to think of them is as digital keys or access passes. Their main job isn't to be an investment; it's to give the holder access to a specific product or service on a blockchain platform.

Think of an arcade token. You don't buy it expecting its value to skyrocket; you buy it so you can go play some Pac-Man. In the crypto world, you’d get a utility token to use a feature within a decentralized application (dApp). For example, Filecoin (FIL) is a perfect illustration. To store data on its decentralized network, users pay storage providers with FIL tokens. The token is the "utility" that makes the whole system work.

Governance Tokens: A Voice at the Table

As decentralized projects grow, they need a way to make decisions without a CEO calling all the shots. This is where governance tokens step in. Holding these tokens gives you voting rights on proposals that shape the project's future.

It's pretty straightforward: the more tokens you hold, the more your vote counts. This concept is the beating heart of Decentralized Autonomous Organizations (DAOs), where the community collectively decides on everything from protocol upgrades to how treasury funds are spent.

- Uniswap (UNI): Holders of the UNI token can vote on proposed changes to the massive Uniswap decentralized exchange.

- Maker (MKR): This token gives holders the power to govern the MakerDAO system, which is responsible for the DAI stablecoin.

Key Insight: Governance tokens are more than just assets; they turn users into active stakeholders. They provide a transparent way to manage a project from the ground up, giving the community a real say in its direction.

Security Tokens: Digital Investment Contracts

Security tokens are a completely different animal. They represent ownership in a real-world, tradable asset, effectively acting as the digital version of traditional securities like stocks or bonds. Because they are treated as financial instruments, they are heavily regulated and must follow strict securities laws.

For instance, a startup could issue a security token that represents a 1% share of its equity. Instead of a dusty paper certificate locked in a file cabinet, the owner holds a token that legally entitles them to that share and any potential dividends. This whole idea is about making traditional investments more accessible and efficient by putting them on the blockchain.

Non-Fungible Tokens (NFTs): Unique Digital Deeds

Last but not least, we have Non-Fungible Tokens, or NFTs. The name says it all—each token is one-of-a-kind and cannot be replaced by another. An NFT works like a verifiable digital deed of ownership for a specific item, whether it's a piece of digital art, a rare collectible, or even a concert ticket.

Think of it this way: a dollar is a dollar (fungible), but the Mona Lisa is the Mona Lisa (non-fungible). NFTs bring that same concept of unique, provable ownership to the digital realm, tackling long-standing problems with authenticity and creator rights online.

Real-World Token Use Cases and Applications

Knowing the difference between token types is a great start, but the real magic happens when you see them at work in the wild. These aren't just speculative assets for trading; they are practical tools being used right now to solve stubborn problems and even build entirely new industries.

Let's move past the theory and look at how tokens are actually making a difference today.

Shaking Up Finance with DeFi

The most explosive and talked-about use case for tokens is easily Decentralized Finance (DeFi). The whole point of DeFi is to build an alternative to the traditional financial world—think lending, borrowing, and trading—but without the banks and middlemen. It all runs on the blockchain, and tokens are the fuel that makes the engine go.

- Automated Trading: Forget old-school order books. Platforms like Uniswap use liquidity pool tokens to let people trade crypto directly from their own wallets. It's fast and permissionless.

- Decentralized Lending: With a protocol like Aave, you can deposit your crypto to earn interest or use it as collateral to borrow other digital assets. Smart contracts handle everything, no loan officer required.

This token-driven model is incredibly open and transparent. Anyone with an internet connection can tap into these financial services, which is a world away from the gatekept nature of traditional banking. The vision is simple: create a more equitable and accessible financial system for everyone.

Real-World Impact: DeFi isn't just a niche experiment anymore. Protocols powered by tokens currently hold tens of billions of dollars in value. They're providing financial services to a global user base, often with lower fees and much faster settlement than the old way of doing things.

Powering the Next Generation of Gaming

The gaming world is in the middle of a huge transformation, with tokens right at the heart of it. For decades, when you bought an in-game item, you were just renting it. Blockchain games flip that script by using tokens—especially NFTs—to give players true digital ownership of their assets.

Think about buying a rare sword or a custom character skin. With an NFT, that item is genuinely yours, and its ownership is permanently recorded on the blockchain. You're free to sell it on an open marketplace, use it in another game that supports it, or just keep it as a collectible. This creates what's known as a player-owned economy, where the time and effort you put into a game can translate into real, tangible value.

Utility tokens also have a big part to play, often serving as the game's official currency for buying items or entering exclusive events. This approach turns players from simple consumers into active stakeholders who are invested in the game's ecosystem and future success.

Enhancing Supply Chain Transparency

How can you be absolutely sure that a designer handbag is the real deal? Or that a sensitive medication was stored at the correct temperature from the factory to the pharmacy? Historically, tracking this involved a mountain of paperwork that was easy to forge or lose. Tokens provide an elegant and powerful fix.

By creating a unique digital token (an NFT) for a physical product, a company can build a tamper-proof, transparent ledger of its entire lifecycle.

- A token is created, or "minted," the moment a product is manufactured.

- At every checkpoint—from the factory floor to the shipping crate to the retail shelf—the token's data is updated on the blockchain.

- The final customer can simply scan a code to see the product's full history, instantly confirming its authenticity and journey.

This gives everyone involved a "single source of truth" that is secure and can't be secretly altered. It's a brilliant way to slash fraud, boost efficiency, and build unshakable trust with consumers.

The applications of tokens are incredibly diverse, touching nearly every industry you can think of. Here's a quick look at how different sectors are putting them to work.

Token Applications Across Industries

| Industry Sector | Token Application Example | Primary Benefit |

|---|---|---|

| Real Estate | Fractional ownership of properties via security tokens. | Makes high-value real estate investment accessible to more people. |

| Art & Collectibles | NFTs representing ownership of digital or physical art. | Verifiable provenance and secure, transparent trading of assets. |

| Music Industry | Artists issue tokens to fund albums, giving fans a share of royalties. | Creates a direct financial link between artists and their supporters. |

| Voting & Governance | Governance tokens give holders voting rights in a project's future. | Decentralizes decision-making and empowers the community. |

| Carbon Credits | Tokenizing carbon credits to be traded on a transparent market. | Increases liquidity and transparency in the fight against climate change. |

As you can see, the core idea is to use tokens to represent value, ownership, or access in a way that is more efficient, transparent, and secure than traditional systems.

Alright, let's get down to brass tacks. You've wrapped your head around what a crypto token is, and now you're probably seeing the potential they hold for growing your business. For any company that wants to stay ahead of the curve and welcome new customers, accepting token payments is a seriously smart move. It's about more than just adding Bitcoin to your checkout; it’s about offering real, meaningful payment flexibility.

Making this shift throws your doors wide open to a global, tech-forward crowd that’s already using all sorts of tokens in their day-to-day lives. By putting a versatile payment system in place, you can connect with niche communities that have formed around specific utility or governance tokens. This doesn't just expand your market—it instantly paints your brand as a leader in the digital commerce space.

Of course, there’s always a catch. The big challenge has always been the technical headache. How on earth do you manage dozens of different tokens, each on its own blockchain, without getting completely overwhelmed? That's where modern payment platforms change the game.

Making Token Payments Easy with a Gateway

A good crypto payment gateway is built specifically to tear down those barriers. These platforms handle all the messy backend stuff, giving you one clean, simple solution for your business. You can forget about wrestling with individual blockchain integrations and just focus on the single, unified system.

Platforms like BlockBee, for example, provide a non-custodial solution that lets merchants accept a huge variety of tokens without any fuss. This means you can:

- Offer More Choice: Let customers pay with over 70 different cryptocurrencies, including a massive selection of popular tokens.

- Slash Your Costs: Transaction fees are a breath of fresh air compared to traditional credit cards, often starting as low as 0.25%.

- Get Paid Instantly: Payments are sent straight to your own self-custody wallet. You have full control over your money, with no waiting around.

Just look at the dashboard below. It's designed to give you a clear, simple view for managing all these different digital assets.

This kind of setup makes tracking all your different token payments straightforward, giving you total clarity and control over your digital revenue. It turns a ridiculously complex process into something you can manage in minutes.

Strategic Advantage: Accepting a wide variety of tokens isn't just about ticking another box at checkout. It's a clear signal to your customers that your business is flexible, secure, and ready for the future of finance.

Getting a system like this up and running is often surprisingly simple, with pre-built plugins available for most major e-commerce platforms. If you want to see the exact steps involved, our guide on how to accept cryptocurrency payments breaks it all down for you. By taking the technical friction out of the equation, businesses can get back to what they do best—serving customers and growing.

The Future of Tokens in a Web3 World

When we look at the road ahead, it’s clear that tokens are more than just a passing trend in the crypto market. They're actually the core components of Web3—the next evolution of the internet. This new digital frontier is all about decentralization and putting ownership back into the hands of users, and tokens are the keys that make it all possible.

We're already seeing them move beyond niche investment assets. Tokens are becoming the main way we'll interact with a more open, interconnected digital world.

One of the most exciting developments is the tokenization of real-world assets (RWAs). Think about what this means: you could take a physical asset, like a commercial building or a priceless painting, and convert its value into digital tokens on a blockchain.

Suddenly, these high-value, traditionally illiquid assets become divisible and easily tradable for anyone in the world. This completely shatters the old barriers to entry for investing. Instead of wading through mountains of legal paperwork, ownership and transfers are handled transparently and securely on the blockchain.

The New Digital Infrastructure

Beyond RWAs, tokens are poised to become the plumbing for our future digital lives. They’ll be the go-to tool for managing everything from our online identities to how we collaborate on community projects.

- Decentralized Autonomous Organizations (DAOs): In a DAO, tokens often represent voting power. This allows communities—not a central corporation—to make decisions and steer the direction of the platforms they use every day.

- Seamless Integration: As the technology matures, expect to see tokens quietly working in the background of your favorite apps. They'll manage your access rights, track loyalty points, and hold your digital credentials without you even thinking about it.

The long-term vision is a world where tokens are seamlessly woven into our digital fabric, representing ownership and facilitating interactions in a way that gives users unprecedented control.

This evolution points toward a fairer and more transparent online experience. The constant innovation in this field is building a truly dynamic digital economy. To get a better sense of how this impacts transactions, you can explore the future of crypto payments in our detailed guide.

The journey for tokens is really just getting started, and its impact is set to redefine what digital ownership means for years to come.

Frequently Asked Questions About Crypto Tokens

As you get more familiar with the world of crypto tokens, you'll naturally start having questions. It's a common experience, so let's walk through some of the most frequent ones to make sure everything is crystal clear.

Can Any Cryptocurrency Have a Token?

Not quite. A token needs a specific kind of foundation to exist—it has to be built on a blockchain that supports smart contracts. Think of blockchains like Ethereum or Solana; they were designed for this kind of versatility.

Here’s a simple analogy: imagine a blockchain is an operating system, like iOS on an iPhone. The native cryptocurrency (like ETH for Ethereum) is the system's core currency, while tokens are like the thousands of different apps you can build and run on it. This is why a blockchain like Bitcoin, which wasn't originally designed for smart contracts, can't host tokens in the same way.

Are All Tokens a Good Investment?

Definitely not. It's easy to get caught up in the hype when you hear stories of tokens that have skyrocketed in value, but the reality is that for every success story, many more tokens fail or simply fade away. A token’s real value usually comes from its utility—what it actually does—and the strength of the project behind it.

This is where you'll hear the crypto community's favorite piece of advice: DYOR, which stands for "Do Your Own Research." Before you even think about investing in a token, you have to dig into the project's whitepaper, understand its purpose, and look into the team building it. Many tokens, particularly memecoins, are pure speculation and come with a huge amount of risk.

Important Note: Remember that price volatility is always part of the equation. One survey pointed out that while 46% of users are drawn to crypto for its speed, security remains a huge concern—and wild price swings only amplify that feeling.

How Do I Get Cryptocurrency Tokens?

Getting your hands on tokens has become surprisingly straightforward. There are a few main ways people do it:

- Decentralized Exchanges (DEXs): On platforms like Uniswap or PancakeSwap, you can trade a blockchain's native currency (like ETH) directly for tokens, all without needing a company to process the transaction.

- Centralized Exchanges (CEXs): Big, well-known exchanges like Coinbase or Binance list hundreds of popular tokens. You can often buy them directly with your local currency.

- Airdrops: Sometimes, new projects will give away free tokens to early adopters or loyal users as a way to build a community and create buzz.

- Earning in Games: The world of blockchain gaming is booming, and many games reward players with tokens for completing quests or winning battles.

Ready to position your business for the future of digital commerce? With BlockBee, you can effortlessly accept payments in over 70 cryptocurrencies, including a vast array of popular tokens. Our secure, non-custodial platform makes it simple to tap into a global customer base while enjoying low fees and instant payouts. Explore how BlockBee can elevate your payment options today!