What Is Cryptocurrency Token? Easy Explanation & Guide

So, what exactly is a cryptocurrency token? Think of it like this: if a blockchain like Ethereum is the entire operating system on your computer, its native coin (Ether) is the core currency used to run the system. A token, on the other hand, is like an application—a piece of software that runs on that operating system to do something specific.

This means a token is a digital asset built on top of an existing, secure blockchain network. It doesn't need its own from-scratch infrastructure.

A Simple Answer to What Is a Cryptocurrency Token

While native coins like Bitcoin and Ether are the lifeblood of their own blockchains, tokens are a different breed. They piggyback on the technology that's already there, which is a crucial difference. To really get a handle on tokens, it helps to first understand the basics of what cryptocurrency is as a whole.

This "piggybacking" approach is incredibly efficient. Developers can launch a new token without the massive expense and technical headache of building and securing an entirely new blockchain. Instead, they get to focus on what their token actually does.

This simple but powerful idea has unleashed a tidal wave of innovation. It allows anyone to create a digital asset representing virtually anything—from a share in a new tech project to a membership pass for a club—all while relying on the proven security of a major blockchain.

To clear things up, let's quickly break down the main differences between coins and tokens.

Cryptocurrency Coins vs Tokens at a Glance

This table offers a straightforward comparison between native cryptocurrencies (coins) and the tokens built upon them.

| Characteristic | Cryptocurrency Coin (e.g., Bitcoin) | Cryptocurrency Token (e.g., UNI) |

|---|---|---|

| Foundation | Operates on its own independent blockchain. | Built on an existing blockchain (e.g., Ethereum, Solana). |

| Primary Use | Acts as a store of value or a medium of exchange within its network. | Represents a specific asset, utility, or right. |

| Creation | Involves creating and launching a brand new blockchain. | Follows a standard template on an existing platform. |

| Development | Highly complex, time-consuming, and expensive. | Relatively simple, fast, and cost-effective. |

In short, coins are the foundational layer, while tokens are the application layer, opening up a world of possibilities on top of that foundation.

The Ever-Expanding Token Universe

Because it's so much easier to create tokens on established platforms like Ethereum, Solana, and Base, their numbers have absolutely exploded. This isn't just growth; it's a Cambrian explosion of experimentation in the crypto world.

The number of unique tokens has shot up at a mind-boggling rate. In fact, there are now over 37 million tokens in existence. Compare that to the less than 3,000 recorded between 2017 and 2018, and you can see just how massive this trend is.

This vast ecosystem now includes tokens for everything from decentralized finance (DeFi) and gaming to digital art (NFTs) and real-world assets. Sure, many of these projects don't pan out, but the sheer volume is a testament to the relentless pace of development in the space.

If you'd like to dive even deeper, our detailed guide on what is a token in cryptocurrency is a great next step. Having this foundational knowledge is essential for understanding their incredibly diverse roles.

How Cryptocurrency Tokens Are Built and Managed

So, how does a crypto token actually come into existence? It's a lot simpler than you might think, especially when you compare it to building a crypto coin from scratch. Coins need their own, brand-new blockchain, which is a massive undertaking. Tokens, on the other hand, take a shortcut.

The best way to think about it is like building an app for your smartphone. Developers don't construct a whole new operating system every time they create an app. Instead, they build on top of established platforms like iOS or Android, immediately gaining access to their security, infrastructure, and user base. Tokens do the exact same thing with blockchains like Ethereum.

By building on an existing network, a project can launch its own digital asset without having to worry about the immense challenge of securing a new blockchain. The secret sauce that makes this all possible is the smart contract.

The Role of Smart Contracts

A smart contract is the very soul of a token. Forget legal jargon; this is a computer program that runs on the blockchain. The rules of the agreement are baked directly into its code, and once it's live, it’s unstoppable and unchangeable. It just runs as programmed, no intermediaries needed.

This little piece of code defines everything about the token. It sets the name (like BlockBee Token), the ticker symbol (like BBT), and the total number of tokens that can ever exist. Crucially, it lays out the fundamental rules for how the token is issued, sent, and managed.

Think of a smart contract as a digital rulebook for the token—one that’s automated, completely transparent, and can’t be cheated. It guarantees that every single transaction plays by the rules. If the contract says the total supply is 1 million tokens, then it’s physically impossible for anyone, even the creators, to mint a single extra one.

Every time you interact with a token—whether you're sending it to a friend or using it in an app—you're actually triggering a function within its smart contract. The contract checks if your request is valid and, if it is, updates the blockchain's public ledger.

The Power of Tokenization

This smart contract architecture is what gives rise to tokenization—the process of creating a digital representation of an asset on a blockchain. Because you can program smart contracts with all sorts of custom logic, tokens can represent so much more than just monetary value.

For example, a token can be designed to represent:

- Ownership: A unique claim to a piece of digital art, known as an NFT.

- A Vote: The right to participate in a project's governance decisions.

- Access: A key to unlock special features on a software platform (a utility token).

This isn't just a theoretical concept; it's already happening. For instance, Robinhood now offers tokenized versions of stocks and ETFs in the EU, giving customers on-chain exposure to US equities. These tokens, first launched on the Arbitrum network, are a perfect example of how the lines between traditional finance and the crypto world are blurring.

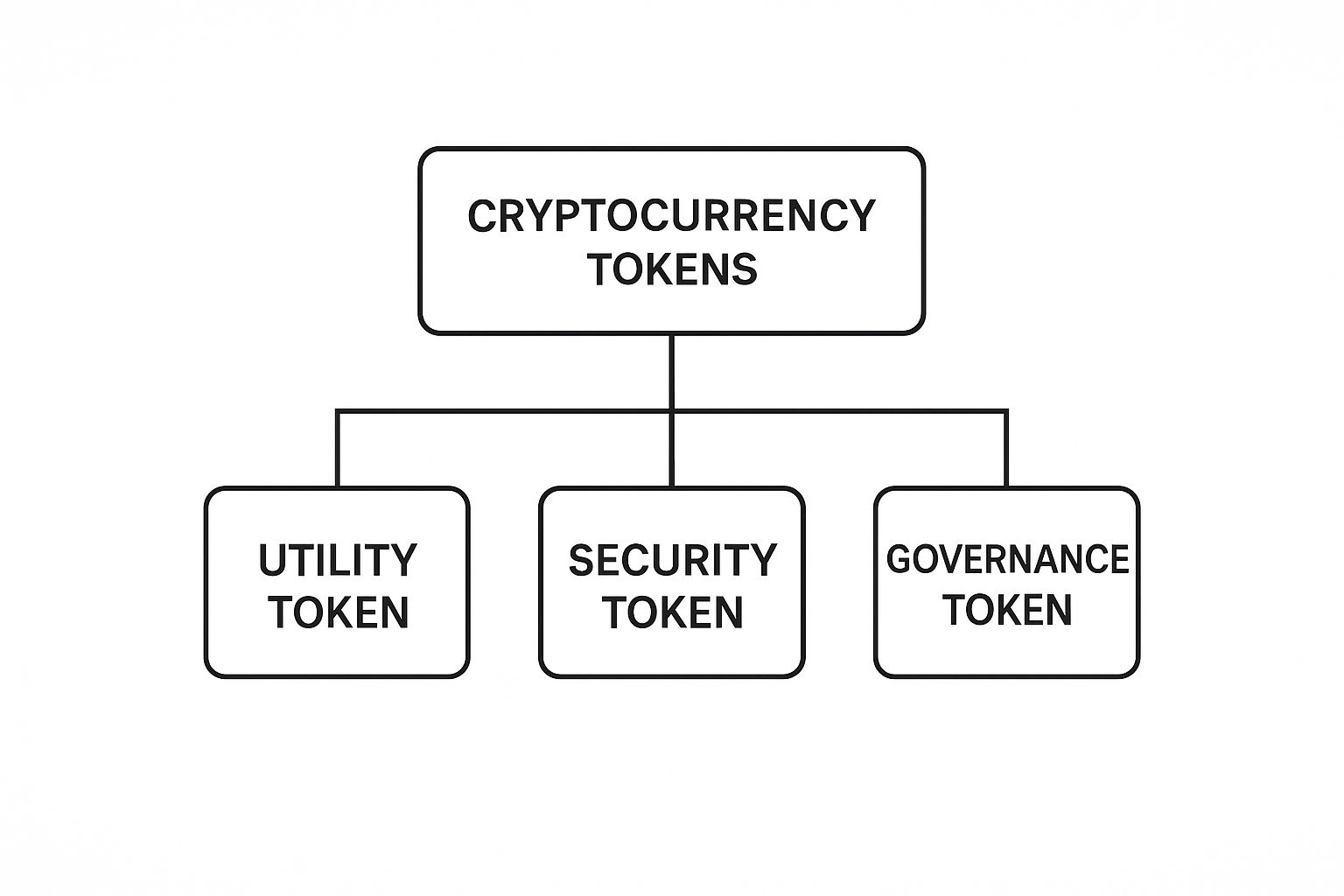

The Different Types of Crypto Tokens You Should Know

It's easy to think of all crypto tokens as being the same, but that couldn't be further from the truth. They're not all created equal. In reality, a token's value and purpose are defined by its job. Think of it like the apps on your phone: one is for connecting with friends, another is for managing your bank account. Each serves a unique function. Crypto tokens work the same way within their own digital ecosystems.

Getting a handle on these categories is the first step to truly understanding what a token is and what it can do. Most fall into a few key groups based on their core function, which helps to map out the major branches of the token world.

As you can see, tokens branch out into very distinct types, each designed for a specific job on the blockchain. Let's dig into what these categories actually mean for users and businesses.

Utility Tokens: Your Key to Access

Utility tokens are probably the most common type you'll encounter. The best way to think of them is like a digital key or a pre-paid pass for a specific service. Their main job is to grant you access to a product or feature within a particular blockchain project.

A company might issue a utility token that you need to spend to use their software, access decentralized storage, or even just participate in their network. These aren't really designed as investment vehicles; they're functional tools meant to be used.

A great example is the Basic Attention Token (BAT). It’s the native token for the Brave browser. Users can opt-in to view privacy-friendly ads and earn BAT, which they can then use to tip their favorite content creators. This creates a neat, self-contained economy right inside the browser.

Security Tokens: A Piece of the Pie

Security tokens are a whole different ballgame. At their core, they are digital, blockchain-based versions of traditional financial assets. Think of them as the crypto equivalent of stocks, bonds, or even a deed to a property.

Because they represent ownership in a real-world asset, security tokens are heavily regulated by government bodies, just like their old-school counterparts. Their promise is huge: making it easier to trade and own things that have historically been hard to access, like a stake in a commercial building or private company equity.

By "tokenizing" real-world assets, companies can take something massive and illiquid—like a skyscraper—and slice it into thousands of small, tradable digital shares. This opens the door for a much wider pool of investors to get involved.

Governance Tokens: Giving You a Say

Next up, we have governance tokens. These are all about power and influence. Holding a governance token gives you a voice in a project's future direction, almost like having a voting share in a company.

Your vote could help decide anything from changing the platform's transaction fees to approving funding for new development work. This idea is central to what's known as a Decentralized Autonomous Organization (DAO), where the entire community of token holders governs the project together. The UNI token from the Uniswap protocol is a perfect example, as it lets holders vote on proposals that shape the future of the decentralized exchange.

Non-Fungible Tokens (NFTs): Proving It's One of a Kind

Finally, we have Non-Fungible Tokens (NFTs). These represent ownership of a unique, irreplaceable digital or physical item. The term "non-fungible" just means it can't be swapped for an identical item. A dollar bill is fungible—one is as good as any other—but there's only one Mona Lisa. That's non-fungible.

This unique quality makes NFTs incredibly useful for:

- Digital Art: Proving who owns a specific piece of digital artwork.

- Collectibles: Creating verifiable digital trading cards or rare memorabilia.

- Gaming Items: Representing unique in-game assets, like a legendary sword or a special character skin that players genuinely own and can trade.

- Tickets and Memberships: Issuing exclusive, one-of-a-kind passes for events or private communities.

Each NFT is a unique token on the blockchain, creating an unbreakable, public record of ownership. It's a simple concept that is completely changing how we think about digital property.

To help put it all together, here’s a simple table that breaks down these common token types with some everyday analogies.

A Breakdown of Common Token Types and Uses

| Token Type | Primary Function | Real-World Analogy | Example |

|---|---|---|---|

| Utility Token | Grants access to a product or service | Arcade Token or Software License | Basic Attention Token (BAT) |

| Security Token | Represents ownership in an asset | Company Stock or Real Estate Deed | tZERO (TZROP) |

| Governance Token | Provides voting rights in a project | A Board Seat or Shareholder Vote | Uniswap (UNI) |

| Non-Fungible Token (NFT) | Proves ownership of a unique item | A Signed Painting or Concert Ticket | CryptoPunks |

As you can see, each token has a distinct role. Understanding these differences is the key to seeing how they can be used to build new kinds of applications, communities, and even financial systems.

Why Token Standards Like ERC-20 Matter

When you come across terms like “ERC-20,” it's easy to dismiss them as just another piece of crypto jargon. But these aren't just technical labels; they are token standards, the shared rulebooks that prevent the entire crypto world from descending into chaos.

Think of it like this: a token standard is the digital equivalent of a USB-C port. Because all sorts of manufacturers agree on that one design, you can use the same cable to charge your phone, connect a monitor, or transfer files between devices that have nothing else in common. They work together because they speak the same physical language.

Token standards do precisely the same thing, but for assets on a blockchain.

The Power of a Shared Blueprint

At its core, a token standard is a set of rules and functions built into a smart contract template. When a developer decides to create a new token using a popular standard, like ERC-20 on Ethereum, they aren't starting from scratch. They're using a trusted blueprint.

Building on a standard like ERC-20 means the new token is instantly compatible with a massive, pre-existing ecosystem.

This immediately unlocks a few huge advantages:

- Crypto Wallets: Any wallet that supports the ERC-20 standard can hold, send, and receive the new token. No custom software or special integrations are needed.

- Exchanges: Getting the token listed on a decentralized exchange (DEX) like Uniswap is straightforward because the exchange is already designed to interact with ERC-20 tokens.

- Applications: Other dApps on the blockchain can communicate with the token because they know exactly how it’s programmed to behave.

A token standard isn't just about making things easy. It's a powerful engine for innovation. By offering a common framework, it dramatically lowers the barrier to entry for developers and creates a network effect where every new token strengthens the entire ecosystem.

This interoperability is the secret sauce. Can you imagine needing a different, proprietary wallet for every single token you own? The market would grind to a halt. Standards are what prevent that digital nightmare.

Beyond the Basics: Evolving Standards

While ERC-20 is the undisputed king for fungible (interchangeable) tokens, it’s not the only blueprint out there. The crypto space has developed different standards for different jobs.

For instance, the ERC-721 standard is the go-to for creating NFTs, where every single token needs to be unique and non-interchangeable. As the industry matures, these standards keep evolving to meet new demands.

This shared infrastructure is what allows builders to plug their creations directly into a growing universe of tools and services, making development faster, more secure, and far more affordable.

How Tokens Are Changing Our Digital World

Cryptocurrency tokens have broken out of their niche corner of the tech world and are now actively reshaping entire industries. Their impact is becoming more tangible every day, acting as the foundation for new economic models and digital interactions. This isn't just theory anymore—it's happening right now.

One of the biggest waves is being made in decentralized finance (DeFi). Here, tokens are the engine behind lending, borrowing, and trading services that run completely on the blockchain. By cutting out traditional banks and financial middlemen, DeFi creates a far more open and accessible financial system where anyone with an internet connection can participate.

At the same time, tokens are fueling the creator economy. Through Non-Fungible Tokens (NFTs), artists, musicians, and game developers can create unique, verifiable digital assets. This empowers them to sell their work directly to fans, opening up new revenue streams and building stronger, more engaged communities around their creations.

The Growing Mainstream Adoption

This isn't a trend confined to the fringes of the internet. The public's acceptance of crypto tokens is picking up serious speed, signaling a fundamental shift in how we think about and use digital assets.

This growing adoption is mirrored by incredible market growth. Consider this: by 2024, an estimated 40% of American adults owned cryptocurrency. That's a huge jump from just 15% in 2021. The North American crypto market alone is on track to pull in revenues of €24.46 billion in 2024, and it shows no signs of slowing down. To really grasp the scale of this shift, you can learn more about the cryptocurrency investment statistics and see the numbers for yourself.

This mainstream embrace shows that what a cryptocurrency token is has evolved from a technical curiosity into a fundamental building block of the modern economy. Tokens are driving real innovation and creating entirely new forms of value.

As tokens weave themselves into the fabric of our digital lives, they're also changing the playbook for businesses. For instance, using tokens for payments and rewards is becoming a go-to strategy for online retailers. It's a move that not only modernizes how we pay but also boosts customer loyalty and engagement. You can dive deeper into this in our guide on how crypto is redefining ecommerce transactions.

Powering New Business Models

The sheer flexibility of tokens gives businesses the power to build unique solutions that simply weren't possible before. From making complex supply chains more transparent to inventing new kinds of digital memberships, companies are finding powerful new uses for them every day.

Just look at these practical examples:

- Loyalty Programs: Instead of simple points, businesses can issue their own branded tokens as rewards. Customers can then use these for discounts or exclusive access, creating a much more dynamic and engaging loyalty system.

- Supply Chain Management: A token can be tied to a specific product, creating an unchangeable, transparent record of its entire journey from the factory to the consumer's hands.

- Gaming Economies: In-game tokens let players truly own their digital items. This ownership fuels vibrant secondary markets and gives players a real stake in the success of the games they love.

These applications prove that tokens are much more than just assets for speculation. They are practical tools with real-world benefits, offering businesses a way to build systems that are more efficient, transparent, and centered around the user.

Key Things to Consider in the Token Market

Jumping into the token market can be thrilling, but it’s a world that moves fast and often feels complicated. If you really want to grasp what a cryptocurrency token can do, you have to understand its core dynamics. And in crypto, that conversation almost always starts with the market giants: Bitcoin and Ethereum.

These two aren't just another pair of assets. Their performance sets the mood for the thousands of other tokens out there. When Bitcoin or Ethereum makes a big move, up or down, you can bet a ripple effect is coming for the rest of the market. It’s why so many experienced traders keep a close eye on their market dominance—it’s a vital sign for the health of the entire crypto ecosystem.

You can think of it like this: a rising tide led by Bitcoin can lift all boats, but a sudden storm can just as easily pull them under. It's a stark reminder of just how interconnected everything is in this space.

This is just scratching the surface. There are many compelling reasons to invest in cryptocurrency that tie directly into these market dynamics and where things might be headed long-term.

Analyzing Market Trends

To get a real feel for the token market, you need to look past the price charts. Metrics like trading volume and market capitalization paint a much clearer picture of what’s actually happening. For instance, high trading volume paired with a climbing market cap is often a sign of strong, confident momentum.

Just look at the recent data. In Q2 2025, the total crypto market cap saw an impressive rebound, growing by 24.0% to land around $3.5 trillion. Bitcoin (BTC) shot past $100,000 to a new all-time high, pushing its market dominance up to 62.1%. Ethereum also saw its share tick up to 8.8%.

But here’s the interesting part: while all this was happening, spot trading volume on major exchanges actually dropped by 27.7%. This suggests that even as the market grew, people were trading less frequently, perhaps more strategically. You can dig into a detailed breakdown of these Q2 2025 crypto market findings for a closer look.

This data is a perfect example of how the market is maturing. Climbing prices don't always mean frantic trading; sometimes, they signal a more calculated, long-term approach from investors.

Answering Your Top Questions About Crypto Tokens

You'll often see new crypto projects issue a token instead of creating a brand-new coin from scratch. Why? It really comes down to saving a massive amount of time, money, and effort.

Think about it: launching a token on an established network like Ethereum means you don't have to build and secure an entire blockchain yourself. You get to piggyback on their proven security and immediately tap into a huge, ready-made community of users and developers.

It’s a lot like developing an app for iOS or Android instead of trying to build a whole new smartphone and operating system from the ground up.

This practical approach lets teams focus on what truly matters—building their product or service—rather than reinventing the wheel.

Where Does a Token's Value Come From?

This is probably the most common question people have. Unlike a traditional stock, a token's value isn't always tied to company profits. Instead, its financial value is driven by a mix of factors.

Value can come directly from demand. If you need the token to use a specific application or access a service, people will buy it. It can also come from pure speculation, where traders bet on a project's future success based on news, partnerships, or adoption rates.

Other value drivers include:

- Asset-backing, where the token represents a claim on a real-world asset like gold or real estate.

- Revenue-sharing models, where token holders receive a portion of the project's income.

- Community support and listings on major exchanges, which provide liquidity and legitimacy.

A strong combination of these elements is what gives a token a solid price foundation.

Can a Token Live on More Than One Blockchain?

Surprisingly, yes! This is possible through clever technologies like wrapped tokens and cross-chain bridges. It’s a way to make assets from one network usable on another.

A perfect example is Wrapped Bitcoin (WBTC). It's an ERC-20 token that runs on Ethereum, but each WBTC is backed 1:1 by actual Bitcoin held in reserve. This allows Bitcoin's value to be used within Ethereum's sprawling ecosystem of apps.

Cross-chain bridges work by "locking" the original asset on its native chain and then "minting" an equivalent, mirrored token on the destination chain. This interoperability is a huge deal for connecting the fragmented crypto world.

How Can I Verify if a Token is Legitimate?

With thousands of tokens out there, knowing which ones are credible is crucial. It’s important to do your homework to avoid scams or poorly designed projects.

Here are a few key steps anyone can take:

- Review the smart contract: Is the code public and has it been audited by a reputable security firm?

- Check the audit reports: Look for reports from well-known firms that check for vulnerabilities.

- Examine the tokenomics: Investigate the token's total supply, its distribution plan, and its release schedule.

These checks help you spot red flags, like a contract that allows for unlimited minting (which can devalue the token) or hidden functions that could exploit users.

“Transparency in token economics builds trust and reduces market risks.”

What are the Best Practices for Launching a Token?

For any project looking to succeed, transparency and clear communication are non-negotiable. It's about building a sustainable ecosystem, not just launching a token.

Foundational steps include publishing a detailed whitepaper and a clear roadmap, keeping the token supply transparent and ideally capped, and consistently engaging with your community through regular updates and open discussions.

With these common questions answered, you should have a much clearer picture of what a cryptocurrency token is and how it might fit into your business strategy.

Ready to accept crypto payments effortlessly?

Try BlockBee today and start receiving payments instantly.