What Is Cold Storage Wallet? Secure Your Crypto Today

Think of a cold storage wallet as the digital equivalent of a Swiss bank vault for your cryptocurrency. It's a type of wallet that stores your private keys completely offline, shielding your assets from the kinds of online threats that plague internet-connected devices.

This method is widely considered the most secure way to hold digital currency for the long haul.

Unpacking the Cold Storage Wallet Concept

To really get a feel for how this works, let's use a simple analogy. Your checking account is perfect for daily spending—it's online, accessible, and ready to go. In the crypto world, this is like a "hot wallet," which stays connected to the internet for quick and easy transactions. But that constant connection is also its biggest weakness, creating a doorway for potential hackers.

A cold storage wallet flips that model on its head. It generates and stores your private keys—the secret passcodes to your crypto—on a device that has no connection to the internet. By creating this "air gap" between your keys and the online world, you essentially eliminate the risk of remote digital theft.

The Foundation of Crypto Security

This deliberate offline isolation is what makes cold storage so powerful. When you decide to send funds, the transaction is signed inside the secure, offline device. Only the signed, verified transaction is broadcast to the network. Your private keys never get exposed to your internet-connected computer.

The core idea behind cold storage is straightforward: never let your private keys touch the internet. This one simple rule is the single most effective defense against the vast majority of crypto hacks.

The main advantages of this strategy are crystal clear:

- Protection from Hacking: If the device is offline, hackers have no way to reach your private keys from across the web.

- Immunity to Malware: Nasty software like viruses or keyloggers on your main computer can't steal keys they can't access.

- Total Self-Custody: You, and only you, hold the keys. This gives you absolute control over your funds without needing to trust a bank or exchange.

For anyone serious about safeguarding their crypto investments, especially for holding assets long-term, using a cold storage wallet isn't just a good idea—it's essential. It represents the gold standard in digital asset protection.

Why Offline Storage Is the Gold Standard in Crypto Security

In a world buzzing with digital threats, from clever phishing scams to invasive malware, keeping your crypto assets safe isn't just important—it's everything. The most surefire way to lock them down is to take your private keys completely offline with a cold storage wallet, which slashes your risk dramatically.

This entire security strategy boils down to one simple concept: shrinking the "attack surface." Think of the attack surface as all the doors and windows a hacker could try to get through. An online "hot" wallet is like a house with a dozen open windows because it's always connected to the internet.

A cold wallet, on the other hand, bricks up every single one of them. It’s the digital equivalent of taking your most prized possessions out of a flimsy glass cabinet and locking them away in a steel bank vault. This is what true self-custody is all about.

The Power of the Air Gap

So, what makes this possible? A simple but powerful idea called the "air gap." This is the physical isolation between your private keys and any online network. This gap makes it physically impossible for a hacker on the other side of the world to get to your funds.

Even if your main computer gets riddled with viruses, the keys stored on your disconnected cold wallet remain untouched and secure.

A cold wallet ensures your private keys never touch an internet-connected device. This single principle is the most powerful defense against the vast majority of crypto theft, giving you peace of mind that your assets are under your exclusive control.

This offline approach is no longer just a "best practice"—it's a fundamental strategy for anyone serious about preserving their wealth long-term. As cyber threats get smarter, the need for safeguarding digital fortresses against modern threats has never been more obvious.

With cybersecurity risks on the rise, cold wallets have become an essential tool for managing a crypto portfolio. The market reflects this, with projections showing stored assets growing from $3.8 billion in Q3 2025 to an anticipated $12.2 billion by 2033.

Getting a handle on how key management works is the first real step toward achieving this level of security. If you want to build a stronger foundation, https://blockbee.io/blog/post/private-key-security is a great place to start.

Exploring the Different Types of Cold Wallets

Not all cold storage is created equal. The options range from high-tech gadgets to surprisingly simple, low-tech methods, each striking a different balance between security and convenience. Figuring out which one is right for you starts with understanding what makes them tick.

The most common choice you'll see today is the hardware wallet. Picture it like a specialized USB drive built for a single, crucial job: keeping your private keys safely offline. When you need to approve a transaction, you plug the device into your computer or phone. The magic happens inside the wallet—it signs the transaction without ever letting your keys touch the internet-connected machine.

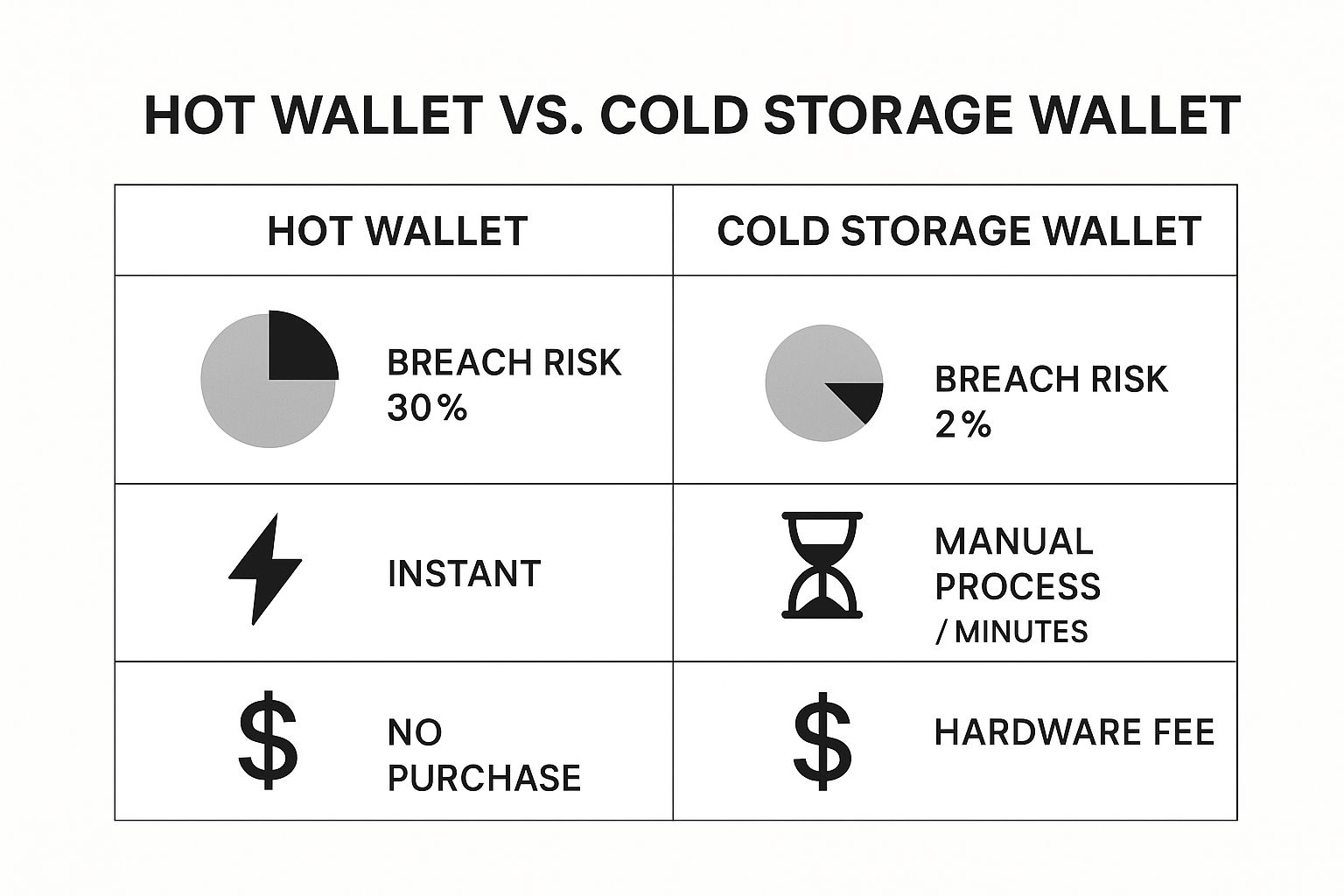

This simple visual breaks down the core difference between an online hot wallet and an offline cold wallet.

As you can see, the huge drop in breach risk with cold storage comes with a trade-off. You give up the instant access you get with a hot wallet, but you gain peace of mind that your assets are locked down.

Hardware Wallets: The Modern Standard

Hardware wallets have really become the gold standard for most crypto users. They hit that sweet spot, blending serious security with an experience that isn't overly complicated. It's no surprise the market is booming—valued at around $348 million in 2025, it’s expected to climb to over $2 billion by 2032.

Right now, 75% of cold wallet sales are these physical devices, which now come in all sorts of forms like USB sticks, crypto cards, and even wearable rings. They’ve become popular because they make top-tier security accessible to almost anyone. To get a deeper dive into how they function, check out our complete guide explaining what a hardware wallet is.

Paper Wallets: The Original Offline Method

Before sleek hardware devices hit the scene, paper wallets were a go-to method. The concept is straightforward: you generate a new pair of public and private keys and print them out, usually as QR codes, on a piece of paper. This is cold storage in its purest form, since your keys only exist on that physical document.

While that sounds incredibly secure, paper wallets come with some serious practical downsides:

- They're fragile. A fire, a flood, or even just a spilled drink could wipe out your entire stash. The ink can also fade over time.

- They're tricky to use. Spending just a portion of the funds is a headache. It often forces you to move the entire balance to a new wallet, which can be both complex and risky.

- They're easy to compromise. Since the keys are physically printed, a prying eye or a quick photo is all it takes for someone to gain access.

Air-Gapped Devices: The Ultimate Security Fortress

For those who need the absolute highest level of protection, there are air-gapped devices. This setup involves a dedicated computer that has never, and will never, connect to the internet.

The process is methodical: you create a transaction on a regular online computer, move it to the air-gapped machine via a USB drive for signing, and then transfer the signed transaction back to the online machine to broadcast it to the network. It's a complex workflow, but it creates an unbreakable barrier against online attacks, making it the preferred choice for institutions and individuals securing massive crypto fortunes.

Choosing Your Cold Storage Method

Deciding on the right cold storage solution comes down to your personal or business needs. You have to weigh how much security you need against how often you'll need to access your funds and what you're willing to spend.

This table breaks down the main options at a glance:

| Wallet Type | Security Level | Ease of Use | Typical Cost |

|---|---|---|---|

| Hardware Wallet | Very High | Moderate | $50 - $200+ |

| Paper Wallet | High (if managed perfectly) | Low | Free (cost of printing) |

| Air-Gapped Device | Extremely High | Very Low | Cost of a dedicated computer |

For most people, a hardware wallet offers the best all-around package. However, understanding all the options ensures you can make an informed decision that truly protects your assets.

How to Use a Cold Storage Wallet the Right Way

It’s one thing to own a cold storage wallet, but it’s another thing entirely to use it correctly. How you handle your device is what truly secures your digital assets, turning a simple piece of hardware into a personal vault for your crypto. The whole process starts before you even break the seal on the box.

Here's the most important first step: buy your device directly from the manufacturer. It can be tempting to grab one from a third-party seller on Amazon or eBay, but doing so opens the door to supply chain attacks. A compromised device could be on its way to you before you even know it.

Getting Started and Handling Your Seed Phrase

Once the wallet is in your hands, the setup process is your next critical mission. As you initialize the device, it will generate a unique recovery phrase—often called a seed phrase—which is usually a list of 12 to 24 random words. This phrase is the master key to everything.

Think of your recovery phrase as the ultimate fail-safe. If your hardware wallet gets lost, stolen, or smashed, this exact sequence of words is the only thing that can bring your funds back on a new device.

Guarding this phrase is everything. Here’s what you absolutely have to do:

- Write It Down Offline: Never, ever type your seed phrase into a computer, smartphone, or password manager. Don't even take a picture of it. Physically write it down on the recovery sheets that came with your wallet, or better yet, on a piece of metal.

- Double-Check Your Work: Most wallets will ask you to re-enter the words to confirm you wrote them down correctly. This isn’t a step you want to skip.

- Store It Somewhere Safe: Keep your written phrase in a secure, secret location that only you know about. Think fireproof safes or bank deposit boxes, and always store it separately from the wallet itself.

Exploring more advanced methods for seed phrase storage can give you an extra layer of defense against theft or disaster.

Signing Transactions Securely

The whole point of a cold wallet is to sign transactions offline, away from prying eyes. When you decide to send crypto, you'll start the transaction on your computer or phone, which is connected to the internet. The unsigned transaction details are then sent over to your hardware wallet for approval.

This is where the magic happens. You’ll verify the transaction details on the wallet's own little screen and then physically press a button to sign it. This action uses your private key—which never leaves the device—to give the final authorization. Only the signed, secure transaction is sent back to the network. This two-step dance ensures your keys stay completely isolated, even when you're actively making a transfer.

So, is a cold storage wallet right for you? It really boils down to what you're trying to achieve with your crypto, how much you're holding, and frankly, your personal tolerance for risk.

Think of it as a trade-off. Moving your assets offline gives you fortress-like security, but you sacrifice the grab-and-go convenience of an online "hot" wallet.

Who Really Needs Cold Storage?

Certain people absolutely benefit from making this trade. If you're playing the long game with your crypto—what the community affectionately calls a "HODLer"—then a cold wallet is basically a must-have. It's your digital vault, built to protect your assets for years without you losing sleep over the latest exchange hack or phishing scam.

It’s the same story for high-volume investors and institutions. When you're managing substantial funds, the extra steps involved with cold storage are a tiny price to pay for securing millions of dollars in assets. It's just smart risk management.

But it's not just for the crypto-wealthy anymore. We're seeing more and more everyday users make the switch. After watching countless horror stories of centralized exchanges freezing withdrawals or collapsing overnight, many people are realizing that true ownership is far more valuable than convenience. A cold wallet gives you exactly that: absolute, undeniable control over your funds.

The numbers back this up. The global market for cold storage wallets was valued at around $1.63 billion in 2025. We saw retail investor ownership jump by 34% and institutional adoption climb by a massive 51%. Still, hot wallets are the more common choice, with about 78% of users keeping their funds online. This suggests cold storage commands a solid 22-30% of the market. You can dive deeper into these wallet statistics to see the full picture.

Here's the bottom line: If your crypto vanished tomorrow, would it be a small headache or a serious financial blow? If it's the latter, then a cold storage wallet isn't just a good idea—it's essential.

Frequently Asked Questions About Cold Wallets

https://www.youtube.com/embed/xrDpH6Dr3L0

Even after getting the hang of cold storage, a few key questions often pop up. Let's walk through some of the most common ones so you can feel completely confident about managing your crypto.

Can My Cold Storage Wallet Be Hacked If It’s Stolen?

It's extremely unlikely. Hardware wallets are designed with physical theft in mind and are protected by a PIN or password that you set.

If a thief tries to guess your PIN too many times, the device will automatically wipe itself, making it nothing more than a useless piece of plastic. The real magic is your recovery phrase. As long as you have that phrase backed up securely, you can simply buy a new device, restore your crypto, and you’re back in business.

What If the Wallet Company Shuts Down?

Believe it or not, your crypto is still perfectly safe. Hardware wallet manufacturers all use a universal recovery standard, often called BIP39. Think of your recovery phrase as a master key that isn't tied to any single brand.

If the company that made your wallet goes under, you can just buy a device from a competitor, enter your original recovery phrase, and regain full access to all your assets.

This standard is what makes the system so resilient. You always have control, no matter what happens to any one company.

Do I Really Need a Cold Wallet for Small Amounts?

This boils down to your personal risk tolerance and what you consider a "small" amount. The best way to decide is to ask yourself a simple question: "Would I be seriously upset if I lost this crypto?"

If the answer is yes, then investing in a cold wallet is a no-brainer. While a trusted hot wallet is fine for pocket change you might use for daily transactions, getting into the habit of using cold storage is one of the best long-term security practices you can adopt.

Ready to bring the security of cold storage to your business's crypto payments and payouts? BlockBee provides a non-custodial payment gateway, ensuring you have full control over your funds. Explore BlockBee’s secure payment solutions today and take charge of your digital assets.