What is an ipn? A quick guide to instant payments

Think of an Instant Payment Notification (IPN) as a behind-the-scenes messenger service. It’s an automated message sent directly from a payment processor, like BlockBee, to your server. This digital heads-up tells you the exact status of a transaction—whether a payment was successful, failed, or was refunded—all without you having to lift a finger.

In short, it’s the invisible engine that keeps modern e-commerce running smoothly and in real time.

The Foundation of Automated E-commerce

Imagine a customer buys a digital download from your website. Without an IPN, you're stuck in a manual loop. You'd have to log into your account, check for the payment, verify it, and then manually send the customer their download link. It's slow, tedious, and a recipe for mistakes. For anyone just starting an online store, getting a handle on IPNs is one of the first steps toward building a business that can actually scale.

An IPN completely automates this process. It's a trusted courier that travels between the payment gateway and your application. The moment a payment goes through, the gateway sends a secure notification to a special "listener" URL on your server. This message is packed with all the crucial transaction details. Your server then checks that the message is legitimate and immediately kicks off the next step, like emailing that digital download to the customer.

Why IPNs Are a Game Changer

This direct server-to-server chat is the backbone of online sales today. It works entirely in the background, completely separate from what the customer is doing. Even if they close their browser window right after paying, the IPN ensures the order is processed perfectly. This reliability is what creates a truly seamless experience for your buyers.

The benefits of this automated approach are huge:

- Instant Fulfillment: Customers get their digital products, service access, or order confirmations the moment they pay. No more waiting.

- Enhanced Security: It provides a verifiable, server-side record of payment, which helps shut down fraudulent claims that a purchase was made.

- Accurate Record-Keeping: Your database, inventory, and sales records are updated automatically, keeping everything in sync.

- Improved Scalability: It eliminates manual intervention, letting your business handle thousands of transactions a day just as easily as it handles one.

At its core, an IPN transforms a passive payment system into an active, event-driven one. It’s the mechanism that says, "A payment just happened; now do this," enabling full automation and creating a frictionless journey for your customers.

To help you visualize how these pieces fit together, let's look at the main components of a typical IPN system.

IPN Core Components at a Glance

Each part plays a specific role in making sure the communication is secure, reliable, and instant.

| Component | Role | Analogy |

|---|---|---|

| Payment Gateway | Sends the notification when a transaction status changes. | The Post Office that sends out the mail. |

| IPN Message/Payload | The data packet containing all transaction details (ID, amount, status). | The Letter itself, containing all the important information. |

| Listener URL | A dedicated endpoint on your server that receives the IPN message. | Your Mailbox, waiting to receive the letter. |

| Your Server | Processes the incoming message, validates it, and triggers business logic. | You, opening the mail and acting on what it says. |

Understanding these roles is the first step toward building a robust and automated system. By putting IPNs to work, businesses can deliver the kind of instant gratification that modern customers expect. This system is a fundamental piece of many digital payment solutions for businesses and is essential for running an efficient online operation.

How an IPN Transaction Actually Works

To really get what an IPN is, it helps to walk through the entire journey of a single transaction. This isn't just one thing happening; it's a rapid-fire series of conversations between different systems, all taking place in a matter of seconds. Think of it like a perfectly timed relay race where each runner hands off the baton, ensuring the final message gets delivered securely and instantly.

Let's break down this server-to-server chat, step by step. The whole thing kicks off the moment a customer clicks "Pay," but the IPN works completely behind the scenes, long after the customer might have closed their browser. This "asynchronous" nature is exactly what makes it so robust.

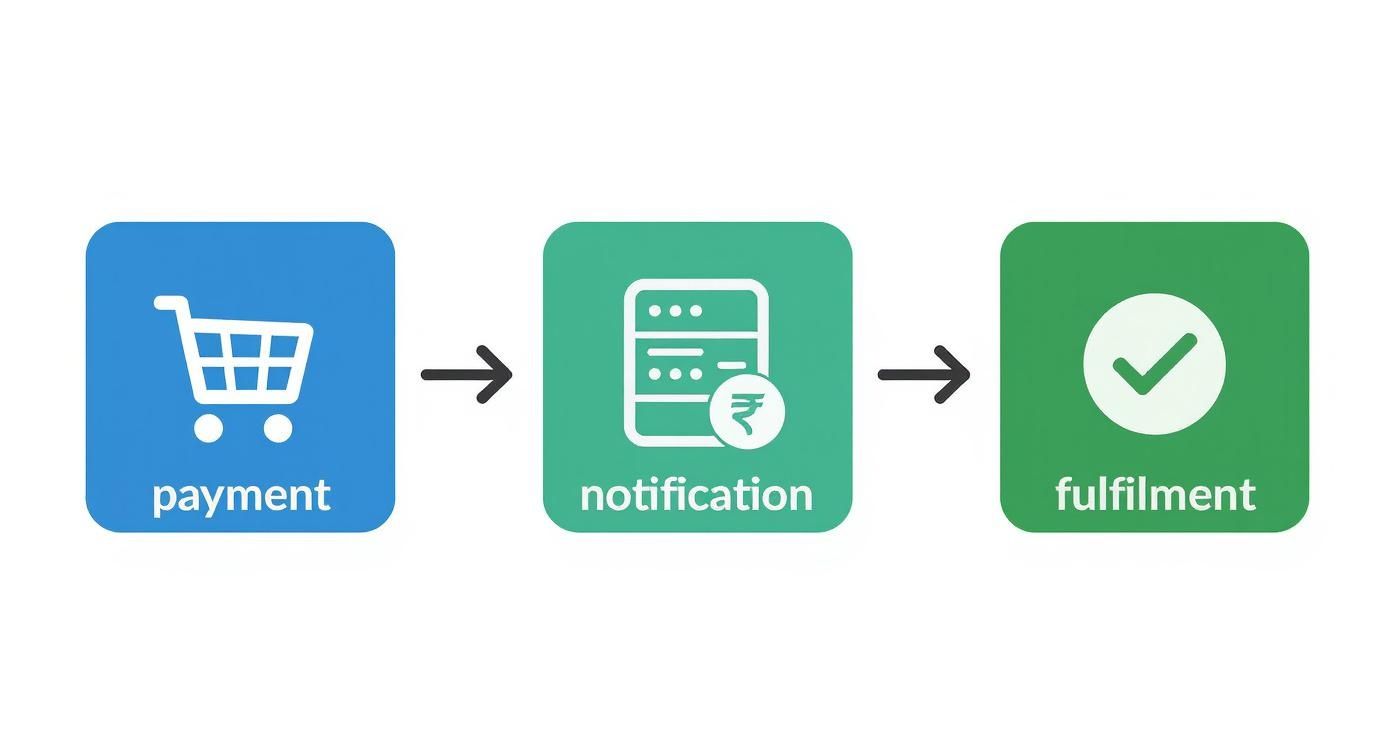

This diagram shows the core three-stage flow of a successful IPN, from the customer's payment to your system's automated fulfillment.

As you can see, the payment gateway's notification is the critical link connecting a customer's action to your server's automatic response.

The IPN Transaction Flow

The back-and-forth between your store and the payment gateway follows a very specific sequence. While the little details might change depending on the provider, the fundamental logic is always the same. Getting this flow down is a huge part of mastering payment gateway API integration for any e-commerce business.

Here's how it typically plays out:

Payment Initiation: A customer buys something on your site. Your server packages up the transaction details and sends them to the payment gateway (like BlockBee) to generate a payment request.

Gateway Sends Notification: As soon as the payment is confirmed—either on the blockchain or by a bank—the gateway’s server sends an HTTP POST message to a special URL you’ve set up, called an IPN listener. This message is the "payload," and it's packed with all the details about the transaction.

Listener Receives and Validates: Your IPN listener catches this incoming payload. Its first and most important job is to make sure the message is legitimate and actually came from the payment gateway, not an imposter. This usually involves a quick back-and-forth check with the gateway to confirm the message's authenticity.

Server Takes Action: Once the message is verified, your server gets to work. It updates your database to mark the order as paid, adjusts your inventory count, and kicks off whatever needs to happen next, like emailing a download link or sending a notification to your shipping department.

Confirmation Handshake: Finally, your listener sends an HTTP 200 OK response back to the gateway. This is the digital "handshake" that says, "Got it, thanks!" If the gateway doesn't get this response, it assumes you missed the message and will usually try sending the IPN again.

The entire IPN system is built for automation and reliability. It ensures that even if a customer's internet cuts out right after they pay, your system still gets the official confirmation it needs to fulfill the order without a hitch.

This kind of automated communication is a cornerstone of the modern financial world. The global market for interbank payment networks was valued at $14.3 billion and is expected to more than double, reaching $29.8 billion by 2033, all fueled by the growing demand for secure, automated transaction processing.

IPN vs Webhooks: Understanding The Key Differences

In the world of automated server communication, people often toss around the terms IPN and webhook as if they’re the same thing. They're related, for sure, but they aren’t interchangeable. Getting the distinction right is crucial for building solid systems, especially when there's money on the line.

The easiest way to think about it is that an IPN is a very specific type of webhook. It has one job and one job only: to tell you about payment events.

So, all IPNs are webhooks, but not all webhooks are IPNs.

A Simple Analogy

Think of your phone’s notification system. A general webhook is like your entire notification panel. It can ping you about anything—a new email, a calendar reminder, a friend’s post, a weather alert. It’s a versatile messenger that can handle any kind of event data from any app. For instance, a tool like the Webhook Audio Recorder uses a general webhook to capture audio—a very different job from processing payments.

An IPN (Instant Payment Notification), however, is like a single, dedicated alert from your banking app. It only ever tells you about one thing: "Payment Received," "Payment Failed," or "Refund Processed." It's designed from the ground up for financial transactions, carrying a payload packed with specific details like transaction IDs, amounts, and currency.

Purpose and Specificity

The main difference really boils down to purpose. A general webhook is a generic tool that lets one server push information to another when something happens. A developer might use one to get an alert when new code is pushed to a repository on GitHub, receive messages from a chat app, or monitor server health. The data structure is completely flexible.

An IPN, on the other hand, is purpose-built for e-commerce and payment processing. Its data structure is standardized by the payment provider (like BlockBee), and it’s engineered to meet the strict security and reliability needs of financial data.

An IPN is more than just a message; it's a secure, verifiable receipt delivered straight to your server. This specialization is precisely why it's the industry standard for automating things like order fulfillment and keeping your books in order.

Let's break down these differences side-by-side to make it even clearer.

Feature Comparison IPN vs General Webhook

Here’s a quick table to highlight the practical differences between a specialized IPN and a more general-purpose webhook.

| Feature | IPN (Instant Payment Notification) | General Webhook |

|---|---|---|

| Primary Purpose | To confirm payment status and transaction events. | To notify about any type of event (e.g., code push, new user). |

| Payload Content | Highly structured financial data (transaction ID, amount, status). | Flexible and can contain any data relevant to the event. |

| Built-in Security | Often includes specific validation protocols and cryptographic signatures. | Security implementation is up to the developer; not always standard. |

| Common Use Case | Automating order fulfillment after a successful payment. | Integrating disparate systems, triggering CI/CD pipelines. |

As you can see, while they both operate on the same push-notification principle, their design, security, and use cases are worlds apart. Choosing the right tool for the job starts with understanding exactly what that job is.

Essential Security Practices for Your IPN Listener

Alright, you've got your IPN listener set up and ready to catch incoming messages. Now, the real work begins: securing it. An IPN listener is essentially an open doorway into your server, and if you don't guard it properly, you're inviting trouble. Malicious actors are always looking for ways to spoof transactions, so handling payment data demands a security-first mindset.

The absolute most important security measure you can take is to validate the cryptographic signature on every single IPN message you receive. Think of this signature as a high-tech, tamper-proof seal. It gives you mathematical proof of two critical things: the message genuinely came from the payment gateway, and its contents haven't been messed with along the way.

Skipping signature validation is like taking a pile of cash without checking if the bills are counterfeit. You’re leaving yourself wide open to attackers sending fake "payment successful" messages, which could trick your system into shipping products or granting services for orders that were never actually paid for.

Building Multiple Layers of Defense

While signature validation is your foundation, a truly secure setup relies on multiple layers of defense. Every extra check you add makes it exponentially harder for an attacker to break through. The goal is to create a series of security gates that every incoming message has to clear before your system ever acts on it.

Here are the best practices you simply can't ignore:

Enforce HTTPS: Your listener URL must use HTTPS. This encrypts the entire conversation between the payment gateway and your server, stopping anyone from spying on the data as it travels across the internet.

Whitelist Gateway IP Addresses: Most gateways publish a list of the IP addresses their IPNs will come from. By setting up your firewall to only accept connections from these specific IPs, you can immediately block a massive amount of fraudulent traffic from random sources.

Sanitize All Incoming Data: Never, ever trust the data inside an IPN payload. You have to sanitize and validate every single field before you use it in a database query or any other server-side logic. This is your best defense against common attacks like SQL injection and cross-site scripting (XSS).

An unverified IPN is just an unconfirmed claim. Treat every incoming notification as untrustworthy until it has been rigorously validated through signature checks, IP whitelisting, and data sanitization. Only then can you safely act on the information it contains.

Protecting Sensitive Financial Information

Getting these security practices right is more important than ever. Real-time payments are booming, a trend highlighted in McKinsey's Global Payments Report. The report found that global payments revenue has been growing by an average of 7% each year, while cash transactions have fallen to just 46% of worldwide volume. This huge shift to digital and account-to-account (A2A) payments makes secure systems non-negotiable. You can learn more from the full McKinsey report.

Protecting the data within those transactions is equally critical. For another powerful layer of security that keeps raw card numbers and bank details out of your system entirely, you might want to learn about what payment tokenization is. By combining these strategies, you’re well on your way to building a payment infrastructure that's both resilient and trustworthy.

Building a Resilient IPN System

In a perfect world, every IPN would arrive exactly once, on time. But the internet is anything but perfect. Network hiccups, server timeouts, and gateway retries aren't just edge cases—they're inevitable realities you need to build for. What happens if a notification gets sent twice? Or if a brief network outage causes your server to miss one completely? A truly resilient system anticipates these problems to keep your data and your business running smoothly.

This is where idempotency becomes your best friend. It sounds complicated, but the concept is simple and absolutely critical: your system must be able to handle the exact same IPN message multiple times without processing the order more than once. Get this wrong, and you could end up shipping two products for a single payment or, even worse, charging a customer twice.

An idempotent IPN listener acts like a meticulous gatekeeper. It checks the ID of every incoming message and says, "Hold on, you've already been counted," preventing duplicate actions no matter how many times the same notification shows up.

Preventing Duplicate Processing

The most reliable way to achieve idempotency is by using a unique identifier. Every payment processed through a gateway like BlockBee comes with a unique transaction ID. Before your system does anything—like updating inventory or triggering a shipment—it needs to perform one crucial check.

Your logic should be straightforward:

- Receive the IPN: Your listener endpoint gets the notification from the payment gateway.

- Extract the Unique ID: Grab the

transaction_id(or whatever the unique identifier is called) from the IPN payload. - Check Your Records: This is the most important step. Before taking any action, query your database to see if you’ve already processed this specific ID.

- Process or Ignore:

- If the ID is new, go ahead and fulfill the order, then immediately log that ID as processed.

- If the ID already exists, you know it's a duplicate. Simply ignore it and send back an "HTTP 200 OK" status to let the gateway know you've received it.

This simple lookup is your first and best line of defense. It turns a potential disaster, like fulfilling an order twice, into a harmless, logged event.

Robust Error Handling and Monitoring

Beyond handling duplicates, you have to plan for outright failures. Your IPN listener might be temporarily down for maintenance, or a subtle bug in your code could cause an unhandled exception. A robust system doesn't just fall over; it logs exactly what went wrong and understands the payment gateway's retry schedule.

The entire global payment network is built on this kind of resilience. Take China's Cross-Border Interbank Payment System (CIPS), for example. It saw its transaction volume jump by 43% in a single year, handling around $24.45 trillion across 8.2 million transactions. That scale is impossible without systems that are built to tolerate faults. You can read more about the growth of the CIPS payment network to see why this matters.

You should set up detailed logging for every single IPN that fails to process. Capture the full payload and the specific error message. This creates an invaluable audit trail for debugging later. Even better, implement monitoring that sends you an alert the moment your listener starts failing, so you can jump on the problem before it affects your customers or your revenue.

Answering Your Top IPN Questions

Once you get the hang of the basics, you'll inevitably run into some real-world "what if" scenarios. Let's tackle the most common questions that pop up when you're in the trenches, building out your IPN system. Think of this as your go-to FAQ for handling the practical side of things.

We’ll cover everything from server meltdowns to safe testing practices, making sure you have the answers you need to build a solid, reliable integration.

What Happens If My Server Is Down When an IPN Is Sent?

This is probably the number one concern for anyone setting up an IPN listener, and for good reason. The good news? Payment gateways are built for this. Providers like BlockBee have a built-in retry mechanism. If your server is offline or fails to respond with a successful 200 OK status, the gateway doesn't just throw its hands up.

Instead, it will try resending the notification multiple times over a period that could span hours or even days. This is exactly why building an idempotent system is a non-negotiable. Your listener has to be smart enough to receive the same IPN more than once without, for example, shipping the same product twice. Always dig into your gateway’s documentation to find their specific retry schedule.

Should I Fulfill an Order Before Receiving the IPN?

In a word: no. It's tempting to fulfill an order the second a customer lands on your "thank you" page, but it's a huge security hole. A savvy user could simply bookmark that confirmation page and access it without ever paying, or they might just close the browser before the payment actually clears.

The IPN is your single source of truth. It's the only authoritative, server-to-server confirmation that you've actually been paid. Always, always wait for a valid and verified IPN before you ship a product, grant access to a download, or update an invoice.

Treating the IPN as the final word on any transaction keeps your fulfillment process automated, secure, and protected from fraud and simple mistakes.

How Can I Test My IPN Listener Without Real Money?

You should never, ever use live transactions for testing. Thankfully, you don't have to. Every major payment gateway provides a "sandbox" or "test" environment that mimics the real thing perfectly. These sandboxes let you use fake payment details to trigger just about any transaction scenario you can think of.

Most providers also give you developer tools right in their dashboard. A common feature is an IPN simulator, which lets you manually send or resend specific IPN messages to your endpoint. This gives you granular control to test for:

- Successful Payments: Does your system correctly process a standard, successful transaction?

- Failed Transactions: How does your listener handle a payment that gets declined?

- Different Currencies: Can your logic handle payments in various currencies?

- Duplicate Notifications: Is your idempotency check working as expected?

Using a sandbox is the only way to debug and perfect your IPN handler without any financial risk.

Is an IPN the Same Thing as an API?

Not exactly, though they're two sides of the same coin and work together to create a full payment integration. The main difference is who starts the conversation.

An API (Application Programming Interface) is a set of rules and tools you use to ask a service to do something. You call the gateway's API to "pull" information or "push" a command—like creating a new payment address. It's an action you initiate.

An IPN (Instant Payment Notification), on the other hand, is an automated message the gateway sends to you when an event happens on its end. The gateway initiates this "push" to your server to let you know a payment has been confirmed.

Here’s a simple way to think about it: You use the API to ask the gateway to do something. The gateway uses an IPN to tell you how it went.

Ready to build a secure, automated payment system with the power of IPNs? With BlockBee, you can integrate crypto payments seamlessly and manage transactions with a reliable, developer-friendly platform. Get started today and see how easy it is to accept cryptocurrency payments.