Digital Payment Solutions for Businesses A Complete Guide

When you hear "digital payment solutions," what comes to mind? For most businesses, it's simply the tech that lets them accept money online instead of dealing with cash or paper checks. That’s the core of it, but it’s a lot more than just a digital cash register.

These systems cover everything from simple credit card readers to mobile wallets and even crypto payment gateways. They're built for speed, security, and the ability to sell to anyone, anywhere. Frankly, in today's market, having a solid digital payment setup isn't just a nice-to-have; it's essential for keeping your doors open and your customers happy.

Why Bother With a Modern Payment Strategy?

Sticking with old-school payment methods is like trying to run a marathon in hiking boots. You might eventually get there, but you’ll be slow, exhausted, and miles behind everyone else. In a world where customers demand convenience, how you let them pay is just as important as what you're selling.

People expect to pay instantly, without any hassle, from whatever device they happen to be using. If you can't deliver that, you're actively turning away business.

The numbers don't lie. A whopping 73% of consumers admit that a company's payment options directly influence where they decide to spend their money. A clunky, slow, or limited checkout is one of the surest ways to lose a sale you almost had. Modern digital payment solutions for businesses are no longer an optional upgrade—they're a baseline requirement for staying in the game.

The Real-World Payoff of Upgrading Your System

Adopting a smart payment strategy does more than just help you get paid. It's a genuine tool for making your business run smoother and keeping your customers coming back.

Here’s what you stand to gain:

- Better Cash Flow, Instantly: Digital payments slash the time it takes for money to hit your account. Instead of waiting days for a check to clear, you can see funds arrive in hours or even minutes. That means more predictable, healthy cash flow.

- Slash Administrative Headaches: Automation is your best friend. It handles the tedious work of invoicing, chasing down late payments, and balancing the books. This can cut your overhead costs by up to 60% compared to the old way of mailing paper checks, freeing up your team for more important work.

- A Smoother Customer Experience: When you offer a range of options—credit cards, mobile wallets, maybe even crypto—you're meeting customers where they are. Less friction at checkout means happier buyers and more repeat business.

This isn't just some passing trend. The digital payment market was valued at an incredible USD 114.41 billion in 2024 and is on track to hit USD 361.30 billion by 2030. You can discover more about these market projections and see for yourself what’s fueling this explosive growth.

Think of your payment system as a strategic asset. It directly impacts customer satisfaction, how efficiently you operate, and your ability to compete on a global scale.

By getting on board, you’re not just swapping out old tech. You're future-proofing your business, opening up new ways to make money, and building a much stronger connection with the people who keep you in business.

Getting to Grips With Your Digital Payment Options

Trying to understand digital payments can feel like you've been dropped in a foreign country without a dictionary. You’re bombarded with terms like "gateway," "processor," and "merchant account," and it's easy to feel lost. Let’s break it all down into simple, real-world terms so you can see exactly how the money moves from your customer to you.

Imagine your online store is a physical shop. The payment gateway is like the credit card terminal on your counter. It's the customer-facing part that securely reads the payment info, encrypts it, and sends a quick, secure message asking, "Are the funds available?"

The payment processor is the behind-the-scenes engine that the terminal talks to. It takes that encrypted message and efficiently routes it through the right banking networks (like Visa or Mastercard) to get an "approved" or "declined" response. It then zips that answer right back to the terminal. You need both for the sale to go through.

Traditional Payment Rails: The Tried and True

Most businesses operate on traditional payment rails. These are the established, well-oiled machines that have powered commerce for decades, simply updated for the internet age. They're reliable, everyone knows how to use them, and they’re what your customers expect to see at checkout.

Here’s a quick rundown of the main players:

- Credit and Debit Cards: This is the king of the hill, the most common way people pay for things online across the globe. Customers pop in their card details, and the gateway and processor duo handle the rest.

- Bank Transfers (ACH): Automated Clearing House (ACH) payments are a direct line to a customer's bank account. You see them a lot with recurring bills or big B2B invoices because the processing fees are usually much lower than cards.

- Digital and Mobile Wallets: Think Apple Pay, Google Pay, and PayPal. These services securely store a customer's payment info, enabling a super-fast, one-click checkout. This convenience can dramatically lower cart abandonment—a huge win for any online business.

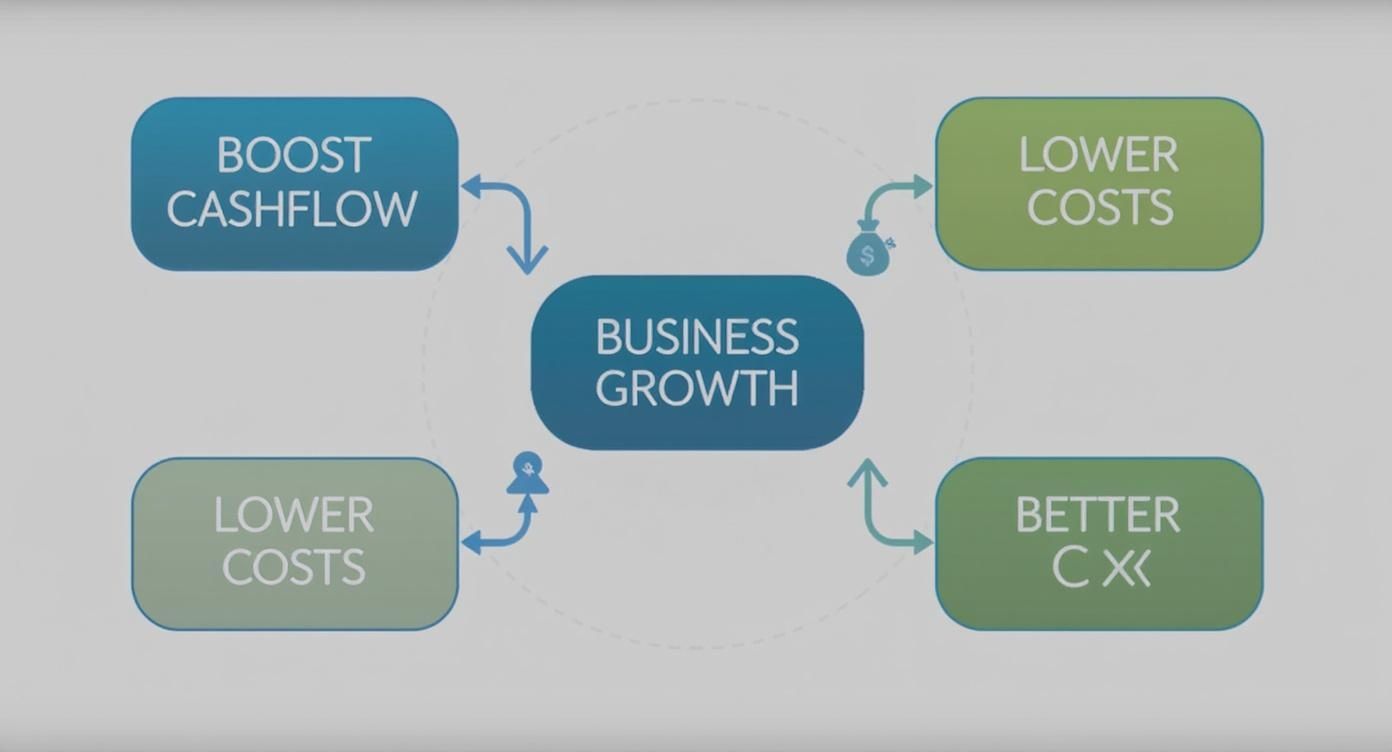

This isn't just about back-office plumbing; it's a direct driver of growth. The right payment setup improves cash flow, cuts costs, and makes customers happier.

As the visual shows, upgrading your payment system isn't just an operational tweak. It's a core strategy for building a more resilient and customer-focused business.

Crypto Payment Rails: The New Frontier

Beyond the familiar, a completely new category of digital payment solutions for businesses is making serious waves: cryptocurrency. Once a niche interest for tech geeks, crypto is quickly becoming a practical and powerful payment option for everyday commerce.

Crypto payments run on a totally different infrastructure called the blockchain. Instead of a central hub of banks, transactions are verified and logged on a decentralized public ledger. This isn't just a technical detail; it changes the entire game.

To help clarify the differences, let's compare these two systems side-by-side.

Comparing Traditional and Crypto Payment Rails

| Feature | Traditional Payment Rails (Cards, ACH) | Cryptocurrency Payment Rails |

|---|---|---|

| Intermediaries | Multiple (Banks, Card Networks, Processors) | Few to None (Direct Peer-to-Peer) |

| Transaction Fees | 2-4% + fixed fees | Typically under 1% |

| Settlement Time | 2-5 Business Days | Minutes to Hours |

| Chargebacks | Common (Customer can dispute charges) | Irreversible (No chargebacks) |

| Global Reach | Subject to regional banking rules & fees | Borderless by design |

| Security | Centralized fraud detection systems | Secured by cryptographic proofs on a blockchain |

This table shows a clear trade-off. While traditional rails offer familiarity and consumer protections like chargebacks, crypto offers a compelling alternative with its speed, low cost, and global accessibility.

For a business, this translates into real-world benefits. Crypto payments are inherently borderless, often settle much faster than a standard bank transfer, and can slash transaction fees. There are no confusing interchange rates or international banking headaches to deal with.

Services like BlockBee are the bridge to this new world, acting as both the gateway and processor for crypto. We make it easy for a customer to pay with Bitcoin, Ethereum, or other digital currencies at checkout. Our system manages all the blockchain complexity, confirms the payment, and delivers the funds straight to your digital wallet. If you want to dive deeper into the mechanics, you can learn more about how https://blockbee.io/blog/post/cryptocurrency-payment-gateways work behind the scenes.

Finding the Right Mix for Your Business

The smartest approach isn't an "either/or" decision. It’s about creating a blend of options that fits your unique customer base. An e-commerce brand will likely lean on card payments and digital wallets for quick, impulse purchases. A SaaS company might prefer the low cost of ACH for handling large monthly subscription fees.

And don't forget geography. If you're selling internationally, you have to think locally. For instance, QR code payments are king in many Asian markets. Getting familiar with something like Using WeChat QR Codes for Payments could be the key to unlocking a massive new audience.

Ultimately, by offering a thoughtful mix of digital payment solutions, you remove friction at the most critical point of the sale. You make it as easy as possible for people to pay you, no matter where they are or how they prefer to do it.

Unpacking the Must-Have Payment Solution Features

Choosing a digital payment solution isn't just about finding a way to get paid. The right system is a growth engine for your business, packed with features that solve real problems and open up new opportunities. Without them, you’re just using a digital cash drawer. With them, you have a strategic tool.

Think of it like buying a car. The basic model gets you from A to B, sure. But the one with GPS, cruise control, and modern safety features makes the journey faster, easier, and a whole lot more efficient. The same goes for digital payment solutions for businesses. The real value is in the features that power your operations.

Go Global with Multi-Currency Support

The internet erases borders, turning your local shop into a potential global marketplace almost overnight. But that opportunity disappears if your customers can't pay in a currency they actually recognize and trust. This is where multi-currency support is a game-changer.

This feature automatically figures out where your customer is browsing from and shows them prices in their local currency. It handles all the messy conversion work behind the scenes. A buyer in Japan sees Yen, someone in France sees Euros, and you don’t have to lift a finger. That small touch builds instant trust and can seriously reduce how many people abandon their carts.

Imagine a US-based e-commerce store selling handmade crafts. By simply showing prices in Euros, they can instantly connect with a massive European audience. The customer pays a familiar amount, and the business gets the funds in USD. The payment solution handles the entire process.

Automate Revenue with Recurring Billing

For any subscription or SaaS business, predictable revenue is everything. Recurring billing is the feature that makes this happen, acting as the automated heartbeat of your entire business model. It securely saves customer payment details and automatically charges them on schedule—whether it’s weekly, monthly, or annually.

This single feature gets rid of the awkward, time-sucking process of sending manual invoices and chasing down late payments. It keeps cash flow steady, improves customer retention by making payments completely effortless, and frees you up to focus on your product instead of your billing cycle.

A solid recurring billing system isn't just a convenience; it's the foundation for a scalable subscription business. It gives you the financial stability you need for long-term growth and planning.

Build Trust with Advanced Security and Fraud Detection

Trust is the bedrock of any transaction. Your customers have to feel confident that their sensitive financial data is locked down, and you need protection from fraudsters trying to slip through the cracks. Advanced security features aren't a nice-to-have; they’re your digital bodyguard.

Key security measures you should look for include:

- Tokenization: This is a clever process that swaps sensitive card data for a unique, non-sensitive code called a token. The real card number is never stored on your servers, which dramatically lowers the risk if there's ever a data breach. To get a better handle on this critical security layer, check out our guide on what payment tokenization is and how it works.

- 3D Secure (3DS): You’ve probably seen this yourself. It’s that extra step where a customer has to verify their identity with their bank, usually with a one-time code sent to their phone.

- AI-Powered Fraud Detection: The best systems use machine learning to analyze transactions in real time. They can spot suspicious patterns and block fraudulent attempts before any damage is done.

These tools work in concert to create a secure environment that protects both you and your customers, building the kind of confidence that brings people back again and again.

Turn Data into Decisions with Reporting and Analytics

Your transaction history is so much more than a list of sales. It's a goldmine of business intelligence just waiting to be tapped. A good payment solution comes with a powerful reporting and analytics dashboard, turning all that raw data into insights you can actually use.

This is how you track key metrics like sales volume, average transaction value, and customer lifetime value. You can spot your busiest sales hours, figure out which products are flying off the shelves, and even monitor payment failure rates to fix snags in your checkout. The scale of this is massive; the global transaction value in payment processing is expected to hit around USD 157 trillion by 2025. By tapping into your slice of this data, you can make smarter, evidence-based decisions that drive real growth.

Matching Your Payment Solution to Your Business Model

Picking a payment solution isn't a one-size-fits-all game. What works brilliantly for a retail shop will almost certainly fall flat for a subscription service. The secret is to match your payment setup to how your business actually runs—that’s how you turn payments from a hurdle into a growth engine.

Think of it like choosing tires for a car. You wouldn't put off-road tires on a race car, would you? The same logic applies here. Your business model is the terrain, and your payment solution needs the right tread to grip it perfectly.

When you get this right, your payment system stops being a cost center and starts actively helping you achieve your goals.

For E-commerce Stores

For any online store, the biggest enemy is the abandoned cart. A customer can love your product, add it to their basket, and still walk away if the checkout is slow, confusing, or doesn't have their preferred way to pay. A smooth, frictionless checkout isn't a nice-to-have; it's absolutely essential.

Your focus should be squarely on speed and convenience. One-click checkouts with digital wallets like Apple Pay and Google Pay are a must. So are guest checkouts that don't force someone to create an account just to give you their money. Offering a broad range of options, from credit cards to crypto, means you can cater to everyone.

The goal is to make paying so easy it’s almost an afterthought. Every additional step or field a customer has to fill out is another opportunity for them to leave.

By obsessing over this final step of the sale, you directly boost your conversion rates and, ultimately, your revenue.

For SaaS and Subscription Businesses

If your business is built on recurring revenue, your payment system is your lifeline. The priority shifts from single sales to maintaining a seamless subscription lifecycle. This calls for a totally different set of tools.

At its core, you need rock-solid recurring billing. Your system has to automate charges every month or year without a single hiccup. Just as critical is a smart dunning management system—that’s the automated process for handling failed payments. It should gently remind customers to update an expired card and intelligently retry charges when they’re most likely to succeed.

Essential features for a subscription model include:

- Automated Invoicing: Creates and sends out professional invoices without you lifting a finger.

- Subscription Management: Gives customers a self-service portal to upgrade, downgrade, or pause their plans.

- Prorated Billing: Automatically calculates the right amount to charge when a customer changes their plan mid-cycle.

Nailing these features is the key to predictable cash flow and stopping customers from churning over something as simple as a failed payment.

For Online Marketplaces

Marketplaces have the trickiest payment needs of all. You’re not just taking money from buyers; you’re also splitting it up and paying out to multiple sellers. This introduces a whole new layer of financial and regulatory headaches that standard payment gateways just aren't designed for.

The main challenge is handling split payments, where one payment from a customer has to be automatically divided between your platform and one or more vendors. Your system must do this instantly and without errors. On top of that, things like escrow services—where funds are held securely until a product is delivered—are vital for building trust between the buyers and sellers on your platform.

Another crucial piece is seller onboarding. A great marketplace solution makes it dead simple for vendors to get verified and connect their bank accounts, ensuring they get paid fast. This is how you attract and keep the best sellers. The need for these flexible payment systems is only growing. The number of digital financial service users is expected to jump from 3.55 billion in 2024 to 4.79 billion by 2028. If you want to dive deeper, you can explore more in the latest online payment trends.

How to Choose and Implement Your Payment System

This is where the rubber meets the road. Picking and launching the right payment system isn't just a technical task—it's about turning your checkout from a simple transactional endpoint into a powerful strategic asset. The secret is to look inward at your own business before you ever start looking at outside providers.

Think of it like getting a custom-tailored suit. You wouldn't just grab one off the rack hoping it fits. You need your measurements first. In the same way, you have to audit your business needs before you can find a payment system that’s a perfect fit.

Start with a Self-Audit

Before you get lost comparing a dozen different payment providers, take a moment to get a clear picture of what you actually need. This internal audit is your compass; it will point you toward solutions that genuinely serve your business, not ones that force you into a box.

Start by asking a few fundamental questions:

- What's our typical transaction volume? Are you processing ten high-value sales a month or thousands of smaller ones? The answer dramatically changes which fee structure makes financial sense.

- Who and where are our customers? Are you selling locally, or do you have a global audience? Do your customers stick to credit cards and digital wallets, or are they tech-savvy and open to things like crypto?

- What features are absolute must-haves? If you run a subscription service, you can't live without recurring billing. If you're expanding, multi-currency support is non-negotiable.

Answering these questions first keeps you from getting distracted by flashy features you'll never use. It grounds your search in what will actually create value for your specific business model.

Comparing Providers Beyond the Fees

Once you have your requirements list, you can start evaluating potential partners. It’s incredibly tempting to just look at transaction fees and pick the lowest number, but that's a classic mistake. A cheap solution with terrible support or constant downtime will cost you far more in lost sales and headaches.

A smarter approach uses a more balanced scorecard.

A payment provider is more than just a utility; they are a partner in your growth. Their reliability, support, and ease of integration have a direct impact on your operations and your customers' experience.

When you're sizing up different providers, be sure to weigh these critical factors:

- Settlement Times: How long does it take for the money to get from your customer to your bank account? Faster settlement means better cash flow. Simple as that.

- Integration Difficulty: How hard is it to get this thing up and running? Does it have a simple plugin for your WooCommerce store, or are you going to need a developer for a complex API setup?

- Customer Support: When something inevitably goes wrong at 2 AM, can you get a knowledgeable human on the line quickly? Don't be afraid to test their support channels before you sign anything.

This holistic view ensures you’re not just picking a processor, but a partner that will actually support your business as it grows.

Demystifying the Implementation Process

Okay, you've made your choice. Now it's time to get it working. This step can be anything from a five-minute setup to a more involved technical project, depending entirely on your business and the solution you've selected.

For most businesses using standard e-commerce platforms like WooCommerce or Magento, implementation is surprisingly straightforward. Providers like BlockBee, for example, offer pre-built plugins that you can install and configure with just a few clicks. This is the plug-and-play route, and it requires almost no technical skill.

On the other hand, if you have a custom-built website or a unique application, you’ll likely be working with an Application Programming Interface (API). An API is just a set of rules and tools that allows your software to talk directly to the payment provider’s system, giving you maximum flexibility.

For instance, BlockBee’s API and its well-documented libraries are designed to make this process as smooth as possible, even for complex custom jobs. It allows developers to weave cryptocurrency payments directly into their existing workflows. If you're curious about the nuts and bolts, you can learn more about a payment gateway API integration to see how it all connects behind the scenes. This method gives you total control over the checkout experience, from its look and feel down to its specific functions.

Future-Proofing Your Business Payments

Picking the right digital payment solution for your business goes way beyond just another operational task. It’s a strategic move that hits your bottom line, customer happiness, and your ability to grow in the long run. The system you set up today needs to solve your current headaches, but it also has to be flexible enough for whatever comes next.

This means you have to think bigger than just basic credit card processing. A solid, forward-thinking strategy looks at everything from slick, one-click checkouts to borderless options like cryptocurrency. It's about recognizing that your payment gateway is a critical moment in the customer's journey and a huge lever for making your own operations smoother. As payment tech moves forward, so will what your customers expect from you.

A Strategic Recap for Growth

To keep a competitive edge, always make sure your payment solution is a perfect fit for your specific business model. An e-commerce store lives and dies by speed. A SaaS business absolutely needs rock-solid recurring billing. And a marketplace? That's a whole other level of complexity with multi-vendor payouts. The "right" features are the ones that kill friction and directly help you make money.

Adopting this kind of proactive mindset turns your payment system from a simple utility into a powerful engine for growth.

The ultimate goal is to create a payment ecosystem that is secure, efficient, and ready for what's next. This involves not only choosing the right technology but also ensuring compliance and building trust with every single transaction.

To truly future-proof your digital payment solutions, understanding and implementing a comprehensive data protection policy, particularly in line with regional regulations, is paramount.

By taking a hard look at your current setup and exploring modern, adaptable solutions like BlockBee for crypto payments, you’re setting your business up to not just meet, but beat the demands of a market that’s always in motion. Make a choice that gets you ready for the future of commerce.

Frequently Asked Questions

When you're digging into digital payment solutions for businesses, a few questions always seem to pop up. Getting straight answers is the only way to feel good about the path you choose for your company. Let's clear up some of the most common ones.

Payment Gateway vs Payment Processor

So, what's the real difference between a payment gateway and a payment processor? People often throw these terms around as if they're the same thing, but they play two very different roles in getting you paid.

Imagine a secure deposit box at a bank. The payment gateway is the slot on the front of that box. It’s the secure, customer-facing piece that takes the payment information, encrypts it, and makes sure everything looks right before dropping it safely inside for processing.

The payment processor is the armored truck that comes to collect the contents of that box. It's the engine that takes the encrypted transaction details from the gateway, communicates with the customer's bank and your bank through complex financial networks, and sends back a simple "approved" or "declined" message. You can't have one without the other; they work as a team.

How Much Do These Solutions Cost

Every business owner needs to know the bottom line. While specific pricing can vary, traditional payment providers typically stick to one of two models, which directly affects your per-transaction cost.

- Flat-Rate Pricing: This is the no-surprises approach. You pay a simple, fixed percentage plus a small fee on every sale (a common example is 2.9% + $0.30). It’s incredibly easy to forecast your costs, which is why it's a huge hit with startups and small businesses.

- Interchange-Plus Pricing: A bit more complex, but also more transparent. This model separates the non-negotiable interchange fee (what card networks like Visa or Mastercard charge) from the processor's markup (the "plus"). For businesses doing a lot of sales, this can often work out to be cheaper.

Is Accepting Cryptocurrency Safe

Security is non-negotiable, and when you're talking about something like crypto, it's the first question on everyone's mind. Can a business really accept crypto payments safely? The answer comes down to how you do it.

The secret to staying safe is using a non-custodial service.

With a non-custodial payment gateway like BlockBee, you are always in complete control of your money. The service simply helps the transaction happen, but the crypto itself moves directly from the customer to a digital wallet that only you hold the keys to.

This structure is a game-changer for security. Because the payment provider never actually holds your funds, there's no central pot of money for hackers to target. From the moment a customer pays, the assets are yours and yours alone, protected by the blockchain and under your full control.

Ready to give your customers the speed, security, and borderless convenience of crypto payments? BlockBee offers a secure, non-custodial gateway with easy-to-install plugins and a powerful API to get you up and running in minutes. Learn more at https://blockbee.io.