A Guide to Cryptocurrency Payment Gateways

Think of a cryptocurrency payment gateway as the ultimate financial middleman, a bit like a universal translator for money. It’s the piece of technology that lets a customer pay you from their digital wallet and have the funds land in your business account, just like any other sale. In short, it makes accepting crypto as easy as swiping a credit card.

How Crypto Gateways Open Up a World of Customers

At its core, a crypto payment gateway is simply a payment processor designed for digital currencies like Bitcoin or Ethereum. It does all the heavy lifting for you, automating the entire transaction so you don't need to be a blockchain wizard to get paid. All the technical stuff happens behind the scenes, leaving your customer with a simple, familiar checkout process.

Let's say you run an e-commerce shop. A customer in Japan wants to buy one of your products, but they're staring down a mountain of international bank fees. With a crypto gateway, they can just pay you in their crypto of choice. The gateway instantly verifies the payment, converts it into your preferred currency (like USD or EUR), and drops the money right into your bank account.

Just like that, the old hurdles of cross-border payments disappear, and your business is suddenly open to anyone with an internet connection.

So, Why Are Businesses Really Making the Switch?

The move to accept digital currencies isn't just about being trendy; it's a strategic decision that solves some very real headaches for modern businesses. Merchants are now using crypto to get a leg up on the competition.

Here’s what’s really driving the adoption:

- Dramatically Lower Fees: Credit card companies typically skim 2-4% off the top of every transaction. Crypto gateway fees? They’re usually around 1% or even less. For businesses processing a lot of sales, those savings add up fast.

- No More Chargebacks: Crypto payments are final. Once a transaction is confirmed on the blockchain, it’s set in stone. This completely wipes out the risk of fraudulent chargebacks, a persistent and costly problem for any online seller.

- Get Your Money Faster: Forget waiting days for a bank transfer to clear. Crypto payments often settle in minutes. This means better cash flow and much quicker access to the money you've earned.

- Tighter Security and Privacy: Because they're built on blockchain, these transactions are incredibly secure. Customers never have to hand over sensitive financial details, which drastically cuts down the risk of data theft for everyone involved.

A crypto payment gateway acts as a secure buffer, shielding you from the volatility and technical complexity of the crypto world. It's designed to give you all the benefits of digital currencies without any of the associated risks. The goal is to expand your payment options, not create more work.

Ultimately, adding a crypto payment gateway is about preparing your business for the future. It sends a clear signal to a growing, tech-savvy audience that you’re a forward-thinking brand ready to do business on their terms.

How Crypto Payment Gateways Actually Work

So, how does this all happen behind the scenes? The easiest way to think about a crypto payment gateway is to picture it as a super-smart translator and bodyguard for your money. It takes a foreign language (crypto) from your customer and instantly translates it into your native currency (like dollars or euros), all while making sure the entire exchange is secure.

The whole point is to make a complex blockchain transaction feel just like any other online checkout. For you, the merchant, it smooths over all the intimidating technical stuff.

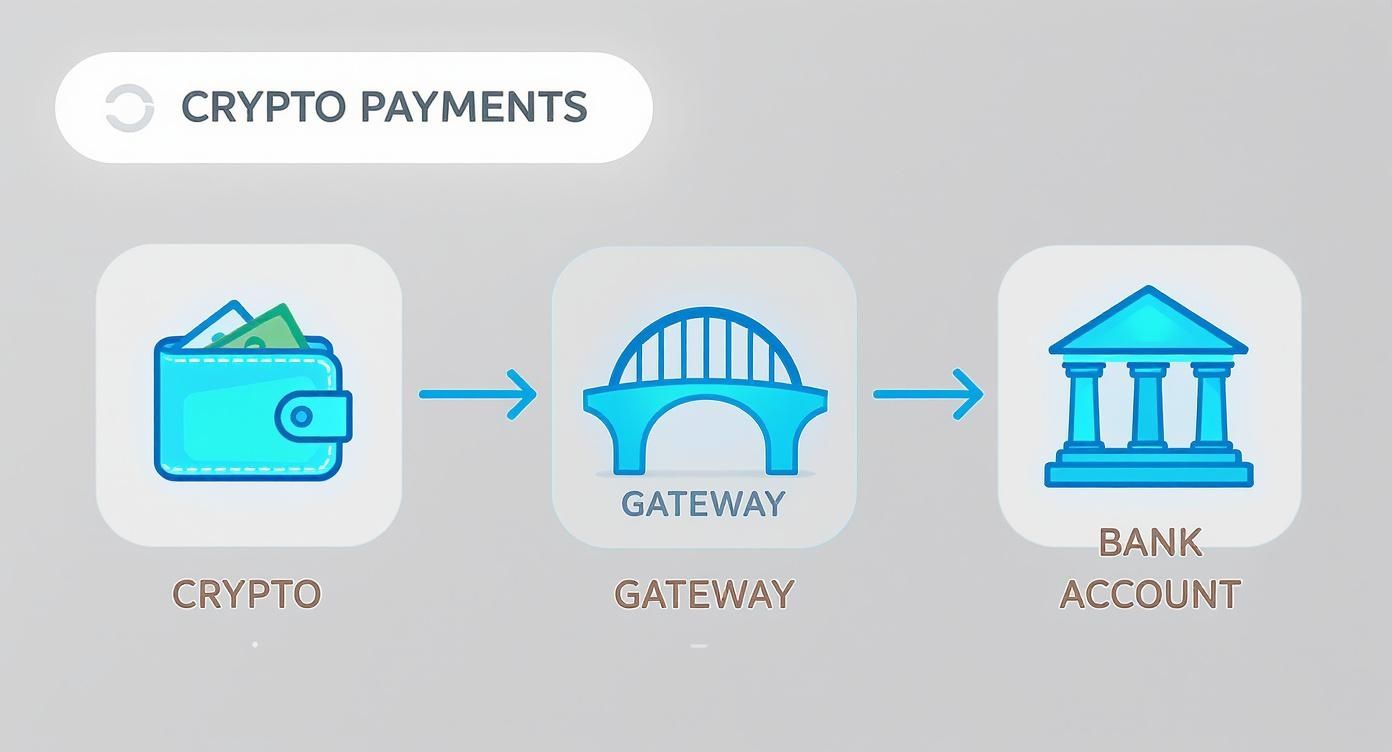

This visual breaks down the simple three-part journey a payment takes from your customer's crypto wallet to your bank account, with the gateway doing all the heavy lifting in the middle.

As you can see, the gateway is the essential bridge connecting the two worlds. It handles the tricky conversion and transfer so that everything feels effortless for both you and your customer. Let's walk through what’s really going on at each stage.

Stage 1: The Customer Kicks Off the Payment

It all begins on your checkout page. A customer decides to buy something and selects the "Pay with Crypto" option. This is the moment the cryptocurrency payment gateway springs into action.

The gateway instantly creates a unique payment invoice. This isn't just a simple request; it includes the precise amount of crypto needed and a specific wallet address, usually shown as a handy QR code. The system calculates this amount based on real-time exchange rates and locks it in for a few minutes, so you're protected if the market suddenly swings.

From there, the customer just opens their crypto wallet, scans the code, and hits "send." Simple as that.

Stage 2: The Gateway Verifies the Transaction

Once the customer sends the funds, the payment is broadcast across the blockchain. The gateway is already watching the network, waiting for that specific transaction to appear. This isn't quite instantaneous—the network needs a moment to confirm the payment is legitimate and can't be reversed.

Different cryptos have different confirmation speeds, but this is where a good gateway proves its worth. It can often provide an almost-instant payment validation for you, confirming the payment is on its way long before it’s fully settled on the blockchain. This means you can ship the product or provide the service right away.

The gateway is basically giving you a guarantee that "the check is in the mail." It takes on the small risk of any network lag so your customer gets a fast, smooth checkout experience, preventing them from getting frustrated and abandoning their cart.

This immediate feedback is a game-changer for e-commerce, where every second of delay can hurt your conversion rates.

Stage 3: Conversion and Settlement into Your Currency

Now for the part most businesses care about. Unless you're planning to hold crypto yourself, you need that payment in your local currency. The gateway handles this automated fiat conversion without you ever having to lift a finger.

The second the transaction is verified, the service executes a trade. It sells the Bitcoin (or other crypto) it received and buys the equivalent amount in your currency at the locked-in rate.

This completely insulates you from crypto's famous price volatility. You know you're getting the exact amount you charged for your product, no matter what the crypto markets do an hour later.

Stage 4: The Money Lands in Your Bank Account

The final step is getting paid. After the crypto is converted, the gateway deposits the funds directly into your business bank account. How often this happens usually depends on the provider and your own preferences.

Typically, you can pick a schedule that works for you:

- Daily Payouts: Get your funds at the end of each business day.

- Weekly Payouts: Bundle your sales into a single, larger weekly transfer.

- Manual Payouts: Let your balance build and withdraw it whenever you want.

From your end, the whole thing feels no different than a standard credit card transaction. A customer pays, and the money shows up in your account. The key differences? The fees are lower, chargebacks are a thing of the past, and you can now sell to anyone in the world. The gateway handles all the blockchain complexity so you don't have to.

The Business Case for Crypto Payments

It’s one thing to know how a crypto payment gateway works, but it's far more important to understand why it's a smart move for your business. This isn't just about adding a new payment button to your checkout page; it's about making a fundamental upgrade to your financial operations.

The real advantages go way beyond just being trendy. They offer concrete solutions to some of the most frustrating problems merchants have been dealing with for years. From cutting costs to reaching entirely new customers, the argument for making the switch is surprisingly strong.

Dramatically Reduce Transaction Fees

Let's start with the most obvious win: cost savings. Traditional payment processors, especially credit card companies, can take a significant slice of your revenue, with fees typically ranging from 2% to 4% of every transaction. Over a year, that adds up to a staggering amount of lost profit.

Crypto payment gateways, on the other hand, run on a much leaner structure. Their fees often land around 1% or even less. That difference isn't just pocket change; it's capital you can pour back into growing your business.

Think about an e-commerce store doing $100,000 in monthly sales. A standard 3% credit card fee costs them $3,000. With a crypto gateway charging 1%, that cost drops to $1,000. That’s an extra $2,000 in their pocket every single month—or $24,000 a year.

To get a clearer picture of the savings, it helps to see a detailed comparison of payment gateway fees.

Achieve Faster Settlements and Better Cash Flow

Ever waited for money to clear? With traditional banking, "settlement" can feel like it takes forever. It can be several business days before the money from a credit card sale actually lands in your bank account, which can put a serious strain on cash flow.

Crypto payments move at the speed of the blockchain. Transactions are usually confirmed in a matter of minutes, not days. A good cryptocurrency payment gateway can then convert that crypto to cash and get it moving to your bank almost right away.

This speed gives your business more financial agility. You can pay suppliers, run payroll, and jump on new opportunities without waiting on slow, outdated banking systems.

Eliminate Fraudulent Chargebacks Permanently

Chargeback fraud is a massive headache—and a multi-billion dollar problem—for merchants. A customer buys something, receives it, then disputes the charge with their credit card company, forcing a refund and often sticking you with a penalty fee.

This is where the blockchain's design becomes a huge asset. Transactions are final. Once a crypto payment is sent and confirmed, it can't be reversed by the sender. This simple fact completely wipes out the risk of fraudulent chargebacks. For any business that’s been a target of this kind of fraud, this benefit alone is a game-changer.

Tap Into New Global and Unbanked Markets

Traditional payment systems are tangled up in geography and banking regulations. A potential customer in another country might see their payment declined or get hit with high conversion fees—if they can even pay you at all.

Cryptocurrencies are borderless by nature. All someone needs is an internet connection and a digital wallet to send a payment from anywhere in the world. This instantly opens your business up to a vast, untapped global customer base, including people in regions where credit cards aren't common.

Let's take a look at how these two systems stack up side-by-side.

Crypto Gateways vs Traditional Payments

The differences become even clearer when you compare them directly. While traditional methods are familiar, crypto gateways offer distinct advantages in key areas that matter most to a modern business.

| Feature | Cryptocurrency Payment Gateway | Traditional Payment Methods |

|---|---|---|

| Fees | Typically 0.5% - 1% per transaction. | Average 2% - 4% plus various other fees. |

| Settlement Time | Minutes to a few hours. | 2 - 5+ business days. |

| Chargebacks | Impossible due to blockchain immutability. | Common and a major source of revenue loss. |

| Global Reach | Borderless; accepts payments from anyone, anywhere. | Limited by banking regions and high cross-border fees. |

| Security | Decentralized, cryptographic security. | Centralized systems are frequent targets for data breaches. |

As you can see, the shift towards crypto gateways isn't just about accepting a new type of currency; it's about choosing a more efficient, secure, and globally-minded financial tool.

What to Look For in a Crypto Payment Gateway

Choosing the right cryptocurrency payment gateway is a lot like picking a business partner. You need someone reliable who can handle the job without causing constant headaches. The market is full of options, but not all of them are built the same.

Focusing on a handful of core features will separate the truly useful tools from the ones that just talk a good game. These are the absolute must-haves that protect your revenue, keep your customers happy, and make your life easier. Think of it as a simple checklist for making a smart decision.

Multi-Coin and Stablecoin Support

The first question you should always ask is, "What coins can I actually accept?" If a gateway only handles Bitcoin or Ethereum, you're immediately shutting the door on a huge portion of the market. A solid platform needs to offer multi-coin support, letting you take payments in all the major coins plus a good selection of popular altcoins.

Even more critical is support for stablecoins. These coins are pegged to a stable asset like the US dollar, and they've become the backbone of crypto e-commerce. In fact, stablecoins now account for a staggering 76% of all crypto payments because they remove the guesswork of price swings for both you and your customer. It’s a trend that shows just how important stability is in day-to-day transactions.

Offering a wide range of crypto options isn't just about convenience. It shows your customers that you understand their world and are serious about doing business with them, which goes a long way in building trust.

Instant Fiat Conversion

For most merchants, this is the single most important feature, period. The crypto market is famously volatile; a coin’s value can spike or dip in the time it takes to get a coffee. Without instant fiat conversion, the $100 payment you receive today could be worth $85 by tomorrow. That's a risk most businesses can't afford to take.

A good gateway solves this problem completely. The second a customer’s payment clears, the system automatically converts the crypto to your preferred fiat currency (like USD or EUR) at a guaranteed rate. This means you always get the exact amount you charged, protecting your profit margins and making your bookkeeping infinitely simpler.

Seamless E-commerce Integration

Your payment gateway needs to fit into your existing setup, not force you to rebuild everything around it. Modern e-commerce relies on flexible systems, often using a composable commerce approach to mix and match the best tools. The best gateways understand this and provide ready-made plugins and simple APIs to get you up and running fast.

Look for a gateway that offers official integrations for the big players, like:

- WooCommerce: The go-to for millions of WordPress stores.

- Shopify: A giant in the e-commerce world, from small shops to huge brands.

- Magento: A powerful choice for larger, more complex online businesses.

- PrestaShop: A popular and flexible open-source solution.

When integration is this easy, you can start accepting crypto in a matter of hours, not weeks, without needing to hire a developer. It creates a smooth, professional checkout flow that keeps customers from abandoning their carts and builds confidence in your brand.

Tackling the Common Worries About Crypto Payments

Let's be honest—jumping into any new payment tech can feel a bit daunting. When it comes to crypto, business owners usually have the same three things on their minds: wild price swings, tech headaches, and security. It's completely understandable to be cautious.

The good news is that a well-designed crypto payment gateway, like BlockBee, was built from the ground up to solve these exact problems. They turn what seem like deal-breakers into total non-issues, making it simple and safe for any business to start accepting crypto.

Let’s unpack these common hurdles and see how the right tools completely dismantle them.

Taming Price Volatility

The biggest fear most merchants have about crypto is its infamous price volatility. You don't want to accept a $100 payment only to see it shrink to $90 an hour later. That’s a real risk, but it’s one that modern gateways have completely solved.

The secret weapon here is instant fiat conversion. It’s a simple but brilliant process:

- Your customer pays for a $100 item with Bitcoin.

- The gateway immediately locks in that $100 value.

- It then instantly converts the Bitcoin to your preferred currency, like USD or EUR.

This means you are completely shielded from the crypto market's ups and downs. The money that hits your bank account is the exact amount on the price tag. You get all the advantages of offering crypto payments without ever holding a volatile asset yourself.

Simplifying Technical Integration

The mere mention of "blockchain integration" can make a non-technical business owner's head spin. The last thing you want is to get bogged down with complex APIs and a setup process that requires a team of developers.

This is where a user-friendly gateway changes the game with plug-and-play solutions. Instead of forcing you to write custom code, platforms like BlockBee provide simple plugins for all the major e-commerce platforms. Adding a crypto payment option can be as easy as installing an app—just a few clicks and you're ready to go.

A modern gateway's job is to make crypto easy for everyone, not just for the tech wizards. All the heavy lifting and backend complexity should be handled for you, so you can stay focused on your business.

This push for simplicity is a huge reason why the crypto payment gateway market is booming. It was valued at $1.45 billion in 2024 and is expected to rocket to $8.81 billion by 2035. As you can learn more about in the analysis from Market Research Future, this incredible growth is fueled by gateways making crypto a practical reality for businesses everywhere.

Ensuring Top-Tier Security

When it comes to payments, security isn't just a feature; it's everything. You need to know your money is safe and that you're operating within the rules. While crypto itself is secure by design, the gateway you use adds another important layer of protection.

The gold standard for security is a non-custodial model. This is a crucial difference you need to understand:

- Custodial gateways are like a bank—they hold your funds for you. This creates a central target for hackers.

- Non-custodial gateways never touch your money. Payments flow directly from the customer’s wallet to your own private wallet. You, and only you, have control.

The non-custodial approach dramatically cuts down your risk. On top of that, top-tier gateways add their own security measures, like monitoring transactions for suspicious activity. If you're concerned about staying compliant, it's vital to understand how these systems help with anti-money laundering transaction monitoring.

By choosing a non-custodial gateway with robust security, you can offer crypto payments with complete confidence, knowing both your business and your customers are fully protected.

Getting Started with Crypto Payments

Adding a **cryptocurrency payment gateway** isn't just a quirky experiment for tech companies anymore. It's a smart, practical move for any business that wants to grow. We've walked through how these gateways work, what to look for, and how they solve real-world problems for merchants. Now, let's put that knowledge into action.Taking this step is all about meeting a growing slice of your audience where they are and future-proofing your business. The journey doesn't start with code; it starts with your customers.

Your Action Plan for Implementation

To keep things simple, here’s a quick checklist to take you from thinking about it to going live. This roadmap helps you cover all the important steps for a smooth rollout.

Assess Your Customer Base: First things first, get to know your audience. Are they tech-savvy? Do you have a lot of international customers? Or maybe they're just people who really value their privacy? Figuring this out confirms that adding crypto payments will solve a real problem and get used.

Compare Gateway Features: With your customer in mind, start comparing providers using the criteria we talked about. Zero in on the important stuff: transaction fees, support for multiple coins (especially stablecoins), and whether they offer a non-custodial setup so you’re always in control of your funds.

Plan the Technical Integration: For a lot of businesses, the first step is having a solid online store. Professional Shopify website design services can get you set up right. Once your site is ready, check out the gateway’s plugins and API guides to see what the setup involves. If you want to get into the nitty-gritty, our guide on payment gateway API integration is a great resource.

Communicate the New Option: Once you're set up, shout it from the rooftops! Let your customers know through email, social media, and a big banner on your website. Be sure to explain what’s in it for them, like lower fees or more privacy.

Embracing crypto payments is an accessible and valuable step for any modern business. It signals innovation, expands your market reach, and equips you with a more efficient and secure way to handle transactions. The tools are ready—all that's left is to begin.

Frequently Asked Questions

Jumping into the world of crypto payments can feel like a big step, and it's natural to have questions. Let's tackle some of the most common ones we hear from merchants just like you.

How Secure Are Crypto Payment Gateways?

This is probably the most important question on your mind, and rightly so. Security here isn't just a single feature; it's built in layers. The first layer is the blockchain itself. Its very nature provides a foundation of cryptographic security that makes transactions transparent and irreversible.

But a good gateway doesn't stop there. Reputable providers add their own security protocols on top of that, like encrypting all communication and requiring two-factor authentication (2FA) to access your account. For maximum peace of mind, look for a non-custodial gateway. This means the payment goes straight from your customer to your personal wallet. You're the only one who ever controls the keys, which just about eliminates the risk of a third party losing your funds.

Do I Need to Be a Crypto Expert to Use One?

Not at all. In fact, one of the biggest jobs of a payment gateway is to shield you from the technical complexity. You don't need to know how a blockchain works any more than you need to know how a credit card network functions to accept Visa.

The whole point is to make it simple. Features like automatic fiat conversion are a great example. A customer can pay you in crypto from anywhere in the world, and you can receive dollars or euros directly in your bank account. You never even have to touch the cryptocurrency yourself, making the whole process feel just like any other payment you’re used to.

The best gateways are built on the idea that you shouldn't have to be a crypto expert to get paid. They handle all the complexity behind the scenes, so you can focus on running your business.

What About Crypto Price Volatility?

This is a huge one. We all know crypto prices can swing wildly, and no business wants their revenue tied to that kind of unpredictability. Thankfully, the best gateways have solved this problem completely with instant conversion.

It’s actually quite clever. The second your customer's payment is confirmed, the gateway locks in the current exchange rate and immediately converts the crypto into your preferred fiat currency (like USD). This means you receive the exact amount you charged, down to the last cent. The market can do what it wants—your revenue is always protected.

Ready to unlock global payments, lower your fees, and eliminate chargebacks? BlockBee provides a secure, non-custodial cryptocurrency payment gateway that makes it simple to accept crypto. Get started for free today!