What Is a Digital Asset? A Practical Explainer

At its most basic, a digital asset is any piece of data in a digital format that you can prove you own and that has real-world value. Think of it as property, but instead of existing in the physical world, it lives online. This can be anything from cryptocurrencies and NFTs to digital art and even online accounts.

Understanding What Makes an Asset Digital

Let's use a simple analogy. Imagine you have a photo on your computer. You can copy it, email it, and post it anywhere, creating endless identical versions. Because of this, it's just a file—there's no way to prove which one is the original or who truly owns it.

Now, what is a digital asset in comparison? It’s that same photo, but with a unique, unforgeable certificate of authenticity attached to it. This certificate, often secured by blockchain technology, proves you are the one and only owner.

That single difference is what turns a simple file into something with verifiable scarcity and value. This isn't just a niche idea; it's the foundation of a massive, growing economic sector. The global digital asset management market was valued at over USD 5.65 billion in 2025 and is projected to rocket to USD 25.58 billion by 2035, as detailed in this digital asset management market analysis.

The Key Characteristics of a Digital Asset

So, what are the core ingredients that separate a true digital asset from a regular computer file? It boils down to a few fundamental properties that work together to create trust, value, and real-world utility.

Here’s a quick breakdown of what gives a digital asset its power.

| Characteristic | Simple Explanation | Example |

|---|---|---|

| Provable Ownership | There’s an unbreakable, public record showing who owns it. | A Bitcoin transaction recorded on the blockchain. |

| Transferability | You can send it directly to someone else without a middleman. | Sending an NFT from your digital wallet to a friend's. |

| Scarcity | It can't be copied or faked, protecting its uniqueness and value. | There will only ever be 21 million Bitcoin created. |

These characteristics are what allow digital items to behave like physical property, giving them a solid foundation for building value and trust online.

The core idea behind a digital asset is turning information into property. It's about giving digital items the same properties of ownership and value we've always had with physical objects.

A Look at the Main Types of Digital Assets

Saying all digital assets are the same is a bit like saying all vehicles are cars. It completely misses the nuances of motorcycles, boats, and planes, each built for a very different job. The world of digital assets is just as diverse, with each category designed to solve a unique problem across finance, art, and even how we build online communities.

Let's start with the most famous of the bunch: cryptocurrencies. At their core, these are designed to be digital money. They're built on blockchain technology, which allows two people to send value to each other securely without needing a bank to approve the transaction. Bitcoin (BTC) is the poster child here, created to be a completely decentralized alternative to the money we're used to.

But even within this category, there's a lot of variety. Take Ethereum (ETH), for instance. It works as a currency, sure, but it's also the fuel for a massive global computer that runs thousands of decentralized apps. The financial world has certainly taken notice. The total value of all cryptocurrencies shot up by an incredible 94% in just one year, climbing from $1.65 trillion to $3.21 trillion in 2024. This massive surge was largely driven by new investment products hitting the market, a trend highlighted in this 2025 outlook on digital assets from Citigroup.

Tokens: The Keys to Digital Ecosystems

This is where things get interesting. Tokens are a whole different animal from cryptocurrencies. While a crypto like Bitcoin aims to be money, a token represents a specific asset or a right to do something within a particular project. Don't think of them as cash; think of them more like digital vouchers or access keys.

They generally break down into two main types:

- Utility Tokens: These are your keys to the kingdom. They give you access to a product or service. A perfect analogy is an arcade token—you can't use it to buy groceries, but you absolutely need it to play Pac-Man inside the arcade.

- Security Tokens: These are digital, blockchain-based versions of traditional investments. Imagine owning a tiny piece of a skyscraper or a fraction of a famous painting. That ownership is represented by a security token, which is regulated just like stocks or bonds.

Getting the difference between a coin and a token is crucial to seeing the bigger picture. If you want to dive deeper, you can learn more about what a crypto token is in our guide.

To make these distinctions clearer, here’s a simple breakdown of the different asset types.

Comparing Different Types of Digital Assets

This table provides a side-by-side comparison of the main digital asset categories to clarify their unique features, uses, and underlying principles.

| Asset Type | Primary Use Case | Example | Key Feature |

|---|---|---|---|

| Cryptocurrency | Peer-to-peer digital cash | Bitcoin (BTC) | Acts as a store of value or medium of exchange |

| Utility Token | Accessing a product or service | Basic Attention Token (BAT) | Provides specific functionality within an ecosystem |

| Security Token | Representing ownership of an asset | tZERO (TZROP) | A digital form of a traditional, regulated investment |

| NFT | Proving ownership of a unique item | CryptoPunks | Each token is one-of-a-kind and cannot be replaced |

As you can see, each asset is engineered for a completely different purpose, from everyday payments to exclusive access and verifiable ownership.

NFTs: Unique Digital Property Deeds

Last but not least, we have Non-Fungible Tokens (NFTs). While one Bitcoin is exactly the same as any other Bitcoin, every single NFT is unique and can't be replaced. This "non-fungible" quality makes them the perfect tool for proving you own a one-of-a-kind item.

An NFT acts like a digital deed or a certificate of authenticity for a specific item, whether it's digital art, a collectible, an event ticket, or even a piece of virtual land.

This is a game-changer. It allows artists to sell their work directly to a global audience and earn royalties automatically, all while providing an unbreakable chain of ownership. For buyers, it means you can truly own a digital item, with proof that can't be faked or copied. From concert tickets that can't be scalped to digital art that can't be forged, NFTs are completely reshaping our ideas about property in the modern world.

How Blockchain Makes Digital Assets Work

So, what’s stopping someone from just right-clicking and saving a valuable digital asset, creating a perfect copy and destroying its value? The secret sauce is the brilliant design of blockchain technology. It’s the engine running under the hood, giving these assets the same kind of security and scarcity you’d expect from a physical item.

Think of it like a digital record book. But instead of one person or company holding it, this book is copied and shared across thousands of computers all over the world. This is the core idea of a decentralized ledger. With no single point of failure and no one company in charge, nobody can secretly go in and change the records.

Every time a digital asset changes hands, that transaction gets recorded as a new "block" of information. This block is then cryptographically chained to the one before it, building a permanent and unchangeable record—the blockchain.

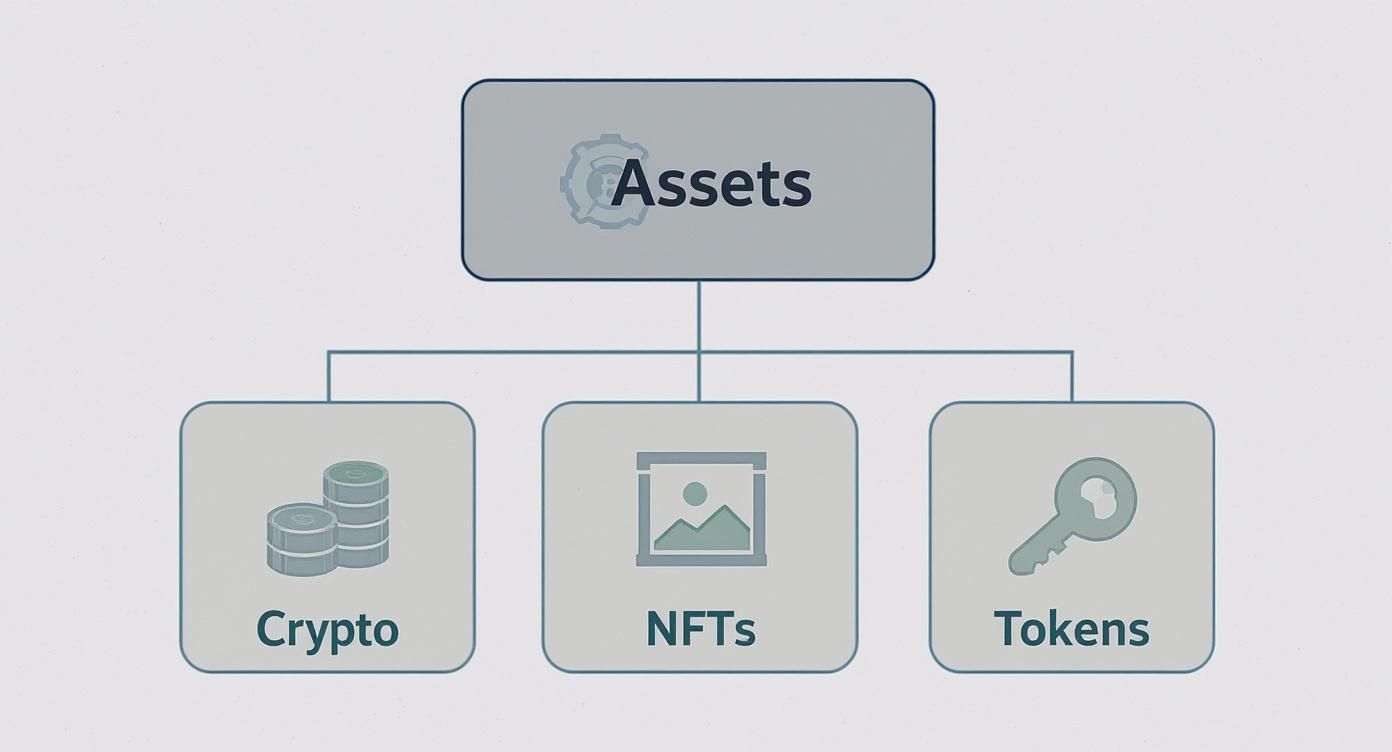

This diagram gives a great visual of how different asset types fit into this system.

As you can see, whether we're talking about crypto, NFTs, or tokens, they all live under the same roof of secure, verifiable assets made real by this technology.

The Pillars of Trust and Security

This whole structure is built on two game-changing benefits: immutability and transparency. You can’t really grasp how digital assets work without digging into the underlying blockchain technology that makes them tick. Once a transaction is locked into the chain and confirmed by the network, it’s set in stone.

It can't be secretly tweaked or deleted, which is what makes ownership both provable and permanent. It’s like writing in pen on a public document that gets updated in thousands of places at the exact same time.

That brings us to the second key feature: transparency. While the people involved are usually anonymous (or pseudonymous), the transactions themselves are out in the open for anyone to look at and verify. This public accountability keeps everyone honest and playing by the same rules, which creates a "trustless" environment.

You don't need to trust a central authority like a bank to validate a transaction because the network itself does the job. The code and the consensus of the participants are the ultimate arbiters of truth.

How It All Connects

This is the system that gives a digital asset its unique identity and a traceable history. It's the reason you can definitively prove you own a specific Bitcoin or that one-of-a-kind NFT. The blockchain essentially acts as a global, automated notary, stamping its approval on every single exchange.

Here’s a quick rundown of how these pieces work together to keep an asset secure:

- Decentralization: Spreads control across the network, so no single person or group can call all the shots or bend the rules.

- Cryptography: Locks down each transaction, tying it to the owner's digital wallet and making it virtually impossible to tamper with.

- Transparency: Gives anyone the ability to check the public ledger, confirm who owns what, and prevent fraud.

This framework isn't just for digital money; it's a powerful way to manage all sorts of digital property. The security and efficiency it provides are also shaking up how businesses think about payments. To see what that looks like in the real world, check out our deep dive into how blockchain for payments is building faster and more secure transaction systems. By cracking the code on digital duplication, blockchain has laid the groundwork for a new economy built on verifiable online ownership.

Real-World Use Cases of Digital Assets Today

While the tech behind digital assets is fascinating, it’s what they do in the real world that really matters. We’re not just talking about trading charts and market speculation. These assets are already solving concrete problems for people in industries ranging from music to global shipping.

Think of them less as investments and more as practical tools. Each of these examples shows a move away from relying on middlemen, putting power back into the hands of creators and consumers. This simple shift is opening up new ways of doing business that just weren't possible before.

Empowering Artists and Musicians

For decades, creators have had a tough deal. Musicians and artists often found themselves at the mercy of record labels, galleries, or streaming giants that took a huge slice of the pie. NFTs are starting to flip that script by giving creators a direct connection to their audience.

Picture a musician releasing a new song as an NFT. Instead of getting a tiny fraction of a penny for each stream, they can sell a limited run of digital editions straight to their most dedicated fans. Better yet, they can build a royalty right into the NFT’s smart contract, so they automatically get a percentage every single time it’s resold down the line.

This creates a brand-new, sustainable income stream that rewards artists for the long-term appreciation of their work. It’s a direct-to-fan economy, all built on provable ownership.

Digital assets give creators the power to control their own work and finances. An NFT isn't just a collectible; it's a tool for artistic independence and fair compensation.

Overhauling Supply Chain Management

The path a product takes from the factory to your front door is often a tangled, confusing mess. As a consumer, you have no idea where your coffee beans really came from. For companies, tracking goods is a nightmare, often leading to costly waste and fraud.

This is a perfect problem for the blockchain to solve. Companies are now using digital assets to create a digital twin for physical goods moving through the supply chain. Every step of the journey—from the farmer to the shipper to the store—is recorded as a transaction on a permanent, unchangeable ledger.

- For Consumers: You could scan a QR code on your bag of coffee and see its entire history, right down to the specific farm and the day it was roasted. That kind of transparency builds serious trust.

- For Businesses: This allows companies to spot bottlenecks, prove their products are authentic, and stop counterfeit goods from ever hitting the shelves.

Suddenly, everyone involved has access to a single, reliable source of truth. This accountability alone drastically improves how everything works.

Unlocking New Financial Services with DeFi

Decentralized Finance, or DeFi, is easily one of the most powerful applications for digital assets. The goal here is ambitious: to build an entirely new financial system that is open, transparent, and available to anyone with an internet connection—no traditional banks required.

DeFi platforms use smart contracts to automate financial services like lending, borrowing, and earning interest. For instance, you can lend out your digital assets to a decentralized lending pool and start earning interest from borrowers, all without a bank taking a cut in the middle.

The implications here are massive, especially when you consider the 1.4 billion adults around the world who don't have a bank account. For these people, DeFi provides a direct path to financial tools that were completely out of reach, paving the way for greater economic inclusion. Digital assets are the essential Lego blocks for building this fairer financial world.

Why Digital Assets Should Be on Every Business's Radar

If you're running a business today, you can't afford to ignore digital assets. This isn't about jumping on a bandwagon; it's a fundamental shift in how business gets done. We're talking about practical solutions to old problems, like sky-high transaction fees and being locked out of international markets. Digital assets offer a real-world path to working smarter and finding new ways to grow.

Think about it: by simply accepting cryptocurrencies, you can suddenly sell to anyone, anywhere in the world. Customers who were once held back by clunky banking systems or steep currency conversion fees can now pay you in an instant. This is a game-changer for reaching a truly global audience.

The numbers back this up. North America is already a major hub for this activity, leading the global digital asset management (DAM) market in 2023 with a value north of USD 1.56 billion. That kind of growth comes from serious corporate investment and a real push to build digital know-how. Just in the United States, the DAM market is expected to rocket from USD 2,706.6 million in 2024 to a staggering USD 9,998.6 million by 2033. You can dig deeper into the stats in this United States digital asset management market report.

Finding New Revenue and Forging Stronger Customer Bonds

Beyond simple payments, digital assets open the door to entirely new ways of making money. One of the most interesting ideas here is tokenization—the process of turning the rights to an asset into a digital token that lives on a blockchain.

It sounds complex, but the idea is simple. A real estate developer could sell tiny fractions of a building through tokens, making a massive investment accessible to more people. A startup could offer early investors digital tokens representing equity, making it easier for them to trade their stake later on. Suddenly, things that were hard to sell, like a piece of a skyscraper, become easy to trade.

Then you have Non-Fungible Tokens (NFTs), which are completely changing the customer loyalty game. Forget the old paper punch cards. Imagine giving your best customers a unique digital collectible.

Owning this NFT could be their key to early access for new products, special discounts, or even a voice in what your company does next. It’s no longer just a transaction; it's a relationship. They have a real, ownable stake in your brand’s community.

That's a level of connection you just can't get with traditional marketing.

Gaining a Real Competitive Edge

At the end of the day, bringing digital assets into your business gives you a serious leg up on the competition. It helps you run a tighter ship, connect with more people, and build much deeper relationships with the customers you have.

Here’s a quick look at the core advantages for any business:

- Lower Transaction Costs: Cutting out the traditional banking middlemen often leads to much smaller fees, especially for international payments.

- Quicker Payments: A bank wire can take days to clear. A crypto transaction? Often just a few minutes.

- Tighter Security: The underlying blockchain technology is built on cryptography, which drastically cuts down the risk of fraud and frustrating chargebacks.

- Access to New Customers: There’s a huge, global community of tech-savvy people who prefer to use crypto. Why not make it easy for them to buy from you?

When you start to understand what a digital asset is, you realize you're not just adding a new payment option. You're laying a more flexible, forward-thinking foundation for whatever comes next.

Getting Started with Your First Digital Asset

Ready to dive into the world of digital ownership? Getting your hands on your first digital asset is a lot less complicated than it might seem, as long as you get the basics right. The first step on this journey is setting up a digital wallet, which is essentially your personal, ultra-secure vault for everything you own in the digital space.

Think of it just like a physical wallet. It’s where you keep your assets and what you use to interact with others. The big difference is that a digital wallet is protected by some seriously powerful cryptography. You'll run into two main types, each with its own pros and cons.

Choosing the Right Wallet

Your first big decision is whether to go with a hot wallet or a cold wallet. This choice really comes down to balancing convenience against security.

- Hot Wallets: These are software wallets that live on your phone or computer and are always connected to the internet. They're perfect for everyday use and making quick transactions, but that constant online connection makes them a bigger target for cyberattacks.

- Cold Wallets: These are physical hardware devices—like a specialized USB drive—that keep your assets completely offline. This makes them the Fort Knox of digital asset storage, ideal for securing larger amounts or for assets you plan to hold for the long haul.

Your private key is the one and only master key to your digital assets. If you lose it, your funds are gone for good. Never, ever share it with anyone or store it on a device that's connected to the internet.

Securing Your Digital Footprint

After you've picked a wallet, your next mission is locking it down. Your private keys are the most critical piece of information you’ll manage. When you set up a wallet, you'll be given a seed phrase—a list of random words that can be used to recover your wallet if you lose your device. Write it down and store it somewhere safe and offline, like in a fireproof safe.

To get a deeper understanding of how to truly keep your assets safe, check out our guide on non-custodial crypto wallets. It's a must-read.

With the security fundamentals in place, the next logical step is learning how to interact with digital assets. You can even practice trading digital assets risk-free using a simulator. This is a fantastic way to get a feel for how exchanges work and understand market dynamics without putting any real money on the line. It helps you build the confidence you need before making that first purchase.

Got Questions About Digital Assets? We’ve Got Answers.

Even with the basics down, you probably still have a few questions rattling around. That's completely normal. Let's tackle some of the most common ones to make sure you have a rock-solid understanding of how this all works.

Are Digital Assets and Cryptocurrency the Same Thing?

That’s a great question, and the answer is no, not exactly. It's a common point of confusion, so let's clear it up.

Think of it this way: cryptocurrency is just one flavor of digital asset. The term "digital asset" is the big umbrella that covers everything.

So, while all cryptocurrencies like Bitcoin are digital assets, not all digital assets are cryptocurrencies. The family also includes things like NFTs, security tokens, and all the other unique digital items we've talked about.

How Do I Keep My Digital Assets Safe?

This is probably the most important question of all. Security isn't just a feature; it's everything. The best practice is to use a trusted digital wallet and fiercely protect your private keys. You’ll generally encounter two kinds:

- Hot Wallets: These live online, which is super convenient for making regular transactions. The trade-off is that they're more exposed to digital threats.

- Cold Wallets: These are offline hardware devices, like a specialized USB stick. They offer maximum-security for stashing assets you don't plan on touching for a while.

If you remember one thing, make it this: never, ever share your private keys or seed phrase with anyone. Treat them like the keys to your entire financial life. Always use strong, unique passwords and turn on two-factor authentication (2FA) wherever you can.

Staying sharp and skeptical of phishing scams or "too good to be true" offers is just as crucial.

Can My Business Start Accepting Digital Assets for Payment?

Absolutely, and it's a lot easier than you might imagine. You don't need to become a blockchain developer overnight.

This is where crypto payment gateways come in. These are services designed to do all the heavy lifting for you. They plug right into your website or online store and handle the entire payment process from the moment a customer clicks "pay" to the moment the funds settle.

These platforms let you accept a huge variety of cryptocurrencies from customers anywhere in the world. Better yet, they solve the headache of price swings by letting you instantly convert crypto into your local currency, like USD or EUR. For many businesses, this is a game-changer—it can mean lower fees, faster payments, and a direct line to a new, tech-savvy audience.

Ready to open your doors to digital asset payments? BlockBee is a secure, non-custodial crypto payment gateway that lets you easily accept over 70 different cryptocurrencies. With low fees and instant payouts, it's a simple way to expand your business and streamline how you get paid. Find out more and get started with BlockBee.