payment processing fees comparison: Find the best rates now

When you start comparing payment processing fees, it's easy to get fixated on the big, advertised rate. But the truth is, what you actually pay is a cocktail of three separate charges. You’ve got interchange fees, assessment fees, and the processor’s own markup. Getting a handle on these is the first real step to finding a deal that actually saves you money.

Understanding Your Payment Processing Fees

Trying to make sense of a merchant statement can feel like deciphering a secret code. There's a long list of confusing charges, and it’s rarely clear where your money is actually going. But if you want to compare providers effectively, you have to break through that complexity first.

Every single time a customer pays you, the fee you're charged gets split between three different players. Once you understand who gets what, you can analyze any processor's fee structure with a lot more confidence.

The Three Core Fee Components

To make a smart choice, you need to know the trio of fees that make up your total cost per transaction. Each one goes to a different party for a different reason.

- Interchange Fees: This is the biggest slice of the pie. It goes straight to the bank that issued your customer's credit card (think Chase or Bank of America). Card networks set these non-negotiable rates to cover the risks and operational costs of the transaction.

- Assessment Fees: A much smaller fee that you pay directly to the card networks like Visa, Mastercard, or Discover. Think of it as a toll for using their payment network and brand.

- Processor Markup: This is what your payment processor charges for their service. It's the only part of the fee that changes from one provider to another, and it’s where you can actually find savings.

The processor's markup is the only truly negotiable part of your payment processing fees. While interchange and assessment fees are fixed, the markup is where you can find significant savings by comparing providers.

How These Fees Work in Practice

So, what does this look like in the real world? In the United States, interchange fees generally hover around 1.8% for credit cards and a much lower 0.3% for debit cards. All-in-one processors often roll all these costs into one simple rate, usually charging merchants somewhere between 2.5% and 3.5% per transaction. To get a better feel for the different charges, it helps to understand what merchant fees are in more detail.

Here’s a simple table to show how the money gets divided on a hypothetical $100 sale.

| Fee Type | Responsible Party | Example Rate | Cost on $100 Sale |

|---|---|---|---|

| Interchange Fee | Card-Issuing Bank | 1.80% + $0.10 | $1.90 |

| Assessment Fee | Card Network (Visa) | 0.14% + $0.02 | $0.16 |

| Processor Markup | Your Provider | 0.40% + $0.10 | $0.50 |

| Total Merchant Cost | Your Business | 2.34% + $0.22 | $2.56 |

This breakdown shows why simply comparing top-line rates can be a trap. A provider might advertise a tiny markup but be passing along higher interchange rates than necessary. For a more accurate picture, you can use a fee estimator to see potential costs for your specific business at https://blockbee.io/fees/estimate. With this knowledge in hand, you’re ready to dive into some real comparisons.

Comparing the Main Pricing Models

Once you know what makes up a transaction fee, the next step is figuring out how payment processors package those costs. The pricing structure they use makes a huge difference in transparency and predictability. You'll almost always run into one of three models: Interchange-Plus, Flat-Rate, or Tiered pricing.

Each model is built for a different kind of business. Picking the wrong one can mean you’re needlessly overpaying, while the right fit can save you a significant amount of money as you grow. It all comes down to your sales volume and average transaction size.

Interchange-Plus: The Transparent Choice

Interchange-Plus, which you’ll often hear called Cost-Plus, is widely seen as the most transparent pricing model out there. Processors using this structure pass the direct interchange and assessment fees straight to you. Then, they add their own separate, fixed markup on top. The result? Your statement clearly breaks down the wholesale cost versus the processor's profit on every single transaction.

This unbundled approach is a huge win when it comes to low-cost transactions, like those from a standard debit card, because you get to keep the savings. The real advantage here is that your costs scale fairly with the actual wholesale rates set by the card networks themselves.

Of course, that level of transparency brings a bit of complexity. Your monthly statements will be longer and far more detailed, listing dozens of different interchange rates. Because of this, Interchange-Plus is usually the best fit for established businesses with high sales volume, where the potential savings are well worth the effort of digging into the detailed reports.

Flat-Rate: The Simple Solution

The Flat-Rate model is exactly what it sounds like—simple. It’s the model that powers giants like Stripe and Square. It works by bundling the interchange fee, assessment fee, and processor markup into a single, predictable percentage and a fixed per-transaction fee, like the common 2.9% + $0.30.

Simplicity is its biggest selling point. You know exactly what you’ll pay every time a customer makes a purchase, no matter what card they use. This makes budgeting and forecasting a breeze, which is a massive relief for new businesses, startups, or shops with a low average ticket price.

The trade-off for that simplicity, however, is cost. You’ll inevitably overpay on low-cost debit card transactions to help the processor cover the higher cost of premium rewards cards. In essence, the processor builds a buffer into that flat rate to protect its own margins from fluctuating wholesale costs.

Flat-Rate pricing offers unmatched predictability, making it a safe harbor for startups. However, as your business grows and processes more low-cost debit transactions, this model can become significantly more expensive than Interchange-Plus.

Tiered: The Opaque Model

Tiered pricing works by lumping transactions into several buckets, or "tiers." You'll typically see them labeled as Qualified, Mid-Qualified, and Non-Qualified. The processor sets a different rate for each tier and—here’s the catch—gets to decide which transactions fall into which bucket. A standard debit card might be deemed "Qualified," but a corporate rewards card could easily be pushed into the "Non-Qualified" tier, sticking you with the highest rate.

The biggest problem with this model is the complete lack of transparency. The processor holds all the cards, and the way transactions are categorized can feel totally arbitrary. This often leads to more of your sales being "downgraded" to more expensive tiers, causing unpredictable and often inflated processing costs.

While Tiered pricing used to be common, it’s fallen out of favor precisely because of its potential for hidden fees. Most businesses today find that either the crystal-clear transparency of Interchange-Plus or the straightforward simplicity of Flat-Rate is a much better deal.

To really see how these stack up, let's put them side-by-side.

Pricing Model Comparison for Businesses

Choosing a pricing model is a critical decision that directly impacts your bottom line. This table breaks down the three main options to help you see which one aligns best with your business goals and transaction profile.

| Pricing Model | How It Works | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|---|

| Interchange-Plus | Passes through wholesale interchange rates and adds a fixed markup. | High-volume, established businesses. | Full Transparency: Lowest possible cost on most transactions. | Complexity: Merchant statements can be difficult to read. |

| Flat-Rate | A single, blended rate for all card types and transactions. | Startups and businesses with small average tickets. | Simplicity: Extremely predictable and easy to understand. | Higher Cost: Overpays for low-cost transactions like debit. |

| Tiered | Groups transactions into categories with different rates. | Rarely recommended for most modern businesses. | Initial Simplicity: Appears simple on the surface. | Lack of Transparency: Prone to inflated costs and downgrades. |

Ultimately, picking the right model isn’t a one-size-fits-all decision. It requires a hard look at your own business—your monthly sales volume, your average ticket size, and the kinds of cards your customers typically use. That's what will truly determine which structure offers you the most value in the long run.

A Closer Look at the Top Payment Processors

Alright, let's move past the theory and get into a real-world comparison of the big players in payment processing. The advertised rates you see are just the start; the true cost of a processor is buried in the details—things like secondary fees, contract gotchas, and how helpful they are when something goes wrong.

We're going to put Stripe, PayPal, Square, and a traditional merchant account under the microscope to see how they stack up. This isn't just about the numbers. It's about what really hits your bottom line, from chargeback penalties and PCI compliance costs to those sneaky monthly minimums. By laying them all out side-by-side, you’ll get the clarity you need to pick a partner that will actually help your business grow, not just take a cut.

Stripe: The Developer-First Powerhouse

Stripe has carved out a name for itself with a killer API and a dead-simple, flat-rate pricing model. For any online business, especially those with developers on staff or a need for custom payment flows, Stripe is usually the first name that comes up. Their standard fee for online transactions is a predictable 2.9% + $0.30.

This simplicity is a godsend for startups and e-commerce stores that just need to get going without getting a PhD in payment processing fees. Stripe bundles everything—interchange, assessments, and their own markup—into one clean rate. You always know what you'll pay, no matter what kind of card your customer uses. The flip side? This convenience can cost you if you process a lot of debit cards, where you'll end up overpaying compared to an Interchange-Plus model.

Stripe’s real magic is its incredible API and developer ecosystem. While the flat-rate pricing is simple, it’s the ability to build highly customized checkout experiences that makes it the go-to for tech-focused companies and subscription businesses.

A huge plus for Stripe is the absence of monthly fees, setup costs, or other hidden charges for its main services. But you have to watch out for the extras. They tack on +1% for international cards and another +1% if currency conversion is needed. If a chargeback happens, it's a straightforward $15 fee.

PayPal: The Global Trust Signal

PayPal is a household name, and that brand recognition is its superpower. With over 360 million active users, just having that PayPal button at checkout can give your conversion rates a serious bump. Customers know it, and they trust it. The standard fee for online commercial transactions is a bit higher than Stripe's, coming in at 3.49% + $0.49.

Just like Stripe, PayPal uses a flat-rate model, so your costs are predictable. Its main advantage is that massive user base and the built-in trust it brings. If you're selling internationally, this can be a game-changer.

However, PayPal's fee structure isn't always as simple as it looks. International transactions get hit with an extra 1.5% fee, and its chargeback fee is $20. If you want a seamless, on-site checkout experience without sending customers to PayPal's site, you’ll need to spring for a plan like PayPal Payments Pro, which adds a $30 monthly fee. For many merchants, exploring the best payment processors for small business can uncover more cost-effective alternatives.

Square: The Omnichannel Champion

Square got its start by making it ridiculously easy for small businesses to take credit cards in person, but it has grown into a true omnichannel powerhouse. It beautifully integrates online and offline sales, which is perfect for retailers who have both a brick-and-mortar shop and an e-commerce site. The online processing rate is the same as Stripe's at 2.9% + $0.30, while the in-person rate is a lower 2.6% + $0.10.

Square's biggest strength is its entire ecosystem of business tools. It's not just about payments. They give you free POS software, inventory management, appointment scheduling, and even payroll services. This all-in-one approach is a dream for small business owners who want to run everything from one place.

The fee structure is flat-rate, offering the same predictability as Stripe and PayPal. There are no monthly fees for the standard plan, and hardware like the basic magstripe reader is often free. But, just like the other flat-rate guys, it can get expensive for high-volume businesses that could save a bundle on an Interchange-Plus plan.

Traditional Merchant Accounts: The Custom Solution

A traditional merchant account from a bank or a dedicated provider is a completely different beast. Forget the one-size-fits-all flat rate. These providers almost always use Interchange-Plus pricing. This means you pay the rock-bottom wholesale interchange rate set by the card networks, plus a small, fixed markup for the provider.

For any established business processing a decent volume—think over $10,000 a month—this model is almost always cheaper. It’s totally transparent. You see exactly what you’re paying in wholesale costs and what the processor is making. You get the direct benefit of low-cost transactions, like debit cards.

So, what's the catch? Complexity and commitment. These accounts typically come with a few strings attached:

- Monthly Fees: Expect to pay $10 to $40 for things like statement and payment gateway fees.

- Contract Terms: Many will lock you into multi-year contracts with hefty early termination fees.

- PCI Compliance Fees: You'll likely see an annual or monthly fee to cover security compliance.

- Longer Setup: The application and underwriting process is way more involved than signing up for Stripe or Square.

While it takes more work to manage, a traditional merchant account offers savings that flat-rate providers just can't touch for the right kind of business. The best choice really boils down to your sales volume, where you sell, and how much technical control you need.

How to Find and Avoid Hidden Costs

When you're trying to compare payment processors, the advertised rate is just the tip of the iceberg. The real costs—the ones that truly impact your bottom line—are almost always buried in the fine print of the merchant agreement, just waiting to catch you by surprise. A deal that looks great on paper can quickly become a financial headache if you don't know what to look for.

The only way to protect your business is to understand where these potential costs hide. From hefty early termination penalties to mysterious compliance fees, knowing what's out there lets you dissect any contract and negotiate from a much stronger position.

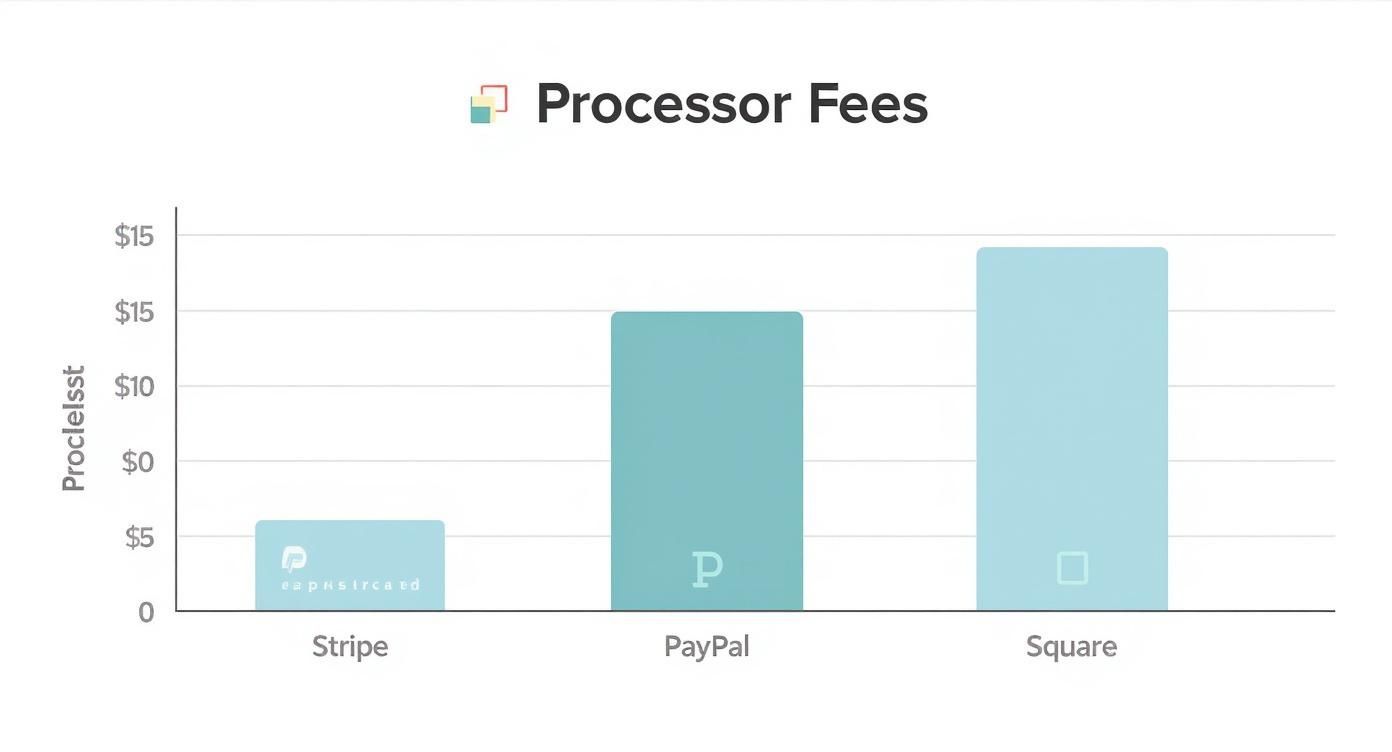

The infographic below gives you a glimpse into how different processors structure their standard fees, which is really just the first layer of costs you need to consider.

This visual is a good starting point, but the real challenge is digging up all the other fees that aren't advertised so clearly.

Common Unexpected Charges to Watch For

Beyond the basic transaction rate, a whole host of other charges can easily inflate your monthly bill. Processors will tell you these are for account maintenance, security, or just administrative overhead. The reality is that many of these are negotiable—or can be avoided altogether if you're prepared.

Here are some of the most common "gotchas" I see:

- Early Termination Fees (ETFs): This is a big one. If you sign a multi-year contract, the processor can slap you with a huge penalty—often hundreds of dollars—if you try to leave before the term is up.

- PCI Non-Compliance Fees: The Payment Card Industry Data Security Standard (PCI DSS) isn't optional. If you don't validate your compliance every year, processors will charge a monthly penalty until you do.

- Statement Fees: Yes, some providers will actually charge you a monthly fee just to send you your processing statement, whether you get it online or in the mail.

- Batch Fees: Processors often charge a small, fixed fee every time you "batch out" or settle your daily credit card transactions. It seems tiny, but it adds up quickly over the course of a month.

Always ask a potential provider for a complete fee schedule before you even think about signing anything. If a fee isn't listed and clearly explained on that schedule, demand to have it waived or struck from your contract entirely.

Strategies to Minimize Surprise Costs

Avoiding these fees takes a bit of work, both when you're negotiating and while you're managing the account. The trick is to treat your merchant agreement like a starting point for discussion, not a final offer. While standard payment processing fees usually hover between 1.5% and 3.5%, things like chargeback fees and fraud prevention tools can easily add another 1-2% to your total costs. For a deeper dive into how these costs break down for different business models, you can learn more about the full breakdown of payment processing expenses on PayCompass.com.

Actionable Tips for Fee Reduction

You can cut your costs significantly with a few smart moves. First, always push for a month-to-month agreement. This completely eliminates the threat of an Early Termination Fee. If a processor is adamant about a long-term contract, tell them you'll sign only if the ETF clause is removed.

Next, make PCI compliance a priority. Most processors provide tools or partners to help you fill out the annual self-assessment questionnaire. Taking an hour to complete this simple task on time is the easiest money you'll ever save.

Finally, get in the habit of reviewing every single line item on your monthly statement. If you see a fee you don’t recognize, question it. Don't hesitate to push back on charges like statement fees or monthly minimums, as these are often negotiable, especially if you have a consistent processing volume. A little vigilance goes a long way in making sure the rate you were promised is the rate you actually pay.

Choosing the Right Processor for Your Business

https://www.youtube.com/embed/74ZabaUrDkM

So, you've got a handle on how payment processing fees work. Now comes the hard part: turning that knowledge into the right choice for your business. Let's be clear, there's no single "best" processor out there. The right fit is completely dependent on how you operate.

Making a smart decision means matching a provider's fee structure and strengths directly to your sales profile. Before you even think about comparing rates, the first step is to get a crystal-clear picture of your own sales activity. This data is everything—it's what will tell you which processor will save you money and which will slowly eat into your profits.

Assess Your Business Profile

To compare your options effectively, you need to know your numbers inside and out. These key metrics are what determine which pricing model makes the most financial sense.

- Average Transaction Size: Are you selling high-end furniture or a daily cup of coffee? A business with a small average ticket will feel the sting of a high per-transaction fee, while a store selling expensive items should focus more on finding the lowest percentage rate.

- Monthly Sales Volume: What's your total revenue each month? Once your business starts consistently processing over $10,000 a month, you should almost always be looking for an Interchange-Plus plan to get the best rates. For newer or lower-volume businesses, the predictability of flat-rate pricing might be a better starting point.

- Business Model: Where do you make your sales? Are you purely online, running a brick-and-mortar shop, or juggling both? A provider like Square is fantastic for businesses that need to sync in-person and online sales. For a more detailed breakdown, our guide on the best payment gateway for ecommerce dives deeper into options for digital-first sellers.

With this information in hand, you’re ready to start talking to providers and asking the questions that will uncover any hidden surprises.

The biggest mistake I see business owners make is getting fixated on one low advertised rate. A true partner is one whose entire fee schedule—from monthly costs to contract terms—lines up perfectly with your sales volume and average ticket size.

Critical Questions for Potential Providers

Don't go into a sales call unprepared. Have this checklist ready to go, because the answers you get will tell you the real story about what you'll be paying.

- Can I see a complete fee schedule? Don't settle for just the transaction rate. Insist on seeing a full breakdown of every single charge. Keep an eye out for monthly fees, PCI compliance fees, batch fees, and especially chargeback penalties.

- What are the contract terms? You need to know the contract length and, more importantly, the early termination fee (ETF). The gold standard is a simple month-to-month agreement with no penalty for leaving.

- How is customer support handled? When your payments go down, you need help, fast. Is support available 24/7? Can you actually get a human on the phone, or are you stuck with chatbots and email tickets?

As you weigh your options, consulting an essential payment processing guide for small businesses can offer valuable perspective. This decision isn't just about finding the cheapest rate; it's about finding a long-term partner who can support your growth. By doing your homework now, you can pick a processor that helps your business thrive.

Got Questions About Payment Fees?

Even after digging into a side-by-side comparison, it's normal to have a few questions lingering. Let's tackle some of the most common things business owners ask, so you can feel confident in your choice.

Can I Actually Negotiate My Processing Fees?

Yes, you can—but only a specific part. The interchange and assessment fees are non-negotiable; those are set by the card networks (like Visa and Mastercard) and the banks. The only piece of the puzzle you can haggle over is the processor's markup.

Your leverage here really comes down to your sales volume. If your business is pulling in over $250,000 a year, you’re in a great position to push for a lower markup, especially on an Interchange-Plus plan. For newer or smaller businesses, that negotiating power just isn't there yet, which is why the predictable nature of a flat-rate model often makes more sense.

Your best negotiating tool is your processing history. Walk into that conversation with several months of statements that prove you have consistent volume and a low chargeback rate. Show them you're a low-risk, high-value client.

What’s a Chargeback Fee, and How Do I Avoid Them?

A chargeback fee is a penalty your processor hits you with when a customer disputes a purchase and gets their money back from the bank. It's an administrative fee, usually between $15 and $25 per incident, and it’s completely separate from the actual refund amount.

You can't eliminate chargebacks entirely, but you can definitely minimize them. Here’s how:

- Be Recognizable: Make sure your billing descriptor—the name that shows up on a customer's card statement—is clear. "XYZ WEBSHOP" is much better than a generic corporate name they won't recognize.

- Make Refunds Easy: Proactive customer service is your best friend. It’s always cheaper to issue a refund yourself than to deal with the hassle and cost of a chargeback.

- Use Fraud Prevention Tools: Simple things like AVS (Address Verification System) and CVV checks can weed out a surprising number of fraudulent transactions before they ever happen.

Why Do International Transactions Cost More?

Selling internationally is great, but those transactions almost always come with higher fees. There are a few reasons for this. First off, there's just a higher perceived risk of fraud with cross-border payments, so the card networks bake that into their interchange rates.

Then you have currency conversion. If a customer pays in their local currency but you get paid in yours, the processor tacks on a fee for the exchange, typically around 1-2% of the transaction value.

And to top it all off, processors like Stripe and PayPal often add their own cross-border fee, which can pile on an extra 1% to 1.5% to the total cost.

How Does PCI Compliance Affect My Fees?

PCI (Payment Card Industry) compliance is the set of security rules you must follow when handling credit card information. Processors usually approach this in two ways, and both can affect your bottom line.

Some providers will charge you a monthly or annual PCI compliance fee, which covers their help in keeping you compliant. Others take a different approach: they don't charge you for being compliant, but they'll hammer you with a steep monthly PCI non-compliance fee if you fail to validate your security. The penalty is always more expensive, so staying compliant is a no-brainer.

The global payment processing market is a beast. Projections show it will handle a staggering $157 trillion in transactions in 2025, with processors earning about $64 billion just from fees. When you add in related services like fraud prevention and gateways, that revenue figure jumps to over $170 billion. This massive, complex system is exactly why it pays to understand every single fee, including the ones tied to PCI compliance. You can learn more about these payment processing market insights on ClearlyPayments.com.

Ready to escape high fees and complex payment systems? With BlockBee, you can accept over 70 cryptocurrencies with transparent transaction fees starting at just 0.25%. Our non-custodial platform gives you full control over your funds with instant payouts, seamless e-commerce integrations, and dedicated support. Get started with BlockBee today!