Choosing a Payment Gateway for SaaS

A payment gateway for SaaS is the digital plumbing that lets you automatically and securely collect subscription payments from your customers. Think of it as the financial engine running under the hood of your software, connecting your service to your customers' bank accounts and keeping your revenue flowing predictably.

Your SaaS Revenue Engine Explained

At its heart, a payment gateway is a secure middleman. It’s like a point-of-sale terminal you’d see in a store, but it's specifically designed for the unique world of subscription businesses. When a new customer signs up, the gateway securely grabs their payment info, encrypts it, and zips it through the payment network to get the transaction approved.

But for a SaaS company, this is way more than just a one-and-done transaction. The gateway is the nerve center of your entire revenue operation. It's what handles the repetitive, critical tasks that keep the business running smoothly.

More Than Just a Transaction Tool

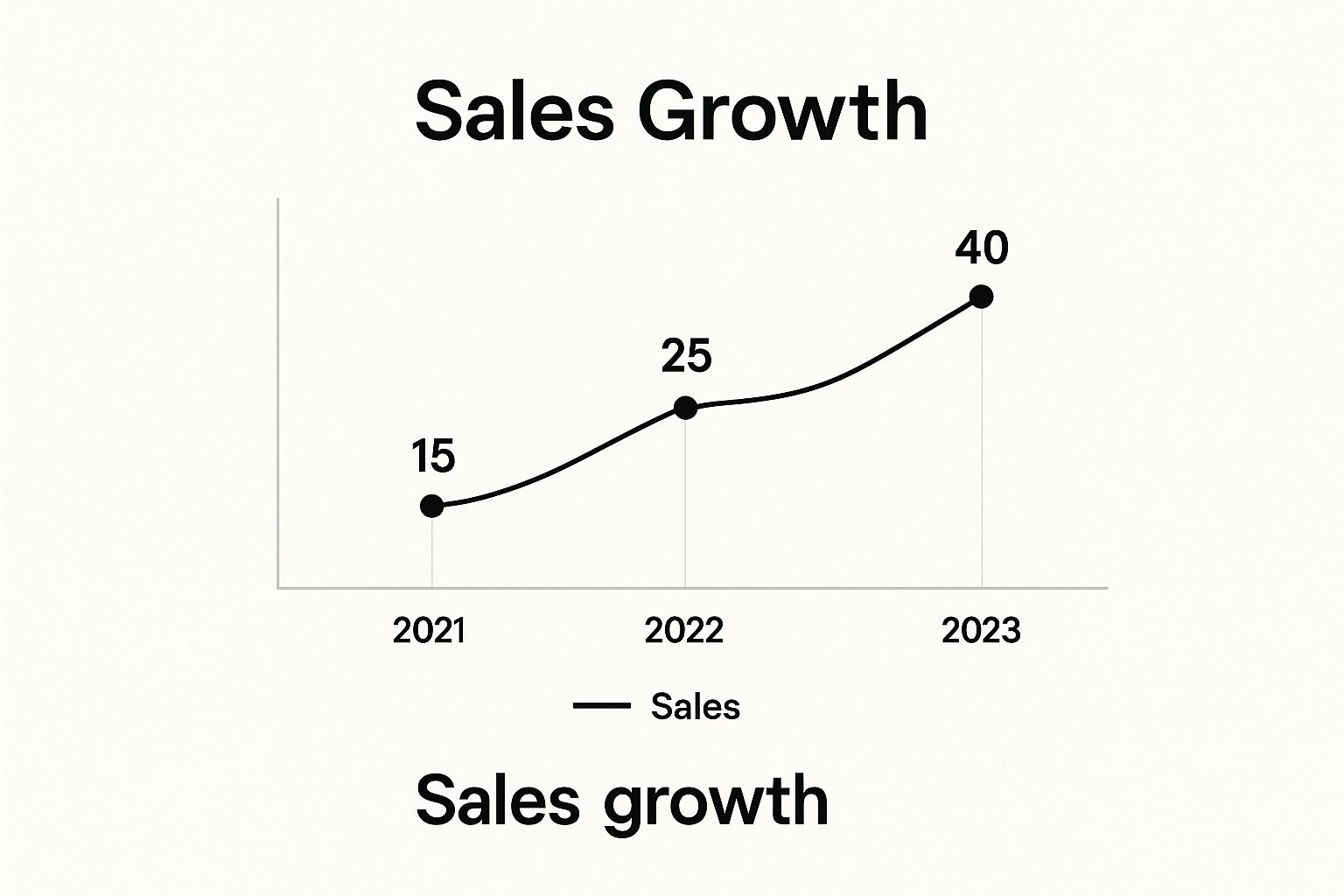

A generic payment processor just won't cut it for a modern SaaS platform. Your payment gateway for SaaS is a strategic piece of your business that has a real impact on customer retention and your ability to scale. It manages the nitty-gritty of dunning (the process of automatically retrying failed payments) to combat involuntary churn and gives you the data you need to keep a close eye on metrics like Monthly Recurring Revenue (MRR).

Of course, a great payment gateway works best when paired with a smart pricing model. To dig deeper into that, you can learn how to Master Your SaaS Pricing Strategy for Faster Growth.

Let's break down the essential jobs a SaaS payment gateway does for you.

Core Functions of a SaaS Payment Gateway

This table shows what a gateway actually does and why each function is so important for a subscription-based model.

| Function | What It Does For Your SaaS | Why It Matters |

|---|---|---|

| Recurring Billing Automation | Automatically charges subscribers on a set schedule (monthly, annually, etc.) without any manual work. | Ensures a steady, predictable cash flow and frees up your team from tedious administrative tasks. |

| Secure Payment Vault | Safely stores encrypted customer payment details (a process called tokenization) for future billing cycles. | Builds trust, meets PCI compliance standards, and makes it easy for returning customers to update their info. |

| Subscription Logic Management | Handles all the complexities of SaaS plans—free trials, upgrades, downgrades, add-ons, and prorated charges. | Gives you the flexibility to offer sophisticated pricing tiers and lets customers change their plans without friction. |

| Dunning & Churn Reduction | Intelligently retries failed payments due to expired cards or insufficient funds and sends automated reminders. | Recovers revenue that would otherwise be lost and significantly reduces involuntary churn, which is a silent killer of growth. |

Each of these functions is designed to take a complex financial process and make it feel seamless for both you and your customers.

The global payment gateway market is projected to skyrocket from $50 billion in 2025 to an incredible $451 billion by 2035. This explosive growth is being fueled by subscription models like SaaS that rely on seamless digital payments. You can explore the full report on payment gateway market trends.

What does this mean for you? It means picking the right partner isn't just a small technical choice—it's a foundational business decision that will directly support your growth for years to come.

What to Look For in a SaaS Payment Gateway

When you're picking a payment gateway for SaaS, you need more than just a simple tool to process transactions. Your entire business model is built on predictable, automated revenue, and a generic payment solution just won't cut it. They often stumble when faced with the unique challenges of subscription billing, leaving you with manual headaches and, worse, frustrated customers.

The goal isn't to find a gateway with the longest feature list. It's about finding one with the right features—the ones that will automate your operations, fight customer churn, and give you a clear, real-time view of your company's financial health.

Automated Recurring Billing

This is the absolute cornerstone of any SaaS business. The ability to automatically charge customers on a recurring basis is the engine that drives your cash flow. Without it, you’d be stuck chasing down invoices every single month. A solid recurring billing system needs to effortlessly handle various subscription cycles, whether they're monthly, quarterly, or annual.

This is what makes the subscription model so powerful in the first place. A good gateway should handle all the tricky parts for you, including:

- Flexible Billing Cycles: Letting you offer monthly, yearly, or even custom billing periods.

- Proration Management: Automatically calculating the right charge when a customer upgrades or downgrades in the middle of their billing cycle.

- Trial Period Logic: Seamlessly converting users from a free trial to a paid plan without anyone needing to lift a finger.

Getting the technical side of this right is crucial. If you're diving into the details, our guide on how to set up recurring payments walks through the entire process.

Smart Dunning Management

Let's be real: payments will fail. It’s an unavoidable part of doing business online. But a failed payment doesn't have to mean a lost customer. Dunning is simply the process of communicating with customers to collect payments that are past due. A smart dunning system automates this entire conversation, working behind the scenes to recover revenue and prevent involuntary churn.

Involuntary churn, which is churn caused by things like an expired credit card, can be responsible for 20-40% of your total churn rate. A smart dunning process is one of the most effective ways to plug that leak.

Instead of just sending a generic "payment failed" email and calling it a day, a robust dunning system will automatically retry the charge at strategic times. It also sends out a series of customizable notifications, giving your customers plenty of opportunities to update their billing information before their subscription is canceled.

Security and PCI Compliance

In the online world, trust is everything. Your payment gateway must be rock-solid on security and fully compliant with the Payment Card Industry Data Security Standard (PCI DSS). This is a non-negotiable set of rules for any company that handles credit card information, ensuring all data is kept in a secure environment.

Choosing a gateway that manages PCI compliance for you lifts a massive security weight off your shoulders. They do this through a process called tokenization, where sensitive credit card numbers are swapped out for a secure, unique token. This means you never have to store raw payment details on your own servers, protecting both you and your customers from risk.

Multi-Currency and Global Payments

As your SaaS company grows, your customer base will naturally expand across borders. Being able to accept global payments is key to scaling internationally. A gateway with multi-currency support lets you bill customers in their local currency, a simple change that can boost conversion rates by up to 33%.

Think about it from the customer's perspective. Seeing a price in a familiar currency and avoiding surprise foreign transaction fees makes for a much smoother, more trustworthy checkout experience. The right gateway will handle all the currency conversion complexities, making it easy for you to sell to a worldwide audience.

How to Select the Right Payment Gateway

Choosing the right payment gateway for your SaaS business is a lot like picking a long-term business partner. This decision goes way beyond just transaction fees. You're looking for a system that actually supports your growth, doesn't overcomplicate your operations, and won't give your dev team nightmares.

It’s a choice that ripples through your entire business, affecting everything from monthly revenue to customer churn. A cheap but clunky gateway can end up costing you far more in lost sales and wasted development hours than a slightly more expensive, reliable one. It's all about striking the right balance for where you are now and where you want to go.

Evaluate the Pricing Models

Payment gateway pricing can feel deliberately confusing, but it usually boils down to two main types. Getting a handle on them is key to accurately forecasting your costs.

Flat-Rate Pricing: This is the most straightforward model. You pay a simple, predictable percentage plus a small fixed fee for every transaction (for example, 2.9% + $0.30). It’s easy to understand and budget for, which is why it's a go-to for startups and businesses with a lower average transaction size.

Interchange-Plus Pricing: This model is more transparent but also a bit more complex. You pay the direct interchange fee from the credit card networks (like Visa or Mastercard) plus a fixed markup from the gateway provider. For high-volume businesses, this often translates to lower overall costs, but the fees will vary with each transaction.

Your decision here directly impacts your profit margins. A flat-rate model gives you predictability, while interchange-plus can unlock serious savings as you scale.

To give you a clearer picture, let's compare a few popular options and see how their models serve different SaaS needs.

Comparing Popular SaaS Payment Gateway Models

| Provider | Best For | Key SaaS Feature | Typical Fee Structure |

|---|---|---|---|

| Stripe | Startups to Enterprises | Unmatched developer tools and extensive API for custom subscription logic. | Flat-Rate (e.g., 2.9% + $0.30) with custom pricing available for high volume. |

| Braintree | Businesses seeking flexibility | Strong support for multiple payment methods, including PayPal and Venmo. | Flat-Rate (e.g., 2.59% + $0.49), generally competitive. |

| Adyen | Global-scale enterprises | All-in-one platform that unifies payments across online, mobile, and in-person. | Interchange-Plus, optimized for large transaction volumes. |

| Chargebee | Subscription-first SaaS | Deep subscription management and billing automation features. | Tiered pricing based on revenue, plus gateway fees from their partners (like Stripe). |

This table is just a starting point. Always dig into the fine print to understand what works best for your specific business model and volume.

Prioritize Developer Experience and Integration

A payment gateway with amazing features is completely useless if your team can't integrate it without pulling their hair out. This is where developer experience (DX) comes in. Look for providers that offer crystal-clear documentation, well-maintained SDKs for different programming languages, and a developer support team that actually responds.

A smooth integration process can save you hundreds of development hours and get your product to market that much faster. Always check if they offer a sandbox environment so your developers can test everything thoroughly without touching real money.

A solid API lets you tailor the checkout flow to perfectly match your brand, creating a seamless experience for your customers. Bad documentation or a confusing API, on the other hand, is a recipe for delays, bugs, and endless frustration.

Security and compliance are the bedrock of any trustworthy payment gateway. It's not just a feature; it's a requirement.

This just drives home how critical security is in the payment world. It’s a non-negotiable part of your decision-making process.

Consider Scalability and Global Reach

Finally, think about your long-term vision. The global payment processing industry is expected to hit $139.9 billion by 2030, fueled by the worldwide shift to digital payments. You need a partner who can keep up.

As you weigh your options, ask yourself these questions:

- What payment methods are supported? Does it just do credit cards, or can it handle digital wallets like Apple Pay and Google Pay, plus bank transfers like ACH?

- Can it handle multiple currencies? Billing customers in their local currency is a proven way to reduce friction and boost conversion rates.

- How portable is my data? If you ever decide to switch providers down the line, how much of a headache will it be to move your customer and subscription data?

While some details might change from one business model to another, these core principles hold true. For a slightly different angle, you can see our guide on choosing the best payment gateway for ecommerce. Answering these tough questions now will ensure the partner you pick is one that can grow with you, not hold you back.

Integrating a Payment Gateway Into Your Platform

Alright, you've picked your payment gateway for SaaS. Now for the fun part: plugging it into your platform. This might sound like a job for a team of developers locked in a room for a month, but it's often more straightforward than you’d expect.

You really have two main roads you can go down. Each one offers a different blend of simplicity versus control, and the right choice depends entirely on your resources and how much you want to customize the user's checkout experience.

The Simpler Path: Hosted Checkout Pages

Think of a hosted checkout page as letting the experts handle the heavy lifting. When your customer clicks "buy," they're whisked away to a secure, pre-built payment page managed entirely by your gateway provider. They punch in their card details there, and once the payment goes through, they’re sent right back to your site. Simple.

This hands-off approach is a lifesaver for many businesses, especially early on. Here’s why:

- Fast & Easy: You can get this up and running in a fraction of the time. Minimal coding required.

- Less PCI Headache: Because your servers never even see the sensitive payment data, the gateway takes on most of the PCI compliance burden for you.

- Borrowed Trust: Customers often recognize the look and feel of major gateways like Stripe or PayPal, which can make them feel more secure.

The trade-off? You lose some control over the branding and the exact flow of the checkout. But for many startups, the sheer speed and security make it a no-brainer.

The Flexible Path: Direct API Integration

If you want a checkout experience that feels 100% like your brand, a direct API integration is your answer. With this method, you build the payment form directly into your own app. The customer never leaves your site, giving you complete command over the look, feel, and flow from start to finish.

This path gives you maximum control, but that freedom comes with more responsibility. You'll need dedicated development time to build it, and because you're now handling sensitive data, you're on the hook for much stricter PCI compliance.

Want to get into the technical weeds? Our guide on payment gateway API integration breaks down the nuts and bolts.

No matter which integration you choose, your journey always starts in the same place: grabbing your API keys from the gateway’s dashboard. Think of these keys as the secret handshake that lets your platform talk securely to the payment provider.

This connection is the engine behind a colossal industry. In 2025 alone, the global payment gateway market was projected to handle transactions worth about $2.78 trillion. That's a 16.4% jump from the year before, all driven by businesses like yours needing a reliable way to get paid.

One final piece of advice: test, test, and test again. Every gateway provides a "sandbox" or "test mode." Use it. This lets you run countless fake transactions to find and fix any glitches before a single real customer—and their real money—is involved.

Optimizing Your SaaS Payment Operations

Getting a payment gateway integrated is a huge first step, but it’s really just the beginning. The real magic happens when you stop thinking of it as just a tool for processing transactions and start seeing it as the engine for your entire revenue operation. Your gateway isn't a passive component; it's a dynamic system that can actively fight churn, strengthen customer relationships, and give you the hard data you need to grow.

This shift in mindset starts with how you handle failed payments. Instead of just letting a failed payment turn into a lost customer, you need a smart, automated strategy to get things back on track. This is where a solid dunning process comes into play.

Reducing Involuntary Churn

Involuntary churn is the silent killer for so many SaaS businesses. This isn't about customers who are unhappy with your product; these are people who leave because of a simple payment hiccup, like an expired credit card. An effective dunning campaign automates the recovery process, sending a series of well-timed, friendly reminders and intelligently retrying the payment at optimal times.

Another game-changer is a self-service billing portal. When you give customers an easy way to update their own payment info, peek at their invoices, or manage their subscription, you remove a massive point of friction. It empowers them, cuts down on support tickets, and helps keep their billing details fresh, stopping payment failures before they even happen.

A well-executed dunning strategy can recover between 10% to 20% of your churned revenue. By automating this process, you plug a significant leak in your revenue bucket without any manual effort.

Clear communication ties all of this together. Your gateway should be set up to send out automated notifications for all the important billing moments.

- Upcoming Renewals: Just a simple heads-up before their card is charged.

- Successful Payments: A quick confirmation that gives them peace of mind.

- Payment Failures: A clear, non-alarming message with simple steps to fix the problem.

This kind of transparency builds trust and prevents the billing surprises that often lead to frustrated customers and cancellations.

Turning Data Into Action

Your payment gateway is an absolute goldmine of data. Don't just look at the dashboard as a log of transactions—it's a real-time health report for your entire business. By keeping a close eye on key metrics, you can spot trends early, identify potential problems, and make smarter decisions to guide your company.

Make sure you're tracking these essential SaaS metrics:

- Monthly Recurring Revenue (MRR): This is the predictable lifeblood of your business. Watching its growth and movement tells you everything about your company's momentum.

- Churn Rate: The percentage of customers who cancel their subscriptions over a certain period. For any subscription business, this is arguably the most critical indicator of long-term health.

- Customer Lifetime Value (LTV): The total revenue you can reasonably expect from a single customer over their entire time with you. Understanding your LTV is key to figuring out how much you can actually afford to spend to acquire a new customer.

When you start treating your payment gateway as an active part of your growth strategy, you move far beyond just processing payments. You build a resilient, efficient system that doesn't just collect revenue—it actively works to protect and grow it.

Frequently Asked Questions

Let's be honest, the world of subscription payments can feel a bit tangled. When you're trying to choose the right tools for your business, a few questions pop up time and time again. Here are some straightforward answers to the most common things people ask when picking a payment gateway for SaaS.

Payment Gateway vs Payment Processor

It's easy to get these two mixed up, and many people use the terms interchangeably. But they are two different, equally important pieces of the puzzle.

Think of it like a restaurant. The payment gateway is the waiter who takes your credit card at the table. They securely handle your information and run it through the point-of-sale terminal. The payment processor is like the bank's network working behind the scenes, connecting the restaurant's bank with your bank to actually move the money.

So, the gateway is the technology on your site that captures and encrypts the payment details, while the processor is the financial service that does the heavy lifting of transferring funds.

How Do I Handle Global Sales Tax and VAT?

This is a huge headache for any SaaS business looking to scale. As soon as you start selling across borders, you're hit with a complex web of tax rules. Some high-end payment gateways have built-in features to help with this, automatically calculating taxes based on where your customer is.

That said, for most businesses with serious global ambitions, a dedicated tool is the way to go.

Integrating a specialized tax platform like Avalara or TaxJar with your gateway is usually the smartest move. These services live and breathe international tax law, so you can be confident you're always compliant, no matter how much the rules change.

Can I Switch My Payment Gateway Later On?

The short answer is yes, but it’s definitely not a simple flick of a switch. The biggest challenge you'll face is data portability. This refers to moving all of your customers' saved payment information from the old provider to the new one.

This process is a big deal. Because of strict PCI compliance regulations designed to protect sensitive data, the migration has to be handled with extreme care and requires coordination between both your old and new gateway providers. When you're picking your first payment gateway for SaaS, ask about their data portability policies. Choosing a provider that plays well with others can save you from a world of pain and vendor lock-in later on.

At BlockBee, we provide a secure, non-custodial cryptocurrency payment platform designed for modern businesses. Explore how our developer-friendly tools can simplify your transactions.